Officially launchedOfficially launched. At the same time, the PLOT / ETH trading pair will also be listed on Uniswap simultaneously to start liquidity mining.

A few days ago, PlotX just announced the completion of a $ 2.4 million seed round of financing, investors include NGC Capital, Brilliance Ventures, Origin Capital and 3commas.

secondary title

How to play?

While we still have to wait for the mainnet version of PlotX to be released, we can get a glimpse of it through the Alpha version that has been running on the Ethereum Kovan testnet for several months.

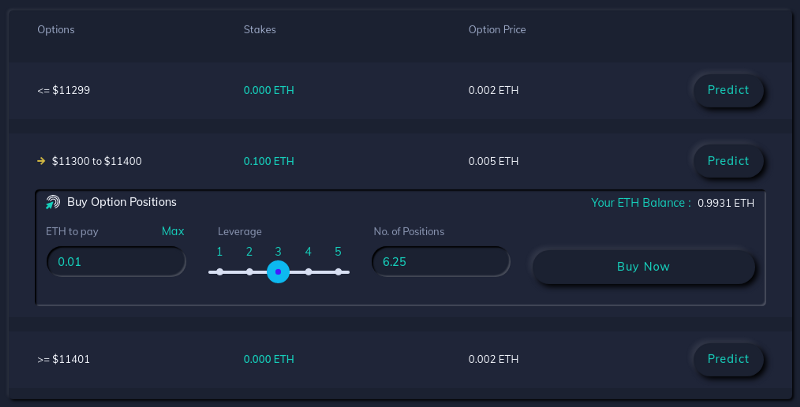

The Alpha version currently only supports the prediction of the price performance of BTC/USDT, and users can only use KETH (Kovan testnet token) for betting. When the mainnet version is launched, PlotX will support BTC/USD and ETH/USD markets, and the types of betting tokens will also be expanded to ETH (0.1% handling fee) and PLOT (0.05% handling fee). Later, the community can make decisions on which new markets to add and bet currencies.

Taking the current only BTC/USDT market as an example, users can first link to PlotX Alpha through the MetaMask wallet. After entering the main interface (as shown above), you can first use the three options of Hourly, Daily, and Weekly to predict the price performance of the BTC/USDT trading pair in one hour, one day, or one week. In addition, the current opening price, the number of participants, the total number of pledged tokens, and the end time of the prediction of different prediction results will also be displayed directly on the main interface.

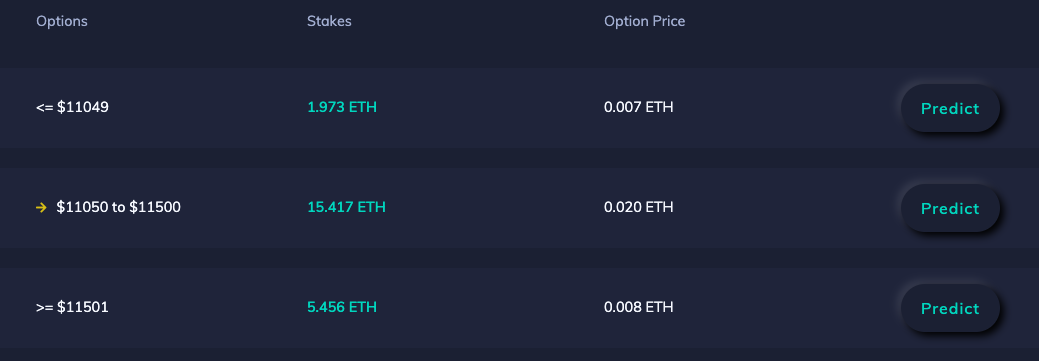

As shown in the figure above, currently in the prediction market about how the BTC-USDT price will behave at 21:00 tomorrow (Daily):

Select "BTC price will not be higher than 11049 USDT" to open a position with a price of 0.007 ETH, and the bet amount for this option is 1.973 ETH;

Select "BTC price will be between 11040 - 11500 USDT" and the opening price is 0.020 ETH. The bet amount for this option is 15.417 ETH. The small yellow arrow means that the current BTC price is within this range.

The opening price for choosing "BTC price will not be lower than 11501 USDT" is 0.008 ETH, and the bet amount for this option is 5.456 ETH.

Users can bet on the corresponding options according to their own investment judgment. The options that currently seem more likely will have a correspondingly higher opening price; on the contrary, options with lower prices currently seem less likely, but The potential benefits are even greater.

secondary title

What are the PLOT tokens for?

The PlotX protocol follows the Automated Market Making (AMM) algorithm, once the market is launched, new forecasts are automatically created based on one-hour, one-day, one-week intervals. Since PlotX runs on Ethereum, there is a gas fee for each new forecast creation. In order to support the long-term operation of the PlotX protocol, PlotX will charge users who participate in the prediction a certain handling fee, and there will be a certain handling fee discount for betting with PLOT - the handling fee for using ETH is 0.1%, and the fee for using PLOT is 0.05% %. The surplus portion of the fee will be accumulated in a decentralized autonomous organization (DAO), and users can use PLOT to participate in protocol governance and decide how to use these funds.

method of obtainingmethod of obtainingThere are many kinds:

Liquidity mining is coming soon. After PLOT / ETH is listed on Uniswap, users can pledge the corresponding Uniswap LP tokens in the PlotX smart contract to participate in PLOT mining. PLOT tokens.

In addition to liquidity mining, users can also obtain more tokens by directly staking PLOT and participating in predictions (currently participating in Alpha version predictions can receive airdrop rewards).

Finally, PlotX will also reward users who contribute to the ecology with bPLOT tokens (recommended mining + community mining). bPLOT is always equivalent to PLOT, but it can only be used within PlotX. Contributors include inviting new users and promoting proposals that benefit PlotX in other prediction-related protocols such as ChainLink.

PlotX's so-called Automated Market Making (AMM) algorithm actually uses an oracle pricing mechanism (currently using Chainlink) to ensure the creation of an orderly and credible environment. PlotX requires an oracle pricing mechanism to achieve two key functions:

Specific odds calculation: Since the new forecast will automatically start after a fixed time interval, it is necessary to calculate the odds of the new option through an algorithm, and the result of the specific odds will depend on the current market price of the selected currency;

Market settlement: At the end of each forecast, the oracle machine will record the real-time price of the selected asset, and use this as a basis to automatically judge the winner of the forecast. There is no manual intervention in the whole process, and the data is transparent and verifiable.

Through this model, PlotX can eliminate counterparty risk in traditional centralized prediction markets. In the traditional market, the system is mainly driven by trust, and the possibility of platforms doing evil cannot be completely ruled out. Even if there are some platforms with good reputations, they are often accompanied by sky-high intermediary fees. In addition, the betting data in the traditional market cannot be verified, it is difficult for users to know the betting choices of other real users, and there is insufficient reference information. On PlotX, the user's interaction objects are only smart contracts, and all data is presented on the chain, which is clear and checkable.

Compared to the early birds on other decentralized prediction markets like Augur, Omen, etc., PlotX is more vertical, focusing only on price predictions for the cryptocurrency market.

On Augur, since a large number of predictions involve the outside world (such as the US general election), it is impossible to determine all the prediction results through a general oracle solution, and the platform itself cannot verify what the real outcome of the event is. Augur must rely on users and a sophisticated result reporting system to encourage honest result reporting behaviour. In contrast, Plotx, being vertical to the field of price prediction, can ensure that its oracle pricing mechanism completely covers the odds calculation and settlement of all projects, and everything is automatically completed by the agreement.

In addition, the forecast project cycle on Augur is often long. Even if the forecast is correct, the excessively long return period will bring a certain amount of capital turnover pressure, which will discourage some users. However, the longest forecast period in Plotx is only one week. The operation is relatively more flexible.

The founder of PlotX, Ish Goel, was once the CTO of Nexus Mutual, a well-known decentralized insurance project. In a recent tweet, Ish revealed that PlotX has been in development for nine months. At present, the smart contract of the main network version of PlotX has passed the security audit of CertiK and Mudit Gupta, and the audit report portal is as follows:CertiK(mainly focus on token sales, redemption and pledge contracts, etc.),Mudit Gupta(follow all smart contracts).