Odaily Planet Daily reports that Circle, the issuer of the USDC stablecoin, has announced its latest batch of funded teams, including 13 project teams: Droplinked, Encifher, Hurupay, Kantin, Locker, Lympid, Orbital Pay, Paymonei, Perpflow, Sivo Revenue Marketplace, Sorbet, Tixbase, and WanderWallet. Circle stated that its developer funding program aims to provide more than just financial support; it actually serves as a springboard for so-called "bold" thinkers shaping the next era of on-chain finance. (Crowdfundinsider)

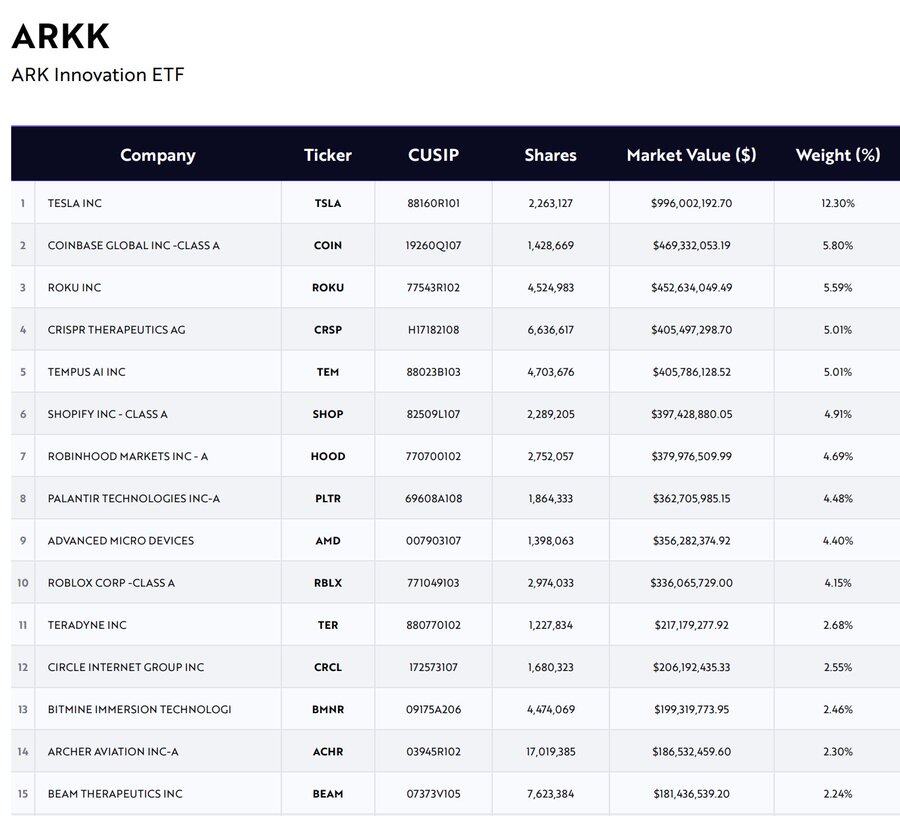

According to Odaily Planet Daily, Cathie Wood's ARKK ETF has disclosed its top 15 holdings, which include several cryptocurrency-related companies: Tesla (12.3%), Coinbase (5.8%), ROKU (5.59%), CRISPR (5.01%), Tempus AI (5.01%), Shopify (4.91%), Robinhood (4.69%), Palantir (4.48%), AMD (4.4%), Roblox (4.15%), Teradyne (2.68%), Circle (2.55%), BitMine (2.46%), Archer Aviation (2.3%), and Beam Therapeutics (2.24%).

Odaily Planet Daily reports that digital asset infrastructure company BDACS has announced plans to issue the Korean won stablecoin KRW1 on Circle's new blockchain, Arc.

To advance the project, BDACS has signed a memorandum of understanding with Circle and established a collaborative mechanism. Furthermore, BDACS completed the trademark registration for KRW1 in December 2023. (Yonhap News Agency)

According to Odaily Planet Daily, Circle has launched a public beta of its payments-focused Arc blockchain, with participation from over 100 institutions, including Visa, HSBC, BlackRock, AWS, Anthropic, Coinbase, and Kraken. Arc is positioned as a foundational layer for financial services, offering US dollar billing, sub-second settlement, optional privacy, and integration with the Circle payment system. Visa is testing stablecoin settlement to accelerate cross-border payments, while BlackRock is exploring stablecoin settlement and on-chain FX. Circle's long-term goal is decentralization, with open validators and governance. (CoinDesk)

According to Odaily Planet Daily, according to Lookonchain monitoring, with Circle's dilution in the past 1 year, 750 million USDC has been minted. Tether and Circle have minted stablecoins worth $8.5 billion since the "10.11 crash".