WLFI's partnership with Solana pushes its market capitalization past $3 billion, fueling concerns among insiders.

- 核心观点:WLFI扩张Solana生态挑战USDC主导地位。

- 关键要素:

- 与Solana巨头Bonk、Raydium达成合作。

- USD1七个月跃居第六大稳定币。

- 币安上线推动市值暴涨1550%。

- 市场影响:加剧稳定币竞争,或改变市场格局。

- 时效性标注:中期影响

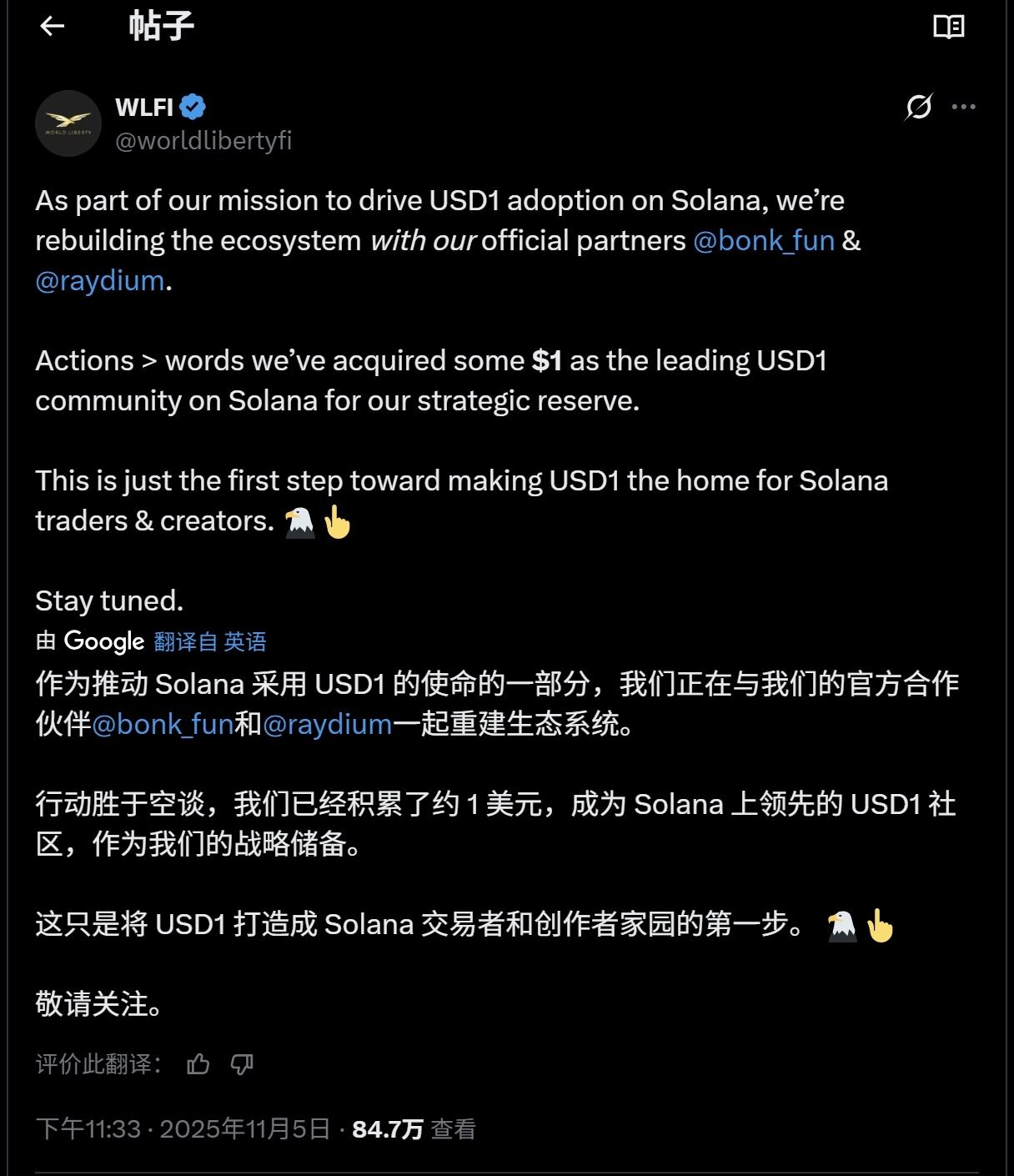

On November 5th, World Liberty Financial (WLFI) dropped a bombshell, causing a huge stir in the cryptocurrency community. This Trump-backed decentralized finance (DeFi) platform announced a partnership with Solana's two giants, Bonk and Raydium. This move signifies WLFI's aggressive expansion of its USD1 stablecoin, aiming to establish it as a significant force within one of the fastest-growing ecosystems in the cryptocurrency space—the Solana ecosystem. This also indicates WLFI's active expansion beyond Ethereum and BSC, targeting Solana's burgeoning DeFi sector. Currently, USDC accounts for over $9 billion of the network's $14.12 billion stablecoin supply.

Since TGE, WLFI has experienced a rollercoaster ride.

WLFI's journey began on September 1st with its high-profile token offering. Trading volume was phenomenal that day, with early pre-sale participants (who purchased at $0.015 and $0.05 respectively) finally having the opportunity to trade. The token price surged to an all-time high of $0.46 within just a few hours, delivering returns of over 2900% to these early investors. However, the cryptocurrency market is volatile, and WLFI was not immune to this phenomenon.

As of October 11, the token's price plummeted to an all-time low of $0.091, a staggering 80% drop from its peak. Currently, WLFI is trading at approximately $0.122, with a market capitalization approaching $3 billion. The October crash coincided with market turmoil triggered by Trump's tariff policies, but the token's price subsequently stabilized and showed signs of recovery after the recent announcement of its partnership with Solana, rising nearly 10% in 24 hours.

The WLFI token economic model was designed from the outset to create interesting market dynamics. At the TGE trade show, only 3 billion tokens (approximately 3% of the total supply of 100 billion) were available for trading, while the remaining 80% of the pre-sale allocation was locked in a Lockbox smart contract, with the final allocation determined by community voting. This prudent supply management was intended to prevent large-scale dumping, but even so, the token experienced significant volatility in the first three months of trading.

The explosive growth trajectory of the US dollar.

While the WLFI token itself has shown somewhat sluggish growth, the project's stablecoin, USD1, presents a completely different picture. Launched in April 2025, USD1's circulating supply surged from zero to $2.91 billion in just seven months, making it the sixth-largest stablecoin globally. This rapid growth places USD1 among the fastest-growing stablecoins of 2025, second only to several established stablecoins: Tether's USDT ($146 billion), Circle's USDC ($56 billion), MakerDAO's DAI, and Sky's USDS.

On October 29th, Binance launched the USD1 stablecoin, significantly boosting its growth. Within just a few days of its launch, USD1's market capitalization surged from $127 million to over $2.1 billion, an increase of over 1550%. Binance also established a dedicated task force to deepen its integration with WLFI, noting "strong institutional demand" for this dollar-pegged asset. Currently, the vast majority of USD1 is held in Binance wallets, and World Liberty Financial can generate approximately $80 million annually by investing these reserves in government bonds and money market funds.

The USD1 points program has proven particularly effective in driving user adoption. Launched approximately two months before the TGE (token lottery), the loyalty platform generated over $500 million in trading volume by rewarding users who traded USD1 pairs on partner exchanges. On October 28th, WLFI announced it would distribute 8.4 million WLFI tokens to early adopters of USD1 on six exchanges (Gate.io, KuCoin, LBank, HTX, Flipster, and MEXC) in recognition of their contributions to launching liquidity.

SOLANA's strategy aims to weaken USDC's dominant position.

Bonk's latest partnership with Raydium is WLFI's most aggressive expansion move to date. Through this collaboration, USD1 will be integrated into Bonk.fun's memecoin issuance platform and Raydium's automated market maker pools, allowing token creators to choose to pair newly issued tokens with USD1, instead of traditional alternatives like USDC or USDT. This integration also supports USD1 trading pairs through the platform interface and third-party trading bots, significantly improving trading convenience for Solana users.

From a data perspective, this strategic move makes perfect sense. USDC controls over 64% of the Solana stablecoin market, creating a huge opportunity for any competitor that can offer similar functionality and better incentives. WLFI is attracting users by offering millions of dollars in referral rewards for providing liquidity or trading USDC currency pairs, and leveraging its platform's political connections and strong financial resources to challenge Circle's existing dominance.

In addition to Solana, USD1 continues to expand its presence in the DeFi space, covering multiple blockchains. Currently, the stablecoin runs on four major blockchains: Ethereum, Solana, TRON, and the BNB smart chain, with TRON accounting for approximately 85% of USD1's market share. On October 24th, USD1 added support for the Aptos blockchain, further enhancing its cross-chain access capabilities. Furthermore, the stablecoin has integrated with lending protocols such as JustLend, yield platforms through partnerships with Euler and KernelDAO, and DeFi infrastructure providers like Chainlink (for obtaining price data).

Insider trading allegations shake market confidence

However, the remarkable growth story of the US dollar is now facing a serious credibility challenge, stemming from widespread concerns about market manipulation. The cryptocurrency community was in an uproar after the market crash of October 10-11. At that time, a mysterious whale established a large short position on Bitcoin and Ethereum 20 to 30 minutes before Trump announced tariffs on 100% of Chinese goods. This perfectly timed trade allowed the whale to profit approximately $160 million to $200 million in a single day, leading many to speculate that the trader had prior knowledge of Trump's policy announcement.

The timing was so precise it couldn't be ignored. This "10.11 insider" shorted $1.1 billion worth of cryptocurrencies just before the market crash, resulting in the liquidation of a total of $19 billion across the industry. Social media immediately erupted with speculation linking the big player to Trump's youngest son, Barron, but no concrete evidence has yet emerged. The big player denies being a "Trump insider," but he continues to engage in large-scale leveraged trading, the timing of which seems remarkably consistent with statements from the Trump family.

This is not an isolated incident. Senator Adam Schiff publicly called on Congress to investigate whether Trump was involved in insider trading. In April, Trump posted on Truth Social, "Now is a great time to buy!!! DJT," and hours later, he announced a 90-day suspension of tariffs, causing the S&P 500 to surge 9.5% in a single day. Trump himself profited approximately $410 million through his stake in Trump Media & Technology. CNN reporter Abby Phillips described Trump's betting market predictions as "insider trading in disguise," emphasizing how political power creates unprecedented opportunities for market manipulation.

The issue of transparency is becoming increasingly prominent.

These insider trading scandals have fueled concerns about USD1's transparency—or more precisely, its disturbing lack of transparency. Unlike USDT, which releases quarterly certified reports, and USDC, which provides monthly reserve reports, USD1, despite its $2.9 billion market capitalization, has not released any reserve documents since July 2025. This five-month silence stands in stark contrast to the stablecoin's prominent claim on the World Liberty Financial website to be "monthly certified reports, full transparency."

Given that USD1 does not hold excess reserves as a safety buffer like most mainstream stablecoins, but rather has zero excess reserves, this lack of transparency is even more worrying. Although USD1 is claimed to be 1:1 backed by US Treasury bonds, US dollar deposits, and money market funds managed by Fidelity Investments, and custodied by BitGo Trust, the lack of independent verification forces users to blindly trust these claims. Approximately 78% of the USD1 supply is held in offshore exchange wallets, further complicating the verification of its authenticity.

Market data reveals another warning sign: USD1's trading volume turnover rate is only 15.1%, far lower than USDC's approximately 50%. This suggests that the stablecoin primarily functions as a reserve asset rather than an active medium of exchange, raising questions about whether its $2.9 billion market capitalization truly reflects market demand or is inflated by strategic holdings and political manipulation.

Insider trading allegations, lack of reserve audits, conflicts of interest, and the Trump family's documented history of market manipulation have collectively created a crisis of confidence. If future investigations reveal that Trump's associates profited from insider information in promoting USD1 and WLFI, the regulatory and reputational impact could be severe. Given that the GENIUS Act is expected to establish a comprehensive stablecoin regulatory system by 2027, USD1's current opaque regulatory approach may be legally untenable, forcing it to either significantly increase transparency or face regulatory sanctions.

Currently, USD1 continues its strong growth momentum, primarily driven by exchange listings, DeFi integration, and the unparalleled influence of the Trump family. However, with growing concerns about market manipulation and lack of transparency, whether this growth momentum can withstand the test remains a key question for World Liberty Financial as it heads towards 2026, impacting billions of dollars in revenue.