BTC Halved, DAT Companies Face Billions in Floating Losses: Who's "Selling to Stop the Bleeding"?

- Core Viewpoint: The significant crypto market correction in early 2026 has exposed the fragility of the Digital Asset Treasury (DAT) company model, forcing some firms to sell crypto assets to address leverage risks and cash flow pressures. The industry is undergoing stratification and a test of resilience.

- Key Elements:

- Market Context: BTC retraced from its December 2025 high of $120,000 to around $60,000, a drop of nearly 50%, leading to massive floating losses on the books of many DAT companies.

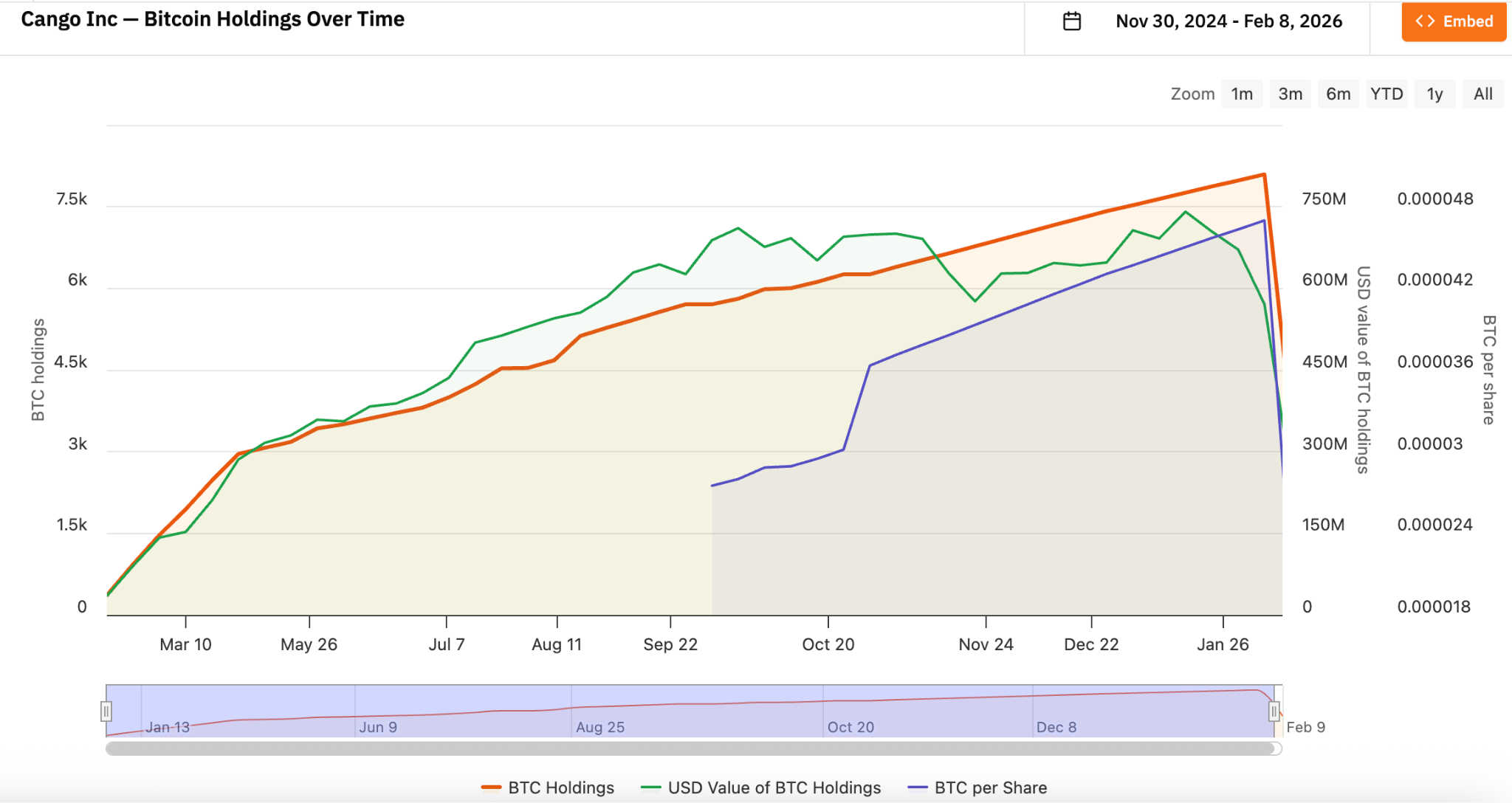

- Mining Dilemma: Taking Cango as an example, its mining costs exceed the coin price, forcing it to sell nearly half of its BTC holdings to repay collateralized loans. This highlights the vulnerability of the mining industry's high-leverage model in a bear market.

- Financing Logic Reversal: Companies like Empery Digital, which raised funds and bought BTC at the bull market peak, are now in trouble after the price drop, forced to "sell coins for buybacks + deleverage" to sustain operations.

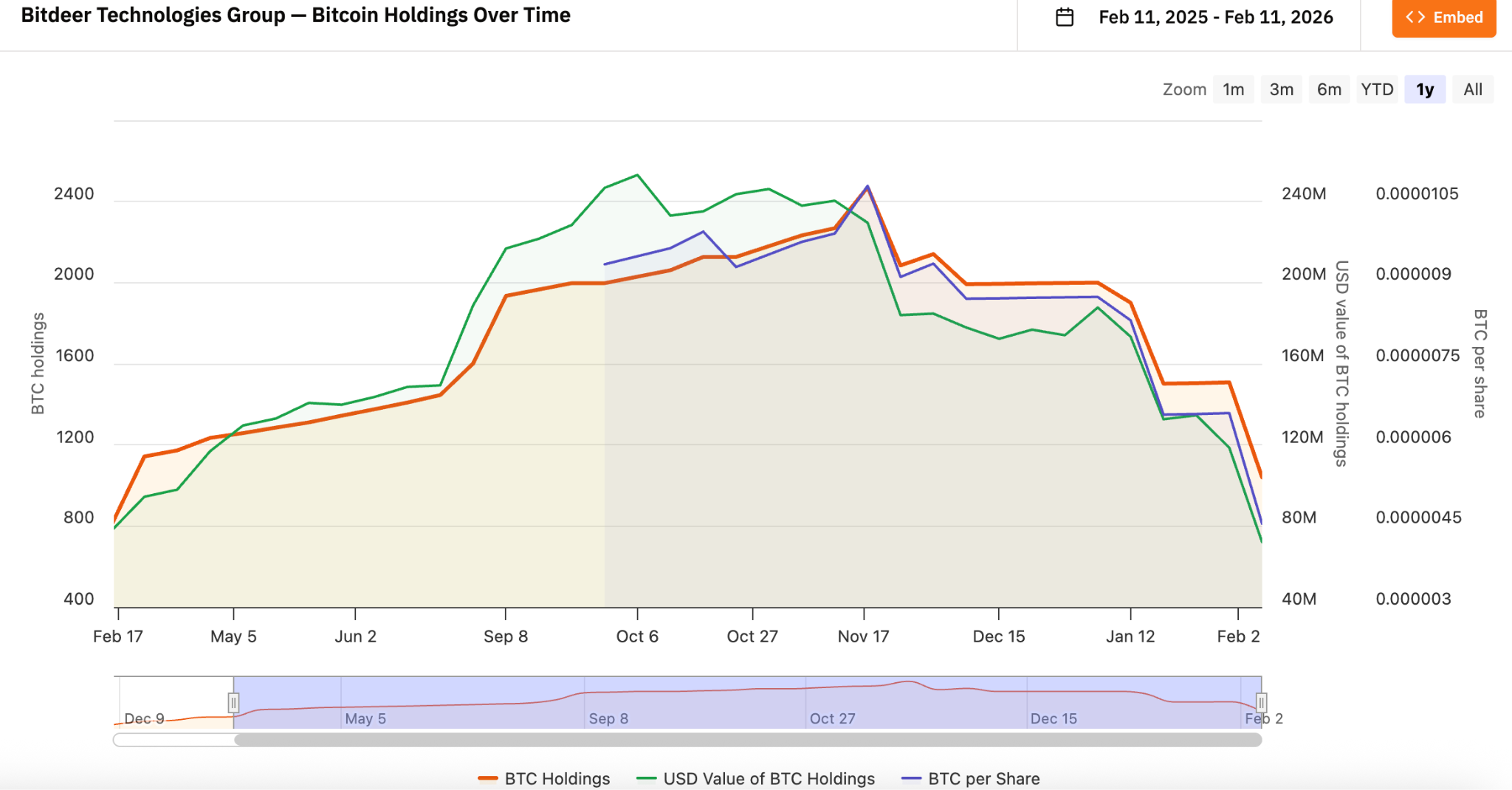

- Strategic Shift: Leading miners like Bitdeer have adjusted their strategies, shifting from "full holding" to "mine and sell simultaneously," prioritizing stable cash flow.

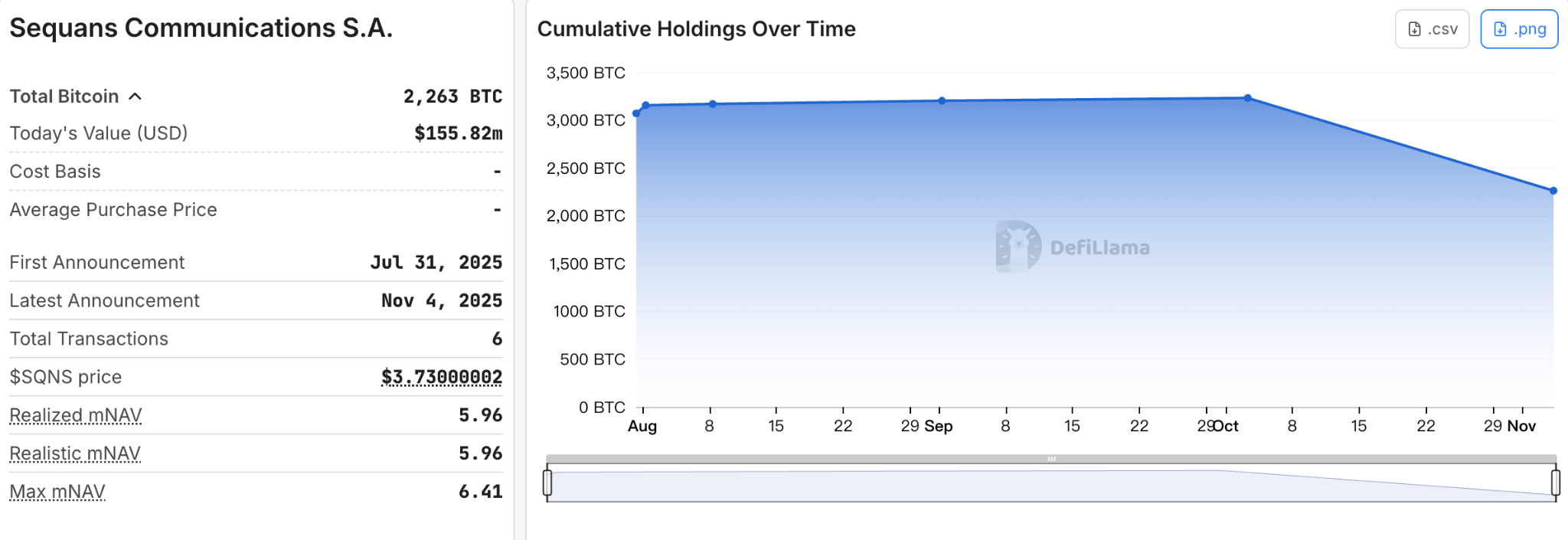

- Debt Repayment Pressure Emerges: Sequans has become the first publicly known DAT company to sell BTC on a large scale specifically to repay debt, marking an industry turning point.

- Business Diversification Attempts: Under pressure, some companies (e.g., Cango, ETHZilla) are seeking to pivot towards new businesses like AI computing and RWA to reduce dependence on the price of a single crypto asset.

Original | Odaily (@OdailyChina)

Author | Ding Dang (@XiaMiPP)

The beginning of 2026 delivered a heavy blow to DAT (Digital Asset Treasury) companies.

BTC retreated from its December 2025 peak of around $120,000 to near $60,000, a drop of nearly 50%. ETH was not spared either, falling below the $2,000 mark and nearly erasing all gains made since May 2025. This period coincided with the high-profile announcements by a group of DAT companies, represented by SharpLink and Bitmine, of their strategic pivots and aggressive allocations into crypto assets.

What does this mean? It means that those publicly listed companies or institutions that once treated BTC and ETH as "strategic corporate reserves" are now collectively mired in unrealized losses, with paper losses often amounting to hundreds of millions or even billions of dollars. Top players like Strategy and Bitmine are gritting their teeth and continuing to accumulate, trying to maintain the narrative stability of "long-term believers." However, more small-to-medium-sized or highly leveraged DAT companies have already begun substantial selling or even phased liquidation.

The crypto world is never short of stories. If 2025 was the year of "writing faith into financial reports," then 2026 is the test of "how faith endures a bear market." When prices retreat, leverage tightens, and the financing environment reverses, can these DAT companies still hold up their balance sheets?

Odaily will dissect several representative cases of companies that have already started "selling coins to stop the bleeding," examining how much they sold, why they sold, and what their next steps are.

Cango Inc. (NYSE: CANG): The Leverage Limit of the Mining Model

On February 9, Cango disclosed that it had sold 4,451 bitcoins on the open market, with net proceeds of approximately $305 million, and used all funds to repay a BTC-collateralized loan. This sale represented nearly half of its previous holdings, leaving only 3,645 BTC on its books post-sale.

Founded in 2010 and headquartered in China, Cango was initially a well-known automotive transaction service platform. Starting in November 2024, Cango formally entered the digital asset space, transforming into a Bitcoin mining company through business restructuring and a strategic pivot, treating BTC as its core corporate reserve asset. Cango's early Bitcoin strategy leaned towards HODL + mining accumulation, meaning not selling coins and relying on hash rate to continuously accumulate. This model can be self-reinforcing in a rising price cycle: rising coin prices boost net asset value, which enhances financing capacity, which in turn supports hash rate expansion.

Cango began accumulating Bitcoin continuously from November 2024, and its Bitcoin holdings once made it the world's second-largest mining company after MARA Holdings.

Related Reading: "Finding Promising Crypto Stocks: How Did Cango Leap from Auto Dealer to World's Second-Largest Bitcoin Miner?"

However, mining is inherently a leveraged industry. Miner purchases, mining farm construction, and power contracts all require upfront capital expenditure. Miners often use their self-held BTC as collateral to obtain equipment from manufacturers with deferred payments or borrow USD/stablecoins from institutions/platforms to expand farms, purchase equipment, and maintain operations. The downside of this model is that when the BTC price experiences a significant correction, the collateral ratio deteriorates rapidly, leverage risk is amplified, while fixed costs like electricity, maintenance, and equipment depreciation do not decrease accordingly, putting extreme pressure on cash flow.

According to Q3 2025 data released in December, Cango's average all-in mining cost (including depreciation) was approximately $99,000 per coin, with a cash cost (excluding depreciation) of about $81,000 per coin. The Bitcoin price is now far below its shutdown price, forcing it to "stop the bleeding" by selling BTC to improve its balance sheet and reduce financial leverage.

It is worth noting that Cango has announced a partial shift of resources towards artificial intelligence computing infrastructure, seeking business diversification to reduce dependence on a single asset price.

Empery Digital Inc. (NASDAQ: EMPD): The Reverse Pressure of Bull Market Financing Logic

Empery Digital was founded in February 2020 (originally named Frog ePowersports Inc., later renamed Volcon Inc.) and is headquartered in Texas, USA. It was originally a company focused on all-electric off-road powersports vehicles.

In July 2025, the company announced its Bitcoin treasury strategy. Looking back, this timing was near the peak of this Bitcoin price cycle. The company raised approximately $4.5-5 billion through private placements and credit financing, accumulating around 4,000 bitcoins between July and August 2025 at an average cost of approximately $117,000 per coin. At current prices, the unrealized loss is close to 57%.

On February 6, Empery Digital announced the sale of 357.7 BTC at an average price of about $68,000 per coin, raising about $24 million to fund share repurchases and repay part of its debt. It has repurchased over 15.4 million shares at an average price of $6.71, aiming to narrow the NAV discount. Empery now holds approximately 3,724 bitcoins.

The case of Empery Digital actually reflects the typical dilemma of small-to-medium-sized DATs. They transformed aggressively, relying on bull market financing, but are forced to "sell coins for buybacks + deleverage" when prices correct. Compared to Cango's mining background, Empery resembles more of a "pure financial play." Its original main business was unsustainable, so it leveraged high bull market valuations to raise funds and buy BTC in bulk, attempting to replicate Strategy's path. However, BTC's sharp correction exposed its leverage risk, and it lacked the space for long-term issuance and capital market operations. If prices continue to fall, sustained selling becomes almost inevitable.

Bitdeer Technologies Group (NASDAQ: BTDR): From Price Betting to Cash Flow Priority

Bitdeer was founded in December 2021 by crypto OG Jihan Wu (co-founder of Bitmain) and is among the world's major Bitcoin miners alongside MARA and Riot.

Through a vertically integrated model, Bitdeer provides end-to-end solutions from equipment procurement, logistics, data center design/construction, equipment management to daily operations, while expanding into cloud hashrate, hosting services, and proprietary ASIC miner R&D. This has shifted Bitdeer's business from pure mining to diversified high-performance computing, buffering to some extent against Bitcoin price volatility.

According to data from bitcointreasuries.net, starting in November 2025, Bitdeer's BTC strategy has shifted to "mine and sell", no longer holding everything (HODL), but partially liquidating to maintain cash flow and operational stability. Preserving cash flow takes priority over long-term holding. Is this the industry sensitivity of an OG who has experienced multiple market cycles?

Sequans Communications S.A. (NYSE: SQNS): Selling Coins to Repay Debt Becomes an Industry Turning Point

Sequans was founded in October 2003 and was originally a semiconductor company focused on wireless cellular technology chips and modules. In June 2025, the company raised approximately $380 million through private equity and convertible bonds to accumulate Bitcoin, transforming itself from a pure IoT chipmaker into an "IoT + BTC DAT" hybrid.

Between July and October 2025, Sequans accumulated 3,233 bitcoins. Rough estimates put the average cost around $116,000.

In November 2025, it conducted its first major sale of 970 BTC to redeem approximately 50% of its convertible bonds, reducing total debt from $189 million to $94.5 million. The company called this a "strategic asset reallocation," not an abandonment of the strategy. However, the market viewed Sequans as the starting point of the BTC treasury "bubble burst" – the first DAT company to publicly admit needing to sell coins to repay debt.

ETHZilla Corporation (NASDAQ: ETHZ): A Deleveraging Sample of an ETH Treasury

ETHZilla Corporation was originally a clinical-stage biotechnology company focused on drug R&D and therapeutic development for chronic pain, inflammation, and fibrosis. The company faced issues like cash shortages, poor liquidity, and slow R&D progress, with its stock price remaining low for a long time.

In August 2025, it raised $425-565 million through a private placement, with investors including crypto institutions like Electric Capital, Polychain Capital, GSR, and entities related to Peter Thiel holding about 7.5%. These funds were directly used to purchase ETH and establish an Ethereum treasury. At its peak, ETHZilla held up to approximately 102,000 ETH, worth about $210 million, with an average entry cost of $3,841 per coin.

On November 13, 2025, ETHZilla began its first reduction, selling 8,293 ETH. On December 25, ETHZilla disclosed the sale of 24,291 ETH for proceeds of about $74.5 million. This transaction was part of redeeming outstanding senior secured convertible notes and represented the first sample of an ETH treasury reduction. Currently, ETHZilla holds approximately 65,700 ETH.

Similar to Empery, ETHZilla is also on a path of forced coin selling for deleveraging. However, the company is accelerating its pivot towards RWA (Real World Asset tokenization), focusing on areas like auto loans, home loans, land/commercial real estate. It plans to launch its first RWA token product in early 2026, attempting to reshape its value through business innovation.

Conclusion

The above are just a few representative samples, mostly in the middle tier of the industry. They lack the capital market pricing power of a Strategy, nor can they exit the stage quietly like the smallest companies. Beyond them, some smaller, structurally weaker DAT companies have already vanished silently in this correction. Others, which planned to transform but hadn't fully implemented their treasury strategies, have chosen to pause or even terminate projects before launch as the financing environment tightened abruptly.

The 2026 correction acts like a mirror, reflecting the fragility and resilience of the DAT model. Companies built purely on "storytelling + leverage" are now paying the price for their aggressive expansion. Crypto faith may still exist, but it must ultimately coexist with the realities of cash flow, leverage management, and business sustainability.

The gap between top players and small-to-medium-sized companies is widening in this process. Rather than marking the end of the DAT model, this is more like the starting point of its stratification phase.