Will CME Issue a Coin? Wall Street Giants' "New Hunt"

- Core Viewpoint: The world's largest derivatives exchange, CME Group, plans to issue "CME Coin." This move signifies that traditional financial giants are leveraging blockchain technology to strengthen their core intermediary roles, aiming to build a high-compliance, institution-grade digital financial infrastructure dominated by themselves. The goal is to regain market influence and reshape the competitive landscape.

- Key Elements:

- CME Coin is positioned as an institutional settlement tool and liquid tokenized collateral. It aims to address the weekend liquidity issues for its planned 24/7 crypto futures trading and serves as a key component of its 2026 digitalization strategy.

- CME's move intends to recapture the massive interest income currently earned by stablecoin issuers like USDT and USDC, keeping the capital flow within its own balance sheet. Simultaneously, it leverages its status as a "Systemically Important Financial Institution" to build a compliance moat.

- If this token becomes an official margin asset, it will create "mandatory holding" institutional demand, directly embedding itself into the core clearing layer of the global financial system, posing a fundamental challenge to existing stablecoins.

- This path aligns with that of giants like JPMorgan Chase: embracing blockchain efficiency for instant settlement. However, its essence is a "digital upgrade" that reinforces the traditional financial power structure, not a victory for decentralized finance.

Original Author: Seed.eth, Bitpush News

In the power games of Wall Street, giants are never absent; they are merely waiting for the right moment to sweep the board.

This morning, a statement by Terry Duffy, CEO of the world's largest derivatives trading platform, CME Group, during the Q4 earnings call, stirred the entire market.

Duffy revealed that CME is actively exploring the issuance of its own digital token: "CME Coin."

This is not merely a technical experiment. Under the narrative of "tokenizing everything," CME's move appears more like a deep "encirclement" launched by traditional finance (TradFi) against crypto-native infrastructure.

1. The Mystery of Its Positioning: Is It a Chip or Ammunition?

Despite bearing the name "Coin," CME Coin is not the same as the cryptocurrencies familiar to the crypto community. From Duffy's brief response, the following information can be extracted:

The token is intended to operate on a decentralized network.

CME distinguishes it from its ongoing "Tokenized Cash" project (in collaboration with Google Cloud), stating these are two separate initiatives.

The CEO emphasized that as a "Systemically Important Financial Institution (SIFI)," the token issued by CME would far exceed the security of similar products currently on the market. (Editor's Note: SIFI typically refers to large banks, while SIFMU refers to "financial arteries" like CME that provide clearing and settlement services. CME's SIFMU status grants it access to Federal Reserve accounts.)

We can infer that the underlying logic of CME Coin leans more towards the digital upgrade of financial infrastructure, with its core functions likely being the following two:

· Settlement Tool: Similar to an internal, advanced "chip" used for 24/7 instant settlement between institutions.

· Tokenized Collateral: Transforming margin into liquid tokens, allowing previously locked funds to become "active" on-chain.

2. Why Now? CME's Triple Calculation

CME's entry at this moment is not a whim but is based on a triple calculation for its 2026 digital strategy:

Solving the "Weekend Liquidity Drought"

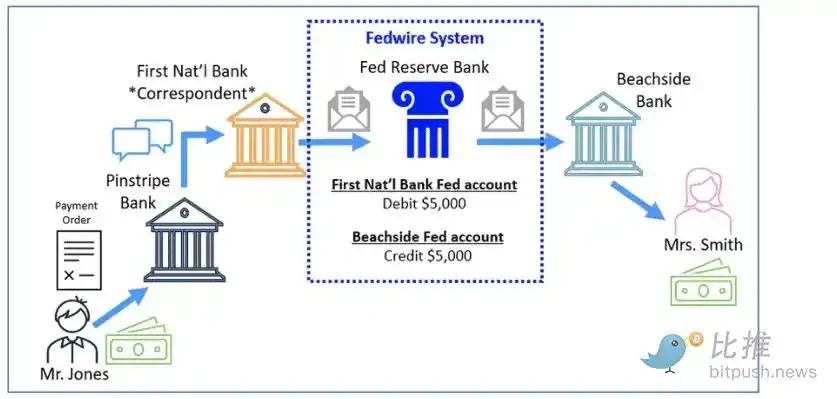

CME has already planned to fully launch 24/7 trading for crypto futures in 2026. The traditional bank wire transfer system (FedWire) does not process transactions on weekends. If Bitcoin crashes on a Saturday night, institutions cannot transfer funds to replenish margin, causing liquidation risks to multiply exponentially. A blockchain-based, round-the-clock token like CME Coin is the "fast-acting heart pill" for the margin system.

Recapturing the "Interest Profit" That Was Taken

Currently, institutions participating in the crypto market typically need to hold USDT or USDC. This means hundreds of billions of dollars in cash are held by companies like Tether and Circle, generating hundreds of millions in interest income enjoyed solely by these firms. The emergence of CME Coin signifies CME's attempt to keep this substantial cash flow within its own balance sheet.

Building a "Compliance Moat"

With BlackRock issuing the BUIDL fund and JPMorgan Chase deepening its work on JPM Coin, giants have reached a consensus: future financial competition is no longer about seats but about "collateral efficiency."

CME's CEO put it bluntly: compared to tokens issued by third- or fourth-tier small banks or private companies, they trust those issued by "systemically important" financial giants like JPMorgan Chase (SIFI) more. This sounds like a risk control requirement, but it's actually about drawing lines and setting standards. By raising the requirements for the "pedigree" of collateral, CME is essentially crowding out existing "private" stablecoins, building a higher-threshold, safer "members-only" playground for the core traditional finance circle. How the game is played in the future will have to follow their rules.

Therefore, CME Coin is more like a "stepping stone" for traditional financial giants attempting to regain control over the narrative in the crypto world. This show has just begun.

3. Erosion of Existing Stablecoins?

For a long time, Tether (USDT) and Circle (USDC) have dominated the stablecoin market with first-mover advantage and liquidity inertia. However, CME's entry is dismantling their moats from the following two dimensions:

It's an Asset, and More Importantly, "Liquid Clearing Power"

USDT or USDC primarily act as "fund movers," while CME handles trillions of dollars in derivative positions covering interest rates, commodities, equities, and more.

· Heart Position: Once CME Coin becomes an officially recognized margin asset, it will directly enter the "heart" of the global financial system—the foundational layer for price discovery and stability assurance.

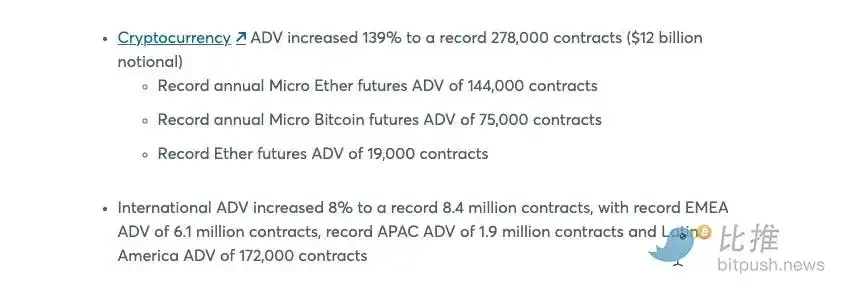

· Forced Holding: CME Coin captures the "clearing flow." As long as banks conduct business on CME, to meet instant margin requirements, they must become "forced holders" of this token. With surging demand, this institutional necessity is unattainable for any native crypto asset. According to the financial report released in January, CME's average daily cryptocurrency trading volume reached $12 billion in 2025, with Micro Bitcoin (MBT) and Micro Ethereum (MET) futures contracts performing particularly strongly.

Collateral as Sovereignty: Reshaping the Market's "Digital Throat"

In modern finance, collateral is the real throat. It determines who can enter the market and how much leverage they can take.

· Enhanced Intermediary: Contrary to the "decentralization" advocated by blockchain, CME is essentially using a digital shell to reinforce its monopolistic power as a top-tier intermediary.

· Closed Fortress: Unlike permissionless DeFi, CME Coin is highly likely to be a closed-loop game exclusive to institutions. It has no open governance, only legally protected clearing rights.

Yield "Siphoning": Tokens launched by Wall Street giants often come with built-in "yield-bearing" properties or fee deduction functions. Faced with risk-free U.S. Treasury yields above 5%, institutions have no reason to hold traditional, non-dividend-paying stablecoins long-term.

Summary

Looking at the bigger picture, CME's strategy is not alone. JPMorgan Chase (JPMorgan) recently launched tokenized deposit services via its token named JPM Coin (JPMD) on Coinbase's Layer 2 blockchain, Base. Unlike traditional transfers that take days, JPMD enables settlement in seconds, quietly changing how large financial institutions adjust their positions. The paths of these financial giants are strikingly similar: embracing the efficiency of blockchain while firmly holding onto the traditional power structure.

This is not the victory of decentralized finance that many crypto natives hoped for. It more closely resembles a "digital upgrade" of the traditional financial order, where giants are skillfully transforming their past "clearing monopoly" into the future's "digital pass."

Once this rulebook, dominated by them, is finalized, the battlefield will be redrawn. At that point, not only today's private stablecoins but even tokens issued by many small and medium-sized banks may lose their eligibility to compete under this new set of "compliance" standards.