Nearly $1.26 Billion Frozen: How to Prevent USDT Freeze Risks

- Core Viewpoint: Tether's unprecedented efforts in address freezes and fund destruction for USDT in 2025 highlight that stablecoin regulation has entered an era of strong compliance. Market participants need to build proactive risk prevention and control systems to cope with continuously escalating enforcement risks.

- Key Elements:

- In 2025, Tether blacklisted 4,163 addresses, freezing $1.26 billion worth of USDT. Of this, 55.6% ($698 million) was permanently destroyed, and only 3.6% of the addresses were unfrozen within the year.

- The freezes primarily stem from three compliance scenarios: responding to requests from global law enforcement agencies, proactively implementing OFAC sanctions list screenings, and conducting proactive risk prevention and control through blockchain intelligence.

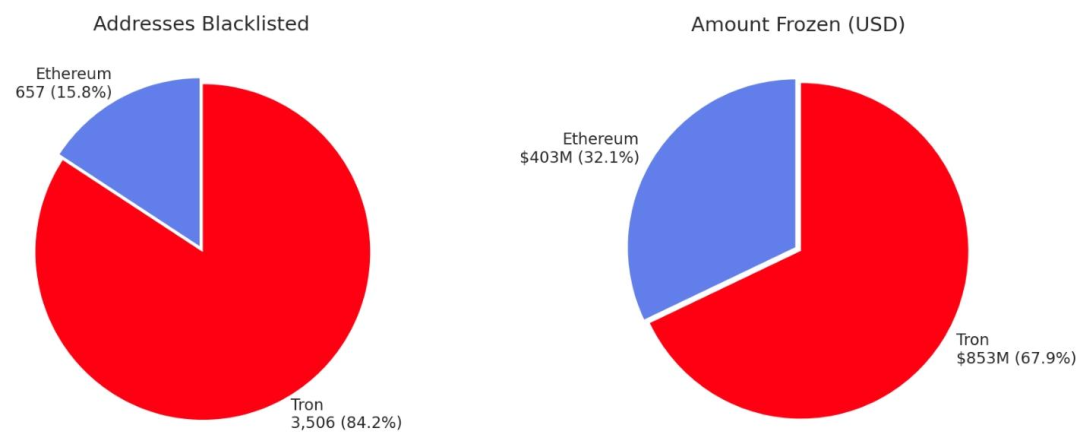

- The Tron (TRC20) chain is the primary distribution area for frozen addresses (accounting for 84.2%), while the average freeze amount per address on the Ethereum (ERC20) chain is higher, reaching $613,000.

- The regulatory trend continues to tighten. From 2023 to 2025, cumulative frozen funds exceeded $3.29 billion. With the GENIUS Act bringing stablecoin issuers under financial institution supervision, compliance pressure will further increase.

- It is recommended to use professional KYT (Know Your Transaction) tools for pre-transaction screening, in-transaction monitoring, and post-transaction record-keeping of counterparty addresses to build a proactive compliance defense system.

Compliance enforcement in the stablecoin sector is intensifying. Tether's freezing operations targeting various addresses as the issuer of USDT serve as a stark warning of risks for the industry. In 2025, Tether blacklisted a cumulative total of 4,163 unique addresses, freezing funds amounting to $1.26 billion. Of this, 55.6% ($698.42 million) was destroyed, and only 3.6% of the blacklisted addresses were unfrozen within the year. Behind these figures lies a profound shift in the stablecoin regulatory landscape, posing an urgent risk management challenge for all USDT users.

1. Analysis of Tether Freeze Data and Trend Review for 2025

We analyzed all AddedBlackList, RemovedBlackList, and DestroyedBlackFunds events related to USDT on Ethereum (ERC20) and Tron (TRC20) throughout 2025, leading to the following two key conclusions.

1. Over half of the frozen USDT was ultimately permanently destroyed. Of the total $1.26 billion in USDT frozen throughout the year, Tether destroyed $698 million, accounting for 55.6% of the total frozen value. This data indicates that the majority of blacklisted funds are linked to concluded investigation cases. It is important to note that destroyed funds are typically re-minted for victims or law enforcement agencies.

2. The proportion of addresses being removed from the blacklist is relatively low. In 2025, Tether blacklisted 4,163 unique addresses, while only 150 addresses (3.6%) were removed from the blacklist within the same year. Furthermore, an additional 231 address removal events occurred in 2025, involving addresses that had been blacklisted prior to 2025. This suggests that once an address is added to Tether's blacklist, the likelihood of successful removal is extremely low.

Examining the 2025 freeze data, Tether's blacklisting operations exhibit significant structural characteristics and trend changes, providing important reference points for market participants.

First, there is a clear difference in on-chain distribution, with TRON emerging as a high-risk area. Among the addresses blacklisted in 2025, 84.2% (3,506) were from the TRC20 (Tron) ecosystem, corresponding to $853 million in frozen funds, reflecting a preference for chains with low transaction costs and fast confirmation speeds for illicit activities. Although ERC20 (Ethereum) addresses accounted for only 15.8% (657), the average frozen amount per address was $613,000, 2.5 times that of TRC20 addresses, highlighting the regulatory focus on large-value transactions on the Ethereum chain.

2025 USDT Blacklist: Chain Distribution

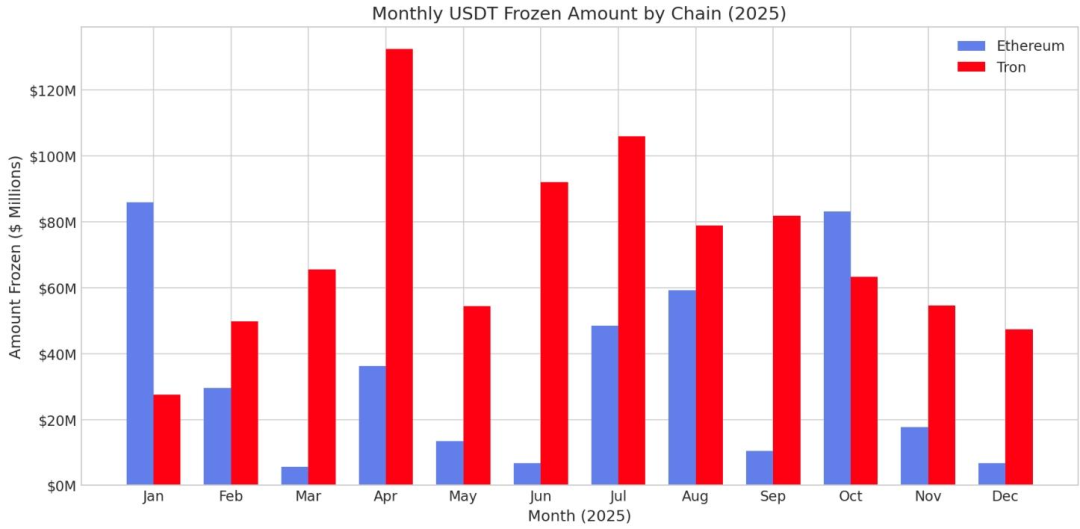

Second, the temporal dimension shows concentrated peaks, with a notable pattern of weekend enforcement. July was the peak month for freezes, with 1,158 addresses frozen in that month alone, corresponding to $154 million. This surge is highly correlated with factors such as the enactment of the GENIUS Act and global joint counter-terrorism operations. On a weekly basis, Saturday was the most active day for freezes (22.4%), while Sunday dropped to 2.1%, indicating that compliance monitoring needs to cover all time periods.

Monthly USDT Freeze Volume by Chain in 2025

Finally, the long-term trend continues to tighten, with freeze volumes climbing year by year. From 2023 to 2025, Tether has cumulatively frozen over $3.29 billion in funds, involving 7,268 addresses. In early 2026, Tether froze $182 million across 5 TRON addresses in a single operation, signaling a further escalation in regulatory intensity. Compliance has shifted from an "option" to a "mandatory requirement."

2. Why Are Addresses Frozen?

Based on Tether's official statements, public disclosures, and industry practices, freezing actions primarily stem from three compliance scenarios, all centered around legal regulatory requirements and risk prevention.

First, responding to requests from law enforcement agencies is the primary trigger for address freezes. Tether has established deep cooperation with over 275 law enforcement agencies across 59 jurisdictions globally, granting it considerable flexibility in freezing operations—it does not require a formal court order and can freeze relevant addresses based solely on a verified request from a cooperating agency. In urgent situations, freezing measures can even be taken based on informal email notifications. Statistics show that over the past three years, Tether has processed more than 900 law enforcement freeze requests, with over 50% initiated by U.S. agencies, highlighting the concentration of enforcement needs in Europe and America.

Second, proactively implementing sanctions compliance requirements to fulfill international regulatory obligations. Since December 2023, Tether has formally launched an active sanctions screening mechanism. For all addresses appearing on the OFAC (Office of Foreign Assets Control) Specially Designated Nationals (SDN) list, Tether will proactively execute freezes without requiring external agency intervention. Shortly after this policy was implemented, Tether swiftly completed the batch freezing of 161 addresses on the list, fully demonstrating its strict adherence to international sanctions rules and its commitment to compliance.

Third, leveraging blockchain intelligence to conduct proactive risk prevention. Through deep collaboration with the T3 Financial Crime Joint Unit, Tether can proactively investigate and freeze addresses associated with various illegal financial activities such as hacking attacks, telecom fraud, and terrorist financing. Some freezing actions even occur before formal law enforcement requests, enabling preemptive risk control. As of October 2025, this joint unit has successfully frozen over $300 million in illicitly linked assets across 23 jurisdictions worldwide, effectively curbing the circulation of illegal funds.

3. How to Prevent It? Building Full-Process Protection with BlockSec KYT

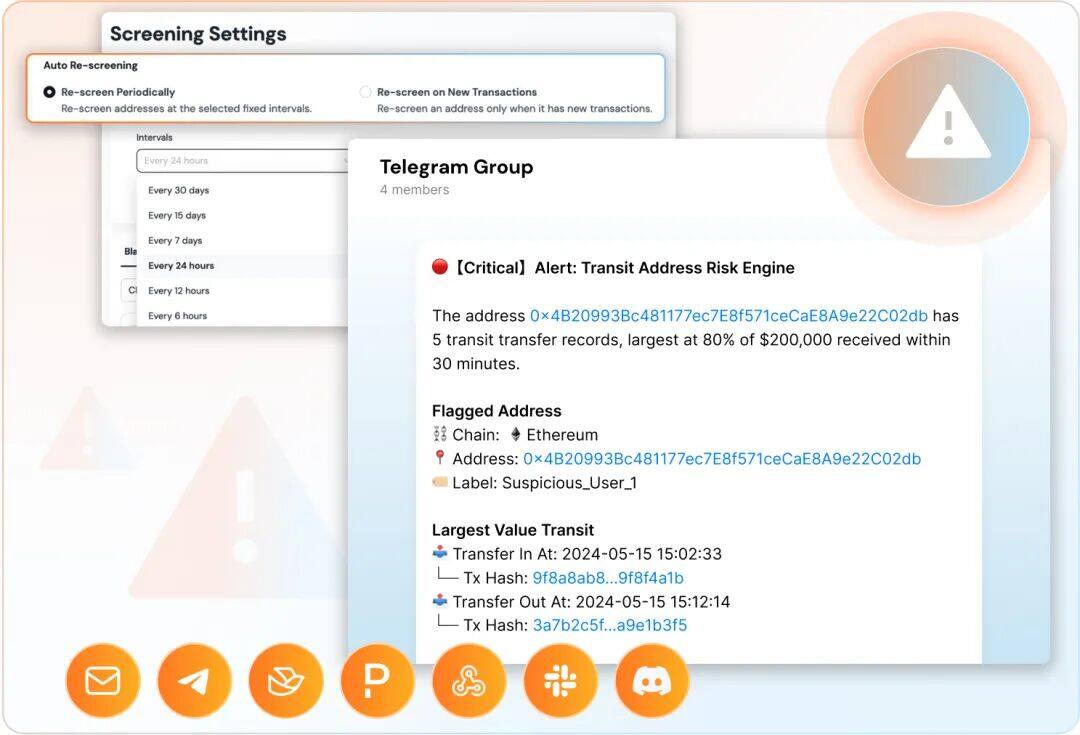

In the face of escalating freeze risks, passive response is no longer viable. It is necessary to build a proactive prevention system through professional KYT (Know Your Transaction) tools. BlockSec Phalcon Compliance, with its ultimate ease of use and precise risk control capabilities, provides an efficient solution for market participants.

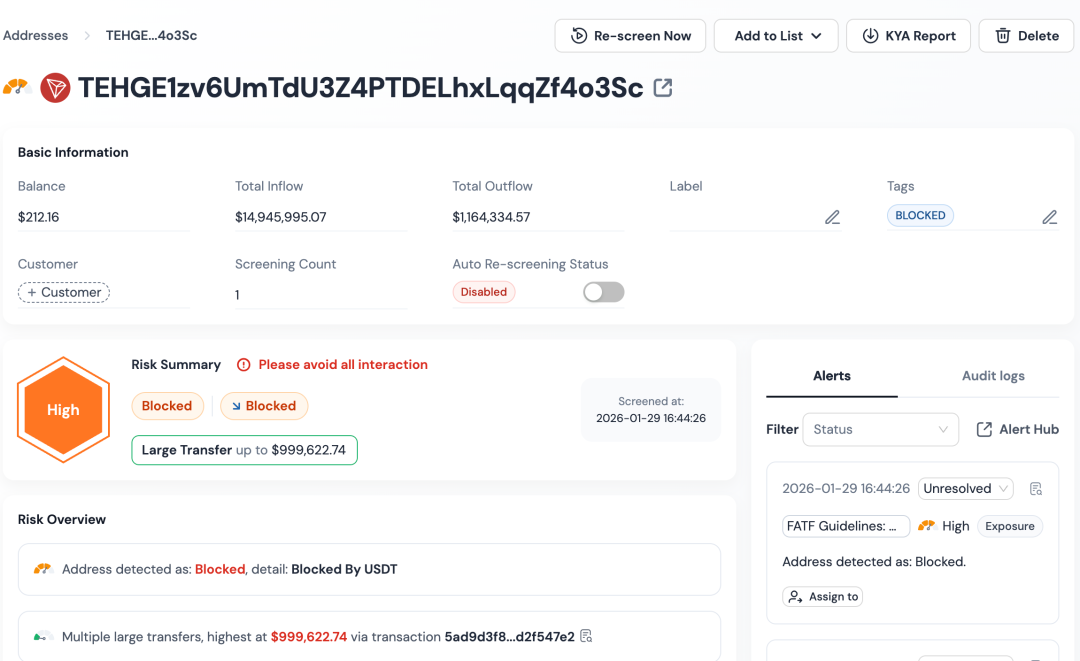

Accurate Pre-Transaction Screening to Avoid Source Risks. Conducting a comprehensive scan of counterparty addresses before a transaction is the first line of defense against freezes. Phalcon Compliance supports instant, registration-free scanning. By inputting an address or transaction hash, users can obtain a risk score. It not only covers the Tether blacklist but also integrates with over 4 million labeled addresses, including the OFAC sanctions list, known scam addresses, and mixer service nodes, achieving full-dimensional risk identification across 20+ blockchains, far surpassing basic screening that only queries contract status.

Real-Time Monitoring During Transactions to Track Dynamic Risks. A single static scan cannot address the dynamic changes in address risks. 33.7% of blacklisted addresses had a zero balance at the time of freezing, meaning the risk exposure occurred after the transaction was completed. Phalcon Compliance's real-time monitoring function can track multi-hop fund flows, processing 500+ transactions per second and analyzing 200+ risk signals. When a counterparty address's risk level changes (e.g., association with a sanctioned entity), alerts are pushed through multiple channels, helping to promptly block risky transactions.

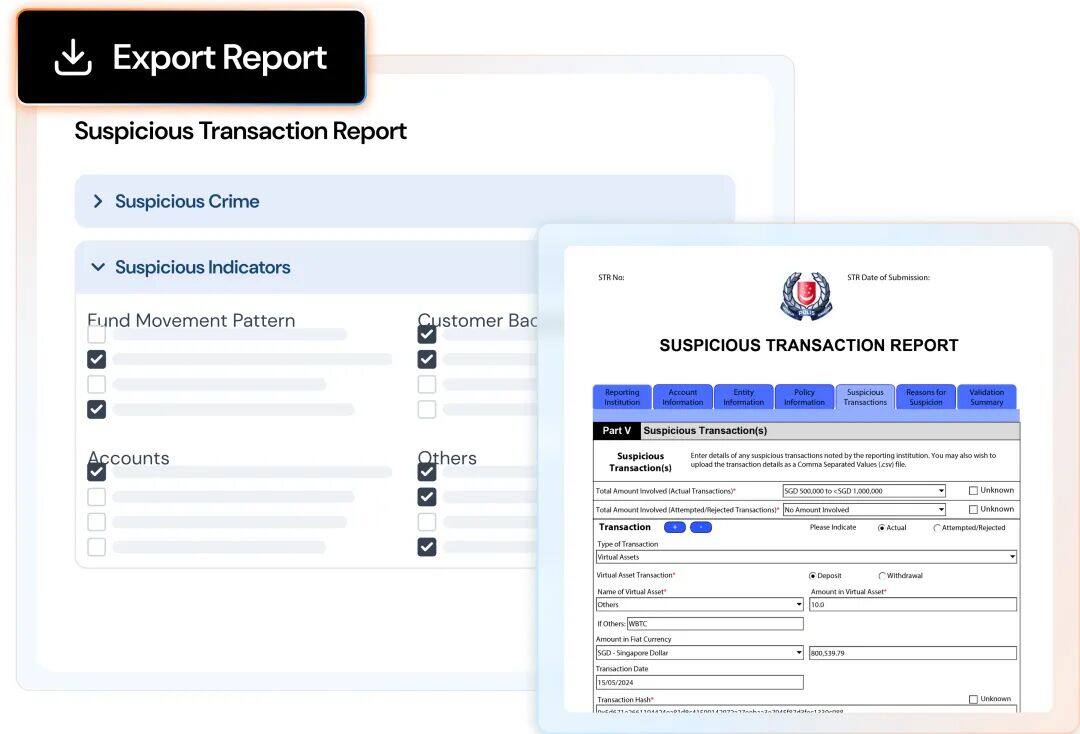

Post-Transaction Compliance Record-Keeping to Solidify the Response Foundation. The platform supports one-click generation of Suspicious Transaction Reports (STR) compliant with FATF standards, adaptable to the regulatory requirements of 27+ jurisdictions, and fully records the entire process of screening, monitoring, and handling. These compliance records become crucial evidence when facing regulatory audits or appeals for mistaken freezes, significantly improving problem resolution efficiency.

4. How to Check if a Wallet is Frozen?

Compared to the complex operation of querying contract status via a blockchain explorer, Phalcon Compliance offers a more convenient and comprehensive method for verifying freeze status, balancing professionalism and ease of use.

Ultra-Simple Operation Process, Results in Seconds. Users do not need to learn how to query contract functions. By directly visiting the Phalcon Compliance product page and inputting the wallet address to be checked, they can quickly obtain the result of whether it is blacklisted by Tether. Simultaneously, it displays associated address risks (e.g., whether it touches the sanctions list, has fund flows with illegal activity addresses), not only indicating "if frozen" but also explaining the "reason for risk."

Full Multi-Chain Coverage, No Blind Spots in Verification. Whether the wallet is in TRC20 or ERC20 format, verification can be completed through the platform, avoiding omissions due to on-chain differences. The platform's millisecond-level API response speed ensures rapid decision-making in urgent scenarios, while also supporting batch query functionality to meet the compliance needs of enterprise-level batch transactions.

5. What to Do If Unfortunate Enough to Be Frozen?

If an address is inadvertently blacklisted, it is crucial to act proactively during the investigation lag period before fund destruction and leverage compliance records to maximize the chances of a successful appeal.

Step 1: Confirm Freeze Status and Associated Reasons. Verify the freeze status via Phalcon Compliance and simultaneously review transaction records to clarify key information such as whether it's due to counterparty address involvement and the legitimacy of fund sources, avoiding blind appeals due to unclear reasons. Note that freezing (addBlackList) and destruction (destroyBlackFunds) are two-step operations; the former is a temporary lock, the latter is permanent disposal. Appeals must be completed before destruction.

Step 2: Initiate Appeals Through Multiple Channels. Prioritize submitting requests through Tether's official channels. Visit the Tether website contact page (https://cs.tether.to) and provide materials such as the frozen address, complete transaction records, and proof of legitimate fund sources. If involved due to a law enforcement investigation, contact the corresponding agency to explain the situation and have them coordinate with Tether for unfreezing—this was the primary path for the 150 successfully unfrozen addresses in 2025. If necessary, hire a lawyer experienced in crypto asset forfeiture to pursue legal recourse.

Step 3: Strengthen Appeal Efforts with Compliance Records. Submit compliance materials generated by Phalcon Compliance, such as address screening reports and transaction monitoring logs, to demonstrate that sufficient due diligence obligations have been fulfilled. In cases of mistaken freezes, this can significantly increase the probability of unfreezing. Simultaneously, be vigilant against scams; any claims of being able to "hack the contract to unfreeze" are fraudulent. The blacklist can only be modified by Tether's multi-signature governance team.

With the implementation of the GENIUS Act, stablecoin issuers are brought under the "financial institution" regulatory framework. The comprehensive compliance deadline before mid-2028 is clear, and Tether's blacklisting operations are highly likely to intensify further. For market participants, building a proactive compliance system with professional KYT tools is not only a necessary means of risk prevention but also a core competency for adapting to the industry's new landscape. BlockSec Phalcon Compliance, with its simple experience, precise risk control, and flexible pricing, provides low-barrier compliance solutions for various entities, helping them navigate steadily through the wave of regulatory escalation.