Bitcoin Briefly Fell Below $72,000, How Much Faith Remains in the Crypto Space?

- Core Viewpoint: Bitcoin's price fell below a key support level, and its decline was synchronized with global risk assets, triggering a "crisis of faith" in its narrative as "digital gold" or a safe-haven asset. Investors are reassessing its role during market turbulence.

- Key Factors:

- Bitcoin broke below the key $72,000 level, with a year-to-date decline of approximately 17%. It has retreated over 42% from its peak in October last year, reaching its lowest price since November 2024.

- This round of decline was driven by cross-asset pressure, moving in sync with the weakness of risk assets like the Nasdaq index. This indicates Bitcoin has not demonstrated independent safe-haven resilience and behaves more like a high-volatility risk asset.

- Market sentiment indicators show "extreme fear," with professional institutions warning that if the $72,000 level is lost, it could drop to $68,000 or even lower.

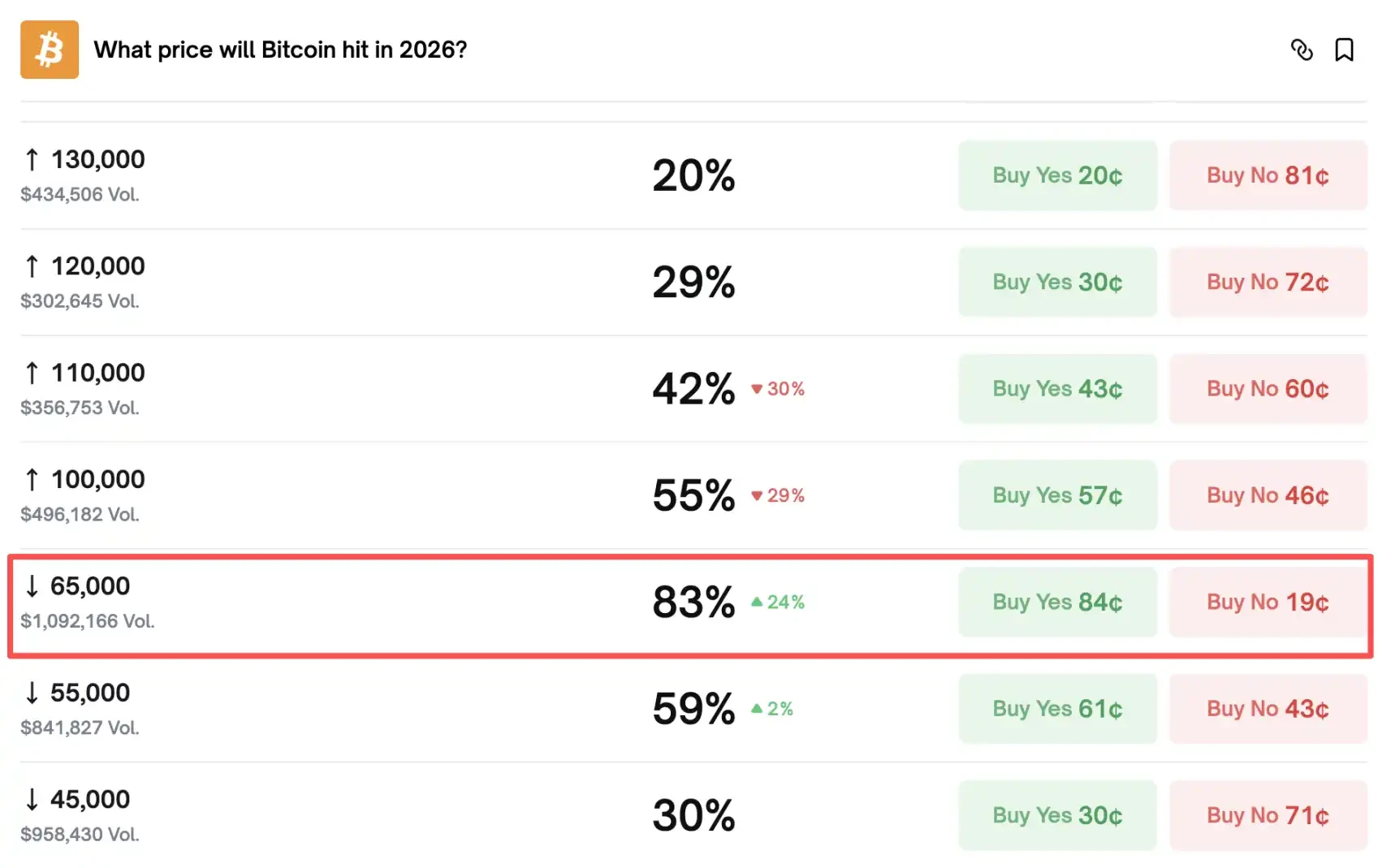

- Prediction market data shows an 83% probability that Bitcoin will fall to $65,000 within the year, with the probability of dropping below $55,000 rising to about 59%.

- The total market capitalization of the crypto market evaporated over $460 billion in a week. Unstable inflows into U.S. Bitcoin spot ETFs have exacerbated market volatility and uncertainty.

Original Author: Yang Chen, Wall Street CN

Bitcoin's fall below the $72,000 mark has brought the issue of 'faith' in the crypto market to the forefront. Against the backdrop of a sharp decline in global risk appetite, investors are reassessing Bitcoin's role during market turbulence, putting its safe-haven narrative to the test.

According to Bloomberg, Bitcoin briefly fell to $71,739 during the New York afternoon session on Wednesday, marking its first dip below $72,000 in approximately 15 months. Compared to its peak last October, Bitcoin has now experienced a cumulative pullback of over 42%, with a year-to-date decline of about 17%, sliding to its lowest level since November 6, 2024.

This round of decline is no longer merely a continuation of internal deleveraging within the crypto market but is driven by broader cross-asset pressures. A synchronized sell-off occurred across global markets on Wednesday, with the Nasdaq 100 Index falling over 2%, putting pressure on more rate-sensitive sectors like software and chips, and Bitcoin weakened in tandem.

On the sentiment front, a 'crisis of faith' is taking shape. Shiliang Tang, Managing Partner at Monarq Asset Management, stated that the market is experiencing a 'crisis of faith'.

Andrew Tu, Head of Business Development at Efficient Frontier, noted that crypto market sentiment is already in 'extreme fear'. If the $72,000 level fails to hold, Bitcoin could potentially test $68,000, or even retreat to the low range seen before the initial rebound in early 2024.

According to Polymarket, there is an 83% probability that Bitcoin will fall to $65,000 this year, while the probability of dropping below $55,000 has climbed to about 59%.

Risk Appetite Plummets, Bitcoin Treated as a 'High-Volatility Risk Asset'

According to Bloomberg, the selling pressure on Bitcoin on Wednesday was related to broader cross-asset tensions rather than being solely driven by internal crypto asset liquidations. This sends a clear message to investors: during a synchronized market sell-off phase, Bitcoin has not demonstrated resilience independent of risk assets; instead, it behaves more like a high-volatility, long-tail risk asset.

The Nasdaq 100 Index fell over 2% on the day, with the weakness spreading to sectors like software and chips. Bitcoin's breach of a key round-number level on the same trading day reinforced the market perception that it moves in sync with risk appetite.

42% Pullback from Peak, Crypto Market Loses Over $460 Billion in a Week

The price pullback is rapidly transmitting through market cap contraction. According to CoinGecko data, the total market capitalization of crypto assets has shrunk by approximately $1.7 trillion since the peak last October. In just the past week, the crypto market's total value has decreased by over $460 billion.

As the largest cryptocurrency, the magnitude and speed of Bitcoin's decline have an 'anchoring effect' on market sentiment. When Bitcoin's year-to-date losses widen to around 17%, pressures from risk control, margin management, and fund redemptions often rise simultaneously, thereby exacerbating overall volatility.

How the 'Crisis of Faith' Emerged: From Liquidation Shocks to Sentiment Collapse

Statements from market participants indicate that sentiment shifts are becoming a core variable. The 'crisis of faith' referred to by Shiliang Tang points to investors' simultaneous wavering in both the long-term narrative and short-term pricing mechanisms of crypto assets.

More crucially, the driver of the decline has changed. According to Bloomberg, previous downturns were more driven by crypto-specific liquidations, whereas Wednesday's pressure stemmed from broader cross-market tensions.

This means that even if the internal deleveraging within the crypto market subsides, Bitcoin may still lack catalysts for an independent rebound as long as external risk assets remain under pressure.

$72,000 Becomes Short-Term Watershed, Prediction Markets Bet on Drop to $65,000 This Year

Several trading-side professionals view the $72,000 level as a critical short-term price point. Andrew Tu pointed out that if this level cannot be held, Bitcoin is 'very likely' to test $68,000 and could potentially return to the low range seen before the initial rebound in early 2024.

According to Polymarket, there is an 83% probability that Bitcoin will fall to $65,000 this year, while the probability of dropping below $55,000 has climbed to about 59%.

The capital flow side is also sending mixed signals. According to data compiled by Bloomberg, U.S.-listed spot Bitcoin ETFs recorded approximately $562 million in net inflows on Monday, but this turned into $272 million in net outflows on Tuesday, indicating that incremental capital is not stable.

Amid the price decline and fluctuating capital flows, market skepticism about Bitcoin's role as a 'safe-haven asset during stress periods' is rising.