The Kevin Warsh Era Begins: Which Assets Will Benefit, and Which Face Revaluation?

- Core Viewpoint: Kevin Warsh's appointment as Federal Reserve Chair signals a shift in the policy paradigm from the traditional demand-side inflation model towards attributing inflation to fiscal expansion and government inefficiency. It places hope in AI technology to boost productivity and strengthen fiscal auditing, thereby reshaping market pricing logic.

- Key Elements:

- Warsh's inflation theory posits that the root cause of inflation is excessive government spending and fraud, not an overheated labor market. This forms the core of his advocated "institutional shift."

- Palantir, as an AI execution tool, is already deeply embedded in the US federal government's (e.g., SBA, Fannie Mae) anti-fraud and expenditure auditing systems, translating Warsh's fiscal discipline philosophy into actionable government capability.

- Warsh views AI as a structural deflationary force capable of increasing productivity and lowering costs, providing a theoretical basis for supporting interest rate cuts even without significant economic cooling.

- Markets will face structural repricing: extremely bullish on AI/semiconductors, bearish on traditional inflation-hedge assets like gold; long-term bullish on crypto assets but constrained in the short term by a "rate cuts without balance sheet expansion" liquidity environment.

- His policy mix (rate cuts + quantitative tightening + strong dollar) will have a divergent impact on global assets, benefiting Japan and South Korea closely tied to the AI supply chain, but putting pressure on emerging markets and Europe.

Original Author: @Globalflows, @aleabitoreddit

Original Compilation: Peggy, BlockBeats

Editor's Note: Kevin Warsh's appointment as Fed Chair impacts far more than just a personnel change; it signifies a shift in the market's very pricing logic. Under Warsh's framework, inflation is being reinterpreted as a problem of fiscal indiscipline and government inefficiency, while AI is seen as a key tool for lowering costs, boosting productivity, and reshaping governance capabilities.

As AI systems like Palantir are deployed in areas such as federal spending audits, housing finance, and medical reimbursements, this institutional pivot is moving from concept to execution, and beginning to manifest in the market as structural differentiation and repricing.

With AI and fiscal discipline becoming central policy themes, the question of which assets will command new pricing premiums and which business models will face systemic revaluation is one the market must now answer. The following is the original text:

The appointment of Kevin Warsh as the new Federal Reserve Chair signals far more than a personnel change; it heralds a deeper shift in the global monetary policy paradigm and the AI arms race. The connection between these two is far more intertwined than most realize.

AI is becoming the sole asymmetric leverage point determining the future landscape, and Warsh's appointment is an institutional arrangement centered around this core objective.

Discussions about him—such as "Will he cut rates?", "Is he a hawk or a dove?", "How will he handle the Fed's balance sheet?"—are certainly important, but they miss a crucial fact: a larger institutional transition is already underway.

The key issue is not short-term policy orientation, but rather *why* Kevin Warsh, and *how* he fits into this emerging new system. Understanding this will be the most critical variable for judgment as we move toward 2026.

From Personnel Appointment to Institutional Signal: Why Warsh?

Warsh is not a traditional "policy technocrat." He has long been seen as someone with a systemic understanding of global capital flows, financial market structures, and institutional incentives.

More importantly, he does not exist in isolation.

Warsh has long maintained close ties with Druckenmiller, Bass, and Karp, all of whom have deep connections with Palantir. Druckenmiller has publicly praised Warsh's understanding of global capital flows and financial market structures on multiple occasions.

In an interview with Bloomberg, Druckenmiller went so far as to call Warsh his "trusted advisor."

But the connection goes further: Druckenmiller himself is an early investor in Palantir and has a close relationship with its co-founder and CEO, Alex Karp. (Related reading: Interview link)

Why is this important? Because Kevin Warsh himself has direct ties to Palantir.

In 2022, Alex and Kevin recorded an interview discussing a world moving toward greater disorder and higher complexity.

As they stated in the interview: "Tomorrow, complexity will take a step-function leap."

This is not an empty statement of techno-optimism, but a forward-looking judgment on the impending changes in national governance, fiscal systems, and the methods of achieving macroeconomic stability.

Palantir: The "Execution Layer" of Institutional Transition

Understanding Warsh requires confronting Palantir.

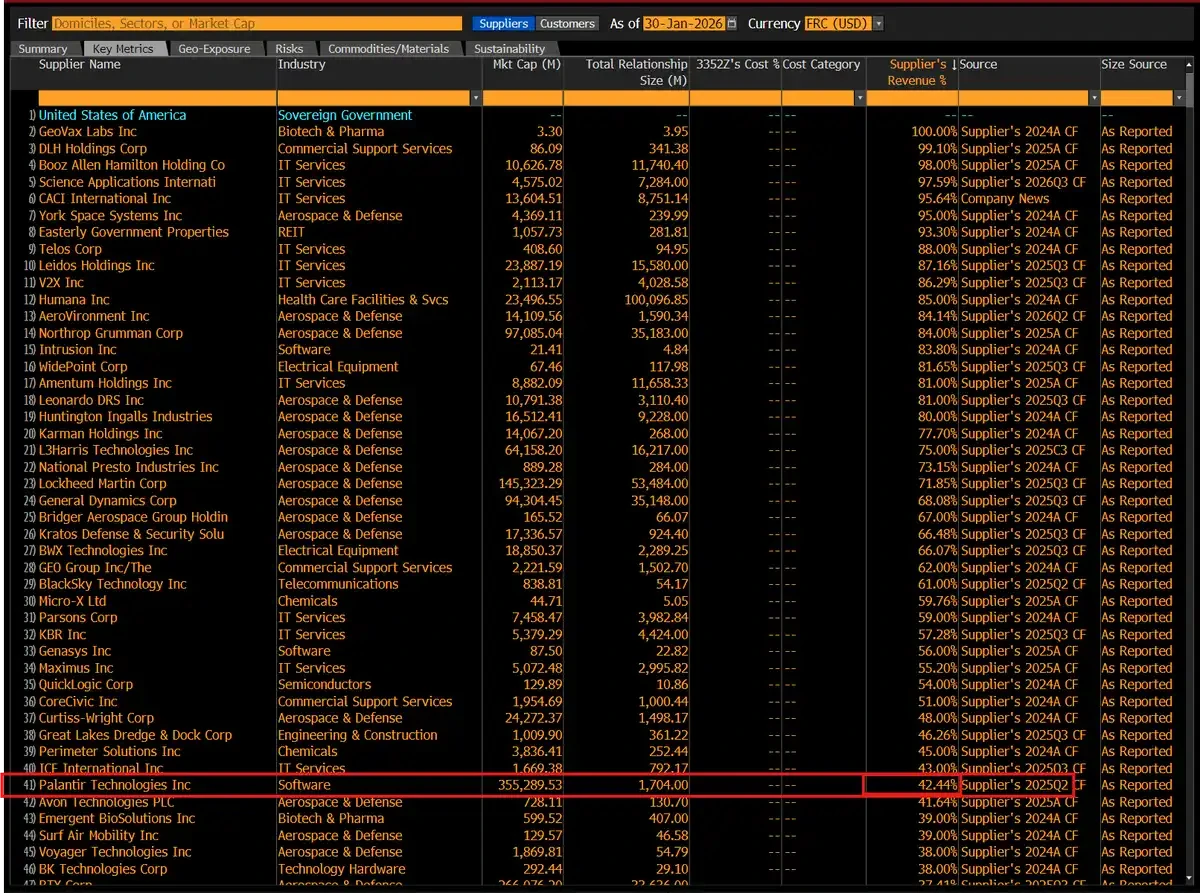

Palantir's critical importance lies in its gradual evolution into the "operational hub" of the U.S. federal government's anti-fraud system. Currently, 42% of Palantir's revenue comes from the U.S. government. Its technology is being deployed across multiple agencies to identify and curb large-scale fraud, as well as excessive and inefficient government spending.

Why is this important?

Because Palantir is being used to systematically address waste and various frauds in government spending. Its technology is being implemented across multiple federal agencies, becoming a key tool for identifying anomalous fund flows and eliminating redundant expenditures.

SBA: From a Single State to a National "Zero-Tolerance" Reckoning

A prime example comes from the U.S. Small Business Administration (SBA).

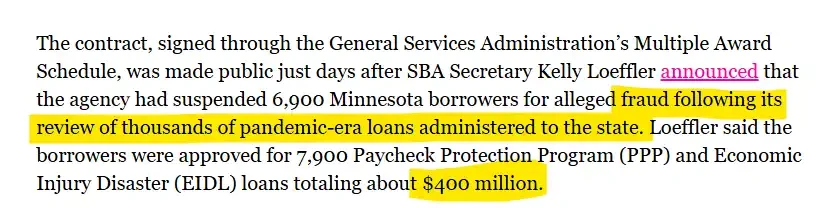

While investigating pandemic-era loan programs, the SBA discovered large-scale irregularities in Minnesota: involving 6,900 borrowers, approximately 7,900 PPP and EIDL loans, totaling about $400 million.

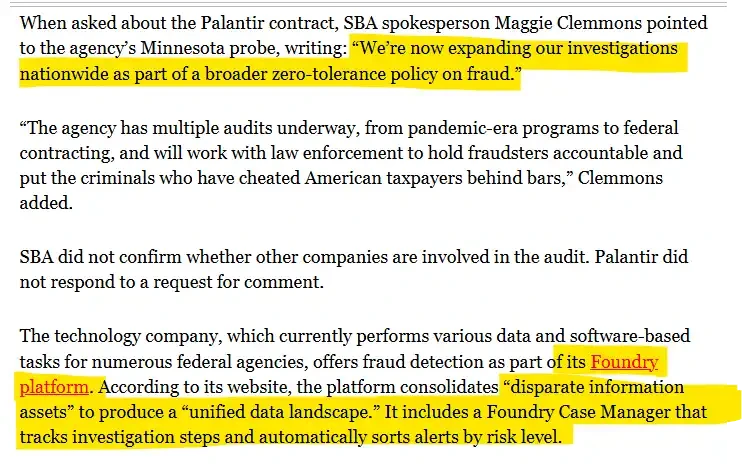

In this context, the SBA brought in Palantir, explicitly stating that the investigation would expand from a single state to a nationwide, "zero-tolerance" systemic anti-fraud operation.

Relevant documents show that Palantir, through its Foundry platform, integrates government data scattered across different agencies and systems, tracks the investigation process, and prioritizes leads by risk level. This means Palantir is no longer just providing analytical tools but is deeply embedded in the federal government's audit and anti-fraud workflow.

Fannie Mae: Systemic Pre-Audit in the Housing Finance System

A similar logic is unfolding in the housing finance system.

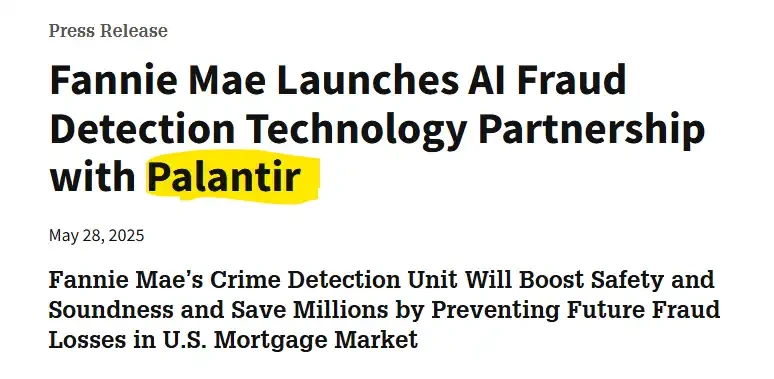

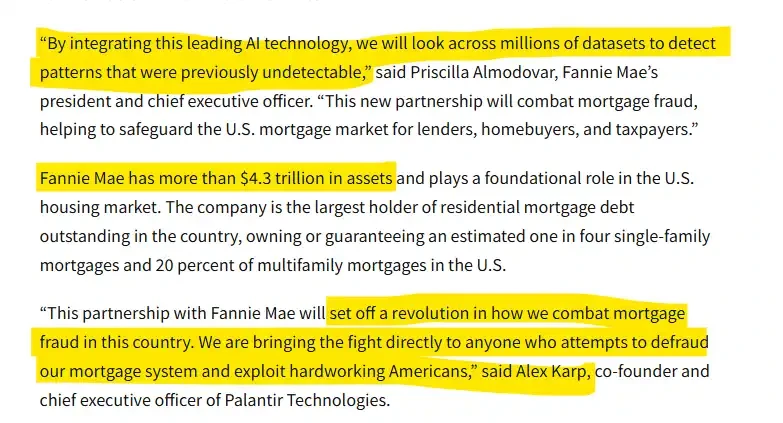

Fannie Mae has formally established an AI anti-fraud technology partnership with Palantir, integrating Palantir's AI capabilities into its crime detection system. This is used to identify previously undetectable fraud patterns within datasets of millions of records, aiming to reduce future losses in the U.S. mortgage market.

The context of this partnership is particularly critical: Fannie Mae manages over $4.3 trillion in assets, holding a foundational position in the U.S. housing finance system, covering nearly a quarter of single-family mortgages and 20% of multifamily mortgages. Fannie Mae emphasizes that this move will enhance the safety and soundness of the entire mortgage market; Palantir CEO Alex Karp stated directly that this collaboration will "change how America fights mortgage fraud," embedding anti-fraud capabilities directly at the system level.

So, what is the "connection" between them? The answer lies in this: the federal government is increasingly deploying Palantir's anti-fraud capabilities across different domains.

This indicates that the "fiscal theory of inflation" advocated by Warsh is not merely academic but is being translated into executable, auditable, and accountable government capabilities through AI systems like Palantir.

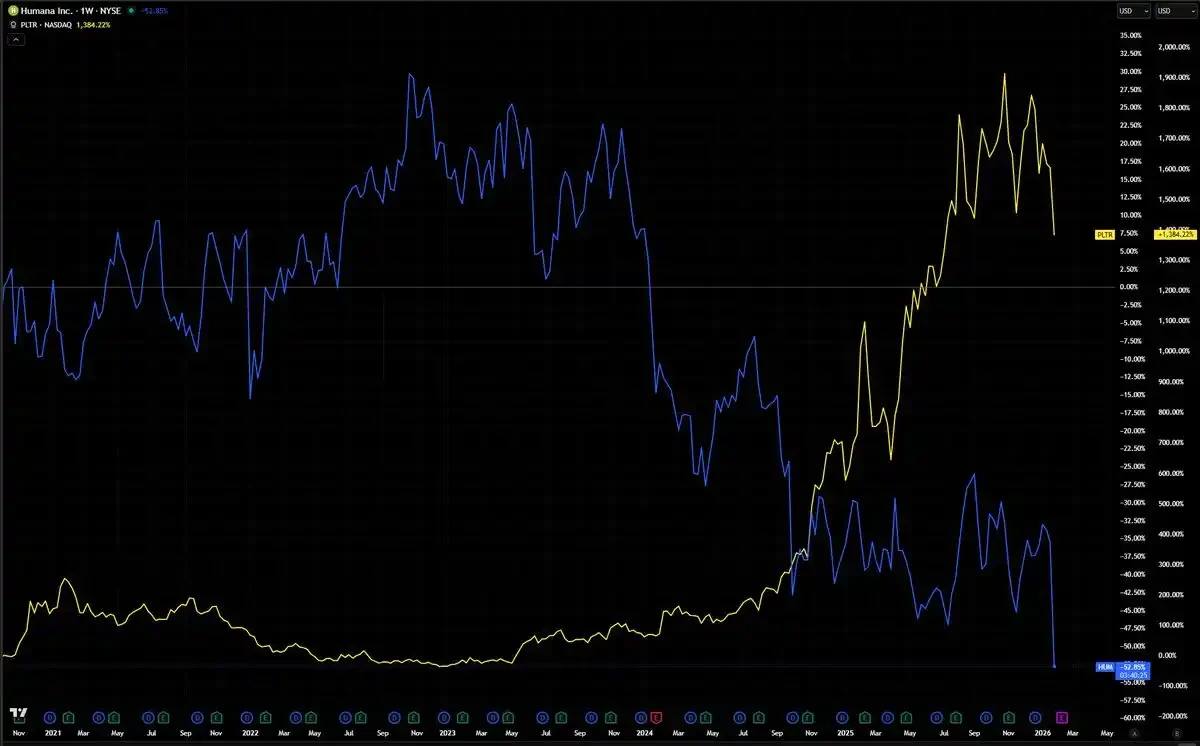

I find one phenomenon very interesting: Humana, a company with government contracts exceeding $100 billion, is one of the government's largest contractors, yet its stock price has been weakening even as Palantir's continues to rise.

Regardless of whether there is a direct correlation between these two stocks, this relative performance is noteworthy in itself. Humana's business model is largely built on the high complexity of the government medical reimbursement system—a complexity historically difficult to audit at scale and systematically. In contrast, Palantir is being increasingly deployed to bring transparency to precisely these kinds of programs.

This divergence may be signaling a broader macro message: the market is repricing two types of companies—those that benefit from opacity and those that provide visibility and transparency. If AI-driven oversight and auditing become the norm for federal fiscal expenditures, this structural change will likely occur not just in healthcare but across more industries.

Humana Inc. can arguably be considered the single largest publicly traded company with the greatest exposure to U.S. government healthcare spending, with Medicare Advantage at its core. Compared to its peers, Humana has the highest proportion of its revenue and profits directly tied to Medicare reimbursement formulas, making it exceptionally sensitive to CMS rate adjustments, audits, and policy changes, with few comparable counterparts.

When AI Meets Inflation: Why This is an Institutional Shift

Kevin Warsh has been calling for a "regime change" at the Federal Reserve for over a decade. But what does that actually mean?

The answer begins with a completely different theory of inflation.

The dominant inflation models within the current Fed mostly originated in the 1970s and remain in use today. These models posit that inflation arises from an overheating economy and excessively rapid wage growth.

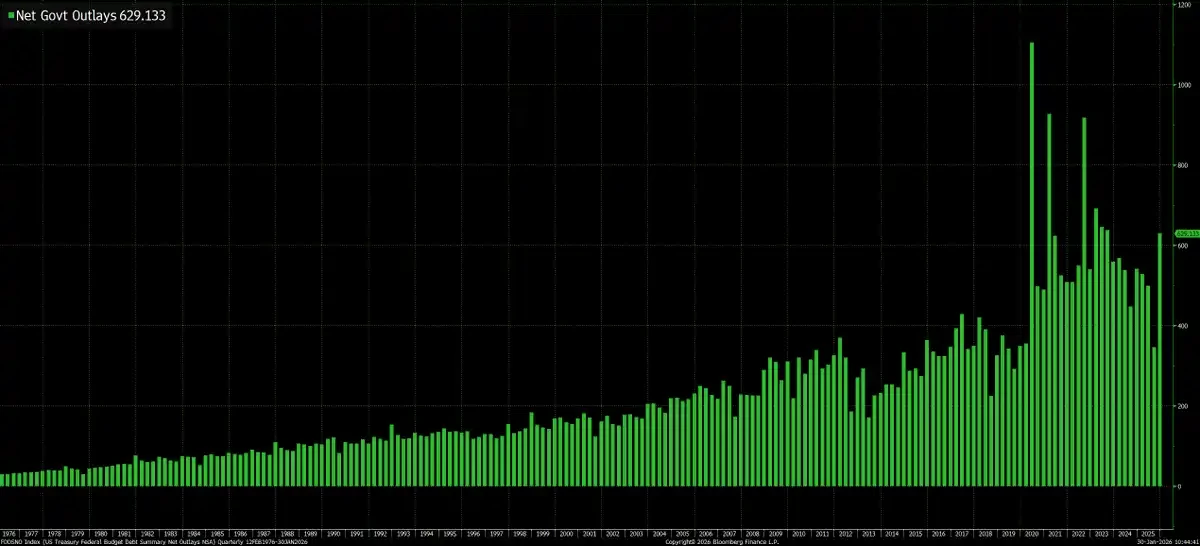

Warsh completely rejects this explanation. In his view, the root of inflation lies not in wages but in the government itself—when the government prints too much, spends too much, and becomes too "comfortable," inflation occurs.

This is not a subtly implied position but one he has explicitly stated multiple times.

This is the true "regime change." It's not about whether the Fed is hawkish or dovish, nor whether rates are raised or cut by 25 basis points. The key is to completely rewrite the Fed's inflation analysis framework, shifting from a theory that attributes inflation to workers and economic growth to a framework that holds government spending itself accountable.

This is where things get interesting.

Warsh is also highly optimistic about AI. In the same interview, he pointed out that AI will lower the cost of almost everything and that the U.S. is at the beginning of a massive productivity boom. He believes the current Fed fails to see this clearly, constrained by old models and misinterpreting economic growth as inflation.

Therefore, on one hand, Warsh sees AI as a structural deflationary force that will continuously lower costs across the economy. On the other hand, he believes the true source of inflation is excessive government spending and fraud—where large amounts of money are injected into the system without corresponding real output.

These two seemingly different judgments converge at the same node: Palantir.

In fact, this regime change is not just about reshaping the Fed itself but about reordering the entire framework through which we understand interest rates, the dollar, and global capital flows.

If Warsh's judgment is correct—that inflation stems primarily from fiscal expansion, not supply-side shocks—then the traditional macro playbook becomes obsolete.

Under this framework, cutting rates no longer signifies a dovish stance but signals policymakers' confidence that fiscal discipline and AI-driven efficiency gains are taking on the primary task of suppressing inflation. The Fed is no longer the antithesis of fiscal constraint but its collaborator.

A Fed that refuses to monetize fiscal deficits while actively supporting fraud reduction and spending compression will create a monetary regime entirely different from the environment priced by markets over the past decade.

This is equally significant at the global level. If the U.S. can demonstrate that AI can be deployed at scale to strengthen fiscal accountability—including cutting waste, identifying fraud, and streamlining government operations—then this model will either be emulated by other developed economies or become something they must compete against.

The so-called AI arms race is not just about chips or model capabilities; it's about who can first use AI to reshape the relationship between government and the economy.

Furthermore, there is the deflationary force of AI itself. Warsh's position is clear: he believes AI will lower costs across the economy, and we are on the cusp of a productivity boom that the current Fed has yet to fully grasp.

If his judgment holds, we will enter an unprecedented phase: structural forces are deflationary (productivity gains from AI), while the sources of inflation are directly targeted and suppressed (government waste and fraud). This would constitute an investment environment not seen since the 1990s.

Old mental frameworks—hawk vs. dove, rate hikes vs. cuts, risk-on vs. risk-off—are insufficient to explain the changes underway.

The real question for 2026 is not where the federal funds rate lands, but whether this alliance truly possesses the capability to execute its grand vision.

How Will Markets Be Repriced After the Regime is Implemented?

Kevin Warsh will become the next Federal Reserve Chair. Markets may instinctively categorize him as a "hawk," but this understanding is inaccurate. As we truly enter 2026, Warsh's policy stance will present more complex and structural characteristics.

The following are the main policy directions he may push, along with the potential impact of these changes on different asset classes:

- AI / Semiconductors ($NVDA, $MU): Extremely Bullish

- Metals (Silver, Gold): Extremely Bearish

- Crypto Assets ($BTC, $CRCL): Seemingly Contradictory, Actually Leaning Bullish

- Banking & Financial Sector ($JPM, $BOA): Bullish

- Housing & Real Estate: Divergent / Uncertain

- Renewable Energy: Bearish

- Small-Cap Stocks ($RUT): Bullish

- International Equities:

- Japan, South Korea: Relatively Resilient

- Emerging Markets (EM): Under Extreme Pressure

- China & Hong Kong: Leaning Bearish

- Europe ($VGK, $EZU): Cautious View

AI / Semiconductors (From NVIDIA to Micron): Extremely Bullish

Warsh is an explicit and consistent AI bull.

In late 2025, he publicly stated that AI is a powerful structural "deflationary" force. In his view, the productivity leap brought by AI allows the economy to maintain high growth without necessarily pushing up inflation.

It is precisely this judgment of a "productivity boom" that provides a solid theoretical foundation for him to support rate cuts even without significant economic cooling.

(*The Fed's Leadership Failure*, The Wall Street Journal, November 16, 2025)

This contrasts sharply with the market's previous stereotype of him—Warsh was often seen as a rigid, high-rate, anti-inflation hawk.

Now, he not only supports rate cuts but explicitly hopes to accelerate the deployment and expansion of AI.

Metals (Silver, Gold): Extremely Bearish

Gold has long been seen as a hedge against a weakening dollar and monetary expansion. But under Warsh's policy framework, this logic is being undermined.

He advocates for shrinking the Fed's balance sheet and ending "money-printing" easing, directly challenging the core rationale for holding gold. Simultaneously, a strong dollar further raises the cost of metals for international buyers.

It should be added that silver's 33% intraday plunge was primarily driven by technical factors like margin-triggered cascading liquidations; the influence of the new Fed Chair is likely a secondary force.

Crypto Assets ($BTC, $CRCL): Seemingly Contradictory, Actually Leaning Bullish

Warsh has bluntly stated: "If you're under 40, Bitcoin is your new gold." In his view, Bitcoin is a legitimate store of value, representing an intergenerational shift from physical precious metals to digital assets.

He also highly praises blockchain, calling it the "newest, most disruptive foundational software," and believes the U.S. must maintain leadership in this field to sustain long-term competitiveness.

But the question is: If the stance is bullish, why is the price under pressure? The reason is the market's growing realization: while Warsh supports lower policy rates, he simultaneously insists on balance sheet reduction and monetary discipline.

This raises a new concern—we might be entering an era of "rate cuts, but without accompanying QE." Borrowing costs may fall, but the "liquidity flood" that has repeatedly pushed Bitcoin to new highs may not reappear.

Thus, a tension forms: Warsh is bullish on crypto assets from a technological and long-term trend perspective, but his monetary constraints may suppress liquidity premiums in the short term.

Banking & Financial Sector: Bullish

With his background at Morgan Stanley and his long-standing criticism of regulatory "mission creep," Warsh has always been a policy figure favored by the banking system. The market widely expects him to roll back some complex bank capital requirements (like Basel III).

Analysts believe this will significantly benefit regional and community banks, as more capital will be freed up for real credit expansion.

Housing & Real Estate: Divergent

Warsh advocates for a significant reduction in the federal funds rate, which would directly lower the cost of **adjustable-rate mortgages (ARMs)** and construction financing.

But the risk lies in this: he explicitly opposes the Fed holding approximately $2 trillion in mortgage-backed securities (MBS). Many economists warn that even if other rates fall, 30-year fixed mortgage rates could still be pushed into the 7%–