"Betting on Madness Not Happening": Vitalik's Prediction Market Trading Strategy

- Core Viewpoint: The core of Ethereum founder Vitalik Buterin's trading strategy on the prediction market Polymarket is to identify and bet on extreme events whose probabilities are overestimated due to market sentiment ("madness mode") not occurring, thereby profiting from the probability gap between rationality and emotion.

- Key Elements:

- In 2025, Vitalik used approximately $440,000 in principal capital to earn about $70,000 in profit through Polymarket. His strategy is based on in-depth research into the market system.

- Using "Trump wins the Nobel Peace Prize" as an example, he pointed out that the market's 15% probability reflects sentiment rather than genuine likelihood. He profited by betting "No".

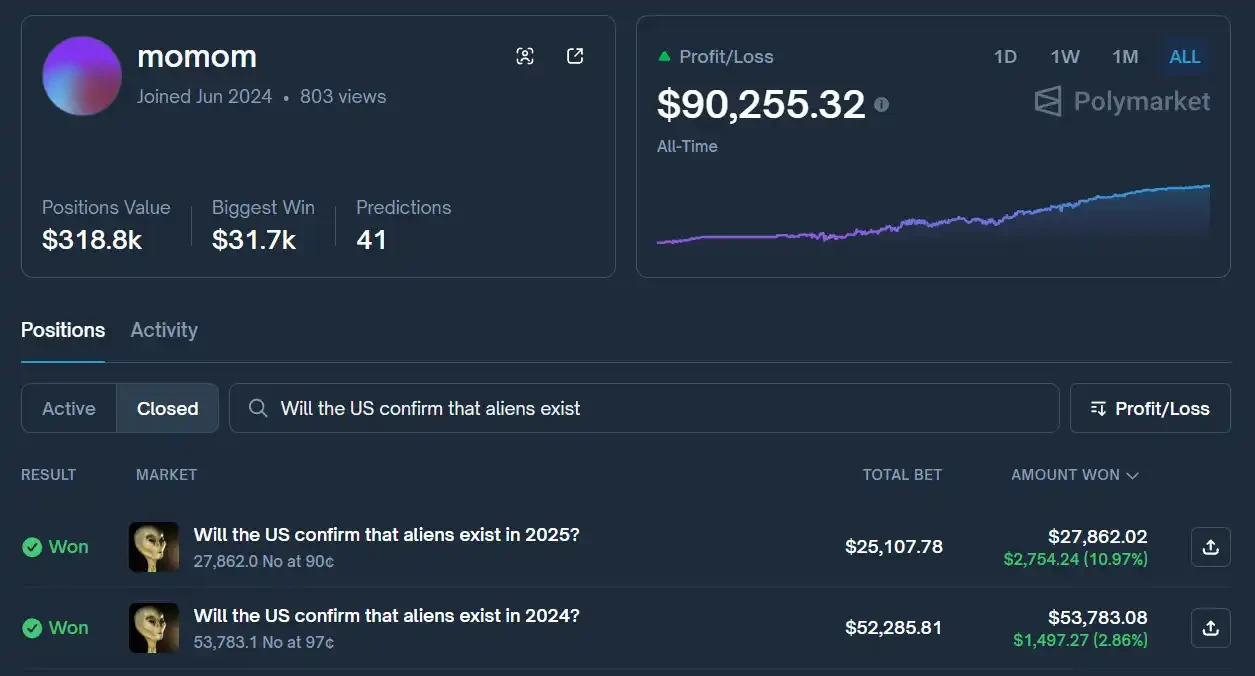

- Analysis speculates that the account "momom" may belong to Vitalik, as its trading logic is highly consistent: over 70% of trades bet on events not happening, and it avoids sectors like coin prices and sports.

- In a specific operation, when the probability for "The US announces the existence of aliens in 2025" was pushed up to 10% due to media reports, he bet "No" and ultimately profited, demonstrating his characteristic of counter-sentiment trading.

- The article points out that in an era of uncertainty, prediction markets instantly convert news and sentiment into price fluctuations, providing rational traders with opportunities for steady profits by betting on overestimated probability events.

"My approach is actually quite simple," said Vitalik Buterin last week when asked how he made seventy thousand dollars in a year. "I look for markets that have already entered 'crazy mode' and then bet—that these crazy things won't happen."

When the World Goes Crazy, Rationality is the Best Arbitrage

At the end of January 2026, in an interview in Chiang Mai, Ethereum founder Vitalik Buterin publicly discussed his trading experience on the prediction market Polymarket: in 2025, using approximately $440,000 in principal, he earned a profit of about $70,000.

While this amount is insignificant for Vitalik, whose net worth is hundreds of millions of dollars, the trading strategy he mentioned in the interview and his understanding of Polymarket's settlement mechanism indicate that he wasn't just "playing around." Instead, he had constructed a very well-developed trading logic after deeply exploring the entire prediction market system.

To make it easier for the audience to understand, he proactively gave several specific examples: for instance, last year's highly controversial Nobel Peace Prize winner. Trump had repeatedly publicly stated that he was the most qualified person to receive the award.

After extensive media coverage, the probability of Trump winning the award once exceeded 15%. Many traders believed that, given Trump's style, he would use various means of coercion and inducement to force the Norwegian Nobel Committee to eventually compromise and award him the prize.

Vitalik's judgment on this matter was straightforward: this 15% was not reflecting the real probability, but rather reflecting sentiment. What I need to do is stand on the opposite side of sentiment and use rationality to profit from that overestimated probability gap.

Starting from "Trump Won't Win the Nobel," Reverse-Engineering Vitalik's Polymarket Account

Based on the clues Vitalik revealed in the interview and Polymarket's mechanism where traders' "records are searchable," we can actually try to sketch a profile of his account: $440,000 principal, $70,000 annual profit, made money by betting that Trump would not receive the 2025 Nobel Peace Prize.

After a round of filtering, two accounts surfaced: momom and terremoto.

Besides matching the principal and profit, their trading logic perfectly aligns with Vitalik's profit system of "shorting sentiment": over 70% of their trades are bets that something won't happen, and there are no trades related to guessing coin prices or sports.

Further on-chain fund tracing revealed that while the total deposit amount for terremoto matched $440,000, the money was split into dozens of small deposits of a few thousand dollars each. Moreover, apart from fund transfers between them, the multiple on-chain wallets had no other activity.

In contrast, momom's on-chain deposits were a few large transfers exceeding $100,000 each. Considering that only 1 trade in momom's account history was a bet on "Yes," and that terremoto's trading frequency was so high it resembled a full-time trader active on the prediction market every day, we ultimately concluded that momom better fits Vitalik's profile.

If momom is Vitalik: What Exactly is His Strategy?

Imagine this: Today is March 3, 2025. As a die-hard Trump supporter, you are absolutely convinced he is different from previous puppet presidents controlled by the deep state. In the year since Trump took office, he has fulfilled various campaign promises (ICE agents patrolling streets to arrest immigrants, imposing tariffs to "protect domestic businesses," etc.).

You also clearly remember him saying during the campaign that he would push for the release of UFO and alien-related documents.

Just yesterday, you saw in a news report that US lawmakers are pushing for new legislation to establish a "UFO Task Force." Someone in the comments mentioned another related news item:

A former US Air Force officer and intelligence official, David Grusch, disclosed that the US government has been running a "decades-long UAP crash retrieval and reverse-engineering program," recovering "vehicles of non-human origin" and "non-human biological remains."

Connecting these clues, you realize something incredible: Trump is highly likely to release the alien files!

At this moment, you see the probability of "Will the US announce the existence of aliens to the world in 2025?" on the prediction market is only 10%. This means Trump has nearly 11 months to release the relevant documents.

"This probability is severely underestimated!" you conclude after gathering information from the news, comments, and even your own searches. Subsequently, you place a bet on "Yes."

This is a bet with a potential return of nearly ten times. You believe this is your most successful investment since the start of 2025. What you don't know is that the counterparty on the other side of the order book is Vitalik.

This was precisely this account's operation in March of last year: amidst a cacophony of market noise and overwhelming related media coverage, he bet at a 10% probability that the US would not announce the existence of aliens within the next ten months. This trade ultimately brought him a 10% profit.

Interestingly, the exact same market has reappeared, and he has again bet that the event will not happen this year. Even as of the time of writing, this trade of his is still at a loss. You could even follow his trade at a lower cost than Vitalik's entry price.

Conclusion

Only one month into 2026, various events that previously seemed impossible have repeatedly dominated headlines across major media outlets: Venezuelan President Maduro was captured by the US like a chicken, taken from his own country onto a helicopter, and transported back to the US; Trump, in his bid to acquire Greenland, didn't even spare NATO allies; the Epstein files mentioned almost every major US political and business figure.

It is undeniable that we are living in an era flooded with uncertainty. Against this backdrop, "it seems like anything could happen."

The emergence of prediction markets directly translates this illusion into probability: every breaking news story, every tweet, every exaggerated media interpretation briefly pushes up the price of "Yes" for a particular market.

And star traders like Vitalik capitalize on this probability overestimation by betting that certain extreme events will not occur. After optimization through well-developed trading systems based on mathematics and statistics, such as the Kelly Criterion, this strategy has become one of the most robust investment methods in prediction markets today.