Bitcoin Continues to Plummet, Will MicroStrategy Be Forced to Sell?

- Core Viewpoint: The Bitcoin market is undergoing a severe stress test from institutional holdings. High-cost, highly concentrated institutional holdings, represented by MicroStrategy and spot ETFs, are collectively in an unrealized loss position. Their potential selling pressure could replace the old "institutional inflow" narrative and become a new source of downside risk for the market.

- Key Elements:

- Bitcoin has broken below the key psychological level of $80,000, hitting a new low since April 7, 2025, with a cumulative recent decline exceeding 30%, indicating a clear lack of market liquidity.

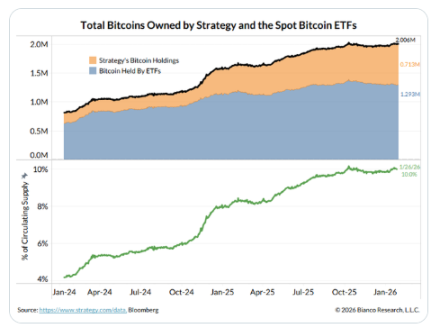

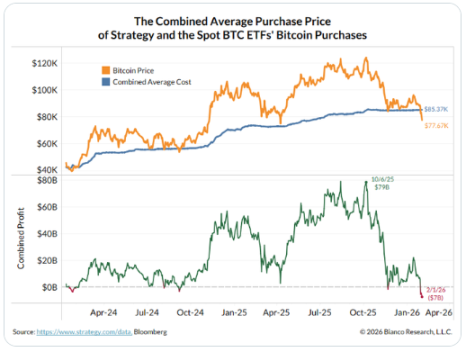

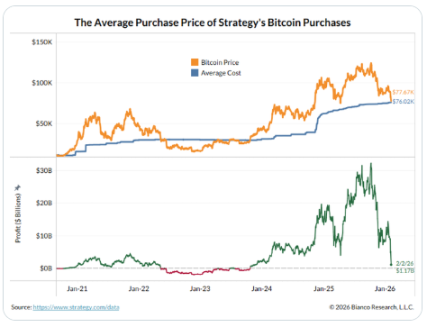

- MicroStrategy and the 11 spot Bitcoin ETFs collectively hold approximately 10% of the circulating supply, with an average cost basis around $85,360, resulting in a total unrealized loss of roughly $7 billion.

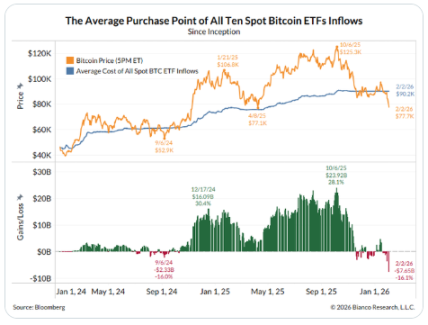

- The average purchase cost for spot ETF investors is as high as $90,200. These ETFs have experienced net outflows for 10 consecutive trading days, with high-cost redemptions amplifying the market's downward volatility.

- MicroStrategy's average Bitcoin cost basis is approximately $76,037, with its unrealized gains narrowing to less than 3%. Its strategy of financing through high-interest (11.25%) preferred share issuance faces cash flow risks.

- Market analysis suggests the old "institutional inflow" narrative has become ineffective. The core issue is the lack of new, sustainable buying momentum. The trapped institutional holdings could reverse into significant selling pressure.

Original Author: Ye Zhen

Original Source: Wall Street News

Bitcoin is undergoing a severe stress test on institutional holdings. As the price falls below key psychological levels, approaching the cost basis of major institutional holders like MicroStrategy, market concerns over liquidity for highly leveraged holders are rapidly intensifying.

Over the weekend, Bitcoin decisively broke below the $80,000 mark, hitting its lowest level since April 7, 2025. This round of selling occurred against a backdrop of significantly thin market liquidity, further exacerbating Bitcoin's recent cumulative decline of over 30%.

Despite the gloomy market sentiment, MicroStrategy Executive Chairman Michael Saylor posted an image with the words "More Orange" on social media platform X on Sunday, hinting at continued accumulation. The company announced a 25 basis point increase in the dividend for its Series A Perpetual Extension Preferred Stock (STRC) to 11.25%, aiming to attract capital at a high financing cost to sustain its Bitcoin acquisition strategy. However, analysis points out that if the price stagnates or falls below its cost basis, the substantial dividend payments could trigger severe cash flow pressure.

Jim Bianco, Macro Strategist at Bianco Research, analyzed that the Bitcoin market is facing a crisis of narrative exhaustion. The current market structure exhibits highly institutionalized characteristics, with ETF investors and MicroStrategy collectively controlling about 10% of the circulating supply, and currently in an overall unrealized loss position. This suggests that the once-supportive narrative of "institutional adoption," after being trapped at high prices, could reverse into a significant source of selling pressure.

Institutional Holdings' Unrealized Losses Worsen, ETFs See Net Outflow Wave

Jim Bianco's analysis shows that Bitcoin is becoming highly "institutionalized," meaning the market can, for the first time, clearly observe the cost basis and profit/loss status of large capital holdings. Currently, MicroStrategy and the 11 spot Bitcoin ETFs collectively hold about 10% of Bitcoin's circulating supply, with a combined average purchase cost of approximately $85,360. At the current price, these institutional holdings are facing an overall unrealized loss of about $8,000 per Bitcoin, with a total unrealized loss amounting to roughly $7 billion.

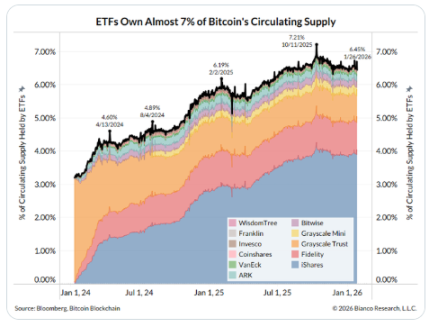

Among them, spot ETFs have become a core force influencing the supply-demand structure. Data shows that the 11 largest spot Bitcoin ETFs hold 1.29 million Bitcoins, accounting for 6.5% of the total circulating supply, with a market value of approximately $115 billion. However, the average purchase cost for these ETF investors is as high as $90,200, and the current price is about $13,000 below their cost basis.

This structure of buying at high levels has led to a typical pro-cyclical effect. Bianco points out that these ETFs have experienced net outflows for 10 consecutive trading days. Investors are choosing to redeem after the pullback from their high-price purchases, and this capital structure is amplifying the market's downward volatility.

MicroStrategy's Safety Margin Narrows, Aggressive Financing Raises Concerns

As the benchmark for corporate Bitcoin holdings, MicroStrategy's balance sheet is facing its most severe test in months. Currently, the company holds 712,647 Bitcoins with an average cost of approximately $76,037. As Bitcoin trades around $78,000, the company's unrealized gains have significantly narrowed to less than 3%.

Despite the thinning safety margin, MicroStrategy shows no signs of retreating. To fund the next phase of purchases, the company adjusted the yield on its STRC product to 11.25%. This return rate represents a huge premium compared to typical corporate bonds, reflecting the company's extreme thirst for capital and the inherent volatility risk of its Bitcoin-centric model. Data shows that since the STRC product's debut in November, sales of this product alone have funded the acquisition of over 27,000 Bitcoins.

Analysis suggests that MicroStrategy remains profitable, but its margin for error has significantly shrunk. If the price falls further, the company will face overall unrealized losses. Maintaining such high-cost dividend payments could create cash flow strain, a risk that becomes particularly acute if the Bitcoin price falls below its $76,000 cost "waterline."

Old Narratives Fail, Market Desperately Needs New Catalysts

From a macro perspective, this sharp decline has intensified the market's disappointment over recent weeks. Jim Bianco believes the real problem Bitcoin faces is a lack of new narratives. The previously highly anticipated "Boomer Adoption" story has already been fully priced in and is even being disproven.

The current market structure shows that ETFs and MicroStrategy not only bought heavily and concentratedly but are also currently trapped overall. Bianco points out that as long as no new, sustainable buying narrative emerges, the trend of capital outflows is likely to continue. In this scenario, the once-bullish high-level institutional holdings could instead become the market's greatest source of pressure. Bitcoin's current problem is not whether people bought in the past, but where the next batch of buyers will come from at the current price level.