In-Depth Research Report on the Stock Contract Sector: The Next Trillion-Dollar Battlefield for On-Chain Derivatives

- Core Viewpoint: Stock perpetual contracts are a key innovation connecting traditional assets with on-chain derivatives. They provide exposure to the price movements of traditional assets like U.S. stocks through synthetic asset forms and are becoming a crucial sector for Perp DEXs seeking growth and driving financial integration. However, their development faces multiple challenges, including underlying mechanisms, market competition, and regulatory compliance.

- Key Elements:

- Fundamental Product Difference: Stock perpetual contracts are on-chain synthetic derivatives tracking stock prices and do not involve real equity ownership; whereas tokenized stocks (RWA) are on-chain certificates representing real equity, placing them in different sectors.

- Core of Underlying Mechanism: Relies on oracles (e.g., Pyth, Chainlink) for reliable transmission of traditional market data and requires intelligent handling of special market structures like the non-24/7 trading hours of U.S. stocks.

- Critical Risk Control Design: Employs dynamically adjusted liquidation and leverage mechanisms (e.g., increasing margin requirements during U.S. market closures) to mitigate risks arising from cross-market volatility mismatches.

- Market Competitive Landscape: Leading Perp DEXs (e.g., Hyperliquid, Aster, Lighter) exhibit differentiated competition in terms of technical architecture, product models, and liquidity strategies.

- Major Regulatory Challenges: Their legal nature may be classified as securities derivatives or Contracts for Difference (CFDs), facing uncertainty regarding inclusion under existing financial regulations.

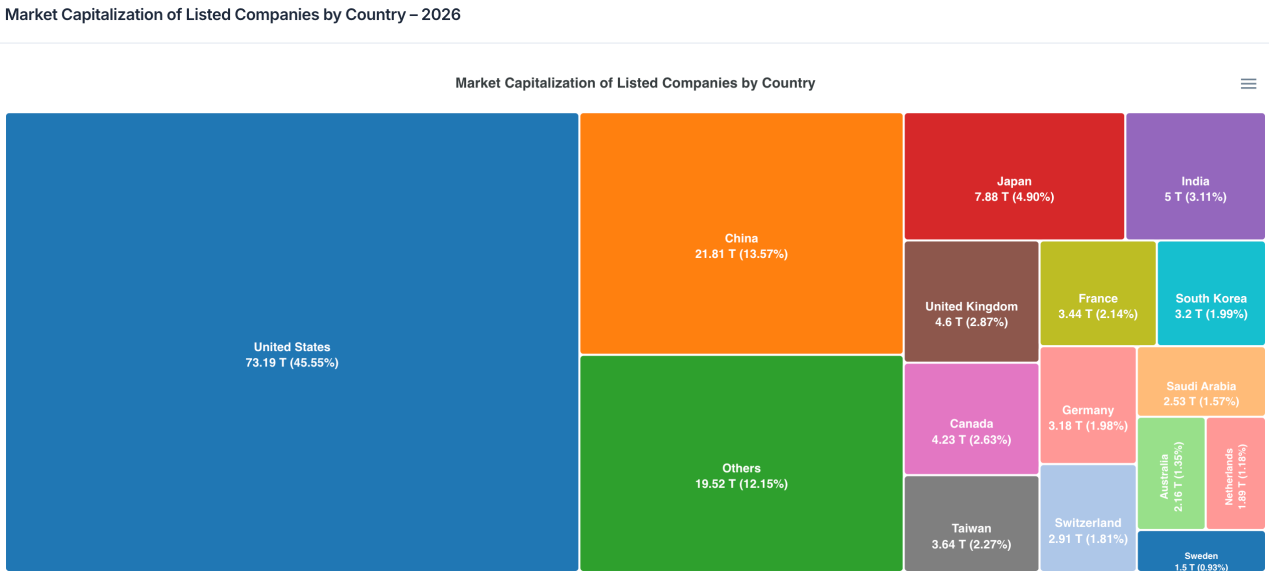

- Immense Market Potential: The total market capitalization of the global listed companies they are anchored to is vast. Even a minuscule participation rate could create a potential market worth hundreds of billions of dollars.

- Future Evolution Direction: Likely to expand from stocks to a full range of asset classes including commodities, stock indices, and forex, becoming a comprehensive derivatives market interface connecting traditional finance with the on-chain ecosystem.

1. Product Essence: Structural Integration of Traditional Assets and On-Chain Derivatives

The essence of stock perpetual contracts is a type of on-chain synthetic derivative that anchors the price fluctuations of traditional stocks. By depositing stablecoin as margin, users gain long or short exposure to the price movements of US stock targets like Apple, Tesla, and NVIDIA, without actually holding the stocks themselves or enjoying shareholder rights such as dividends or voting. This product design cleverly combines the asset base of traditional financial markets with the mature perpetual contract mechanisms of the crypto market, creating a new financial instrument that retains the risk characteristics of stock prices while possessing the flexibility of on-chain trading.

From a product positioning perspective, it is essential to clearly distinguish the fundamental differences between stock perpetual contracts and tokenized stocks (RWA Stock Tokens). Tokenized stocks typically involve a custodian actually holding the corresponding stocks and issuing tokenized certificates on-chain that represent real equity, with their legal attributes and regulatory framework highly consistent with traditional securities. In contrast, stock perpetual contracts do not involve any equity relationship at all; they merely track stock prices through oracles and construct a pure price risk trading market on-chain based on funding rates, margin, and liquidation mechanisms. This difference places them in completely different tracks: the former is a custody and circulation solution for asset tokenization, while the latter is a derivative innovation for risk trading.

The rise of stock perpetual contracts is not accidental but the result of multiple factors working together. From the demand side, there is a long-suppressed global demand for US stock trading—traditional brokerages have cumbersome account opening processes, restricted cross-border capital flows, and fixed trading hours, which starkly contrast with the trading habits of crypto users: "24/7, stablecoin settlement, high leverage flexibility." Stock perpetual contracts provide users with an alternative path to bypass the traditional financial system and directly participate in US stock price volatility. From the supply side, since 2025, the maturation of oracle technology, the proliferation of high-performance blockchain infrastructure, and the intense competition among Perp DEXs have provided the technical foundation and market momentum for the productization of stock perpetuals. More importantly, stock perpetuals stand precisely at the intersection of the two major narrative themes: "RWA (Real World Assets)" and "on-chain derivatives." They possess both the vast capital base of traditional assets and the high-growth potential of crypto derivatives, naturally becoming a focal point of market attention.

2. Underlying Mechanisms: The Triple Challenge of Price, Liquidation, and Leverage

The stable operation of stock perpetual contracts relies on a precisely designed underlying mechanism covering multiple dimensions such as price discovery, asset synthesis, risk control, and leverage management. Among these, the price source (oracle) is the cornerstone of the entire system. Since on-chain protocols cannot directly access real-time quotes from Nasdaq or the NYSE, decentralized oracles must reliably transmit traditional market price data to the blockchain. Current mainstream solutions include Pyth Network, Switchboard, Chainlink, and some protocols' self-developed Oracle systems. Pyth obtains first-hand quotes through direct partnerships with market makers and exchanges, emphasizing high-frequency updates and anti-manipulation; Switchboard provides highly customizable price source aggregation solutions, allowing protocols to switch update strategies based on different time periods; Chainlink relies on a decentralized node network to provide robust, continuous, and verifiable price feeds. A few leading protocols like Hyperliquid employ self-developed Oracles, achieving a higher degree of pricing autonomy through multi-source quote aggregation, internal index construction, and off-chain risk control verification.

The core issues oracles need to address extend far beyond data transmission. The US stock market has unique structural features such as trading hour limitations (not 24/7), pre-market and after-hours volatility, and trading halts. This requires oracles to intelligently handle market state transitions. Mainstream solutions incorporate mechanisms like market open/close markers, TWAP smoothing algorithms, and outlier filtering to ensure that on-chain prices do not detach from their real-world anchors during US market closures, while also avoiding price manipulation risks due to insufficient liquidity. For example, after the US market closes, oracles may automatically switch to a low-frequency update mode or generate an internal reference price based on the last valid price combined with on-chain supply and demand, maintaining trading continuity while controlling tail risks.

At the synthetic asset construction level, stock perpetual contracts do not mint tokens representing real equity. Instead, they create virtual positions linked to the price movements of the underlying stocks through smart contracts. Users deposit stablecoins like USDC as margin to open long or short positions, with their profits and losses entirely determined by the contract price and settlement rules. Protocols use a funding rate mechanism to balance long and short positions—when positions become overly concentrated in one direction, the funding rate incentivizes users to open positions in the opposite direction, keeping the system's overall risk exposure relatively neutral. Compared to crypto perpetuals, the funding rates for stock perpetuals must also consider additional factors like the overnight costs inherent to US stocks and the trading rhythm of the real-world market, resulting in more complex cyclical characteristics.

The liquidation mechanism is the core component of the risk control system for stock perpetuals. Its challenge lies in simultaneously responding to volatility in two asynchronous markets: US stocks trade only during specific hours, while the crypto market operates 24/7. When US markets are closed and the crypto market experiences sharp volatility, the value of a user's collateral can rapidly depreciate, putting their stock perpetual position at risk of liquidation. To address this, mainstream protocols have introduced cross-asset risk engines and dynamic parameter adjustment mechanisms. During US market closures, the system automatically increases the maintenance margin rate, lowers the maximum leverage cap, and advances liquidation thresholds to mitigate gap risk arising from discontinuous information flow. Once the US market opens, risk control parameters gradually return to normal. This design preserves the continuity of on-chain trading while reducing systemic risk from cross-market mismatches through dynamic risk controls.

Leverage design also reflects the differences between traditional assets and crypto products. In crypto asset perpetual contracts, some platforms offer leverage of 100x or even higher. However, in the stock perpetual space, mainstream protocols generally cap leverage between 5x and 25x. This stems from multiple considerations: First, stock prices are influenced by fundamental factors like corporate earnings, macroeconomic events, and industry policies, resulting in a different volatility structure compared to crypto assets. Second, US stocks have special scenarios like gap openings and after-hours trading, where high leverage can easily trigger chain liquidations. Finally, regulators maintain a cautious stance towards equity-linked derivatives, and restrained leverage helps mitigate compliance risks. Even if a platform interface displays a maximum of 20x leverage, the actual available leverage is often dynamically adjusted based on market conditions, underlying liquidity, user position concentration, and other factors, forming a risk control system that is "flexible on the surface, strict at its core."

3. Market Landscape: Differentiated Competition and Ecosystem Evolution of Perp DEXs

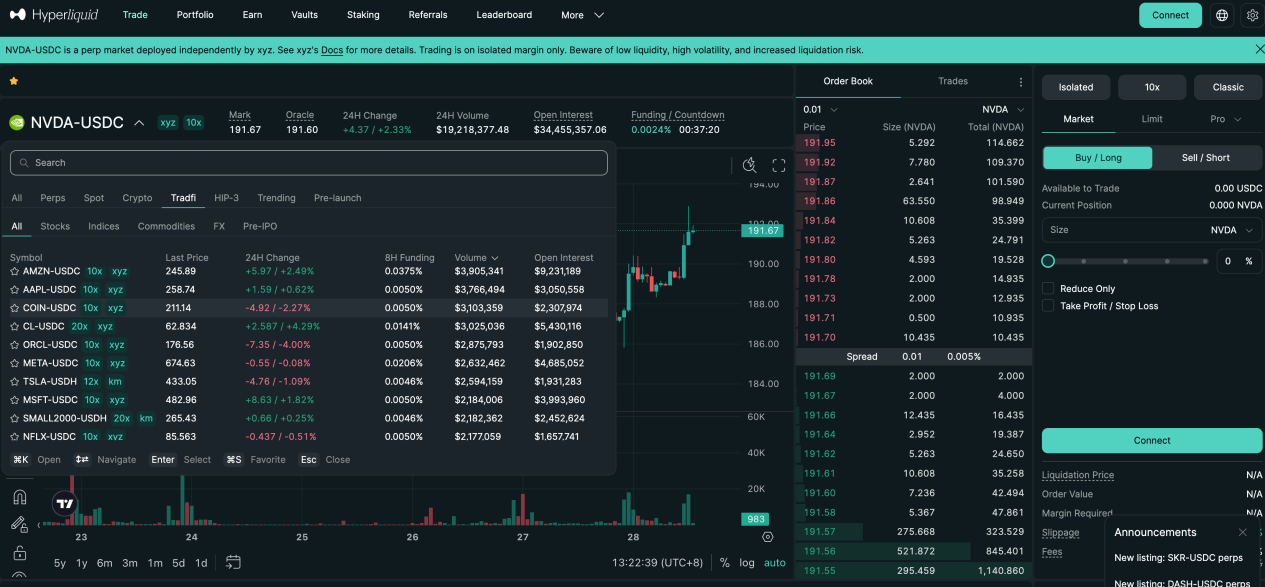

The current stock perpetual contract market has formed a competitive landscape led by Perp DEXs like Hyperliquid, Aster, Lighter, and ApeX, each showing distinct differentiation in technical architecture, product design, and liquidity strategies.

Hyperliquid, leveraging its high-performance self-developed chain and the HIP-3 third-party builder framework, quickly entered the stock perpetual arena through projects like Trade.xyz. Its core advantage lies in its deep order book and institutional-grade liquidity—the XYZ100 (a synthetic contract for the Nasdaq 100 index) can achieve daily trading volumes in the billions of USD, while open interest for commodities like SILVER and GOLD remains stable in the tens of millions of USD. Hyperliquid employs a multi-source median pricing mechanism, synthesizing external oracle prices, internal EMA smoothed values, and order book market prices to generate a robust mark price for liquidation and margin calculations. This dual-channel design of "professional-grade matching + synthetic pricing" strikes a good balance between high-frequency trading and risk control.

Aster innovatively launched a dual-mode parallel architecture—Simple and Pro—catering to users with different risk appetites. The Simple mode uses an AMM liquidity pool mechanism, allowing users to open/close positions with one click and zero slippage, suitable for high-frequency, small-scale, short-term operations, with a stock perpetual leverage cap of 25x. The Pro mode is based on an on-chain order book, supporting advanced order types like limit orders and hidden orders, providing deeper liquidity and more precise strategy execution, with a stock perpetual leverage cap of 10x. Data performance shows that contracts for tech stocks like NVDA under the Pro mode maintain daily trading volumes in the millions of USD, with open interest steadily growing, indicating sustained participation from professional traders. Through this two-tier design of "traffic entry + deep market," Aster effectively segments its user base and expands its ecosystem.

Lighter's core selling point is its zk-rollup provable matching system, where all trading and liquidation processes can be verified on-chain via zero-knowledge proofs, emphasizing transparency and fairness. Its stock perpetuals currently support 10 US stock targets, with leverage uniformly set at 10x, demonstrating a relatively prudent risk control orientation. The liquidity structure shows a clear concentration at the top—COIN (Coinbase) often sees daily trading volumes exceeding tens of millions of USD, while targets like NVDA, though with moderate trading volume, have high open interest, reflecting the presence of medium-to-long-term strategic capital. Lighter strikes a clever balance in user experience: the front-end interaction is extremely simple, suitable for beginners to get started quickly; the underlying layer remains a professional order book, meeting institutional execution needs.

It is noteworthy that the traffic entry points for stock perpetuals are expanding from single official websites to a diversified ecosystem. Based.one provides a more consumer-friendly trading interface by aggregating Hyperliquid's contract engine; Base.app integrates Lighter as a built-in trading module, allowing users to open positions without leaving their wallet; super apps like UXUY further simplify the operational path, packaging stock perpetuals into an experience closer to Web2 products. This division of labor and collaboration between "underlying protocols + application-layer entry points" is lowering the barrier to user participation, driving the evolution of stock perpetuals from niche professional tools to mainstream trading products.

4. Regulatory Challenges: Finding Balance Between Innovation and Compliance

The greatest uncertainty facing stock perpetual contracts comes from the regulatory sphere. Although no specific legislation targeting this product category exists globally, regulatory bodies are already highly attentive to its potential risks. The core issue lies in defining its legal attribute: Do stock perpetual contracts constitute unregistered securities derivatives?

From regulatory practice, the U.S. SEC has consistently applied a substance-over-form principle to derivatives based on security prices. As long as a product's economic substance is highly correlated with regulated securities, regardless of its technical packaging, it may fall under securities law jurisdiction. The European ESMA has also repeatedly emphasized under the MiCA framework that on-chain derivatives anchored to traditional financial assets must still comply with existing financial regulations. This means that although stock perpetuals do not involve real equity custody, their close linkage to US stock prices may lead to their classification as securities derivatives or Contracts for Difference (CFDs), thereby triggering a series of compliance requirements such as licensing, disclosure, and investor protection.

Current regulatory focus remains primarily on products that directly mirror physical assets, like tokenized stocks. However, for "synthetic risk exposure" products like stock perpetuals, regulatory attitudes are still in an observation phase. Possible future regulatory paths include: strengthening the compliance responsibilities of front-end operators (e.g., trading interface providers, liquidity facilitators); requiring transparency of price indices and oracle data sources; restricting high leverage and strengthening KYC and geographic access controls; and explicitly bringing products under existing derivatives regulatory frameworks.

For protocols, strategies to mitigate compliance risks include: clearly distinguishing between "price tracking" and "equity tokens," emphasizing the synthetic and risk-hedging nature of the product; employing multi-source decentralized oracles to avoid suspicions of price manipulation; setting reasonable leverage caps and risk parameters to avoid excessive speculation; and fully disclosing product risks and legal disclaimers in user agreements. In the long run, the compliant development of stock perpetuals may need to explore paths such as partnerships with licensed institutions, servicing restricted jurisdictions, or innovative pilots based on regulatory sandboxes.

Beyond regulatory risk, stock perpetuals face a series of market and technical risks. Oracle failures or malicious manipulation could lead to erroneous liquidations; cross-market volatility mismatches could amplify tail risks; insufficient liquidity could cause extreme slippage and difficulty closing positions; smart contract vulnerabilities could be exploited to cause fund losses. These risks necessitate that protocols establish multi-layered risk control systems, including but not limited to: multi-oracle redundancy and anomaly detection, dynamic margin adjustments, insurance fund buffers, smart contract security audits, and bug bounty programs.

5. Future Outlook: From Niche Innovation to Mainstream Financial Infrastructure

In terms of market size, the potential space for stock perpetual contracts is extremely vast. The total global market capitalization of listed companies is approaching $160 trillion, with non-US markets accounting for over half, forming a massive asset pool of approximately $80 trillion. Even if only a tiny fraction of this capital participates through perpetual contracts, the absolute scale could easily reach hundreds of billions of USD. Considering that perpetual contract trading volume in the crypto market already exceeds three times that of spot trading, stock perpetuals have the potential to replicate a similar trend of derivativeization in the traditional asset space.

In terms of product evolution, stock perpetuals may be just the starting point of a "full-asset perpetualization" wave. As pricing mechanisms, liquidation systems, and liquidity infrastructure mature, macro assets such as commodities (gold, crude oil), indices (S&P, Nasdaq), foreign exchange (EUR, JPY), and even interest rates could potentially be introduced into the perpetual contract framework. Perp DEXs will gradually evolve from crypto-native trading platforms into comprehensive derivatives markets covering multiple asset classes, becoming a key interface connecting traditional finance with the on-chain ecosystem.

The regulatory environment will gradually move from ambiguity to clarity. It is expected that within the next 2-3 years, major jurisdictions will issue classification guidelines and regulatory frameworks for on-chain derivatives, clarifying the compliance boundaries for stock perpetuals. This may bring short-term pain but will benefit industry consolidation and standardized development in the long run. Platforms that can proactively build compliance capabilities, establish risk management systems, and maintain communication with regulators will gain a competitive advantage under the new rules.

In conclusion, stock perpetual contracts are at a critical breakthrough phase from zero to one. They are both an inevitable choice for Perp DEXs seeking new growth narratives and a testing ground for the fusion of traditional assets and crypto finance. Although the path ahead remains filled with technical challenges and regulatory uncertainty, the immense market demand and asset scale they represent determine that this is a track that cannot be ignored. In the future, stock perpetuals may not only become a pillar category in the on-chain derivatives market but also potentially reshape how global retail investors participate in US stock and even global asset trading, truly realizing a borderless, 24/7, and democratized financial market. In this process, protocols that can balance innovation, risk, and compliance are most likely to become the builders of the new era's financial infrastructure.