"JST Q4 2025 Report" Interpretation: Real Ecosystem Revenue Drives Long-Term Deflation, Unleashing Strong JST Token Value

- Core Viewpoint: JUST, a core DeFi project within the TRON ecosystem, has established a value model driven by protocol real revenue for its governance token JST through a large-scale, regular buyback and burn mechanism. This provides solid support for JST's long-term value appreciation.

- Key Elements:

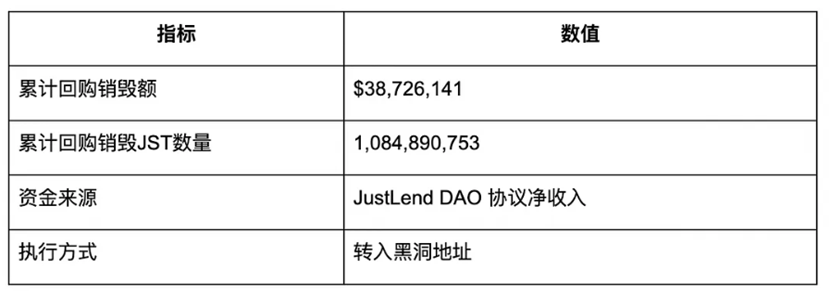

- As of January 27, 2025, JST has completed two rounds of large-scale on-chain buyback and burn, cumulatively destroying over 1.08 billion tokens, accounting for 10.96% of the total supply. The funds invested exceeded $38.72 million, achieving a rigid contraction of the circulating supply.

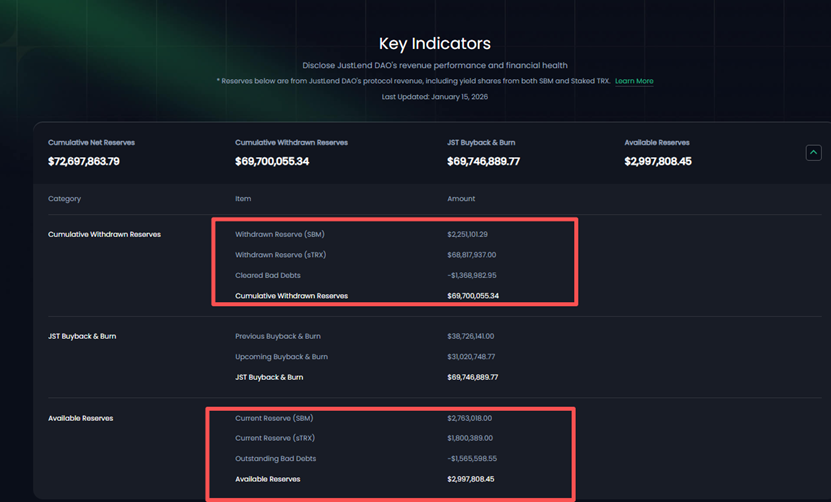

- The buyback and burn funds primarily originate from the net revenue of the core protocol JustLend DAO. With a TVL of $6.81 billion, JustLend DAO extracted $69.7 million in reserve revenue in Q4 2025, demonstrating robust cash flow generation capabilities.

- The price of JST accumulated an increase of approximately 40% after the buyback and burn proposal was passed (October to December 2025), indicating positive market feedback on the deflationary mechanism and value logic.

- JustLend DAO and the USDD official team have launched a transparent disclosure page, publicly sharing core data such as treasury reserves and the buyback fund pool, enhancing community trust.

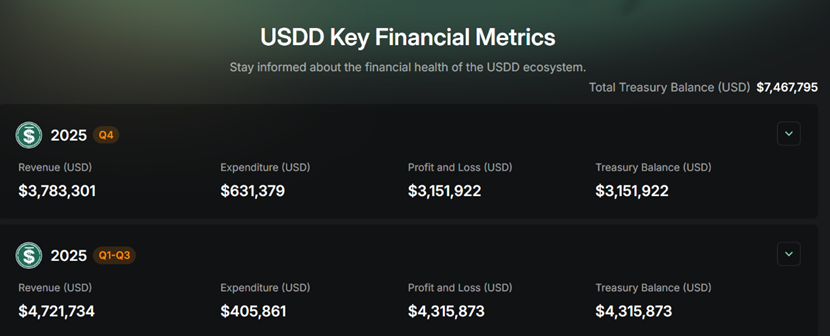

- Excess revenue generated in the future by the decentralized stablecoin USDD ecosystem (total supply exceeding $1.1 billion) will serve as a potential incremental funding source for JST buyback and burn.

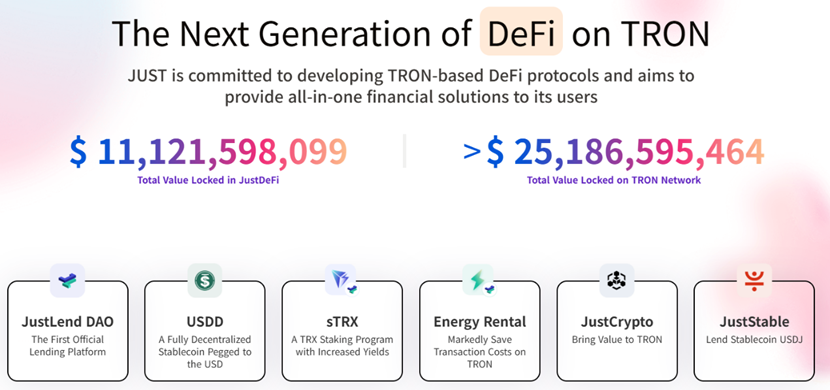

- The JUST ecosystem's TVL has reached $11.1 billion, accounting for 44% of the total TVL on the TRON network. This solid ecosystem foundation provides underlying support for JST's value.

Recently, the overall crypto market has entered an adjustment cycle. However, JUST, a core DeFi project within the TRON ecosystem, has managed to stand out against the trend through the successive execution of large-scale JST token buyback and burn actions, becoming a focal point in the crypto market.

On January 28, the "JST Q4 2025 Report" was officially released, systematically disclosing key information such as the operational progress of the JST governance token, its ecosystem value empowerment strategy, and the quarterly revenue performance of the core protocol JustLend DAO. This clearly outlines the panorama of ecosystem development for market participants and releases a clear long-term value signal.

The fourth quarter of 2025 marked a significant milestone for the development of the JST token. The team successfully facilitated the complete implementation process of the JST buyback and burn mechanism, from proposal voting to execution, and smoothly carried out two rounds of buyback and burns. This officially heralds JST's entry into a new phase of regular deflation and opens a new chapter for its value growth.

As of January 28, JST has completed two large-scale on-chain buyback and burn rounds, with a cumulative burn volume exceeding 1 billion tokens, accounting for 10.89% of the total token supply. Behind this steady and orderly burn action is JustLend DAO's core driver of real ecosystem revenue, directly empowering token value with protocol earnings to establish a positive, virtuous cycle of revenue-driven deflation. On this foundation, the value effect of the JST deflation model is fully unleashed, and the continuously realized deflationary dividends have solidified the developmental foundation for JST's value.

JustLend DAO, as the core supplier of funds for the current JST buyback and burn, plays a key role in the implementation of the deflation mechanism. Relying on its diverse product matrix including lending, staking, and energy rental, JustLend DAO achieves sustained and stable profitability. The real protocol revenue generated is fully allocated to JST buyback and burns, not only laying a solid foundation for JST's long-term value growth but also directly demonstrating the stability and sustainability of the protocol's profitability. This series of actions not only showcases JustLend DAO's strong cash flow generation capability to the market but also releases a core signal: JST's value growth is not based on hype but is supported by solid underlying economic fundamentals, with its long-term development potential receiving a hardcore endorsement from real ecosystem revenue.

Cumulative Burn Volume Across Two Rounds Exceeds 1.08 Billion Tokens, JST Token Deflation Effect Fully Strengthened

According to the "JST Q4 2025 Report," the quarter consistently focused on building JST's long-term value and the ecosystem's sustainable growth, deepening core business operations, refining the ecosystem layout, and prioritizing the implementation of the JST buyback and burn mechanism and the establishment of a transparent on-chain disclosure system. Significant phased results have already been achieved.

Currently, the JST buyback and burn mechanism has achieved quarterly, orderly, and regular stable execution. This mechanism is driven by the core engines of real revenue from the core protocol JustLend DAO and the stablecoin USDD, promoting the smooth implementation and stable operation of a long-term deflation mechanism. It continuously unleashes the long-term value potential of the JST token, laying a solid ecological foundation for its steady value appreciation.

Reviewing the implementation timeline: On October 21, 2025, the JustLend DAO community officially passed the JST buyback and burn mechanism proposal. It clearly stipulates that the protocol's existing revenue, future net income from JustLend DAO, and the portion of multi-chain USDD ecosystem revenue exceeding $10 million will be fully used for JST buyback and burns.

Following the proposal's passage, the JustLend DAO ecosystem's decentralized community organization, Grants DAO, acted swiftly. It immediately withdrew over 59.08 million USDT from the protocol's existing revenue and formulated a phased execution strategy of "30% for immediate first-round burn + 70% for interest-bearing quarterly burns." Simultaneously, it completed the first round of JST burns, destroying approximately 560 million JST tokens, accounting for 5.66% of the total token supply, with an investment of about $17.72 million. This series of actions marked the substantive implementation phase of the mechanism linking JUST ecosystem protocol revenue to JST token value recycling, laying a solid foundation for subsequent quarterly and regular buyback and burn operations.

On January 15 of this year, JST underwent its second large-scale buyback and burn round. This round destroyed a total of 525 million tokens, accounting for 5.3% of the total token supply, corresponding to a token value of approximately $21 million. This burn not only effectively continued JST's stable and orderly buyback and burn rhythm but also demonstrated strong momentum in capital investment—actual invested funds increased by nearly $4 million compared to the first round, pressing the "accelerator" for deflationary dividend release. This fully demonstrates the project's firm determination and substantial financial capability in executing deflation.

As of January 27, JST has successfully completed two large-scale on-chain buyback and burn rounds, with a cumulative burn volume exceeding 1.08 billion tokens (specifically 1,084,890,753 tokens), accounting for 10.96% of the total token supply, corresponding to over $38.72 million invested in buybacks. Such a large-scale on-chain deflation operation is extremely rare in the history of cryptocurrency development.

The successful completion of the two large-scale buyback and burn rounds has achieved a rigid contraction of the JST circulating supply, with significant deflationary results. The destruction of over 1.08 billion tokens reduced the total JST supply from 9.9 billion to approximately 8.815 billion. Crucially, JST has long achieved 100% full circulation, with no unlocked tokens remaining. This means every token burned represents real deflation of the actual circulating supply, making the deflation effect solid and effective. It continuously optimizes the supply-demand structure, strengthens token scarcity, thereby propelling JST's value onto a long-term upward trajectory.

This series of buyback and burn operations not only significantly reduced the scale of the JST circulating supply in the short term but also sent a clear signal to the market about the project's firm commitment to value feedback. With the regular operation of the deflation model, JST's deflationary effect is fully unleashed, and its long-term value support is further consolidated.

Simultaneously, JST's market performance fully confirms the positive results of ecosystem development and the deflation mechanism, with the implementation receiving positive market feedback. Since the buyback and burn proposal passed on October 21, 2025, JST's price began a sustained upward trend from 0.032 USDT, soaring to a high of 0.045 USDT on December 3 of the same year, representing a cumulative increase of approximately 40%. This trend directly reflects the market's high recognition of JustLend DAO's stable operational capability and JST's long-term value growth logic. As of January 27, the total JST token supply is approximately 8.815 billion tokens, with the latest price at $0.044, corresponding to a total market capitalization of about $387 million.

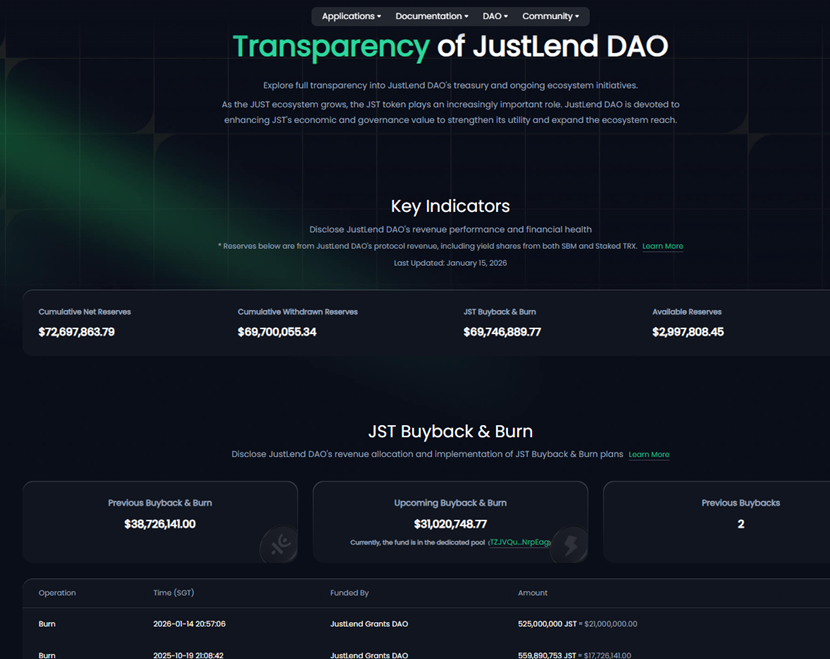

Furthermore, in terms of ecosystem transparency construction, not only have details of reserve treasury assets been disclosed, continuously improving the on-chain disclosure system to allow community users to clearly grasp the full picture of treasury funds, but JustLend DAO and the official USDD platform have also officially launched dedicated "Financial Operational Metrics (Transparency)" disclosure pages. These pages centrally display core data such as protocol treasury reserves, JST buyback and burn fund pool balances, executed buyback amounts, and full on-chain transaction records, achieving one-stop visual presentation of core operational data. This helps community members track the entire process execution dynamics of protocol revenue accumulation, fund allocation, and buyback and burns in real-time.

JustLend DAO Cash Flow Engine Operates Steadily, Fortifying the Foundation for JST's Long-Term Value

As the core "cash flow engine" of the JUST ecosystem, JustLend DAO continuously expands revenue channels and enriches user application scenarios through a series of structured product matrices. Currently, the JustLend DAO product matrix encompasses lending SBM, liquid staking sTRX, Energy Rental, and the GasFree smart wallet, among others. Leveraging these products, JustLend DAO has achieved steady growth in cash flow, providing a continuous stream of financial support for JST buyback and burns, thereby laying a solid foundation for the long-term value of the JST token.

The value foundation of the JST token lies in the underlying JUST ecosystem. As a one-stop DeFi solution within the TRON ecosystem, JUST has established a complete and mature DeFi ecosystem, encompassing core lending protocol JustLend DAO, decentralized stablecoin USDD, staking product sTRX, Energy Rental, and cross-chain product JustCrypto, among other diverse on-chain financial tools. It can one-stop meet users' full-scenario needs from asset appreciation to flexible allocation. According to the latest official data on January 28, the total value locked (TVL) across the entire TRON network has reached $25.1 billion, with the JUST ecosystem's TVL at $11.1 billion, accounting for 44%, firmly holding a core position within the TRON ecosystem.

Within the JUST ecosystem, JustLend DAO is the core hub for cash flow creation and value capture. By integrating a diversified product matrix including lending SBM, liquid staking sTRX, Energy Rental, and the GasFree smart wallet, it continuously provides core momentum for the diversified growth of ecosystem revenue.

According to the JST buyback and burn mechanism, its funds primarily come from two core segments: first, the existing revenue and future net revenue of JustLend DAO; second, the excess revenue from the USDD multi-chain ecosystem exceeding $10 million. Currently, the relevant revenue from the USDD multi-chain ecosystem has not reached the set standard. Therefore, the funds for JST buyback and burns are primarily fully supported by the JustLend DAO protocol.

In terms of buyback and burn execution, the JustLend DAO project demonstrates strong execution capability and financial backing. Compared to the first round's investment of $17.72 million, the second single-round burn directly invested approximately $21 million. These funds were sourced from JustLend DAO's Q4 2025 net income and historical carried-over income, showing a clear acceleration compared to the planned pace. According to the plan, the remaining 70% of existing revenue from the first round was to be used for buybacks over four quarters, with an expected quarterly investment of $10.34 million. The investment amount for the second burn far exceeded this expectation. This indicates that JustLend DAO's net income in Q4 also exceeded $10 million, showcasing its powerful profitability.

According to official website data, in Q4, the total value locked (TVL) on the JustLend DAO platform reached as high as $6.81 billion, ranking among the top three globally in the Lending sector, covering over 480,000 users, demonstrating its strong competitiveness and broad influence in the market. Simultaneously, various business segments of JustLend DAO performed excellently:

- SBM Market Performance Stands Out: Deposit size is approximately $4.03 billion, borrowing size is about $205 million, with total borrowing volume increasing by over 35% quarter-over-quarter. According to DeFiLlama data, the interest fees captured by SBM in Q4 2025 reached $2.2 million, hitting a historical high, reflecting the continuous expansion of lending business scale. This growth trend not only reflects high market demand for the SBM product but also indicates JustLend DAO's strong operational capability and market expansion ability in the lending business domain.

- Active User Participation in sTRX Liquid Staking: The amount of TRX staked reached approximately 9.32 billion tokens, with cumulative participating users exceeding 13,600. The active participation of numerous users not only brings stable capital inflow to JustLend DAO but also further enhances the ecosystem's vitality and stability.

- Continuous Optimization of Energy Rental Service: Through multiple fee adjustments and lowered usage thresholds, the minimum deposit has been reduced to 20 TRX, further solidifying its infrastructure position in the resource market and promoting efficient allocation and utilization of resources within the ecosystem.

In terms of revenue data, according to the Transparency page, JustLend DAO's cumulative net revenue has reached $72.69 million. In Q4 2025, a cumulative reserve revenue of $69.70 million was extracted from the protocol, with over $68.81 million extracted from the sTRX segment and $2.25 million from the SBM segment. Currently, the remaining revenue reserve on the JustLend DAO platform is approximately $2.99 million, with $1.8 million available in sTRX reserves.

From a revenue structure perspective, the liquid staking product sTRX has become the core segment for JustLend DAO to obtain stable revenue and distribute protocol income, and is also a key source of funds for JST buyback and burns. This revenue structure lays the foundation for the platform to achieve stable, sustainable revenue growth, continuously empowering long-term ecosystem development.

According to disclosures in the "JST Q4 2025 Report," the JustLend DAO treasury and JST buyback and burn reserve addresses collectively hold 130 million sTRX and approximately 2.1 billion jUSDT. These reserve assets not only provide ample financial security for JST buyback and burns but also form a solid material foundation for the stable development of the JUST ecosystem.

The team will strictly fulfill community governance commitments, prioritizing the execution of JST buyback and burns with existing revenue according to the established plan. Following the completion of the first two buyback and burn rounds, relevant addresses still retain equivalent assets worth $31.02 million, which will be executed in phases subsequently, continuously injecting momentum into JST value enhancement and ecosystem development.

JUST Ecosystem Synergy Deepens Continuously, JST Value Growth Potential Promising

Today, JustLend DAO is using a transparent and sustainable buyback and burn mechanism to directly return ecosystem development dividends to JST holders through the deflation effect. Supported by hardcore real revenue and empowered by clear value logic, JST has transcended being a single-function utility token to become the core carrier of the JUST ecosystem's growth value. Its future growth potential deserves long-term market anticipation.

According to predictions in the "JST Q4 2025 Report," based on JustLend DAO's revenue situation, approximately $21 million is expected to be invested in JST buyback and burns in Q1 2026, with the sTRX business expected to contribute $10 million in revenue. The specific burn scale will be dynamically adjusted based on the actual operating conditions of the quarter.

As an important incremental source of funds for future JST buyback and burns, the decentralized stablecoin USDD ecosystem is growing rapidly. Its total supply has now exceeded $1.1 billion, and the platform's TVL has surpassed the $1.3 billion mark, reserving sufficient momentum for the continuous strengthening of the JST deflation mechanism. As of January 27, the cumulative treasury revenue of USDD has reached $7.4678 million. With the continuous expansion of the ecosystem landscape, the excess revenue generated by USDD in the future will become another important incremental funding source for JST buyback and burns, further strengthening the JST deflation effect and continuously empowering token value appreciation.

Thus, JST has formed a deeply bound value closed loop with the protocol revenue of the JUST ecosystem. In this value loop, the stable development of JustLend DAO and USDD provides hardcore support for JST token value appreciation, while the value growth of the JST token further attracts global users to participate in ecosystem construction, feeding back into the business expansion and revenue growth of both. This virtuous cycle within the ecosystem not only injects strong endogenous momentum into the sustained development of the JUST ecosystem but will also lay a solid foundation for the long-term prosperity of the TRON ecosystem, helping to advance the process of ecosystem development within the cryptocurrency industry.

In the future, with the continuous expansion of the JUST ecosystem and the deepening of internal synergy, the funding pool injected into the JST deflation mechanism is expected to achieve continuous expansion. Ultimately, this will construct a positive reinforcement loop of ecosystem expansion → revenue increase → deflation acceleration → value appreciation, continuously raising the ceiling for JST's long-term value.