It's not difficult for data projections to show Polymarket's annual revenue exceeding 100 million, with the premise being...

- Core View: Polymarket has begun charging trading fees for its "15-minute cryptocurrency price movement" markets for the first time. Preliminary data indicates that the prediction market model possesses significant and sustainable revenue potential. As the fee scope expands and the platform grows, its revenue scale is expected to increase substantially in the future.

- Key Elements:

- Since implementing fees on January 6, Polymarket has accumulated approximately $2.19 million in transaction fees. Static projections suggest an annualized revenue of around $38 million.

- Over the past week, the trading volume of fee-charging markets (approx. $159 million) accounted for 9.1% of the platform's total trading volume (approx. $1.75 billion). If fees were applied platform-wide, the static annual revenue ceiling could reach approximately $418 million.

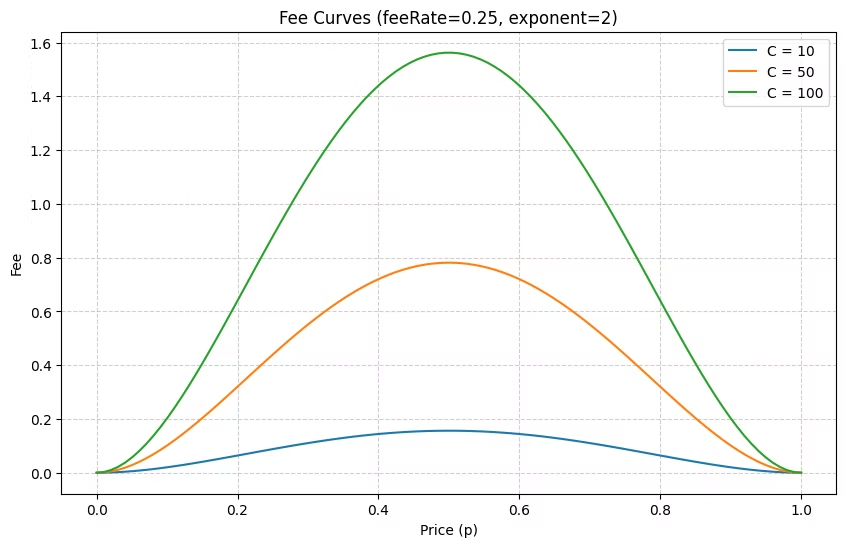

- The fee mechanism is dynamic; the closer the odds are to 50%, the higher the fee, with a maximum of 1.56%. The US market has a fixed fee of 0.01%.

- Polymarket previously operated for an extended period in a free and loss-making state. This move to charge fees marks a shift in its business model.

- The platform is still in a growth phase. Future trading volume may continue to increase with events like the 2026 FIFA World Cup, US midterm elections, and broader market concept adoption.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

On January 6th of this year, Polymarket officially began charging trading fees for markets related to "15-minute cryptocurrency price movements." The specific fee percentage fluctuates with the market's real-time odds — the closer the odds are to 0% or 100%, the lower the fee; conversely, the closer the odds are to 50%, the higher the fee, with a maximum of 1.56%.

This marks the first time, apart from the US market (where Polymarket charges a 0.01% fee), that Polymarket has ended its completely free model and started charging trading fees for a specific type of market. Now, three weeks have passed, providing a sufficient observable data sample. It's time to make a rough estimate of Polymarket's revenue-generating capability.

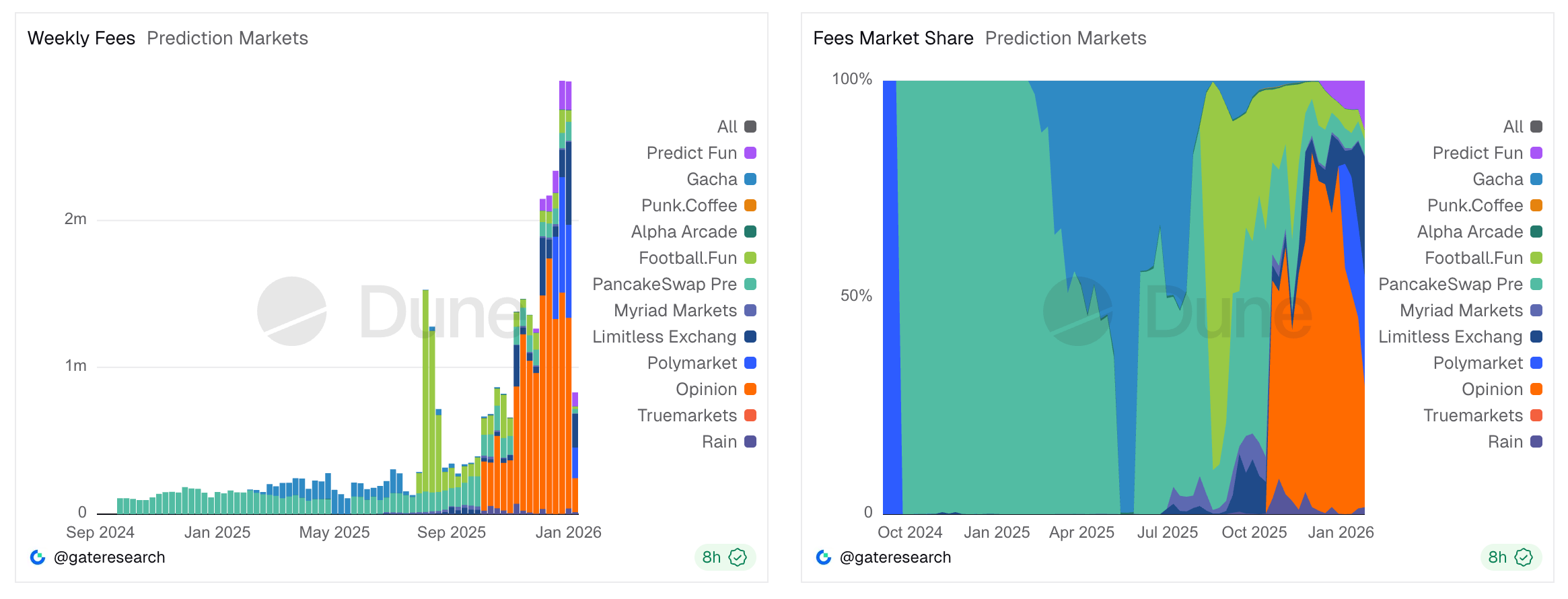

First, let's look at the most direct metric: the scale of fee revenue. According to data compiled by Gate Research on Dune, since the fee implementation began, Polymarket has accumulated approximately $2.19 million in fee revenue, averaging about $730,000 per week. Extrapolating this data statically, assuming trading volume and activity structure in the relevant markets remain unchanged, this could translate to an estimated annual revenue of around $38 million for Polymarket.

It is foreseeable that Polymarket's fee-charging scope will certainly not be limited to just the "15-minute cryptocurrency price movements" category. Prior to officially charging fees for this category, Polymarket had long maintained a completely free model while also subsidizing market liquidity out of its own pocket. At the end of last year, Coplan himself admitted that Polymarket was operating at a loss... But we have seen too many such "cash-burning" stories in the internet market. As Polymarket's user habits and market position gradually solidify, it would not be surprising to see fees introduced for more markets in the future.

- Odaily Note: For more on Polymarket's revenue issues, refer to Odaily's previous Tea Talk column "Odaily Editorial Tea Talk (January 7th)".

Assuming Polymarket will continue to apply the current fee standard to other markets in the future, we might be able to glimpse the theoretical revenue ceiling for Polymarket at its current trading volume level by comparing the trading volume of the "15-minute cryptocurrency price movements" market with Polymarket's total platform-wide trading volume — naturally, the more markets that charge fees, the higher the revenue.

Data compiled by Odaily shows that the total trading volume for the "15-minute cryptocurrency price movements" market on Polymarket over the past week was approximately $159 million (among the four major tokens, BTC accounted for $114 million, ETH for $30.29 million, SOL for $8.93 million, and XRP for $5.73 million). This represents about 9.1% of Polymarket's total weekly trading volume of approximately $1.75 billion. Based on this ratio, a static extrapolation suggests that, at the current trading volume level and transaction structure, if Polymarket introduces a similar fee model across all markets, it could potentially generate an estimated annual revenue of $418 million for the platform.

It should be noted that the above are all extrapolations by Odaily based on historical data. In reality, Polymarket's actual revenue situation will inevitably deviate due to various variables. First, Polymarket has only been charging fees for three weeks, so the sample size is still relatively small. Second, Polymarket may not apply a similar fee mechanism to other markets, and differences in user trading behavior across different markets will also lead to variations in the final fee outcomes under a dynamic fee mechanism. Third, and most crucially, Polymarket is still in a phase of strong growth. It is expected that with the further popularization of the prediction market concept, coupled with potential catalysts like the 2026 World Cup and midterm elections, the platform's trading volume will continue to grow in the future.

However, even considering these uncertainties, one trend is becoming quite clear — Polymarket is demonstrating the revenue potential of this new business model of prediction markets. It is no longer just a novel, innovative concept but a truly sustainable, revenue-generating business with highly imaginative profit potential.