After the RWA Boom: How Is Value Capture Redistributed Among Different Roles?

- Core Viewpoint: The article points out that as the tokenized real-world asset (RWA) market matures in 2025, the core issue for 2026 has shifted from "which assets are being tokenized" to "where in the technology stack is value captured." Value will concentrate towards key players controlling issuance, distribution, and trust.

- Key Elements:

- The RWA market has scaled, with total value growing from approximately $3 billion in 2022 to over $35 billion by the end of 2025, primarily driven by institutional capital inflows and demand for compliant on-chain yield products.

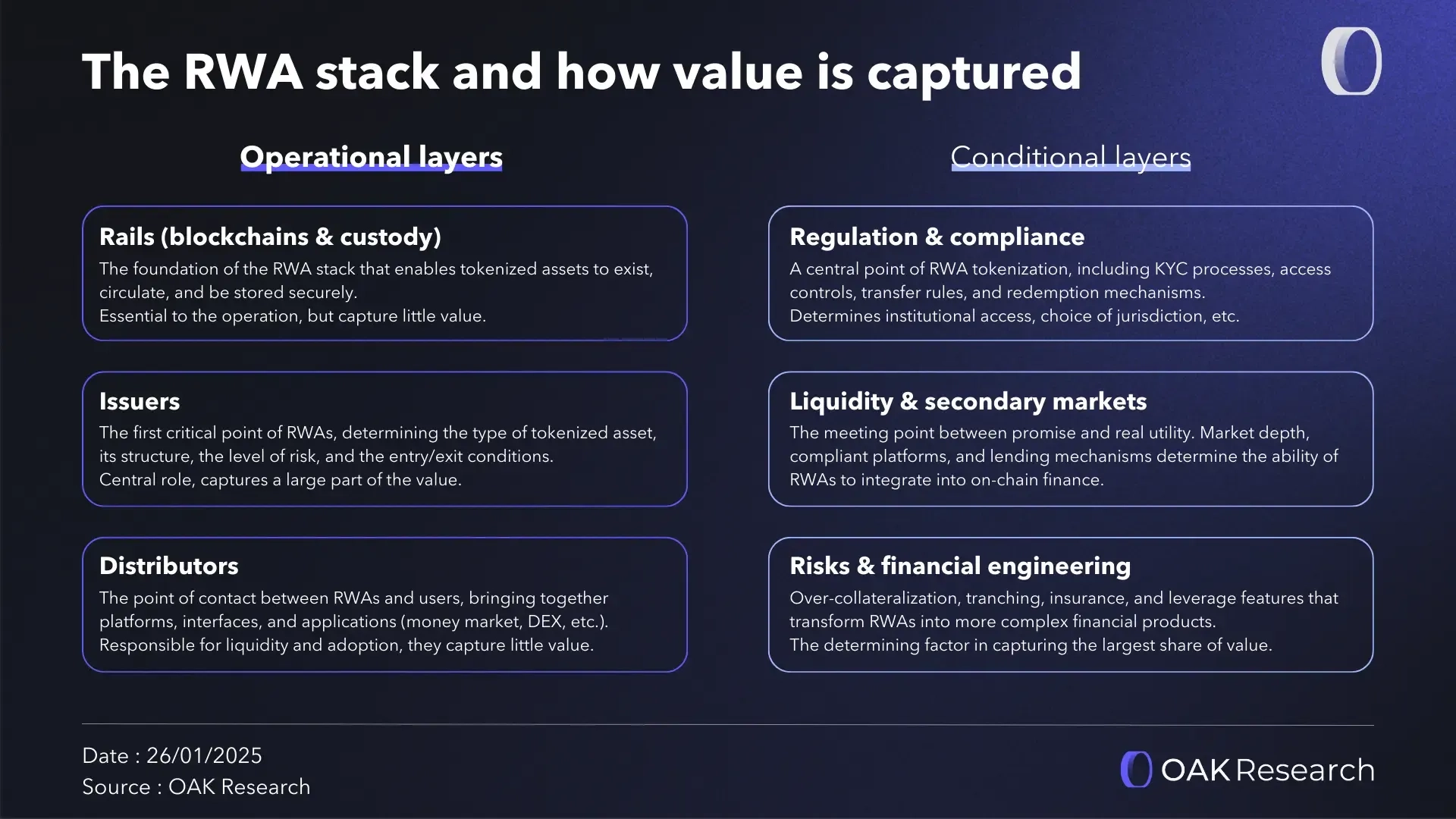

- The RWA tech stack is divided into the operational layer (infrastructure, issuers, distribution) and the conditional layer (regulatory compliance, liquidity, risk management). Value capture capabilities vary across layers, with the issuer and distribution layers being critical control points.

- Stablecoins (e.g., USDe) and U.S. Treasuries (e.g., BUIDL) are currently the most mature RWA sub-sectors. The former serves as the cornerstone of ecosystem liquidity, while the latter provides safe yield assets on-chain. Both demonstrate a trend of value shifting towards simple, compliant, and easily integrable products.

- Asset classes like private credit (e.g., Maple Finance) and tokenized equities (e.g., xStocks) highlight the central role of risk structure design, distribution capability, and user experience in value capture, rather than relying solely on the underlying asset itself.

- The main winners in the 2026 RWA market are expected to be stablecoin issuers, tokenized financial asset issuers, custodians, and distributors (e.g., Aave, Uniswap), as they control key aspects such as liquidity, product issuance, asset security, and market access, respectively.

Author | OAK Research

Compiled by | Odaily (@OdailyChina)

Translator | DingDang (@XiaMiPP)

Introduction

The tokenization of real-world assets is often seen as a multi-trillion dollar opportunity. That may be true, but currently, it's not the most critical question. Because it obscures a more central issue for 2026: once assets truly migrate on-chain, who is actually capturing the value?

In 2025, the status of RWA underwent a fundamental shift. Long confined to experimental projects, tokenization has now evolved into a mature, scalable on-chain market. The total value of RWAs grew from around $3 billion in 2022 to over $35 billion by the end of 2025. This growth stemmed from both institutional capital inflows and sustained market demand for "on-chain yield products backed by compliant assets."

This trend has profoundly reshaped the landscape of on-chain finance. An increasing number of projects are building products around asset custody, issuer control, identity verification, and transfer rules. Secondary liquidity no longer depends solely on technology but increasingly relies on the existence of compliant trading venues, the portability of assets across platforms, and the ability to navigate regulatory constraints across different jurisdictions.

Therefore, RWA is not a single, homogeneous asset class. It depends on a complex, multi-layered, interconnected system, from blockchain infrastructure to custody and distribution platforms. All layers are indispensable, but they do not hold equal positions in terms of power and value capture.

In 2026, the key to understanding RWA is no longer just "which assets are being tokenized and why," but to identify: Where exactly are the control points located within the stack? And how is economic value flowing and being redistributed among different participants?

This is precisely the question this article attempts to answer.

The Overall Structure of the RWA Stack

The RWA space is not composed of a single type of participant but is built upon a multi-layered stack. Each layer plays a distinct and different role in transforming traditional assets into investable instruments usable on-chain.

All these layers are necessary for the system to function, but they are not equal in their ability to capture value. Some are clearly identifiable operational participants (like blockchains, custodians, issuers), while others are horizontal conditional layers that determine whether the former can be successfully deployed, attract capital, and achieve scale.

Operational Layer

The operational layer consists of entities directly involved in the issuance, circulation, and access of RWAs. They form the day-to-day operational structure of the RWA market, hold most of the key control points, and capture a significant proportion of the value.

Infrastructure Layer (Blockchain & Custody)

The infrastructure layer forms the base of the RWA stack, including blockchain networks and custody solutions that enable tokenized assets to exist, transfer, and be securely held. This layer handles value transfer, near-instant settlement, and the synchronization between underlying assets and their on-chain representations.

It is indispensable but tends to become increasingly standardized as the market matures. Ultimately, value concentrates on infrastructure perceived as the safest and most robust. The infrastructure layer is a prerequisite for the system to run, but its value capture potential is relatively limited compared to higher layers in the stack.

Issuers

Issuers are the first key control point in the RWA stack. They decide which assets can be tokenized, how they are structured, what risk levels they carry, and under what conditions investors can enter or exit.

Whether it's US Treasuries, private credit, equities, or commodities, these products rely on complex offline legal and financial structures that must be accurately mapped on-chain. Issuers aren't just "providing assets"; they are essentially guaranteeing the legal and economic consistency of the entire system.

Distribution

The distribution layer includes platforms, applications, and interfaces through which investors access RWAs, such as lending markets, DEXs, etc. It determines which products are visible, usable, and how easily capital can be deployed.

In reality, the assets that attract the most capital are often not the most complex or sophisticated, but the most accessible and seamlessly integrated into user journeys. Distribution directly determines adoption rates, liquidity, and scaling speed. Whoever controls the gateway controls the flow of capital.

Conditional Layer

The conditional layer does not correspond to a specific participant but rather a set of horizontal standards that determine whether the operational layer can function smoothly, build trust, and capture value over the long term.

Regulation, Compliance & Redemption Mechanisms

Regulation is a core component of RWA tokenization. KYC processes, access controls, transfer rules, and redemption mechanisms do not disappear because of blockchain; instead, they must be integrated into products more systematically.

This layer determines whether institutional investors can participate, whether the rights attached to tokens are recognized, and whether cross-jurisdictional expansion is possible. Therefore, the choice of jurisdiction itself is a highly strategic decision, as regulatory frameworks differ significantly.

Liquidity & Secondary Markets

Liquidity is the intersection between the "theoretical promise" of tokenization and its "practical usability." An asset can be perfectly structured and fully compliant, but if it cannot be traded, used as collateral, or exited conveniently, its practical value remains limited.

The depth of secondary markets, the existence of compliant trading platforms, and lending mechanisms determine whether RWAs can truly integrate into financial strategies. Only with liquidity do the other layers truly gain significance.

Odaily Note: Tokenization holds great promise, but the current practical issue is that most tokenized assets operate in extremely fragile, illiquid markets. Related reading: Big Money Gets Serious, RWA Liquidity Issues Come to the Fore.

Risk & Financial Engineering

Risk management and structural design are the final pieces determining value capture. Over-collateralization, tranching, insurance, and leverage transform simple assets into complex financial products tailored to different investor needs.

Historical experience shows this layer has always been one of the most important sources of value in the financial system. In the RWA space, this layer is still under construction, but it is likely to become the most critical long-term value creation lever.

Major Tokenized Asset Types

After understanding the structure of the RWA stack, we can observe how this logic manifests in different asset classes. Their maturity and value capture capabilities vary, but each reveals a different facet of tokenization.

Stablecoins

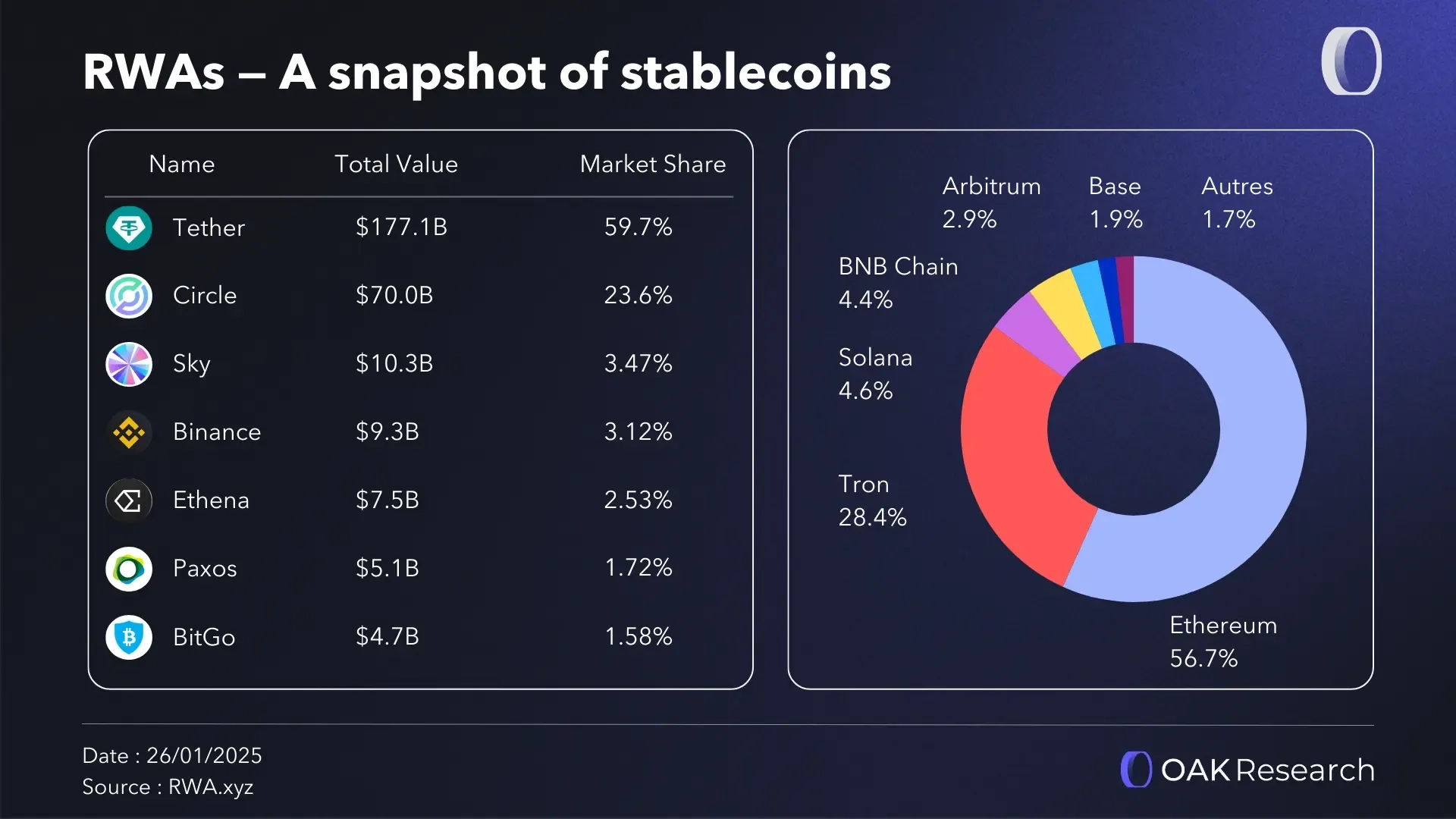

Stablecoins are the cornerstone of the RWA market. Almost all on-chain capital flows related to real-world assets use stablecoins as the unit of account, medium of exchange, and settlement tool.

Initially seen simply as "digital dollars," stablecoins have undergone profound changes. Many are now backed by high-quality real-world assets, particularly short-term US Treasuries. This structure explains both their stability and their growing appeal to institutional investors, who view stablecoins as liquid, predictable tools that fit operational constraints.

Thus, stablecoins play a dual role in the RWA stack: on one hand, they are the primary liquidity rails for capital entering and exiting the ecosystem; on the other, they themselves constitute one of the largest tokenization cases, with their reserves effectively representing tokenized portfolios of massive sovereign debt.

In practice, stablecoins are not just products but infrastructure. They ensure settlement continuity, market liquidity, and the bridge between traditional and on-chain finance, thereby capturing structural value across the entire RWA market.

Spotlight Case: Ethena (USDe)

Ethena is a decentralized protocol best known for its stablecoin USDe. USDe generates yield through a Delta-neutral strategy, with an annualized yield ranging from about 5%–15% under different market conditions.

In September 2025, Ethena launched Ethena Whitelabel—a "Stablecoin-as-a-Service" infrastructure allowing any blockchain, application, or wallet to quickly issue a stablecoin while significantly reducing technical complexity.

This is a major innovation because it directly addresses the "stablecoin tax" problem. The current stablecoin market is dominated by a Tether-Circle duopoly, controlling about 95% of the market share and capturing billions in revenue from their collateral assets.

In contrast, the blockchains, protocols, and users that enable and distribute stablecoins capture almost none of this value. Ethena aims to solve this value leakage problem with USDe.

US Treasuries

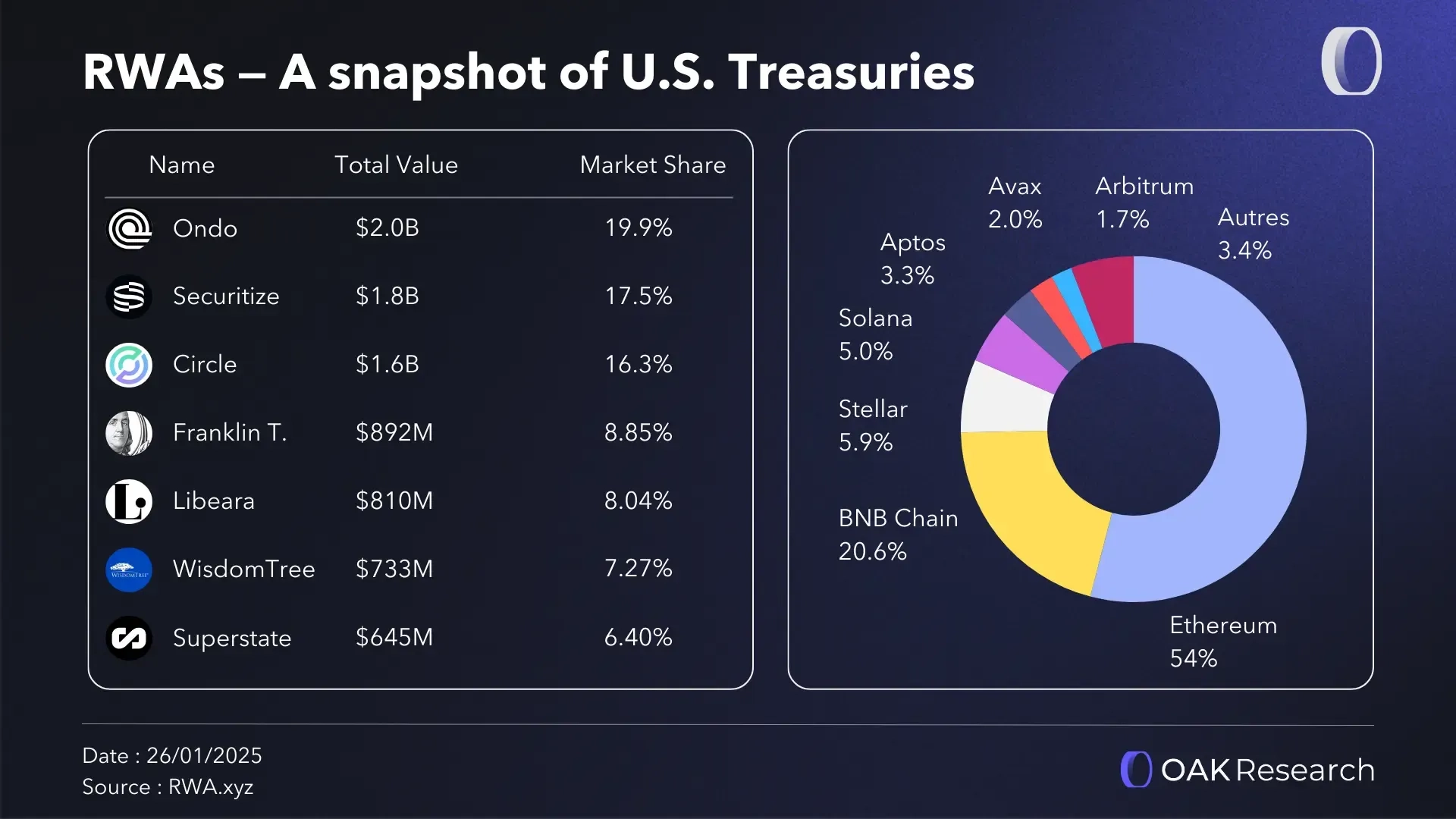

US Treasuries are currently the most mature and dominant RWA sub-sector. By tokenizing the world's safest, most liquid asset, issuers provide investors with continuous access, near-instant settlement, and fractional ownership.

The primary use case is clear: to provide safe, yield-bearing, and regulatory-compliant collateral assets for on-chain financial protocols. Tokenized US Treasuries allow crypto investors to gain exposure to US sovereign debt yields without relying on traditional finance channels.

Interest from institutions surged notably after 2023 when the Federal Reserve's interest rates exceeded the yields of most stablecoins. The combination of credible yield, persistent liquidity, and usability as collateral has made tokenized US Treasuries a key tool for on-chain treasury management.

Some key metrics:

- Since early 2023, the total market capitalization of major tokenized US Treasury products has grown from nearly zero to close to $9 billion.

- In 2025 alone, tokenized US Treasury volume increased by $4.4 billion, an 85% year-over-year growth.

- BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) dominates this market, followed by Circle's USYC and various Ondo products.

- In terms of on-chain deployment, Ethereum is the primary network for tokenized US Treasuries, followed by Arbitrum, Polygon, BNB Chain, and Solana.

- Securitize is currently the core tokenization service provider, although WisdomTree, Franklin Templeton, and Centrifuge have also seen significant growth in recent years.

This sub-sector clearly illustrates a trend: value is shifting from purely technological infrastructure to issuers who can build "simple, compliant, and easily integrable" products.

Spotlight Case: BUIDL (BlackRock)

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is BlackRock's first tokenized fund. This product brings a traditional institutional-grade money market fund strategy on-chain, combining daily yield distribution, multi-chain deployment capability, and deep liquidity through partners like Securitize and Circle.

BUIDL is distributed via the US-compliant platform Securitize, enabling it to serve high-barrier institutional clients with a high minimum investment, a stable $1 Net Asset Value (NAV), and an on-chain daily dividend experience. The fund is deployed across multiple blockchain networks via Wormhole, including Ethereum, Solana, Avalanche, Arbitrum, Optimism, Polygon, and Aptos.

Currently, BUIDL's Assets Under Management (AUM) exceed $2.5 billion. Despite having an extremely limited number of holders (only 93 investors), this scale fully demonstrates the high recognition and tangible commitment from institutions towards tokenized funds.

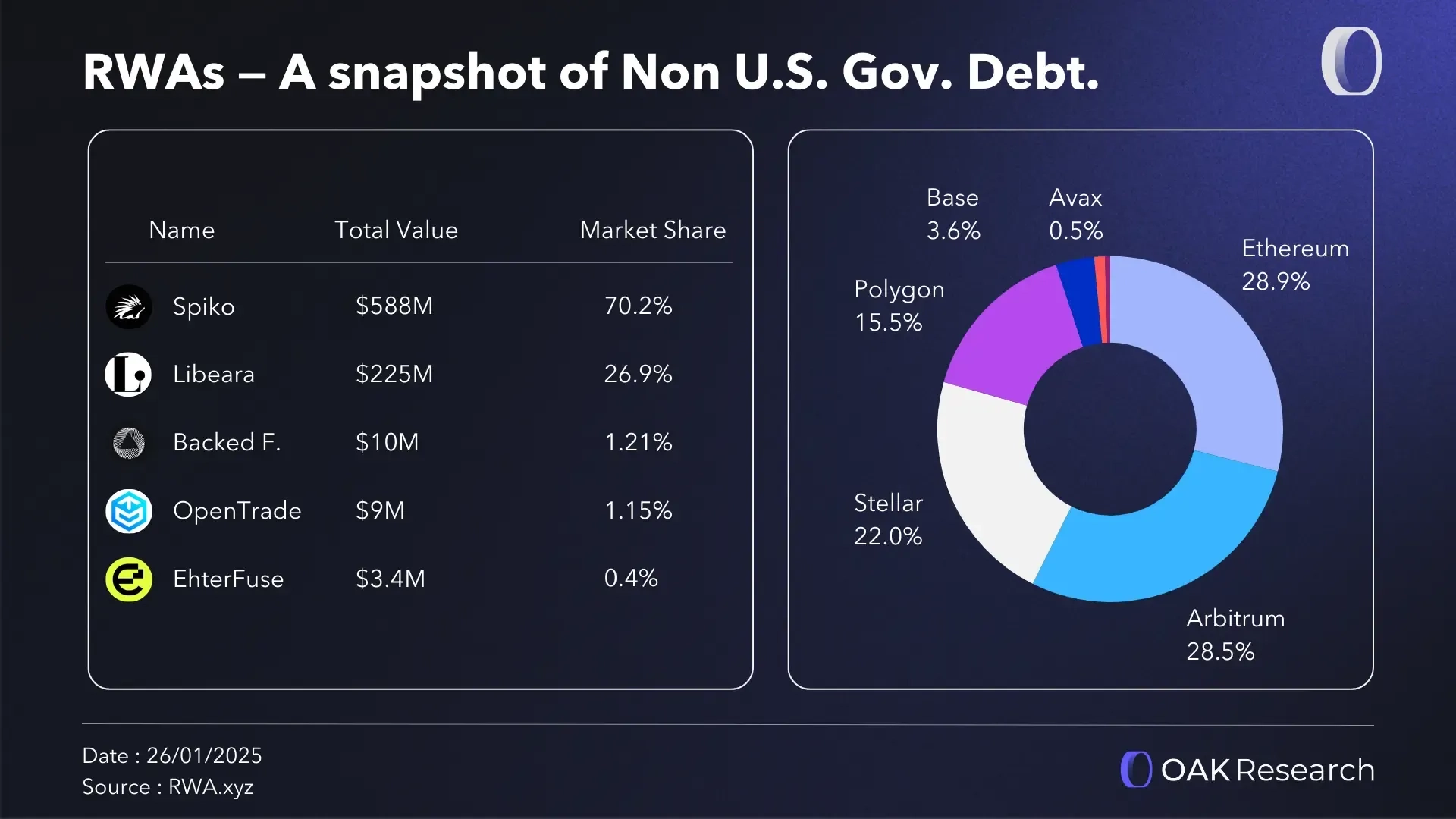

Non-US Sovereign Debt

The tokenization of non-US sovereign debt extends the advantages seen with US Treasuries to other public issuers. It significantly reduces the operational complexity of cross-border investment in foreign government bonds while retaining a regulatory framework acceptable to institutions.

In the traditional financial system, purchasing foreign sovereign debt often involves multiple intermediaries, complex jurisdictional settlement rules, and even long settlement cycles. Tokenization makes these assets more accessible, with faster settlement and higher capital efficiency, while still meeting the compliance requirements of institutional investors.

Although this sub-sector is still small, it clearly reflects the trend of RWA geographical diversification. In this area, value capture heavily depends on the issuer's ability to handle local regulatory frameworks and provide understandable, usable products to global investors.

Currently, the non-US sovereign RWA market is dominated by issuers from Hong Kong (67% market share) and France (30%), corresponding to the main tokenized funds in this category, such as ChinaAMC in Asia and Spiko in Europe.

Spotlight Case: Spiko

Spiko is a French fintech company founded in 2023 that has grown to become Europe's largest issuer of euro-denominated tokenized money market funds. Its products enable businesses to allocate funds to funds backed by French, UK, and US government bonds.

In January 2026, Spiko announced it had received a MiFID investment management license granted by the ACPR and AMF, meaning it can provide compliant services across the entire European Union.

Spiko was one of the fastest-growing RWA projects in 2025, with its TVL growing from $130 million to over $730 million. These assets are distributed across the Spiko Euro Fund ($523 million), Spiko Dollar Fund ($202 million), and the Spiko Pound Fund launched in December.

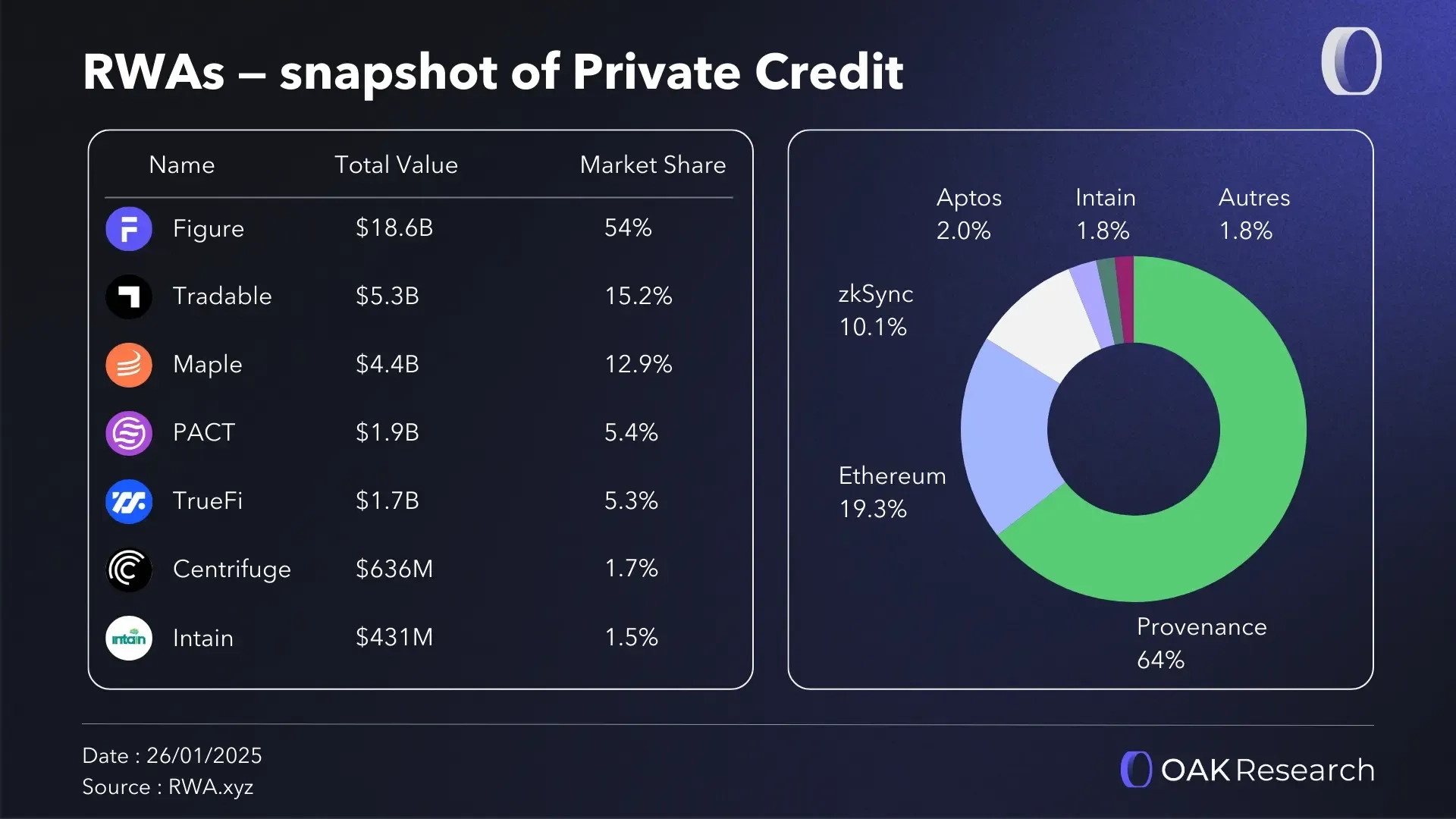

Private Credit

Private credit is one of the asset classes with the greatest tokenization potential. This space has long been illiquid and accessible only to professional investors, but its clear cash flows and automatable loan monitoring make it naturally suited for on-chain deployment.

Tokenization allows non-listed debt instruments like corporate loans and trade finance to be split into smaller, potentially tradable units, enhancing liquidity for lenders and broadening funding sources for borrowers. It also enables real-time tracking of collateral, repayment schedules, and cash flows.

This section highlights a core truth of the RWA stack: value does not reside solely in the underlying asset itself, but in the ability to design, analyze, and manage risk structures. As the market matures, competitive differentiation will increasingly depend on risk management capabilities and structural credibility.

Spotlight Case: Maple Finance

Maple is a clear example of the demand for on-chain financial products backed by private credit. The protocol offers permissioned pools backed by BTC lending and has also launched permissionless pools built around syrupUSD via syrupUSDC and syrupUSDT. This allows Maple to serve both KYC-compliant institutional clients and crypto-native users.

In 2025, Maple achieved significant growth. Its Assets Under Management (AUM) exceeded $4.5 billion (+800%), total institutional borrowing reached $1.7 billion, and protocol revenue approached $11.7 million (+370%).

A key advantage for Maple lies in its clear recognition that for RWA products, distribution capability is one of the most critical foundational modules, as discussed earlier. The protocol created concrete, actionable use cases for syrupUSDC and syrupUSDT by expanding integrations across multiple new blockchains and key partners.

In 2025, Maple deployed its products to Solana via Kamino and Jupiter; to Plasma via Midas; to Arbitrum via Fluid, Euler, and Aave; and recently expanded to Base via Aave as well.

Tokenized Equities

Tokenized equities are digital representations of shares in publicly listed or private companies, enabling continuous trading outside traditional market hours and faster settlement. For public market stocks, these tokens are typically backed by real shares held in custody accounts; for private equity, tokenization simplifies equity structure management and enables compliant secondary markets.

This sub-sector is primarily driven by asset exposure demand, rather than yield generation demand. It attracts a broader, often retail-oriented user base and highlights the central role of distribution capability and user experience in value capture.

Tokenized equities demonstrate that even when the underlying asset is well-known, the concentration of value is not in the asset itself, but in the ability to organize access, liquidity, and compliance. Currently, most trading activity is still driven by perpetual futures markets, though some projects are beginning to integrate the spot ownership of tokenized equities into the on-chain financial system.

<