Leading Prediction Markets Are Frenziedly Competing for Top Sports IP

- Core View: Major League Soccer (MLS) has entered into an exclusive partnership with prediction market platform Polymarket. This move reflects the deepening trend of integrating prediction markets with sports events. However, the exclusive license currently does not constitute a legal barrier for other platforms to open related markets. Its core value lies in obtaining official data and brand rights to enhance service quality and mitigate risks.

- Key Elements:

- MLS and Polymarket have reached a multi-year exclusive partnership covering several of its top-tier events, requiring the platform to use official data and avoid easily manipulated betting items.

- The legality of sports betting depends on state-level licensing rather than league authorization; therefore, an exclusive commercial license itself does not directly prohibit other platforms from offering markets.

- The core value of the license for prediction markets lies in accessing more accurate and timely official data to optimize services and leveraging brand authorization for compliant marketing.

- The cooperation helps the event organizer and the platform jointly standardize betting scopes and share abnormal data to reduce the risk of market manipulation.

- Sports-related events are a primary traffic source for leading prediction markets like Polymarket and Kalshi. Both sides are expected to engage in more intense competition for licenses surrounding top-tier sports events.

- Unlike the US market's focus on sports, prediction markets in other regions (e.g., Opinion) are developing differently, with a higher proportion of native event trading such as cryptocurrency.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

On January 27, US local time, Soccer United Marketing (SUM), the commercial arm of Major League Soccer (MLS), announced a multi-year partnership with prediction market platform Polymarket. Under the agreement, Polymarket will become the official and exclusive prediction market partner for the MLS regular season, MLS All-Star Game, MLS Cup, and Leagues Cup. In return, MLS will require Polymarket to use official league data and third-party integrity monitoring systems, and prohibit the creation of markets deemed by the league as easily manipulated or prone to involving insider information.

This is not the first time a sports league has partnered with a prediction market. As early as October last year, the National Hockey League (NHL) entered into multi-year licensing agreements with both Kalshi and Polymarket. Subsequently, in November, Polymarket also reached a deal with the Ultimate Fighting Championship (UFC), becoming its official exclusive prediction market partner.

What does "official exclusive prediction market" mean? Does it imply that other unauthorized platforms will be unable to offer related markets in the future? How will this affect future competition in the industry? Although there are currently limited mature cases of prediction markets partnering with sports events, offering few observable samples, we can find similar answers to the above questions from the sports betting market, which provides a service effect remarkably similar to prediction markets.

- Odaily Note: For the similarities in service and differences in regulation between prediction markets and sports betting, as well as the regulatory battles surrounding prediction markets, please refer to our article from two weeks ago: "Threatening the Trillion-Dollar Betting Industry, Prediction Markets Are Being Hunted by the Old Order".

Exclusive Authorization ≠ Market Permission

First, let's answer the most critical question — Does the existence of exclusive authorization mean that other unauthorized platforms will be unable to offer related markets in the future?

The current state of sports betting is that since the US Supreme Court overturned the federal law, the Professional and Amateur Sports Protection Act (PASPA), which had prohibited commercial sports betting, on May 14, 2018, individual states have gained the authority to decide whether to legalize sports betting within their jurisdictions. In other words, the legality of betting services depends on state-level licensing, not commercial authorization from the leagues — in reality, when betting companies offer markets or betting services for various legal sporting events, they do not need to obtain commercial authorization from the league operators.

However, in a few states like Tennessee, state-level sports betting regulators require betting companies to use official league data when offering in-play betting services, unless they can prove such data is unsuitable or unavailable. This makes official authorization, in practice, affect the scope of services a betting company can offer — only with data authorization can they provide the most complete betting services.

But this logic does not currently directly apply to prediction markets. Due to the still unclear (and objectively more lenient) regulatory framework for prediction markets, until final rulings from appellate courts or the Supreme Court are issued, platforms like Polymarket and Kalshi are not obligated to follow similar requirements found in betting regulations.

Therefore, although Polymarket has now secured exclusive authorization from MLS, at least at this stage, it does not mean that other platforms like Kalshi are already prohibited from offering MLS-related markets.

If Not Necessary, What's the Point of Authorization?

While it's not "authorization required to open a market," in actual commercial operations, there are indeed numerous commercial partnerships and licensing agreements between major sports leagues and betting companies. For example, the NFL has a long-term partnership with Genius Sports, authorizing Genius as the sole official data provider to supply real-time game data—including rosters, play-by-play, statistics, etc.—to betting companies.

For betting companies, the main significance of authorization is that through commercial agreements, they can directly obtain official data and brand licensing from sports event operators to enhance their service quality and user experience. If it's an exclusive authorization, an additional layer of exclusivity is added on top of that.

The core significance naturally lies in the quality and completeness of the data. Compared to data scraping through third-party channels, official data obtained through licensing agreements is bound to be more accurate, timely, and comprehensive. This has a direct impact on improving the accuracy of betting odds, speeding up settlement efficiency, and expanding betting categories. As for brand and trademark licensing, it allows betting companies more flexibility in promoting related markets — they can use league, team, and player logos while avoiding infringement risks.

Conversely, for sports events, directly entering into licensing agreements with betting companies also helps reduce the possibility of market manipulation (this may sound abstract...). Both parties can regulate betting ranges and share abnormal betting data to promptly identify potential manipulation. For instance, in the partnership between Polymarket and MLS, it has been explicitly stated that markets deemed easily manipulated by individuals (like red/yellow card decisions) or prone to involving insider information (like coach dismissals, player transfers) are prohibited.

Given the high degree of overlap in service effects between prediction markets and sports betting, the significance of licensing agreements for the sports betting market will equally apply to prediction markets.

Head-to-Head Leaders, Unconventional Second Tier

Sports betting has long been validated as a large-scale, steadily growing business. Within prediction markets, sports-related events have gradually become the category with the highest trading volume share.

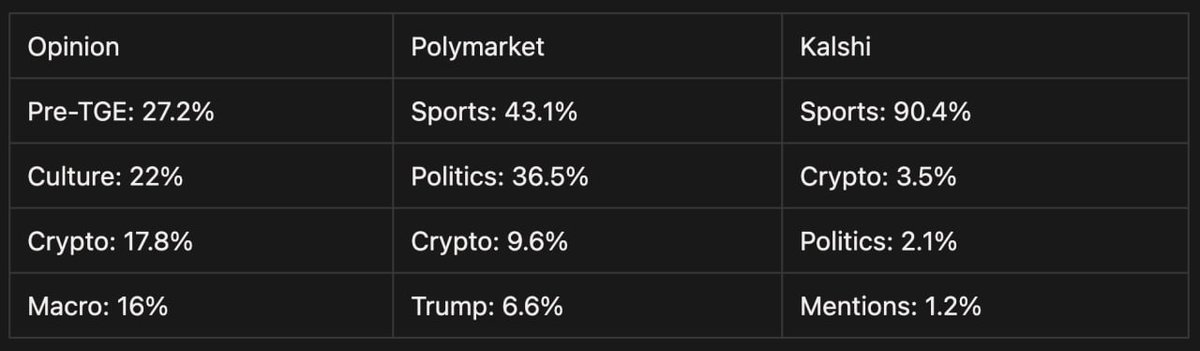

Dovey Wan (@DoveyWan), founder of Primitive Ventures, yesterday posted the share of trading volume for various event types on several major prediction markets. Among them, the betting volume share for sports events on Kalshi exceeds 90%, and on Polymarket, it also reaches 43% — clearly, sports events have become the core traffic source for these two leading prediction markets.

Faced with a massive existing scale and visible incremental space, market competition is inevitable. Currently, among the four major US sports leagues, only the NHL has entered the fray, signing licensing agreements with both Kalshi and Polymarket. The NFL, NBA, and MLB are still in a wait-and-see phase. It is anticipated that after Polymarket successively secured exclusive authorizations from UFC and MLS, the two leading players, Kalshi and Polymarket, which hold advantages in compliance and funding, are likely to engage in more intense competition for authorizations from various top-tier sports events, and more exclusive agreements are destined to emerge.

However, the data also reveals another interesting phenomenon — perhaps due to cultural differences and user habits, emerging prediction markets on the other side of the world are charting a distinctly different, differentiated path. As shown in the previous chart, the share of trading volume for events centered around the native cryptocurrency market on Opinion is significantly higher than on Kalshi and Polymarket. While the leaders are clashing head-on over the huge cake of sports events, choosing an unconventional path might be an opportunity for second-tier projects to catch up from behind.