From Pro-Cyclical Expansion to Cross-Cycle Survival: A 2026 Outlook on Digital Asset Treasury (DAT) Sustainability — An Analysis Based on Financing Structure and Currency Differences

- Core Viewpoint: This article systematically analyzes the Digital Asset Treasury (DAT) model, pointing out that its sustainability hinges on the alignment between financing structure and the choice of underlying currency. It constructs a cross-cycle survival capability assessment framework centered on "premium windows, cash buffers, and debt covenants."

- Key Elements:

- The essence of DAT is the active management of the balance sheet. Its value creation stems from the synergy between asset-side returns (β) and capital-side operations (α), forming positive and negative feedback loops known as the "Reflexive Flywheel" and "Death Spiral."

- Regarding financing structure, equity financing (e.g., ATM) is the core driver of the flywheel, heavily reliant on a market premium over net asset value (mNAV > 1). Debt financing (e.g., convertible bonds) provides leverage efficiency but introduces maturity mismatch and refinancing risks.

- Regarding currency choice, Bitcoin (BTC) offers a more resilient financing window due to its strong consensus. Ethereum (ETH) adds yield-bearing attributes but demands higher transparency and compliance. Smaller-cap tokens pursue aggressive "token-equity linkage" through mechanisms like SPACs.

- The industry trend has shifted from pro-cyclical expansion to cross-cycle survival. Valuation logic is moving from "channel premium" to "capability pricing" based on financing ability, governance, and execution discipline. The industry structure is heading towards consolidation at the top and shakeout at the tail.

- The key to sustainability assessment lies in: the mNAV level determining financing windows, whether cash reserves can cover fixed expenditures, and whether debt covenants allow time for recovery, thereby avoiding forced disposal of core assets during downturns.

The Digital Asset Treasury (DAT) model continues to gain traction and evolve among global publicly listed companies. Particularly following the market correction in Q4 2025, the sustainability of this business model during downturns has become a focal point for market scrutiny. This article, grounded in the market environment of early 2026, systematically deconstructs the operational mechanisms of DAT companies. It focuses on a dual-dimensional analysis of "Financing Structure × Underlying Asset" to delve deeply into the effective boundaries and potential risks of the "Reflexive Flywheel" for DAT enterprises.

The research indicates that the DAT model is, in essence, an actively managed balance sheet strategy. Its value creation stems from the synergy between asset-side returns (β) and capital-side operations (α). Regarding financing structure, the article demonstrates the high dependence of equity financing (e.g., ATM, PIPE) – as the core driver of the flywheel – on valuation premiums (mNAV). It also analyzes the term mismatch risks introduced by debt financing (e.g., convertible bonds) as a secondary funding source, which provides leverage efficiency. In terms of asset selection, the article provides a comparative analysis: Bitcoin's (BTC) financing resilience derived from its strong consensus; the compliance and transparency challenges for Ethereum (ETH) compounded by its yield-bearing attributes; and the aggressive liquidity transmission mechanism of smaller-cap assets achieving "Token-Equity Linkage" via SPAC channels.

Drawing on case studies such as Strategy (formerly MicroStrategy), Core Scientific, and MARA, this paper proposes a sustainability assessment framework centered on "Premium Window—Cash Buffer—Debt Covenants." It offers four key trend insights: First, the industry has entered a phase of cross-cycle survival. The critical challenge is not paper losses but the liquidity pressure arising from shrinking financing windows, impacting refinancing capabilities and potential debt covenant triggers. Second, valuation logic will shift from "channel premium" to "capability pricing." With the proliferation of compliant allocation tools like spot ETFs, financing premiums for DAT companies will become scarcer and more transient. Divergence in mNAV among companies will persist. Third, differences in underlying assets will further amplify corporate divergence. BTC-DATs are more likely to form a financing anchor but are more sensitive to financing timing. The ceiling for ETH-DATs depends on their ability to consistently provide clear disclosures on revenue sources, risk boundaries, and verifiable governance and execution records. Fourth, DAT as a capital market strategy will persist, but the industry structure is likely to trend towards consolidation at the top and attrition at the tail. This paper provides a framework for assessing DAT company sustainability in downturns and offers reference points for the standardized evolution of the DAT industry.

Keywords: Digital Asset Treasury (DAT); Financing Structure; Asset Differences; mNAV; Sustainability Analysis

Table of Contents

1. Introduction

2. Concepts and Definitions

2.1. Conceptual Definition: Defining Treasury

2.2. Terminology Explanation

2.3. Analysis of the Current State of Digital Asset Reserves (DAT) in Global Public Companies

3. The Business Model of DAT Companies

3.1. Business Model Positioning: Actively Managed Balance Sheet Companies

3.2. Value Creation Mechanism: Assets Determine Outcome, Financing Determines Speed

3.3. Structural Characteristics of the Business Model: Weakened Income Statement, Concentrated Assets, Financing-Driven, Valuation Divergence

3.4. Sources of Model Variation: Financing Structure × Asset Attributes

4. Comparative Analysis of Core DAT Financing Structures

4.1. Equity Financing: The Core Driver of the DAT Flywheel

4.2. Debt Financing: Secondary Funding Source and Time Dimension Constraints

4.3. Equity + Debt Coordination: Flywheel Formation and Survival Boundaries

5. Asset Analysis: How Core Assets Reshape DAT Revenue Sources and Stress Resilience

5.1. Bitcoin (BTC): Consensus Advantage for a More Resilient Financing Window

5.2. ETH: Layered with Ecosystem and Yield Variables, Demanding Higher Transparency

5.3. The "Token-Equity Linkage" Model for Small-Cap Assets: Asset Mapping and Liquidity Transmission via SPAC Channels

5.3.1. Core Mechanism: Liquidity Transmission Post-Reverse Merger

5.3.2. Typical Path Analysis: Static Treasury vs. Dynamic Market Making

6. DAT Risk Analysis

6.1. DAT Cycle Stages and Divergence Paths

6.2. Financing Structure Risk: The Boundary Between Equity and Debt

6.3. Asset Portfolio Risk: BTC's Macro Sensitivity and ETH's Allocation Paradox

6.4. Core Assessment Metrics: Quantifying Financial Health and Expansion Potential

7. Case Studies of Typical Risk Management

7.1. Strategy: Cyclical Pressure from Equity-Debt Arbitrage and the Distant Debt Wall

7.1.1. Constraints of Premium Rate Volatility on the Financing Window

7.1.2. Pressure from Distant Debt Maturities

7.2. Core Scientific: The Painful Lesson of Debt-Fueled Hoarding and Term Mismatch

7.3. MARA: The Survival Game Under Equity Dilution

8. Sustainability Analysis and Trend Outlook for DAT Companies

8.1. DAT Company Sustainability Assessment Framework: Premium Window, Cash Buffer, Debt Maturity & Covenants

8.2. Trend Outlook: From Expansion Narrative to Survival Test

8.2.1. Core Proposition Reshaped: From Pro-Cycle Expansion to Cross-Cycle Survival

8.2.2. Valuation Model Shift: Premium Scarcity and Functional Pricing

8.2.3. Underlying Asset Divergence: BTC's Consensus Pricing vs. ETH's Strategic Yield

8.2.4. Industry Endgame Projection: Intensifying Matthew Effect and Tail Attrition

1. Introduction

DAT (Digital Asset Treasury) typically refers to companies (or DAO organizations) incorporating crypto assets like BTC and ETH onto their balance sheets, managing and allocating them as "long-term reserves." Driven by the benchmark effect of Strategy (formerly MicroStrategy) and amplified by signals of support from the U.S. White House for a "Strategic Bitcoin Reserve," this strategy is gradually evolving from isolated exploration to a broader strategic option for public companies. A Bitwise report indicates that as of Q3 2025, 172 global public companies held BTC, with a combined holding exceeding 1 million coins. [1] Thus, measuring solely from the public company dimension, the asset scale of BTC-related DATs already exceeds $100 billion (calculated at the Bitcoin price at the time of the Bitwise report's publication). If other digital assets and non-public entities are further included, its potential coverage and scale still have significant room for expansion.

However, with the sustained weakness in BTC and ETH prices since Q4 2025, the effectiveness of the DAT path has begun to face broader skepticism. Some entities employing "equity + debt" financing have experienced model failure and被迫 strategy adjustments following stock price declines: the stock price of the largest Bitcoin treasury, MicroStrategy, fell over 50%, and the stock price of the largest Ethereum treasury, Bitmine, fell over 80%. Concurrently, some small and medium-sized DAT companies have also seen strategy contraction or even suspension, such as the BTC treasury company Prenetics, endorsed by soccer star David Beckham, halting its treasury strategy. These changes have shifted market focus on DAT from "whether to hold coins" to "how to navigate drawdown cycles": Against the backdrop of declining coin prices, falling stock prices and debt pressure can form a dual shock—in other words, the core variable determining whether the strategy can survive across cycles is precisely "what financing method to use for holding coins + what coins to hold."

Based on this, this article, grounded in early 2026, reviews the development status and recent stress tests of DAT enterprises. Starting from the two main threads of financing structure and asset selection, it provides a framework analysis of the sustainability and key risk points of corporate DAT strategies, aiming to offer verifiable references for subsequent strategy design and risk control.

2. Concepts and Definitions

2.1. Conceptual Definition: Defining Treasury

This article studies DAT (Digital Asset Treasury) and first defines its concept.

· Broad Definition: Any fund pool that incorporates crypto assets into its capital management system with medium to long-term holding intent can be considered a DAT. Classified by treasury vehicle (i.e., the entity holding the DAT): DATs can be divided into on-chain and off-chain categories.

(1) On-chain: Primarily includes DAO organizations and project foundations;

(2) Off-chain: One category is DATCo (Digital Asset Treasury Company) centered on "coin hoarding," and the other is companies with other primary businesses that incorporate crypto assets into their asset allocation (e.g., crypto miners);

(3) Reverse Merger: In recent years, a new hybrid path combining on-chain and off-chain has emerged, such as project teams achieving a reverse merger via a shell company (SPAC, Special Purpose Acquisition Company) to bridge on-chain funds with off-chain capital market channels.

· Narrow Definition: In the current market context, DAT often refers specifically to DATCo (Digital Asset Treasury Company), i.e., companies (mostly public) whose primary business activity is off-chain holding and management of crypto assets. [2]

Based on the above definitions, the term "DAT enterprise" in this article primarily refers to DATCos, i.e., companies (mainly public) whose primary business is off-chain coin hoarding—with Strategy (formerly MicroStrategy) as the pioneer of this model. For companies with clear primary businesses that only treat crypto assets as investments (e.g., miners), this article does not focus on them as primary analysis objects.

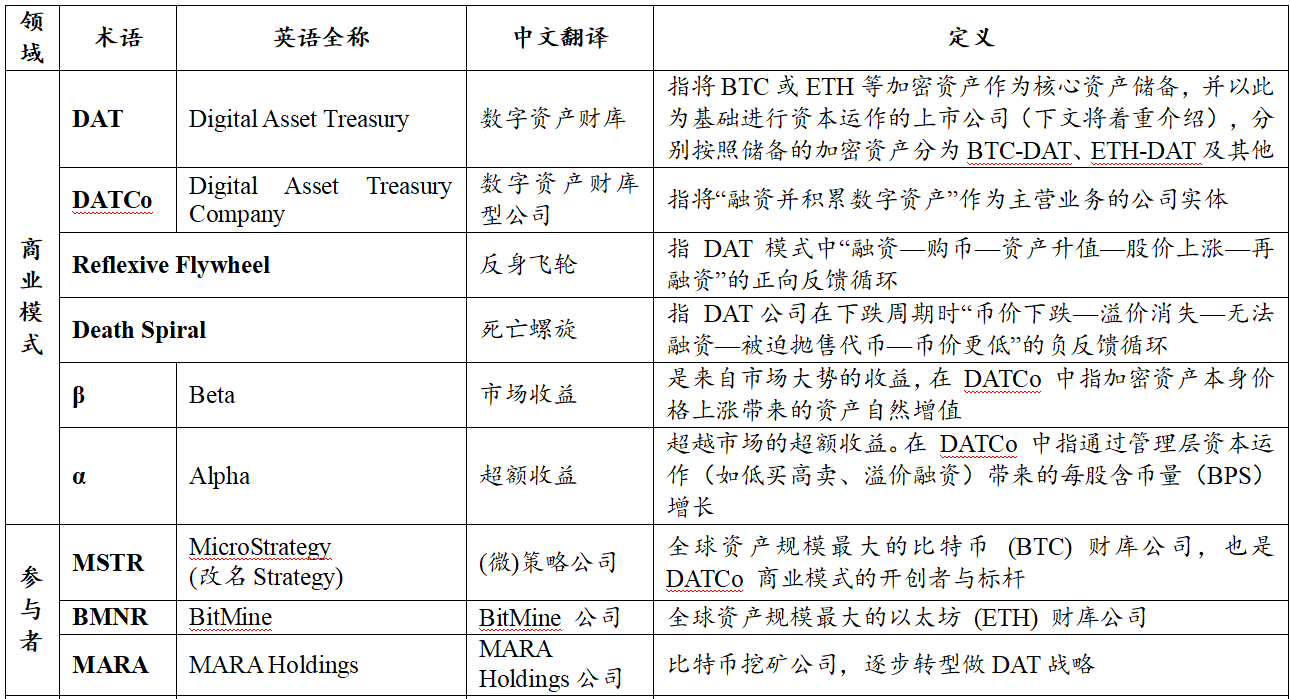

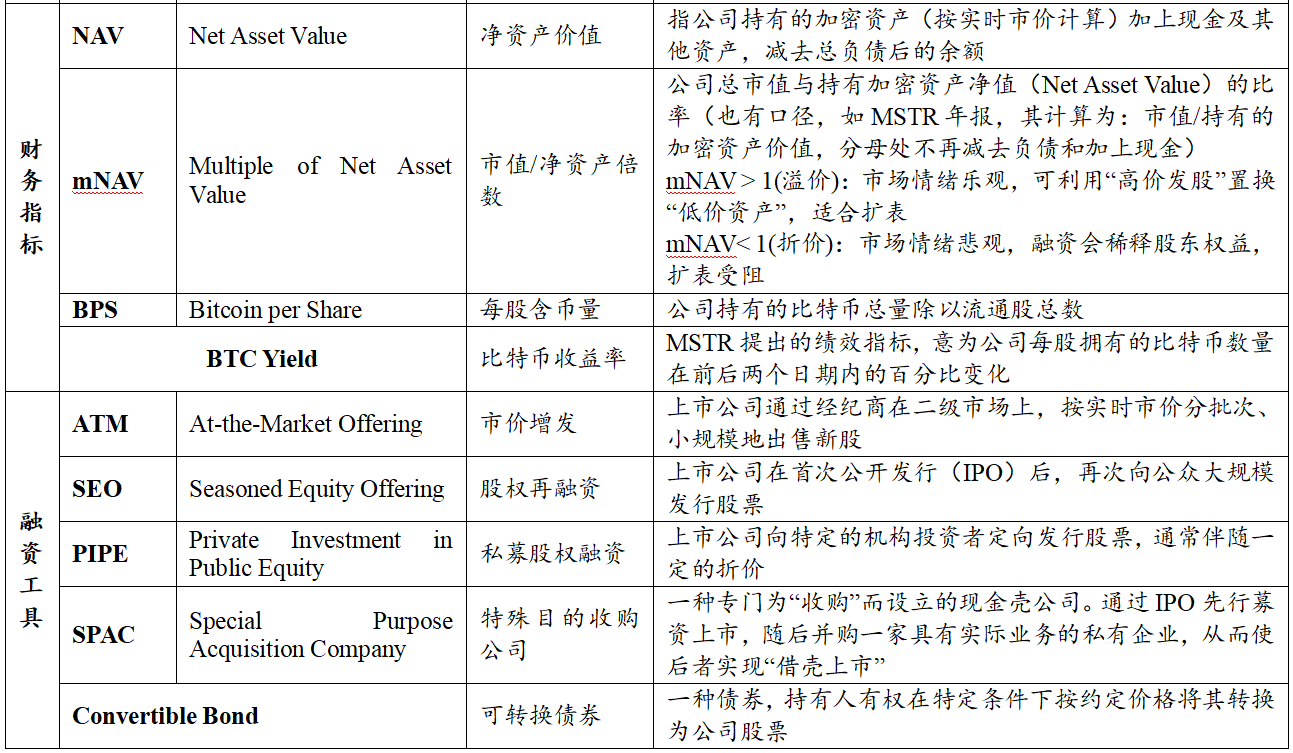

Table 1: Key Terminology Explanation Table

Source: PKUBA compilation

2.2. Analysis of the Current State of Digital Asset Reserves (DAT) in Global Public Companies

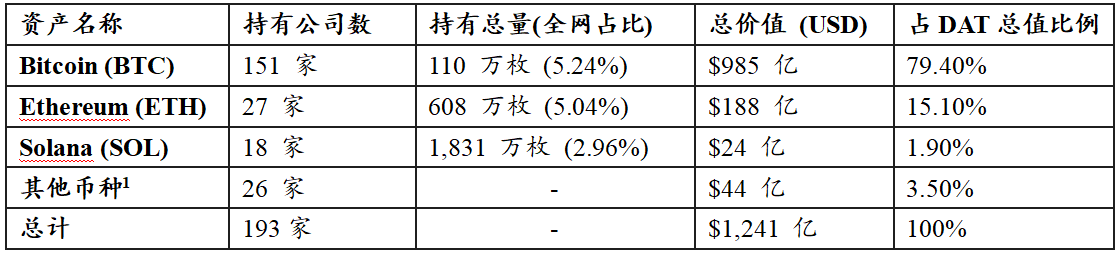

Based on Coingecko data (as of January 2, 2026), statistics for digital asset reserves (DAT) held by global public companies are as follows. (Note: This statistic only covers publicly listed company data; holdings of non-public companies are not within the statistical scope.)

Table 2: Public Company Digital Asset Reserve (DAT) Statistics Table

Source: Coingecko, as of: January 2, 2026

Note: Other assets include XRP, BNB, TON, SUI, etc.

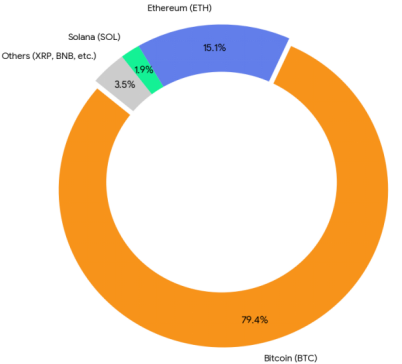

Figure 1: Public Company Digital Asset Reserve (DAT) Value Proportion Chart

Source: Coingecko, as of: January 2, 2026

Based on the above, the basic landscape of global public company DATs is as follows:

First, Asset Scale and Top-Heavy Effect: Statistics show that the total scale of current global public company DATs has reached $124.1 billion. In terms of value composition, Bitcoin (BTC) exhibits overwhelming dominance, accounting for 79.4%; Ethereum (ETH) ranks second at 15.1%; Solana (SOL) and other long-tail assets account for only the remaining 5.5%.

Second, Allocation Preference and Consensus Difference: The penetration rate of various major asset classes on corporate balance sheets differs significantly. The total reserve value of BTC is approximately 5.2 times that of ETH and over 41 times that of SOL. In terms of institutional coverage breadth, the number of public companies holding BTC is as high as 151, far exceeding ETH (27) and SOL (18). This data strongly corroborates that BTC remains the preferred allocation target for institutional capital.

Third, Structural Characteristics of Long-Tail Assets: Within the "Other Assets" category (3.5%), two main characteristics are present:

· Established Infrastructure Type: Includes older public chain or exchange tokens like XRP, LINK, TRON, BNB, often representing associated business holdings of public companies;

· Capital Operation Type: Some emerging projects (e.g., 0G, Babylon, Pump.fun, etc.) exhibit clear "token-equity linkage" characteristics, reflecting attempts by some project teams to achieve deep binding between public company equity and digital asset value through capital market operations.

3. The Business Model of DAT Companies

3.1. Business Model Positioning: Actively Managed Balance Sheet Companies

DAT enterprises possess a relatively clear and replicable business model: their essence is a type of actively managed company centered on balance sheet management, rather than a passive ETF or closed-end fund tracking underlying assets.

Unlike traditional companies relying on products and services to generate operating cash flow, DAT's core action is raising capital through capital markets to purchase and hold crypto assets on a large scale over the medium to long term. Therefore, their asset side typically shows a high allocation ratio to digital assets like BTC and ETH, while the liability and equity sides are primarily composed of equity and debt financing; the operational objective is also more reflected in continuously accumulating digital asset scale on the balance sheet and increasing the asset content per unit of equity.

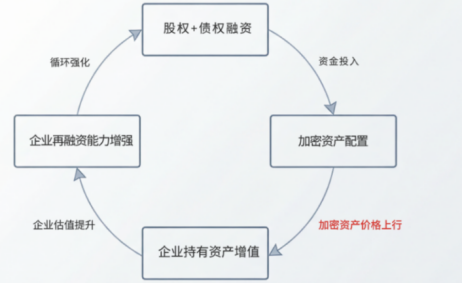

Figure 2: DAT Company Value-Added Cycle Diagram (Reflexive Flywheel Diagram)

Source: PKUBA compilation

Surrounding this model, DAT is often summarized as a "Reflexive Flywheel": a pro-cyclical positive feedback process of financing—buying coins—asset appreciation—market cap increase—refinancing. Its logical chain can be deconstructed as: the company obtains funds through equity or debt financing and allocates them to crypto assets; when coin prices rise, the increase in asset-side value drives market re-pricing of the company's valuation; rising stock prices further strengthen refinancing capability, thereby driving a new round of balance sheet expansion.

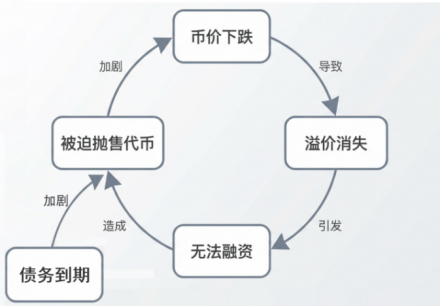

Conversely, DAT may fall into a "Death Spiral" during downturns: coin price decline—premium消失—inability to finance—forced token sales—further coin price decline—an inverse negative feedback process. That is: decline in the underlying asset (coin price) first leads to company balance sheet contraction; impairment of asset-side value triggers disappearance of stock price premium and valuation markdown, causing external financing windows to rapidly close; liquidity drying up or debt default risk forces the company to sell tokens at low prices to repay debt, further depressing coin prices and exacerbating a new round of balance sheet contraction.

Figure 3: DAT Company Downturn Cycle Diagram (Death Spiral Diagram)

Source: PKUBA compilation

This bidirectional cycle mechanism, one positive and one negative, endows the DAT model with极强的 pro-cyclicality in the highly volatile crypto market. The stability of its financial structure is极度 dependent on the price trend of the underlying token. Once entering a downward channel, companies lacking external liquidity injection are极易卷入 irreversible asset sales and valuation collapse.

Therefore, the expansion speed of DAT enterprises depends on the financing window, which is influenced both by the crypto asset cycle and by management's ability to complete financing and allocation during phases of optimal valuation. The ability to conduct forward-looking balance sheet management,储备 emergency liquidity, and dynamically adjust holding strategies becomes key for DAT enterprises to survive cycle shifts.