Gate 2025 Spot Listing Key Data: Nearly 80% of Exclusive Projects Close Higher Within 30 Minutes of Opening, Median Gain Approximately 81%

- Core Viewpoint: Based on data analysis of 447 newly listed assets on the Gate trading platform in 2025, the study finds that first-listed (especially exclusive) assets generate significantly higher median returns and probabilities of positive returns in the early stages post-listing (5 minutes to 24 hours). However, the overall return distribution exhibits long-tail characteristics, and this early-stage advantage typically diminishes after 72 hours.

- Key Findings:

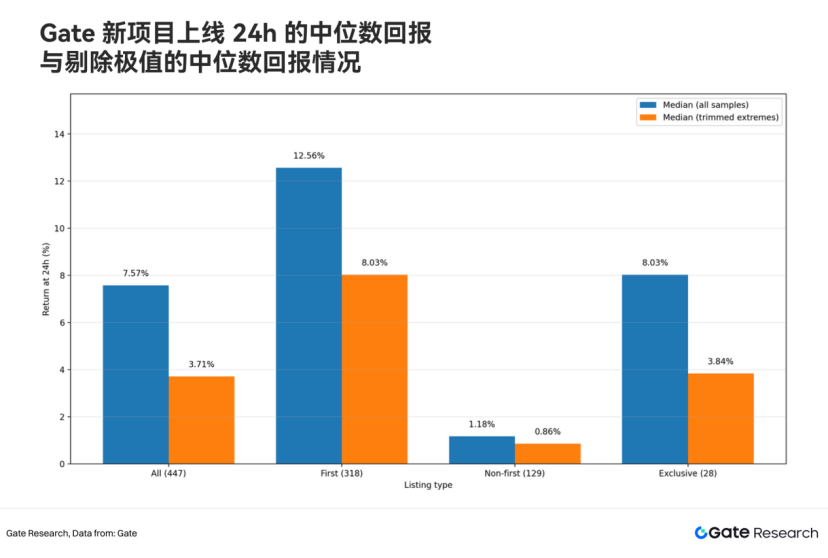

- In the overall sample, 54.8% of assets remained above their opening price 24 hours after listing, but the median 24-hour gain for the full sample was only 7.57%, indicating that high-multiple returns are concentrated in a minority of tokens.

- The median 24-hour gain for the full sample of first-listed projects was 12.56%, significantly higher than the 1.18% for non-first-listed projects. The gap is even more pronounced in the 30-minute window (25.69% vs. 0.98%).

- Exclusive first-listed projects performed particularly well, with nearly 80% rising within 30 minutes of opening, a median gain of approximately 81%, and over one-third of projects gaining ≥100%.

- The return structure of new assets is non-linear. The 72-hour window is a key inflection point where the median return for the full sample approaches breakeven. By the 30-day window, the proportion of rising samples drops to 35.12%.

- Case studies show that the first-listing system can capture diverse narratives (e.g., Pi Network, AI infrastructure, Meme coins) and achieve rapid price discovery and significant wealth effects for high-attention assets (e.g., PI surged nearly 60x in 7 days).

In 2025, the total market capitalization of the crypto market repeatedly reached new all-time highs, the scale of on-chain stablecoins and asset tokenization continued to expand, and the flow of funds between on-chain platforms and centralized exchanges accelerated significantly. In this environment of high volatility and high supply, a platform's ability to cover and screen new assets, as well as the price discovery and pricing trajectory after an asset's listing, have become crucial entry points for observing liquidity absorption efficiency and changes in risk appetite. Based on a sample of 447 assets newly listed on Gate's spot market in 2025, this article conducts a statistical review across multiple time windows from 5 minutes to 30 days post-listing, using metrics such as the proportion of gainers, the average gain of rising samples, and median values to depict overall performance and its structural differences.

Overall Sample Overview: Listing Structure and First-Day Return Distribution

In terms of supply quantity, a total of 447 assets were newly listed on Gate's spot market in 2025. Among these, 318 were initial listings (including 28 exclusive listings), and 129 were non-initial listings, with initial listings accounting for approximately 71%. The platform's new asset supply primarily came from initial listing projects, rather than secondary listings of tokens already available on other platforms.

Using the opening price at listing as a unified benchmark, approximately 54.8% (245/447) of assets remained above their opening price 24 hours after listing. Among the rising samples, the average gain after 24 hours reached 635%. However, observing the median value across the full sample (including declining projects), the median 24-hour gain was 7.57%, which further converged to 3.71% after removing extreme volatility (gains >1,000%, < -90%). This contrast reflects, on one hand, the existence of significant excess return potential within the first-day window, and on the other hand, indicates that high-multiple gains are concentrated in a minority of tokens, with the overall return distribution exhibiting typical long-tail characteristics.

Further breaking down by listing type, there is a noticeable performance difference between initial and non-initial listings on the first day: the median gain for initial listing projects across the full 24-hour window sample was 12.56% (8.03% after removing extremes), significantly higher than the 1.18% (0.86% after removing extremes) for non-initial listings. This difference is not only evident in the 24-hour window but also widens further at more granular early time points, forming clearer layers of return curves between different types.

Multiple Time Windows: Return Trajectories from 5 Minutes to 30 Days

Deconstructing along the time dimension, a segmented statistical analysis was conducted on the performance of Gate's new tokens at 5 minutes, 30 minutes, 1 hour, 12 hours, 24 hours, 72 hours, 7 days, and 30 days post-listing:

1. Short-Term Windows Exhibit Higher Positive Return Coverage

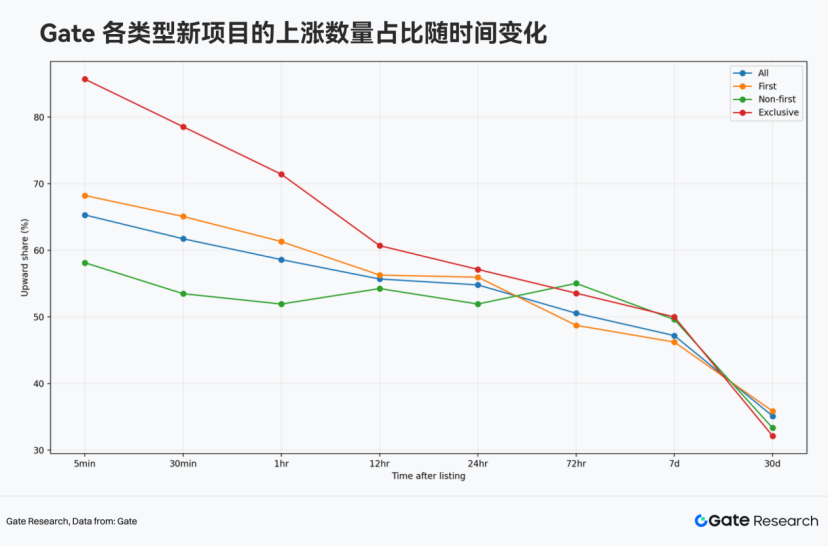

The 447 samples overall showed higher positive return coverage in short-term windows after listing, but this advantage diminishes over time.

Calculated based on the full sample:

• 30 minutes: 276/447 assets rose, accounting for 61.74%

• 24 hours: 245/447 assets rose, accounting for 54.81%

• 72 hours: 226/447 assets rose, accounting for 50.56%

• 7 days: 211/447 assets rose, accounting for 47.20%

• 30 days: 157/447 assets rose, accounting for 35.12%

Overall, the time range where "the proportion of rising assets exceeds half" is mainly concentrated within 24 hours after listing. By around 72 hours, the proportion of rising assets is close to 50/50. At the 30-day dimension, the number of rising samples drops to about one-third.

2. Significant Divergence in Median Returns Between Initial and Non-Initial Listings in Early Windows

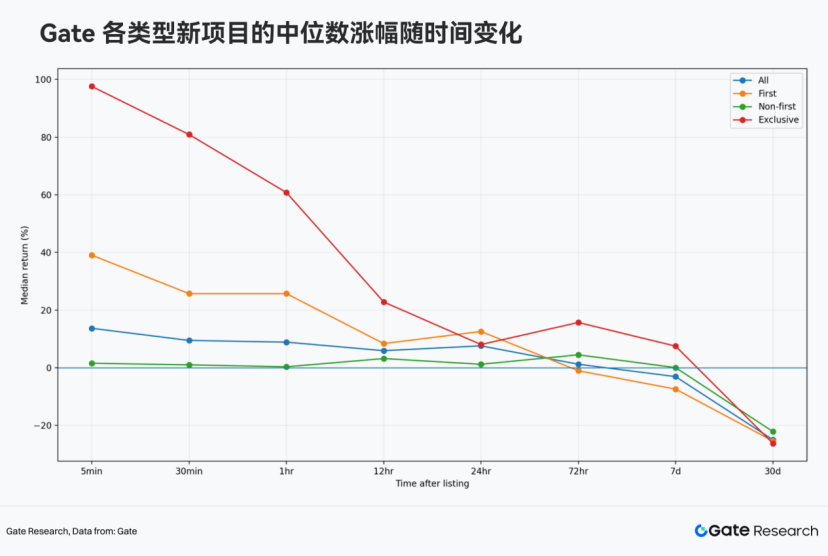

Looking at the time series of median returns, Gate's different types of new projects show clear stratification in early post-listing windows: initial listing projects, especially exclusive ones, maintain higher median return levels at multiple time points from 5 minutes to 24 hours; the median for non-initial listing projects overall stays closer to the zero axis. As the window extends to 72 hours and beyond, medians generally weaken and gradually converge.

Comparing the median gain of the full sample with that of initial and non-initial listing projects:

• 30 minutes: Initial 25.69%, Non-initial 0.98%

• 24 hours: Initial 12.56%, Non-initial 1.18%

A corresponding gap also exists in the number of rising assets:

• 30 minutes: Initial 65.09%, Non-initial 53.49%

• 24 hours: Initial 55.97%, Non-initial 51.94%

It is evident that during the most critical price discovery window after asset listing, Gate's initial listing samples offer greater median return potential, while non-initial listings are closer to "narrow fluctuations around the zero axis." Exclusive Gate listings, in particular, exhibit higher positive return coverage: nearly 80% (22/28) of exclusive projects rose within 30 minutes of opening, with a median gain of approximately 81%; in the 1-hour window, the median gain still exceeded 60%.

3. Around Three Days is the Key Node Where Overall Positive Returns Shift to "Only a Few Can Sustain Gains, Most Give Back or Weaken"

Observing the time series of the full sample median, the median gain in the 24-hour window remains positive (7.57%), but weakens significantly by 72 hours (median gain 1.20%, -0.49% after removing extremes), indicating that the break-even line is approached around the three-day mark. Subsequently, entering the 7-day and 30-day windows, median gains drop to -3.10% and -25.01% respectively (after removing extremes: -5.72% and -24.12%), and the proportion of rising projects also declines to 47.20% and 35.12% respectively. This result shows that the return structure of new tokens post-listing does not exhibit a linear continuation relationship. On a timescale of around three days, the advantages of the price discovery phase gradually fade, and trend divergence and pullbacks among assets begin to dominate.

Initial, Exclusive, and Non-Initial Listings: Return Curve Divergence and Opportunity Density

Through the above data statistics across multiple time windows, it is evident that Gate's initial listing projects and non-initial listing projects exhibit different return curve patterns. Initial listings are more prone to converting hype into more visible gains and higher rising coverage, while non-initial listings are closer to relatively flat fluctuations around the zero axis. Behind this difference lies the systematic outcome of Gate's annual listing structure, project selection, and initial listing execution: initial listing projects not only constitute the main body of new supply in terms of quantity (318/447) but also tend to generate clearer market feedback during the most critical price discovery phase.

Within the initial listing system, exclusive listing projects further reinforce this characteristic: they resemble a "curated sample" of Gate's initial listing capability, demonstrating higher positive return coverage and clearer price feedback in early listing windows—nearly 80% of exclusive projects achieved positive returns within 30 minutes of opening, with a median gain of about 81%, and over one-third of exclusive projects realized gains ≥100% within 30 minutes.

The significance of exclusive samples lies not only in the rise or fall of individual projects but also in their more direct reflection of Gate's comprehensive capabilities in project screening, initial listing execution, liquidity organization, and market heat capture—meaning the platform can not only provide new supply but also transform "new listings" into a process of trading, pricing, and wealth effect creation that can be quickly validated by the market.

Looking back at the trajectories of representative projects in 2025, Gate's initial listing system is not short of "multi-tenfold" wealth effect cases. From entry-level assets with massive user and traffic bases, to technical narrative targets like AI infrastructure, to community culture-driven Meme assets, some initial listing projects completed rapid transitions from attention to trading volume to price revaluation within short cycles. Although high-multiple returns do not occur uniformly across all assets, exclusive projects within initial listings clearly tend to generate stronger market feedback, precisely reflecting Gate's efficiency in screening high-attention assets, execution speed for initial listings, and liquidity absorption capability during critical windows.

1. Among assets in the "ultra-large user scale and traffic entry" category, projects represented by Pi Network (PI) possess extremely strong external attention and community foundations. After listing on Gate, PI's price rose nearly 60x within 7 days. For the platform, the challenge with such assets is not merely "whether to list," but also whether it can quickly absorb concentrated incoming trading demand amidst an environment of both high attention and high controversy, drive efficient price discovery within critical windows, and convert attention into tangible trading volume and wealth effects.

2. As the AI narrative continued to diffuse in 2025, moving from the application layer to the infrastructure layer, Gate consistently covered assets in the AI+Infra direction, forming a more complete listing structure between "traffic-type" and "technology-type" assets. Taking early-stage AI infrastructure potential targets like Unibase (UB), related to the x402 protocol, as an example, its phased price trend after listing on Gate showed characteristics of steady ascent. It remained relatively stable and continued its upward trajectory during the market's sharp volatility on October 11, eventually reaching an ATH of $0.086 on October 30, representing a gain of over 500% from the opening high.

3. In a cycle where Crypto-native driven Memes and community culture accelerate segmentation, attention often exhibits characteristics of high-frequency migration, explosive dissemination, and rapid differentiation. Projects represented by Mubarak (MUBARAK) and Useless (USELESS) derive their pricing logic more from cultural symbols, dissemination efficiency, and the speed of community consensus diffusion. The key to a platform's capability with such assets lies in whether it can respond quickly and timely absorb trading demand during the hype uptrend phase. After Gate listed MUBARAK during the early stages of its hype, its single-day gain once exceeded 120%. Behind this is Gate's keen grasp of the rhythm of the attention economy—keeping up with and absorbing hype during uptrends, thereby maintaining stronger participation potential and higher opportunity density within its initial listing pool amidst narrative rotations.

Synthesizing the sample of 447 assets newly listed on Gate's spot market in 2025, the data reveals three relatively clear conclusions: First, in a market environment of high volatility and high supply, Gate maintained a high density of new asset supply, with initial listings accounting for approximately 71%, making the initial listing pool the main structure of the platform's new supply. Second, from the critical price discovery windows of 5 minutes to 24 hours, the median returns and positive return coverage of initial and exclusive listing samples are more prominent, indicating that Gate not only lists assets quickly but also more easily generates perceptible wealth effects in early windows. Third, when the timeframe extends to 72 hours, 7 days, and 30 days, the median gains of the samples gradually weaken and enter a phase of divergence, suggesting that the return structure of new tokens is not linearly continuous. However, this precisely highlights the value of the platform's screening and execution in early windows—in a cycle of accelerating narrative rotations and frequent attention shifts, Gate's initial and exclusive listing systems can more easily convert attention into trading volume and pricing outcomes, forming stronger wealth effects and market responses for some high-potential projects.

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform, providing readers with in-depth content including technical analysis, hot topic insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of the assets and products they purchase before making any investment decisions. Gate is not liable for any losses or damages resulting from such investment decisions.