MicroStrategy's Bitcoin Leverage Strategy: Betting on Fiat Currency Depreciation

- Core Viewpoint: Bitwise believes that crypto-native stocks, represented by MicroStrategy, may outperform traditional tech stocks in the future due to their unique capital structure and inherent leverage tied to crypto cycles. Their strategy resembles a long-term Bitcoin call option supported by a cash-generating business, rather than simple leveraged speculation.

- Key Elements:

- Bitwise's report points out that companies like MicroStrategy possess an inherent leverage effect related to cryptocurrency cycles, which traditional tech stocks lack, potentially leading to excess returns.

- MicroStrategy primarily finances Bitcoin purchases through long-term, low-interest convertible bonds without forced liquidation clauses, a debt structure fundamentally different from traditional high-risk, short-term leverage.

- The company's core software business continuously generates cash flow to pay interest, providing liquidity support for long-term Bitcoin holdings, with debt maturities extending as far as 2027-2032.

- The essence of the strategy is a macro monetary play: issuing long-term, low-interest USD debt to short fiat currency while hedging with a fixed-supply asset like Bitcoin. If inflation persists, the real value of the debt shrinks.

- Unlike the retail investor perspective, corporations can manage risks through methods like refinancing and debt rollovers. As long as market access remains open and the core assumptions (Bitcoin as a store of value, fiat depreciation) hold, the strategy's logic remains sound.

When Bitwise released its 2026 outlook report, one of its conclusions immediately sparked heated discussion: crypto-native stocks like Coinbase and MicroStrategy, along with listed mining companies, could significantly outperform traditional Nasdaq tech stocks. The reasoning is straightforward yet controversial. Bitwise argues that these companies possess an inherent leverage effect tied to the cryptocurrency cycle, which traditional tech companies lack.

Among them, MicroStrategy is the most polarizing example. In private discussions, it is often described as a ticking time bomb—an over-leveraged Bitcoin proxy destined to implode if prices remain depressed for an extended period. Yet, it is precisely this widespread skepticism that makes the case fascinating. Historical experience shows that excess returns rarely stem from consensus; they often emerge where opinions diverge the most.

Before judging whether MicroStrategy represents systemic fragility or financial sophistication, it is necessary to look beyond surface-level comparisons and examine how its strategy actually operates.

MicroStrategy's Bitcoin Leverage is Not Traditional Debt Financing

At first glance, the criticism seems reasonable. MicroStrategy borrows money to buy Bitcoin, facing downside risk if the price falls below its average acquisition cost. From this perspective, failure seems inevitable in a prolonged bear market.

However, this framework implicitly assumes a traditional leverage model—short-term loans, high interest rates, and forced liquidation. MicroStrategy's balance sheet structure is fundamentally different.

The company primarily funds its Bitcoin purchases through convertible notes and senior unsecured bonds. Most of these bonds carry zero or very low interest rates and mature between 2027 and 2032. Crucially, these bonds do not have margin calls or price-based forced liquidation mechanisms. As long as the company can pay the minimal interest, it is not forced to sell its Bitcoin holdings at low prices.

This distinction is critical. Leverage with forced liquidation risk behaves entirely differently from leverage designed around time and options.

MicroStrategy's Cash Flow Supports Long-Term Bitcoin Investment

Another common misconception is that MicroStrategy has abandoned its operating business and now relies entirely on Bitcoin appreciation. In reality, the company remains a profitable enterprise software provider.

Its core analytics and software business generates approximately $120 million in revenue per quarter, providing stable cash flow that helps cover interest expenses. While this business constitutes only a small fraction of the company's total market capitalization, it plays a vital role from a credit perspective. It provides the liquidity needed to sustain the capital structure during prolonged periods of market stress.

Time is the second structural advantage. With debt maturities years away, MicroStrategy does not need immediate stock price appreciation. The company would only face genuine pressure if Bitcoin prices crashed significantly below its average cost and remained there for several years.

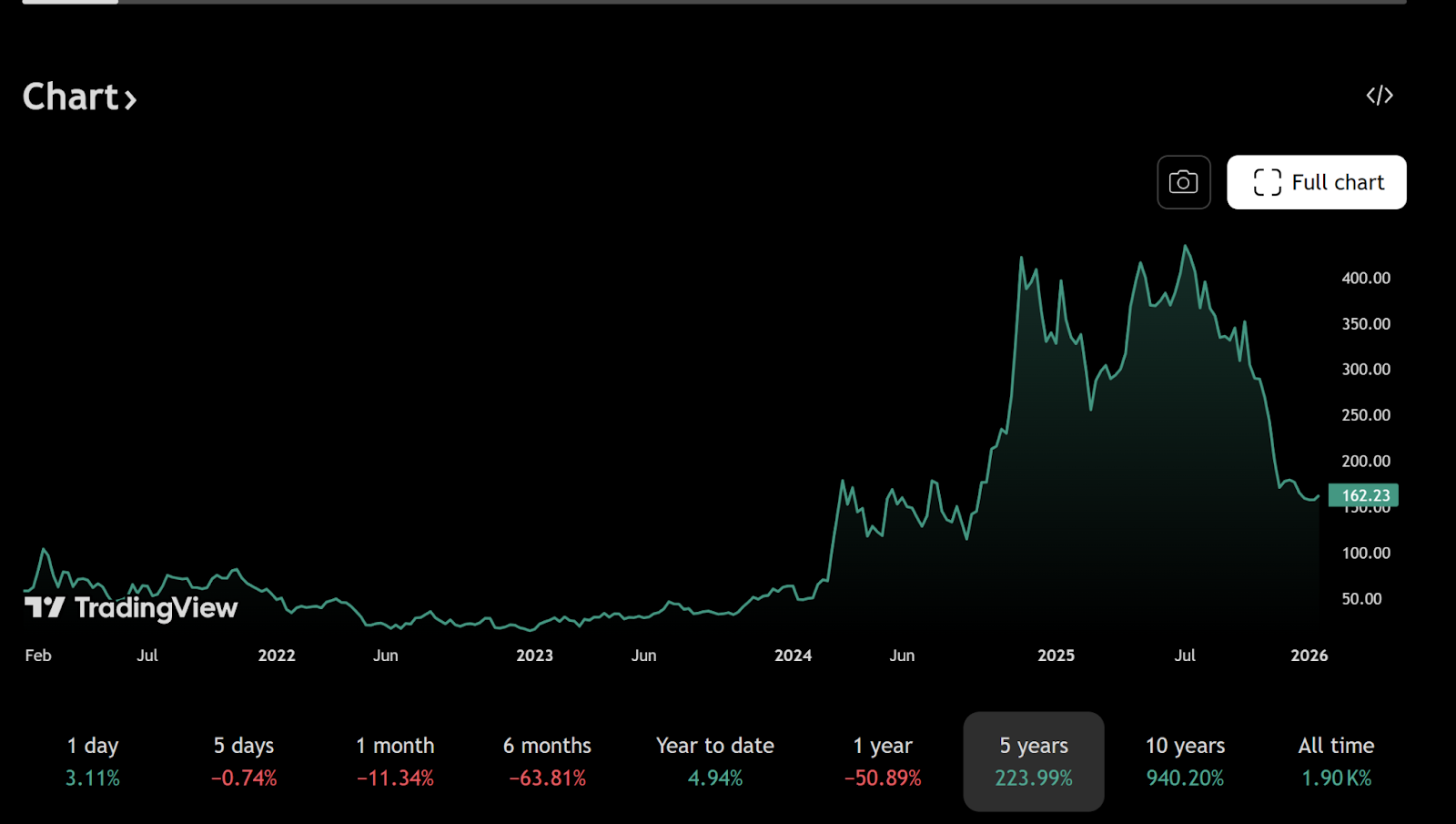

As of December 30, 2025, MicroStrategy holds approximately 672,500 Bitcoins with an average acquisition cost near $74,997. This figure is often cited in bearish arguments, but focusing solely on the spot price overlooks the asymmetric payoff embedded in the company's liabilities.

MicroStrategy's Convertible Bonds Create Asymmetric Options on Bitcoin

Convertible bonds introduce a repayment structure that is often misunderstood. If MicroStrategy's stock price rises significantly—typically driven by Bitcoin price increases—bondholders can choose to convert their bonds into equity instead of demanding principal repayment.

For example, some bonds issued in 2025 and maturing in 2030 have a conversion price around $433 per share, far above the current trading price of approximately $155. At current prices, conversion is not economical, so the company pays only minimal interest.

If Bitcoin surges, the equity value expands, and a portion of the debt can be effectively eliminated through conversion. If Bitcoin prices stagnate but do not crash, MicroStrategy can continue operating while paying very low effective interest. Forced deleveraging only becomes a concern if Bitcoin prices fall to around $30,000 and persist into the late 2020s.

This scenario is possible but far more extreme than many casual commentators suggest.

MicroStrategy's Bitcoin Strategy is a Macro Monetary Play

At a deeper level, MicroStrategy is not merely speculating on Bitcoin's price. It is expressing a view on the future of the global monetary system, particularly the long-term purchasing power of the US dollar.

By issuing long-term, low-interest bonds denominated in US dollars, the company is effectively shorting fiat currency. If monetary expansion continues and inflation remains elevated, the real value of its liabilities will erode over time. Bitcoin, with its fixed supply of 21 million coins, is the hedge in this trade.

This is why comparing MicroStrategy to a reckless leveraged trader misses the point. The strategy resembles a long-term macro investment more than short-term speculation. Borrowing a depreciating currency to acquire a scarce digital asset is a classic move in an environment where debt can be inflated away.

In simple terms, if future dollars are worth less than today's dollars, repaying nominal debt becomes easier over time. The longer the debt maturity and the lower the interest rate, the more pronounced this effect becomes.

Why Retail Investors Misread MicroStrategy's Bitcoin Leverage Strategy

Retail investors typically evaluate leverage through the lens of personal finance. Loans must be repaid, losses materialize quickly, and leverage is inherently risky. Large-scale corporate financing operates under a different set of rules.

MicroStrategy can refinance, extend debt, issue equity, or restructure obligations—options unavailable to individuals. As long as capital markets remain open and the company's creditworthiness is maintained, time becomes an asset, not a liability.

This difference in perspective explains why Michael Saylor's strategy often appears reckless to outsiders. In reality, as long as one accepts its core assumptions—long-term monetary debasement and Bitcoin's continued existence as a global store of value—the strategy is internally coherent.

Bitwise, Crypto Stocks, and the Upside Potential of Bitcoin Leverage

From this angle, Bitwise's optimism about crypto stocks becomes more understandable. Companies like MicroStrategy and Coinbase are not just participants in the crypto ecosystem; they are structurally levered to it.

When the crypto cycle turns bullish, their profitability, balance sheets, and equity valuations can expand faster than those of traditional tech companies. This leverage amplifies downside risk, but during speculative expansions, markets rarely reward linear exposure; they reward convexity.

Conclusion: MicroStrategy is More Like a Bitcoin Call Option Than a Time Bomb

MicroStrategy is neither a sure bet nor an imminent collapse. Comparing it to a ticking time bomb is an oversimplification that ignores both its capital structure and strategic intent. In reality, it resembles a large, publicly traded Bitcoin call option—financed by long-term, low-cost debt and backed by a cash-generating operating company.

Whether this ultimately proves visionary or disastrous depends on Bitcoin's long-term trajectory and the credibility of the fiat monetary system over the next decade. However, it is clear that this is not a naive gamble but a calculated macro investment executed with institutional tools.

In financial markets, it is often these unsettling, heavily questioned structures that produce the most asymmetric outcomes.

Recommended Reading: