2026 InfoFi Leading Platforms Review: How Three Major Prediction Markets Price the Future

- Core Viewpoint: By 2026, prediction markets have evolved from niche tools into a nascent financial infrastructure. Their core value lies in pricing "uncertainty" and "market expectations," forming a new paradigm of "Information Finance" (InfoFi).

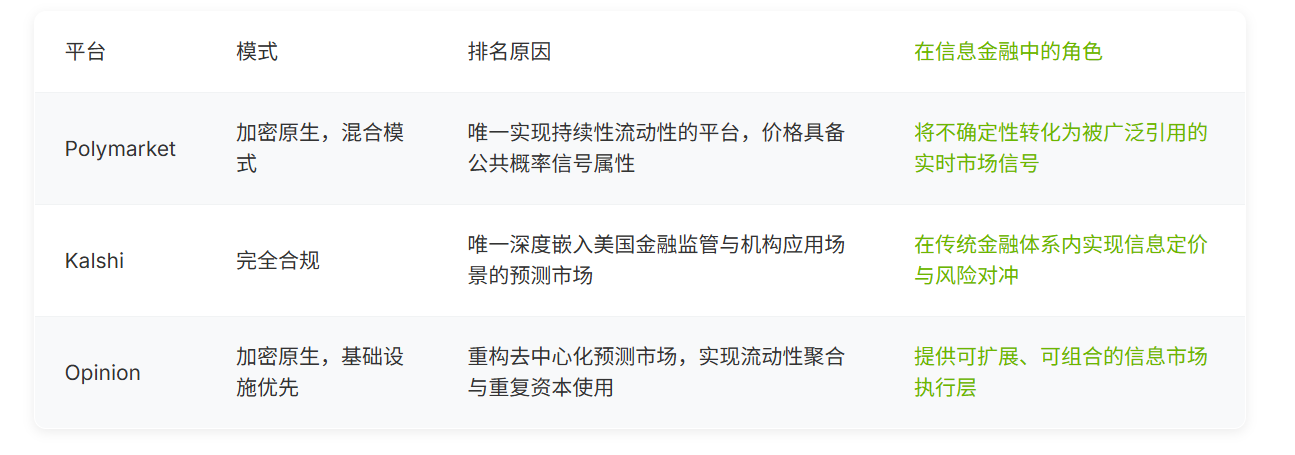

- Key Elements:

- Polymarket has become an industry benchmark with its deep liquidity. Its price signals are widely used as real-time probability benchmarks and risk indicators, validating that liquidity is key to information value.

- Kalshi, as a CFTC-regulated event futures exchange, has paved a realistic path for the compliance and institutionalization of prediction markets within the traditional financial system.

- The Opinion platform focuses on infrastructure reconstruction. By aggregating liquidity and optimizing design, it drives prediction markets from experimental betting towards sustainable, scalable information pricing mechanisms.

- The essential shift of Information Finance (InfoFi) is moving from "pricing assets" to "pricing expectations," transforming uncertainty into tradable public information signals through capital-weighted trading.

- The role of prediction markets has shifted from "predicting the future" to real-time reflection and pricing of the market's collective consensus on future events.

For a long time, prediction markets have been labeled as "niche." They are often equated with election betting, sports outcomes, or experimental governance tools within crypto communities, seen more as a form of entertainment than a genuine financial instrument.

This perception began to shift in 2025 and took a decisive turn in 2026. The capital structure changed, with short-term bets gradually being replaced by persistent capital; prediction prices started to be cited by mainstream media and professional institutions; regulators also moved from long-term neglect to positive engagement and institutional inclusion. Prediction markets are no longer just a lively side show but are gradually entering the purview of the financial system.

As uncertainty began to be priced by capital, liquidity, and continuous exchange, the role of prediction markets changed accordingly. They no longer "predict the future" but instead reflect the market's consensus on the future in real-time. This article will focus on three representative platforms, analyzing how they collectively shaped the operation of InfoFi in 2026.

TL;DR Quick Summary

- By 2026, prediction markets have evolved from niche betting tools into nascent financial infrastructure.

- Information Finance (InfoFi) focuses not on assets or opinions, but on pricing uncertainty and market expectations.

- Liquidity is the key factor determining whether a prediction market can transition from an internal tool to a public information signal.

- Polymarket, Kalshi, and Opinion represent the three core layers of InfoFi: liquidity, regulatory legitimacy, and infrastructure execution capability.

- Overall, prediction markets are gradually becoming a sustainable mechanism for pricing future outcomes and expressing market consensus.

The Next Stage of Prediction Markets: The Rise of Information Finance

From "Pricing Assets" to "Pricing Expectations"

The traditional financial system operates around asset pricing. Stocks reflect expectations of future earnings, bonds price interest rate risk, and derivatives express exposure to volatility or commodities. Information Finance (InfoFi) operates on a different axis. It focuses not on assets themselves, but on pricing "future states." This shift is significant because markets are increasingly driven by expectations rather than fundamental changes that materialize only after the fact.

Prediction markets make this shift tangible. They convert uncertainty into tradable probabilities tied to specific outcomes. As participants continuously react to new information, prices adjust accordingly, reflecting changes in collective expectations in real-time. In practice, InfoFi does not amplify opinions but transforms uncertainty into tradable signals derived from the interplay of real capital, not verbal commentary.

What Makes Prediction Markets Different

The fundamental difference between prediction markets and other forecasting tools lies in their incentive mechanisms. Polls collect opinions, often without consequence; prediction markets reflect judgments weighted by capital. Participants with greater confidence are willing to commit more capital, and their trades have a larger impact on price. Once a price is formed, it becomes a public signal that can be interpreted by external observers, even those not participating in trading.

Therefore, prediction markets are more like information processors than prediction contests. They are not "predicting the future" but are pricing beliefs about the future in real-time.

Liquidity is the Key Watershed

Within the InfoFi system, what truly differentiates platforms is not ideas but execution capability. Liquidity determines whether information remains confined within a platform or can diffuse outward and be widely referenced. Trust and usability support sustained user participation, while regulation primarily affects the scale ceiling, not the inherent informational value.

When market depth reaches a certain level, prices cease to be merely internal metrics and begin to function as public information. This moment marks the watershed where prediction markets transition from experiment to infrastructure.

Positioning Comparison of Leading Platforms in 2026

Overall, these three platforms outline the formation path of InfoFi from different angles. Opinion demonstrates how decentralized prediction markets can be redesigned to support continuous liquidity and real-world utility; Kalshi introduces legitimacy into the regulated financial system; Polymarket clearly shows what happens when liquidity reaches a critical mass. It is this final leap that explains why liquidity sits at the core of InfoFi and why Polymarket is the ideal starting point for understanding Information Finance.

#1 Polymarket: How Liquidity Translates into Information Influence

The Decisive Factor for Polymarket's Rise in 2026

The core reason Polymarket ranks first is singular: liquidity.

It directly addresses and solves the long-standing key problem of prediction markets, achieving breakthroughs through the following design choices:

- Providing deep and continuous liquidity in major event categories

- Adopting stablecoin-denominated contracts to reduce the cost of price understanding and comparison

- Offering a low-cost, fast-execution trading experience paired with a simple, intuitive user flow

These choices make markets easier to participate in, more scalable, and significantly harder to manipulate.

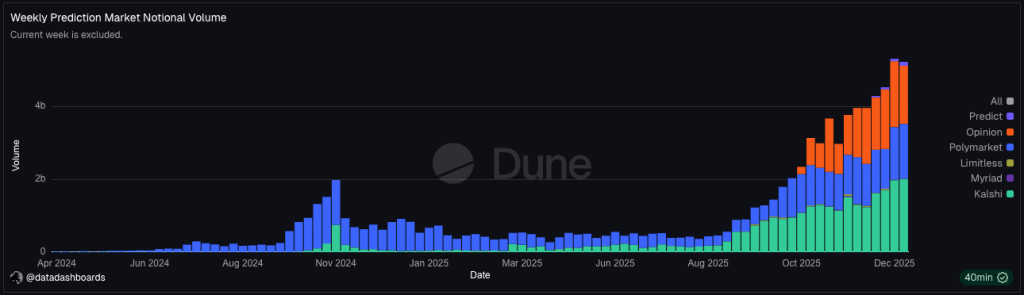

Polymarket's liquidity advantage accelerated in the second half of 2025, with weekly nominal trading volume consistently climbing, highlighting that scale is the key foundation for reliable price discovery. (Dune Analytics)

Polymarket's liquidity advantage accelerated in the second half of 2025, with weekly nominal trading volume consistently climbing, highlighting that scale is the key foundation for reliable price discovery. (Dune Analytics)

Polymarket's Key Choices in Information Pricing Mechanisms

Polymarket clearly validates a core principle of InfoFi:

Only information with liquidity has practical value.

As liquidity increases:

- Prices can reflect new information more quickly

- The influence of any single trader on the outcome is significantly diminished

- Market prices begin to stably reflect collective expectations, not individual opinions

How Markets Actually Use Polymarket's Price Signals

By 2026, markets on Polymarket have been widely used as:

- Real-time probability benchmarks

- Media reference indicators for major events

- Tradable signals for macro and political risks

Its hybrid design deliberately avoids ideological extremes: it neither sacrifices usability for decentralization nor trades complete centralization for efficiency. This balance is precisely the key to Polymarket's scalable expansion.

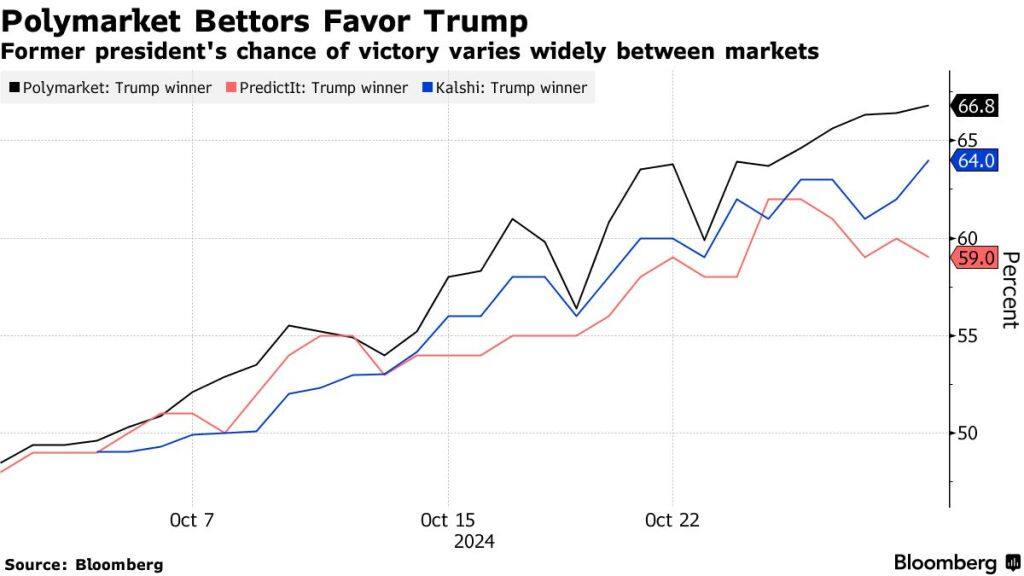

During the 2024 US presidential election, prices on Polymarket, including Trump's probability of winning, were widely used as real-time reference metrics for gauging political expectations. (Bloomberg)

During the 2024 US presidential election, prices on Polymarket, including Trump's probability of winning, were widely used as real-time reference metrics for gauging political expectations. (Bloomberg)

Core Conclusion Polymarket proves that the true formation of Information Finance requires markets to possess three characteristics:

- Easy to participate in

- Difficult to manipulate

- Large enough in scale to exert influence beyond their own user base

#2 Kalshi: The Path of Information Finance Within a Regulatory Framework

Kalshi's Unique Position in the Compliant System

If Polymarket represents the liquidity advantage within the crypto-native world, then Kalshi defines how Information Finance operates within the traditional financial system.

Kalshi is a CFTC-approved event futures exchange. Rather than avoiding regulation, it chooses to treat compliance as a strategic advantage, building a sustainable and scalable market framework upon it.

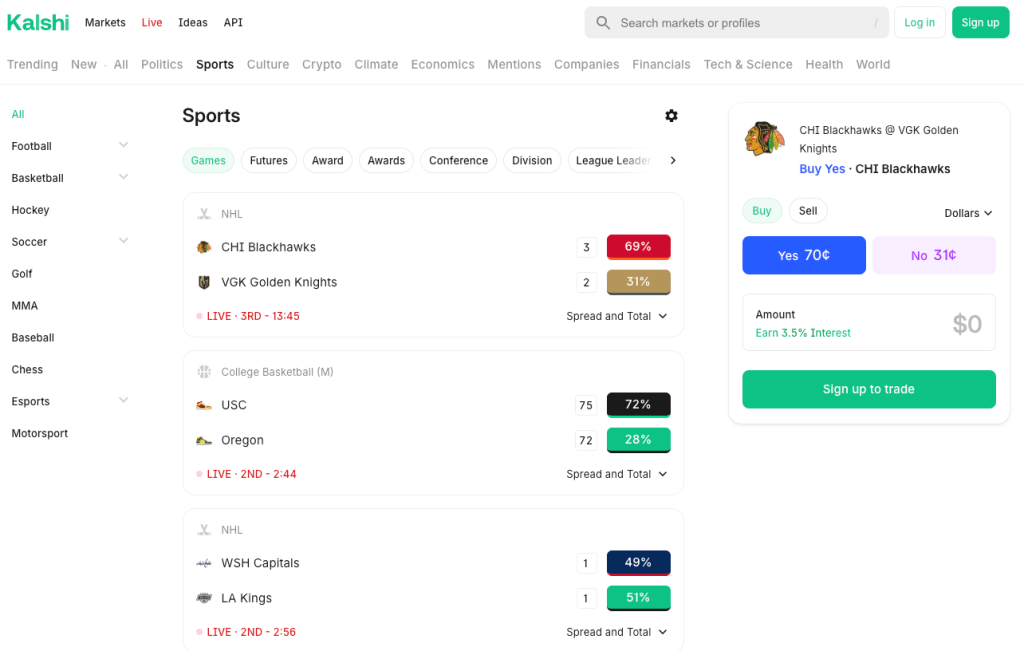

Kalshi extends its event contract model to the sports domain, transforming real-time game outcomes into regulated, tradable probability products, rather than traditional betting odds. (Kalshi)

Kalshi extends its event contract model to the sports domain, transforming real-time game outcomes into regulated, tradable probability products, rather than traditional betting odds. (Kalshi)

Compliant Application Scenarios Opened by Kalshi

Kalshi allows US users to legally and compliantly trade contracts tied to real-world events, including:

- Inflation data releases and interest rate decisions

- Policy and macroeconomic outcomes

- Regulated sports event results

This positioning redefines prediction markets as an event-driven asset class, rather than a traditional gambling product.

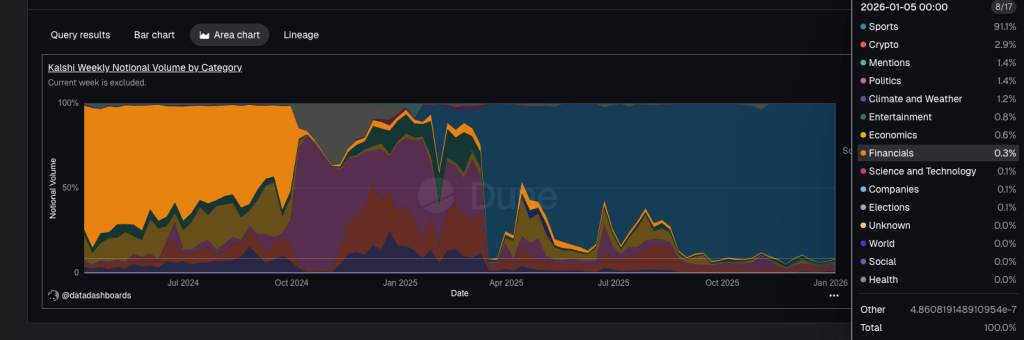

Under the constraints of the regulatory framework, Kalshi's trading volume is primarily concentrated in approved sports contracts, with other categories like macro, crypto, and politics representing a relatively limited share. (Dune Analytics)

Under the constraints of the regulatory framework, Kalshi's trading volume is primarily concentrated in approved sports contracts, with other categories like macro, crypto, and politics representing a relatively limited share. (Dune Analytics)

Advantages and Constraints Brought by Regulation

Kalshi's path also comes with clear structural constraints:

How Kalshi Changes Regulatory Perception of Prediction Markets

Kalshi proves that prediction markets can operate entirely within the regulated financial system. It forces regulators to formally distinguish between "information pricing" and "gambling," laying the foundation for the legitimate existence of InfoFi within traditional finance.