Hong Kong's RWA Regulatory Practices and Representative Projects | Traditional Finance Perspective on RWA Series (Part 3)

- Core Viewpoint: Hong Kong's RWA market has undergone cyclical adjustments and entered a new phase of compliance-focused development.

- Key Factors:

- Tightening regulations in mainland China have cut off the primary sources of incremental capital and assets.

- Market growth momentum has shifted towards connecting with globally compliant capital and US-based on-chain assets.

- Low-risk, high-transparency RWA products such as cash management will continue to experience rapid growth.

- Market Impact: The market is shifting from unregulated growth to compliance-driven development, resulting in a clearer and more sustainable structure.

- Timeliness Note: Medium-term impact

In early August 2025, Hong Kong's RWA and stablecoin sectors reached their most fervent peak in nearly five years. At that moment, the entire city was filled with an energy not seen since 2017-2018: executives from traditional financial institutions, AI entrepreneurs, and even captains of industrial capital flocked to Hong Kong seeking paths for Web3 integration. Dinner tables and hotel lobbies buzzed with heated discussions about tokenized treasury bonds, cash management tools, and stablecoin legislation. A Wall Street banker who had just relocated from New York to Hong Kong remarked bluntly: in terms of crypto topic density and breadth of participation, Hong Kong had replaced New York as the world's hottest blockchain city.

However, just over two months later, market temperatures plummeted sharply. Signals from mainland regulators regarding policies for mainland financial institutions and assets to undergo RWA tokenization in Hong Kong showed significant tightening. Multiple mainland physical asset tokenization projects that were on the verge of launch were suspended or shelved, with trading volumes on some China-backed RWA platforms plunging by 70%-90%. The once-deemed "world's number one" RWA fervor in Hong Kong seemed to slide from midsummer into deep autumn overnight, sparking market concerns about Hong Kong's status as an international Web3 hub. On November 28, 2025, led by the People's Bank of China, 13 national-level departments including the Central Financial Affairs Commission, the National Development and Reform Commission, and the Ministry of Justice convened the "Coordination Mechanism Meeting on Combating Virtual Currency Trading and Speculation." For the first time, the meeting included stablecoins within the scope of virtual currency regulation, explicitly stating that virtual currency-related businesses constitute illegal financial activities, emphasizing their lack of legal tender status and inability to circulate as currency.

While the tightening of mainland regulation also affected China-based clients to some extent in the short term, restricting capital outflows and causing some mainland institutions to suspend their Hong Kong RWA businesses, Hong Kong possesses a unique "one country, two systems" framework and an independent regulatory system, theoretically insulating it from direct mainland policy influence. This does not represent a fundamental shift in Hong Kong's RWA policy but rather another manifestation of the recurring "high-temperature cooling - structural repositioning" cycle that has characterized this sector in Hong Kong over the past two years. Looking back at 2023-2025, a clear three-stage evolutionary path emerges:

- 2023 - H1 2024: Regulatory Opening and Sandbox Experimentation Period

The HKMA launched Project Ensemble, the SFC consecutively approved multiple tokenized money market ETFs and bond funds, and local licensed platforms like HashKey and OSL obtained expanded Virtual Asset (VA) licenses, formally establishing Hong Kong's position as a "regulated RWA testing ground."

- H2 2024 - July 2025: Explosive Growth Period Driven by Internal and External Resonance

The passage of the US GENIUS Stablecoin Act, the start of the Fed's interest rate cut cycle, the Trump administration's pro-crypto stance becoming clear, coupled with the release of Hong Kong's local stablecoin legislative consultation paper, triggered an accelerated influx of global capital and projects. Products like the Bosera-HashKey tokenized money market ETF, XSGD, and multiple tokenized private credit funds saw their AUM surge from tens of millions to billions of dollars within months, briefly making Hong Kong the world's fastest-growing RWA market.

- August 2025 - Present: Limited Participation and Risk Isolation Period

Mainland regulators adopted a more cautious stance towards cross-border asset tokenization, explicitly restricting deep involvement of mainland institutions and individuals in Hong Kong's RWA ecosystem, objectively severing the primary source of incremental capital and assets. Local Hong Kong and international capital continue to be allowed full participation, but the growth driver has shifted from "mainland assets going on-chain" to "local + global compliant capital allocating to US-led on-chain assets."

The underlying logic of this cyclical cooling is precisely the dynamic balance policymakers strike between "participating in the new global digital economic order" and "preventing systemic financial risks." Hong Kong's role has been re-anchored as: leveraging local resources to their limit to fully connect with the US-led blockchain economic network, while simultaneously building a firewall to block risk transmission to the mainland.

This means Hong Kong's RWA market is not heading towards decline but entering a clearer, more sustainable third stage: transitioning from the previous "wild growth" to a new paradigm of "compliance-led, DeFi-integrated, global capital connecting with US-led on-chain assets." Purely on-chain, highly transparent, low-risk cash management RWAs (money market funds, tokenized treasury bonds) will continue to grow rapidly, while paths for physical asset RWA tokenization heavily reliant on mainland assets and capital will be significantly compressed.

For industry participants, short-term pain from policy fluctuations is inevitable, but the compliant space that remains is still ample. Particularly, the US regulatory window of temporary tolerance for DeFi, combined with the on-chain services legally offered by Hong Kong's licensed platforms, creates a rare overlapping advantage. This provides a valuable strategic runway for the next step: deeply cultivating on-chain liquidity, structured products, and cross-chain asset allocation within a regulated framework.

The story of Hong Kong RWA is far from over; it has merely transitioned from the noisy excitement of the crowd into a calmer, more professional period of deep cultivation. This article will further elaborate on the Hong Kong RWA market and its representative projects.

Hong Kong RWA Market Landscape

As a global frontier for blockchain and traditional finance integration, Hong Kong's RWA (Real World Assets) market had established itself by 2025 as Asia's most regulatorily mature ecosystem hub. Driven primarily by the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC), through the Project Ensemble sandbox and the "Digital Asset Policy 2.0" framework, the market focuses on tokenized money market instruments, government bonds, green bonds, and emerging physical assets (such as EV charger revenue and international shipping lease income). The overall landscape exhibits characteristics of "institution-led, compliance-first, DeFi gradual integration": transitioning from experimental issuance in 2024 to scaled infrastructure construction in 2025, emphasizing cross-chain settlement, stablecoin integration, and global liquidity connectivity. Hong Kong's RWA ecosystem has transformed from a "financing window" into an "innovation platform," deeply connected with the US-led on-chain network while building a robust risk isolation wall to prevent cross-border transmission.

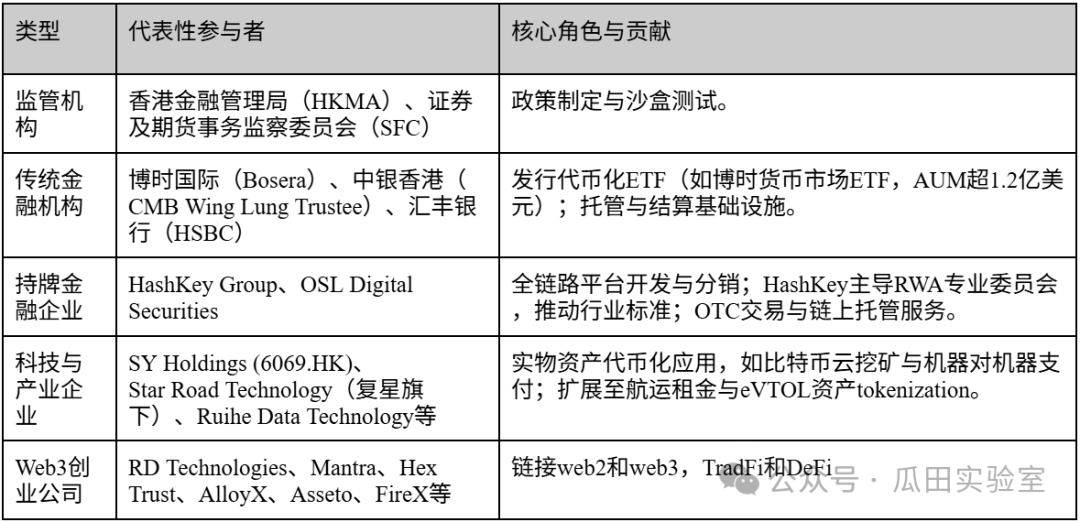

Participant Types: Institutional Capital Dominance, Coexistence of Tech Firms and Startups

Hong Kong's RWA market participants are highly stratified, dominated by institutional capital, supplemented by local tech enterprises and emerging Web3 startups, forming a closed-loop ecosystem. The table below outlines the main types (based on active entities in 2025):

It can be seen that the Hong Kong market is still dominated by institutions, accounting for approximately 70%, leading high-barrier product issuance; enterprises and startups fill technological and application gaps, benefiting from the SFC's VA license expansion.

Overall Scale and Growth Trajectory

In 2025, Hong Kong's RWA market size is embedded within the global $26.59B - $35.8B on-chain TVL framework, with AUM leaping from tens of millions of dollars at the start of the year to billions. Growth momentum stems from policy superposition effects—the 2025 Policy Address called for RWA infrastructure investment, the stablecoin ordinance is set to take effect in 2026, expected to reduce cross-border payment costs by 90% and settlement times to 10 seconds. Annualized growth exceeds 200%, with TVL expanding 58-fold over 3 years, but high compliance costs (over $820,000 per product issuance) limit retail penetration, with institutional inflows accounting for over 80%.

Future Development Potential Assessment

Hong Kong's RWA potential is vast, with the market size projected to reach the trillion-dollar level from 2025-2030, ranking among the top three globally (after the US and Singapore). Advantages lie in the iterative speed of regulatory sandboxes and international alignment: the SFC is set to open global order book sharing, enhancing liquidity; the Ensemble project will build a tokenized deposit settlement system, radiating to emerging trade chains like Brazil/Thailand. The DeFi tolerance window and AI+blockchain integration (e.g., shipping lease tokenization, unlocking a $200 billion market) will drive diversified scenarios, with the startup ecosystem expected to add 50+ new projects. Challenges include cost barriers and mainland capital isolation, but this conversely strengthens Hong Kong's "global neutral hub" positioning: attracting US/EU institutions to allocate US Treasuries/MMFs, while local enterprises deepen cultivation of Asian physical assets. Overall, Hong Kong RWA is transitioning from "hype-driven" to "sustainable growth," with policy continuity and infrastructure maturity being key.

Hong Kong RWA Related Platforms

HashKey Group — The "Full-Stack" Cornerstone of the Compliant Ecosystem

In Hong Kong's grand narrative of striving to become a global Web3 hub, HashKey Group is undoubtedly the most representative "flagship" entity at present. As a leading end-to-end digital asset financial services group in Asia, HashKey is not only a pioneer in Hong Kong's compliant trading market but also a builder of key infrastructure for RWA (Real World Asset) issuance and trading. Its strategic layout forms a complete compliant closed loop, spanning from underlying blockchain technology to upper-layer asset management and trading.

HashKey Group was founded in 2018 and is headquartered in Hong Kong, with deep ties to Wanxiang Blockchain Labs. From the outset of the SFC's virtual asset trading platform licensing regime, HashKey established a path of embracing regulation.

In August 2023, HashKey Exchange became one of the first exchanges in Hong Kong to obtain upgraded Type 1 (dealing in securities) and Type 7 (providing automated trading services) licenses, authorized to serve retail investors. This milestone not only cemented its legal monopoly advantage in the Hong Kong market (one of a duopoly) but also provided an effective channel for the secondary market circulation of future compliant RWA products (like STOs).

On December 1, 2025, HashKey Group passed the Hong Kong Stock Exchange hearing and is set to list on the Hong Kong Main Board, poised to become the "first Hong Kong-licensed virtual asset stock." Regarding the analysis of HashKey's prospectus and listing outlook, several industry experts have provided related analyses. The author believes HashKey's listing is a landmark event that will help Hong Kong compete for pricing power and discourse in the global Web3 arena (especially relative to Singapore and the US), solidifying Hong Kong's status as a "compliant digital asset center."

HashKey's architecture is not a singular exchange model but rather an ecosystem built to serve the entire RWA lifecycle:

- HashKey Exchange (Trading Layer): Hong Kong's largest licensed virtual asset exchange, providing fiat (HKD/USD) on/off-ramps. For RWAs, this is the future liquidity destination for tokenized assets.

- HashKey Tokenisation (Issuance Service Layer): This is the core engine of its RWA business. This department focuses on assisting institutions in tokenizing real-world assets (like bonds, real estate, art), providing end-to-end STO solutions from consulting and technical implementation to legal compliance.

- HashKey Capital (Asset Management Layer): A globally top-tier blockchain investment firm with Assets Under Management (AUM) exceeding $1 billion. Its role in the RWA space is more evident in capital-side support and product structuring (e.g., ETFs).

- HashKey Cloud (Infrastructure Layer): Provides node validation and underlying blockchain technical support, ensuring the security and stability of asset on-chain processes.

In the Hong Kong RWA market, HashKey's core competitiveness lies in two dimensions: "compliance" and "ecosystem synergy":

- Regulatory Moat: The core of RWA lies in mapping regulated offline assets onto the chain. HashKey possesses a complete suite of compliance licenses, enabling it to legally handle tokens classified as "securities," a threshold most non-licensed DeFi platforms cannot cross.

- "Consolidated" Level Ecosystem Capability: Able to connect the asset side (Tokenisation), the capital side (Capital), and the trading side (Exchange). For example, a real estate project can be tokenized and packaged by HashKey Tokenisation, participated in early subscription by HashKey Capital, and finally listed for trading on HashKey Exchange.

- Institutional-Grade Connector: HashKey has established fiat settlement partnerships with traditional financial institutions like ZA Bank and Bank of Communications (Hong Kong), solving the most critical "on/off-ramp" and fiat settlement challenges for RWAs.

HashKey's practice in the RWA field is mainly reflected in two directions: "traditional financial asset on-chain" and "compliant issuance." The following is a summary of its typical cases:

HashKey Group is more than just an exchange; it is the operating system of Hong Kong's RWA market. By holding scarce compliance licenses and building full-stack technical facilities, HashKey is transforming "asset tokenization" from a concept into an executable financial business. For any institution looking to issue or invest in RWAs in Hong Kong, HashKey is currently an indispensable partner.

OSL Exchange — Traditional Finance's "Digital Armory" and Infrastructure Specialist

In the chess game of Hong Kong RWA, if HashKey is the "flagship" charging forward to build a complete ecosystem, then OSL Group (formerly BC Technology Group, 863.HK) is the "armory" operating behind the scenes, providing technology to traditional financial institutions.

As the only listed company in Hong Kong focused solely on digital assets, OSL possesses the financial transparency and audit standards of a public company. This makes OSL the preferred "safe passage" for risk-averse traditional banks and sovereign wealth funds entering the RWA market.

Unlike HashKey's active expansion into retail users and public chain ecosystem building, OSL's strategic focus is intensely concentrated on institutional business. Its architecture is not designed to "build an exchange" but to "help banks build their products":

- Unique "Listed Company" Moat: The core of RWA lies in passing traditional finance (TradFi) compliance reviews. For large banks, the compliance cost of partnering with a public company is far lower than with a private entity. OSL's financial statements are audited by the Big Four; this "institutionalized trust" is its biggest trump card in the B2B market.

- Technology Exporter (SaaS Model): OSL is not fixated on having all assets trade on the OSL platform; instead, it is willing to export technology (OSL Tokenworks) to help banks build their own tokenization platforms. This is a "selling shovels" strategy—whoever issues RWAs, as long as they use OSL's underlying technology or liquidity pools, OSL profits.

- Monopoly-Level Status in Custody: In the issuance of Hong Kong's first batch of Bitcoin/Ethereum spot ETFs, both Harvest Global Investments and China Asset Management (Hong Kong) chose OSL as their virtual asset custodian. This means OSL safeguards over half of the underlying assets in Hong Kong's ETF market. For RWAs, "whoever controls custody controls the lifeline of the assets."

In the RWA industry chain, OSL defines itself as the precise pipeline connecting traditional assets to the Web3 world:

- RWA Structuring & Distribution (Structurer & Distributor): Leveraging its status as a licensed broker, OSL excels at handling complex financial product structuring. It's not just simple "asset on-chain" but focuses on tokenizing investment-grade products like bank notes and structured products.

- Cross-Border Compliant Liquidity Network: OSL has deep collaborations with Zodia Markets (under Standard Chartered) and Japanese financial giants. For RWA liquidity, OSL follows an "institution-to-institution" dark pool and OTC route, not a retail order book model.

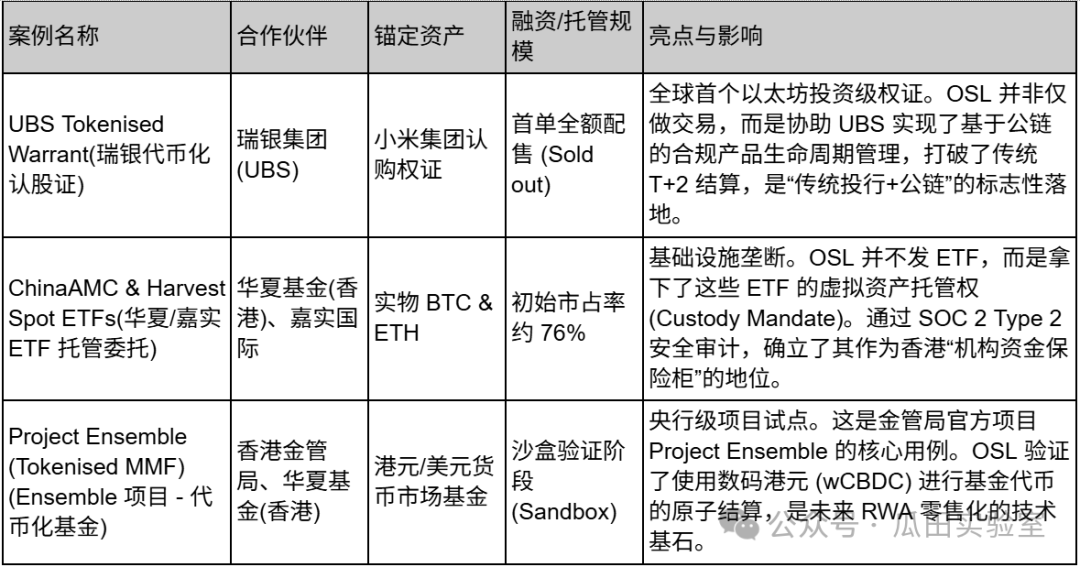

OSL's cases often extend beyond Hong Kong, carrying strong international demonstration effects, with partners being top-tier TradFi giants. Due to its B2B nature, financing scales are generally not disclosed:

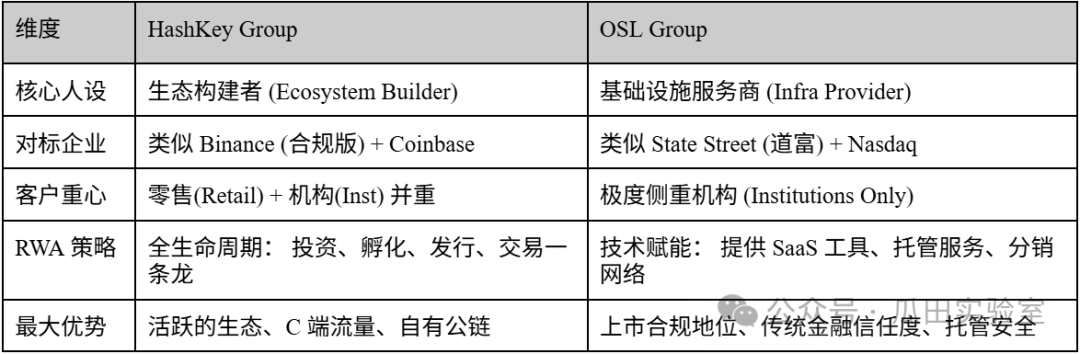

To more intuitively understand the differences between the two, a comparison table of HashKey vs. OSL is specially summarized:

If HashKey is building a bustling "Web3 commercial city" in Hong Kong, then OSL is like the chief engineer responsible for that city's underground pipelines, vault security, and power transmission. In the RWA market, OSL does not pursue the most high-profile "issuance" but strives to become the safest "warehouse" and most compliant "channel" for all RWA assets.

Ant Digital (Ant Digital) — The "Trusted Bridge" for Physical Asset On-Chain

In Hong Kong's RWA landscape, Ant Digital (and its Web3 brand ZAN) represents a dimensional shift from internet giants. Unlike financial institutions focusing on "licenses" and "trading," Ant Digital's core competitiveness lies in solving the most fundamental pain point of RWA: how to prove that the Token on-chain truly corresponds to the physical asset off