RWA Weekly Report|Private Credit Surges Nearly 40%; Bipartisan Senate Inclination to Adjust GENIUS Stablecoin Revenue Rules (1.7-1.13)

- Core Viewpoint: The total on-chain value of RWA continues to grow, with market structure accelerating its expansion.

- Key Elements:

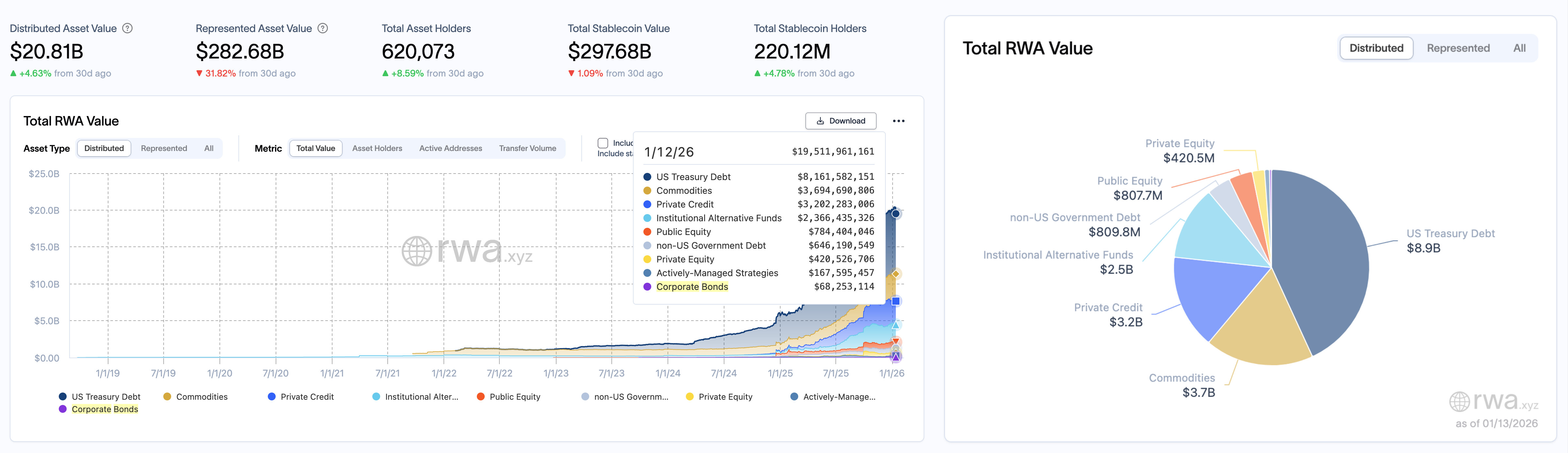

- The total on-chain value of RWA increased by 6.23% in a single week to $20.81 billion.

- Private credit assets surged by 39% in a single week, showing outstanding performance.

- Stablecoin annual transaction volume reached a historic high of $33 trillion.

- Market Impact: Drives the tokenization of traditional assets, attracting more institutions and users.

- Timeliness Note: Medium-term impact

Original | Odaily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

RWA Sector Market Performance

According to the rwa.xyz data dashboard, as of January 13, 2026, the total on-chain value of RWA (Distributed Asset Value) continued to rise, growing from $195.9 billion last week (January 6) to $208.1 billion, a net increase of $12.2 billion in a single week, representing a week-over-week growth of 6.23%, showing a stronger momentum compared to the previous week's 2.83% increase. Possibly due to another adjustment in statistical methodology, the broad RWA market size saw a significant correction, dropping from $4015.3 billion to $2826.8 billion, a reduction of approximately $1188.5 billion, with a steep decline of 29.6%. The user base on the on-chain asset side continued to grow, with the total number of holders increasing from 604,909 to 620,073, adding over 15,100 new users in a week, a growth of 2.5%. The expansion momentum for stablecoin users continued to strengthen, with holding addresses growing from 217.94 million to 220.12 million, an increase of 2.18 million, up 1% week-over-week. The total market capitalization of stablecoins saw a slight correction, decreasing from $2985.8 billion to $2976.8 billion, a reduction of $9 billion, a decline of about 0.3%.

In terms of asset structure, U.S. Treasury bonds remained firmly in the top position, with a total size of $8.9 billion, a slight increase of $200 million from the previous period's $8.7 billion, up 2.3%. Commodity assets saw little change, recorded at $3.7 billion, up $100 million from last week's $3.6 billion, an increase of 2.78%. Private credit rebounded significantly, growing from $2.3 billion to $3.2 billion, a massive single-week surge of $900 million, representing a growth of 39%. Institutional alternative funds saw a slight correction, decreasing slightly from $2.6 billion to $2.5 billion, down about $100 million, with minimal volatility. Non-U.S. government debt increased from $772.1 million to $809.8 million, a week-over-week increase of $37.7 million, up 4.88%. Public equity rose steadily, from $775.4 million to $807.7 million, an increase of approximately $32.3 million, up 4.2%. Private equity increased from $407.7 million to $420.5 million, recording modest growth of about 3.14%.

Trend Analysis (Compared to Last Week)

Overall, during this period, the on-chain RWA asset scale, excluding the impact of the sharp correction in the broad RWA market caused by statistical methodology adjustments, still showed a significantly accelerated growth momentum, with user numbers continuing to climb. Structurally, private credit performed exceptionally well this period, while U.S. Treasury bonds and commodity assets remained core allocation targets, showing small fluctuations but continuously attracting capital. Non-U.S. debt and public equity continued their warming trend, indicating the market maintains a stable preference for debt and equity assets with moderate risk. Alternative assets (such as private equity, institutional strategies) remained stable, but their overall proportion did not increase further.

Market keywords: On-chain acceleration, structural expansion, private credit explosion.

Key Event Review

Crypto Market Structure Draft Prohibits Interest Payments for Holding Stablecoin Balances

SolanaFloor posted on X platform, stating that the latest crypto market structure draft adopts the stablecoin yield treatment method long advocated by banks, prohibiting interest payments solely for holding. Rewards linked to activities such as trading, staking, liquidity provision, or governance participation are still permitted.

RWA Market Cap Excluding Stablecoins Breaks $200 Billion, Setting Another Record High

The tokenized digital securities platform Securitize cited rwa.xyz data on X platform, showing that the market capitalization of RWA (Real World Assets) excluding stablecoins has surpassed $200 billion, setting another historical high, indicating sustained investor interest in the blockchainization of traditional assets. The tokenized U.S. Treasury market performed particularly well, with a market cap exceeding $8.87 billion. Additionally, BlackRock's BUILD fund currently has a market cap of $1.73 billion.

Senate Bipartisan Tendency to Adjust GENIUS Stablecoin Yield Rules, CLARITY Act Nearing Advancement

Sources revealed that bipartisan senators are gradually accepting the banking lobby's demands to adjust the stablecoin yield rules in the GENIUS Act. Potential adjustment paths include: adopting the proposal by Senator Alsobrooks to limit yields to trading activities (more favored by Democrats); or requiring that only institutions holding an Office of the Comptroller of the Currency (OCC) bank charter can offer stablecoin yields. The latter is considered more friendly to parts of the crypto industry but is highly controversial in the DeFi space.

Furthermore, sources indicate that Scott is expected to submit the House version of the CLARITY Act as placeholder text tonight to initiate next week's review process. The official text must be submitted by midnight Monday at the latest.

Another industry insider involved in discussions with Senate staff stated that the previous remark about "needing prayer to pass the bill" was more of a light-hearted joke than a pessimistic judgment on the legislative outlook. The final direction may become clearer in the coming days.

Fan Wenzhong, Vice President of the Beijing Academy of Social Sciences and Executive Director of the Chinese Finance Society, wrote in Hong Kong's Wen Wei Po article "Steadily Promoting the Collaborative Innovation of Digital Yuan and Hong Kong Stablecoins," pointing out: Currently, the cross-border use of the digital yuan mainly relies on internal regulations and pilot policies of the People's Bank of China, lacking explicit legal authorization. It is suggested to add clauses during the revision of the "People's Bank of China Law" to clarify the digital yuan's cross-border payment functions and the legality of its interconnection with compliant foreign digital currency systems. Simultaneously, efforts should be made to specify "special regulatory requirements and preferential policies for stablecoin issuers exchanging with the mainland's central bank digital currency" in the implementation rules of Hong Kong's "Stablecoin Ordinance," forming institutional synergy.

2025 Stablecoin Transaction Volume Reaches $33 Trillion, Setting a New Historical High

Bloomberg cited Artemis Analytics data reporting that global stablecoin transaction volume surged 72% year-over-year in 2025, reaching a record $33 trillion. Driven by a pro-crypto policy environment, the scale of stablecoin usage expanded significantly.

Among them, USDC issued by Circle recorded a transaction volume of $18.3 trillion, ranking first; Tether's USDT transaction volume was $13.3 trillion, also maintaining a high level. Together, they account for the vast majority of stablecoin transaction activity.

The report stated that after the Trump administration signaled more friendly crypto policies, the use of stablecoins in payments, transaction settlements, and cross-border capital flows grew significantly, becoming one of the core infrastructures of the crypto market. Analysis suggests that the explosive growth in stablecoin transaction volume highlights its rising importance in the global financial system and brings higher attention to future regulatory and policy directions.

Hong Kong's Financial Secretary, Paul Chan, stated at an event today that Hong Kong's economy grew by 3.2% last year. Regarding the development of virtual currency and artificial intelligence, Chan pointed out that virtual currency is part of financial innovation, and Hong Kong should embrace it. However, the confidentiality of blockchain technology may bring risks such as insufficient investor protection, impacts on anti-money laundering efforts, and threats to financial stability. He emphasized that the Hong Kong government must handle it cautiously, incorporating an appropriate regulatory framework. Chan also expressed reservations about promoting virtual currency investment to the general public, believing that education and awareness should be strengthened.

An audience member suggested that Hong Kong could consider launching a gold-backed stablecoin, as gold has long been historically regarded as a true store of stable value, especially meaningful in the current economic environment. Chan indicated that stablecoins would be developed step by step, and suggestions for gold or other asset-backed stablecoins would be considered after the first step is properly handled, emphasizing the need for cautious processing.

The South Korean Financial Services Commission has finalized guidelines allowing listed companies and professional investors to trade cryptocurrencies. The new regulation ends a nine-year ban, permitting eligible corporate entities to invest up to 5% of their net assets annually in cryptocurrencies ranked within the top 20 by market capitalization on South Korea's five major exchanges.

This policy adjustment is expected to grant market access to approximately 3,500 entities, including listed companies and registered professional investment institutions. Regulators will also require exchanges to implement staggered execution and order size limits. Currently, discussions are ongoing regarding whether dollar stablecoins like USDT qualify for investment.

70 Economists Release Open Letter: Calls for Digital Euro Project to Prioritize Public Interest

Seventy economists and policy experts released an open letter urging Members of the European Parliament to support a digital euro that clearly serves the public interest. The letter argues this is crucial for Europe's monetary sovereignty and ensuring access to central bank money in an economy with declining cash use. It warns that without a strong public option, private stablecoins and foreign payment giants could exert greater influence over Europe's digital payments. Signatories include José Leandro, former EU Executive Board Director of the European Bank for Reconstruction and Development (EBRD), French economist Thomas Piketty, among others. They describe the proposed Central Bank Digital Currency (CBDC) as a public good, advocating for a public digital payment method issued by the Eurosystem, with basic services free and covering the entire euro area, to complement rather than replace cash.

World Liberty Markets Lending Platform to Support ETH and Stablecoins USD1, USDC, and USDT

The Trump family's crypto project, World Liberty Financial, launched a platform allowing users to lend and borrow digital assets among themselves, named "World Liberty Markets." The service will officially launch on Monday. In addition to Ethereum, stablecoins USDC and USDT, it will also support the company's own token WLFI and stablecoin USD1.

Stablecoin Company Rain Raises $250 Million at $1.95 Billion Valuation, Led by ICONIQ

Stablecoin company Rain announced it has raised $250 million at a $1.95 billion valuation, led by ICONIQ, with participation from Sapphire Ventures, Dragonfly, Bessemer, Lightspeed, and Galaxy Ventures, among others. To date, the company's total funding exceeds $338 million. Rain helps clients launch stablecoin cards on the Visa network. The company plans to use this capital to expand its footprint in North America, South America, Europe, Asia, and Africa markets. It will also use the funds to help adapt to the rapidly changing global regulatory environment.

Stablecoin financial infrastructure provider VelaFi announced the completion of a $20 million Series B funding round, led by XVC and Ikuyo, with participation from Planetree, BAI Capital, Alibaba Investment under Alibaba Group, among others. To date, the company's total funding has reached $40 million. Founded in 2020, VelaFi initially built payment infrastructure in Latin America and has since expanded its business to the United States and Asia. Its platform connects local banking systems, cross-border payment networks, and mainstream stablecoin protocols, enabling businesses to transfer funds across markets faster and at lower costs than traditional systems.

Cathie Wood: U.S. Government May "Directly Purchase" Bitcoin for National Asset Reserves

ARK Invest founder Cathie Wood stated that the U.S. government may begin directly purchasing Bitcoin in the future to build up the national Bitcoin strategic reserve, rather than solely relying on assets seized by law enforcement.

Wood noted in a recent episode of the "Bitcoin Brainstorm" podcast that although the Trump administration has established a national Bitcoin reserve via executive order, the reserve sources so far have been limited to confiscated BTC, with no market purchases made yet. "The initial goal is to hold 1 million Bitcoin, so I think they will eventually start buying," Wood said.

She believes that Trump, under midterm election pressure, will still highly prioritize cryptocurrency issues, which is favorable for the Bitcoin strategic reserve. On one hand, Trump and his family's interests in the crypto industry are deepening; on the other hand, the crypto community played a significant role in his presidential election victory.

"He doesn't want to be a 'lame duck president.' He wants one or two more productive years in office, and he sees crypto as a path to the future," Wood said.

The report stated that the Trump administration has signed multiple executive orders establishing Bitcoin reserves and crypto asset inventories and formed a crypto and AI working group led by David Sacks to promote industry legislation, including the GENIUS Act (stablecoin legislation).

Wall Street's main trade group, SIFMA, held private meetings with DeFi and crypto industry representatives to discuss differences in the Senate's crypto market structure bill, reportedly making "progress" particularly around DeFi regulatory provisions.

Sources said SIFMA recently opposed regulatory exemptions for some DeFi protocols and developers in the bill, while also joining banking lobby groups in pushing to restrict yield-bearing dollar stablecoins. The crypto industry side is trying to persuade them to lower their demands to avoid derailing bipartisan negotiations.

The time window is rapidly closing. Senate Banking Committee Chairman Tim Scott plans to advance the bill for review next week. The industry widely believes that if bipartisan support cannot be secured at the committee stage, the bill will struggle to reach a full Senate vote. The bill is seen as key legislation reshaping the U.S. crypto regulatory framework, and its final direction remains highly uncertain.

Coinbase May Withdraw Support for CLARITY Act Due to Stablecoin Reward Ban

U.S. cryptocurrency exchange Coinbase is increasing pressure on U.S. lawmakers to resist proposals in the major cryptocurrency bill named the CLARITY Act that would ban certain decentralized finance provisions. Bloomberg cited informed sources stating that if the bill restricts stablecoin issuers from offering rewards on platforms like crypto exchanges, Coinbase may reconsider its support for the bill.

Banking groups are concerned that stablecoin rewards and yield products could siphon trillions of dollars from the traditional banking system. The GENIUS Act passed in July 2025 prohibits stablecoin issuers from providing interest or yields to holders but does not explicitly