2026 CEX Token New Landscape: How Exchanges and On-Chain Ecosystems Are Integrating

- Core Viewpoint: Centralized exchanges and on-chain ecosystems are accelerating integration, forming hybrid platforms.

- Key Elements:

- User demand drives integrated experiences, pursuing liquidity, execution, and simplicity.

- CEXs lead on-chain ecosystem development, with token functions evolving towards ecosystem synergy assets.

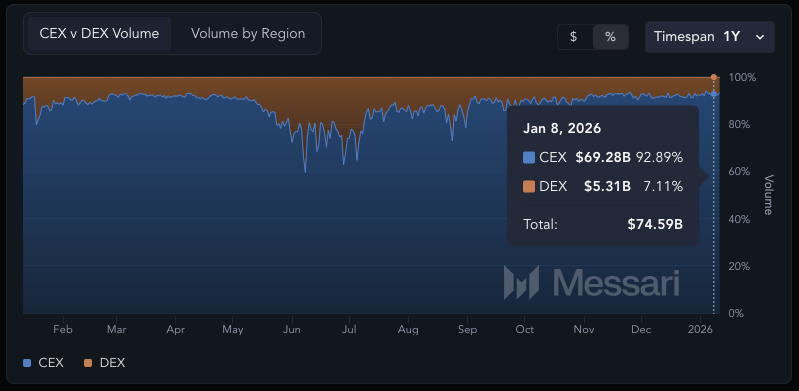

- CEXs still account for 93% of trading volume, serving as the core liquidity hub and innovation distribution gateway.

- Market Impact: Drives the upgrade of crypto business models and reshapes platform competition dynamics.

- Timeliness Note: Medium-term impact

In the early stages of competition, centralized exchanges and on-chain protocols developed along different paths. Exchanges built their moats by leveraging scale in users and liquidity, while on-chain ecosystems continuously produced new financial models and asset forms. While seemingly separate, both sides have always existed within the same market cycle.

As decentralized platforms continuously improve execution efficiency, centralized exchanges have also felt structural pressure from on-chain developments. Relying solely on trading functions is no longer sufficient to support long-term growth. Consequently, a two-way convergence has begun: on-chain products learn from centralized experiences, while exchanges actively integrate on-chain capabilities.

By 2026, this competition has ultimately evolved into fusion. Exchanges have begun building their own or deeply integrated on-chain ecosystems, forming hybrid platforms that combine liquidity, execution, and settlement. CEX tokens are being repositioned in this process, shifting from marketing tools to assets for ecosystem coordination. This is not merely a change in product form but an upgrade to the crypto market's business model.

TL;DR Quick Summary

- By 2026, centralized exchanges and on-chain markets are accelerating their integration, gradually forming a hybrid platform model.

- The core drivers of this change are user demand for simplified experiences, sufficient liquidity, and high-quality execution.

- Integration is primarily achieved through exchange-led on-chain ecosystem development and execution models that combine centralized and on-chain elements.

- CEX tokens are evolving from single-purpose fee discount tools into assets with greater ecosystem attributes and synergistic functions.

- Not all exchange tokens will benefit equally; execution capability and transparency will become the most critical differentiating factors.

How User Demand Drives the Accelerated Integration of Exchanges and On-Chain

The integration of CEXs and on-chain markets is not accidental but driven by structural changes in the usage patterns and construction logic of the crypto market.

For most users, the core criteria for choosing a platform are not whether trade execution happens on-chain or off-chain, but rather whether prices are competitive, liquidity is sufficient, execution is stable, and the user experience is simple enough. Under such shifting demands, the market increasingly favors an integrated platform form, allowing trading, asset management, and yield opportunities to be completed within the same interface.

Simultaneously, on-chain ecosystems remain the primary source of financial innovation. Whether it's new asset types, market structures, or yield mechanisms, they often appear first on-chain. However, in terms of distribution capability, centralized exchanges still hold a clear advantage. They control large-scale user entry points, manage fiat on/off-ramps, and can efficiently aggregate liquidity across different markets.

As of early January 2026, centralized exchanges still dominate crypto trading, contributing approximately 93% of total trading volume, while decentralized exchanges account for about 7%. This data clearly indicates that centralized platforms remain the core liquidity hubs in the current market. (Messari)

As of early January 2026, centralized exchanges still dominate crypto trading, contributing approximately 93% of total trading volume, while decentralized exchanges account for about 7%. This data clearly indicates that centralized platforms remain the core liquidity hubs in the current market. (Messari)

Competitive pressure further reinforces this trend. On one hand, decentralized platforms are introducing features like perpetual contracts and high-performance order matching that are closer to the centralized experience. On the other hand, centralized exchanges are continuously integrating wallet, staking, and on-chain settlement capabilities to maintain their relevance. In this context, integration is no longer just an optional strategy but is gradually evolving into a competitive reality that trading platforms must address.

The Core Structure and Practical Forms of Current CEX–On-Chain Integration

Exchange-Supported Public Chains and Layer-2 Networks

The most intuitive and representative integration model is exchanges launching or deeply participating in the construction of public chains and Layer-2 networks. These networks typically aim to support decentralized applications, payments, and settlements while maintaining a high degree of integration with the centralized trading platform.

In this model, exchange tokens often occupy a central position, usable for paying Gas fees, participating in staking, or as validator incentives, and frequently serve as the base asset for ecosystem incentive programs and liquidity support initiatives. The strategic goal is clear: exchanges use this to open new revenue streams, extend their business boundaries from trading to a broader ecosystem, and further strengthen the practical utility value of their tokens.

However, this model also comes with non-negligible risks. Security incidents, cross-chain bridge vulnerabilities, and over-reliance on incentive-driven rather than genuine usage demand can all undermine market confidence. The ability to achieve sustained user adoption, rather than short-term trading volume or data performance, is key to distinguishing a long-term ecosystem from a temporary experiment.

Centralized Exchanges as On-Chain "Super Apps"

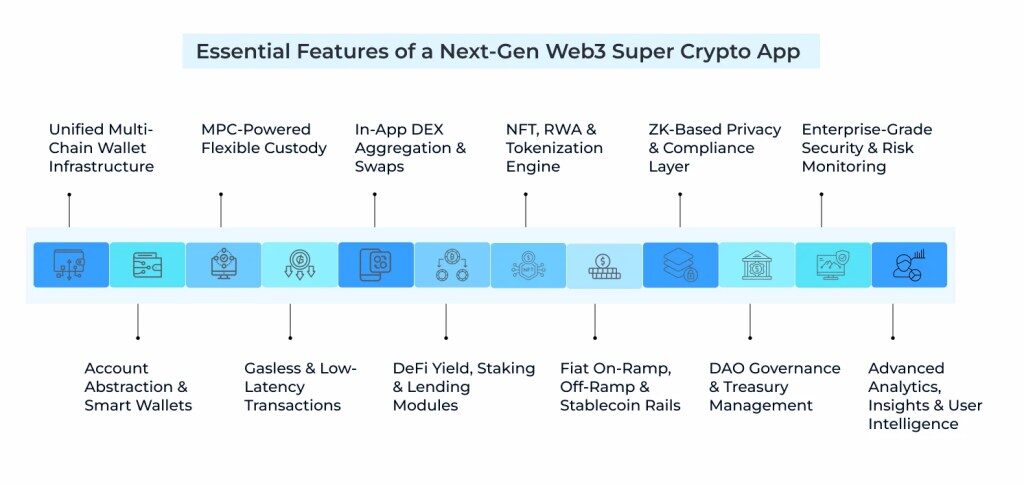

Another important path is exchanges positioning themselves as on-chain super apps. In this model, wallets, cross-chain bridges, swaps, and yield products are directly integrated into the centralized platform's interface, allowing users to participate in on-chain strategies without managing multiple tools or accounts.

Image Source: Antier Solutions

Image Source: Antier Solutions

This approach is often referred to as CeDeFi, where centralized platforms abstract away on-chain complexity while providing users with access to decentralized markets. Exchange tokens in this context serve functions like tiered permissions, fee optimization, and reward enhancement, becoming an important link between the platform and its users.

The trade-offs of this model are mainly reflected in transparency and compliance. As exchanges continuously lower the barrier to on-chain usage, they also need to fully disclose underlying risks and consistently meet regulatory requirements. Its ultimate success depends on whether users trust the centralized platform to responsibly manage on-chain risk exposure.

Liquidity Routing Across Centralized and On-Chain Markets

Liquidity routing represents a more technically oriented form of integration. An increasing number of exchanges are implementing smart routing between centralized order books and on-chain liquidity pools to obtain better prices and execution outcomes. For users, this often means narrower spreads and less market fragmentation.

Under this model, exchange tokens can be used to provide unified fee discounts or priority access, regardless of whether the trade is ultimately executed centrally or on-chain. Users receive a consistent pricing experience without managing multiple trading venues, which helps improve long-term retention.

The main challenge lies in operational complexity. Especially during periods of heightened market volatility, the routing logic and execution results must remain highly transparent. Any execution discrepancies or unclear attribution can quickly impact user trust.

Tokenized Assets, Payment, and Settlement Infrastructure

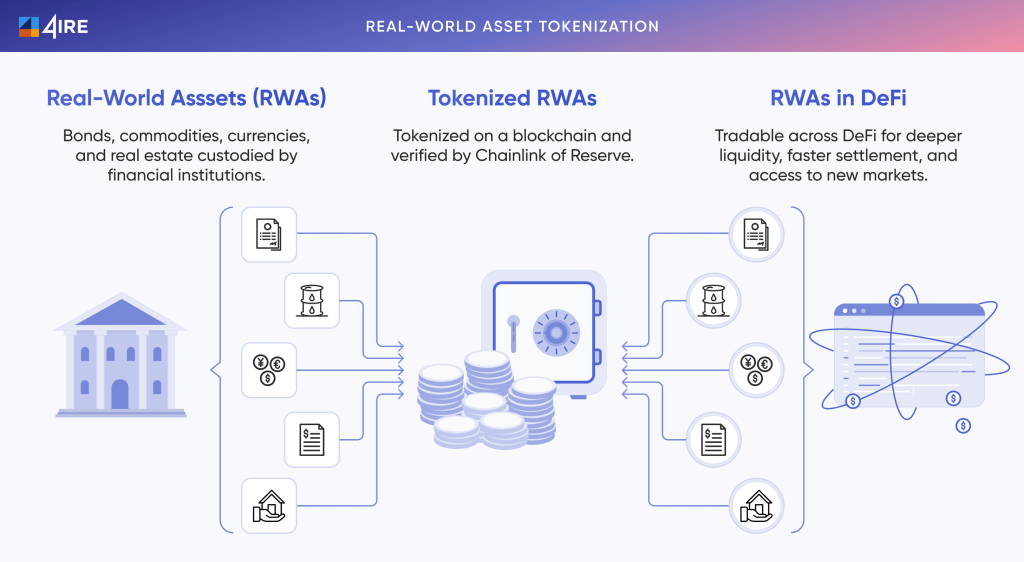

The final integration model is reflected in the expansion into tokenized assets, stablecoin payments, and institutional-grade settlement processes. Leveraging their compliance systems and channel advantages, centralized exchanges possess inherent strengths in providing tokenized real-world assets (RWA) and cross-border payment channels.

Image Source: 4IRE Labs

Image Source: 4IRE Labs

In this scenario, exchange tokens play more of a role as access credentials, fee adjustment tools, or ecosystem incentive vehicles, rather than purely speculative assets. This model is highly dependent on the regulatory environment but is also seen as an important long-term growth direction as the crypto market continues to integrate with traditional finance.

The Evolving Positioning of CEX Tokens in the Integrated Market

From Platform Utility Tool to Ecosystem Asset

Historically, most exchange tokens had relatively singular functions, primarily used to reduce trading fees or participate in platform activities. As CEX and on-chain integration accelerates, this positioning is undergoing a significant change. Token demand no longer solely reflects trading activity but is also becoming closely tied to on-chain usage scenarios.

When exchange tokens are incorporated into a more complete ecosystem, their demand sources also diversify. Gas consumption, staking mechanisms, and application-layer incentives are forming a complementary relationship with usage scenarios within the exchange. This multi-faceted demand structure helps enhance the token's resilience to volatility but also imposes higher requirements on design and operation.

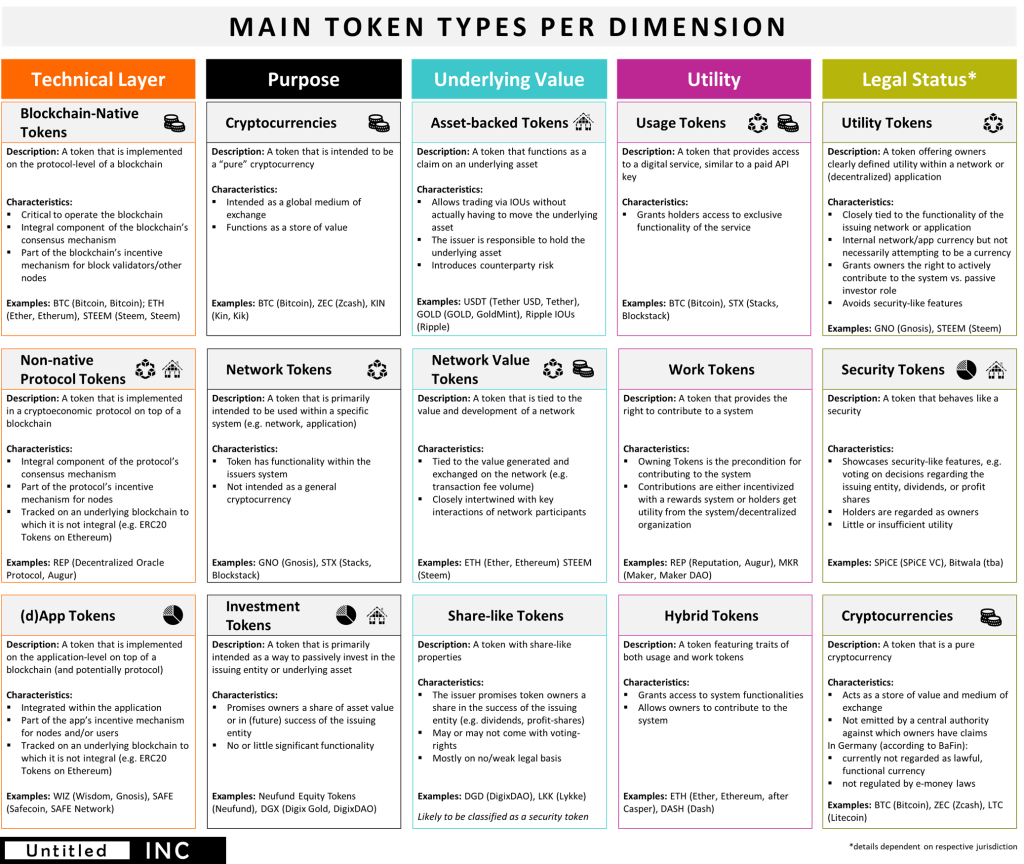

How to Evaluate Exchange Tokens in an Integrated Environment

In an integrated market structure, evaluating exchange tokens requires a more comprehensive analytical framework. Key metrics include: the depth of on-chain use cases, the actual scale of user migration to on-chain functions, and the transparency and sustainability of token value return mechanisms (such as burns or buybacks).

Token Classification Framework | Thomas Euler (Medium)

Token Classification Framework | Thomas Euler (Medium)

Ecosystem maturity is equally important. Tokens deeply tied to active applications and stable liquidity depth often perform significantly differently from those reliant on short-term incentive drives. As technical exposure continues to expand, a platform's operational resilience and historical security record have also become important variables affecting token performance.

Impact on Token Performance

Overall, exchanges with more diversified business structures and clearer integration paths typically hold certain advantages in the convergence trend. Their tokens can simultaneously carry demand drivers from trading, on-chain functions, and ecosystem usage. In contrast, platforms with more singular execution paths see their token performance more susceptible to changes in a single scenario or incentive strategy.

However, the exchange's development pace and execution approach are also crucial. Some platforms choose to advance integration in a more measured, gradual manner, maintaining relative balance between product launch, user migration, and token utility. For example, the XT token demonstrates relatively steady and sustained growth characteristics in terms of use case expansion, community participation, and platform synergy, reflecting more of an evolution path oriented towards execution quality and long-term planning.

In general, targeted incentives or periodic campaigns may boost token activity in the short term, but only tokens built on genuine usage demand and sustained adoption exhibit more stable and sustainable performance.

Key Token Metrics for Evaluating CEX–On-Chain Integration

To assess the extent to which an exchange token genuinely reflects the progress of CEX and on-chain integration, the following metrics are becoming increasingly critical:

- On-Chain Usage: Focus on the proportion of token usage in Gas payments, staking, or ecosystem incentives, as well as its trading or staking activity on associated networks.

- User Migration Status: Measure the proportion of users utilizing exchange wallets or on-chain functions, and the retention performance of users participating in both centralized and on-chain services.

- Token Value Return Mechanism: Emphasize examining the transparency, consistency of burn or buyback mechanisms, and their correlation with platform revenue.

- Ecosystem Depth: Evaluate the number of applications actually using the token and whether related activities can persist after incentives end.

- Operational and Risk Metrics: Include security incidents involving wallets or cross-chain bridges, and the transparency of proof-of-reserves disclosures.

It's important to note that exchange tokens often reflect different stages of integration status, not a single fixed optimal model. In the early stages of integration, a more common strategy is to prioritize emphasizing controllable use cases and community engagement over aggressive expansion.

2026 CEX Token Integration Positioning Comparison

This comparison emphasizes the stage differences of various exchange tokens in the integration process, not a direct judgment of superiority or inferiority. Overall, platforms with larger ecosystems focus more on coverage breadth and settlement capability construction, while other platforms pay more attention to advancing integration and feature expansion at a controlled pace.

Strategic Changes for Exchanges and Users Under the Integration Trend

For exchanges, the integration trend is driving tokens to evolve from simple user incentive tools into more systematic ecosystem coordination mechanisms. By building integrated platforms, exchanges can not only expand product boundaries but also enhance user lifetime value and strengthen their overall positioning and moat in competition.

For users and token holders, integration brings richer use cases and more diverse demand sources, while also introducing platform-level risk exposure and higher technical complexity. In this context, evaluating an exchange's fundamentals and execution capabilities is becoming as important as understanding the token's own mechanisms.

Conclusion | From Trading Platform to Integrated Crypto Ecosystem

The integration of CEXs and on-chain represents a structural evolution in crypto market architecture. Centralized exchanges are gradually transforming into comprehensive platforms integrating liquidity, gateway capabilities, and on-chain execution.

Correspondingly, the value of CEX tokens is increasingly reflected in platform coverage breadth, ecosystem integration depth, and operational discipline, rather than being confined to singular trading incentives. In 2026, more competitive tokens are often supported by genuine usage demand, clear value alignment mechanisms, and consistently stable execution capabilities.

Key metrics worth continuous monitoring include: growth in on-chain activity related to the exchange, wallet usage penetration, execution discipline of burn/buyback mechanisms, security performance, and regulatory progress in major jurisdictions.

Frequently Asked Questions (FAQ) about CEX Tokens / Platform Tokens

1. What is a CEX Token?

A CEX token is a native token issued by a centralized exchange, typically used for scenarios such as fee discounts, platform privilege access, or ecosystem incentives.

2. What changes are happening to CEX tokens by 2026?

The functionality of CEX tokens is gradually expanding from singular trading benefits to on-chain use cases and ecosystem coordination roles, with a significantly broadened scope of participation.

3. Can all exchange tokens benefit from the integration trend?

Not necessarily. Whether a token benefits depends on the platform's execution capability, user adoption level, and the transparency of related mechanisms.

4. Are CEX tokens and DeFi tokens the same concept?

No. Even if some CEX tokens are introduced for on-chain use, their core remains tied to the centralized trading platform, and their positioning is fundamentally different from native DeFi tokens.

5. What risks should users be aware of when holding or using CEX tokens?

Mainly include platform-specific risks, uncertainties brought by changes in the regulatory environment, and the increased technical complexity that comes with deeper integration.

6. How should the value of exchange tokens be evaluated in the future?

It can be comprehensively judged from multiple dimensions such as on-chain usage, value return mechanisms, ecosystem depth, and the platform's operational resilience.

Further Reading

- XT Christmas Carnival Officially Begins, $2,000,000 in Holiday Rewards Fully Distributed

- X Legends Futures Competition Ranking Strategy: How to Efficiently Accumulate Trading Volume to Compete for the $5 Million Prize Pool

- Top 5 L1 Blockchains to Watch in 2026: The Main Evolution from DeFi to RWA

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform, now boasting over 12 million registered users, with business covering more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports 1300+ high-quality tokens and 1300+ trading pairs, offering diverse trading services including spot trading, margin trading, and futures trading, and is equipped with a secure and reliable