94,500 May Become Bitcoin's Bull-Bear Watershed, Daily Chart Structure Enters Critical Observation Zone | Guest Analysis

- Core View: Bitcoin is expected to oscillate within the range of $84,000 to $94,500.

- Key Elements:

- Last week's range prediction was precisely validated, yielding a 3.4% return.

- The weekly chart model indicates a bearish trend, with a bull-bear battle on the daily chart.

- This week's strategy includes A/B/C contingency plans to respond to either a breakdown or a breakout.

- Market Impact: Provides a clear range and operational reference for short-term trading.

- Timeliness Note: Short-term impact.

Odaily's exclusive market analyst Cody Feng holds a Master's in Financial Statistics from Columbia University. Since his university days, he has focused on quantitative trading in U.S. stocks and gradually expanded into digital assets like Bitcoin. Through practical experience, he has developed a systematic quantitative trading model and risk control framework. He possesses keen data-driven insights into market volatility and is committed to continuous, in-depth exploration in the professional trading field, pursuing steady returns. He will conduct weekly deep dives into BTC's technical, macroeconomic, and capital flow dynamics, review and showcase practical trading strategies, and preview noteworthy upcoming events for reference.

Core Summary of the Trading Weekly Report:

• Strategy Execution (Short-term) Performance Verification: Last week's trading strictly adhered to the established strategy, successfully completing one short-term operation (1x leverage), achieving a cumulative return of 3.4%.

• Core View (Short-term) Verification: The core view proposed last week that "Bitcoin may maintain a consolidation range between $84,000 and $94,500" has been precisely validated by the market. Over the past week, the price reached a high of $94,789 and a low of $89,311, closely aligning with the given resistance level of $94,500 and support level of $89,500. This outcome strongly confirms our judgment of key price levels.

The following sections will provide a detailed review of market predictions, strategy execution, and specific trading processes.

1. Trading Market Review: (01.05~01.11)

1. Review of Last Week's Short-term Operations:

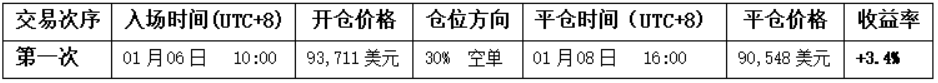

Strictly following the trading signals generated by our self-built "Spread Trading" and "Momentum Quantification" models (see red/green block signals in Figure 1), combined with accurate predictions of market trends, we successfully completed one short-term operation, achieving a cumulative return of 3.4%. The specific trade details and review are as follows:

①、Trade Details Summary: (No leverage used)

②、Short-term Trade Review:

• Trade (Profit 3.4%): This operation perfectly executed the "Shorting at Resistance" strategy: First, when the price rallied to challenge the key resistance level of $94,500, coinciding with the top signal (green dot) from the Spread Trading model, we decisively entered to establish a 30% short position. Second, after the price retreated to the target support zone and triggered the model's bottom signal (red dot), we closed the position to lock in profits.

2、Review of Last Week's Trend Prediction and Trading Strategy:

①、Last week, we clearly stated: Focus on observing the dynamics within the $84,000~$94,500 zone. Unless there is a decisive breakout above or below this range, the price will likely maintain a consolidation pattern.

②、Review of Key Levels: Primary resistance was identified in the $93,000~$94,500 zone; primary support was identified in the $89,500~$91,000 zone.

②、Review of Trading Strategy:

• Mid-term Strategy: If the market maintains consolidation within the $84,000~$94,500 range, continue holding the existing ~65% mid-term position (short).

• Short-term Strategy: If the price maintains consolidation within the $84,000~$94,500 range, execute according to Plan A:

• Entry: When the price rebounds to the $93,000~$94,500 zone and shows signs of rejection, establish a 30% short position.

• Risk Control: Set stop-loss for the short position above $95,500.

• Partial Close: When the price declines to the $86,000~$86,500 zone and shows signs of stabilization, gradually close part of the short position.

• Full Close: When the price probes near $84,000 and shows signs of stabilization, close all positions to realize profits.

Figure 1

2. Trend Model Analysis: Bitcoin's Future Direction and How to Enter

Combining market movements, the author provides an in-depth analysis of Bitcoin's price structure from multiple models and dimensions based on a self-built trading framework.

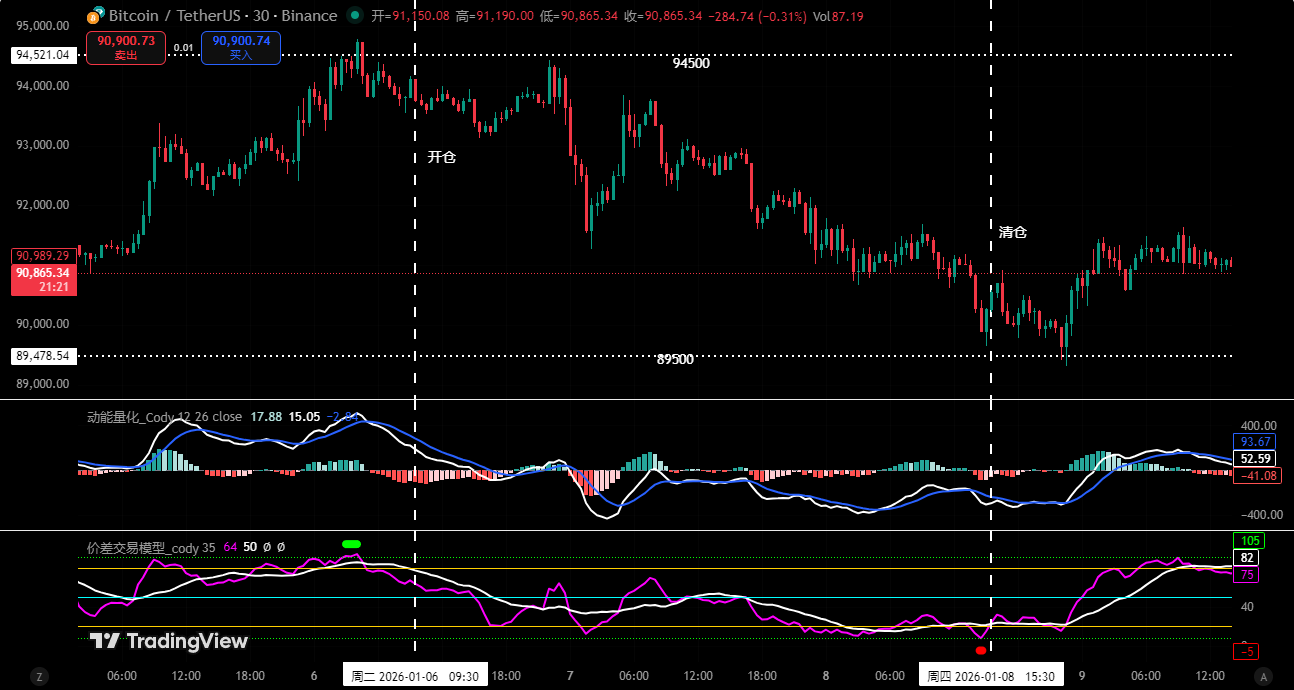

1、As shown in (Figure 2), analyzing the weekly chart:

• Momentum Quantification Model: Technical indicators show the momentum lines converging below the zero axis, while negative momentum bars continue to shrink, indicating a slowdown in the rate of decline. However, current signals do not confirm a trend reversal.

The Momentum Quantification Model indicates: Probability of Price Decline: High

• Sentiment Quantification Model: Blue sentiment line value is 52.61, intensity zero; Yellow sentiment line value is 20.76, intensity zero; peak value is 0.

The Sentiment Quantification Model indicates: Price Pressure & Support Index: Neutral

• Digital Monitoring Model: The price has been below the Bull-Bear (Yellow-Blue line) demarcation for 8 weeks. Last week, bulls attempted to challenge this line again but retreated after encountering resistance from bears. This failed attempt suggests bears still hold market dominance.

The Digital Monitoring Model indicates: No monitoring (top/bottom) digital signals appeared; the weekly candlestick closed as a doji with an upper shadow, declining approximately 0.57%.

The above data suggests: Bitcoin's weekly chart has entered a bearish trend; be alert to the risk of consolidation and adjustment.

Figure 2

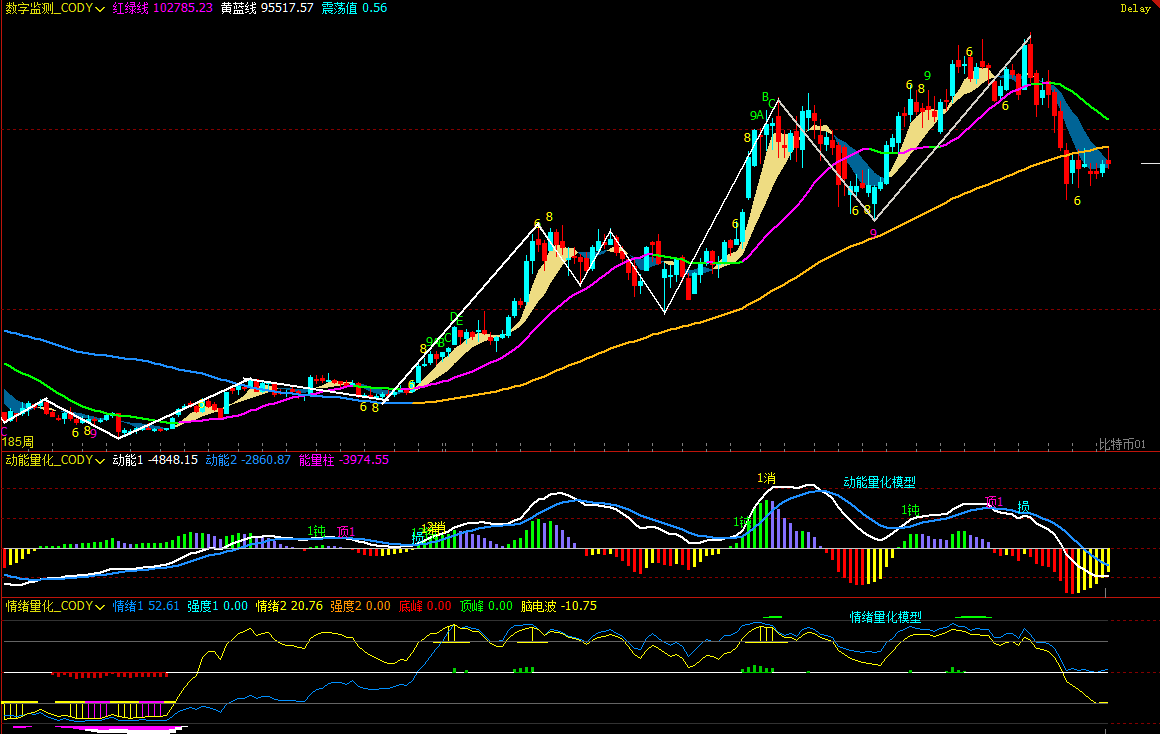

2、As shown in (Figure 3), analyzing the daily chart:

• Momentum Quantification Model: Last week's overall trend was "rising first, then falling." In the first half, momentum lines crossed above the zero axis, and positive momentum bars expanded. However, in the latter half, momentum lines converged again, and momentum bars significantly shrank, indicating weakening bullish momentum.

The Momentum Quantification Model indicates: The daily timeframe is in a bull-bear tug-of-war phase; watch the zero axis.

• Sentiment Quantification Model: After last week's daily close, the blue sentiment line value is 28, intensity zero; the yellow sentiment line value is 62, intensity zero.

The Sentiment Quantification Model indicates: Pressure & Support Index: Neutral

The above data suggests: The daily timeframe is at a bull-bear watershed; the trend direction awaits further confirmation.

Figure 3

3. This Week's Market Forecast: (01.12~01.18)

1、This Week's Core View:

• Bitcoin is expected to continue fluctuating within the $84,000~$94,500 range, but focus on observing the bull-bear battle at both ends of the range.

• Breakdown: If it decisively breaks below $84,000, the trend will turn downward, with the primary test target at $80,000.

• Breakout: If it can firmly hold above $94,500, it may initiate a relatively strong technical rebound.

2、Core Resistance Levels:

• First Resistance Zone: $92,000~$93,000

• Second Resistance Zone: $94,500~$95,000

• Major Resistance Area: Near $97,500~$99,500.

3、Core Support Levels:

• First Support Zone: $89,500~$91,000

• Second Support Zone: $86,000~$86,500

• Third Support Zone: $83,500~$84,500

• Major Support Level: Near $80,000.

4. This Week's Trading Strategy (Excluding Sudden News Impact): (01.12~01.18)

1、 Mid-term Strategy:

• Maintain the existing ~65% mid-term position (short) as long as the price does not decisively break above $94,500.

• If the price successfully breaks and holds above $94,500, close all mid-term positions (short) and hold funds for observation.

2、 Short-term Strategy: Utilize 30% of capital, set stop-loss points, and look for "spread" trading opportunities based on support and resistance levels. (Using a 30-minute timeframe for operations).

3、 To dynamically respond to market evolution and combine real-time model signals, we have prepared three short-term operation plans A/B/C:

• Plan A: If the price maintains consolidation within the $84,000~$94,500 range:

• Entry: Based on core resistance level judgment (see this week's forecast), when the price rebounds to the $93,000~$94,500 zone and combines with the hourly chart model's top signal, establish a 30% short position.

• Risk Control: Initial stop-loss for the short position is set approximately 1.5% above the entry price (i.e., 1.015 * entry price).

• Close: When the price probes near core support levels and combines with model signals, gradually close the position to realize profits.

• Plan B: If the price decisively breaks below the $84,000 support:

• Entry: If it decisively breaks below a core support level, consider shorting to establish a 30% short position.

• Risk Control: Initial stop-loss for the short position is set approximately 1.5% above the entry price (i.e., 1.015 * entry price).

• Close: When the price probes near $80,000 and combines with model signals, gradually close the position to realize profits.

• Plan C: If it successfully breaks and holds above the $94,500 resistance:

• Entry: If it successfully breaks a core resistance level and combines with model signals, establish a 30% long position.

• Risk Control: Initial stop-loss for the long position is set approximately 1.5% below the entry price (i.e., 0.985 * entry price).

• Close: When the price rebounds to near $97,500 and combines with model signals, gradually close the position to realize profits.

5. Macro & Liquidity Weekly Observation: (01.12~01.18)

I. Dense Schedule of FOMC Official Speeches: A Crucial Window for Recalibrating Policy Expectations

This week, the Federal Reserve system will witness a rare window of concentrated remarks from its officials. Multiple Fed Presidents and Governors with varying annual voting rights will deliver speeches focusing on the economic outlook, inflation trajectory, and policy stance, providing critical information for the market to judge the future path of monetary policy.

The lineup includes both permanent FOMC voting members and rotating voting members for 2026-2028, covering information dimensions from short-term policy orientation to medium-term decision-making frameworks, offering significant guidance for interest rate expectations.

Key events include:

Tuesday: Speeches by 2027 FOMC voter, Atlanta Fed President Bostic; 2027 FOMC voter, Richmond Fed President Barkin; Permanent FOMC voter, New York Fed President Williams; 2028 FOMC voter, St. Louis Fed President Musalim.

Wednesday: Richmond Fed President Barkin speaks again; 2026 FOMC voter, Philadelphia Fed President Harker speaks on the economic outlook; Fed Governor Waller speaks publicly.

Thursday: 2026 FOMC voter, Minneapolis Fed President Kashkari speaks, while 2027 FOMC voter, Atlanta Fed President Bostic speaks again; Fed releases the Beige Book; Permanent FOMC voter, New York Fed President Williams delivers opening remarks at an event; Bostic speaks again on economic and policy issues.

Friday: Richmond Fed President Barkin speaks on regional economic prospects.

II. Market Focus: Whether Early Signals of a Policy Pivot Are Released

Against the backdrop of marginal disinflation and signs of cooling in the labor market, the market's core focus is whether officials will continue to emphasize the necessity of "maintaining restrictive policy for an extended period" or begin to provide clearer forward guidance for the next phase of policy shift.

It should be noted that officials' speeches primarily influence expectation structures rather than short-term direction, typically reflected in medium-term adjustments to the interest rate curve, the US Dollar Index, and the valuation framework for risk assets.

III. Potential Impact on Risk Assets and the Crypto Market

If multiple officials maintain a cautious stance, emphasizing continued uncertainty in the inflation path, it could temporarily suppress risk appetite.

However, if speeches gradually acknowledge the economic slowdown trend and downplay the necessity for further policy tightening, it could facilitate a repricing of medium-term easing expectations.

For crypto assets like Bitcoin, the core impact of Fed officials' remarks lies in liquidity expectations and discount rate changes, which are more medium-term in nature and better suited as macro pricing references rather than short-term trading signals.

6. Special Notes:

1. Upon Entry: Immediately set the initial stop-loss level.

2. When Profit Reaches 1%: Move the stop-loss to the entry price (breakeven point) to ensure capital preservation.

3. When Profit Reaches 2%: Move the stop-loss to the 1% profit level.

4. Continuous Tracking: Thereafter, for every additional 1% profit, move the stop-loss up by 1% accordingly, dynamically protecting and locking in existing profits.

(Note: The 1% profit trigger threshold mentioned above can be flexibly adjusted by investors based on their own risk preferences and the volatility of the asset.)

Financial markets are ever-changing; all market analysis and trading strategies require dynamic adjustment. All views, analytical models, and operational strategies mentioned in this article are derived from personal technical analysis, intended solely as a personal trading log, and do not constitute any investment advice or operational basis. The market carries risks; invest with caution, DYOR.