Gold Strikes Before Quantitative Easing, Bitcoin Awaits Liquidity (Part 2)

- Core Viewpoint: Interest rate cuts have not boosted Bitcoin due to liquidity constraints.

- Key Factors:

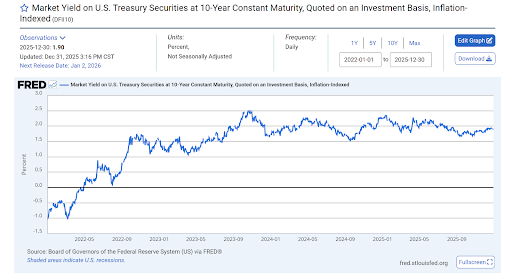

- Real interest rates remain high, with no substantial easing of liquidity.

- This round of cuts is defensive, leading to capital flowing out of crypto assets for safety.

- U.S. debt dilemma; the market awaits larger-scale liquidity injections from the Fed.

- Market Impact: Short-term capital flows into gold; Bitcoin needs to wait for the liquidity floodgates to open.

- Timeliness Note: Medium-term impact

Why Rate Cuts Fail to Boost Bitcoin: The Blocked Liquidity Pipeline

To understand why Bitcoin has reacted tepidly to rate cuts, it's helpful to start with gold. Gold is a globally priced asset. While retail investors typically trade in grams, international pricing is based on troy ounces and tons. It is precisely this global pricing structure that makes the impact of macroeconomic factors so significant.

Bitcoin shares this characteristic. Furthermore, its price is uniform globally, meaning any serious analysis must begin with the macroeconomic conditions in the United States.

The puzzle is evident. The US has entered a new rate-cutting cycle, yet Bitcoin prices remain hovering around $80,000, while gold prices continue to climb. Traditional theory suggests that low interest rates should benefit risk assets like stocks and cryptocurrencies. However, so-called defensive assets are rallying against the trend.

This contradiction can be explained by two structural factors.

The "Middle Layer Blockage" Problem

The market is focused not on nominal rates, but on real rates. With inflation stubbornly high, as long as inflation persists, even if policy rates are lowered, real rates struggle to break out from elevated levels.

From the perspective of the real economy, rate cuts have not translated into easier financial conditions. Banks have not meaningfully loosened lending standards. Businesses remain reluctant to borrow. In other words, the intermediate link between policy and capital allocation remains blocked.

Meanwhile, the US Treasury continues to issue a massive volume of new debt. In the second half of 2025, the pace of bond issuance for refinancing existing debt outpaced the liquidity released by rate cuts. The result, seemingly paradoxical but crucial, is that overall liquidity has not expanded; it has, in fact, contracted.

There is currently not enough "available capital" to drive Bitcoin prices higher.

This is a Defensive Rate-Cutting Cycle, Not a Growth Cycle.

This rate-cutting cycle is fundamentally different from previous ones that fueled bull markets. The Fed is cutting rates not because economic growth is strong, but due to rising unemployment, increasing corporate default rates, and government debt servicing costs becoming unsustainable.

This is a defensive rate cut, driven primarily by recession fears and stagflation risks.

In this environment, capital behaves differently. Institutional investors prioritize survival over returns. Their first instinct is not to chase volatility but to reduce risk exposure and build cash buffers.

Despite its long lifecycle, Bitcoin remains one of the world's most liquid high-risk assets. When market stress increases, it is seen as a source of liquidity—a financial ATM. Risk aversion begins with cryptocurrencies, not ends with them.

This mirrors the logic during price expansions. During price expansion phases, capital flows into cryptocurrencies last; during rising uncertainty, capital flows out of cryptocurrencies first.

In contrast, while investors await a significant drop in real rates, gold is being used as a hedge against dollar devaluation.

The Deeper Issue: America's Debt Trilemma

US interest payments now exceed defense spending, becoming the federal government's third-largest expenditure after Social Security and Medicare.

Washington effectively has only three choices left.

First, roll over the debt indefinitely by issuing new bonds to repay old ones. Given the total federal debt exceeding $38 trillion, this only exacerbates the problem.

Second, suppress long-term yields by shifting issuance towards short-term bills, lowering the average funding cost, but not addressing the fundamental imbalance.

Third, and most critically, allow for a stealth default through currency devaluation. When debt cannot be repaid in real value, repay it with devalued dollars.

This is the structural reason behind gold's surge to $4,500. Nations worldwide are hedging against the late-stage credibility crisis of the US dollar.

Rate cuts alone are insufficient. Many on Wall Street now openly state that to avoid collapse, the financial system needs continuous monetary expansion and controlled inflation. This creates a vicious cycle: either print money leading to currency devaluation, or refuse to print triggering defaults.

History suggests the choice is inevitable. The Fed is unlikely to tolerate systemic collapse. The reintroduction of quantitative easing and yield curve control now seems more a matter of timing than probability.

2026 Strategic Outlook: From Liquid Darkness to Flood

Once this framework is understood, the current divergence between gold and cryptocurrencies becomes logical. Both assets hedge against inflation, but timing is crucial.

Gold signals the impending trend of monetary expansion; Bitcoin awaits confirmation.

In my view, the path forward unfolds in two stages.

Act I: Recession Shock and the "Gold Peak"

When recession indicators are fully confirmed—for example, US unemployment exceeding 5%—gold prices may hold at elevated levels or even spike further. It will then be seen as the safest asset.

However, Bitcoin may face a final round of decline. In the initial phase of a recession, all assets are sold to raise cash. Margin calls and forced liquidations dominate market behavior.

History provides clear precedent. In 2008, gold fell nearly 30% before rebounding. In March 2020, gold dropped 12% in two weeks, while Bitcoin was halved.

Liquidity crises affect all assets. The difference lies in which asset recovers first. Gold typically stabilizes and rebounds faster, while Bitcoin requires more time to rebuild market confidence.

Act II: The Fed Capitulates and Bitcoin's Liquidity Explosion

Ultimately, rate cuts will prove insufficient to address economic stress. Economic strain will force the Fed to expand its balance sheet once more.

This is the moment the liquidity floodgates truly open.

Gold prices may consolidate or trade sideways. Capital will aggressively rotate into high-beta assets. Bitcoin, as the purest expression of excess liquidity, will absorb this flow.

In such scenarios, price moves are rarely gradual. Once momentum builds, Bitcoin's price could change dramatically within months.

A Note on Silver and the Gold-Silver Ratio

Silver's 2025 rally was driven by two main factors: its historical correlation with gold and its industrial demand. AI infrastructure, solar power, and electric vehicles are all heavily reliant on silver.

In 2025, inventories at major exchanges, including the Shanghai Futures Exchange and the London Bullion Market Association, fell to critical levels. In bull markets, silver typically outperforms gold, but in bear markets, it carries higher downside risk.

The gold-silver ratio remains a key indicator.

A silver price above $80 is historically cheap. Below $60, silver is expensive relative to gold. Below $50, speculative excess tends to dominate.

With the current price around $59, this signal suggests a rotation into gold rather than aggressive silver accumulation.

The Long View: Different Leaders, Same Destination

Setting aside the specific timeframe of 2026, the long-term conclusion remains unchanged. Both gold and Bitcoin are on an upward trajectory against fiat currencies.

The only variable is leadership. This year belongs to gold; the next phase belongs to Bitcoin.

As long as global debt continues to expand and monetary authorities rely on currency devaluation to relieve pressure, scarce assets will outperform. In the long run, fiat currency remains the only consistently losing asset.

What matters now is patience, data, and discipline. The transition from gold dominance to Bitcoin dominance will not be publicly announced—it will manifest through liquidity metrics, policy shifts, and capital rotation.

I will continue to watch for these signals.