New Capital Incentive Pathways Under the New Regime: The True Picture of Crypto Investment and Financing in 2025

- Core Viewpoint: The crypto primary market is shifting towards rational, concentrated investment in 2025.

- Key Elements:

- The enactment of the Stablecoin and Market Structure Act provides a compliance pathway.

- While the number of financings has decreased, the total amount has risen, with a significant increase in average deal size.

- Capital is highly concentrated in deterministic sectors such as infrastructure and prediction markets.

- Market Impact: Drives the industry towards a more compliant, rational, and mature stage of development.

- Timeliness Note: Medium-term impact

Original | Odaily (@OdailyChina)

Author | DingDang (@XiaMiPP)

2025 marked a year of substantial institutional breakthroughs for the cryptocurrency market, a year where its development path gradually shed its "wild growth" phase and moved closer to the mainstream financial system. In terms of scale, the total global market capitalization of crypto assets has reached $3.2 trillion, while stablecoin transaction volume has exceeded $50 trillion—a figure that far surpasses traditional payment giants like Visa and PayPal. Behind these numbers lies the support of two core legislative advancements.

Firstly, stablecoin-related legislation was formally enacted. The legislation clarified the issuing entities, reserve requirements, and regulatory mechanisms, providing a clear legal status for "on-chain dollars." This not only reduced the policy uncertainty surrounding stablecoin operations but also directly stimulated investment and financing activity in the stablecoin, payment, and settlement sectors. Secondly, the Cryptocurrency Market Structure Bill is also steadily progressing, aiming to incorporate crypto assets into a categorized regulatory framework, avoiding a "one-size-fits-all" approach and providing a predictable compliance path for projects and investors.

The combination of these two legislative developments will, to some extent, reshape how the primary market assesses risk and return.

However, contrasting with the improved institutional environment, the secondary market in 2025 did not provide a correspondingly strong positive feedback. Bitcoin experienced high volatility, and altcoins performed weakly. Against this backdrop, the primary market did not exhibit the widespread frenzy seen in the previous bull cycle. Instead, it showed a state of cautious activity, with noticeable shifts in financing pace and preferences.

Reviewing the Four-Year "Cycle": Two Instances of Divergence Between Deal Count and Amount

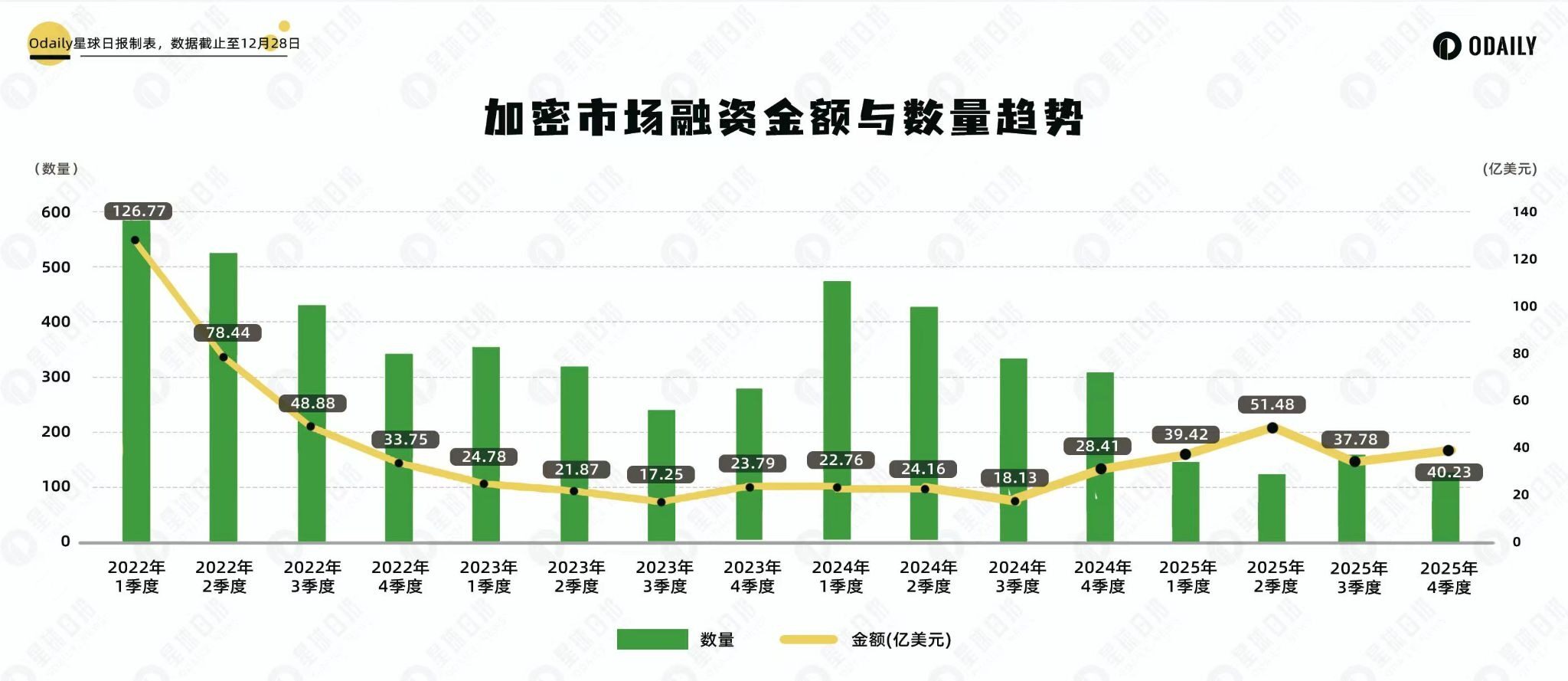

Reviewing the crypto financing trends of the past four years reveals a clear evolution in the relationship between the primary market and secondary market performance.

Early 2022 still benefited from the residual heat of the bull market, with both the number of financing deals and the total amount remaining high. Subsequently, as Bitcoin entered a downtrend, financing activity gradually contracted. Between 2022 and 2023, investment and financing activities were highly correlated with price movements, remaining generally depressed under bear market pressure.

2024 became a significant turning point, marking the first divergence between financing amount and deal count.

This year, with the revival of the Bitcoin halving narrative, the number of financing deals saw a noticeable recovery, but the total amount raised remained restrained. Quarterly financing volumes hovered in the range of $1.8 billion to $2.8 billion, even similar to levels seen during the bear market. The main reason was that during this period, crypto market performance was dominated by Bitcoin and the Meme sector, forming a stark contrast with the previous cycle. In the last cycle, VC-backed projects were often at the core of market trends, whereas in 2024, VC projects overall performed poorly, struggling to exert a substantial influence on the market, which to some extent also suppressed the emergence of large-scale financings.

Entering 2025, the divergence phenomenon reappeared, but this time, the direction reversed.

The number of financing deals saw a significant decline, but the total amount raised began to rise again. Quarterly financing volumes rebounded to the range of $3.7 billion to $5.1 billion. This indicates that the average deal size has increased significantly. Investors are actively reducing the number of investments they make, instead concentrating their bets on a smaller number of projects perceived to have certainty and scalability.

12 Sectors, $17.89 Billion: Structural Changes in the Primary Market

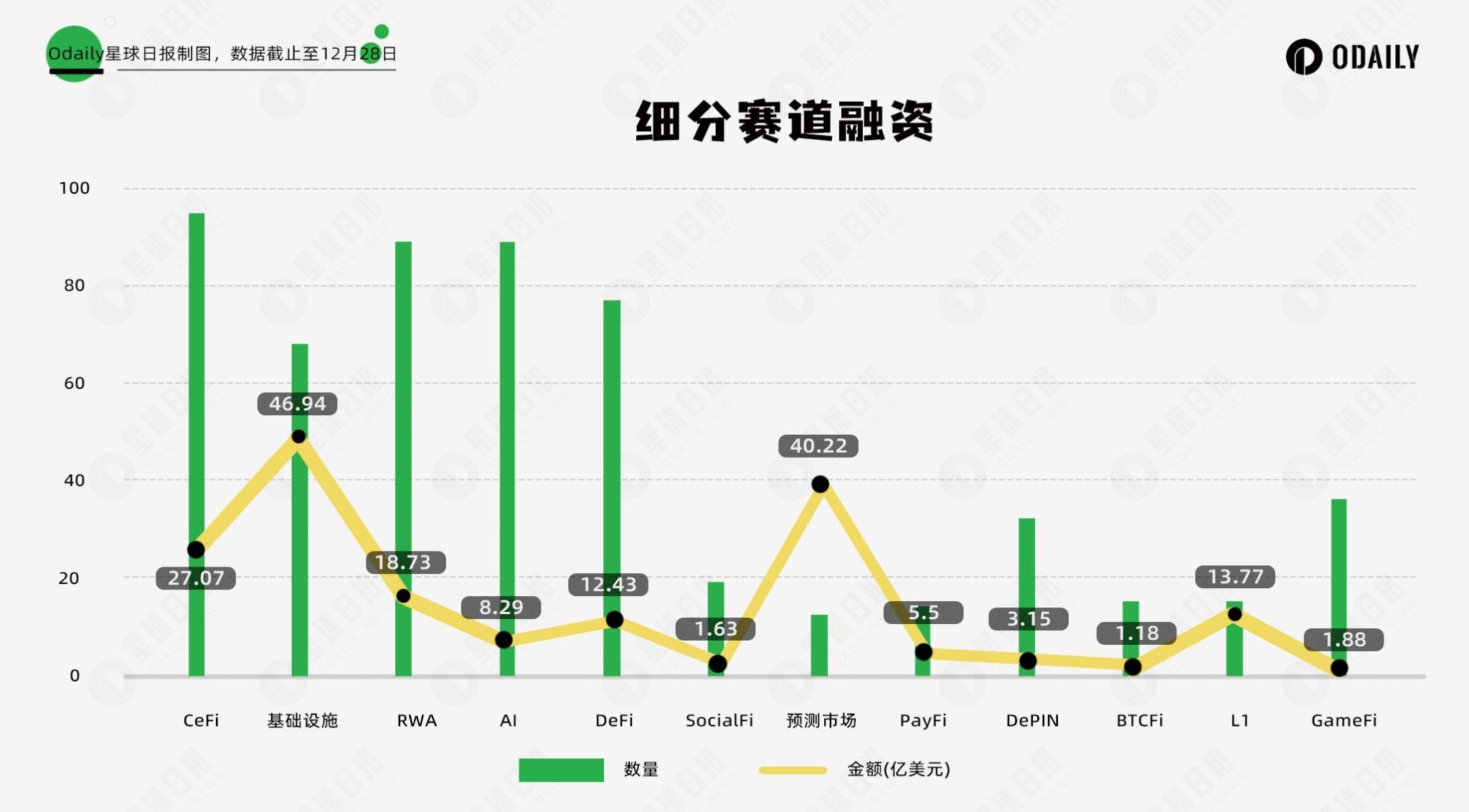

According to incomplete statistics from Odaily, the total amount of primary market investment and financing in 2025 reached $17.89 billion, across a total of 569 financing deals. To more accurately depict the changes in financing preferences, we categorized all disclosed financing projects (the actual close time is often earlier than the announcement) into 12 sectors based on their business type, target users, and business models. These include: CeFi, Infrastructure, RWA, AI, DeFi, SocialFi, Prediction Markets, PayFi, DePIN, BTCFi, L1, and GameFi.

Looking at the financing situation across these specific sectors:

- CeFi and Infrastructure ranked at the top in terms of both financing amount and deal count. Foundational capabilities such as trading, custody, clearing, security, and cross-chain remain key areas for continuous capital investment. The market consensus on "infrastructure first" remains unshaken.

- DeFi projects continue to maintain high activity. The market still shows strong demand for innovation in new DeFi protocols. In particular, the success of Hyperliquid directly demonstrated to the market that decentralized exchanges can also effectively handle large-scale capital inflows, making perp DEX a new financing hotspot.

- AI and RWA have become new narrative pillars. The former aligns with the main theme of the global technology cycle, while the latter directly benefits from the institutional tailwinds of bringing traditional financial assets on-chain. Both paths share a common characteristic: their growth logic no longer relies entirely on the crypto-native market but extends into the broader technology and traditional financial systems.

- The true standout is the Prediction Market sector. Although the number of projects in this sector is not particularly high compared to others, the total financing amount has surged to become the second-largest sector, just behind Infrastructure. This means capital is being highly concentrated, betting heavily on a few leading projects.

- In contrast, once-hot sectors like DePIN and GameFi, while still seeing many projects emerge, have seen a sharp decline in financing appeal. Capital is shifting towards areas perceived to have greater certainty and economies of scale.

Overall, the primary market is shifting from "casting a wide net" to "intensive cultivation."

Polymarket: The Consensus Shift Behind 2025's Top Financing

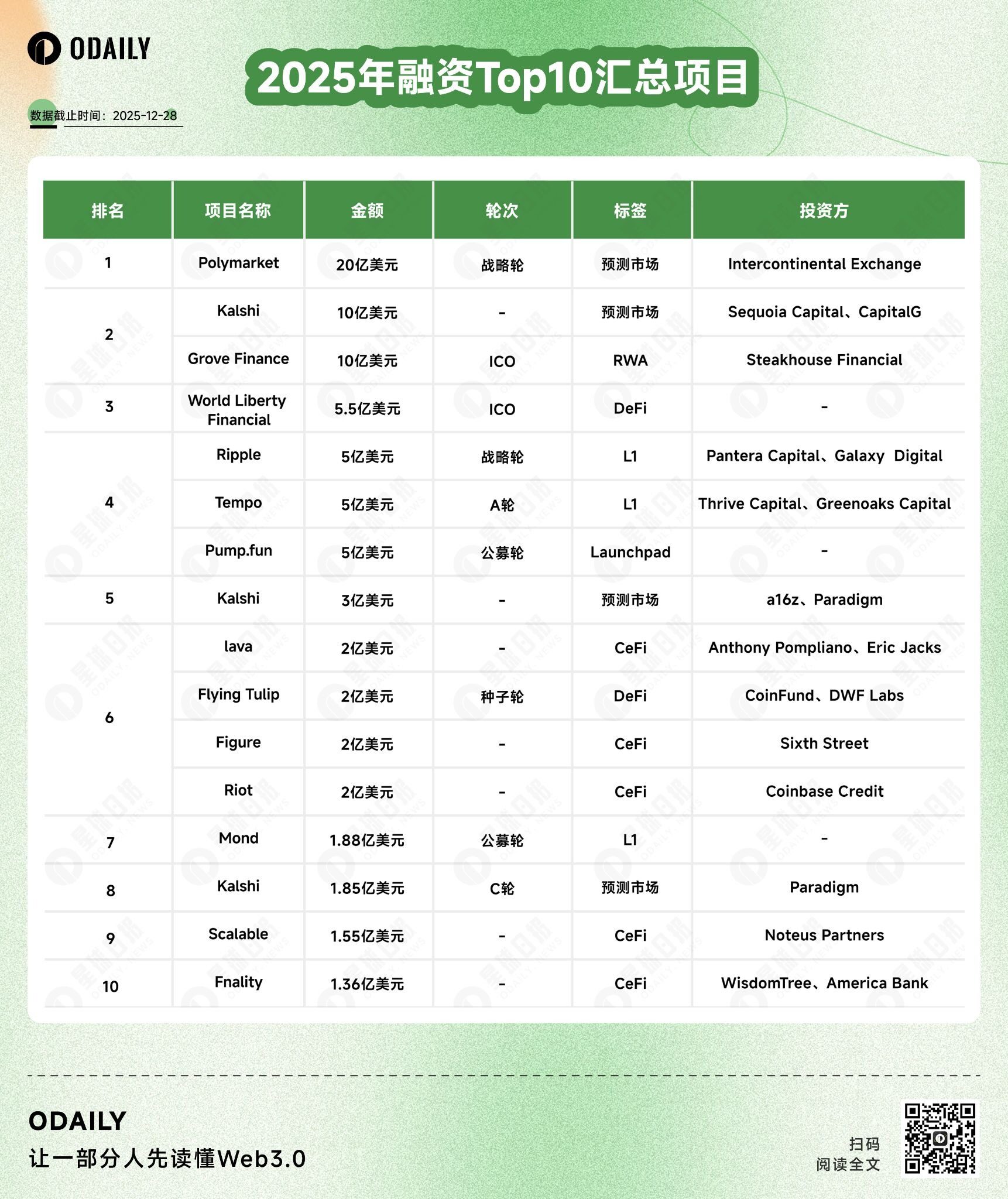

Looking at the Top 10 financing amounts in 2025, Polymarket and Kalshi almost constitute the entire narrative for the year.

Among them, Polymarket has cumulatively raised close to $2.5 billion across multiple rounds, with investors including well-known crypto venture capital funds like Polychain, Dragonfly, and Coinbase. Kalshi began gaining momentum in 2025, cumulatively raising approximately $1.5 billion, backed by Paradigm, a16z, and Coinbase. Unlike Polymarket, Kalshi places greater emphasis on federal regulatory compliance. However, what they share is that prediction markets are being viewed as a financial form with genuine demand, now considered the most vibrant and positively trending sector.

In the L1 sector, capital preferences show continuity. On the list, apart from the established public chain Ripple, others like Tempo and Mond are new-generation projects. Mond has already issued a token, while Tempo has not. This reflects investors' continued commitment to foundational infrastructure, with high-performance L1s still seen as the long-term cornerstone for ecosystem expansion.

Conclusion

Overall, the primary market in 2025 did not cool down; instead, it is undergoing active convergence and restructuring.

Capital is still flowing, but it is no longer chasing quantity. Instead, it is being concentrated around certainty, compliance, and scalability potential. This change does not necessarily mean fewer opportunities. On the contrary, it may signal that the crypto market is entering a more rational and mature stage.