Early-Year Speculative Sentiment Resurges, Crypto Altcoin Season Repeating?

- Core View: The crypto market is currently experiencing a partial rebound; the altcoin season has not truly arrived.

- Key Factors:

- Total market cap still has a gap of over $1 trillion from its peak.

- The Altcoin Season Index remains low at 39.

- The market Fear & Greed Index is at 26, indicating fear.

- Market Impact: Short-term bottom-fishing opportunities may exist, but caution is required.

- Timeliness Note: Short-term impact.

Original|Odaily(@OdailyChina)

Author|Wenser(@wenser 2010 )

At the beginning of the new year, the crypto market has welcomed a rare upward breakout. BTC successfully broke through the key $90,000 level, and mainstream coins like ETH and SOL have finally climbed above $3,100 and $130, respectively. What's even more surprising and makes people exclaim "the bull is back" is the rapid rebound momentum of many altcoins—coins like PEPE, IP, and WLFI have seen their gains surge to over 20% in the past three days.

At the beginning of the new year, the crypto market has welcomed a rare upward breakout. BTC successfully broke through the key $90,000 level, and mainstream coins like ETH and SOL have finally climbed above $3,100 and $130, respectively. What's even more surprising and makes people exclaim "the bull is back" is the rapid rebound momentum of many altcoins—coins like PEPE, IP, and WLFI have seen their gains surge to over 20% in the past three days.

Of course, it's still early. Whether the "altcoin season at the start of the year," as seen in previous years, will repeat itself remains uncertain. However, amidst the complex macro-political and economic landscape, whether cryptocurrencies can, as usual, take over from precious metals and stage a "miracle rally" is already something worth anticipating. Odaily will provide a brief overview and analysis of the current market situation and representative market viewpoints in this article.

Analysis of 3 Major Market Indicators: Altcoin Season Has Not Truly Arrived; Current Situation is a "Partial Rebound"

Apart from the overall market trend, judging by the current overall data, it's difficult to conclude that "the altcoin season has returned." Looking at the exchange gainers' rankings, many of the tokens currently rebounding are previously oversold assets, highly manipulated "pump-and-dump" coins, established meme coins, or trending concept coins. Based on the following three data points, the crypto market is still in a slow "price recovery phase."

Indicator 1: Total Cryptocurrency Market Cap Has Not Significantly Recovered

According to Coingecko data, the total cryptocurrency market capitalization is currently $3.19 trillion, with BTC's dominance at 57% and ETH's at 11.9%.

There remains a gap of over $1 trillion from the previous peak of over $4.3 trillion. While this is partly due to significant declines from their highs for mainstream coins like BTC, ETH, SOL, and BNB, it's also an undeniable fact that many altcoins face lower prices and cooling trading activity against the backdrop of shrinking liquidity and continuous capital outflow from the market.

This shows that the overall environment of the crypto market has not improved significantly.

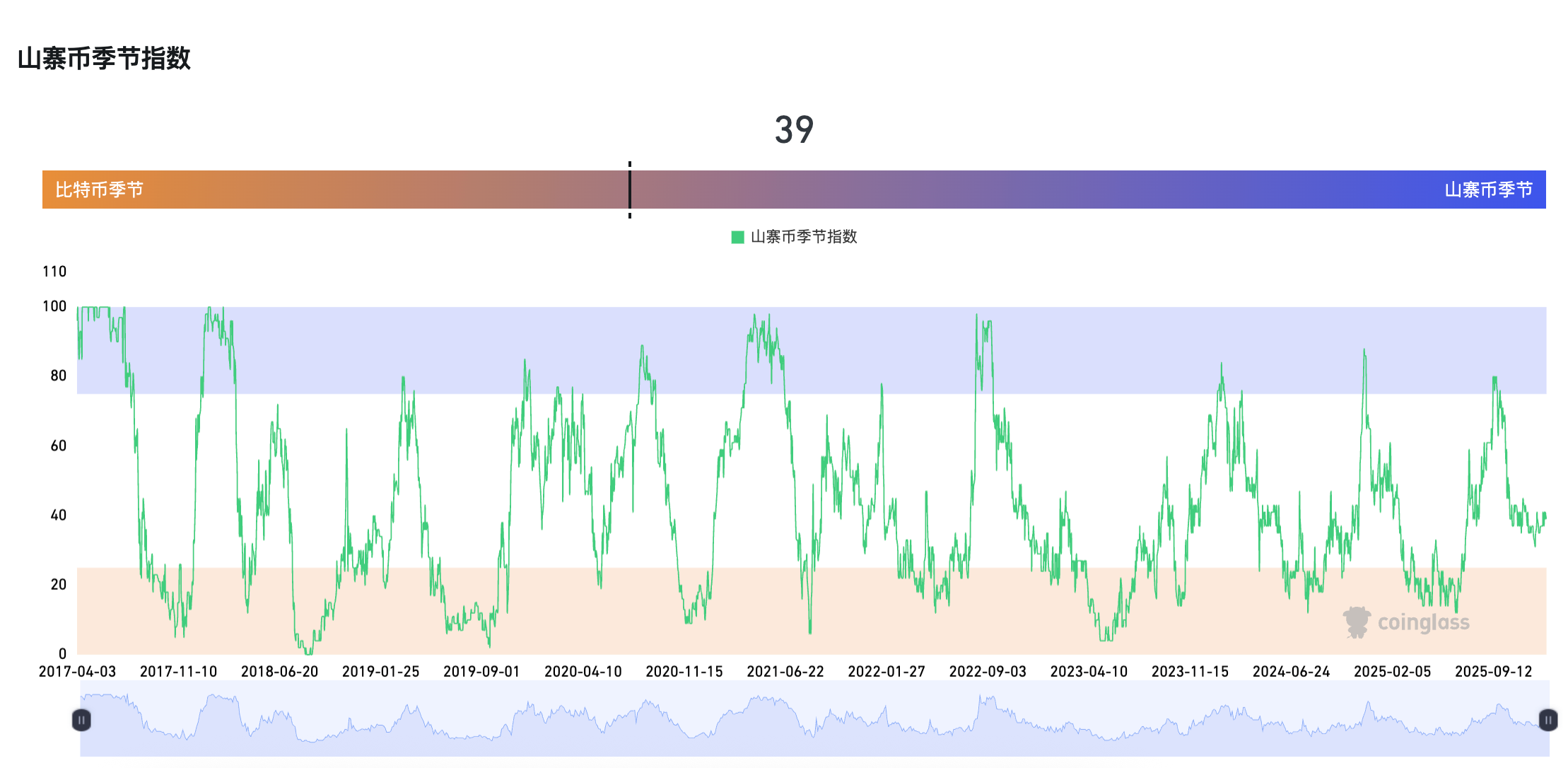

Indicator 2: Altcoin Season Index Remains Low

According to the Coinglass Altcoin Season Index, the current market's altcoin season index is 39, within the same range as the market index indicator in mid-July last year. At that time, the market was still on the eve of the DAT Treasury company's explosion, with various mainstream and altcoins at relatively low points. Subsequently, with the continuous expansion of the DAT Treasury listed company lineup, ETH later took the lead in reaching new highs. Compared to the incremental buying power brought by listed companies back then, the market's liquidity has now shrunk to a certain extent.

Indicator 3: Market Sentiment Remains in the Fear Zone

According to Coinglass website information, the Crypto Fear & Greed Index is currently at 26, in the fear zone. This zone also represents the largest proportion of market sentiment, accounting for 30.86% of the total time, which aligns relatively well with the bearish market sentiment state.

Based on the above indicators, the market remains in a cold phase. But does this mean there are no wealth-creation opportunities? The mainstream market view clearly doesn't think so. On the contrary, many institutions and individuals point out that the current situation might be a good opportunity to buy the dip. Their main supporting logic is the anticipated improvement in liquidity and progress on the macro-political and economic front. As the saying goes, be greedy when others are fearful—of course, the premise is choosing the right assets.

3 Major Signs of a Market Turning Point: Improved Liquidity, BTC Taking Over Precious Metals Rally, and Rational Retail Sentiment

Currently, mainstream market views share some consensus on a short-term bottoming and rebound, but a true turning point may depend on increased market liquidity, BTC's market performance, and a shift in retail sentiment. Below is an overview of current representative market viewpoints:

Global Market Liquidity May Rebound Next Week, Intra-Market Competition Drives Short-Term Rebound

Danske Bank's FX and Rates Strategist Jens Naervig Pedersen stated in a report that global market liquidity is expected to remain light this week but may pick up next week with the release of more economic data. During the year-end period, many market participants are on holiday or closing positions, typically leading to lower market liquidity.

Key data next week includes important US labor market figures, such as the December Non-Farm Payrolls report and ISM survey to be released on January 9th.

CoinKarma published an article stating that the cryptocurrency market has returned to an intra-market competition phase, where internal factors become key to short-term volatility direction. In the absence of clear external incremental capital, the crypto market is dominated by the circulation of existing funds, with short-term price fluctuations stemming from changes in the flow of these funds and overall liquidity.

Furthermore, observations through the USDC/USDT Premium (measuring the discount/premium status of USDC relative to USDT) and Overall LIQ (overall market-weighted liquidity indicator) show that when the USDC/USDT Premium turns positive, it reflects a weakening of dominant market funds' active selling behavior on BTC/USDT. Currently, the USDC/USDT Premium and Overall LIQ are resonating again, with a high probability of forming a bottoming rebound in the short term. CoinKarma also points out that compared to the previous phase, the medium-to-long-term trend is still bearish, and potential selling pressure needs to be watched.

Precious Metals Prices Correct, BTC May Take Over the Rally

After gold and silver staged another new-high frenzy last month, many market participants and analysts have begun to identify cryptocurrencies, including BTC, as the next recipients of liquidity once precious metals prices correct.

TD Securities Senior Commodity Strategist Daniel Ghali stated that he expects up to 13% of the total open interest in the Comex silver market on the New York Mercantile Exchange to be sold off within the next two weeks, leading to significant price revaluation and decline, with low post-holiday liquidity potentially amplifying price volatility.

Delphi Digital published an article stating that gold prices have risen 120% since the beginning of 2024, marking one of the strongest historical gains. Since gold has historically led Bitcoin by about three months at liquidity turning points, this trend holds reference significance for cryptocurrencies. Gold has currently completed its repricing for the easing cycle, while Bitcoin sentiment is still influenced by previous cycle analogies and recent pullbacks. The performance of precious metal assets is signaling policy easing and fiscal dominance. When precious metals outperform stocks, the market is pricing in currency depreciation rather than a growth collapse. Volatility in the precious metals market could be a signal for the subsequent performance of other risk assets.

Garrett Jin, agent for the "10·11 Insider Whale," also published an article stating, as previously analyzed, gold and silver prices have peaked. After the US market opened today, funds have already started shifting towards the cryptocurrency market. Even after the stock market opened and faced selling pressure, cryptocurrencies continued to rise. Fund inflows may persist, and the upward momentum could accelerate, triggering a short squeeze without a pullback.

Retail Sentiment to Become an Important Indicator of Market Change

Brian Quinlivan, an analyst at the blockchain analytics platform Santiment, pointed out that cryptocurrency market participants' sentiment on social media has been strong at the start of the year but also warned that whether the market can rise further depends on whether retail investors can remain rational. He stated that Santiment's social media data shows current retail sentiment is very positive. "Usually, this is somewhat concerning," he said, "but this time it might just be a normal rebound after returning from the holidays."

Quinlivan said he is not overly worried about "a surge of FOMO sentiment" but added that if Bitcoin quickly climbs to $92,000, such sentiment could flood the market. When market excitement becomes too high, the cryptocurrency market often moves in the opposite direction of what the majority expects.

Market Expectations Diverge; On-Chain and Off-Chain Funds Part Ways

Looking at the current market situation, the attitude towards ETF trading remains cautious, in stark contrast to the optimistic stance of on-chain funds in the crypto market.

BTC ETF Net Outflows Exceed $900 Million in Past 3 Weeks

Yesterday, Bitcoin's price rose above $90,000, reaching a near three-week high. However, fund flows in derivatives and spot ETFs show traders remain cautious, indicating limited market confidence in further price increases. Data shows that despite the price rebound, demand for Bitcoin leveraged long positions has remained flat. The Bitcoin futures basis rate is below the neutral threshold, with the current annualized premium at 4%. Since December 15th, Bitcoin spot ETFs have recorded net outflows exceeding $900 million. Additionally, Bitcoin put options traded at a premium on Saturday, indicating increased demand for downside risk protection among professional traders.

DOGE, PEPE Lead Meme Coin Broad Rally; IP, ZEC, WLFI Lead Oversold Rebound Sector

Recently, Dogecoin and PEPE led a wave of meme coin gains at the start of the year. Some analysis suggests momentum traders are chasing a familiar pattern: once liquidity returns, speculative funds flow from large-cap coins into meme coins. Currently, major meme coins are broadly rising, including PEPE, DOGE, SHIB, WIF, FLOKI, etc.

Tokens like IP, ZEC, WLFI, categorized as "hot concept" tokens, have rebounded after the new year following significant previous declines, combined with related news and market fundamentals.

Among AI concept tokens, coins like RENDER and PIPPIN remain actively traded, with both spot and futures showing impressive gains exceeding 15%.

Based on existing information, the biggest variable for the crypto market still focuses on this month's macroeconomic data and the Federal Reserve chair nominee proposed by Trump. Before that, buying the dip is possible, but it's advisable to opt for short-term operations and avoid getting carried away.

BTC Year-End Price Prediction Contest Begins; $120K-$170K Becomes Main Range

Finally, we will conclude the article with existing BTC price predictions, which also represent our expectations for this year's rally.

Ta Kung Pao published an article titled "Speculative Attributes Fade, Bitcoin Volatility Stabilizes," which pointed out: The surge in Bitcoin's price in 2025 differs from previous years, with the core reason being the widespread rollout of ETFs. The recent price correction is not as severe compared to the past four or five years. Behind this change may be the influence of macroeconomic factors on traditional capital operation logic. Regarding Bitcoin's trend predictions for 2026, there are two camps in the market. One believes Bitcoin may experience a significant correction, even returning to lower price ranges. The other camp of investors is optimistic about Bitcoin hitting $150,000 by year-end and expects it to reach $250,000 in 2027.

Forbes published an article "What Is Bitcoin's Price Prediction For 2026," which pointed out: Currently public Bitcoin price predictions for 2026 cover a wide range. Analysts like Tom Lee, Standard Chartered, and Bernstein are bullish, but some institutions are bearish. Although a single Bitcoin target price has not yet emerged in the market, predictions are concentrated in the $120,000 to $170,000 range, indicating that Bitcoin's price discovery is increasingly influenced by structural factors such as ETF fund flows and corporate treasury assets. If macro tailwinds strengthen and institutional participation accelerates, the potential upside could reach $250,000 or higher. How institutions choose to deploy capital will become a key factor in Bitcoin's price increase.