In-Depth Analysis of the Crypto Compensation Report: Huh? These Guys Earn That Much?

- Core Insight: Overall crypto industry compensation is declining but stabilizing.

- Key Elements:

- Salaries and token-based compensation have decreased for almost all job levels.

- Entry-level positions account for less than 10%, suffering the most significant impact.

- Compensation for senior individual contributors and executive management forms a "barbell structure."

- Market Impact: Companies are hiring more cautiously, intensifying talent competition.

- Timeliness Note: Medium-term impact

Original | Odaily (@OdailyChina)

Author|jk

In the crypto industry, compensation is always one of the most frequently discussed yet hardest topics to get reliable conclusions on. Whether it's founders establishing internal salary frameworks or candidates evaluating the fairness of an offer, reality often lacks data support. Industry discussions frequently rely on scattered individual cases, anonymous sharing, or emotional judgments rather than a universal compensation structure.

Against this backdrop, top crypto venture capital firm Dragonfly first released its annual crypto industry compensation report in 2023, conducting extensive questionnaire surveys to summarize universal crypto salary data. Two months ago, Dragonfly released the 2025 edition. This report collected feedback from 85 crypto companies and, for the first time, expanded the research scope to companies outside Dragonfly's portfolio, making the data more representative of a real industry cross-section.

Data collection covered the period from late 2024 to Q1 2025, introducing approximately 3,400 deduplicated employee and candidate-level data points for the first time. While the data isn't the most recent, fortunately, salaries don't fluctuate as wildly as token prices. The report shares detailed compensation data for every function, level, and region, moving beyond "role averages" or "rough ranges." Compared to the 2023 report, this research not only answers "how much does the crypto industry pay?" but begins to show "how money is allocated, and how certainty and risk flow within organizations."

Let's take a look at the key highlights worth referencing. Whether you're a fresh graduate eager to enter Web3 or a mid-level manager exploring the crypto industry, this report should contain plenty of data you can learn from.

All salary figures in this article are in USD/USDT, representing cash salaries only, excluding token/equity compensation.

1. Overall Market Summary

TL;DR: Here are the top ten takeaways from the official Dragonfly report.

- Most crypto companies are in growth mode, not high-speed expansion.

- Crypto hiring has been global from the start; hiring exclusively within the US is almost non-existent.

- Europe has become the primary international hiring hub.

- Salaries and token compensation have declined for almost all levels and regions.

- Remote work remains dominant, and companies have no plans to change this.

- The barrier to entry into crypto is high, with entry-level roles making up less than 10%.

- Engineering roles remain core. Product roles typically start at senior levels, and design roles value individual contributors over management.

- US salary levels have become the global pricing benchmark for engineering management.

Looking at the overall environment, crypto industry compensation from 2024 to 2025 shows a clear characteristic: it's a market in a downward adjustment phase but gradually stabilizing. Although mainstream crypto asset prices remain strong, and the US policy environment has released positive signals for the industry in phases, these macro changes have not quickly translated to the hiring and compensation side. Companies remain cautious in hiring and pricing, with comprehensive contraction in roles and compensation.

At the hiring geography level, the crypto industry's globalization feature has further solidified. Teams hiring only within the US are almost non-existent; cross-regional collaboration is the default from the start. Europe has risen significantly in this cycle, becoming one of the most important international hiring centers, especially occupying key positions in engineering and product-related functions.

Remote work is a very clear long-term trend in this report. Most companies have not shown clear plans to return to the office, directly weakening the singular logic of "location determines pay." Compensation differences are starting to reflect more on an individual's influence within the organization, scarcity, and scope of responsibility, rather than geographic location itself.

Entry-level roles have been hit most noticeably, with significant declines in salary and tokens, partially compensated by higher equity proportions. US entry-level roles still hold an advantage in cash compensation, but international peers often receive 2–3 times more equity and higher token rewards. Mid-level roles are generally squeezed, with limited growth space; senior roles perform relatively more stably, with smaller salary reductions, more stable equity, and tokens increasingly concentrated at the top. The most significant salary increases appear for Senior Individual Contributors (Senior ICs) and executive levels, forming a clear "barbell structure," a phenomenon particularly prominent in product and engineering roles.

Engineering remains the industry's core, but functions outside engineering are showing more pronounced hierarchical differentiation, with returns concentrated on high-level talent and execution layers, while mid-level and junior roles bear more obvious compression pressure. Product roles almost always require senior experience from the start, and the design function clearly favors high-level individual contributors over management paths. Within design roles, the value of management is less than that of senior designers. In the US, senior individual contributors in design have higher total compensation than design managers, and even some executives.

Finally, from a year-over-year perspective, bosses, i.e., founders, are increasing their own salaries every year. The larger the funding round, the higher the founder's salary, and the lower their equity stake. US founders generally have higher salaries, equity, and tokens than their international counterparts.

Overall, salaries and token grants have declined for almost all levels. US roles still lead in cash compensation, while international teams narrow the gap through higher equity and token allocations.

2. Deep Dive into Six Major Roles

2.1 Software Engineer: The Industry Cornerstone

As the technical backbone of the crypto industry, software engineers' salary levels have always been at the forefront.

US Market Salary Progression Path:

From the data, the career development path for software engineers is quite clear. The entry-level salary range is $89k-$138k, averaging around $113k. At the mid-level stage, salaries increase to $123k-$172k, averaging around $147k. Upon promotion to Principal or Senior level, roughly after 7-8 years of experience, there's a significant jump to $172k-$222k, averaging around $197k.

Software Engineer Salaries

Upon reaching Executive or Director level, salaries can reach $208k-$264k, averaging around $236k. From entry to executive level, salaries increase nearly 3-fold.

Particularly noteworthy is the most significant jump from mid-level to senior engineer, i.e., from the 3-5 year experience range to the 7-8 year Senior position, with a salary increase of over 40%. It's evident that companies are willing to pay a premium for engineers who can truly solve complex problems.

International Market:

While international market software engineer salaries are lower, they remain quite attractive. Entry-level is $63k-$109k, roughly equivalent to RMB 400k-700k, which is already a considerable income in many countries, especially in regions with lower living costs like Eastern Europe and Southeast Asia.

Simultaneously, salaries for high-level positions are rapidly catching up to US levels. Executive or Director levels can reach $200k-$253k, already close to US peer levels. This means that with the proliferation of remote work and intensified global talent competition, geographic differences are gradually narrowing. For capable engineers, choosing where to work has become more flexible.

It shows how important it is for engineers to learn English well.

2.2 Crypto Engineer: The Reward of Specialization

Crypto engineers, commonly referred to as smart contract engineers, as an industry-specific role, show a unique salary pattern.

US Market:

In the US market, the crypto engineer salary trajectory reveals an interesting phenomenon. Entry-level salaries ($64k-$108k) are actually lower than traditional software engineers, possibly because new crypto engineers need more time to accumulate domain-specific knowledge, such as deeply understanding various consensus mechanisms, learning Solidity, etc.

But by Mid-level ($119k-$169k), the professional advantage begins to show, with a staggering salary increase of 85%. Continuing to Senior level ($155k-$205k), salaries maintain strong growth. This steep growth curve illustrates an important fact: once you master core crypto technologies, your value increases dramatically.

Smart Contract Engineer Salaries

Interestingly, crypto engineer salaries at the management level (Manager: $145k-$200k) are slightly lower than the pure technical track. This may reflect an industry characteristic: compared to management skills, deep technical expertise is more valued in this field, and talent that can truly understand and improve zero-knowledge proofs or optimize Layer 2 solutions is extremely scarce.

International Market:

In the international market, mid-level crypto engineers perform particularly well. Their salaries ($90k-$142k, RMB 600k-1 million) even exceed the senior levels of some traditional roles. The reason behind this phenomenon is simple: talent with skills in blockchain, smart contracts, and other specialized areas is extremely scarce globally. Whether you're in Silicon Valley or Singapore, excellent Solidity developers are highly sought after by companies.

2.3 Product Manager: The Dark Horse of Salary Explosion

Product managers showed astonishing salary growth in 2024/25, especially at senior levels.

US Market:

The most eye-catching data point is undoubtedly the Executive-level product manager salary, reaching an astonishing $391k-$484k, far exceeding all other roles. This figure even makes many suspect a data error. But upon closer thought, this unusually high salary actually reflects several important pieces of information.

First, the complexity of Web3 products far exceeds that of traditional internet products. One must not only understand user needs but also deeply grasp technical details like tokenomics, on-chain data, and cross-chain interactions. Second, PMs who can truly understand technology and translate it into user value are extremely scarce in the market. Finally, the commercial value a successful crypto product can bring is immense; a successful DeFi protocol or NFT platform can easily see transaction volumes in the tens of billions of dollars.

In other words, if one firmly commits to this path, there are significant opportunities.

For PMs just entering or in the mid-career stage, Entry-level PM salaries ($95k-$140k) are second only to software engineers. By Mid-level ($153k-$203k), PM salaries have surpassed all technical roles, becoming the highest-paid position at the same level.

But this is only in the US.

International Market:

Compared to the frenzy of the US market, international market PM salaries appear more rational and much lower. Executive-level salaries are $145k-$194k, nowhere near as exaggerated as in the US. Meanwhile, entry-level PM salaries are not much different from those of smart contract engineers and software engineers at the same level; remote work is enough for someone earning an average of RMB 750k to live very well.

2.4 Designer: Underestimated but Rising

Design roles have long been underestimated in the crypto industry, but data shows the situation is changing.

US Market:

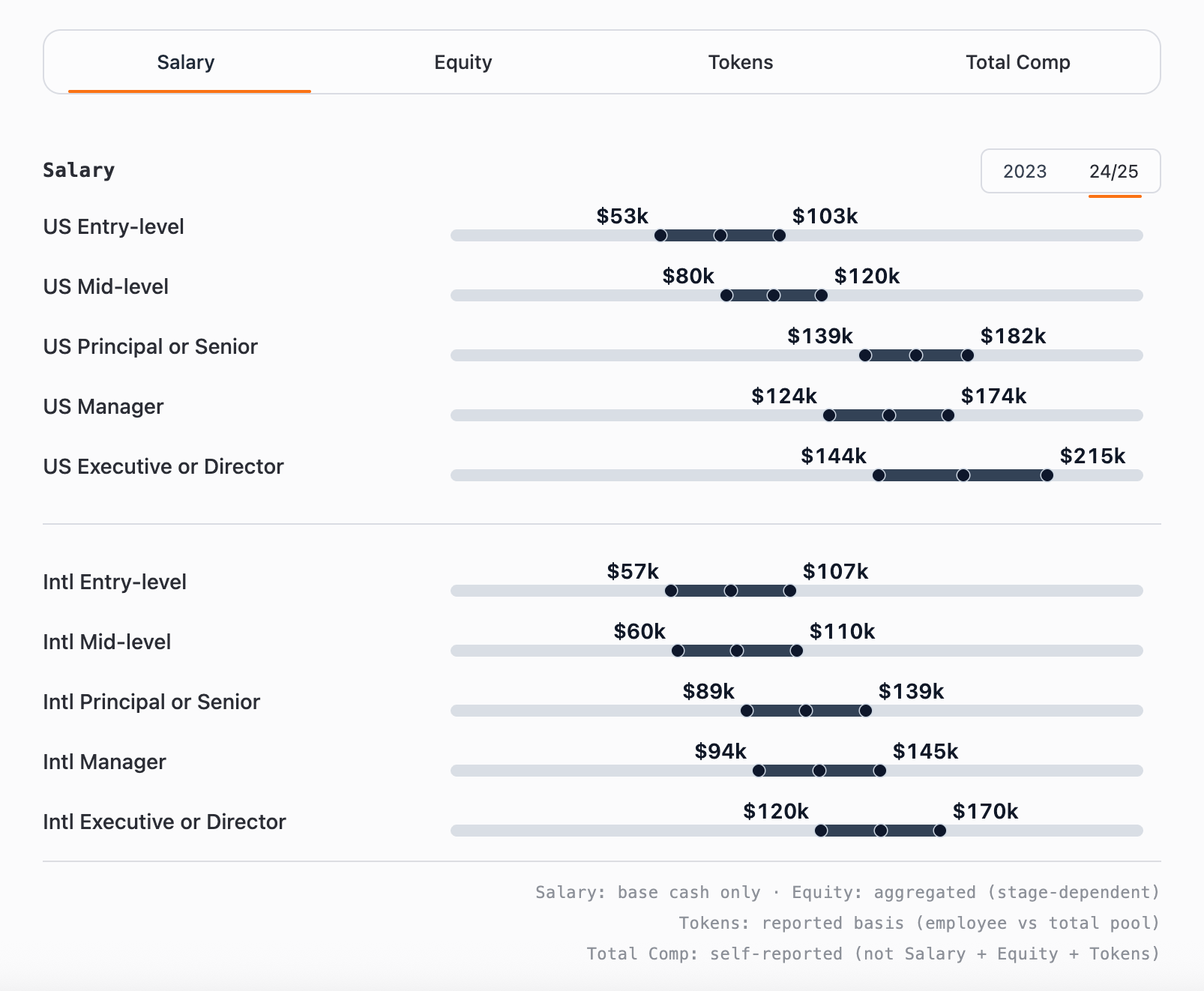

The designer salary trajectory tells an interesting story. Entry-level starting salaries ($53k-$103k) are among the lowest for all roles, which aligns with the crypto industry's reality: for a long time, crypto projects focused more on technical implementation while neglecting user experience, leading to the often abysmal interfaces of many early DApps; even projects with tens of millions in funding often had poor interactions and other experiences.

But the situation is changing rapidly. When designers reach the Senior level ($139k-$182k), salaries see a significant leap. This jump indicates the market is finally realizing the importance of an experienced designer with 7-8 years of experience and the ability to lead a team for product success.

However, mid-level designers face the biggest challenge among all roles. Their salaries ($80k-$120k) grow slowly, with only about a 30% increase compared to entry-level. This "mid-career crisis" may lead to the loss of excellent design talent to other industries or transitions to other functions.

International Market:

Interestingly, designer salaries in the international market are relatively more balanced. Especially at mid-to-senior levels, the salary gap between designers and other functions is smaller. This provides a fairer development environment for designers. If you are a designer, when choosing a work location, you might consider opportunities in the international market more.

2.5 Marketing: The Steadily Growing Backbone

Marketing plays an increasingly important role in the crypto industry, and salary data reflects this trend.

US Market:

Marketing role salaries show a steady and balanced growth pattern. Entry-level salaries ($58k-$108k) provide a reasonable starting point, neither the highest nor the lowest. By Mid-level ($90k-$139k), salaries achieve a stable growth of about 55%. Senior-level salaries are $127k-$176k, while Executive level reaches $166k-$225k. This indicates the transition for marketing professionals from executing marketing strategies to formulating them. In the crypto industry, the value of marketing experts who can understand complex technical concepts and turn them into compelling stories is immense.

International Market Characteristics:

Marketing roles in the international market show a more standardized salary structure, with relatively smaller differences between levels, indicating a steady growth trend.

2.6 Business Development (BD/Go to Market): The Growth Engine

BD/GTM roles play a key role in the success of crypto projects, and salary data reflects this importance.

US Market:

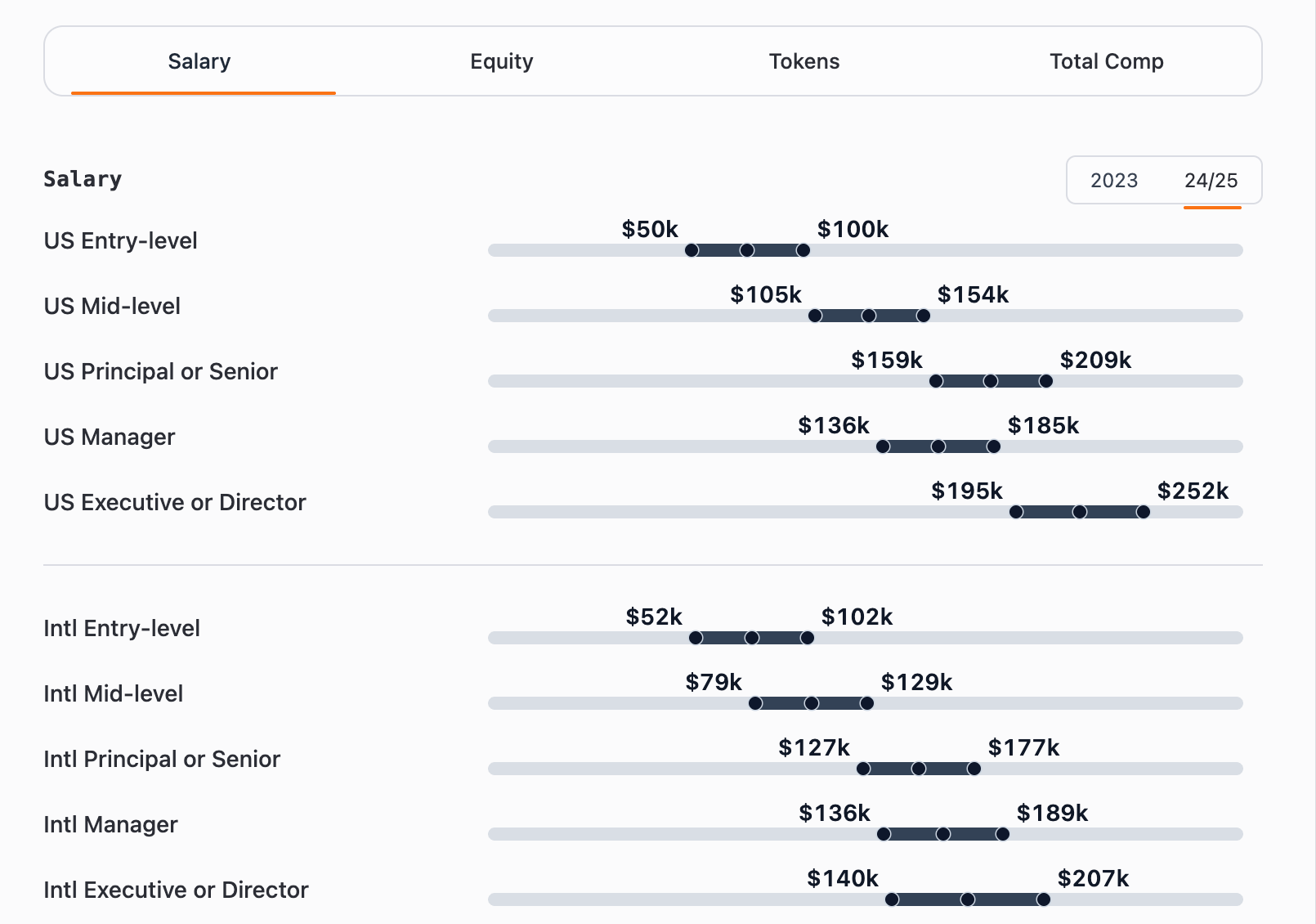

The BD salary story might be the most inspiring. Entry-level ($50k-$100k) starting salaries are the lowest among all roles, but don't be discouraged by this number. Look at the Mid-level data ($105k-$154k), where salaries potentially double! In other words, after 3-5 years of work, salaries can double, the largest increase among all roles. At the Executive level ($195k-$252k), the salaries of excellent BD leaders prove their critical role in company growth.

New BD professionals might start by sending cold emails, attending meetings, and conducting preliminary market research. But once you build your network and understand how the ecosystem operates, your value increases dramatically.

Consider this: an excellent BD professional can help a project get listed on major exchanges, establish key partnerships, and open new markets. In the current market environment of "building in bear markets, harvesting in bull markets," BD talent that can bring actual business growth is naturally highly valued. They must not only understand business but also grasp token economics, know the characteristics of various public chains, and be familiar with the workings of DeFi protocols. This kind of composite talent is in high demand everywhere.

International Market:

There's a particularly interesting phenomenon with BD salaries in the international market. The Principal/Senior level ($127k-$177k) performs exceptionally well internationally, and the Manager level ($136k-$189k) salary even exceeds that of US peers at the same level.

The reason behind this isn't hard to understand: the international market relies more on localized business development capabilities. If you can help US projects land in Asia or help Asian projects enter the European and American markets, your value is immense.

It's clear that US roles lead in cash compensation and total compensation for almost all levels.

2.6 Founder Salaries: How Much Do Bosses Pay Themselves?

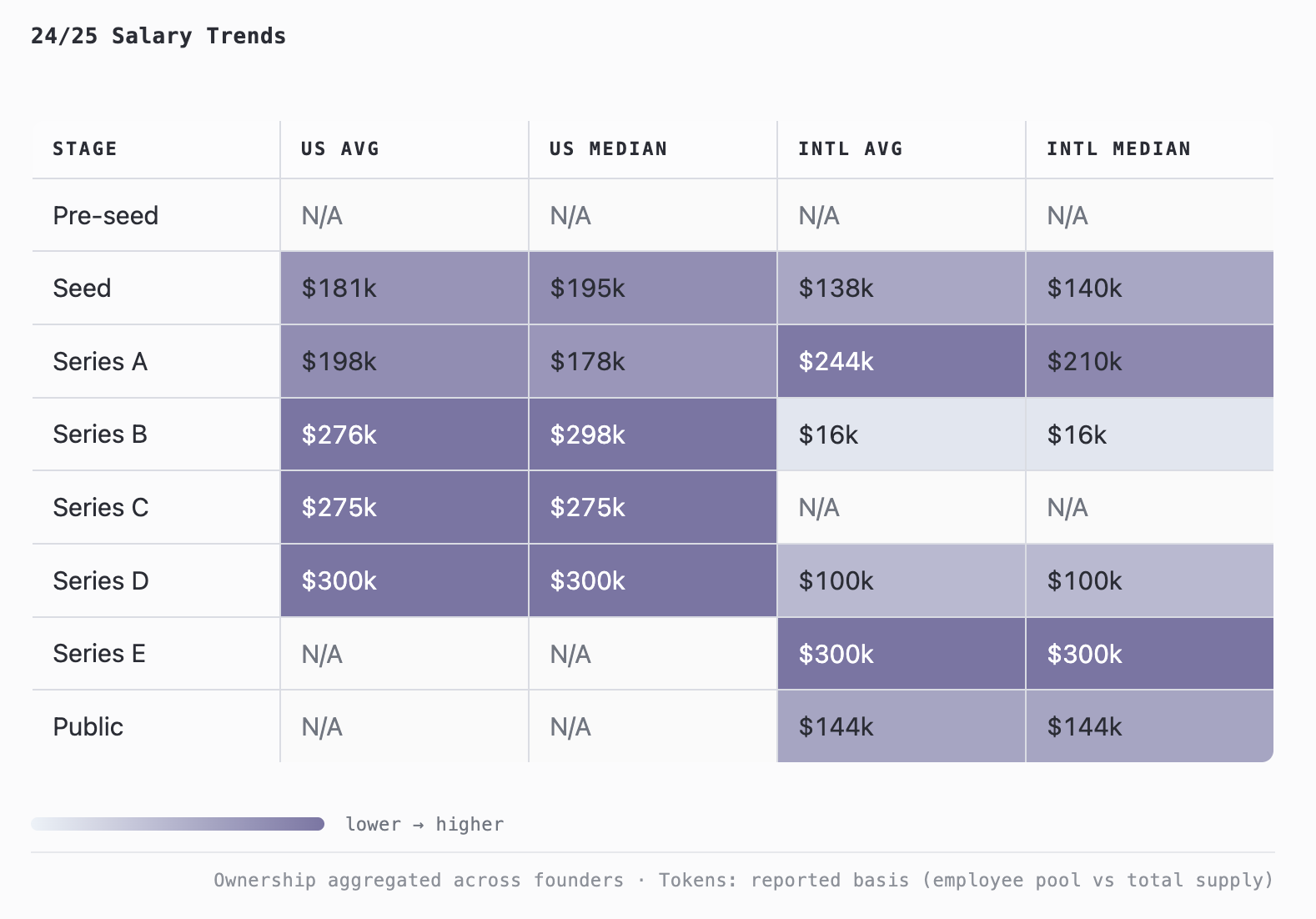

We can observe a very interesting phenomenon: founder salaries show a clear positive correlation with the company's funding stage, but this growth is not linear, and the US and international markets exhibit截然不同的 patterns.

US Market:

In the US market, founder salaries show a stepwise increase with