Messari 2026 Crypto Thesis: Why Speculation Is No Longer Enough (Part 1)

- Core View: The crypto market is shifting from speculation to system integration.

- Key Elements:

- New L1 valuations are decoupling from fundamentals, and monetary premiums will be stripped away.

- Chain abstraction is turning blockchains into backend infrastructure.

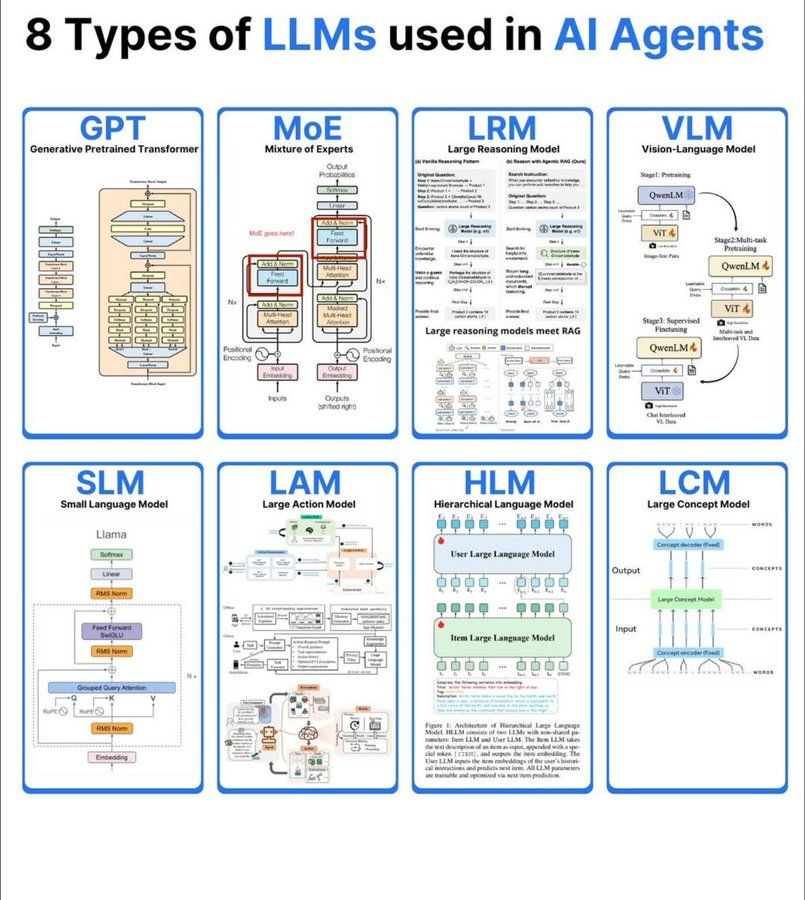

- AI agents and equity perps will dominate new activity.

- Market Impact: Directs capital and talent towards integration and utility.

- Timeliness Note: Medium-term impact

Every year, the cryptocurrency market is flooded with countless outlooks and predictions. Most are quickly forgotten. However, a few predictions can genuinely influence the flow of capital, talent, and attention. Among these, Messari's annual "Crypto Theses" report occupies a unique position.

For many institutions, this report serves more as a strategic memo than a mere forecast. It not only discusses market directions but implicitly defines... what matters. In the next cycle, the sectors highlighted in Messari's theses often become the focal points for venture capitalists and entrepreneurs in the following year.

The 2026 edition revolves around a clear transformation: cryptocurrency is shifting from pure speculation to system-level integration. In the first part of this three-article series, I will focus on several core arguments from the report, combining them with my own interpretations and questions, particularly from the perspective of market participants rather than purely first-order research.

The L1 Valuation Trap

Between 2024 and 2025, a wave of venture-backed Layer 1 blockchain projects emerged, often with fully diluted valuations (FDV) in the tens of billions of dollars. Projects like Monad, Berachain, and Sei arrived with familiar promises: higher TPS, stronger teams, and superior execution environments. The implicit assumption was that each new L1 had the potential to become the "next Ethereum."

Messari argues this assumption is now being disproven by real data.

The early valuation logic treated L1 tokens as potential money. If a chain could become a settlement layer with sufficient activity, a massive monetary premium seemed justified. In practice, however, most such networks end up as highly inflationary systems with minimal own revenue. Token issuance far outpaces on-chain fee revenue, leading to structural losses for many L1 tokens.

Meanwhile, the market landscape has shifted. Ethereum's Layer 2 ecosystem has matured significantly, while Solana has solidified its dominance in high-performance consumer crypto. In this context, new chains struggle to attract loyal, long-term token holders. Instead, they attract airdrop farmers and short-term liquidity tourists.

Messari's conclusion is blunt: beyond BTC and a few truly compelling ecosystems (Solana and Base are the most frequently cited examples), most L1 valuations have completely detached from fundamentals.

Looking ahead to 2026, the report anticipates the market will actively strip away the so-called "monetary premium" from L1 tokens. Merely advertising high throughput is no longer enough to justify multi-billion dollar FDVs. At a minimum, a chain's daily gas fee revenue should exceed the amount it distributes via inflationary rewards. Otherwise, the consequences are unsustainable.

In extreme cases, some newly launched parallel EVM chains still trade at $5-10 billion valuations while generating less than $10,000 in daily gas revenue. At that rate, it would take millennia for fee revenue to offset token issuance costs. This is not a temporary mismatch but a structural issue.

While Messari is optimistic about Solana—perhaps influenced by its own investments—the broader implication is more significant: a viable L1 must possess genuine "commanding authority" or some form of application-layer monopoly. Speed alone is no longer a winning strategy.

Chain Abstraction as a Survival Strategy

One area the report highlights, which I believe deserves closer examination, is chain abstraction.

The goal of chain abstraction is theoretically simple but profoundly impactful. Users shouldn't need to know which chain they are using. With a single wallet, balances denominated in stablecoins, users initiate actions, and the system automatically handles bridging, gas conversion, routing, and signing in the background.

If this vision is realized, blockchains cease to be consumer-facing products and become backend infrastructure.

Projects like Near and Berachain are experimenting with different versions of this idea. Near positions itself as an AI-centric distributed platform, while Berachain reinforces capital stickiness through its "liquidity consensus" model, effectively forcing liquidity to remain within its ecosystem.

From an investment perspective, this redefines how to evaluate the L1 layer. A blockchain that is merely faster at processing transactions is replaceable. One that controls user flow, liquidity routing, or application distribution retains its influence. In a post-abstraction era, power stems not from execution speed but from coordination and control.

The Rise of the Agent Economy

Perhaps the most controversial claim in Messari's report is that by 2026, the majority of on-chain activity will no longer be human-driven.

Instead, AI agents will dominate transaction volume.

The logic is straightforward. The traditional banking system cannot open accounts for autonomous software agents. Yet, AI systems increasingly require 24/7 access to payments, hedging instruments, and yield optimization. Crypto-native assets, especially stablecoins, are perfectly suited for this role.

If AI agents achieve economic autonomy, they could pay each other, rebalance portfolios, and seek optimal execution paths without human intervention. Messari estimates that up to 80% of on-chain transactions in the next cycle could be machine-generated.

This shift is profound. The importance of user interfaces, dashboards, and retail-friendly design diminishes. APIs, smart contract composability, and machine-readable financial primitives become the real battlegrounds.

Protocols like Virtuals and Wayfinder are early attempts at building the infrastructure for this world. Virtuals positions itself as a platform where AI agents can have autonomous identities and control funds. Wayfinder focuses on handling complex on-chain operations on behalf of agents.

However, the real opportunity might lie elsewhere. Rather than speculating on abstract "AI tokens," Messari is essentially encouraging a focus on what AI *consumes*: layers for gas optimization, agent authentication systems, and the infrastructure AI must pay to use. This is a story about tools, not narratives.

Equity Perpetuals & The New Frontier of Derivatives

Another major theme is the emergence of equity perpetuals.

Following the success of protocols like Hyperliquid, DeFi is expanding from crypto-native assets to global equity price exposure. An equity perpetual is a synthetic derivative whose price is anchored by oracles and funding rates, not ownership.

This distinction is crucial. Trading an NVIDIA stock perpetual involves no dividends or shareholder rights. It is purely a bet on price movement, facilitated by a funding rate mechanism. If the underlying stock rises, shorts pay longs; if it falls, the opposite occurs.

Messari contrasts this model with tokenized stocks. Tokenized stocks theoretically represent ownership but suffer from illiquidity, opaque custody, and platform risk in practice. For now, the equity perpetual model appears more scalable.

Messari posits that if Hyperliquid's markets truly expand in 2026, its surrounding ecosystem could see exponential growth. Of course, other competing models exist. Aster, often seen as closely tied to the Binance ecosystem, takes a cross-chain liquidity aggregation approach rather than building a vertically integrated L1.

Hyperliquid prioritizes on-chain transparency and performance by owning the entire blockchain tech stack. Aster prioritizes capital efficiency and convenience, allowing users to deploy leverage across chains with minimal friction. In a bull market, the appeal of the latter is obvious. However, its architectural complexity also carries higher systemic risk.

Decentralization & The Shift to Real Revenue

Finally, Messari points out that DePIN is the only sector it expects to generate hundreds of millions of dollars in verifiable revenue by 2026.

This claim is not without controversy. The DePIN narrative has flourished before, often failing due to one-sided supply growth without genuine demand. Many early projects encouraged hardware deployment while ignoring the question of who would pay for the service.

The report's argument is that this landscape is changing. The infrastructure is now deployed. What follows is demand—driven primarily by the shortage of AI compute power.

Projects like io.net focus on GPU aggregation, not speculative data collection. The key metric is external revenue: are token buybacks funded by genuine enterprise contracts, or merely by new participants buying hardware?

Messari cites Aethir as an example, with over $160 million in annual recurring revenue in Q3, largely from users priced out of AI compute due to high-end hardware costs. Whether this growth is sustainable remains to be seen, but the model is clear.

For DePIN, the quality of revenue—not network size—will determine viability.

A Final Caveat

While Messari's report is comprehensive, it primarily reflects a primary market perspective. For retail investors, fundamentals alone rarely drive price action. Liquidity and market narratives still dominate returns.

Usage does not equal returns. Marginal capital flow equals returns.

This tension—between what should matter and what actually moves markets—will define the next cycle. And that is precisely where a critical reading of reports like Messari's becomes most valuable.

To be continued (Part 2).

The views above are referenced from @Web3___Ace