Distinguishing Types of Pullbacks Is More Important Than Blindly Buying the Dip

- Core Viewpoint: Investors need to distinguish between market-wide systematic pullbacks and company-specific idiosyncratic pullbacks. The former can rely on behavioral advantages (patiently waiting for market recovery), while the latter requires deep analytical advantages (accurate judgment of the company's long-term prospects). The current software stock decline under AI pressure falls into the category of idiosyncratic pullbacks requiring detailed analysis.

- Key Elements:

- Systematic risk is an unavoidable overall market risk that cannot be eliminated through diversification; investors can be compensated for bearing this risk.

- Idiosyncratic risk is company-specific risk that can be eliminated by diversifying a portfolio; investors do not receive extra compensation for bearing it.

- Using FactSet as an example, the decline during the 2008 financial crisis was a systematic pullback, related to overall market concerns. The decline in 2025/26 due to AI concerns is an idiosyncratic pullback, focusing on its own moat and growth prospects.

- To deal with systematic pullbacks, the key is to leverage behavioral advantages—staying patient and buying during market panic.

- To deal with idiosyncratic pullbacks, behavioral advantages alone are insufficient. One must possess deep analysis that surpasses market consensus to clearly judge the company's long-term value.

- Idiosyncratic pullbacks are often accompanied by selling from a large number of informed investors. Before intervening, one must be able to convincingly explain why the market consensus is wrong.

- Investors should avoid using simple "behavioral solutions" suited for systematic pullbacks to address the complex analytical problems posed by idiosyncratic pullbacks.

Original Author: Todd Wenning

Original Compilation: TechFlow

Introduction: Academic finance theory categorizes risk into systematic risk and idiosyncratic risk. Similarly, stock drawdowns are also of two types: market-driven systematic drawdowns (e.g., the 2008 financial crisis) and company-specific idiosyncratic drawdowns (e.g., the current software stock crash driven by AI concerns).

Using FactSet as an example, Todd Wenning points out: during a systematic drawdown, you can leverage a behavioral advantage (patiently waiting for the market to recover); but during an idiosyncratic drawdown, you need an analytical advantage—a more accurate vision of what the company will look like in ten years than the market has.

Amid the current AI-driven impact on software stocks, investors must distinguish: is this a temporary market panic, or is the moat truly eroding?

Don't use a blunt behavioral solution to solve a problem that requires nuanced analysis.

Full Text Below:

Academic finance theory posits two types of risk: systematic and idiosyncratic.

- Systematic risk is the unavoidable market risk. It cannot be eliminated through diversification, and it is the only type of risk for which you are compensated.

- On the other hand, idiosyncratic risk is company-specific risk. Because you can cheaply purchase a diversified portfolio of uncorrelated businesses, you are not compensated for bearing this risk.

We can debate Modern Portfolio Theory another day, but the systematic-idiosyncratic framework is helpful for understanding different types of drawdowns (the percentage decline from an investment's peak to trough) and how we, as investors, should assess opportunities.

From the moment we picked up our first value investing book, we were taught to exploit Mr. Market's despondency when he sells stocks. If we remain calm while he loses his mind, we will prove ourselves to be stoic value investors.

But not all drawdowns are the same. Some are market-driven (systematic), while others are company-specific (idiosyncratic). Before you make a move, you need to know which type you're looking at.

Generated by Gemini

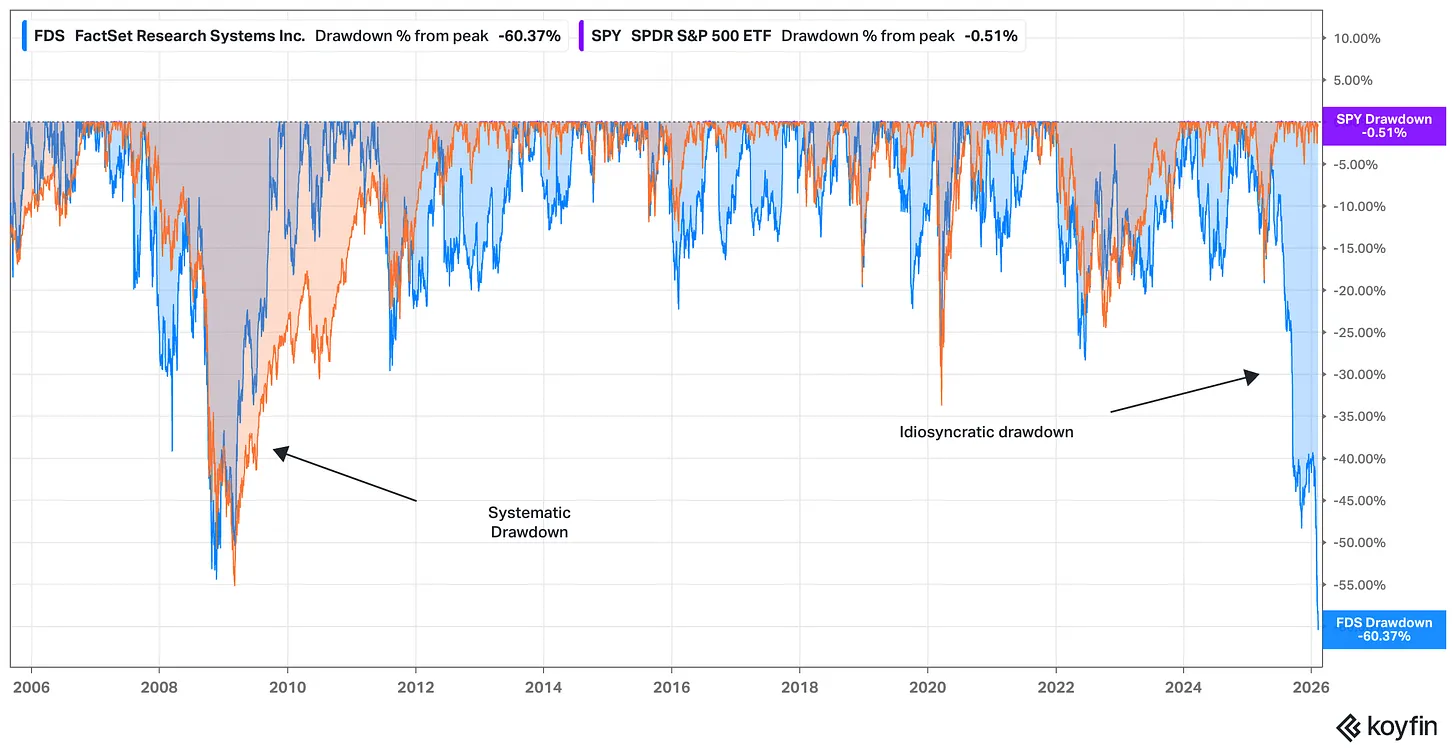

The recent sell-off in software stocks due to AI concerns illustrates this point. Let's look at the 20-year drawdown history between FactSet (FDS, blue) and the S&P 500 (measured via the SPY ETF, orange).

Source: Koyfin, as of February 12, 2026

FactSet's drawdown during the financial crisis was primarily systematic. In 2008/09, the entire market was worried about the durability of the financial system, and FactSet was not immune to these concerns, especially since it sells products to financial professionals.

At that time, the stock's drawdown had less to do with FactSet's economic moat and more to do with whether FactSet's moat would matter if the financial system collapsed.

The 2025/26 FactSet drawdown is the opposite case. Here, the concerns are almost entirely focused on FactSet's moat and growth runway, alongside broader fears about accelerating AI capabilities disrupting pricing power in the software industry.

In a systematic drawdown, you can more reasonably make a time-arbitrage bet. History shows that markets tend to rebound, and companies with intact moats may emerge even stronger than before, so if you are willing and able to be patient while others panic, you can leverage a strong stomach to exploit a behavioral advantage.

Photo by Walker Fenton on Unsplash

In an idiosyncratic drawdown, however, the market is telling you something is wrong with the business itself. Specifically, it suggests increasing uncertainty about the business's terminal value.

Therefore, if you hope to exploit an idiosyncratic drawdown, you need to possess an analytical advantage in addition to a behavioral one.

To succeed, you need to have a more accurate vision of what the company will look like in ten years than what the current market price implies.

This is not easy to do, even if you know a company well. Stocks don't typically fall 50% relative to the market for no reason. A lot of once-steadfast holders—perhaps even some investors you respect for their deep research—had to capitulate for this to happen.

If you're going to step in as a buyer during an idiosyncratic drawdown, you need to have an answer for why these otherwise well-informed and thoughtful investors were wrong to sell and why your vision is correct.

There is a fine line between conviction and arrogance.

Whether you are holding a stock in a drawdown or looking to initiate a new position in one, it's important you understand what type of bet you are making.

Idiosyncratic drawdowns can tempt value investors to start looking for opportunities. Before you take the plunge, make sure you're not using a blunt behavioral solution to solve a problem that requires nuanced analysis.

Stay patient, stay focused.

Todd