Arkstream Capital: When Crypto Assets Return to "Financial Logic" in 2025

- 核心观点:2025年加密市场进入外部变量与金融入口竞争主导阶段。

- 关键要素:

- 政策与宏观流动性成为关键定价变量。

- 稳定币、ETF、企业财库和IPO构成多资金入口。

- 行业内部向稳定产品线和金融基础设施演进。

- 市场影响:市场波动更趋宏观化,资金配置与退出路径多元化。

- 时效性标注:中期影响

In 2025, the main theme of the crypto market will no longer revolve around the technological cycle of a single public chain or the self-circulation of on-chain narratives. Instead, it will enter a deeper phase dominated by "external variable pricing and competition for financial entry points." Policy and compliance frameworks will determine the boundaries of long-term capital access, macro liquidity and risk appetite will determine whether trends can continue, and derivative leverage and platform risk control mechanisms will reshape volatility patterns and drawdown speeds at key junctures. More importantly, a main theme repeatedly validated by the market since 2025 is that price elasticity is no longer determined solely by the "strength of the on-chain narrative," but rather by the entry points through which funds enter, the investable targets they invest in, and how they exit under pressure. The combined forces of external variables and internal evolution have driven the transformation of the crypto industry in 2025 and further laid the foundation for two clear paths for the future development of the crypto industry.

Institutionalization Acceleration and Securitization Breakthrough: External Variables Dominate the Crypto Market in 2025

The "financialization" underwent a structural shift in 2025. Funds no longer entered the market solely through on-chain native leverage, but instead diversified into multiple parallel and clearly layered channels. Crypto portfolio allocation expanded from a single "asset exposure (spot/ETF)" to a dual-track structure of "asset exposure + industry equity," and market pricing shifted from a single-axis drive of "narrative-position-leverage" to a comprehensive framework of "institutional-capital flow-financing capacity-risk transmission."

On the one hand, standardized products (such as ETFs) incorporate crypto assets into the risk budgeting and passive allocation framework of investment portfolios; the expansion of stablecoin supply strengthens the on-chain dollar settlement foundation and enhances the market's endogenous settlement and turnover capabilities; and the Corporate Treasury (DAT) strategy directly maps the financing capabilities and balance sheet expansion of listed companies into spot demand functions. On the other hand, crypto companies "securitize" their licenses, custody, transaction clearing, and institutional service capabilities into listed company stocks through IPOs, allowing institutional funds to purchase the cash flow and compliance moat of crypto financial infrastructure in a familiar way for the first time, and introducing a clearer benchmarking system and exit mechanism.

In the capital structure, IPOs play the role of "buying industry, buying cash flow, and buying compliance capabilities." This path was rapidly opened up in 2025, becoming one of the preferred choices for leading crypto companies and an external variable for the crypto industry.

For the five years prior, this path remained unclear. This wasn't because the public market had formally closed the listing process for crypto companies, but rather because listing had long been characterized by "high barriers to entry, difficulty in pricing, and difficulty in underwriting." On one hand, unclear regulatory definitions coupled with intense enforcement meant that core businesses such as trading, brokerage, custody, and issuance had to bear a higher density of legal uncertainties and risk discounts in their prospectuses (for example, the SEC's 2023 lawsuit against Coinbase, accusing it of operating as an unregistered exchange/broker/clearing house, reinforced the uncertainty of "the nature of the business could be retroactively determined"). On the other hand, increasingly stringent accounting and auditing standards for the capital and liabilities of custody businesses also raised compliance costs and barriers to institutional cooperation (for example, SAB 121 imposed stricter asset/liability reporting requirements on the accounting treatment of "custody of crypto assets for clients," which was widely considered to significantly increase the asset burden and audit friction for financial institutions conducting crypto custody business). Meanwhile, the combined impact of industry credit shocks and macroeconomic tightening has narrowed the overall IPO window in the US stock market. Many projects, even those wishing to utilize the public market, are more inclined to postpone or change course (e.g., Circle terminated its SPAC merger in 2022, and Bullish halted its SPAC listing plan in 2022). More importantly, from the perspective of primary market execution, these uncertainties are amplified into real "underwriting frictions": underwriters, during the project initiation stage, need to conduct stress tests through their internal compliance and risk committees on whether business boundaries might be retroactively identified, whether key revenues would be reclassified, whether custody and client asset segregation would introduce additional balance sheet burdens, and whether potential enforcement/litigation would trigger significant disclosure and compensation risks. If these issues are difficult to explain in a standardized way, it will lead to a significant increase in due diligence and legal costs, a longer prospectus risk factor process, and unstable order quality, ultimately reflected in a more conservative valuation range and a higher risk discount. For issuing companies, this will directly change their strategic choices: rather than forcing progress in an environment of "high explanation costs, suppressed pricing, and uncontrollable post-listing volatility," it is better to postpone the issuance, turn to private equity financing, or seek mergers and acquisitions/other paths. These constraints collectively determine that at that stage, IPOs are more like an "optional" process for a few companies, rather than a sustainable financing and pricing mechanism.

The key change in 2025 was the clearer "removal/easing" of the aforementioned obstacles, restoring continuity to the listing path. One of the most representative signals was the SEC's issuance of SAB 122 and the repeal of SAB 121 (effective that month) in January 2025. This directly removed the most controversial and "asset-heavy" accounting hurdle for institutions involved in custody and related businesses, improving the scalability of the banking/custody chain and reducing the structural burden and uncertainty discount for related companies at the prospectus level. During the same period, the SEC established the Crypto Assets Working Group and signaled its intention to advance a clearer regulatory framework, reducing the uncertainty premium regarding "whether the rules will change or be retroactive." Meanwhile, legislative progress in the stablecoin sector in the middle of the year further provided "framework-level" certainty, making it easier for traditional capital to incorporate key aspects such as stablecoins, clearing, and institutional services into their valuation systems in an auditable and benchmarkable manner.

These changes will rapidly propagate along the execution chain of the primary market: for underwriters, it becomes easier to transform from "unexplainable and unpriceable" compliance conditions to "discloseable, measurable, and benchmarkable"—conditions that can be included in the prospectus and compared horizontally by buyers. Underwriting syndicates can then more easily provide valuation ranges, control the issuance pace, and invest resources in research coverage and distribution. For issuing companies, this means that an IPO is no longer just a "financing activity," but a process of engineering revenue quality, client asset protection, internal control, and governance structure into "investable assets." Furthermore, although the US stock market does not have a clear "cornerstone investor" system like the Hong Kong stock market, anchor orders and long-term accounts (large mutual funds, sovereign wealth funds, and some crossover funds) in the book-building stage play a similar role: when regulatory and accounting frictions ease and industry credit risks are cleared, high-quality demand is more likely to return to the order book, helping to stabilize pricing and make issuance more continuous, thus making IPOs more likely to return from "occasional windows" to "sustainable financing and pricing mechanisms."

Ultimately, marginal improvements in policy and accounting standards will be specifically reflected in the rhythm of the market and the flow of funds throughout the year through the primary market and capital allocation chain. Looking at the year-on-year development from 2025, the aforementioned structural changes are more like a relay-style manifestation.

In early 2025, the convergence of regulatory discounts led to a reassessment of institutional expectations, with core assets, whose allocation paths were clearer, benefiting first. Subsequently, the market entered a period of repeated confirmation of macroeconomic hard boundaries, and interest rate paths and fiscal policies made crypto assets more deeply embedded in the volatility models of global risk assets (especially US growth stocks). By mid-year, the reflexivity of ETH gradually became apparent: the number of listed companies adopting similar treasury strategies rose to hundreds, with a total holding scale of hundreds of billions of dollars, and balance sheet expansion became an important source of marginal demand; at the same time, ETH-related treasury allocation heated up, so that the transmission of "balance sheet expansion - spot demand" no longer revolved solely around BTC. In the third and fourth quarters, with multiple channels running in parallel and funds rebalancing between different entry points, the valuation center and issuance conditions of the public market began to more directly affect the allocation of funds in the crypto sector: whether the issuance was successful and whether the pricing was accepted gradually became a barometer for measuring "industry financing capabilities and compliance premiums," and indirectly transmitted to spot pricing through the redistribution of funds between "buying crypto/buying stocks." As transactions like Circle provide a "valuation anchor" and more companies advance their IPO applications and preparations, IPOs have evolved from a "pricing reference" into a core variable affecting capital structure: ETFs mainly address the questions of "whether to allocate and how to include in the portfolio," while IPOs further address the questions of "what to allocate, how to benchmark, and how to exit," driving some funds to shift from high-turnover on-chain leverage ecosystems to longer-term industrial equity allocations.

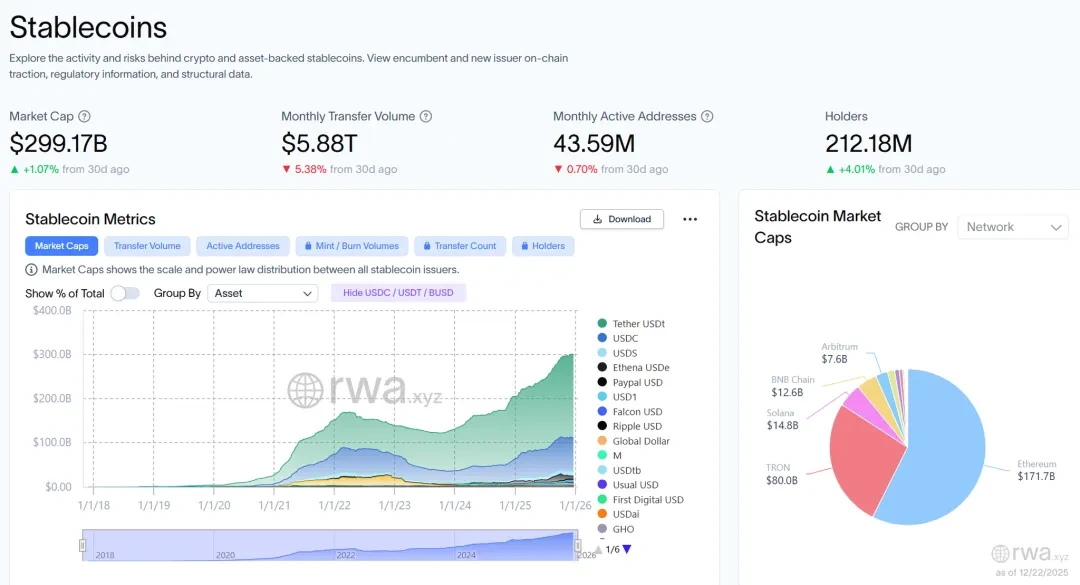

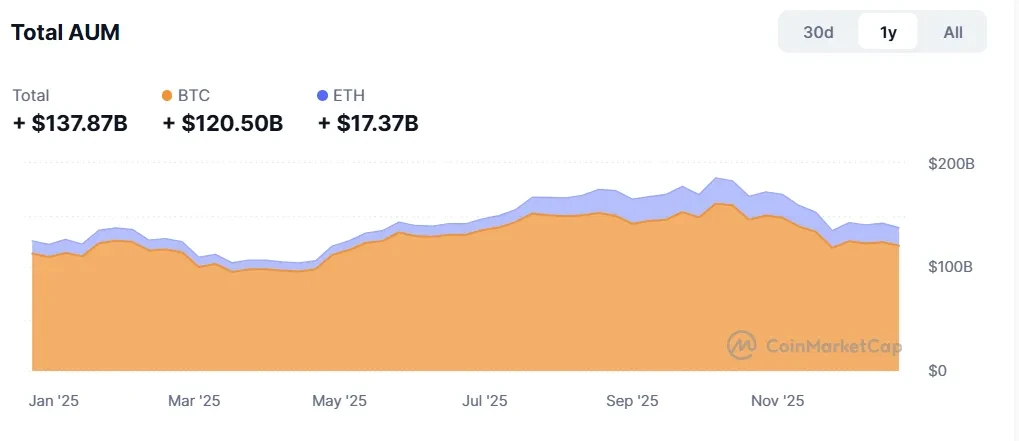

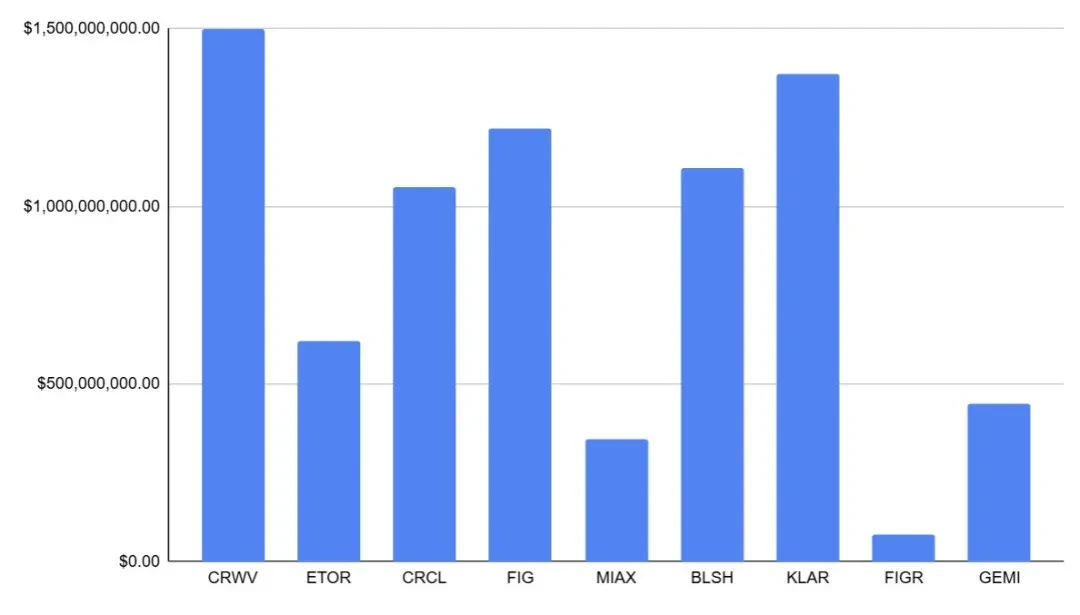

More importantly, this "competition for entry points" is not merely confined to the explanatory framework, but can be directly observed in financial data and market behavior. Stablecoins, as the basis for on-chain USD settlement, saw their supply increase from approximately $205 billion to the $300 billion range in 2025, stabilizing near the end of the year. This provides a thicker settlement and liquidity buffer for on-chain transaction expansion and deleveraging. ETF fund flows have become an explicit pricing factor; despite macroeconomic fluctuations and institutional rebalancing disturbances, IBIT still achieved a net inflow of approximately $25.4 billion during the year, increasing the explanatory power of "net inflow/rebalancing rhythm" on price elasticity. The scaling up of DAT has allowed listed companies' balance sheets to directly influence the spot supply and demand structure. Upward trends may strengthen expansion, while downward trends may trigger reverse transmission due to valuation premium contraction and financing constraints, thus coupling the volatility of traditional capital markets with that of the crypto market. At the same time, IPOs also provide another set of quantitative evidence: in 2025, a total of 9 crypto/crypto-related companies completed IPOs, raising a total of approximately $7.74 billion , indicating that the public market financing window not only exists, but also has the real capacity to support it.

Source: rwa.xyz / Stablecoin Growth in 2025

Source: CoinMarketCap / ETF Funding Data for the Whole Year

Source: Data from Pantera Research Lab / DAT

Against this backdrop, IPOs have become an "external structural variable" for the crypto market in 2025: on the one hand, they expand the range of targets that compliant funds can allocate, providing a public market valuation anchor and benchmark system for stablecoins, trading/clearing, brokerage and custody, and changing the holding period and exit mechanism of funds through the form of "stocks"; on the other hand, their marginal increment is not linear and will still be constrained by macro risk appetite, secondary market valuation center and issuance window.

Overall, 2025 can be summarized as a year of " accelerated institutionalization, strengthened macroeconomic constraints, and the restart of securitization ": Advances in institutional and compliance pathways increased the configurability of crypto assets, expanding funding channels from a single on-chain structure to a parallel system of ETFs, stablecoins, DAT, and IPOs; simultaneously, interest rates, tariffs, and fiscal frictions continued to shape liquidity boundaries, making market movements more akin to the "macroeconomic-driven volatility" of traditional risk assets. The resulting sector differentiation and the return of "listed company vehicles" will form a significant prelude to 2026.

IPO Window Reopens: From Narrative Premium to Financial Primitives

In 2025, the IPO window for crypto-related companies on the US stock market clearly rebounded, evolving from a "conceptual opening" into a set of publicly traded assets that could be quantified and verified. A total of nine crypto/crypto-related companies completed IPOs throughout the year, raising approximately $7.74 billion . This demonstrates that the public market has recovered its capacity to absorb substantial financing for "compliant and accessible digital financial assets," rather than just symbolic small deals. In terms of valuation, these IPOs ranged from approximately $1.8 billion to $23 billion , essentially covering key aspects such as stablecoins and digital financial infrastructure, compliant trading platforms and trading/clearing infrastructure, regulated brokerage channels, and on-chain lending/RWA. This provided the industry with a traceable and comparable pool of equity assets. This not only provided a valuation anchor for the "stablecoin—trading—brokerage—institutional services—on-chain lending/RWA" chain but also allowed the market's pricing language for crypto companies to more systematically shift towards a financial institution framework (emphasizing compliance and licensing, risk control and operational resilience, revenue quality, and sustainable profits). In terms of market performance, the 2025 sample generally exhibited the common characteristics of "strong initial offering followed by rapid differentiation": In terms of issuance structure, many companies had relatively tight initial circulating shares (approximately 7.6%–26.5%), making short-term price discovery more flexible when the risk appetite window opened; the secondary market was generally strong on the first day, with some targets experiencing a doubling of their initial price and most others showing double-digit positive returns, and many companies continued their strong performance in the first week and month, reflecting that buyers had "continuous absorption" of such assets during the window period rather than a one-time pricing; however, the differentiation increased significantly after 1–6 months, and it was closer to the traditional risk asset logic of "macro + quality"—companies with more retail and transactional businesses were more sensitive to changes in risk appetite and experienced faster drawdowns, while assets with more upstream infrastructure and institutional absorption capabilities were more likely to obtain continuous re-ratings.

Source: nasdaq.com / Total IPO Amount of US Crypto Companies in 2025

More importantly, the reason why the "return" of US-listed crypto companies to IPOs is so popular is that it simultaneously satisfies the three things that the public market cares about most during a window of opportunity: buyability, comparability, and exitability . First, it transforms the previously inaccessible "cash flow of crypto financial infrastructure" into equity assets that can be directly held by traditional accounts, naturally aligning with the compliance and risk control frameworks of long-term funds such as mutual funds, pension funds, and sovereign wealth funds. Second, IPOs provide the industry with a pool of comparable equity samples for the first time. Buyers are no longer limited to using "narrative strength/trading volume extrapolation" for valuation; instead, they can use language familiar to financial institutions to segment the market—compliance costs and licensing barriers, risk preparedness and internal control governance, customer structure and retention, revenue quality and capital efficiency. When pricing methods are more standardized, buyers are more willing to offer higher certainty premiums during the window period. Third, IPOs shift the exit mechanism from "on-chain liquidity and sentiment cycles" to "public market liquidity + market making/research coverage + index and institutional rebalancing," which allows funds to offer stronger order quality (including more stable long-term demand and anchor orders) during the issuance stage, thereby reinforcing the repricing momentum in the initial public offering stage. In other words, the enthusiasm does not simply stem from risk appetite, but from the decline in risk premium brought about by "institutional accessibility": when assets become easier to audit, easier to compare, and easier to be included in risk budgets, the public market is more willing to pay a premium for them.

Among these, Circle is the most representative case of a "stablecoin equity valuation anchor": its IPO was priced at $31, raising approximately $1.054 billion, corresponding to an IPO valuation of approximately $6.45 billion. The secondary market strongly repriced it during the window period—approximately +168.5% on the first day, approximately +243.7% in the first week, and approximately +501.9% in the first month, peaking at $298.99, corresponding to a maximum increase of approximately +864.5%. Even at the six-month sample point, it still showed an increase of approximately +182.1%. The significance of Circle lies not in the "increase itself," but in the fact that it transformed "stablecoins" from assets that previously relied more on on-chain growth narratives into, for the first time, a publicly priced "financial infrastructure cash flow" that is auditable, comparable, and can be included in risk budgets: compliance moats and settlement network effects are no longer just concepts, but are directly reflected in the rise of the valuation center through issuance pricing and continuous secondary market absorption. Meanwhile, Circle also validated the typical "buying pattern" of US stocks for this type of asset—when the window opens, the combination of small circulating shares and high-quality buyer demand amplifies price elasticity; however, after the window narrows, valuations will more quickly revert to the realization of fundamentals, the differentiation between cyclical sensitivity and earnings quality. This also constitutes the core reason for our optimistic outlook on US crypto company IPOs: the public market will not indiscriminately inflate valuations, but it will complete the stratification more quickly and clearly. Once high-quality assets establish a comparable valuation anchor in the public market, their cost of capital will decrease, refinancing and M&A liquidity will be stronger, and a positive cycle of growth and compliance investment will be easier to achieve —this is more important than short-term fluctuations.

Looking ahead to 2026, market focus will shift from "whether the window of opportunity exists" to "whether subsequent IPOs can continue to advance and form a more continuous issuance rhythm." Based on current market expectations, potential candidates include Anchorage Digital, Upbit, OKX, Securitize, Kraken, Ledger, BitGo, Tether, Polymarket, and Consensus, totaling approximately 10 companies. These cover a more complete industry chain, from custody and institutional compliance entry points, trading platforms and brokerage channels, stablecoins and settlement platforms, asset tokenization and compliant issuance infrastructure, to hardware security and new information markets. If these projects can continue to be launched in the public market and obtain relatively stable funding, the significance will not only be "a few more rounds of financing," but also further standardize investors' logic for buying into crypto companies: they will be more willing to pay a premium for compliance moats, risk control and governance, revenue quality and capital efficiency, and will also be able to complete the screening more quickly through valuation centers and secondary market performance when macroeconomic headwinds or weakening issuance conditions occur. Overall, we are optimistic about the directional trend of US-listed crypto company IPOs: 2025 has already validated the public market's capacity to absorb IPOs through the number of listings, the scale of financing, and market repricing; and if this trend of "continuous issuance + stable absorption" can continue in 2026, IPOs will be more like a sustainable capital cycle—pushing the industry further from "narrative-driven phased market trends" to "sustainable pricing in the public market," and allowing companies with genuine compliance and cash flow quality to continue to expand their leading advantages at lower capital costs.

Industry Structural Differentiation and Product Line Formation: Internal Evolution of the Crypto Industry

To determine whether this public market path can continue and which companies are more likely to be "bought off" by the market, the key is not to reiterate whether "the window of opportunity exists," but to return to the structural evolution that has already occurred within the industry in 2025: growth drivers are shifting from a single narrative to multiple sustainable product lines, and under macro and regulatory constraints, forming a volatility and differentiation mechanism that is closer to traditional risky assets —it is within this mechanism that the capital market will determine what kind of business model deserves a more stable valuation center and lower capital costs.

In 2025, the structural changes within the crypto industry became clearer than ever before: market growth no longer primarily relied on the spillover of risk appetite driven by a single narrative, but was instead driven by several more sustainable "product lines"—more professional trading infrastructure, applications more aligned with mainstream finance, more compliant funding channels, and a gradually forming closed loop across on-chain and off-chain. Simultaneously, funding behavior and pricing rhythms were more deeply integrated into the global risk asset framework: volatility resembled a "risk budget rebalancing under a macroeconomic window," rather than the relatively independent market movements primarily driven by on-chain narratives and internal liquidity cycles of the past. For practitioners, this meant a shift in focus from "which narrative will explode" to "which products can stably generate trading, retain liquidity, and withstand the stress tests of macroeconomic volatility and regulatory constraints."

Within this framework, the traditional "four-year crypto cycle" weakened further in 2025. The cyclical logic didn't disappear, but its explanatory power was significantly diluted: ETFs, stablecoins, and corporate treasuries brought larger volumes of funds into an observable and rebalanceable asset allocation system; simultaneously, interest rates and the dollar liquidity boundary became harder constraints, making risk budgeting, leverage pricing, and deleveraging paths closer to traditional markets. As a result, upward movement increasingly relied on the resonance of "macroeconomic risk appetite + net inflows," while downward movement was more easily amplified by "liquidity tightening + deleveraging." The performance of various sectors throughout the year resembled a coordinated evolution: what truly drove structural upgrades was not a single-point narrative explosion, but rather the continuous expansion of underlying financial products such as stablecoins, the deepening of derivatives, and event contracts, which thickened the entry points for funds and trading scenarios, while simultaneously strengthening risk transmission.

In 2025, stablecoins exhibited two parallel but asynchronous developments: one was "increased compliance certainty," and the other was "cyclical fluctuations in yield-generating models." The former hinges on the fact that, with the emergence of compliance frameworks and more comparable market samples, stablecoin business models are more easily priced by mainstream funds based on cash flow and risk attributes. The latter manifests as yield-generating/synthetic USD stablecoins being highly sensitive to basis spreads, hedging costs, and risk budgets, resulting in significant contraction after expansion. For example, Ethena's USDe supply peaked at nearly $15 billion in early October, then fell back to around $8.5 billion in November, experiencing a brief de-anchoring during the deleveraging window in mid-October. The industry-wide implication is that yield-generating stablecoins are more like "amplifiers of macroeconomics and basis spreads"—contributing liquidity during favorable periods and amplifying volatility and risk repricing during adverse periods.

The upgrade of trading infrastructure accelerated in 2025, with on-chain derivatives at its core. Platforms like Hyperliquid continued to approach centralized exchanges in terms of depth, matching, capital efficiency, and risk control experience, achieving a monthly trading volume of approximately $300 billion in the middle of the year, indicating that on-chain derivatives had the foundation for large-scale operation. At the same time, new entrants such as Aster and Lighter entered the market by focusing on product structure, fees, and incentive systems, driving the sector from "single-platform dividends" to "market share competition." The essence of the competition is not in short-term trading volume, but in the ability to maintain available depth, clearing order, and a stable risk framework under extreme market conditions; and the expansion of derivatives also makes volatility more "macroscopic"—when interest rates and risk appetite shift, on-chain and off-chain deleveraging is often more synchronized and faster.

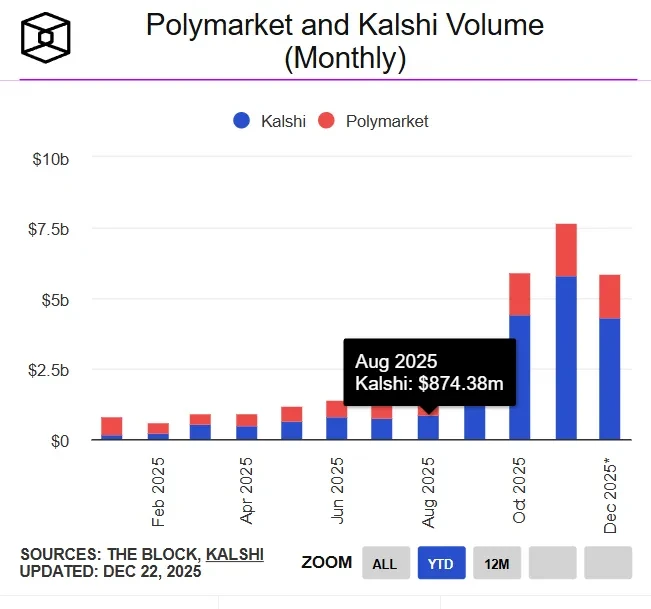

Prediction markets expanded from native crypto applications to a broader event contract market in 2025, becoming a new incremental trading scenario. Platforms like Polymarket saw a significant increase in participation and trading volume for event contracts; monthly trading volume grew from less than $100 million at the beginning of 2024 to over $13 billion in November 2025, with sports and politics becoming the main categories. Its deeper significance lies in the fact that event contracts transform macroeconomic and public issues into tradable probability curves, naturally aligning with media dissemination and information distribution, more easily forming cross-sectoral user entry points, and further strengthening the coupling between crypto and macroeconomic variables (and even political variables).

In summary, the structural upgrades in 2025 are pushing the industry from "narrative-driven price discovery" to "product-driven capital organization." The tiered structure of stablecoins, the infrastructure-ization of on-chain derivatives, and the scenario-based nature of event contracts have collectively expanded the entry points for funds and trading scenarios, making risk transmission faster and more systematic. Against the backdrop of increasing macroeconomic and interest rate constraints, the market cycle structure is further converging towards mainstream risk assets, and the explanatory power of the four-year cycle continues to weaken.

Stablecoins' Dual Themes: Compliance Certainty and Yield Cycle

In 2025, stablecoins upgraded from on-chain transaction mediums to the USD clearing layer and funding base of the crypto system, and completed a clear stratification: USDT/USDC continued to constitute the "cash layer" of mainstream fiat stablecoins, providing a liquidity network covering global transactions and settlements; while yield-generating/synthetic USD such as USDe/USDF were more like "efficiency tools" driven by risk appetite and basis, exhibiting significant cyclicality in expansion and contraction.

The most direct signal throughout the year was the substantial strengthening of the on-chain dollar base: the total supply of stablecoins expanded from approximately $205 billion to over $300 billion , and was highly concentrated at the top (around the end of the year, USDT was approximately $186.7 billion and USDC was approximately $77 billion); issuers collectively held approximately $155 billion in US Treasury bonds , making stablecoins closer to an infrastructure combination of "tokenized cash + short-duration Treasury bonds." The user side also strengthened: stablecoins accounted for approximately 30% of on-chain crypto transaction volume , with cumulative on-chain activity exceeding $4 trillion during the year. The scale of payment-type on-chain transactions was estimated at $20-30 billion per day , and the real demand for cross-border settlement and fund transfers continued to rise.

At the institutional level, the GENIUS Act, which came into effect in July, includes requirements for payment-type stablecoins such as licensed issuance, 1:1 reserves, redemption, and disclosure, and sets up access paths for overseas issuers, making the "compliance premium" begin to be priced institutionally: USDC benefits more from enhanced compliance and institutional availability, while USDT should not be simply classified as a compliant stablecoin under the US framework. Its advantage lies in the global liquidity network, but its availability in the US market will depend more on the implementation details and channel compliance.

The revenue-generating sector has been repositioned: taking Ethena's USDe as an example, the supply has fallen from a high of about $14.8 billion in early October to about $6-7 billion at the end of the year, verifying its structured attribute of "expanding with the wind and contracting against the wind".

Looking ahead to 2026, stablecoins remain the most certain growth trajectory: competition among mainstream fiat stablecoins will shift from scale to channels and clearing networks, while yield-based products will continue to provide liquidity during tailwind periods but will be priced more rigorously in terms of stress testing and redemption resilience.

On-chain derivatives platform upgrades and market share wars

In 2025, on-chain perpetual contracts transitioned from "usable products" to the infrastructure stage of "capable of supporting mainstream trading": matching and latency mechanisms, margin and settlement mechanisms, and the linkage between risk parameters and risk control are closer to the engineering standards of centralized exchanges. On-chain derivatives began to have the ability to divert mainstream trading and participate in price discovery during certain periods. At the same time, the transmission of funds and risks became more "macro-level": during the window of shifts in risk appetite and interest rate expectations in the US stock market, the volatility and deleveraging pace of on-chain perpetual contracts were more likely to resonate in the same direction as traditional risky assets, and the market cycle's sensitivity to "macro liquidity-risk budget" increased significantly.

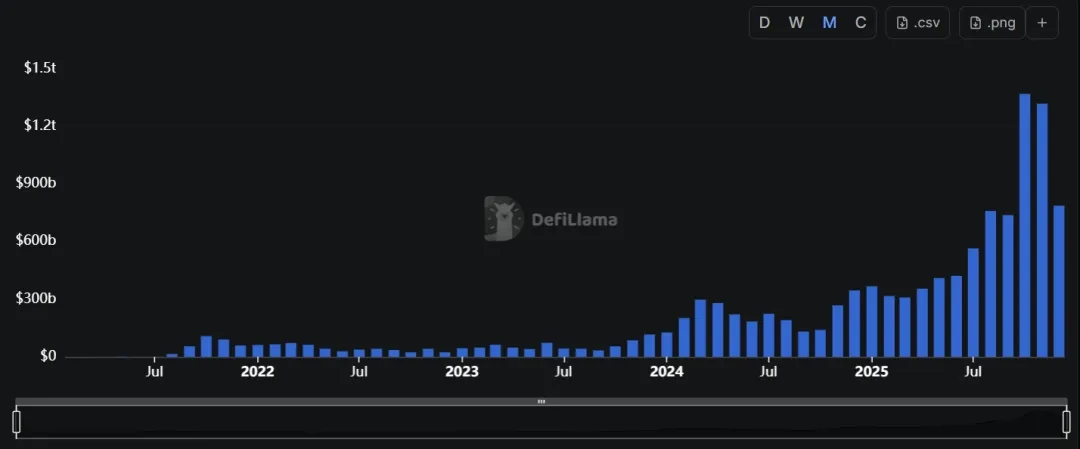

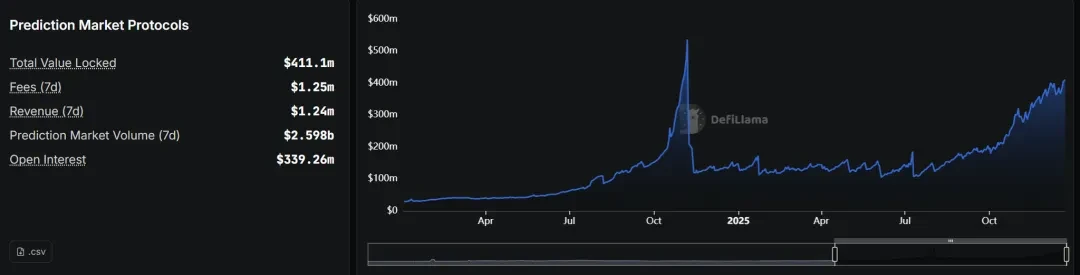

On the scale side, a sustainable "on-chain derivatives market" has been formed. Using the sample point of the end of 2025 as a reference, the trading volume of on-chain perpetual contracts in the past 30 days was approximately $1.081 trillion , and the total open interest in the market was approximately $15.4 billion , reflecting that this sector has the capacity to routinely handle large-scale trading and risk exposure. Leading platforms still hold the core position of "market depth and risk control," but the competitive logic underwent a substantial change in 2025: market share competition no longer primarily relies on subsidies and the speed of token listings, but shifts more towards market depth, the accumulation of open interest, and the stability of the liquidation order under extreme market conditions . Taking Hyperliquid as an example, its open interest at the sample point was approximately $6.88 billion, and its trading volume in the past 30 days was approximately $180.4 billion, demonstrating "stronger risk exposure accumulation + relatively stable trading volume."

Even more encouragingly, new entrants in the second half of 2025 were no longer merely conceptual challengers, but rather entered the competition with quantifiable data, reshaping the market share structure: Lighter's trading volume over the past 30 days was approximately $233.2 billion , its cumulative trading volume was approximately $1.272 trillion , and its open interest was approximately $1.65 billion ; Aster's trading volume over the past 30 days was approximately $194.4 billion, its cumulative trading volume was approximately $811.7 billion , and its open interest was approximately $2.45 billion . Based on open interest rankings, Hyperliquid, Aster, and Lighter are already in the top three ( approximately $6.88 billion/$2.41 billion/$1.6 billion ), indicating that the sector has entered a mature stage of "multi-platform parallel competition."

Source: DeFiLlama / On-chain perpetual contract trading volume

For the industry, 2025 will see competition in on-chain perpetual contracts enter a phase of "quality and resilience pricing"—trading volume can be amplified by short-term incentives, but the size of open interest, the sustainability of fees/revenue, and risk control performance under extreme market conditions better reflect real capital retention and platform stickiness. Looking ahead to 2026, the sector will likely evolve along two lines simultaneously: first, the penetration rate of on-chain derivatives will continue to increase; second, with fee reductions and higher risk control thresholds, the market will further concentrate on a few platforms that can maintain depth and clearing order in the long term. Whether new platforms can move from a scale-driven sprint to a stable retention phase depends crucially on their capital efficiency and risk framework under stress testing, rather than trading volume performance in a single phase.

Prediction markets are shifting from crypto-native to event contract markets.

In 2025, the prediction market, building on the "event contracts (probability pricing)" validated during the 2024 US presidential election, upgraded from a periodic surge to a more independent and sustainable trading scenario . It no longer primarily relied on short-term traffic from single political events, but instead, through high-frequency/reusable contract categories such as sports, macroeconomics, and policy events, it solidified "probability trading" into a more stable trading demand and user habit. Due to the inherent externalization of the underlying assets of event contracts (macroeconomic data, regulatory bills, elections, and sports schedules, etc.), the correlation between the activity of the prediction market and shifts in US stock market risk appetite and interest rate expectations significantly increased. The rhythm of industry applications further shifted from an "internal crypto narrative cycle" to a function of "macroeconomic uncertainty × event density × risk budget."

From a data perspective, the prediction market sector experienced exponential expansion in 2025: total transaction volume for the year reached approximately $44 billion , with Polymarket accounting for about $21.5 billion and Kalshi about $17.1 billion . The scale of leading platforms was sufficient to support stable market making and category expansion. Growth showed a clear event-driven peak throughout the year: monthly nominal transaction volume jumped from less than $100 million at the beginning of 2024 to over $13 billion per month in 2025 (represented by November), demonstrating the strong resilience of high-profile event windows. Structurally, the prediction market evolved from being driven by "political events" to "high-frequency sports retention + multi-category event expansion": Kalshi's transaction volume in November 2025 was approximately $5.8 billion, with about 91% coming from sports; the platform disclosed that its transaction volume had reached over $1 billion per week, and claimed an increase of over 1000% compared to 2024, reflecting a certain foundation for normalized trading.

Source: DeFiLlama / Overview of Prediction Market Data

Source: theblock.co / Trading volume of Polymarket and Kalshi Market

Adding to the aforementioned shifts in capital structure and industry changes brought about by crypto company IPOs, the market is rapidly upgrading from "crypto startups" to "financial infrastructure/data assets": Kalshi completed a $1 billion funding round in December, valuing the company at approximately $11 billion , following a $300 million funding round approximately two months prior at a valuation of around $5 billion ; simultaneously, traditional market infrastructure providers are also entering the market with heavy capital investment, with ICE (the parent company of the NYSE) reportedly planning to invest up to $2 billion in Polymarket at a pre-money valuation of approximately $8 billion . The common implication of these transactions is that event contracts are not only viewed as "trading products" but also as interfaces for integrating market data, sentiment indicators, and risk pricing.

Looking ahead to 2026, prediction markets are more likely to become one of the more certain structural growth drivers in the crypto application layer: growth will be driven by event density and information uncertainty, and commercialization will be closer to a combination of "transaction fees + data products + distribution channels". If compliance paths, distribution entry points, and dispute resolution standards become clearer, prediction markets are expected to evolve from a temporary phenomenon to a more normalized event risk trading and hedging tool; its long-term ceiling will mainly depend on three hard indicators: real market depth (capable of handling large amounts), reliable settlement and dispute governance, and controllable compliance boundaries.

Conclusion

Looking back at 2025, the core characteristics of the crypto market were the externalization of the pricing framework and the deepening competition for access channels : the entry point for funds shifted from an endogenous cycle driven by on-chain leverage and narratives to a multi-channel system comprised of ETFs, stablecoins with a USD base, corporate treasuries, and equity access channels (US crypto company IPOs). This expansion of access channels improved asset allocability and also strengthened macroeconomic boundary conditions—market trends became more dependent on the coordination of net inflows and financing windows, while drawdowns were more likely to be concentrated in the deleveraging and liquidation chain.

The structural evolution within the industry further confirms this shift: stablecoins have completed a stratification between the "cash layer" and the "efficiency tool," on-chain derivatives have entered a stage of large-scale implementation and market share competition, and prediction markets and event contracts have formed more independent trading scenarios. More importantly, the return of IPOs has "securitized" crypto-financial infrastructure into auditable, benchmarkable, and exitable equity assets , allowing mainstream funds to participate in a more familiar way and driving valuation systems to converge towards "compliance moats, risk control and governance, revenue quality, and capital efficiency"—this is the core basis for our optimism about this direction.

Looking ahead to 2026, the industry's trajectory will likely depend on three variables: the sustainability of institutional pathways, the sustainability of capital accumulation, and the resilience of leverage and risk control under stress scenarios . Among these, if US-listed crypto IPOs can maintain a more continuous and stable pace, it will continue to provide valuation anchors and financing flexibility, and strengthen the industry's shift towards sustainable pricing in the public market.

Reference Links

https://app.rwa.xyz/stablecoins

https://coinmarketcap.com/etf/

https://datboard.panteraresearchlab.xyz/

https://defillama.com/perps

https://www.theblock.co/data/decentralized-finance/prediction-markets-and-betting

ArkStream Capital is a crypto fund founded by native cryptocurrency professionals. It incorporates primary market and liquidity strategies, investing in web3 native and cutting-edge innovations, and is dedicated to fostering the growth of web3 founders and unicorns. The ArkStream Capital team entered the cryptocurrency space in 2015 and comes from universities and companies such as MIT, Stanford, UBS, Accenture, Tencent, and Google. Its portfolio includes over 100 blockchain companies, including Aave, Sei, Manta, Flow, Fhenix, Merlin, Avail, and Space and Time.

Website: https://arkstream.capital/

Medium: https://arkstreamcapital.medium.com/

Twitter: https://twitter.com/ark_stream