Bitcoin is about to choose a direction; how to respond flexibly? | Invited Analysis

- 核心观点:比特币短期震荡,中期空头趋势确认。

- 关键要素:

- 上周策略精准,区间震荡预测获验证。

- 技术指标显示市场处低位,多空力量均衡。

- 主力资金或先砸盘后拉升,完成筑底。

- 市场影响:提示短期震荡风险与潜在底部机会。

- 时效性标注:短期影响。

Conaldo, a featured market analyst at Odaily, holds a Master's degree in Financial Statistics from Columbia University. During his university years, he focused on quantitative trading in US stocks and gradually expanded to digital assets such as Bitcoin. Through practical experience, he has built a systematic quantitative trading model and risk control system. He possesses keen data insight into market fluctuations and is committed to continuous professional development in the trading field, pursuing stable returns. He will provide weekly in-depth analysis of BTC technical, macroeconomic, and funding changes, reviewing and showcasing practical strategies, and previewing recent noteworthy events for reference.

Key takeaways from the weekly trading report:

- Validation of the effectiveness of the strategy execution (short term): Last week's trading strictly followed the established strategy and successfully completed two operations, achieving a cumulative return of 3.62%.

- Core Viewpoint (Short-Term) Verification: Our core viewpoint proposed last week, that "the market will exhibit wide-range fluctuations," has been perfectly validated by market movements. The defined core observation range of $89,500–$91,000 and the support zone of $86,500–$87,500 were repeatedly tested by the market. Crucially, last week's high of $90,598 was only $402 away from the upper edge of our core range ($91,000); the mid-week low ($86,400) was only $100 away from the lower edge of the support zone ($86,500), fully demonstrating the accuracy of our price predictions.

- From a macro-technical perspective, Bitcoin has been correcting for 82 days since reaching its all-time high of $126,200 on October 6th, with a maximum drop of approximately 36%, confirming a medium-term downtrend. However, multiple technical indicators suggest that it has entered a low-level zone, with both the duration and magnitude of the correction approaching historically common oversold conditions. Since November 22nd, the price has been consolidating within a low range, indicating a relative balance between bullish and bearish forces, with momentum for a directional breakout accumulating. Although bullish sentiment is growing in the market, we believe that, barring unforeseen news, a key possibility remains: if the market is dominated by major funds, a better strategy for bears might be to first break down, breaching the key psychological level of $80,000, using panic selling to clear out remaining long positions and complete a final bottoming process. Afterward, funds could then shift from short to long positions, quickly pushing the price away from the cost zone and initiating a more robust technical correction. It is important to emphasize that the above trend is merely a deduction based on market behavior logic, and not a certainty. Regardless of how the market evolves, always remember: "The market is always right." Before a directional move is made, maintaining observation and responding flexibly remains crucial at this stage.

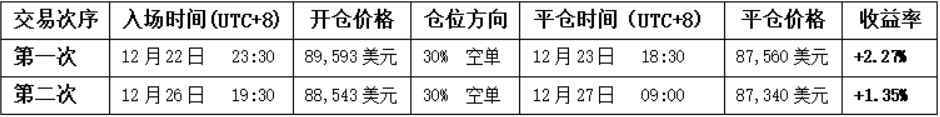

I. Review of last week's trading results: (December 22 - December 28)

1. Short-term trading review (without leverage):

• First trade (profit 2.27%) : Based on the "short sell when rebounding to the core resistance area" pattern. When the price encountered resistance in the $ 89,500-$91,000 range, and the spread trading model simultaneously issued a top signal, a 30% short position was established, and profits were finally taken when the price fell back to the support area.

• Second trade (profit 1.35%) : The logic for this trade was the same as above. When the price encountered resistance in the $ 89,500-$91,000 range, the combined effect of the resonance signals from the two models successfully completed the trade.

2. Review of last week's market trend forecast and trading strategies:

Last week's forward-looking analysis clearly indicated that the market was expected to primarily exhibit a wide-range fluctuation pattern . The core observation range was $ 89,500 to $91,000 , and the outcome of the struggle within this area would determine the short-term direction. The following is a strategy recap and analysis.

① Review of market trend predictions:

• Key resistance levels: First resistance is seen in the $ 89,500–$91,000 area; second resistance is seen in the $ 93,000–$94,500 area.

• Key support levels: First support is seen in the $ 86,500-$87,500 area; second support is seen in the $ 83,500-$84,500 area.

② Review of operational strategies:

• Medium-term strategy: Maintain a medium-term position of around 65% (short positions).

• Short-term strategy: Last week, we initially drafted two short-term trading plans, A and B. Based on the actual market movements, we ultimately adopted Plan B as the core strategy and implemented it accordingly.

( Option B: Rebound verification, the core area of $ 89,500 to $91,000 has been effectively broken)

• Opening a position: When a resistance signal appears during the pullback verification process, a 30% short position can be established.

• Risk control: Stop loss set above $92,000.

• Closing positions: When the price drops to the $ 83,500-$84,500 range and encounters resistance, consider partially or completely closing out positions to lock in profits.

II. Technical Analysis: Bitcoin's Medium-Term Trend Judgment

Based on last week's market performance, this article will utilize a multi-dimensional analysis model to conduct an in-depth analysis of the evolution of Bitcoin's internal structure and trends.

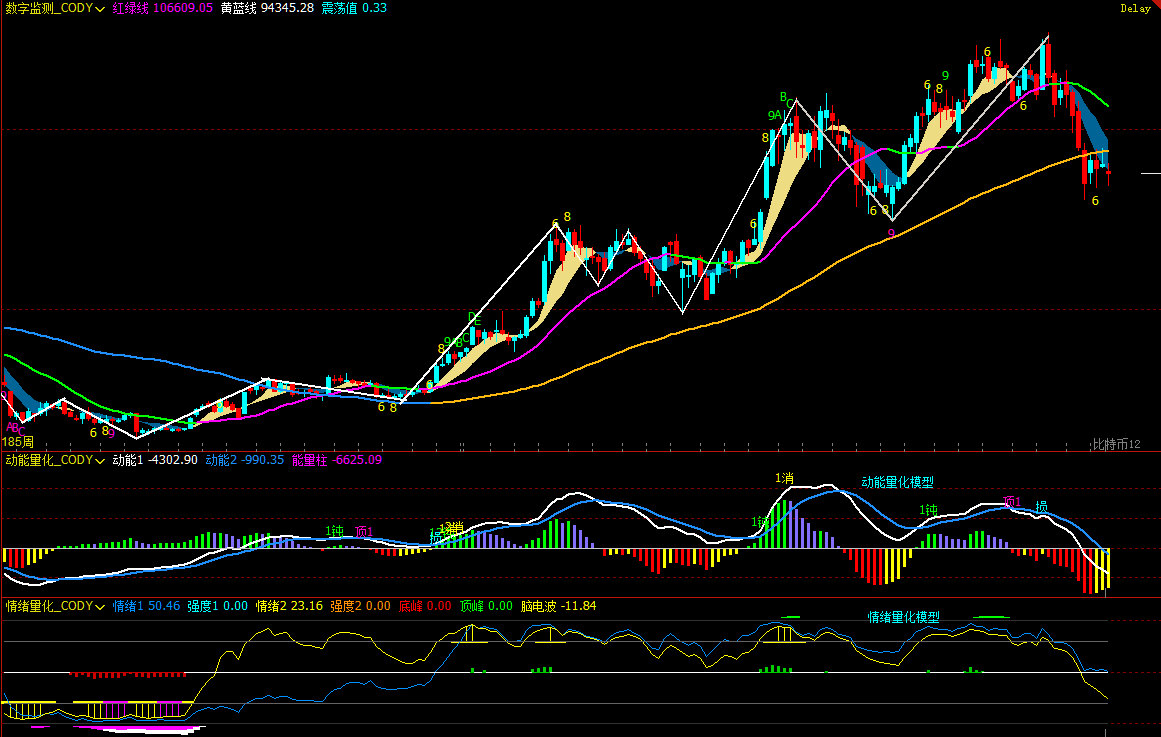

Bitcoin Weekly Chart: (Momentum-based quantification model + sentiment-based quantification model)

Figure 2

1. As shown in Figure 2, analysis from the weekly chart:

• Momentum-based model: After last week's adjustment, the two momentum indicator lines are still running below the zero axis, and the negative momentum bars are gradually shortening. This indicates that although the weekly chart has entered a bear market, the bearish momentum has not yet been fully released.

The kinetic energy model predicts: Price decline index: High

• Emotion Quantification Model: The blue emotion line has a value of 49.74, with an intensity of zero; the yellow emotion line has a value of 19.99 (close to the low threshold), with an intensity of zero, and a peak value of 0.

The sentiment quantification model predicts: Price pressure and support index: Neutral.

• Digital monitoring model : The price has been below the bullish/bearish (yellow and blue lines) dividing line for 6 weeks; a short-term bottoming signal (above 9) has not yet appeared.

The above data suggests that Bitcoin's weekly chart has established a downtrend, and we should be wary of further release of bearish momentum.

Bitcoin daily candlestick chart:

Figure 3

2. As shown in Figure 3, analysis from the daily chart:

• Momentum-based model: In last week's price action, the two momentum lines were almost touching, slowly rising below the zero line and gradually approaching it. Due to the holiday, daily trading volume continued to shrink, and the positive momentum bars showed little change.

The momentum model indicates that buying momentum is weak, and the volume bars have shrunk to "star-like" shapes, suggesting a temporary balance between bullish and bearish forces.

• Sentiment Quantification Model: After the market closed last Sunday, the blue sentiment line value was 16 (close to the low threshold), with an intensity of zero; the yellow sentiment line value was 40, with an intensity of zero.

The sentiment quantification model predicts: Stress and support index: Neutral

The above data suggests that the market is in a downtrend on the daily chart, and a directional move is imminent in the short term.

III. Bitcoin Price Forecast for This Week: (December 29 - January 4)

1. The market is expected to fluctuate and test the bottom this week, with the core observation range being $ 86,000 to $86,500 .

• If the price breaks below this level, it may continue to decline and test the support zone of $ 83,500 to $84,500 .

• If it holds firmly , the market may continue its current range-bound trading pattern between $ 86,500 and $91,000 .

2. Core pressure level:

• First resistance zone: $ 89,500–$91,000 area

• Second resistance zone: $ 93,000–$94,500 area

• Key resistance zone: Around $ 97,000

3. Core support level:

• First support level: $ 86,000–$86,500 area

• Second support level: $ 83,500–$84,500 area

• Key support level: around $ 80,000 .

IV. Bitcoin Trading Strategy for This Week (Excluding Unexpected News): (December 29 - January 4)

1. Medium-term strategy: Maintain a medium-term position of around 65% (short positions).

2. Short-term strategy: Use 30% of your position, set a stop-loss point, and look for opportunities to profit from price differences based on support and resistance levels. (Use a 30-minute timeframe as the trading period).

3. Closely observe the struggle between bulls and bears in the $86,000-$86,500 range. To prepare for market developments, we have formulated two short-term trading plans , A and B :

• Option A : If the price effectively holds above the $86,000–$86,500 range:

• Opening a position: When the price rebounds to the $89,500-$91,000 range and shows signs of resistance, a 30% short position can be established.

• Risk control: Set the stop loss for short positions above $92,500 .

• Close positions: When the price of the coin falls to the $86,000-$86,500 range and shows signs of stabilization, close all short positions to lock in profits.

• Option B: If the price breaks below the $86,000–$86,500 range:

• Opening a position: If the price breaks below the support level, a 30% short position can be established.

• Risk control: Stop loss set above $88,000 .

• Closing positions: When the price of the coin drops to the $ 83,500-$84,500 range and shows signs of stabilization, you can gradually close your positions and take profits.

V. Special Note:

1. When opening a position: immediately set the initial stop loss level.

2. When the profit reaches 1% , move the stop loss to the opening cost price (break-even point) to ensure the safety of the principal.

3. When the profit reaches 2%, move the stop loss to the position where the profit reaches 1%.

4. Continuous monitoring: For every additional 1% profit in the coin price thereafter, the stop loss level will be moved by 1% to dynamically protect and lock in existing profits.

(Note: The above 1% profit trigger threshold can be adjusted flexibly by investors based on their own risk appetite and the volatility of the underlying asset.)

VI. Key Events Preview for This Week: (December 29 - January 4)

1. The Fed meeting minutes signaled "real disagreement"

At 3:00 AM on Wednesday, the Federal Reserve will release the minutes of its latest monetary policy meeting. More crucial than the interest rate decision itself is the degree of disagreement among members regarding the timing, magnitude, and sustainability of rate cuts.

If the minutes show that officials are more confident in the decline of inflation and discuss an earlier or faster easing path, it will strengthen market expectations of a "decline in real interest rates," which would be a medium-term positive for Bitcoin. Conversely, if the minutes emphasize concerns about recurring inflation or too rapid easing of financial conditions, it may temporarily raise the US dollar and US Treasury yields, putting downward pressure on BTC.

For Bitcoin, this is not a short-term directional signal, but a crucial juncture that influences the medium-term pricing anchor for funds .

2. Initial Jobless Claims: A Thermometer of Liquidity Expectations

At 9:30 PM on Wednesday, the United States will release the number of initial jobless claims for the week ending December 27.

The market is currently more focused on whether there is a structural cooling in the labor market, rather than fluctuations in a single data point.

If initial jobless claims continue to rise above trend levels, it will further validate the logic of economic slowdown, strengthen market expectations for continued easing policies, and benefit the valuation recovery of non-yielding assets such as Bitcoin. If the data falls again, it may reinforce the judgment that "the economy is still resilient," which is not conducive to the expansion of risk appetite for BTC in the short term.

The impact of this indicator on Bitcoin is mainly reflected in interest rate expectations rather than the fundamentals themselves .

3. The final manufacturing PMI reading confirms the direction of the real economy.

The final reading of the S&P Global Manufacturing PMI for December will be released at 22:45 on Friday.

As a leading indicator, the PMI will help the market determine whether a "soft landing" is still on track.

If the final figure confirms that the manufacturing sector has stabilized or even improved, the overall sentiment for risk assets is expected to remain stable, with limited systemic pressure on BTC. However, if the PMI is revised downward again, it may trigger a repricing of the economic downturn, which would be negative for risk assets in the short term, but in the medium to long term, it may strengthen expectations for monetary easing.

Financial markets are constantly changing, and all market analysis and trading strategies need to be dynamically adjusted. All views, analytical models, and operational strategies presented in this article are derived from personal technical analysis and are for personal trading journal use only. They do not constitute any investment advice or basis for action. The market is risky; invest with caution. DYOR.