The change in Bitcoin's supply after a halving has been permanently locked by mathematical rules.

- 核心观点:比特币第四次减半完成,供给永久性收缩。

- 关键要素:

- 区块奖励从6.25 BTC降至3.125 BTC。

- 年化供给通胀率降至约0.83%。

- 矿工收入转向依赖交易手续费。

- 市场影响:强化比特币稀缺性,重塑长期供给结构。

- 时效性标注:长期影响。

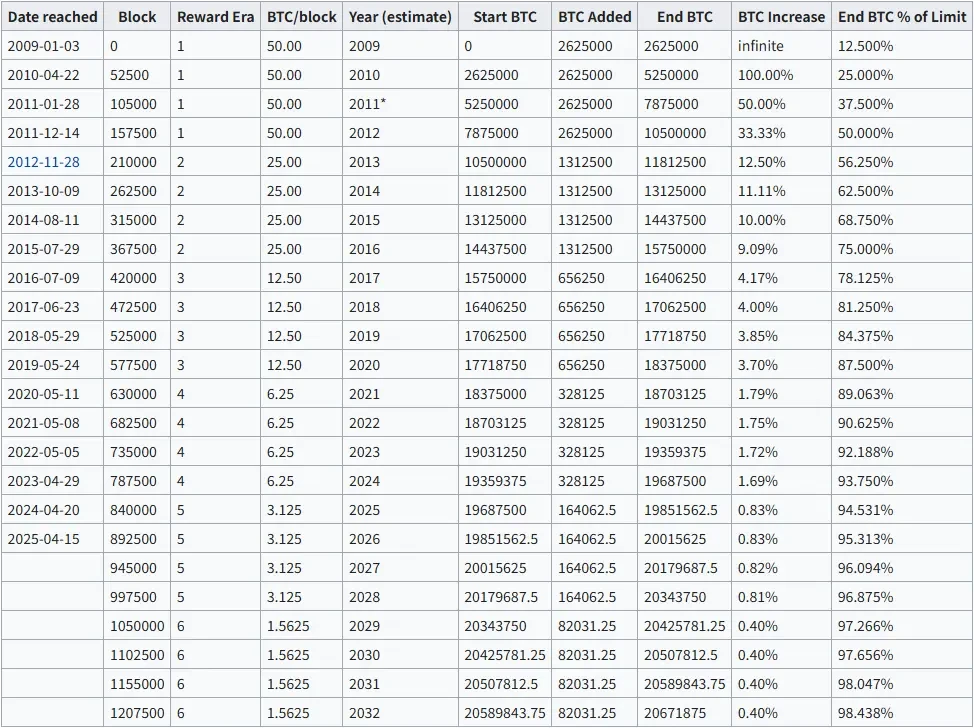

The fourth Bitcoin halving will occur on April 20, 2024.

The fourth Bitcoin block reward halving occurred on April 20, 2024, at block height 840,000, when the block reward decreased from 6.25 BTC to 3.125 BTC. This process followed the pre-set issuance mechanism in the Bitcoin protocol, with a halving automatically triggered every 210,000 blocks.

This supply adjustment is automatically executed by Bitcoin consensus rules without any governance voting or human intervention, further reinforcing the certainty, transparency, and unchangeability of Bitcoin's monetary policy.

Bitcoin's daily new issuance has decreased by 50%.

After the halving in April 2024, the daily new issuance of Bitcoin mathematically decreased from approximately 900 BTC/day to approximately 450 BTC/day. This change is based on a fixed block reward of 3.125 BTC and an average block time of approximately 10 minutes.

On an annualized basis, the annual new issuance of Bitcoin has decreased from approximately 328,500 BTC/year to approximately 164,250 BTC/year. This supply contraction is permanent and completely independent of market demand, miner behavior, or macroeconomic conditions.

The annualized supply inflation rate has fallen below 1%.

As a direct result of the halving in April 2024, Bitcoin's annualized supply inflation rate dropped to approximately 0.83%, a figure calculated based on the circulating supply at that time and the rate of new issuance after the halving.

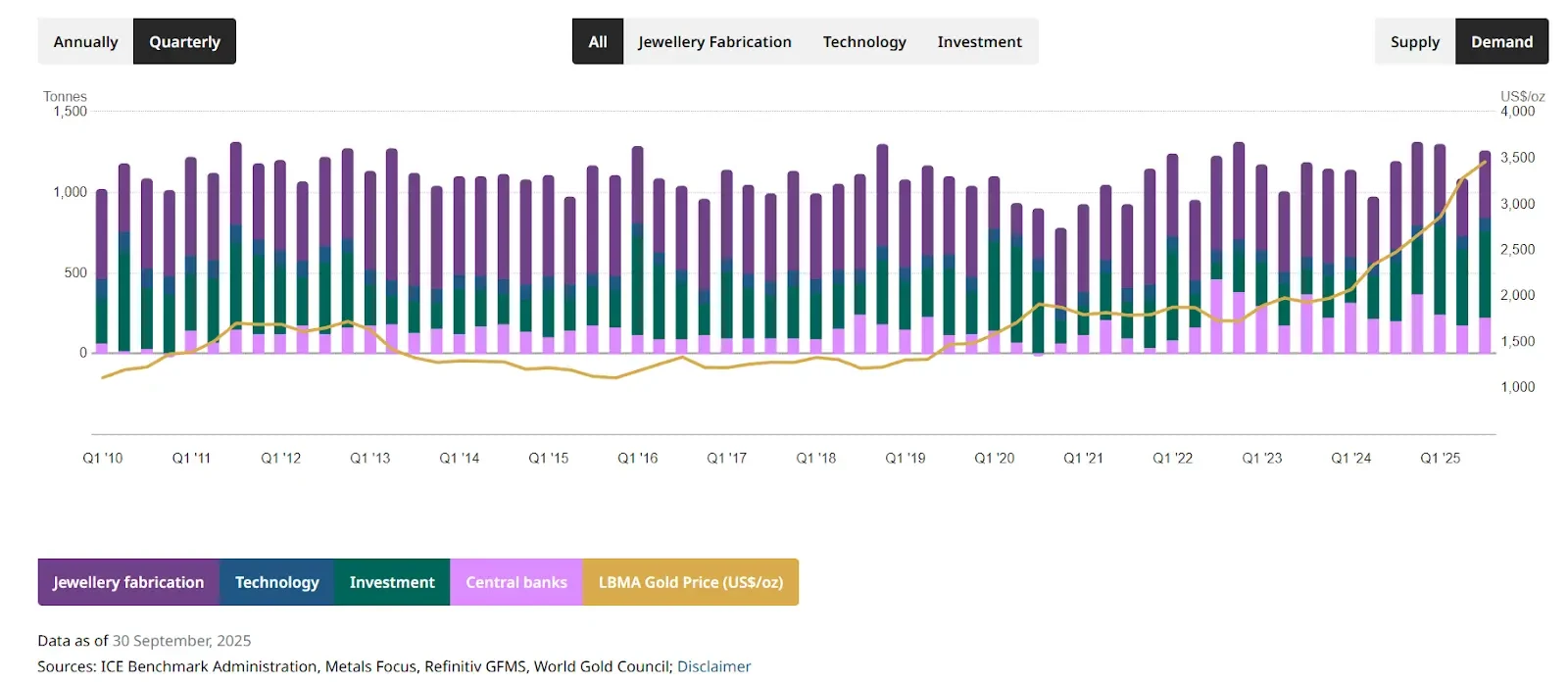

In contrast, the annual supply growth rate of gold is typically estimated to be in the range of 1%–2%, while the rate of monetary expansion in the fiat currency system depends on central bank policies rather than fixed rules pre-written in the code.

As of the end of 2024, the circulating supply of Bitcoin was approximately 19.7 million.

Blockchain data shows that as of December 31, 2024, the circulating supply of Bitcoin was approximately 19.7 million BTC, leaving less than 1.3 million BTC yet to be mined, just shy of the protocol's maximum supply limit of 21 million BTC.

At this stage, over 93.8% of Bitcoin has been issued, which means that the impact of future halvings on the absolute supply will continue to weaken, but its importance in terms of proportion will become more prominent.

After the halving, the miners' income structure changed.

The halving event cut miners’ block subsidy income in half overnight, causing transaction fees to increase significantly as a percentage of miners’ total revenue.

In the months following the halving, transaction fees accounted for a significantly larger share of miners' revenue compared to the pre-halving period. This change aligns with Bitcoin's original long-term design expectation that network security would gradually transition from a block-subsidized model to an economic model primarily based on transaction fees.

Supply is fixed, and adjustments have been completed.

Unlike monetary policies in traditional financial systems that can be adjusted according to economic conditions, the supply change of Bitcoin after the April 2024 halving is final and irreversible. There is no mechanism to accelerate issuance when demand rises or slow down issuance when the market is sluggish.

By the end of 2024, the market was no longer facing an "upcoming halving event," but rather a low issuance baseline that had been adjusted and would continue to operate until the next halving. The next halving is expected to occur around 2028, at which time the block reward will drop to 1.5625 BTC again.

This chart shows the number of bitcoins that will exist in the near future. The Year is a forecast and may be slightly off.

From event to baseline condition

With the fourth halving now fully implemented, Bitcoin's low issuance rate is no longer a short-term narrative driver, but rather a long-term fundamental condition, reshaping its supply structure in a transparent, predictable, and verifiable manner by any participant running a full node.

This change does not depend on market sentiment, policy signals, or the pace of institutional adoption. Instead, it is written directly into the Bitcoin code and enforced by the consensus of the entire network, making the post-halving supply mechanism one of the few variables in the global financial system that can be precisely described mathematically.