Messari: When BTC is disciplined, ZEC's hedging potential is beyond imagination.

- 核心观点:ZEC因隐私属性重估而价值飙升。

- 关键要素:

- 比特币缺乏隐私,ZEC提供确定性隐私保障。

- CBDC与监管收紧,催生对抗监控的隐私需求。

- 基础设施改进,大幅降低ZEC使用门槛。

- 市场影响:隐私赛道价值获系统性重估。

- 时效性标注:中期影响

Author | Messari

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's Note: While Bitcoin has repeatedly "hit the wall" and its price has continued to fluctuate between $80,000 and $90,000, market attention is likely still largely focused on Bitcoin itself. However, ZEC, a representative asset in the privacy sector, has once again broken through the $500 mark, currently trading at $518, representing a nearly 40% increase from its recent low. Even more strikingly, ZEC was once on Binance's delisting shortlist, but in late 2025, it experienced its own explosive growth, with a single-phase increase approaching 13 times.

This shift from a "marginal asset" to being "repriced by the market" raises a more pressing question: Is ZEC's rise merely a short-term surge driven by sentiment and manipulation, or is there a systemic reassessment of privacy as a monetary attribute? Messari attempts to explain why ZEC has gained renewed market attention at this juncture by examining its monetary attributes, regulatory environment, and structural changes in Bitcoin. The following content is excerpted from @MessariCrypto 's "The Crypto Theses 2026" .

Among all crypto assets besides BTC and ETH, ZEC experienced the most significant shift in its perception of monetary attributes in 2025. For a long time, ZEC remained outside the monetary hierarchy of cryptocurrencies, viewed as a niche privacy coin rather than a true monetary asset. However, with growing concerns about financial surveillance and Bitcoin's accelerated institutionalization, privacy has once again been recognized by the market as a core monetary attribute , no longer merely a preference of a few geeks or ideological groups.

Bitcoin has proven that non-sovereign digital currencies can operate on a global scale; however, it has not retained the privacy attributes that people have long taken for granted when using physical cash. Every transaction is broadcast to a completely transparent public ledger, which anyone can track and analyze using a block explorer. The irony is profound: a tool intended to weaken state control has inadvertently created a financial "panopticon."

Zcash combines Bitcoin's monetary policy with the privacy attributes of physical cash through zero-knowledge cryptography. In the current digital asset system, no other asset offers such proven and deterministic privacy guarantees as the latest Zcash privacy pool. This makes ZEC an extremely difficult form of "private currency" to replicate.

We believe that the market has repriced ZEC relative to BTC based on this point—viewing it as an "ideal form of private cryptocurrency" and positioning it as a hedge against the rise of surveillance states and the institutionalization of Bitcoin.

This year, ZEC has surged 666% against Bitcoin, pushing its market capitalization to approximately $7 billion. It even surpassed XMR at one point to become the highest-valued privacy coin. This relative strength indicates that the market is increasingly viewing ZEC alongside XMR as viable forms of private cryptocurrency.

Privacy on Bitcoin: A Nearly Dead End

It is highly unlikely that Bitcoin will introduce a privacy pool architecture similar to Zcash at the protocol layer; therefore, the claim that "Bitcoin will eventually absorb Zcash's value proposition" is unfounded.

The Bitcoin community is known for its highly conservative technical culture, prioritizing the solidification of mechanisms to minimize the attack surface and maintain the integrity of the monetary system. Embedding privacy features at the protocol layer would necessitate modifications to Bitcoin's core architecture, introducing potential inflationary vulnerabilities that could threaten its core monetary credibility. For Zcash, this risk is acceptable because privacy is a core value proposition .

Furthermore, introducing zero-knowledge cryptography at the base layer significantly reduces the scalability of the blockchain. To prevent double-spending, nullifiers and hashed ticket structures are required, which introduces the long-term concern of "state bloat." Nullifiers are essentially a continuously growing list that can eventually lead to a substantial increase in the resource costs required to run nodes. If nodes are forced to store a constantly expanding set of nullifiers, Bitcoin's decentralization will be substantially weakened because the barrier to entry for running a node will increase over time.

As mentioned earlier, in the absence of a soft fork capable of supporting ZK verification (such as OP_CAT), no second-layer Bitcoin solution can achieve Zcash-level privacy while inheriting Bitcoin's security. You either need to introduce a trusted intermediary (such as a consortium structure), accept long and highly interactive withdrawal delays (such as the BitVM model), or simply outsource execution and security entirely to a separate system (such as a sovereign rollup).

Until this landscape changes, there is no realistic path that simultaneously balances the security of Bitcoin and the privacy of Zcash. This is precisely the fundamental reason why ZEC possesses unique value as a privacy cryptocurrency.

Privacy hedging tools against CBDC

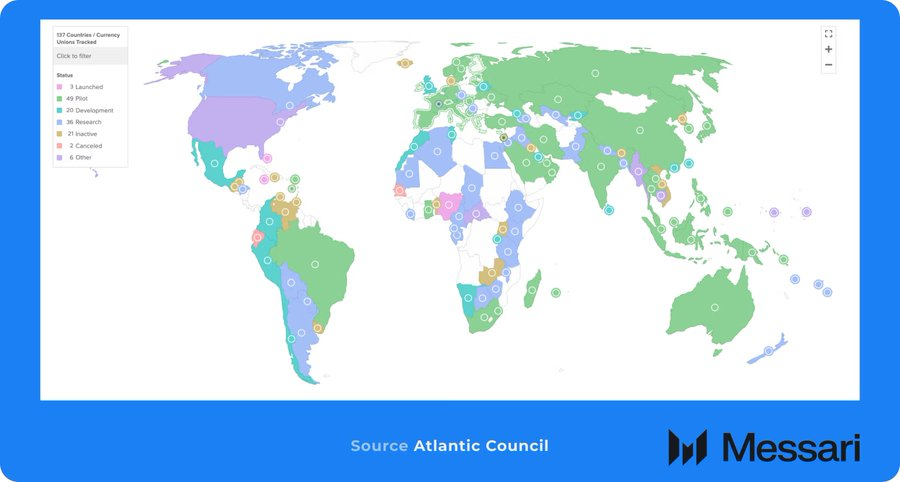

The urgency of privacy needs has been amplified by the emergence of central bank digital currencies (CBDCs) in various countries. Currently, about half of the world's countries are either researching or have already launched CBDCs.

The core feature of CBDC lies in its "programmability": issuers can not only track every transaction, but also directly control how, when, and where the funds are used . Funds can even be set to be effective only at designated merchants or within a specific geographic area.

This is not a dystopian fantasy, but a reality that has already occurred:

- Nigeria (2020) : During the #EndSARS protests against police violence, the Central Bank of Nigeria froze the bank accounts of several protest organizers and women's rights groups, forcing the movement to rely on cryptocurrency to keep going.

- United States (2020–2025) : Regulators and large banks debanked a range of legitimate but politically unpopular industries, citing “reputational risk.” The problem became so serious that the White House ordered an investigation, and a 2025 OCC report documented systemic restrictions on the oil and gas, gun, adult content, and crypto industries.

- Canada (2022) : During the "Freedom Car Rider" protests, the Canadian government invoked the Emergency Act to freeze the bank and crypto accounts of protesters and small donors without court authorization. The Royal Canadian Mounted Police even blacklisted 34 self-custodied crypto wallet addresses, demanding that all regulated exchanges cease trading with them. This incident clearly demonstrates that Western democracies are also willing to weaponize their financial systems to suppress political dissent.

In an era where "currency can be programmed to control you," ZEC offers a clear "exit mechanism." But Zcash's significance extends beyond escaping CBDCs; it is becoming increasingly important for protecting Bitcoin itself.

Insurance mechanisms to prevent Bitcoin from being "co-opted"

As Naval Ravikant and Balaji Srinivasan, among others, have emphasized, Zcash is essentially an insurance policy to safeguard Bitcoin's vision of financial freedom.

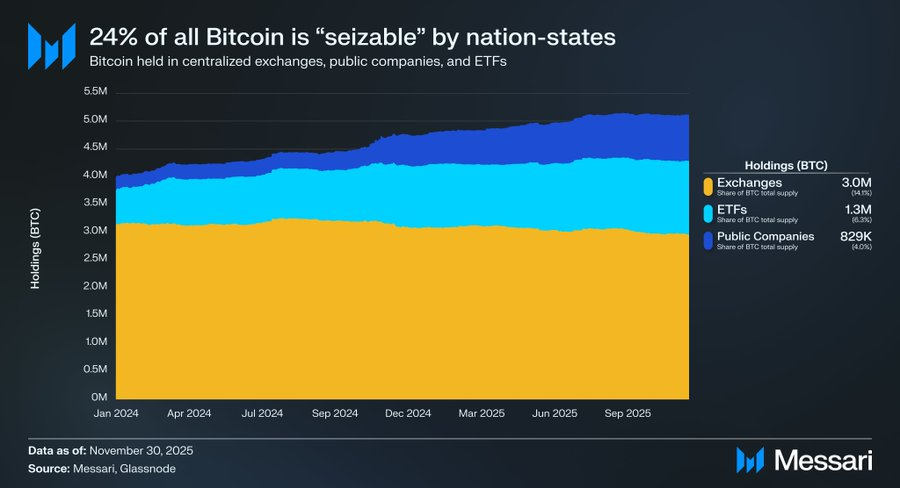

Bitcoin is rapidly concentrating in the hands of centralized entities: centralized exchanges hold approximately 3 million BTC, ETFs hold approximately 1.3 million BTC, and publicly traded companies hold approximately 829,000 BTC. In total, approximately 5.1 million BTC (representing 24% of the total supply) are currently held by third-party custodians.

This means that approximately one-quarter of the BTC supply is theoretically at risk of being seized by regulators. This structure is highly similar to the centralized conditions under which the US government confiscated gold in 1933. Back then, the US government, through Executive Order 6102, forced citizens to surrender more than $100 of their gold reserves and exchange them for paper money at a fixed price. This process did not rely on violence but was completed through the banking system.

For Bitcoin, the path is exactly the same. Regulators don't need to possess your private keys; they only need legal jurisdiction over the custodian. Once a government issues an enforcement order to entities like BlackRock and Coinbase, these companies are legally obligated to freeze and transfer their BTC holdings. Without modifying a single line of code, nearly a quarter of the BTC supply could be "nationalized" overnight.

Furthermore, given the high transparency of blockchain technology, self-custody is no longer a sufficient defense. Any BTC withdrawn from a KYC-verified exchange or brokerage account will ultimately leave a traceable "paper trail."

BTC holders can sever the custody and oversight link by exchanging for Zcash, achieving "air isolation" of their wealth. Once funds enter Zcash's privacy pool, their destination becomes a cryptographic "black hole" in the eyes of observers. Regulators can see funds leaving the Bitcoin network, but cannot know their final destination. Of course, the strength of this anonymity depends entirely on operational security: address reuse and acquiring assets through KYC-compliant exchanges will leave permanent links before entering the privacy pool.

The road to PMF is being paved.

The demand for private currencies has always existed, but the problem has been that Zcash has historically struggled to reach users. For a long time, high memory consumption, lengthy proof times, and complex desktop configurations have made privacy transactions both slow and daunting for ordinary users. Recent breakthroughs at the infrastructure level have systematically removed these obstacles.

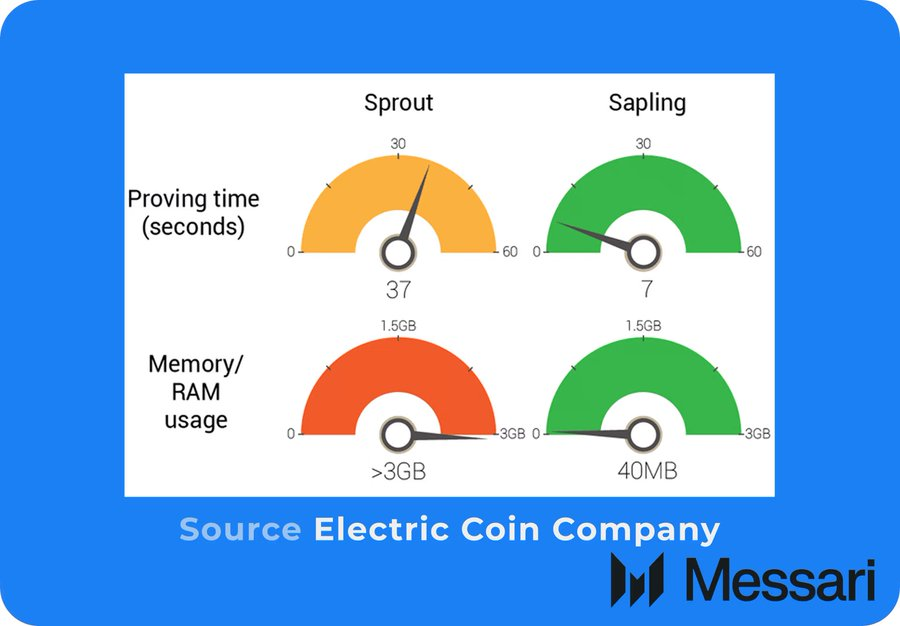

The Sapling upgrade reduces memory requirements by 97% (to approximately 40MB) and proof time by 81% (approximately 7 seconds), enabling privacy transactions on mobile devices.

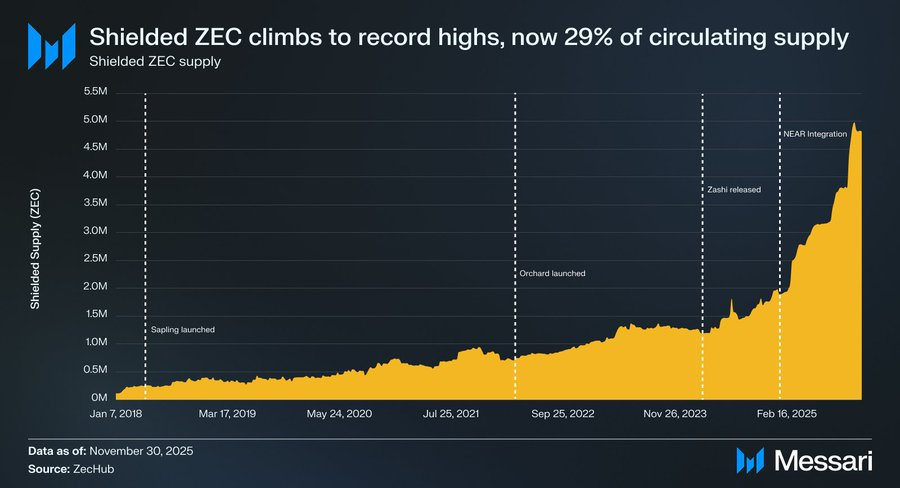

While Sapling solved the speed issue, trusted settings remained a focal point for the privacy community. Subsequently, Orchard completely removed the reliance on trusted settings by introducing Halo 2 and introduced Unified Addresses, integrating transparent and private addresses into a single entry point, significantly reducing the cognitive burden on users.

These improvements ultimately led to the release of the Zashi mobile wallet in March 2024. With its abstract design using a unified address, Zashi simplified privacy transactions to just a few clicks on the screen, making "privacy" the default experience.

After resolving the UX issues, distribution became the final hurdle. Users still relied on centralized exchanges to deposit and withdraw ZEC into their wallets. NEAR Intents' integration eliminates this dependence, allowing users to directly exchange assets like BTC and ETH for privacy-state ZEC, and even use privacy-state ZEC to make payments to any address across 20 blockchains.

These measures together helped Zcash bypass historical frictions, access global liquidity, and align with real market demands.

Looking to the future

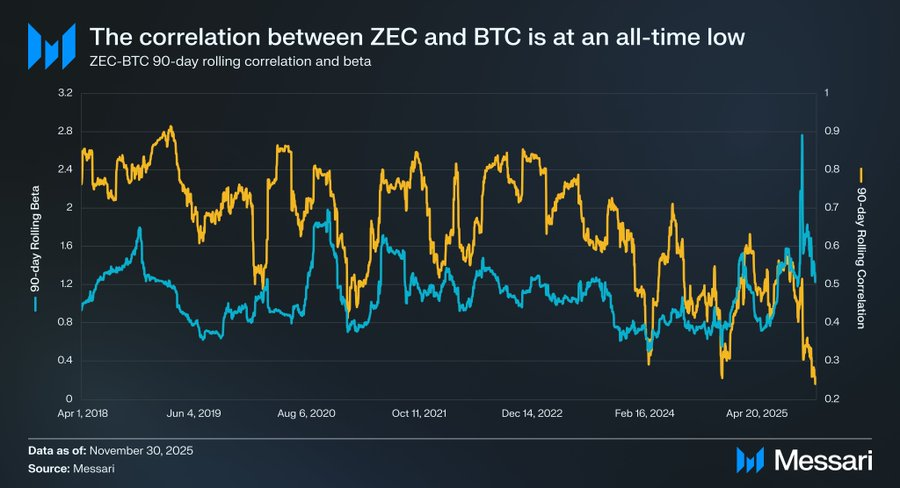

Since 2019, the rolling correlation coefficient between ZEC and BTC has been declining, from 0.90 to a recent 0.24; meanwhile, the rolling beta of ZEC to BTC has risen to an all-time high. This divergence suggests that the market is assigning an independent premium to Zcash's privacy features.

We do not believe ZEC will surpass BTC. Bitcoin has established itself as the most reliable cryptocurrency due to its transparent supply and auditability; while Zcash, as a privacy coin, inevitably faces a trade-off between privacy and auditability.

However, ZEC can carve out its own niche without replacing BTC. They are not solving the same problem, but rather playing different roles within the cryptocurrency system: BTC is a "robust cryptocurrency" optimized for transparency and security, while ZEC is a "private cryptocurrency" designed for privacy and confidentiality.

In this sense, ZEC's success does not depend on defeating Bitcoin, but on making up for the attributes that Bitcoin deliberately gave up.