2026 L1 Big Prediction: A New Era of Stablecoin Dominance, Compliance Integration, and Cross-Chain Interoperability

- 核心观点:加密市场宏观繁荣与微观萧条并存,稳定币是核心血液。

- 关键要素:

- 稳定币年增发900亿美元,市值涨45%。

- 公链专业化,以太坊结算,Solana投机,BNB营销。

- 监管转向合作,美国通过稳定币立法。

- 市场影响:推动行业向互联互通与合规化发展。

- 时效性标注:中期影响。

Introduction: The Contradictory Year of 2025

Crypto Continent has fallen into a strange state of division.

Although the market capitalization of the crypto market will exceed $4.3 trillion in 2025, why do most investors feel "poorer" in that year?

This year, the crypto world has reached a crossroads of divergence. On the one hand, institutions are pouring in, regulatory policies are becoming clearer, and the entire industry seems to be entering an unprecedented "golden age." On the other hand, the vast majority of tokens are performing poorly, ordinary investors' assets are shrinking, and market sentiment has fallen into an unprecedented trough.

This is an unprecedented paradox: the coexistence of "macroeconomic prosperity" and "microeconomic recession. " People are anxiously searching for the next "killer app," but they are ignoring a simple fact—the answer has already surfaced. In 2025, the new issuance of stablecoins reached a staggering $90 billion, quietly becoming the lifeline supporting the entire crypto ecosystem.

Are we witnessing the end of an old era and the beginning of a new crypto era?

Data Overview: Key Processes and Trend Forecasts for 2025-2026

The era of division in the crypto world is coming to an end, and a new era of connection is beginning.

Part One: The Beginning of Each Becoming King

1.1 The L1s have found their own ways of living.

In 2025, major public blockchains no longer fantasized about "one chain ruling everything," but instead found a way to survive based on their own strengths:

Ethereum has completely transformed into a "settlement layer." With the completion of the Pectra hard fork, Ethereum has delegated daily transactions to L2, focusing instead on being a "bank of banks." Mainnet transaction fees have dropped from $7.25 at the beginning of the year to $0.19, returning to 2020 levels.

Source: The Block Data

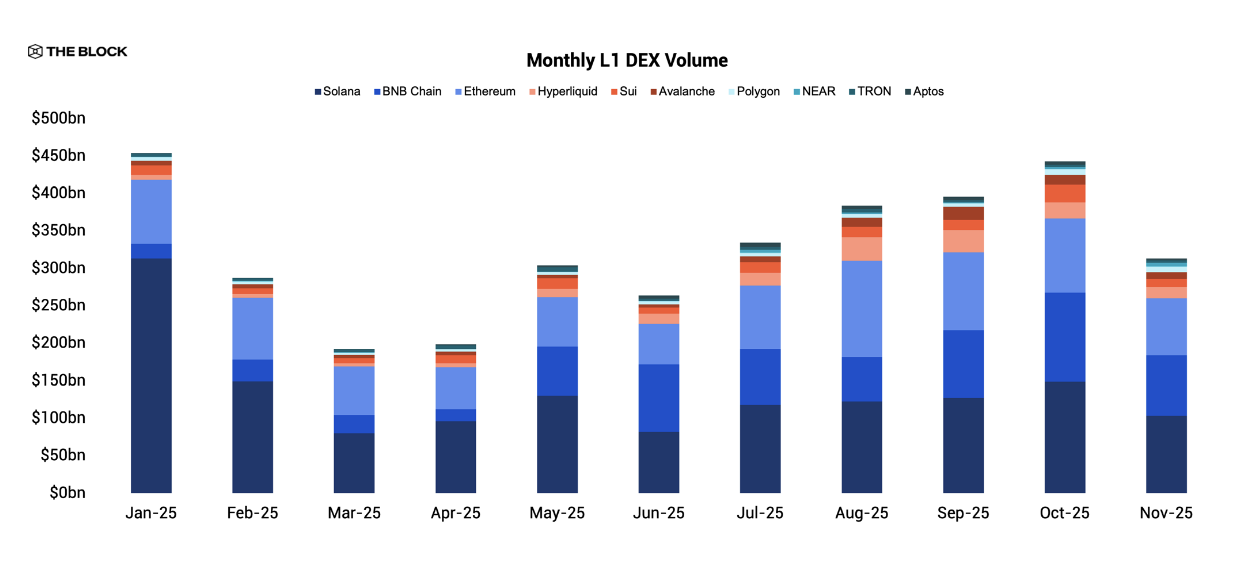

Solana has become a hub for speculative trading. The craze for $TRUMP and $MELANIA memes at the beginning of the year drove Solana's DEX trading volume to an all-time high, with these two coins accounting for 48.5% of the trading volume. Although it has been jokingly referred to as a "casino chain," users still love to play it.

Source: The Block, DeFiLlama

BNB Chain achieved a revival through technological upgrades and cultural marketing . The Lorentz and Maxwell hard fork reduced block time from 3 seconds to 0.75 seconds, and CZ's return and the "BNB Meme Season" also brought in a lot of traffic; users' enthusiasm for cryptocurrency trading was directed to four.meme, which ultimately contributed about 21.8% of BNB Chain's application revenue since the beginning of the year.

Source: @BNBCHAIN

1.2 The Life or Death Moment of Privacy Coins

Meanwhile, a dramatic scene unfolded in the privacy coin sector . Monero, as the leading privacy coin, was "hijacked" by the Qubic chain: Qubic attracted miners with higher returns, at one point taking away more than half of Monero's computing power, and used some of the mining rewards to buy back its own token QUBIC, which was seen by many as a "disguised economic attack".

Source: @c___f___b

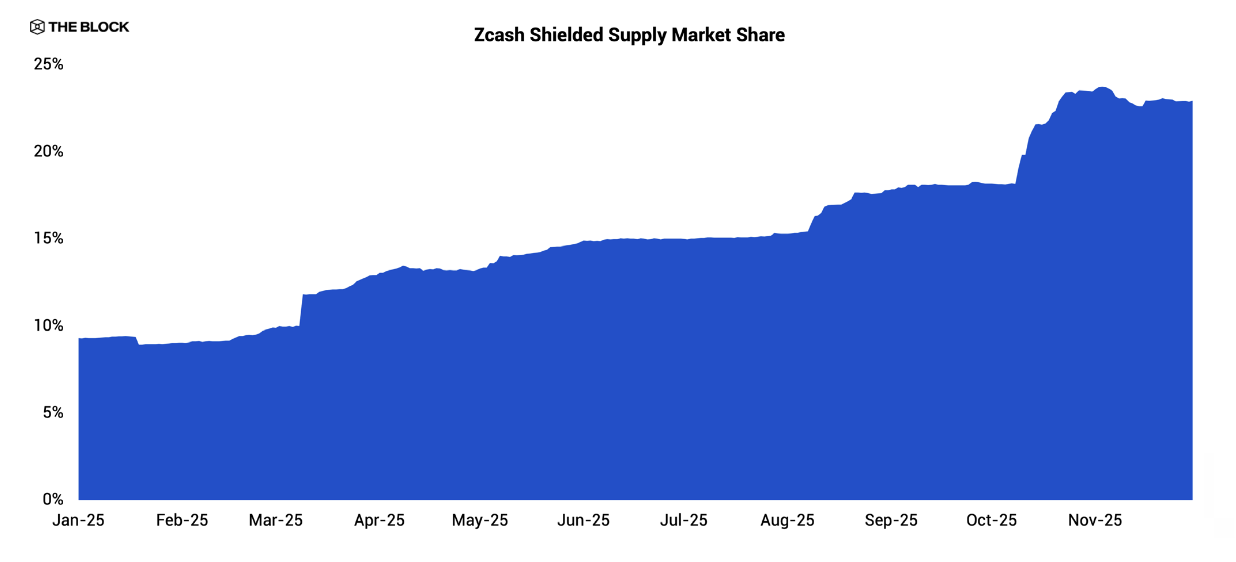

However, Zcash has experienced a resurgence. Through cross-chain technology integration with the NEAR protocol, users can freely switch between transparent and private transactions. The usage rate of its privacy pool has surged from 9% to 24%, demonstrating the value of privacy features within a compliant framework.

Source: The Block, ZecHub

1.3 The Debut of a Performance Monster

Performance-centric L1 networks form another pillar of specialization. These networks are designed to be virtually undetectable to end users, aiming to achieve Web2-level latency and provide a trading experience comparable to centralized exchanges.

Monad launched in November, focusing on "parallel EVM execution"; Fogo, on the other hand, uses an SVM architecture to pursue ultra-low latency.

These new chains attempt to completely eliminate the difference in experience between "on-chain" and "off-chain".

Source: Monad

Source: Fogo

Part Two: In-depth Specialization

2.1 The Rise of Stablechains

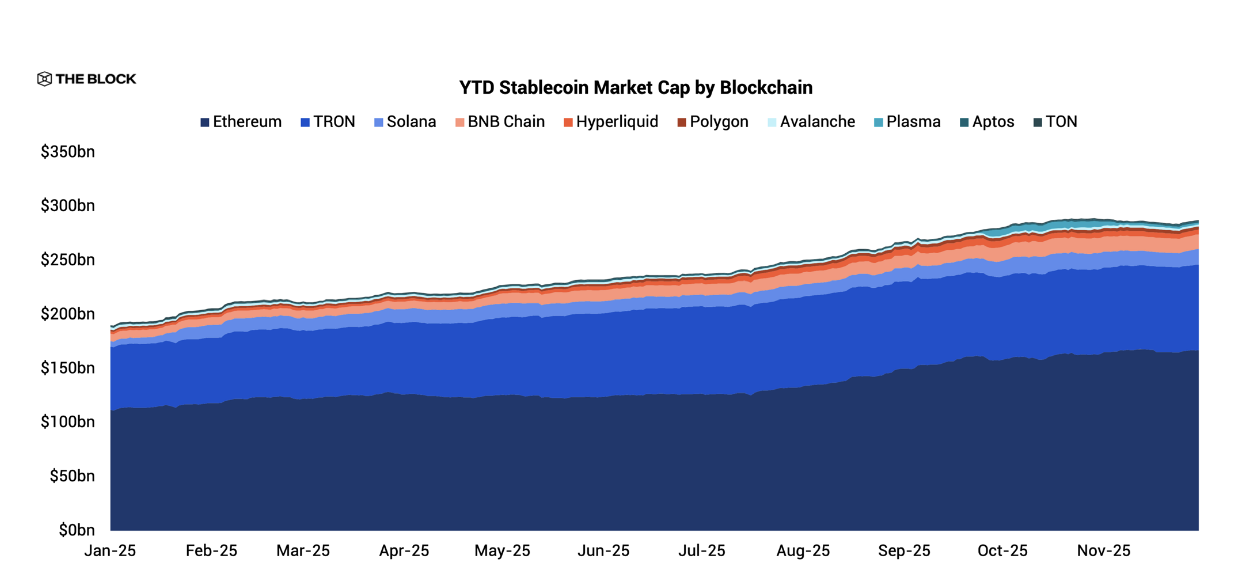

In 2025, stablecoins proved themselves to be the "hard currency" of the crypto world. With a total new issuance of $90 billion and a 45% surge in total market capitalization, they became the core lifeblood supporting the entire crypto ecosystem. This growth was fueled by the meme coin craze, the popularity of perpetual contracts, and the influx of institutional funds.

Source: The Block, DeFiLlama

Solana and Hyperliquid have reaped substantial profits. At the beginning of the year, Solana capitalized on the popularity of meme coins like $TRUMP and $MELANIA, doubling its stablecoin supply in just 23 days and surging 159% throughout the year. Hyperliquid, meanwhile, benefited from the perpetual contract trading boom, achieving a 118% increase in the second half of the year. In contrast, Aptos and Polygon took a "high-end" approach, with significant institutional investment resulting in stablecoin supply growth of 142% and 76%, respectively. The rise of stablecoins has not only reshaped the L1 crypto landscape but also provided a more stable foundation for the crypto ecosystem.

After stablecoins proved their value, "stablechains," specifically optimized for stablecoins, began to emerge.

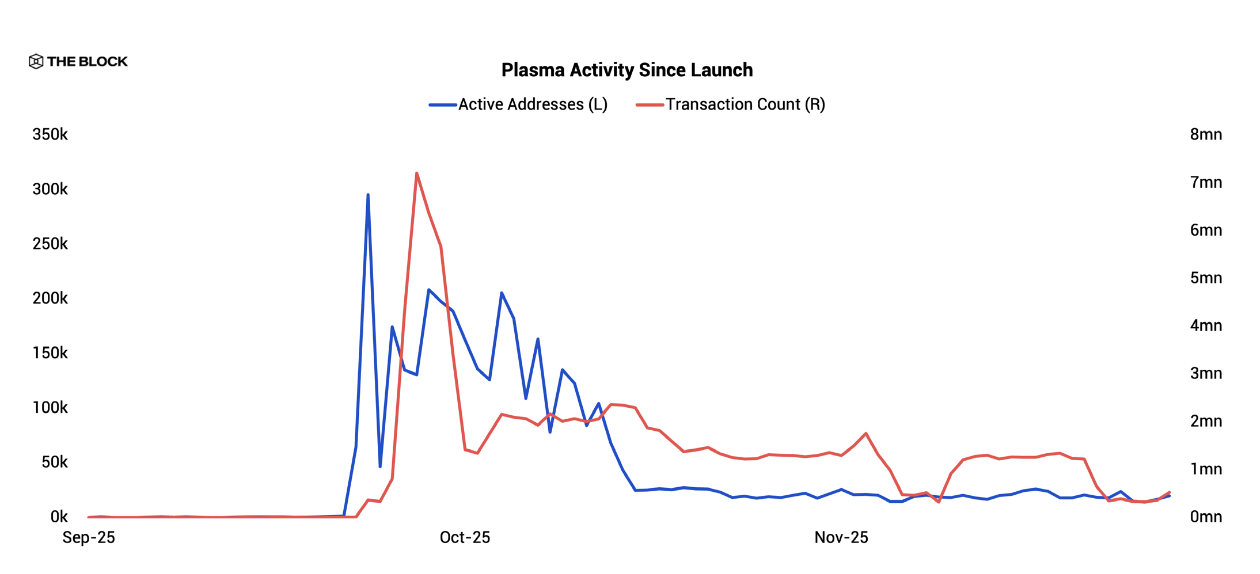

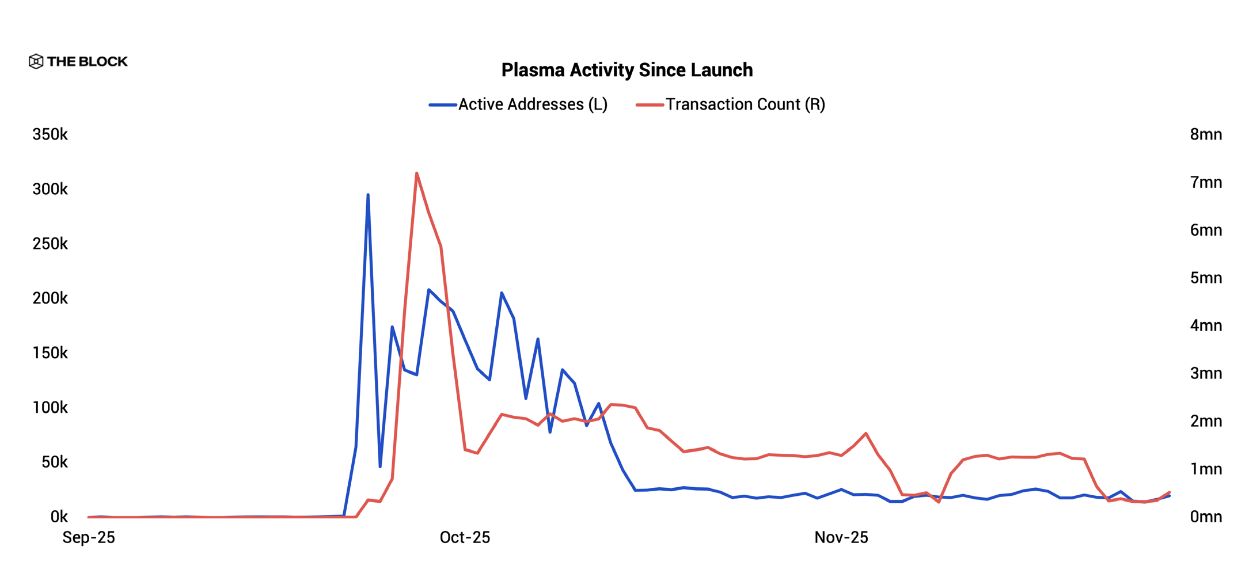

Plasma broke into the top eight stablecoin supply in less than three months after its launch. These chains focus on the issuance, transfer, and settlement of stablecoins and incorporate high-value features such as compliance tools. Although its activity level declined somewhat later, its long-term development trend remains to be seen.

Source: The Block, Plasmascan

2.2 The Integration Battle of L2

Competition in the L2 space intensified in 2025, ultimately resulting in a situation where the strong get stronger. Backed by Coinbase's powerful resources, Base processed over 3.3 billion transactions throughout the year, seven times that of the Ethereum mainnet, firmly establishing itself as the leader in the L2 space.

Other L2 licenses suffered significant losses after the incentive programs ended, with only a few managing to maintain their popularity. This demonstrates a harsh reality: even the best technology is useless without a user entry point.

2.3 The Awakening of Real-World Assets

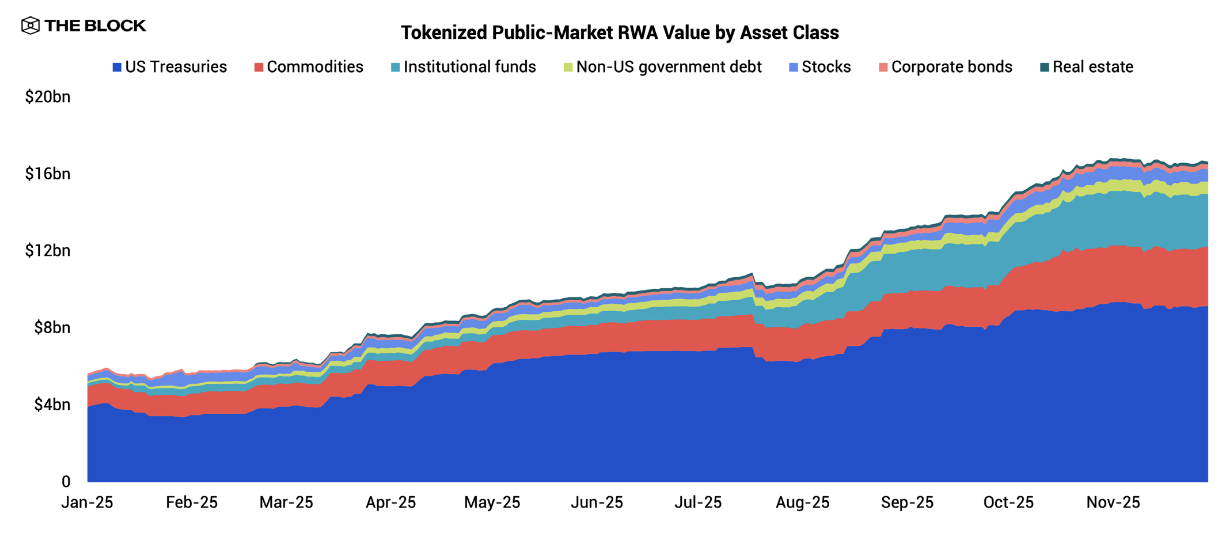

In 2025, the tokenization of real-world assets (RWA) finally experienced explosive growth. After a period of stagnation following the liquidity crisis in 2022, the market regained momentum in 2025, with the total value of tokenized public market assets soaring from $5.6 billion to $16.7 billion, marking the fastest growth rate since the inception of this sector.

This growth is not limited to a single asset class. Whether it's US Treasury bonds, commodities, or institutional funds, all have attracted significant inflows driven by diverse demands. BlackRock's BUIDL fund has become a leader in this wave, pushing traditional assets onto the blockchain on a large scale.

Institutions are no longer just buying and hoarding cryptocurrencies, but are using blockchain as a new channel for issuing and trading traditional assets.

Source: The Block

2.3 The Dawn of a Seamless Experience

Once all the major public blockchains have found their professional positioning, a new question arises: how can users move freely in this increasingly fragmented ecosystem?

The threshold for relevance is constantly rising, but clear integration around a small number of networks still seems a distant prospect. Instead, the landscape of underlying networks is becoming increasingly fragmented, forming a cyclical pattern dominated by niche, specialized chains. Solana specializes in meme trading, Ethereum holds a firm position in the settlement layer, stablechains handle payments, and privacy chains protect data—each chain has its own "little patch of land."

In this environment, interoperability and cross-chain communication become crucial. Users should not be forced to learn the wallet settings, fee mechanisms, and operational procedures for each chain. The real breakthrough will come from systems capable of abstracting a single L1 network and enabling seamless activity routing.

Imagine this: a user wants to buy an NFT but doesn't need to care which blockchain it's on; wants to conduct a DeFi transaction, and the system automatically selects the optimal execution path; wants to transfer stablecoins, and the funds arrive instantly regardless of the recipient's wallet. These systems, by providing a consistent and intuitive user experience, will be key to driving mainstream adoption.

In 2026, when the technological infrastructure is mature enough, the concept of "cross-chain" will be as natural as "cross-website" is today—users will not even realize that they are using different underlying protocols.

Part Three: The Victory of Compliance

3.1 Fundamental Shift in the Regulatory Environment

In 2025, U.S. regulation underwent a major shift. Since Gary Gensler stepped down as chairman of the SEC and was succeeded by Paul Atkins, the regulatory approach has changed from "punish first, then talk" to "establish rules first, then manage," providing a clear compliance path for the entire industry.

In July, the GENIUS Act became the first federal legislation in the United States to support stablecoins. The act requires stablecoins to be 100% backed by reserves and clarifies regulatory responsibilities, setting transparent rules for the industry. Meanwhile, the CLARITY Act is also progressing, providing a new direction for the structure of the digital asset market.

Europe's MiCA (Military Asset Control Act) will also be fully implemented in 2025. The 27 member states have unified their digital asset rules, allowing companies to operate throughout the EU with a license from any one of these countries. Reserve transparency, anti-money laundering, and prevention of market manipulation have become standard features, marking the first time the crypto world has a "European standard."

Global regulation has shifted from "suppression" to "cooperation," marking the beginning of a true integration between traditional finance and the crypto ecosystem.

3.2 The Expansion Path of ETFs

Bitcoin ETF: An Accelerator of Institutionalization

In 2025, Bitcoin spot ETFs ignited the interest of traditional finance, with trading volume soaring to $880 billion for the year, a 37% increase from 2024. Despite the volatility of Bitcoin prices, institutional funds demonstrated remarkable stickiness, pushing total assets under management (AUM) past $120 billion in November. BlackRock's IBIT continued to hold its dominant position, controlling 59% of the market share and boasting $70 billion in AUM. However, as competitors gradually emerged, its market share slipped from 80% in the middle of the year to 70% in November, indicating that the battle for the ETF market's "throne" has only just begun.

Ethereum ETF: The Close Follower

The Ethereum ETF also delivered a stellar performance in 2025, with a cumulative trading volume of $277 billion and an increase of $6.2 billion in AUM during the year, particularly attracting a large influx of funds after the ETH price surged to $4,000. BlackRock's ETHA "replicated" the success of the Bitcoin ETF, capturing 60-70% of the market trading volume and reaching $11.1 billion in AUM. However, the Ethereum ETF's average daily trading volume was only 31% of that of the Bitcoin ETF, indicating that despite Ethereum's strong recognition in technology and applications, it still has room to catch up in terms of appeal to the capital market.

Solana and Altcoin ETFs: Pioneers of Staking Functionality

In 2025, Solana became the "leader" among altcoin ETFs, with the staking Solana ETF officially launching in November, becoming one of the first ETF products to offer direct staking rewards. These products not only distributed validator rewards but also maintained a standard ETF structure, attracting $1 billion in AUM within just one month of launch, demonstrating institutional investors' strong interest in "yield-generating" crypto assets. With a staking yield of approximately 7%, these ETFs unlocked a total return model that spot products could not provide, setting a benchmark for the design of future staking ETFs and showing investors a new possibility of "earning returns while holding tokens."

Conclusion: The Path to Connecting from "Digital City-State" to "Crypto Continent"

By 2025, the "digital city-state" landscape of the crypto world had gradually become clear. Each public chain was like an independent kingdom—Ethereum was the central hub for financial settlements, Solana prided itself on speed and performance, and BNB Chain was known for its traffic and cultural marketing. They each developed their own economic systems, formulated their own "laws" and "rules," and created a prosperous crypto ecosystem. However, this prosperity was also accompanied by fragmentation: users frequently switched between different chains, asset transfer efficiency was low, and technological barriers hindered widespread adoption.

In 2026, connectivity and interoperability are considered core themes of the crypto ecosystem. With breakthroughs in technologies such as cross-chain intent routing and abstraction of underlying chain complexity, the boundaries between chains will gradually blur. Users will no longer need to care which chain they are using; cross-chain transactions and asset transfers will become more seamless and intuitive, paving the way for mainstream adoption.

At the same time, stablecoins have gained further prominence, becoming a cornerstone of global value circulation. "Stablechains," designed specifically for stablecoins, are emerging, providing an efficient payment and settlement environment. The tokenization of real-world assets (RWAs) is also accelerating, with institutional funds flowing in on a large scale, injecting new vitality into the crypto ecosystem.

The crypto world is moving towards an interconnected and clearly defined "crypto continent".

"The next big thing will be lots of small things coming together."

* The data in this article is all from The Block's "2026 Digital Asset Outlook" in-depth report. It is intended to provide in-depth interpretation and narrative reshaping based on professional reports and does not constitute any investment advice.