Kalshi teams up with Solana: Is the US’s first compliant prediction market starting to reap profits from crypto enthusiasts?

- 核心观点:Kalshi合规上链Solana,抢占预测市场流动性。

- 关键要素:

- Kalshi将合规合约代币化接入Solana。

- 利用Solana高TPS、低费用及成熟生态。

- 此举直接冲击对手Polymarket市场份额。

- 市场影响:推动预测市场流动性向合规高效平台集中。

- 时效性标注:中期影响。

I. Breaking News: Kalshi, the US compliance kingpin, teams up with Solana to grab liquidity.

On the morning of December 1, 2025, CNBC broke the exclusive news that Kalshi, the first and currently only prediction market platform in U.S. history to be fully regulated by the CFTC (Commodity Futures Trading Commission), has begun allowing users to buy and sell tokenized versions of its event contracts on the Solana blockchain.

This also means that by tokenizing all compliant betting contracts, Kalshi has brought billions of dollars of liquidity from the crypto world into the legal markets of all 50 US states.

John Wang, head of Kalshi's crypto business, stated in a media interview that by entering the $3 trillion digital asset market, Kalshi will be able to obtain the liquidity needed to scale its products, at a time when investor demand for prediction markets is growing rapidly.

To achieve this, Kalshi did two key things:

- It currently supports decentralized finance (DeFi) protocols such as DFlow and Jupiter to connect Kalshi's off-chain order book with Solana liquidity.

- Kalshi announced over $2 million in "Kalshi Builder Grants," and its next official partner has been confirmed as Axiom, with support for more blockchains to follow.

In addition, a November funding round led by Sequoia Capital and CapitalG raised $1 billion for Kalshi, valuing the company at approximately $11 billion. This puts it on par with its rival Polymarket , which announced a strategic investment agreement with Intercontinental Exchange (ICE, the parent company of the New York Stock Exchange) at the end of October. ICE committed up to $2 billion, pushing Polymarket's post-valuation to approximately $9 billion (pre-money approximately $8 billion).

II. Why now? Why Solana?

Let's rewind three months. In September 2025, Kalshi's monthly trading volume surpassed Polymarket's for the first time ($1.3 billion vs. $773 million). In October, both companies almost simultaneously reached record highs: Kalshi $4.39 billion and Polymarket $3.02 billion. After the election bonus faded, both companies realized that the next trillion-dollar market wasn't in politics, but in sports, macro data, entertainment, and weather. However, their paths were completely different:

Polymarket: Chooses to continue "deepening its focus on decentralization," preparing to officially return to the US market in 2026 and issue the $POLY token;

Kalshi: Decided to "partially go on-chain": The core settlement and compliance layers will remain in our own hands, but the liquidity layer will be fully opened to the crypto world.

Solana's selection was almost a foregone conclusion:

- Real user transaction throughput has been consistently stable at 700–1,000 TPS, with peak throughput exceeding 3,000–5,000 TPS, far surpassing most public chains; the gas fee for a single transaction is typically less than $0.002, and even during congestion, it remains well below $0.01.

- Jupiter is the dominant router and aggregator in the Solana ecosystem, with a TVL of $2.6 billion;

- Phantom Wallet has surpassed 15 million monthly active users, and its mobile experience (built-in DApp browser, native NFT support, one-click swap) is widely considered to be far superior to the mobile version of MetaMask.

Over the past 12 months, the Solana ecosystem's prediction market protocols (Parcl, Hedgies, Limitless, etc.) have accumulated a large user base and understanding of prediction markets, providing a ready-made user foundation and mindshare for Kalshi's on-chain contracts.

Kalshi doesn't need to "build another chain," but rather to "give him ready-made wings." Solana happens to be those wings.

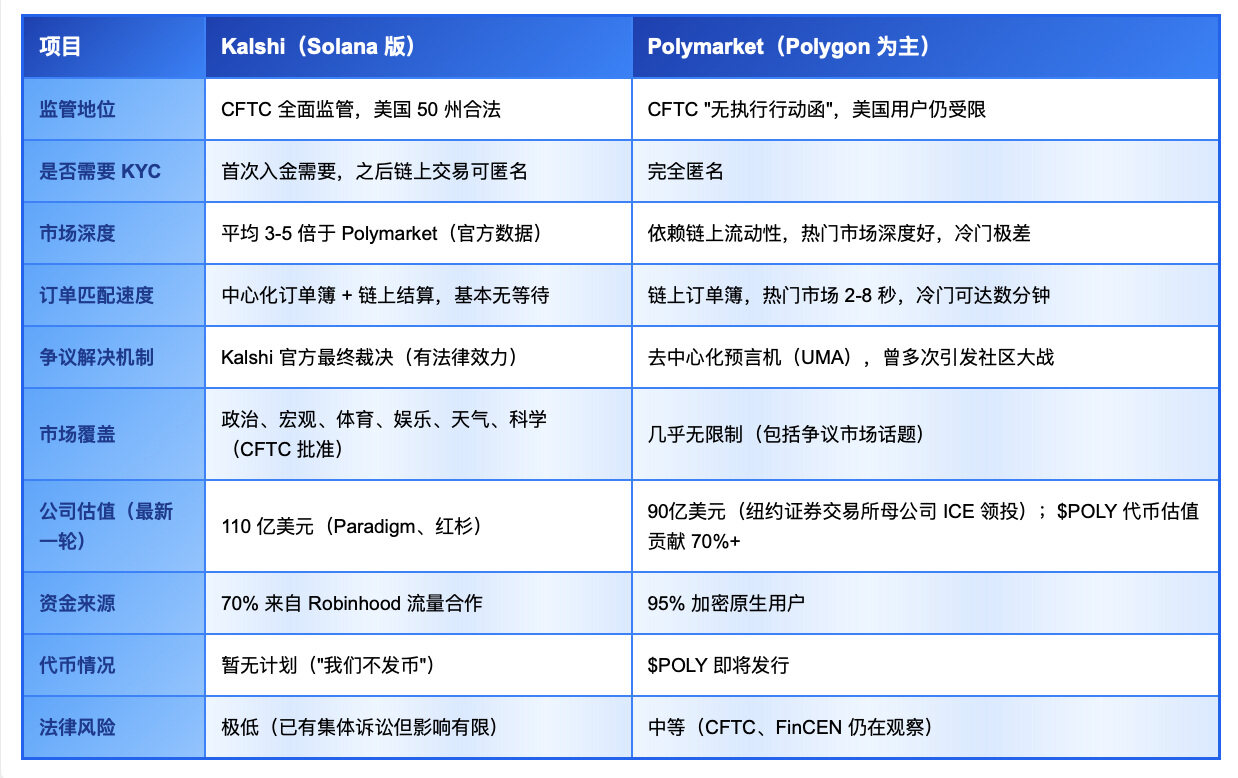

III. Kalshi vs Polymarket: The Ultimate Comparison Table for 2025

IV. When powerful entities join forces: Who will be hurt? Who will benefit?

The hardest hit: Polymarket and its "encrypted native users"

For the past year, Polymarket's biggest boast was that "I can let an Iranian address and an Argentinian address bet against each other on the US election without any problems." Now, Kalshi has perfectly broken this barrier with "KYC once, then play freely." A large number of mid-sized whales have begun migrating funds from Polymarket to Kalshi Solana because:

- Smaller slippage;

- Unafraid of oracle controversy;

- You can still keep your wallet anonymous.

The tokenization initiative will pose a real challenge to the market share of prediction platforms like Polymarket by giving Kalshi users greater anonymity and the backing of compliance.

Biggest beneficiary: Solana ecosystem

Overnight, Kalshi channeled a massive amount of liquidity from compliant prediction markets directly to Solana:

TVL will surge dramatically, Jupiter will experience unprecedented depth of real orders, and Phantom Wallet will surge back to the top of the App Store tools chart—this is not short-term hype, but the official activation of the true "super gateway to the prediction market" in the Solana ecosystem.

From then on, all uncertainties of the real world—politics, sports, macroeconomics, entertainment—have found the fastest, cheapest, and deepest trading venue on Solana.

Long-term beneficiaries: the entire prediction market sector

The competition will only result in further concentration of liquidity, further compression of spreads, and an exponential improvement in user experience. It's a foregone conclusion that monthly trading volume will exceed 10 billion before the 2026 US midterm elections.

V. Polymarket's Counterattack Window: Only 6–9 Months Left

Currently, Polymarket has three cards to play:

- $POLY tokens (community incentives + fee sharing);

- It will officially return to the United States in 2026 (the CFTC waiver is in its final stages).

- More aggressive market themes (as long as it's not illegal, they'll always be more daring than Kalshi).

But time is running out. Kalshi has proven that regulation is not a burden, but the sharpest spear.

When you can provide both compliant security and an ultimate on-chain experience, the so-called "decentralized faith" is actually laughably fragile in the face of real money.

VI. Conclusion: The Next Trigger

December 1, 2025, is destined to be etched in the history of prediction markets. It's not that crypto defeated traditional finance, nor that traditional finance defeated crypto.

It's just a simple business truth being proven once again: users will always vote for the one that is "better to use, cheaper, and safer," even if it's only 5% better than the competition.

Kalshi's "liquidity" switch on Solana today has prematurely ignited the second half of the prediction market.

The only thing left to see is whether Polymarket can flip its own switch before the summer of 2026.