Infinex's new token sale rules: A one-year lock-up period for $0.0099 tokens, or unlocking for $0.03 tokens – choose one.

- 核心观点:Infinex下调代币销售估值以适应当前市场。

- 关键要素:

- Sonar代币销售估值从3亿美元下调至9999万美元。

- 锁仓期维持一年不变,但提供提前解锁选项。

- Patron NFT持有者权益受损,地板价24小时跌近10%。

- 市场影响:打击早期支持者信心,引发对项目治理的质疑。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

Yesterday, Infinex founder Kain Warwick posted on the X platform that due to overly high pricing feedback, the valuation of Infinex's Sonar token sale on Echo has been lowered from the initial $300 million to $99.99 million, while the lock-up period remains unchanged at one year , in order to better adapt to the current market environment.

Due to the reduction in FDV, the overall allocation of Sonar sales has decreased, making it impossible to guarantee the original priority allocation arrangement for Patron NFT holders. The floor price of Infinex Patrons NFT has fallen by nearly 10% in 24 hours, and the floor price is temporarily reported at 1.387 ETH.

Below, Odaily Planet Daily will guide you through the Infinex project, the new rules for token sales, and community sentiment.

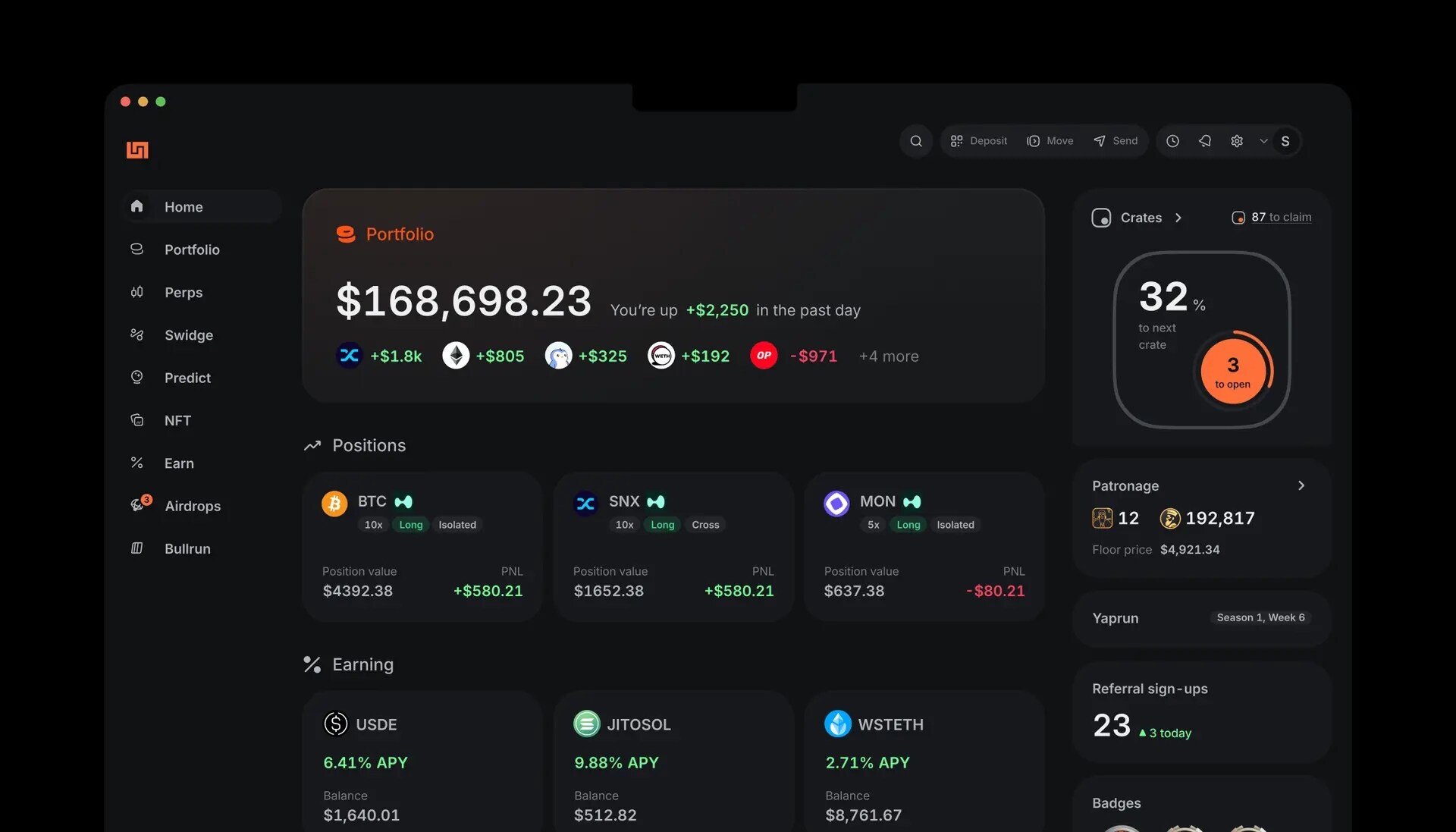

Infinex: A Full-Stack DeFi Service

Infinex is a decentralized finance (DeFi) platform launched in April 2024 by Synthetix founder Kain Warwick. Its goal is to provide a product experience close to that of a centralized exchange while maintaining decentralization, thereby bridging the gap in accessibility between CeFi and DeFi. The platform focuses on optimizing the interaction process and user experience while maintaining non-custodial assets and on-chain security.

From a product positioning perspective, Infinex is not a single-function application, but rather closer to a full-stack DeFi service portal. Its core capabilities include: serving as a non-custodial wallet covering multiple chains to hold user assets; providing a unified interface that aggregates and connects various on-chain DeFi protocols and services; and through a highly abstract interactive design, hiding complex concepts such as address management, cross-chain bridging, mnemonic phrases, and gas fees in the background, allowing users to interact with DeFi applications without needing to understand the underlying mechanisms, resulting in an overall user experience closer to CeFi products.

To date, Infinex supports 15 blockchain networks, including Ethereum, Solana, and Base, and its integrated DeFi functions cover multiple areas such as cross-chain transactions (Swidge), perpetual contracts (Perp), liquidity staking, and other interest-bearing services (Earn).

Infinex New Token Sale Rules

According to the official Infinex documentation, the updated details of the Infinex token sale are as follows:

- INX token sale account registration period: Starting December 27th;

- The official sale date for INX tokens is from January 3rd to January 6th, 2026.

- Infinex TGE Date: Planned for late January 2026;

- Sales quantity: 5% of the total token supply;

- FDV: Valuation lowered from the initial target of $300 million to $99.99 million;

- Lock-up status: Locked for one year;

- Purchase quantity: Minimum amount is $200, maximum amount is $2,500. In the event of oversubscription of the token sale, you can increase your chances of obtaining an allocation by sharing your participation on X. Regular users can receive a 3x bonus by sharing on X, while Patreon NFT holders can receive a 10x bonus.

In addition, the INX tokens in this token sale offer an early unlocking option. If early unlocking is chosen, the valuation at TGE is $300 million FDV, with a price of $0.03 per token. Subsequently, this valuation will be gradually adjusted downwards linearly over the next year, eventually settling at $99.99 million FDV, corresponding to a price of $0.0099 per token.

Community sentiment: Negative sentiment dominates, with Patron NFT holders particularly dissatisfied.

"If a $300 million valuation is enough to unlock all Patron NFTs on TGE, then what about the Patron NFTs I bought at a $500 million valuation?" This is the most direct question raised by many Patron NFT holders after the new rules were announced. According to previous sales expectations, participants could participate in the token sale with a $300 million FDV. If they wanted to unlock them on TGE, they needed a higher valuation threshold, approximately $1 billion FDV. It was under this expectation that some users chose to purchase Patron NFTs at a higher implied valuation in exchange for more certain distribution rights and earlier liquidity.

However, the new plan significantly lowers the valuation threshold for early unlocking to $300 million FDV, noticeably weakening the Patron mechanism that previously relied on high valuations to secure unlocking rights and priority. This means that the premiums previously paid by Patron NFT holders for "certainty" and "early unlocking" are no longer valid, and some holders are now facing negative returns both on paper and in their expectations.

In response to this controversy, Kain Warwick stated that the new plan aims to promote wider token distribution and increase overall participation and market buzz before TGE. However, some Patron holders believe that this explanation fails to cover their core losses and does not adequately address the gap between expectations and reality experienced by early supporters due to the mechanism change, thus not completely quelling the controversy.

Furthermore, the unchanged one-year lock-up period remains the biggest pain point in community discussions. Although the significant reduction in FDV has alleviated market criticism of the high valuation to some extent, it has not changed the strong dissatisfaction of most community members with the "one-year lock-up period," which they believe is almost equivalent to "premature death sentence" in the current market environment.