BitMEX Alpha: Will Western Union be an asymmetric trading opportunity in the stablecoin sector?

- 核心观点:稳定币价值在于分发渠道,而非铸造。

- 关键要素:

- 90%稳定币交易仍限于币圈内。

- Circle因缺乏渠道,利润被合作伙伴侵蚀。

- 西联汇款拥有现成分发网络与合规体系。

- 市场影响:渠道方价值或被重估,挑战纯发行商估值逻辑。

- 时效性标注:中期影响。

Stablecoins have become one of the few “strong PMF” products in the cryptocurrency space. Their supply has reached $250 billion and is expected to continue to grow, with daily settlement volumes reaching tens of billions of dollars, and their role as the internet’s “dollar API” is becoming increasingly clear.

However, when investors try to find the best targets to profit from the stablecoin narrative, the most obvious one—Circle ($CRCL)—may not offer the best risk-reward ratio. Instead, Western Union (WU), a long-established giant with a so-called "outdated" remittance business but double-digit dividend yields, is quietly positioning itself in the stablecoin trend by focusing on distribution channels.

In today's article, we will delve into how to better capitalize on the growth potential of stablecoins: Does value lie in the minting of stablecoins, or in the control of the "last mile" distribution channels?

Current application scenarios for stablecoins

The "last mile" problem: Will Western Union be an asymmetric trading opportunity in the stablecoin race?

Stablecoins have become one of the few "clean" products in the cryptocurrency space. Their supply has reached $250 billion and is expected to continue to grow, with daily settlement volumes reaching tens of billions of dollars, and their role as the internet's "dollar API" is becoming increasingly clear.

However, when investors try to find the best assets to profit from the stablecoin narrative, the most obvious code—Circle ($CRCL)—may not offer the best risk-reward ratio. Instead, Western Union (WU), a long-established giant with a so-called "outdated" remittance business but double-digit dividend yields, is quietly cutting in the opposite direction, integrating itself into this grand trend of stablecoins.

In today's article, we will delve into how to better capitalize on the growth potential of stablecoins: Does the value lie in the minting of stablecoins, or in the control of the **"last-mile distribution" channel**?

Modern applications of stablecoins

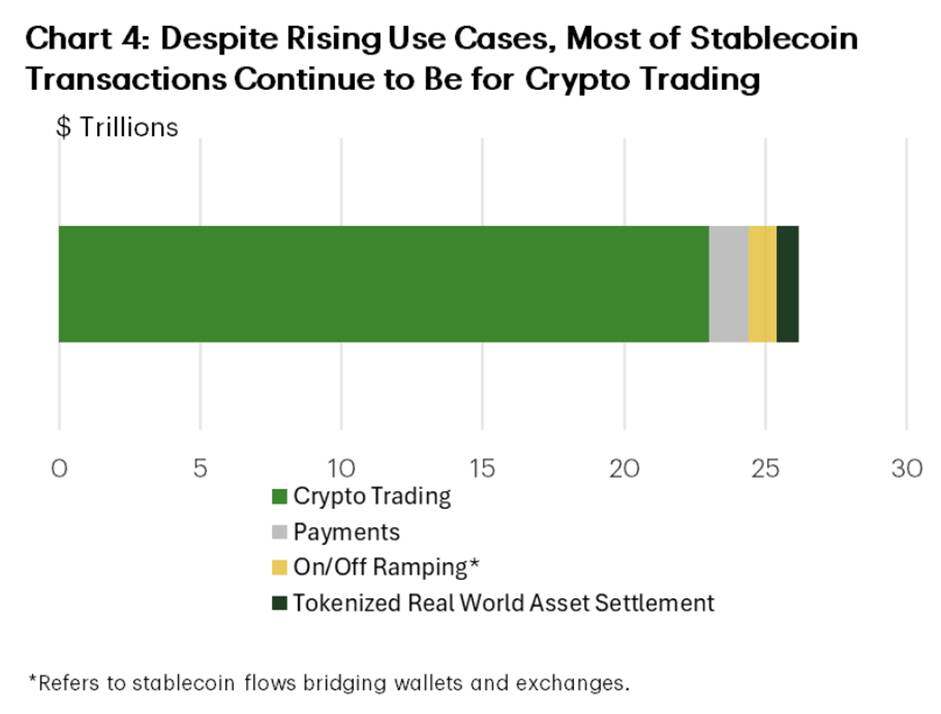

Currently, the highest trading volume for stablecoins is still concentrated within the cryptocurrency market:

Data from TD Economics shows:

● Approximately 90% of stablecoin trading volume is related to transactions, staking, and institutional settlement between exchanges, trading desks, and DeFi protocols.

● Less than 10% are used for “real-world” payments.

● Of these, P2P and remittances account for only about 3% of the cash flow.

Therefore, the claim that "stablecoins will kill traditional finance (TradFi)" is premature at present. Currently, real-world payments are still primarily conducted through banks, money transfer operators, and card network organizations.

To deliver on its hyped expectations, stablecoins must penetrate and replace existing real-world use cases. Mainstream forecasts suggest that stablecoins will account for approximately 20% of cross-border payments by 2030, as blockchain transfers can reduce underlying settlement costs by up to 70% compared to traditional correspondent banking models.

Cross-border payments will be one of the most promising use cases for stablecoin expansion. We believe the current adoption gap in stablecoins is primarily due to distribution channels , which is precisely the area where Western Union has been leading for over 170 years—and where Circle hopes USDC will reach.

Circle's dilemma: the cost of purchasing distribution channels

Circle's business model is quite typical: issue USDC, invest the reserves in short-term Treasury bonds, and earn net interest margin (NIM). However, as an infrastructure provider lacking a native user base, Circle faces a high " distribution tax ."

Because Circle doesn't own end customers, it must acquire them through purchasing channels. To promote USDC, Circle was forced to offer incentives for exchanges and wallets to prioritize its token over competitors like USDT. This dynamic is most evident in its relationship with Coinbase. Publicly disclosed information shows that Coinbase, merely acting as a distribution funnel, took the majority of the economic benefits generated by USDC reserves—typically over 50% of total interest income.

This reveals the fragility of its profitability quality—as the supply of USDC expands, Circle's "distribution, trading and other" costs are also growing aggressively, at a rate that even exceeds the traditional operating leverage effect.

Essentially, Circle is a utility provider, but its marginal customer acquisition cost remains high because each new user requires a revenue-sharing agreement. The company is valued as a high-growth fintech firm, but its revenue is heavily reliant on partners who control customer relationships. Even as Circle builds its own L1 and banking licenses, these still require attractive subsidies to draw in users.

Circle's advantages are real:

● It boasts one of the most trusted fiat-backed stablecoins;

● Stable regulatory position;

● As the second most widely circulated stablecoin, it has been deeply integrated into cryptocurrency trading and on-chain infrastructure.

However, its disadvantages are also obvious:

● Lack of retail distribution channels;

● Heavily reliant on partners such as Coinbase;

● Revenue depends not only on USDC adoption rates, but also on how much profit it retains after paying fees to partners.

Western Union: New Wine in Old Bottles

Western Union's approach to stablecoins has been largely overlooked by the market: it already possesses the distribution channels that Circle is paying to acquire.

It has mastered the distribution network:

● It has hundreds of thousands of physical locations in more than 200 countries/regions.

● Deeply penetrate the immigration remittance corridor with huge cash transaction volumes.

● Possessing a compliance system and licensing portfolio that is extremely difficult to replicate, especially in high-risk jurisdictions.

Most importantly, Western Union can reach customers without paying a cut to Coinbase. It has been the default choice for customers in many remittance corridors for decades.

Currently, Western Union monetizes its distribution network through traditional technology and economic models: cash remittance fees plus FX spreads . This profitability is substantial, explaining why Western Union remains a highly profitable and cash-flow-rich company despite the challenges posed by the growth of stablecoins.

Now, it is layering stablecoin technology on top of it.

Western Union, through the launch of its own stablecoin, USDPT, and the establishment of a "Digital Asset Network," has achieved the following:

● The front end (brand, agents, trusted payment outlets) remains unchanged;

● The backend (settlement channel and float) has been migrated to the stablecoin model.

This gives Western Union two leverages that cannot be combined at the same time:

- Where it has its own distribution channels, it can still charge fees and spreads.

- It can start monetizing using float and on-chain settlement, just like stablecoin issuers.

Circle must pay high costs for distribution and then try to maximize its share of float revenue; while Western Union already has distribution channels and profits from them, and the current stablecoin float is equivalent to adding an additional revenue stream for it.

Western Union Execution Risks: Spread Addiction vs. Blockchain Efficiency

In 1975, Kodak engineer Steven Sasson invented the first digital camera. When he demonstrated it to company executives, the response he received became a textbook example of corporate suicide: "This thing is great—but don't tell anyone."

To protect its highly profitable film business, Kodak shelved this technology. They chose a cash cow while ignoring the inevitable shift where high-tech products would reduce costs and replace older ones, ultimately becoming a relic of the past when the transformation finally arrived.

Today, Western Union ($WU) stands on the same precipice. Can it cannibalize its traditional cash cow business in order to survive digital transformation?

Spread Addiction vs. Blockchain Efficiency: As shown in the diagram above, Western Union's profitability heavily relies on foreign exchange spreads—the markup on currency exchange. The stablecoin narrative promises near-zero settlement costs, but for Western Union, efficiency presents a conflict of interest. If they were to shift to transparent on-chain channels, they could potentially compress the foreign exchange spreads that drive their profit margins.

Valuation Analysis: Value Trap vs. Growth Trap

The divergence in valuation between these two entities presents a typical case of market inefficiency.

Western Union is priced as a troubled company. A P/E ratio of only 4 and a dividend yield of 10% suggest the market has already priced in the expectation that its franchise will be slowly and inevitably eroded by digital disruptors. This view focuses primarily on the " innovator's dilemma "—the fear that digital wallets will cannibalize Western Union's highly profitable cash business. While this view isn't entirely without merit (digital business accounts for about 15% of revenue and is growing, while retail cash is weakening), it seems to ignore the option value of a stablecoin business transformation.

Conversely, Circle's pricing is based on perfect expectations , embedding optimistic assumptions about its long-term market share and the sustainability of its unregulated seigniorage in a high-interest-rate environment. Investors are paying a premium for a future in which Circle not only outperforms Tether but also contends with the inevitable issuance of bank-issued stablecoins and central bank digital currencies (CBDCs).

Conclusion: Consider going long on Western Union ($WU) transfers.

For traders building portfolios around the argument that "stablecoins will revolutionize cross-border finance," investing in a well-established giant with abundant distribution resources is worth one-seventh of the valuation of a capital-intensive stablecoin issuer.

● Circle represents a high-beta, pure stablecoin exposure in the stablecoin category, but it is not the absolute leader in stablecoins and comes with significant concerns about margin compression.

Western Union represents a deep, asymmetric bet on the application of this technology. It offers a “free call option” on its digital transformation success, cushioned by massive cash flow and a low valuation assuming failure. If Western Union can successfully integrate stablecoin channels to defend profit margins and streamline settlement processes, its subsequent valuation multiple expansion could outpace the linear growth trajectory of pure issuers.

In the race to digitize the dollar, whoever wins the users wins the market . Western Union has users; while Circle is still acquiring users through "subsidies".