Stripe for Agents: An Investment Map of Agents from Protocol Stacks to the Payment Ecosystem

- 核心观点:智能体商业将重构机器经济秩序。

- 关键要素:

- 协议栈标准化,实现服务发现到支付闭环。

- 法币与稳定币双轨并行,互补共生。

- x402协议是高频微支付的核心原生轨道。

- 市场影响:催生新的全球商业基础设施核心。

- 时效性标注:长期影响。

Original author: Jacob Zhao

Original source: IOSG Ventures

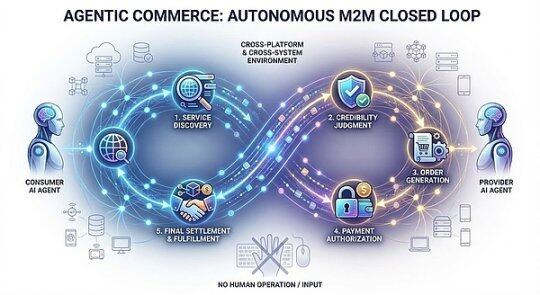

Agentic commerce refers to a business system in which AI agents autonomously complete the entire process of service discovery, trust assessment, order generation, payment authorization, and final settlement. It no longer relies on step-by-step human operation or information input, but rather on intelligent agents automatically collaborating, placing orders, making payments, and fulfilling contracts in a cross-platform and cross-system environment, thereby forming a closed-loop business system (M2M commerce) that is autonomously executed between machines.

In the crypto space, the most practical applications are currently concentrated in stablecoin payments and DeFi. Therefore, in the integration of Crypto and AI, the two most valuable paths are: in the short term, AgentFi, which relies on existing mature DeFi protocols; and in the medium to long term, Agent Payment, which focuses on stablecoin settlement and gradually improves upon protocols such as ACP/AP2/x402/ERC-8004.

In the short term, agentic commerce is limited by factors such as protocol maturity, regulatory differences, and merchant acceptance, making it difficult to scale rapidly. However, in the long run, payment is the underlying anchor of all business loops, and agentic commerce has the greatest long-term value.

Intelligent agent commercial payment system and application scenarios

In the Agentic Commerce system, the real-world merchant network is the greatest value proposition. Regardless of how AI Agents evolve, traditional fiat currency payment systems (Stripe, Visa, Mastercard, bank transfers) and rapidly growing stablecoin systems (USDC, x402) will coexist for a long time, jointly forming the foundation of Agentic Commerce.

Traditional fiat currency payments vs. stablecoin payments: a comparison

Real-world merchants—from e-commerce, subscriptions, and SaaS to travel, paid content, and enterprise procurement—carry trillions of dollars in demand and are the core source of value for AI Agents in automatic price comparison, renewals, and procurement. In the short term, mainstream consumption and enterprise procurement will continue to be dominated by the traditional fiat currency payment system.

The core obstacle preventing stablecoins from scaling in real-world commerce is not technology, but rather regulation (KYC/AML, taxation, consumer protection), merchant accounting (illegal payment of stablecoins), and the lack of dispute resolution mechanisms for irreversible payments. Due to these structural limitations, stablecoins are unlikely to enter highly regulated industries such as healthcare, aviation, e-commerce, government, and utilities in the short term. Their implementation will primarily focus on scenarios with lower regulatory pressure or those native to the blockchain, such as digital content, cross-border payments, Web3 native services, and the machine economy (M2M/IoT/Agent). This is precisely the window of opportunity for Web3 native smart agent commerce to achieve a breakthrough in scale.

However, the institutionalization of regulation is progressing rapidly by 2025: the US stablecoin bill has achieved bipartisan consensus, Hong Kong and Singapore have implemented stablecoin licensing frameworks, the EU's MiCA has officially come into effect, Stripe supports USDC, and PayPal has launched PYUSD. This clarification of the regulatory structure means that stablecoins are being accepted by the mainstream financial system, opening up policy space for future cross-border settlements, B2B procurement, and the machine economy.

Best application scenarios for intelligent agents in business

The core of Agentic Commerce is not about replacing one payment method with another, but rather entrusting the execution of "order placement—authorization—payment" to AI agents, allowing traditional fiat currency payment systems (AP2, authorization credentials, identity compliance) and stablecoin systems (x402, CCTP, smart contract settlement) to each leverage their respective strengths. It is neither a zero-sum competition between fiat currency and stablecoins, nor a replacement narrative for a single payment method, but rather a structural opportunity to simultaneously expand the capabilities of both: fiat currency payments continue to support human commerce, while stablecoin payments accelerate machine-native and on-chain native scenarios, complementing and symbiotically becoming the twin engines of the Agentic Economy.

A panoramic view of the underlying protocol standards for intelligent agents in the business

The protocol stack for Agentic Commerce consists of six layers, forming a complete machine commerce chain from "capability discovery" to "payment delivery". A2A Catalog and MCP Registry are responsible for capability discovery, while ERC-8004 provides on-chain verifiable identity and reputation; ACP and AP2 are responsible for structured order placement and authorization instructions, respectively; the payment layer consists of a traditional fiat currency track (AP2) and a stablecoin track (x402) running in parallel; and there is currently no unified standard for the delivery layer.

- Discovery Layer: This layer addresses how agents discover and understand callable services. The AI side uses the A2A Catalog and MCP Registry to build a standardized capability directory; Web3 relies on ERC-8004 to provide addressable identity guidance. This layer is the entry point for the entire protocol stack.

- Trust Layer: Answers the question "Is the other party trustworthy?" There is currently no universal standard for AI. Web3's key advantage lies in building a unified framework through ERC-8004 that verifies identity, reputation, and execution records.

- Ordering Layer: Responsible for "how orders are expressed and verified". ACP (OpenAI × Stripe) provides a structured description of products, prices, and settlement terms to ensure merchants can fulfill their obligations. Since it is difficult to express real-world business contracts on the blockchain, this layer is mainly dominated by Web2.

- Authorization Layer: Handles whether the Agent has obtained legitimate authorization from the user. AP2 binds intent, confirmation, and payment authorization to the real identity system through verifiable credentials. Web3 signatures do not yet have legal effect and therefore cannot assume contractual and compliance responsibilities at this layer.

- Payment Layer: This layer determines "which payment channel is used to complete the transaction." AP2 covers traditional payment networks such as cards and banks; x402 provides a native API payment interface for stablecoins, allowing assets like USDC to be embedded in automated transactions. The two channels complement each other in this respect.

- Fulfillment Layer: This layer answers the question of "how to securely deliver content after payment." Currently, there is no unified protocol: the real world relies on merchant systems for delivery, and Web3's encrypted access control has not yet formed a cross-ecosystem standard. This layer remains the largest gap in the protocol stack and is also the most likely to give rise to the next generation of foundational protocols.

Detailed Explanation of Key Core Protocols for Intelligent Agent Business

Around the five key aspects of Agentic Commerce—service discovery, trust assessment, structured ordering, payment authorization, and final settlement—organizations such as Google, Anthropic, OpenAI, Stripe, Ethereum, and Coinbase have proposed underlying protocols for their respective aspects, thus jointly building the next-generation Agentic Commerce core protocol stack.

Agent-to-Agent (A2A) – Intelligent Agent Interoperability Protocol (Google)

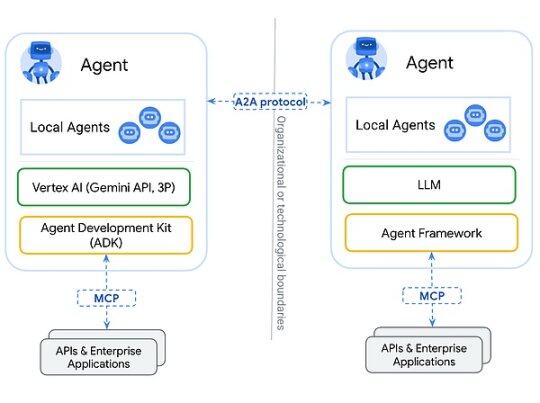

A2A is an open-source license initiated by Google and donated to the Linux Foundation. It aims to provide a unified communication and collaboration standard for AI agents built on different vendors and frameworks. Based on HTTP + JSON-RPC, A2A enables secure and structured message and task exchange, allowing agents to natively conduct multi-turn dialogues, collaborative decision-making, task decomposition, and state management. Its core goal is to build an "Internet of intelligent agents," allowing any A2A-compatible agent to be automatically discovered, invoked, and combined, thereby forming a cross-platform, cross-organizational distributed agent network.

Model Context Protocol (MCP) – Unified Tools Data Access Protocol (Anthropic)

Developed by Anthropic, MCP is an open protocol connecting LLMs/Agents with external systems, focusing on unified tool and data access interfaces. It abstracts databases, file systems, remote APIs, and proprietary tools into standardized resources, enabling agents to securely, controllably, and auditably access external capabilities. MCP's design emphasizes low integration costs and high scalability: developers only need to integrate once to allow agents to use the entire tool ecosystem. Currently, MCP has been adopted by several leading AI companies, becoming the de facto standard for agent-tool interaction.

MCP focuses on "how the agent uses the tool"—providing the model with unified and secure access to external resources (such as databases, APIs, file systems, etc.), thereby standardizing the interaction between agent-tool and agent-data.

A2A addresses the question of "how agents can work together with other agents"—establishing native communication standards for intelligent agents across vendors and frameworks, supporting multi-turn dialogues, task decomposition, state management, and long lifecycle execution, and serving as the basic interoperability layer between intelligent agents.

Agentic Commerce Protocol (ACP) – Order Placement and Checkout Protocol (OpenAI × Stripe)

ACP (Agentic Commerce Protocol) is an open ordering standard (Apache 2.0) proposed by OpenAI and Stripe. It establishes a structured ordering process that can be directly understood by machines, connecting buyers, AI agents, and merchants. The protocol covers product information, price and terms verification, settlement logic, and payment voucher transmission, enabling AI to securely initiate purchases on behalf of users without becoming a merchant.

Its core design is that AI calls the merchant's checkout interface in a standardized way, while the merchant retains full commercial and legal control. ACP enables merchants to enter the AI shopping ecosystem without modifying their systems through structured orders (JSON Schema / OpenAPI), secure payment tokens (Stripe Shared Payment Token), compatibility with existing e-commerce backends, and support for REST and MCP publishing capabilities. Currently, ACP is used in ChatGPT Instant Checkout, becoming an early-deployable payment infrastructure.

Agent Payments Protocol (AP2) – Digital Authorization and Payment Instruction Protocol (Google)

AP2 is an open standard jointly launched by Google and several payment networks and technology companies. It aims to establish a unified, compliant, and auditable process for AI agent-led payments. It binds a user's payment intent, authorization scope, and compliant identity through cryptographically signed digital authorization credentials, providing merchants, payment institutions, and regulators with verifiable evidence of "who is spending money for whom."

AP2 is designed with "Payment-Agnostic" principles, supporting credit cards, bank transfers, real-time payments, and access to crypto payment channels such as stablecoins via extensions like x402. Within the entire Agentic Commerce protocol stack, AP2 does not handle specific product or order details; instead, it provides a universal Agent payment authorization framework for various payment channels.

ERC-8004 – On-Chain Agent Identity/Reputation/Verification Standard (Ethereum)

ERC-8004 is an Ethereum standard jointly proposed by MetaMask, the Ethereum Foundation, Google, and Coinbase. It aims to build a cross-platform, verifiable, and trustless identity and reputation system for AI agents. The protocol consists of three on-chain parts:

- Identity Registry: Casts an on-chain identity similar to an NFT for each Agent, which can be linked to cross-platform information such as MCP/A2A endpoints, ENS/DID, and wallets.

- Reputation Registry: Standardizes the recording of scores, feedback, and behavioral signals, making the agent's historical performance auditable, aggregateable, and composable.

- Validation Registry: Supports validation mechanisms such as stake re-execution, zkML, and TEE, providing verifiable execution records for high-value tasks.

Through ERC-8004, the identity, reputation, and behavior of agents are stored on-chain, forming a cross-platform, discoverable, tamper-proof, and verifiable trust foundation. This is a crucial infrastructure for Web3 to build an open and trustworthy AI economy. ERC-8004 is currently in the review stage, meaning the standard is basically stable and feasible, but it is still widely soliciting community opinions and has not yet been finalized.

x402 – Stablecoin Native API Payment Track (Coinbase)

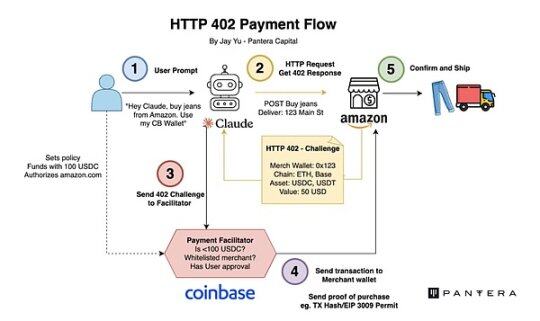

x402 is an open payment standard (Apache-2.0) proposed by Coinbase. It transforms the long-dormant HTTP 402 Payment Required into a programmable on-chain payment handshake mechanism, enabling APIs and AI Agents to achieve accountless, frictionless, and on-demand on-chain settlements without the need for accounts, credit cards, or API keys.

▲ Legend: HTTP 402 Payment Workflow

Source: Jay Yu@Pantera Capital

Core mechanism: The x402 protocol revives the HTTP 402 status code, a legacy of the early internet. Its workflow is as follows:

- Request and Negotiation: The client (Agent) initiates a request -> The server returns a 402 status code and payment parameters (such as amount and receiving address).

- Self-service payments: Agents sign and broadcast transactions locally (usually using stablecoins such as USDC) without human intervention.

- Verification and Delivery: After the server or a third-party "Facilitator" verifies the on-chain transaction, resources are released immediately.

x402 introduces the Facilitator role, serving as middleware connecting the Web2 API and the Web3 settlement layer. The Facilitator handles complex on-chain verification and settlement logic, enabling traditional developers to monetize APIs with minimal code. Servers do not need to run nodes, manage signatures, or broadcast transactions; they only need to rely on the interfaces provided by the Facilitator to complete on-chain payment processing. The most mature Facilitator implementation is currently provided by the Coinbase Developer Platform.

The technical advantages of x402 are: it supports on-chain micropayments as low as 1 cent, breaking through the limitations of traditional payment gateways in AI scenarios that cannot handle high-frequency, small-amount calls; it completely removes accounts, KYC, and API keys, enabling AI to autonomously complete the M2M payment loop; and it achieves gas-free USDC authorized payments through EIP-3009, is natively compatible with Base and Solana, and has multi-chain scalability.

Based on the introduction of Agentic Commerce's core protocol stack, the table below summarizes the protocol's positioning, core capabilities, main limitations, and maturity assessment at each level, providing a clear, structured perspective for building a cross-platform, executable, and payable agent economy.

Representative projects in the Web3 intelligent agent business ecosystem

The current Web3 ecosystem for agentic commerce can be divided into three layers:

- The business payment system layer (L3), including projects such as Skyfire, Payman, Catena Labs, and Nevermined, provides payment encapsulation, SDK integration, credit limit and permission governance, human approval and compliance access, and connects to traditional financial tracks (banks, card organizations, PSPs, KYC/KYB) to varying degrees, building a bridge between payment business and the machine economy.

- The native payment protocol layer (L2), comprised of protocols such as x402 and Virtual ACP, along with their ecosystem projects, is responsible for fee requests, payment verification, and on-chain settlement. It is the core of the current agent economy, enabling true automation and end-to-end clearing. x402 is completely independent of banks, card organizations, and payment service providers, providing native on-chain M2M/A2A payment capabilities.

- The infrastructure layer (L1), including Ethereum, Base, Solana, and Kite AI, provides a trusted foundation for the payment and identity system, including an on-chain execution environment, key system, MPC/AA, and permission runtime.

L3 Business Payment System Layer - Skyfire: AI Agent's Identity and Payment Credentials

Skyfire, centered around KYA + Pay, abstracts "identity verification + payment authorization" into AI-usable JWT credentials, providing verifiable automated access and billing capabilities for websites, APIs, and MCP services. The system automatically generates Buyer/Seller Agents and escrow wallets for users, supporting card, bank, and USDC top-ups.

At the system level, Skyfire generates a Buyer/Seller Agent and a managed wallet for each user, supporting balance top-ups via cards, banks, and USDC. Its biggest advantage is full compatibility with Web2 (JWT/JWKS, WAF, and API Gateway can be used directly), providing "identified, automatically paid access" for content websites, data APIs, and utility SaaS.

Skyfire is a real-world, usable intermediary layer for Agent Payment, but identity and asset custody are centralized solutions.

L3 Business Payment System Layer - Payman: AI-Powered Native Fund Access Risk Control

Payman provides four capabilities: Wallet, Payee, Policy, and Approval, building a governable and auditable "funds permission layer" for AI. AI can execute real payments, but all financial actions must meet user-defined limits, policies, and approval rules. Core interactions are completed through the payman.ask() natural language interface, where the system is responsible for parsing intent, verifying policies, and executing payments.

Payman's key value lies in the principle that "AI can manage money, but it will never overstep its authority." It migrates enterprise-level financial governance to an AI environment: automated payroll, expense reimbursements, supplier payments, and batch transfers can all be completed within clearly defined permission boundaries. Payman is suitable for internal financial automation (payroll, expense reimbursements, supplier payments, etc.) within enterprises and teams. It is positioned as a controlled financial governance layer and does not attempt to build an open agent-to-agent payment protocol.

L3 Business Payment System Layer - Catena Labs: Agent Identity/Payment Standards

Catena uses AI-native financial institutions (custody, clearing, risk control, KYA) as its business layer and ACK (Agent Commerce Kit) as its standard layer to build a unified identity protocol (ACK-ID) for agents and an agent-native payment protocol (ACK-Pay). Its goal is to fill the gaps in the machine economy by providing verifiable identities, authorization chains, and automated payment standards.

ACK-ID establishes the ownership and authorization chain of agents based on DID/VC; ACK-Pay defines payment requests and verifiable receipt formats decoupled from the underlying settlement network (USDC, banks, Arc). Catena emphasizes long-term cross-ecosystem interoperability, and its role is closer to the "TLS/EMV layer of the agent economy," with a high degree of standardization and a clear vision.

L3 Business Payment System Layer - Nevermined: Metering, Billing, and Micropayment Settlement

Nevermined focuses on an AI-driven usage-based economic model, providing Access Control, Metering, Credits System, and Usage Logs for automated metering, pay-per-use billing, revenue sharing, and auditing. Users can top up credits via Stripe or USDC, and the system automatically verifies usage, deducts fees, and generates auditable logs with each API call.

Its core value lies in supporting real-time micropayments and agent-to-agent automated settlement for sub-cent users, enabling data purchases, API calls, workflow scheduling, and more to operate on a "pay-per-use" basis. Nevermined doesn't build a new payment track, but rather a metering/billing layer on top of payments: in the short term, it drives the commercialization of AI SaaS; in the medium term, it supports the A2A marketplace; and in the long term, it may become the micropayment fabric for the machine economy.

Skyfire, Payman, Catena Labs, and Nevermined belong to the business payment layer and all need to connect with banks, card organizations, PSPs, and KYC/KYB to varying degrees. However, their real value lies not in "accessing fiat currency," but in solving machine-native needs that traditional finance cannot cover—identity mapping, permission governance, programmatic risk control, and pay-per-use billing.

- Skyfire (Payment Gateway): Provides websites/APIs with "identity + automatic deduction" (on-chain identity mapping to Web2 identity).

- Payman (Financial Governance): Strategies, limits, permissions, and approvals for internal enterprise use (AI can spend money but not overstep its authority).

- Catena Labs (Financial Infrastructure): Integrating with the banking system, building an (AI-compliant bank) through KYA, custody, and clearing services.

- Nevermined (Cashier): Only performs metering and billing above payments; payments rely on Stripe/USDC.

In contrast, x402 operates at a lower level and is the only native on-chain payment protocol that does not rely on banks, card organizations, or PSPs. It can directly complete on-chain deductions and settlements through the 402 workflow. When upper-layer systems such as Skyfire, Payman, and Nevermined can call x402 as a settlement track, it provides agents with a truly automated native payment closed loop for M2M/A2A transactions.

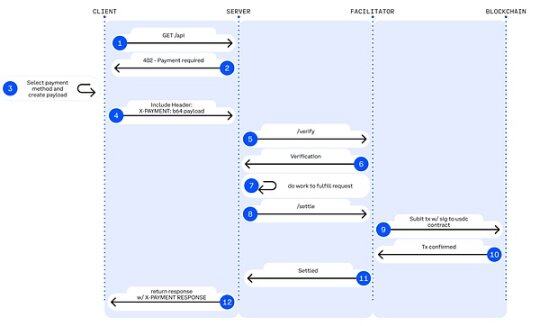

L2 Native Payment Protocol Layer - x402 Ecosystem: From Client to On-Chain Settlement

The x402 native payment ecosystem can be divided into four layers: Client, Server, Payment Execution Layer, and Blockchain Settlement Layer. The Client is responsible for enabling Agents or applications to initiate payment requests; the Server provides Agents with API services such as data, inference, or storage on a per-transaction basis; the Payment Execution Layer completes on-chain deductions, verification, and settlement, serving as the core execution engine of the entire process; and the Blockchain Settlement Layer handles the final token deductions and on-chain confirmation, ensuring tamper-proof payment implementation.

▲ Legend: X402 Payment Flow

Source: x402 White Paper

Client-Side Integrations (The Payers)

Enabling an agent or application to initiate an x402 payment request is the "starting point" of the entire payment process. Representative projects:

- The thirdweb Client SDK is the most commonly used x402 client standard in the ecosystem. It is actively maintained, supports multiple chains, and is the default tool for developers to integrate x402.

- Nuwa AI – Enables AI to directly access x402 services for a fee without coding; a representative project of "Agent Paid Access".

- The official website also lists Axios/Fetch, Mogami Java SDK, Tweazy, etc. as early clients.

Currently, existing clients are still in the "SDK era," essentially developer tools. More advanced clients, such as browser/OS clients, robot/IoT clients, enterprise systems, or those capable of managing multiple wallets/facilitators, have not yet emerged.

Server-side/API Sellers (Services / Endpoints / The Sellers)

Selling data, storage, or inference services to agents on a per-use basis; some representative examples include:

- AIsa provides API calls and settlement infrastructure for real-world AI Agents, enabling them to access data, content, computing power, and third-party services by call, token, or quantity. Currently, x402 has the highest call volume.

- Firecrawl – the most frequently consumed web page parsing and structured web crawling entry point for AI Agents.

- Pinata – a mainstream Web3 storage infrastructure, x402 already covers the real underlying storage costs of non-lightweight APIs.

- Gloria AI – a source of intelligence for trading and analytical agents, providing high-frequency real-time news and structured market signals.

- AEON – Expanding x402 + USDC to offline merchant acquiring in Southeast Asia/Latin America/Africa.

- Neynar—Farcaster's social graph infrastructure—exposes social data to agents via x402 redirects.

Currently, the server-side focuses on crawling/storage/news APIs, while higher-level key layers such as financial transaction execution APIs, advertising APIs, Web2 SaaS gateways, and even APIs for executing real-world tasks are almost undeveloped, representing the most promising growth curve in the future.

Payment Execution Layer (Facilitators / The Processors)

The core execution engine of x402 is responsible for completing on-chain deductions, verifications, and settlements. Representative projects include:

- Coinbase Facilitator (CDP) – an enterprise-grade trusted executor with zero fees on the Base mainnet and built-in OFAC/KYT, is the strongest choice for production environments.

- PayAI Facilitator – the execution layer project with the widest multi-chain coverage and fastest growth (Solana, Polygon, Base, Avalanche, etc.) – is the most widely used multi-chain facilitator in the ecosystem.

- Daydreams—a high-scenario project that combines payment execution with LLM inference routing—is currently the fastest-growing "AI inference payment executor" and is becoming the third pillar of the x402 ecosystem.

According to x402scan's data over the past 30 days, there is also a group of mid-to-long-tail Facilitators/Routers, including Dexter, Virtuals Protocol, OpenX402, CodeNut, Heurist, Thirdweb, x402.rs, Mogami, Questflow, etc., whose overall transaction volume, number of sellers, and number of buyers are significantly lower than the top three.

Blockchain Settlement Layer

The x402 payment workflow is the final point of contact, responsible for completing the actual token deduction and on-chain confirmation. Although the x402 protocol itself is Chain-Agnostic, current ecosystem data shows that settlements are primarily concentrated on two networks:

- Base – Promoted by the official CDP Facilitator, native to USDC, with stable fees, it is currently the settlement network with the largest trading volume and number of sellers.

- Solana, heavily supported by multi-chain facilitators such as PayAI, is experiencing the fastest growth in high-frequency inference and real-time API scenarios thanks to its high throughput and low latency.

The chain itself does not participate in the payment logic. As more Facilitators are added, the settlement layer of x402 will exhibit a stronger trend towards multi-chain integration.

In the x402 payment system, the Facilitator is the only role that truly executes on-chain payments, and is closest to "protocol-level revenue": it is responsible for verifying payment authorization, submitting and tracking on-chain transactions, generating auditable settlement proofs, and handling replay, timeout, multi-chain compatibility, and basic compliance checks. Unlike the Client SDK (Payers) and API server (Sellers) that only handle HTTP requests, it is the final clearing outlet for all M2M/A2A transactions, controlling the traffic entry point and settlement fee rights. Therefore, it is at the core of value capture in the Agent economy and receives the most market attention.

However, in reality, most projects remain in the testnet or small-scale demo stage, essentially just lightweight "payment executors." They lack competitive advantages in key capabilities such as identity verification, billing, risk control, and multi-chain stability processing, exhibiting clear characteristics of low barriers to entry and high homogeneity. As the ecosystem matures, Facilitator will likely see a winner-takes-all scenario: leading institutions with stability and compliance advantages (such as Coinbase) will have a significant lead. In the long run, x402 remains at the interface layer and cannot carry core value. The truly sustainable competitive advantage lies in comprehensive platforms that can build identity, billing, risk control, and compliance systems on top of settlement capabilities.

L2 Native Payment Protocol Layer - Virtual Agent Commerce Protocol

Virtual's Agent Commerce Protocol (ACP) provides a universal standard for business interactions for autonomous AI. Through a four-stage process—Request → Negotiation → Transaction → Evaluation—it enables independent intelligent agents to securely and verifiably request services, negotiate terms, complete transactions, and undergo quality assessments. ACP uses blockchain as a trusted execution layer to ensure the interaction process is auditable and tamper-proof. By introducing Evaluator Agents, it establishes an incentive-driven reputation system, enabling heterogeneous and independent professional agents to form "autonomous business entities" and conduct sustainable economic activities without centralized coordination. Currently, ACP is still in its early stages, with a limited ecosystem, and is more like an exploration of "multi-agent business interaction standards."

L1 Infrastructure Layer - Kite AI: Emerging/Vertical Agent Native Payment Chain

Ethereum, Base (EVM), Solana and other mainstream general-purpose public blockchains provide the Agent with the core execution environment, account system, state machine, security and settlement foundation, and have mature account models, stablecoin ecosystem and a broad developer base.

Kite AI is a representative "Agent-native L1" infrastructure, designed specifically for the underlying execution environment of payments, identity, and permissions for intelligent agents. Its core is based on the SPACE framework (stablecoin-native, programmable constraints, agent-priority authentication, compliance auditing, and economically feasible micropayments), and achieves fine-grained risk isolation through a three-layer key system of Root→Agent→Session. Combined with optimized state channels to build an "Agent-native payment railway," it reduces costs to $0.000001 and controls latency to the hundreds of milliseconds, making API-level high-frequency micropayments feasible. As a general execution layer, Kite is backward compatible with x402, Google A2A, and Anthropic MCP, and backward compatible with OAuth 2.1, aiming to become a unified agent payment and identity foundation connecting Web2 and Web3.

AIsaNet integrates x402 and L402 (a 402 payment protocol standard developed by Lightning Labs based on the Lightning Network) protocols as a micro-payment and settlement layer for AI Agents. It supports high-frequency transactions, cross-protocol call coordination, settlement path selection, and transaction routing, enabling Agents to complete cross-service and cross-chain automatic payments without understanding the underlying complexity.

Summary and Outlook: From Payment Agreements to the Restructuring of the Machine Economy

Agentic Commerce is the establishment of a completely new economic order dominated by machines. It is not as simple as "AI automatically placing orders," but a reconstruction of an entire cross-entity chain: how services are discovered, how trust is established, how orders are expressed, how permissions are authorized, how value is settled, and who bears the responsibility for disputes. The emergence of A2A, MCP, ACP, AP2, ERC-8004, and x402 standardizes the "closed loop of commerce between machines."

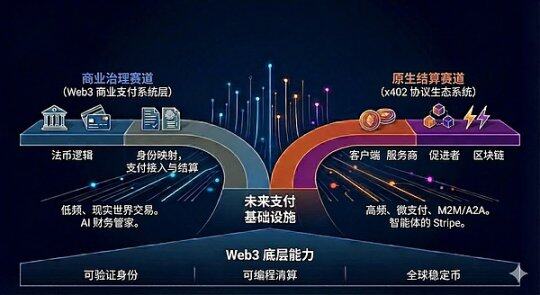

Along this evolutionary path, future payment infrastructure will diverge into two parallel tracks: one based on traditional fiat currency logic for business governance, and the other based on the native settlement mechanism of the x402 protocol. The value capture logics of these two tracks differ.

Business Governance Track: Web3 Business Payment System Layer

Applicable scenarios: Low-frequency, non-micro-payment real-world transactions (such as procurement, SaaS subscriptions, physical e-commerce).

Core logic: Traditional fiat currency will dominate in the long term; agents are merely smarter front-end and process coordinators, not replacements for Stripe/card organizations/bank transfers. The major obstacles for stablecoins to enter the real-world business world on a large scale are regulation and taxation.

The value of projects like Skyfire, Payman, and Catena Labs lies not in the underlying payment routing (usually handled by Stripe/Circle), but in their governance-as-a-Service (GAS) services. This addresses machine-native needs that traditional finance cannot cover—identity mapping, access control, programmatic risk management, accountability, and M2M/A2A micropayments (settled per token/second). The key is who can become a trusted AI financial manager for businesses.

Native Settlement Track: The x402 Protocol Ecosystem and the Endgame of Facilitator

Applicable scenarios: High-frequency, micro-payment, M2M/A2A digital native transactions (API billing, resource flow payment).

Core logic: As an open standard, x402 (L402) achieves atomic binding of payments and resources through the HTTP 402 status code. In programmable micropayments and M2M/A2A scenarios, x402 is currently the protocol with the most complete ecosystem and the most advanced implementation (native HTTP + on-chain settlement), and its position in the agent economy is expected to be comparable to 'Stripe for agents'.

Simply integrating x402 on the client or service side does not bring a premium to the market; the real growth potential lies in upper-layer assets that can accumulate long-term repeat purchases and high-frequency calls, such as OS-level agent clients, robot/IoT wallets, and high-value API services (market data, GPU inference, real-world task execution, etc.).

Facilitators act as protocol gateways, assisting clients and servers in completing payment handshakes, invoice generation, and fund clearing. They control both traffic and settlement fees, making them the closest link to "revenue" in the x402 stack. Most facilitators are essentially just "payment executors," exhibiting clear low barriers to entry and homogeneous characteristics. Giants with usability and compliance advantages (such as Coinbase) dominate the market. The core value to avoid marginalization will shift to the "Facilitator + X" service layer: by building a verifiable service catalog and reputation system, providing high-margin capabilities such as arbitration, risk control, and vault management.

We believe the future will see a dual-track system: fiat currency and stablecoin. The former will support mainstream human commerce, while the latter will facilitate high-frequency, cross-border, and micro-payment scenarios native to machines and on-chain. Web3's role is not to replace traditional payments, but to provide the underlying capabilities for the Agent era: verifiable identity, programmable clearing, and global stablecoins. Ultimately, Agentic Commerce will not be limited to payment optimization, but will represent a restructuring of the machine-based economic order. When billions of micro-transactions are automatically completed by agents in the background, the protocols and companies that first provide trust, coordination, and optimization capabilities will become the core force of the next generation of global commercial infrastructure.