CoinW Research Institute Weekly Report (December 8, 2025 - December 14, 2025)

- 核心观点:加密货币市场本周整体微涨,但情绪恐慌。

- 关键要素:

- 加密货币总市值增长2.2%至3.22万亿美元。

- 恐慌指数为17,处于极度恐慌状态。

- 公链表现分化,Sui活跃度大增,Ton TVL暴跌。

- 市场影响:市场情绪与资金流向背离,需关注结构性机会。

- 时效性标注:短期影响。

Key points

The global cryptocurrency market capitalization reached $3.22 trillion, up 2.2% from $3.15 trillion last week. As of press time, the total net inflow into US Bitcoin ETFs was approximately $57.9 billion, with a net inflow of $286 million this week; the total net inflow into US Ethereum ETFs was approximately $13.09 billion, with a net inflow of $208 million this week.

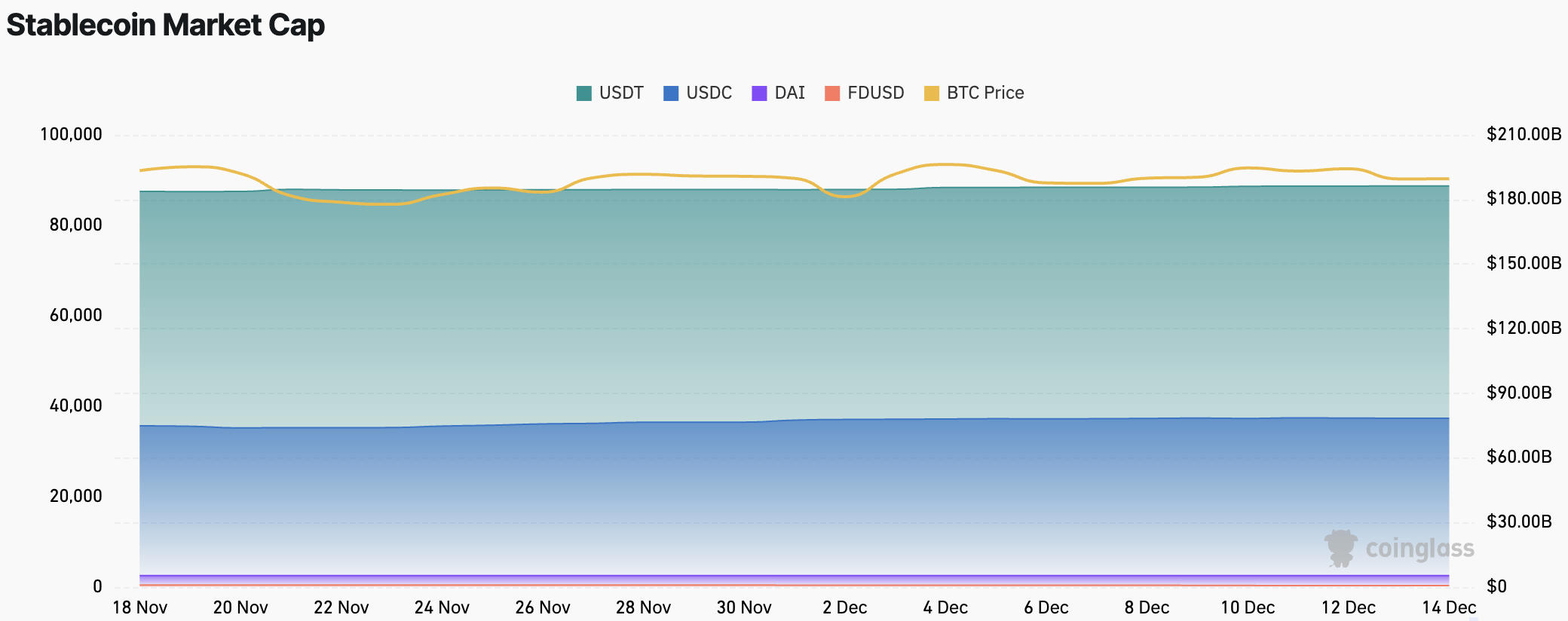

The total market capitalization of stablecoins is $310 billion, of which USDT accounts for $186.2 billion, or 60.06% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $78.4 billion, accounting for 25.29% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.73% of the total stablecoin market capitalization.

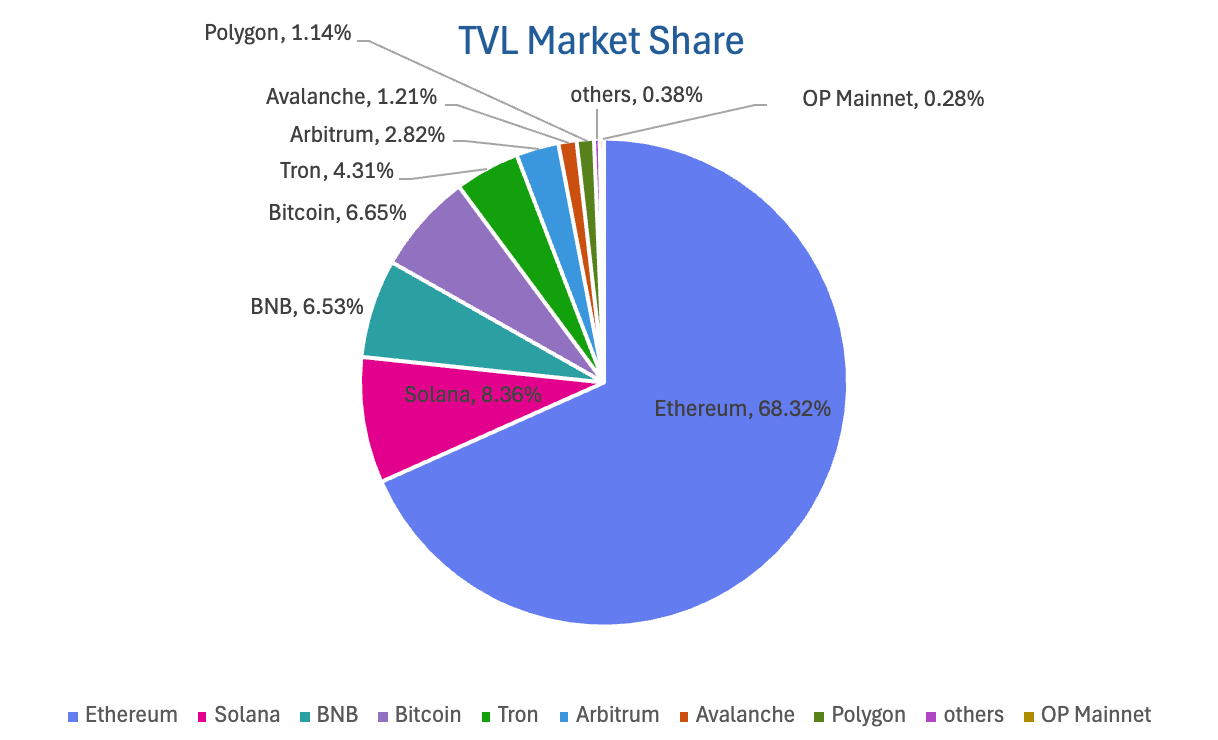

According to DeFiLlama data, the total TVL (TVL) of DeFi this week was $121.4 billion, an increase of approximately 0.49% from $120.8 billion last week. Breaking it down by public blockchain, the three blockchains with the highest TVL are Ethereum (68.32%), Solana (8.36%), and BNB Chain (6.53%).

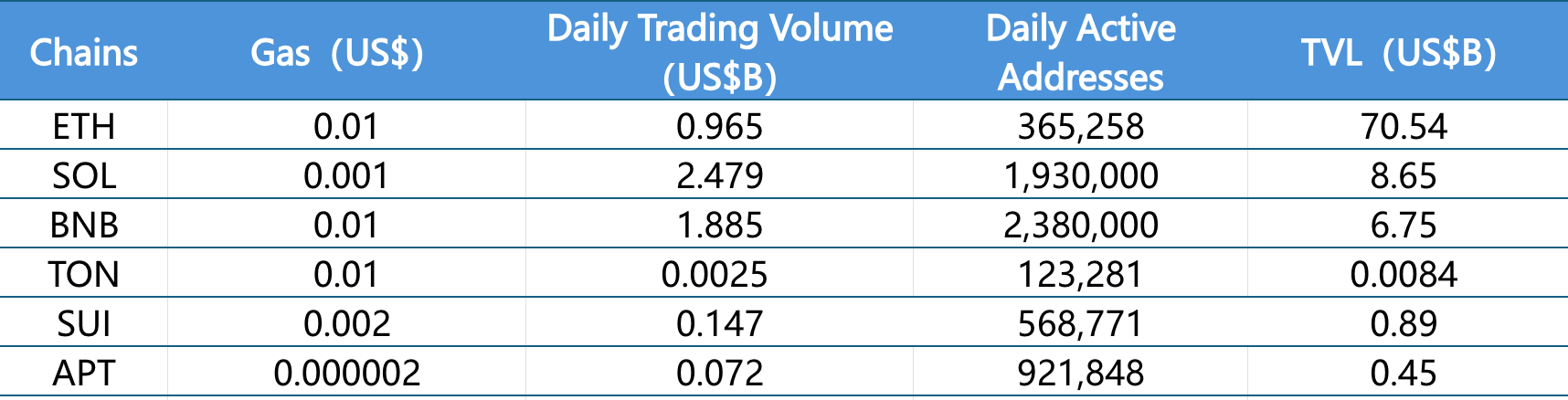

This week, key metrics for public blockchains showed significant divergence: In terms of daily trading volume, Ethereum and Solana fell by 3.5% and 19.25% respectively, while Sui saw a significant increase of 47%, followed by Ton with a 25% rise; BNB Chain and Aptos saw slight increases of 3.01% and 2.86% respectively; transaction fees generally weakened, with Ethereum, BNB Chain, and Ton remaining largely unchanged, while Solana, Sui, and Aptos decreased by 42.94%, 17.63%, and 13.38% respectively. Regarding daily active addresses, only Aptos declined by 22.81%, while all other public blockchains saw growth, with Sui experiencing the highest increase at 49.28%, followed by Ethereum, BNB Chain, and Ton with increases of 7.7%, 9.68%, and 12.17% respectively. TVL performance was weak, with only Ethereum showing a slight increase of 0.75%, while Ton plummeted by 90.67%, and other public chains all experienced a decline of around 1%–4%.

New Projects to Watch: AllScale is a stablecoin "self-custodial" neobank/payment infrastructure platform aiming to help global creators, SMBs, freelancers, and cross-border teams achieve "fast receipt and dispatch of payments" with stablecoins for payments, invoicing, social e-commerce, and cross-border payroll, even without bank accounts. Goblin Finance is a DeFi "yield infrastructure" platform built specifically for the Aptos ecosystem. Through automated liquidity management (ALM), cross-market strategies, delta-neutral, and LST-enhanced products, it automatically channels user funds into the best-performing on-chain or cross-chain strategies, maximizing returns and providing deep liquidity support for Aptos. Magma Finance is a next-generation decentralized exchange (DEX) and liquidity infrastructure platform built on the Sui/Move ecosystem.

Table of contents

Key points

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

2. Fear Index

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD exchange rates

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance Status

II. Hot Money Flows This Week

1. The top five gainers this week: VC Coin and Meme Coin

2. New Project Insights

III. New Industry Trends

1. Major Industry Events This Week

2. Major events that will happen next week

3. Key Investment and Financing Activities Last Week

IV. Reference Links

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

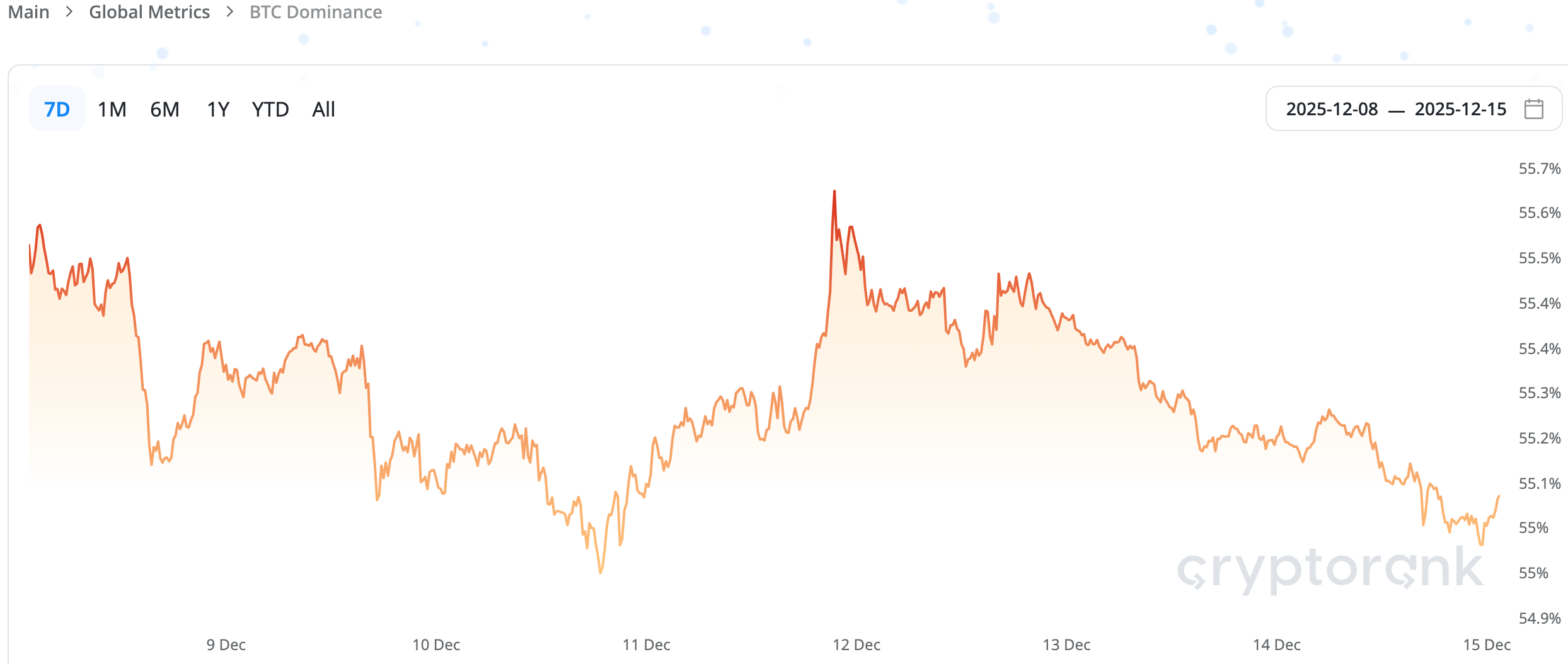

The global cryptocurrency market capitalization is $3.22 trillion, up 2.2% from $3.15 trillion last week.

Data source: cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of December 14, 2025

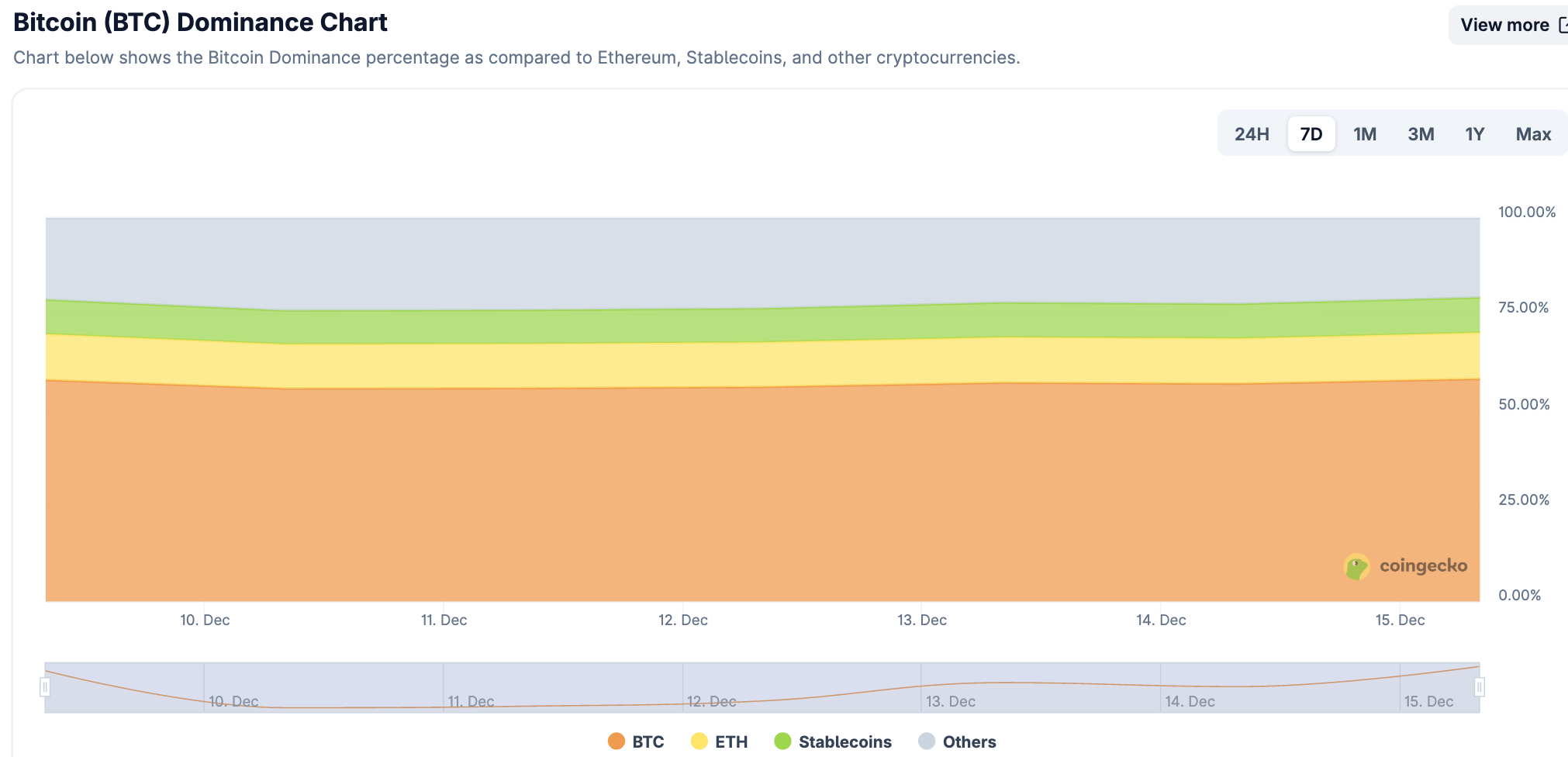

As of press time, Bitcoin 's market capitalization was $1.76 trillion, accounting for 54.6% of the total cryptocurrency market capitalization. Meanwhile, stablecoins had a market capitalization of $310 billion, representing 9.63% of the total cryptocurrency market capitalization.

Data source: coingeck, https://www.coingecko.com/en/charts

Data as of December 14, 2025

2. Fear Index

The cryptocurrency fear index is 17, indicating extreme fear.

Data source: coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of December 14, 2025

3. ETF Inflow and Outflow Data

As of press time, the total net inflow into US Bitcoin spot ETFs is approximately $57.9 billion, with a net inflow of $286 million this week; the total net inflow into US Ethereum spot ETFs is approximately $13.09 billion, with a net inflow of $208 million this week.

Data source: sosovalue, https://sosovalue.com/zh/assets/etf

Data as of December 14, 2025

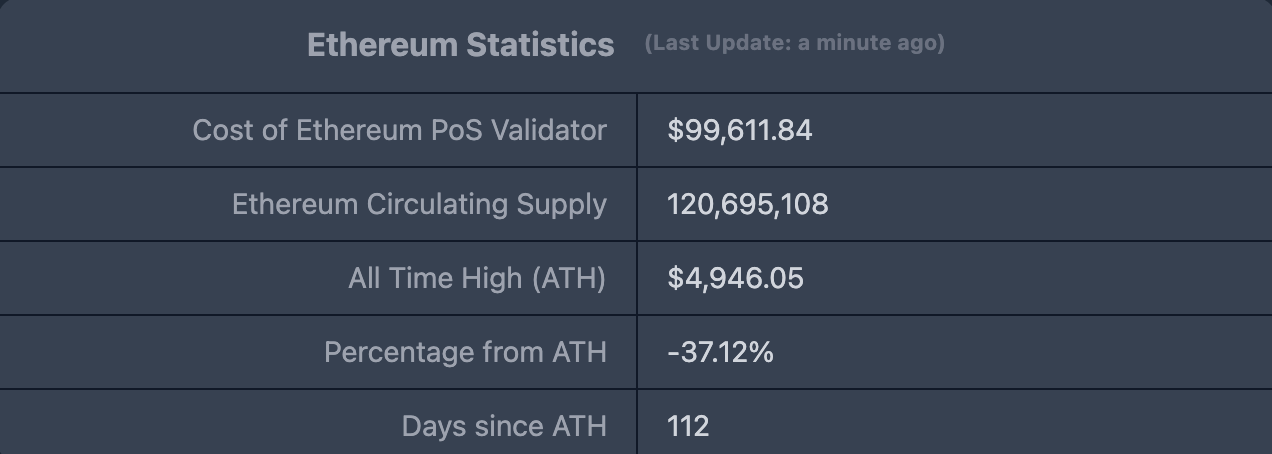

4. ETH/BTC and ETH/USD exchange rates

ETHUSD: Current price $3,114.30, all-time high $4,878.26, down approximately 37.12% from the high.

ETHBTC: Currently at 0.034881, with an all-time high of 0.1238.

Data source: ratiogang, https://ratiogang.com/

Data as of December 14, 2025

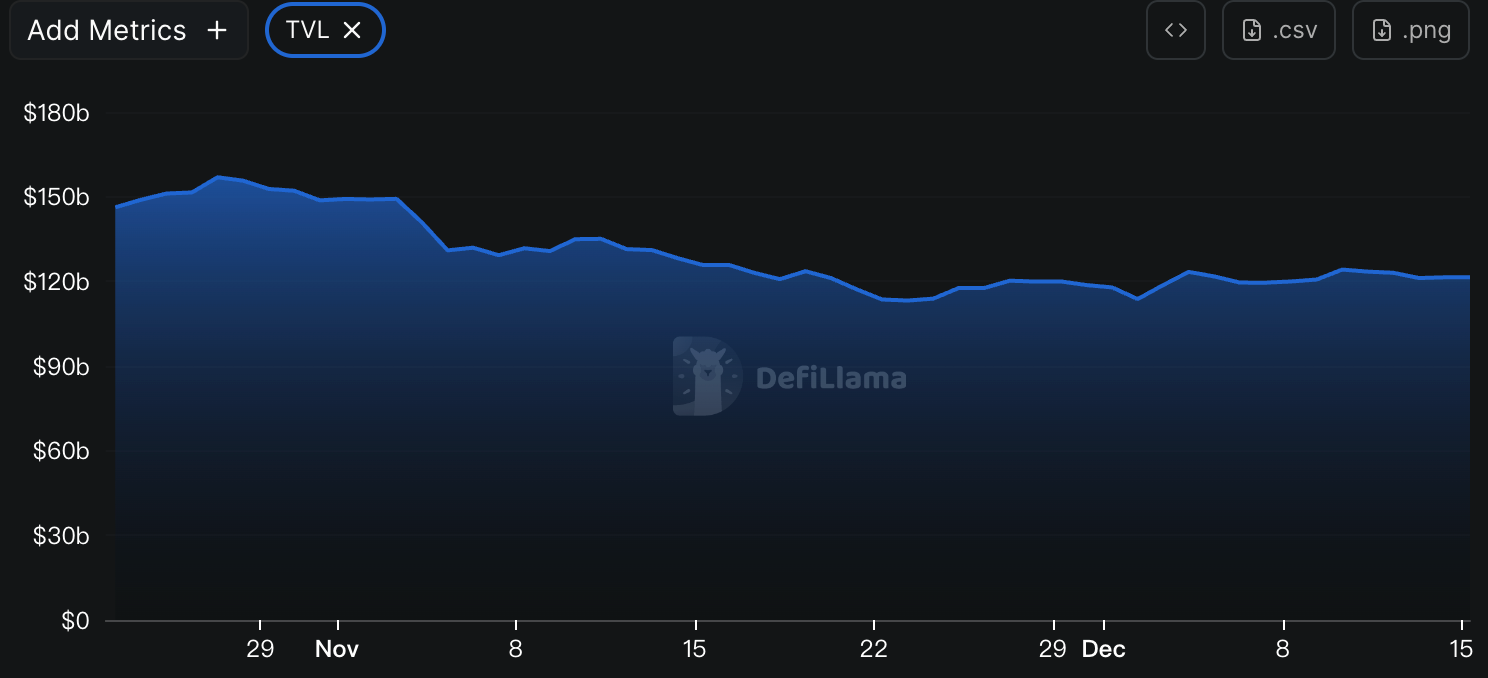

5.Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL of DeFi this week was $121.4 billion, up approximately 0.49% from $120.8 billion last week.

Data source: defillama, https://defillama.com

Data as of December 14, 2025

Based on public blockchains, the three public blockchains with the highest TVL are Ethereum (68.32%), Solana (8.36%), and BNB Chain (6.53%).

Data source: CoinW Research Institute, defillama, https://defillama.com

Data as of December 14, 2025

6. On-chain data

Layer 1 related data

The analysis primarily focuses on daily transaction volume, daily active addresses, and transaction fees, covering the main Layer 1 cryptocurrencies including ETH, SOL, BNB, TON, SUI, and APTOS.

Data source: CoinW Research Institute, defillama, https://defillama.com

Data as of December 14, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core metrics for measuring public chain activity and user experience. In terms of daily trading volume, Ethereum and Solana saw declines of 3.5% and 19.25% respectively this week; the Sui chain saw the largest increase at 47%, followed by Ton at 25%; BNB Chain and Aptos saw slight increases of 3.01% and 2.86% respectively. Regarding transaction fees, Ethereum, BNB Chain, and Ton Chain remained unchanged this week compared to last week; Solana, Sui, and Aptos decreased by 42.94%, 17.63%, and 13.38% respectively.

Daily Active Addresses and TVL: Daily active addresses reflect a public chain's ecosystem participation and user stickiness, while TVL reflects users' trust in the platform. Regarding daily active addresses, only Aptos saw a decrease of 22.81% this week, while all other chains saw increases. Sui chain saw the largest increase at 49.28%; Ethereum, BNB Chain, and Ton increased by 7.7%, 9.68%, and 12.17% respectively; Solana chain saw a slight increase of 0.52%. As for TVL, only Ethereum saw a slight increase of 0.75% this week; Ton chain saw the most significant decrease, dropping by 90.67%; all other chains saw slight decreases, namely Solana (-1.77%), BNB Chain (-2.19%), Sui (-3.98%), and Aptos (-4.26%).

Layer 2 related data

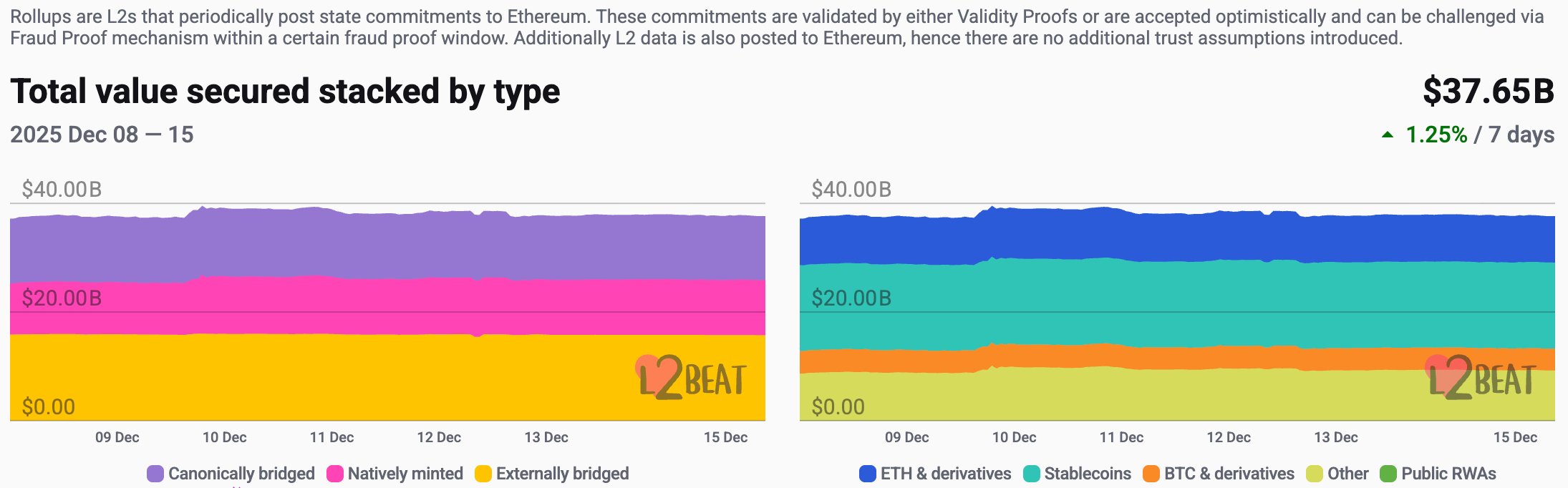

According to L2Beat data, the total TVL of Ethereum Layer 2 is $37.65 billion, a 1.4% increase this week compared to last week ($37.17 billion).

Data source: L2Beat, https://l2beat.com/scaling/tvs

Data as of December 14, 2025

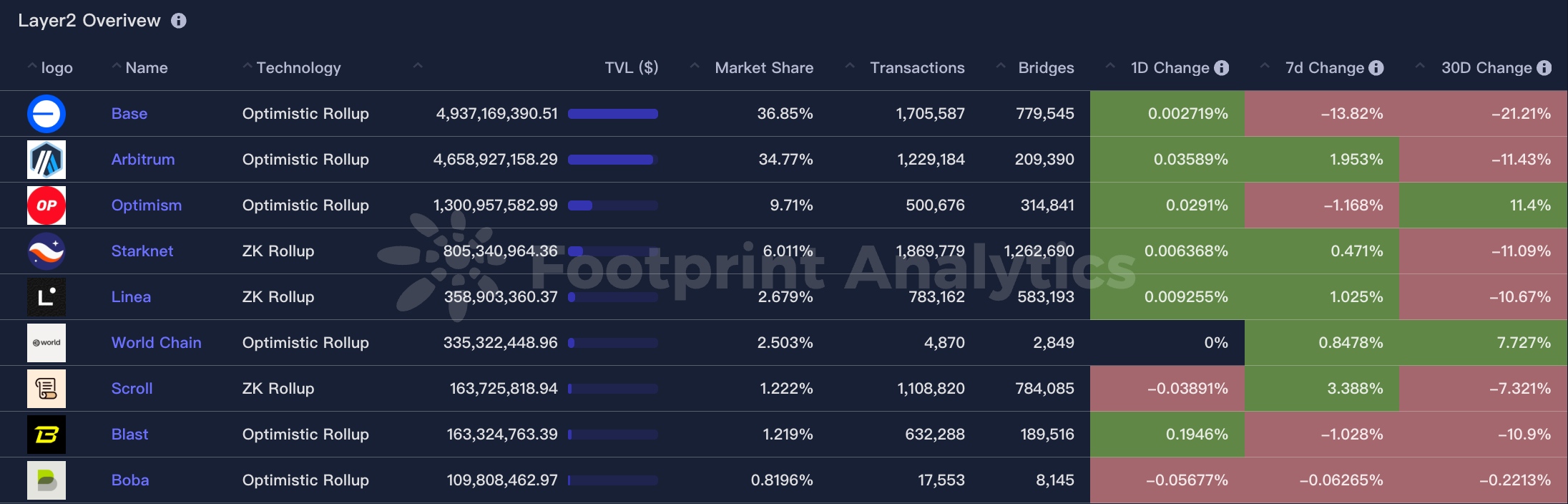

Base and Arbitrum occupy the top positions with market shares of 36.85% and 34.77% respectively. Base's market share has declined in the past week, while Arbitrum's has risen slightly.

Data source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of December 14, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market capitalization of stablecoins is $310 billion, of which USDT has a market capitalization of $186.2 billion, accounting for 60.06% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $78.4 billion, accounting for 25.29% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.73% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of December 14, 2025

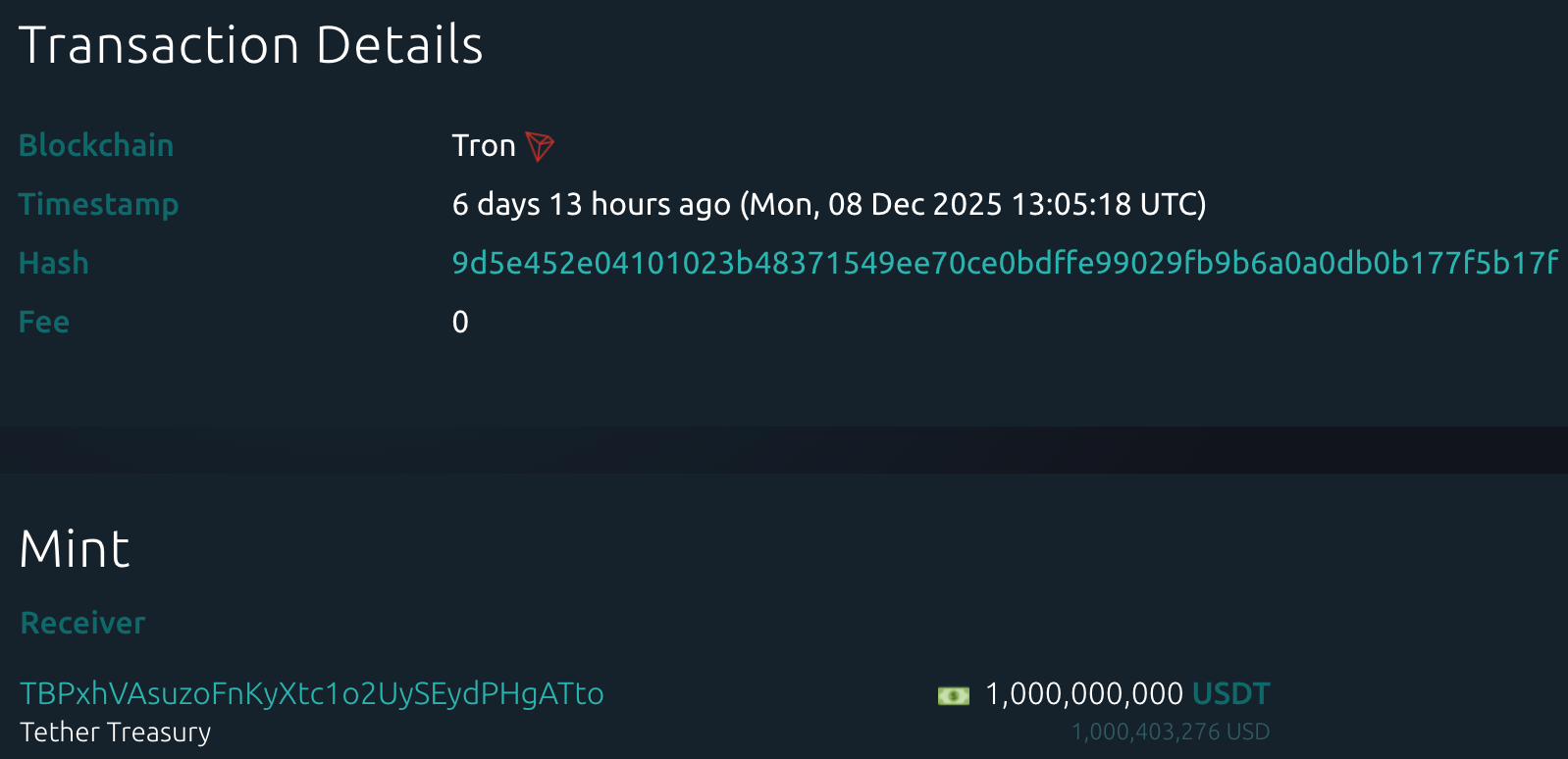

According to Whale Alert data, the USDC Treasury issued a total of 2.667 billion USDC this week, while the Tether Treasury issued a total of 1 billion USDT. The total stablecoin issuance this week was 3.667 billion, a 7.28% decrease compared to last week's total issuance (3.955 billion).

Data source: Whale Alert, https://x.com/whale_alert

Data as of December 14, 2025

II. Hot Money Flows This Week

1. The top five gainers this week: VC Coin and Meme Coin

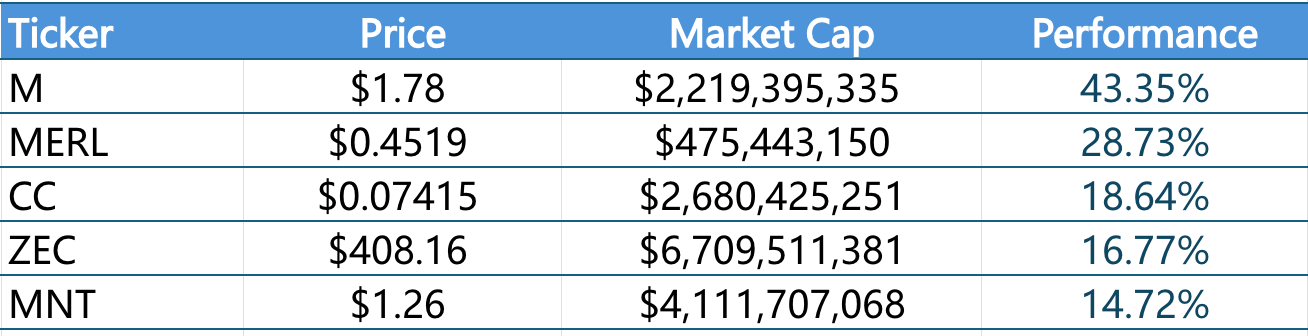

The top five performing VC coins in the past week

Data source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of December 14, 2025

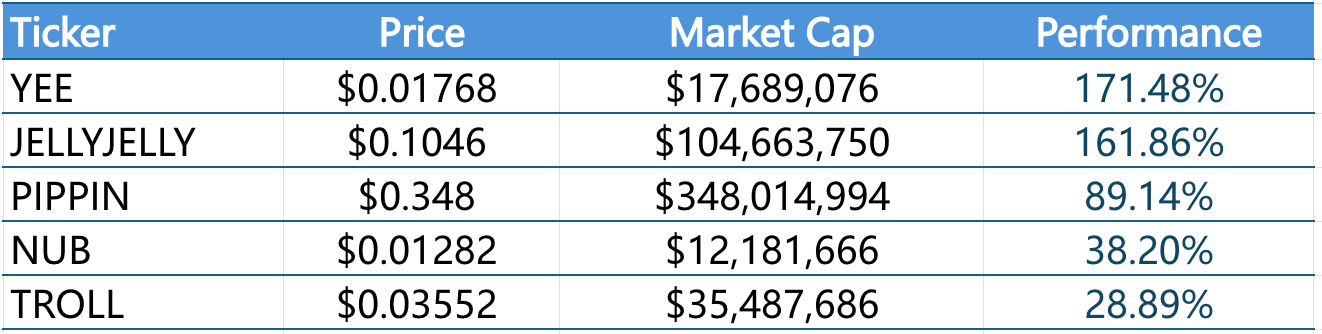

The top five gainers in the past week for Meme coins

Data source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of December 14, 2025

2. New Project Insights

AllScale is a stablecoin "self-custodial" neobank/payment infrastructure platform that aims to help global creators, SMBs, freelancers, and cross-border teams achieve "fast and efficient receipt and sending of payments" in stablecoins, invoicing, social commerce, and cross-border payroll, even without bank accounts. On December 8, 2025, AllScale announced the completion of a $5 million seed funding round, led by YZi Labs, with participation from Informed Ventures and Generative Ventures, and backed by several crypto/venture capital firms. It is also an ecosystem partner of BNB Chain.

Goblin Finance is a DeFi "yield infrastructure" platform specifically built for the Aptos ecosystem. Through automated liquidity management (ALM), cross-market strategies, delta-neutral, and LST-enhanced products, it automatically channels user funds into the best-performing on-chain or cross-chain strategies, maximizing returns and providing deep liquidity support for Aptos. Goblin Finance aims to enable ordinary users to participate in professional-grade asset management with a "one-click deposit," transforming idle assets into efficient "yield machines," while simultaneously promoting the development of decentralized liquidity infrastructure within the Aptos ecosystem.

Magma Finance is a next-generation decentralized exchange (DEX) and liquidity infrastructure platform built on the Sui/Move ecosystem. It combines centralized liquidity AMM (CLMM) and adaptive liquidity mechanism (ALMM), allowing users to provide efficient liquidity, participate in governance, and earn transaction fees and incentives through staking and ve-tokenomics.

III. New Industry Trends

1. Major Industry Events This Week

Stable officially launched its mainnet on December 8, 2025, and completed the issuance of its STABLE token, TGE. Simultaneously, it launched an airdrop program, distributing rewards to early users, developers, and liquidity contributors. The official claim channel is now open, and all eligible users can claim their rewards before March 2, 2026 (UTC). Stable is a new type of blockchain that uses USDT as its native gas, aiming to build a highly stable, high-throughput financial infrastructure for large-scale applications. Its core concept is to use stablecoins directly as the underlying settlement asset of the chain, allowing transactions, payments, and application interactions to be conducted using "native stablecoins," thereby reducing volatility and improving usability.

The public sale of HumidiFi's token WET was initially scheduled to launch on December 3, 2025, on the Jupiter DTF platform. However, due to anti-bot issues, it was adjusted and resold on December 8, 2025. Subsequently, on December 9, 2025, the TGE (Token Generation Event) was officially triggered, and token redemption and liquidity pools were opened. HumidiFi is a high-performance "Prop AMM + DEX" decentralized trading protocol built on Solana, aiming to solve the slippage and fragmentation problems of on-chain trading through professional market making and deep liquidity. Its token WET has a total supply of 1 billion, primarily used for governance, staking incentives, and transaction fee rebates.

Cysic's native token, CYS, was launched on December 9th via TGE, with an initial circulating supply of approximately 160.8 million (total supply 1 billion). The project launched an official airdrop program for early adopters, with registration open from 13:00 UTC on December 1st to 13:00 UTC on December 7th. CYS was allocated based on eligibility to community contributors, CUBE node holders, testnet participants, developers, and partners. Cysic is a ComputeFi infrastructure project centered on decentralized computing power and ZK computing. Its overall token mechanism aims to incentivize computing power contributors, support ZK/AI workloads, and promote network governance and ecosystem development.

RaveDAO's native token, RAVE (total supply of 1 billion), underwent a TGE on December 12th and began partial unlocking and circulation. The project reserved 3% of the tokens as airdrop rewards for early contributors and event participants. Users need to submit their base address on the PLVR platform to claim the airdrop. The airdrop will be processed in three batches: December 10th–11th, December 11th–18th, and December 18th–January 11th, 2026, with the corresponding tokens arriving no later than December 12th, December 19th, and January 12th, 2026. The corresponding amount will be deducted from users' points after the airdrop. Genesis Rewards and other incentive programs will be launched later. RaveDAO is a decentralized community combining music, culture, and Web3.

2. Major events that will happen next week

Rainbow Wallet will conduct a public sale of RNBW tokens via CoinList from December 11th to December 18th, 2025 (price $0.10, representing 3% of the total supply). The public sale tokens will be unlocked in a single transaction at TGE (date to be determined), while team and investor tokens will vest linearly over 2–4 years. The project also plans to airdrop old Rainbow Points loyalty points to RNBW in Q4 2025, completing the conversion from points to token rewards. RNBW is Rainbow Wallet's native token, used to incentivize users and strengthen its multi-chain non-custodial wallet ecosystem.

GrantiX's token GRANT will have its IDO (Initial Denomination) from December 15th to 17th, 2025, priced at $0.088. The specific TGE (Total Geographic Exchange) time will be announced later. The project has reserved approximately 3% of the token economy for community/airdrop rewards. GrantiX is a SocialFi platform focused on social impact investing, utilizing blockchain and AI to build a transparent and traceable funding system for philanthropy and sustainable development.

Helios Blockchain announced an IDO launch on the Spores Network, scheduled for December 16-18, 2025, with a public price of USD 0.02/HLS and a total supply of 25 million HLS, representing approximately 0.5% of the total supply. The TGE time will be announced later. Helios Blockchain (codename HLS) is an EVM-compatible Layer-1 blockchain for multi-chain assets and on-chain ETFs. It employs a unique I-PoSR consensus mechanism and utilizes the "Hyperion + Chronos" module to achieve cross-chain asset portfolio management and automated asset management.

Aztec has completed its AZTEC token public sale, raising 19,476 ETH and attracting 16,741 participants, half of which came from the community. Users holding more than 200,000 tokens have begun receiving block rewards. The TGE (Trust for Tokens) will be triggered by on-chain governance voting, with the official announcement stating it could take place as early as February 11, 2026. At that time, 100% of the tokens obtained through the public sale will be unlocked and freely transferable. The project did not use a traditional airdrop, but instead distributed tokens through a public sale and block rewards.

3. Key Investment and Financing Activities Last Week

Surf announced the completion of a $15 million funding round, led by Pantera Capital, with participation from Coinbase Ventures and Digital Currency Group (DCG). Surf (accessible via ask.surf/asksurf.ai) is an AI-driven "research + action" platform specifically designed for the cryptocurrency space. It provides crypto asset analysis, market insights, and investment decision support by integrating on-chain data, market sentiment, and social trends. (December 10, 2025)

Real Finance has completed a $29 million private funding round, led by Nimbus Capital (approximately $25 million), with participation from Magnus Capital and Frekaz Group. The funding will be used to expand its compliance, custody, settlement, and operational infrastructure, and to drive the development of its full-stack RWA platform. Real Finance is a Layer-1 blockchain/financial infrastructure project focused on "real-world asset (RWA) tokenization + compliant on-chain infrastructure," aiming to help institutions convert traditional assets (such as bonds, credit, funds, alternative assets, etc.) into on-chain tokens and provide institutional-grade services such as compliance, custody, risk assessment, and insurance. (December 10, 2025)

Cascade announced it has raised $15 million in seed funding, led by Polychain Capital and Variant, with participation from Coinbase Ventures and Archetype Ventures. Cascade is a neo-brokerage/perpetual-markets platform aiming to create a 24/7 trading system with a unified margin account, allowing users to trade crypto assets, securities, and even pre-IPO equity of private companies through a single account. (December 9, 2025)

TenX Protocols is a blockchain infrastructure company that provides validator and node infrastructure support for high-performance public blockchains (such as Solana, Sui, and Sei), building a yield-generating asset portfolio through purchasing and participating in staking on these networks. In 2025, TenX completed over C$33 million in funding, including a C$29.9 million subscription receipt financing and approximately C$3.5 million in a seed round earlier this year. It officially listed on the TSX Venture Exchange (ticker symbol TNX) on December 10, 2025. The funds will be used to expand its node and infrastructure deployment, asset acquisition, and operational capabilities on high-throughput blockchains, thereby further providing underlying support for these networks. (December 10, 2025)

IV. Reference Links

1.Coingeck: https://www.coingecko.com/en/charts

2.Coinglass: https://www.coinglass.com/pro/i/FearGreedIndex

3.Sosovalue: https://sosovalue.com/zh/assets/etf

4.Ratiogang: https://ratiogang.com/

5.Defillama: https://defillama.com

6.L2Beat: https://l2beat.com/scaling/tvs

7.Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

8.Coinglass: https://www.coinglass.com/pro/stablecoin

9.Whale Alert: https://x.com/whale_alert

10.Coinmarketcap: https://coinmarketcap.com/

11. Surf: https://www.ask.surf/

12.Real FInance: https://www.real.finance/

13.Cascade: https://cascade.xyz/

14.ALLScale: http://allscale.io/

15.Goblin Finance: https://goblin.fi/

16.Magma Finance: https://magmafinance.io/