In-depth report on account abstraction: The generational leap of the Ethereum account system and the reshaping of the landscape in the next five years

- 核心观点:AA账户是以太坊账户体系向“账户即程序”的现代范式升级。

- 关键要素:

- 提升安全性,支持社交恢复、多签等权限管理。

- 优化体验,支持Gas代付、批量交易等便捷操作。

- 成本瓶颈在Rollup环境中可大幅降低,推动落地。

- 市场影响:推动链上交互体验升级,成为重要基础设施。

- 时效性标注:中期影响

I. Development History and Capabilities Overview of AA Accounts

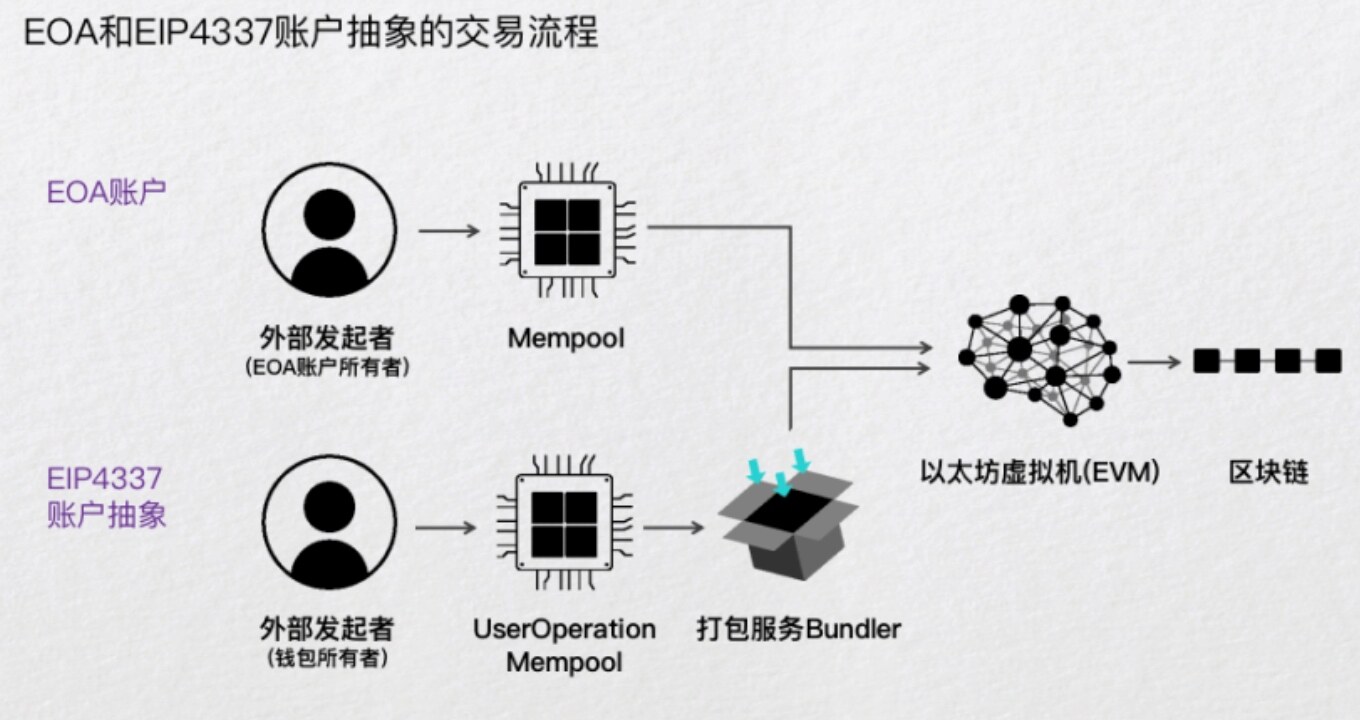

Ethereum will undergo a major upgrade called Fusaka on December 3, 2025. This is Ethereum's third milestone update since The Merge and the Dencun upgrade, aiming to significantly improve network scalability, reduce transaction costs, and optimize node operating efficiency. A key focus is the upgrade and optimization of functions related to account abstraction. In the Ethereum system, the evolution of the account structure actually constitutes the core logic of the entire on-chain user experience, asset security, and even industrial upgrading. The EOA (Externally-Owned Account) and CA (Contract Account) dual-account system we are familiar with today is a technological legacy of Ethereum since its launch in 2015. However, in the 2023-2025 period, with the user base exceeding ten million and Web3 gradually taking on the role of asset custody and user operation infrastructure, this system is revealing increasingly serious structural bottlenecks.

These bottlenecks not only limit the expansion of the industry, but also restrict the scale of users and the implementation of real-world applications. The emergence of Account Abstraction (AA) is precisely to solve the inherent structural defects of the Ethereum account system, enabling the on-chain world to have "modern financial-grade" security, experience and autonomy, and ultimately become a trusted asset infrastructure that carries global users.

The current system has reached a bottleneck because EOA hardcodes the security model of "private key = asset" into the underlying protocol. While this model is simple in engineering, it poses the biggest obstacle to large-scale adoption in practice.

EOA's operational structure resembles a "mechanized assembly line," rather than the "one-click execution" familiar to modern internet users. Furthermore, in terms of access control, EOA completely lacks any granular settings: it cannot set daily limits, define multi-signature rules, create parent-child accounts, freeze certain permissions, or enable automation policies. EOA is like a master key containing all assets and permissions; a single leak exposes all assets and permissions.

Therefore, the Ethereum community began to rethink the question of "what an account should be," and the concept offered by AA (Automatic Accounting) precisely addresses this issue: an account should be "code," not "private keys." Under the AA paradigm, accounts can be programmed, verified, recovered, and upgraded. In other words, the limitations hard-coded into the EOA architecture can be abstracted away; a wallet is no longer just a signing container but can become a "smart account" with logic, strategy, and a permission system.

Firstly, in terms of security, AA provides wallets with a programmable permission system: users can enable social recovery mechanisms, eliminating concerns about lost mnemonic phrases; they can set multi-signature rules, allowing families, institutions, or DAOs to manage funds more securely; they can create parent-child accounts, whitelists, and payment limits; and they can even freeze certain permissions or use temporary keys, increasing flexibility in use cases. The "single point of failure" of EOA is completely eliminated by AA, resulting in an order-of-magnitude improvement in security. In terms of cost, with the introduction of Paymaster, users can pay gas with any ERC-20 currency, and even have project teams pay gas on their behalf, achieving a truly "invisible fee" experience.

Furthermore, AA supports batch execution and transaction aggregation, significantly reducing the number of signatures and failure costs, thus significantly lowering the overall cost of complex interactions. In terms of user experience, AA brings the Web3 interaction experience truly closer to Web2 for the first time. Users can execute combined operations with a single click, without needing to understand complex concepts such as nonce, gas settings, and signature order; new users can even create wallets without a mnemonic phrase, completing account initialization through biometrics, local recovery, and email verification; complex on-chain logic (such as strategy trading, automated liquidation, and scheduled execution) can be embedded within account logic, making on-chain applications capable of functioning as "smart products."

AA's ultimate vision is to transform blockchain from an "experimental system for tech-savvy individuals" into a "universal account infrastructure for global users." If the bottleneck of Web3 over the past decade stemmed from the original "key as account" model, then the breakthrough for Web3 in the next decade will come from the new paradigm of "account as program." AA is not merely an upgrade to a wallet, but a complete rewrite of the on-chain interaction logic; it not only improves user experience but also lowers the development threshold, enabling DApps to design processes and define permissions like Web2 products, and build a trustless security system at the account layer.

With the ERC-4337 ecosystem poised for explosive growth in 2024–2025, the industry chain, including Bundler, Paymaster, AA wallet, and modular security plugins, is gradually taking shape, and account abstraction is transforming from a "concept" into "infrastructure." Just as the evolution of mobile devices from Web 1.0 to Web 2.0 spawned super apps and trillion-dollar industries, the implementation of account abstraction is expected to become the underlying driving force for the next exponential growth of Web3. The limitations of the EOA era are being gradually dismantled, and AA is leading the entire industry towards a safer, more flexible, and more user-friendly on-chain world.

II. Prospects and Challenges of AA Accounts

Account Abstraction (AA) re-emerged as a core narrative in the Ethereum ecosystem between 2023 and 2025, but after the initial hype and anticipation, its structural dilemmas have gradually become apparent. AA's long-term prospects remain promising—it promises a generational leap in security, usability, and automation, replacing the original "private key as account" model of the EOA era; however, in terms of practical implementation, the adoption of ERC-4337 has been repeatedly questioned, considered "all talk and no action." From the perspectives of industry structure, cost models, ecosystem collaboration, and competing protocols, AA's prospects and challenges are intertwined, representing both the future of blockchain account systems and revealing the complexities of its role as a protocol upgrade path.

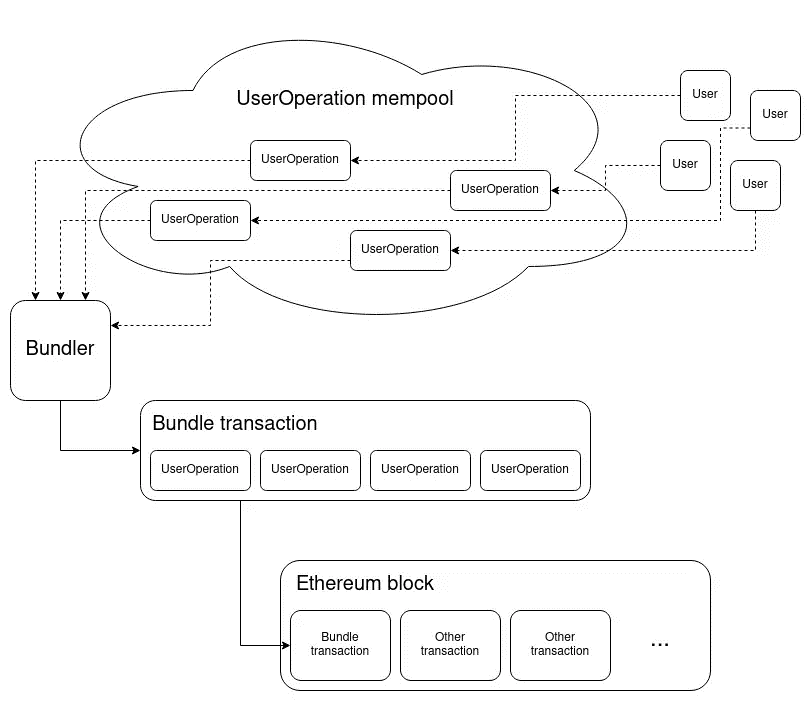

From a cost perspective, AA's primary obstacle comes from gas. Compared to EOA's 21,000 gas, AA's UserOperation on the mainnet averages approximately 42,000 gas, almost double. This isn't wasteful, but rather structural: the 4337 verification calls include validateUserOp, EntryPoint state access, wallet contract bytecode reading, log recording, initCode deployment, and data encoding overhead. Each step implies additional on-chain computation. Most wallets or DApps initially rely on subsidies to attract users, but once subsidies disappear, user migration costs are extremely low, making it difficult to create network effects.

More realistically, the Web3 ecosystem lacks the "advertising, retention, and traffic closed loop" industry chain of Web2, making it difficult for Paymaster's efforts to yield returns and develop a sustainable business loop. Therefore, the slow adoption of AA is not fundamentally a technical issue, but rather a lack of commercial traction. Due to the complexity of AA's structure, user operations are not directly processed by the blockchain but are simulated and aggregated by the Bundler. This means that even slight differences in implementation between different ecosystems can lead to incompatibility. Wallet incompatibility, high DApp integration costs, and complex on-chain testing all force projects to reassess their return on investment when facing AA. While EOA is primitive, it is extremely simple; while AA is advanced, it creates the problem of "ecosystem fragmentation" in its early stages of adoption. For the vast majority of small and medium-sized DApps, supporting 4337 does not bring significant benefits but incurs additional technical costs, resulting in a "avoid using it if possible" approach.

The lack of cross-chain capabilities also weakens AA's system-level value. ERC-4337 is essentially an upgrade to the account system of the EVM Layer, relying on EntryPoint, UserOp mode, and EVM's verification logic, making it inherently difficult to scale to non-EVM chains. To achieve a unified multi-chain experience, more intermediate layers, multiple sets of EntryPoints, multiple verifications, and cross-chain message transmission must be introduced, exponentially increasing costs and complexity. The Web3 world is already fragmented across multiple chains, and AA's inability to form a unified account system across chains prevents it from fulfilling the vision of a "unified account standard for Web3." The inability to seamlessly map a user's smart account on one chain to another significantly diminishes AA's scalability.

However, despite the obvious structural challenges, Alternate Aspects (AA) remain a highly promising direction for the future. This is because the evolution of next-generation blockchain infrastructure is naturally aligning with, rather than deviating from, AA. In particular, the large-scale rise of L2 (Rollups) has structurally resolved the cost pain points of AA. The data compression capabilities of mainstream ZK Rollups and Optimistic Rollups can reduce gas costs by 70%–90% for 4337 operations, while batched UserOperations can further reduce on-chain overhead per operation. Therefore, "Rollup + AA" is highly likely to become the mainstream combination for the next 35 years, relieving the Ethereum mainnet of the cost pressure of high-frequency AA operations. Combined with the compression capabilities of Rollups, the core bottleneck of AA in terms of performance and cost is being unlocked, and the industry is beginning to see its commercial viability.

However, AA's biggest challenge to its future comes from a competitor that suddenly emerges in 2024–2025—the x402 protocol. Compared to AA, x402 is more like an "internet-level unified payment protocol," using HTTP 402 as its entry point to unify the interface logic for Web2 and Web3 payments. AA aims to solve the problem of "in-chain account abstraction"; x402 aims to solve the problem of "internet payment abstraction." AA's target audience is Web3 users; x402's potential audience is the entire internet. More importantly, x402 has a natural business closed loop: Providers and Facilitators can directly charge from the payment process, giving it clear market traction. ERC-8004 becomes a "tool protocol" under the x402 framework, rather than an underlying infrastructure requiring a full network migration, making its promotion much easier than AA's. AA needs to persuade the ecosystem to migrate to its defined system, while x402 chooses to adapt to existing internet habits, giving it a significant advantage in commercial adoption.

Therefore, the future of AA is clear, but the road is arduous. A profound tension exists between the elegance of the technology and the realities of industry: the future defined by AA is indeed better, but before it can be realized, multiple challenges must be overcome, including cost, business incentives, ecosystem fragmentation, and competing protocols. With the arrival of the Rollup era, the maturation of signature aggregation technology, and the opening of a compatibility path by EIP-7702, the cost and compatibility issues of AA will gradually be alleviated, while further breakthroughs are still needed in business models and cross-chain capabilities.

III. Investment Value and Future Outlook of AA Accounts

Account Abstraction (AA) in the blockchain industry is gradually shifting its role from a "revolutionary technological concept" to a "structural infrastructure upgrade." Its investment value has also evolved from early narrative dividends to a comprehensive assessment based on engineering implementation, ecosystem collaboration, and business sustainability. In the next five years, AA will not become the unified entry point for Web3, nor will it replace EOA as the standard account system. However, it will firmly exist at the high-level of wallet and account systems, becoming a core representative of "smart accounts," and deeply embedded in on-chain interactive experiences and transaction execution capabilities in the Rollup era. Therefore, for investors, the value of AA is not a short-term user surge, but a "classic internet-style long-term infrastructure investment opportunity."

The true primary arena for AA (Automatic Assist) will be the Rollup ecosystem. As L2 technologies like zkSync, Scroll, StarkNet, and Base become mainstream execution environments, the cost pain points of AA will be naturally absorbed by Rollup's data compression capabilities, reducing gas costs by 70%–90% compared to L1. Simultaneously, BLS signature aggregation and batch UserOperation will further reduce on-chain data size, transforming account operations under the AA model from "expensive but advanced" to "advanced and affordable." This means the investment value lies not in L1 AA, but in AA wallets, Paymaster, and Bundler infrastructure that deeply embrace Rollups. This direction corresponds to tangible engineering value—not just a concept, but a real driving force for adoption resulting from actual on-chain cost reduction. From an industry chain perspective, the investment value of AA is mainly concentrated in four types of infrastructure areas: smart contract wallets, Paymaster service providers, Bundler infrastructure, and L2 technologies that directly support AA.

Paymaster is one of the most commercially valuable components in the AA system, serving as a bridge between gas subsidies and user growth. While Paymaster's business model is not yet fully mature, it has the potential to become an "on-chain growth engine" as the Rollup environment and on-chain business scenarios become richer: projects can pay gas for high-value users, implement subsidy strategies, and whitelist strategies, thereby creating a marketing effect similar to Web2 "ad exposure." Projects like Stackup and Pimlico are therefore worth paying attention to.

Bundler, as the execution layer of AA, is also an infrastructure with implicit value, equivalent to the "transaction packaging and logistics layer" in the blockchain world. Biconomy, Alchemy's AA Infra, and others will benefit from the growth of the ERC-4337 ecosystem. Bundler does not have the opportunity to directly face users, but it has a scalable and certain revenue model, and may become a direction for on-chain "low volatility and scalability" infrastructure investment in the future.

Meanwhile, AA must contend with both competition and complementarity from the x402 protocol over the next five years. x402 is not intended to replace AA, but rather to become a unified internet payment gateway through the HTTP 402 protocol. It covers both Web2 and Web3, possesses inherent cross-chain capabilities, and has a clear business closed loop (Provider + Facilitator fee model). ERC-8004 becomes a plugin within the x402 framework, rather than an underlying protocol, thus gaining stronger promotional power. From an investment perspective, AA's value lies in the intelligentization of in-chain accounts, while x402's value lies in unifying the entire internet payment experience. The two will coexist and complement each other in the future, rather than one becoming the sole winner.

In summary, AA will constitute the "mid-level infrastructure" of the Ethereum and Rollup ecosystem over the next five years: the bottom layer remains EOA (weakened but still present), the middle layer is Smart Accounts (AA), and the top layer is the unified interoperability network of x402. AA's user base will not experience explosive growth, but its value will steadily increase with rising on-chain transaction volume, demand for strategy automation, professional asset custody, and anti-loss requirements. In a world that is migrating to on-chain in the long term, AA is a highly certain structural investment direction; in a world where Rollup costs are decreasing, it is a "realizable future"; and in an internet that coexists with x402, it is a key force shaping the on-chain account system.

IV. Conclusion

The core value of AA lies in transforming the Ethereum account system from the primitive "private key = account" model to the modern paradigm of "account = program." It fills a crucial gap in the migration from Web2 to Web3, enabling a secure, recoverable, and programmable wallet system. Although AA still faces structural bottlenecks such as high cost, weak business loop, and limited cross-chain functionality, it has become an infrastructure direction for upgrading on-chain experiences. In the future, AA will exist as a high-end account layer for a long time, rather than the sole standard; x402 will fill the gaps in cross-chain and payment interconnection. Together, they will drive Web3 from the geek era to the mainstream era, laying a key foundation for a "unified internet account."