SpaceX, with its $1.5 trillion IPO, is on its way to the largest ever: How can retail investors position themselves in advance?

- 核心观点:链上平台为散户投资IPO前股权提供新途径。

- 关键要素:

- Ventuals提供估值永续合约,无实际股权。

- PreStocks将实际股权代币化,集成DeFi。

- Jarsy专注股权投资,透明度高但流动性受限。

- 市场影响:降低私募股权投资门槛,但流动性问题待解。

- 时效性标注:长期影响。

On-chain trading of US stocks has developed rapidly, but in addition to stocks that are already listed and can be traded directly on the secondary market, there are now many high-quality companies that can raise huge amounts of money through private equity financing without going public, such as OpenAI and SpaceX.

For these private equity investments, retail investors are often unable to access them, and investment opportunities typically only appear after the IPO, with a few institutional investors monopolizing pre-IPO investment opportunities. Although there are platforms in the traditional financial sector, such as Ustockplus under Dunamu in South Korea, and Forge or EquityZen in the United States, that allow retail investors to purchase private equity within the existing regulatory framework, these traditional financial platforms use a P2P matching model. If no one lists the shares for sale, it's still impossible to buy them. The unpredictability of transactions naturally leads to poor liquidity.

So, would the situation change if it were pre-IPO private equity combined with on-chain transactions? Currently, there are already three on-chain platforms that provide pre-IPO private equity transactions: Ventures, PreStocks, and Jarsy. Let's take a look at their respective characteristics.

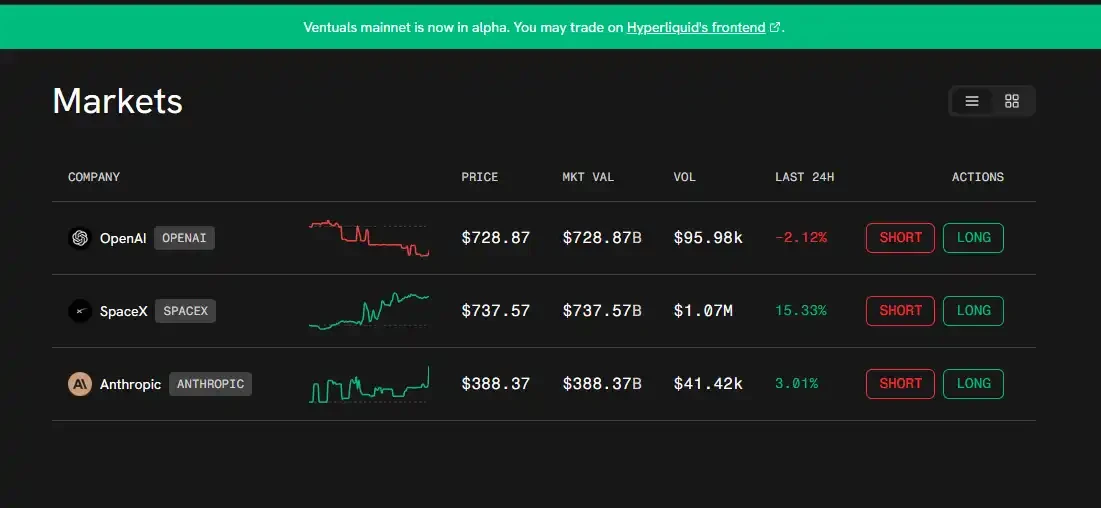

Ventuals

Ventuals is a platform for pre-IPO equity perpetual contracts built using HIP-3. On Ventuals, traders do not trade based on stock prices, but rather on their expectations of changes in a company's total valuation. Holding a position in a pre-IPO company on the Ventuals platform does not imply any actual economic ownership of that company—it is merely speculation on changes in its valuation.

Because they are not linked to actual equity, Ventures are essentially platforms for betting on company valuations. The advantage of this model is that Ventures can quickly list a large number of pre-IPO companies and respond to market trends, while the lack of actual underlying assets also helps to avoid traditional regulations to some extent.

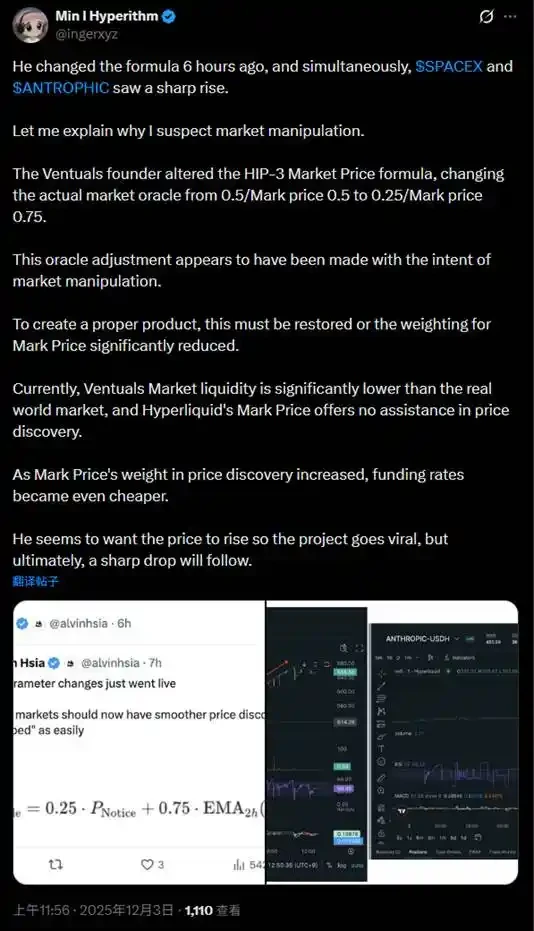

However, a drawback of Ventures is that its reliance on oracles makes it susceptible to market manipulation. Valuation data from private companies is inherently opaque and updated infrequently. Furthermore, Ventures recently reduced the weight of external oracle price feeds to 0.25 and increased the weight of the marked price to 0.75, leading some players to express concerns about potential market manipulation.

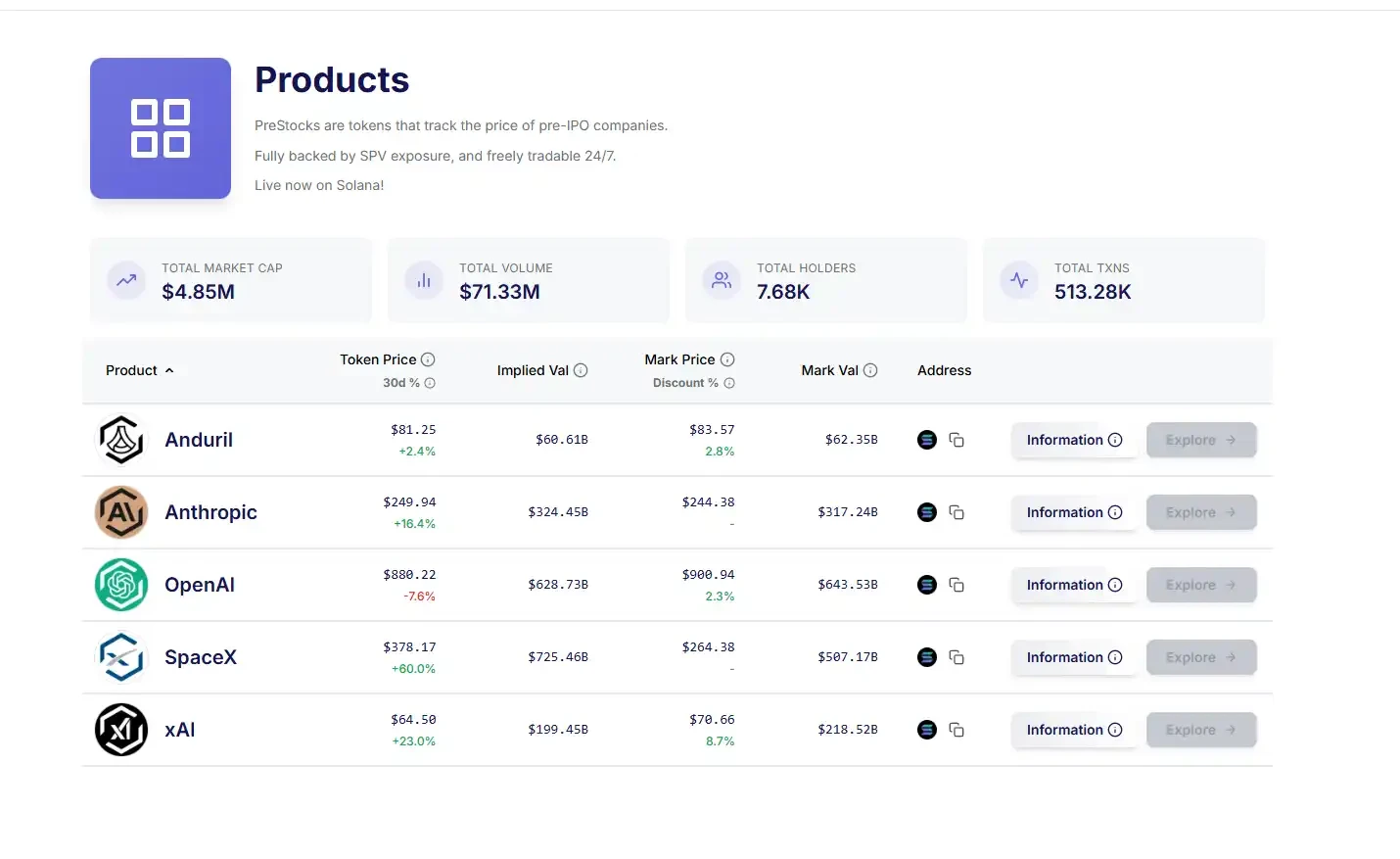

PreStocks

PreStocks is built on the Solana network. Unlike Ventures, PreStocks truly tokenizes the pre-IPO equity held by entities that have directly or indirectly invested in the target company. The team mentions on its website that it will regularly publish third-party verification reports to ensure that the token supply corresponds to the actual equity held, and will also publish them when there is an active request to provide audit fees.

Because it involves actual equity, users in countries like China, the United States, and Canada cannot actually use the platform's minting and redemption services. While it's possible to buy and sell these equity tokens on-chain without KYC, KYC is required if you want to buy them, wait for them to be listed, and then redeem them back to USDC. Furthermore, although backed by actual equity, holding equity tokens does not equate to ownership, voting rights, dividend rights, or other related rights.

PreStocks' main advantage lies in its good integration with the DeFi ecosystem. It can be traded directly on platforms like Jupiter and OKX Wallet, and can also be used for low-price lending or leveraged trading within some dApps in the Solana ecosystem.

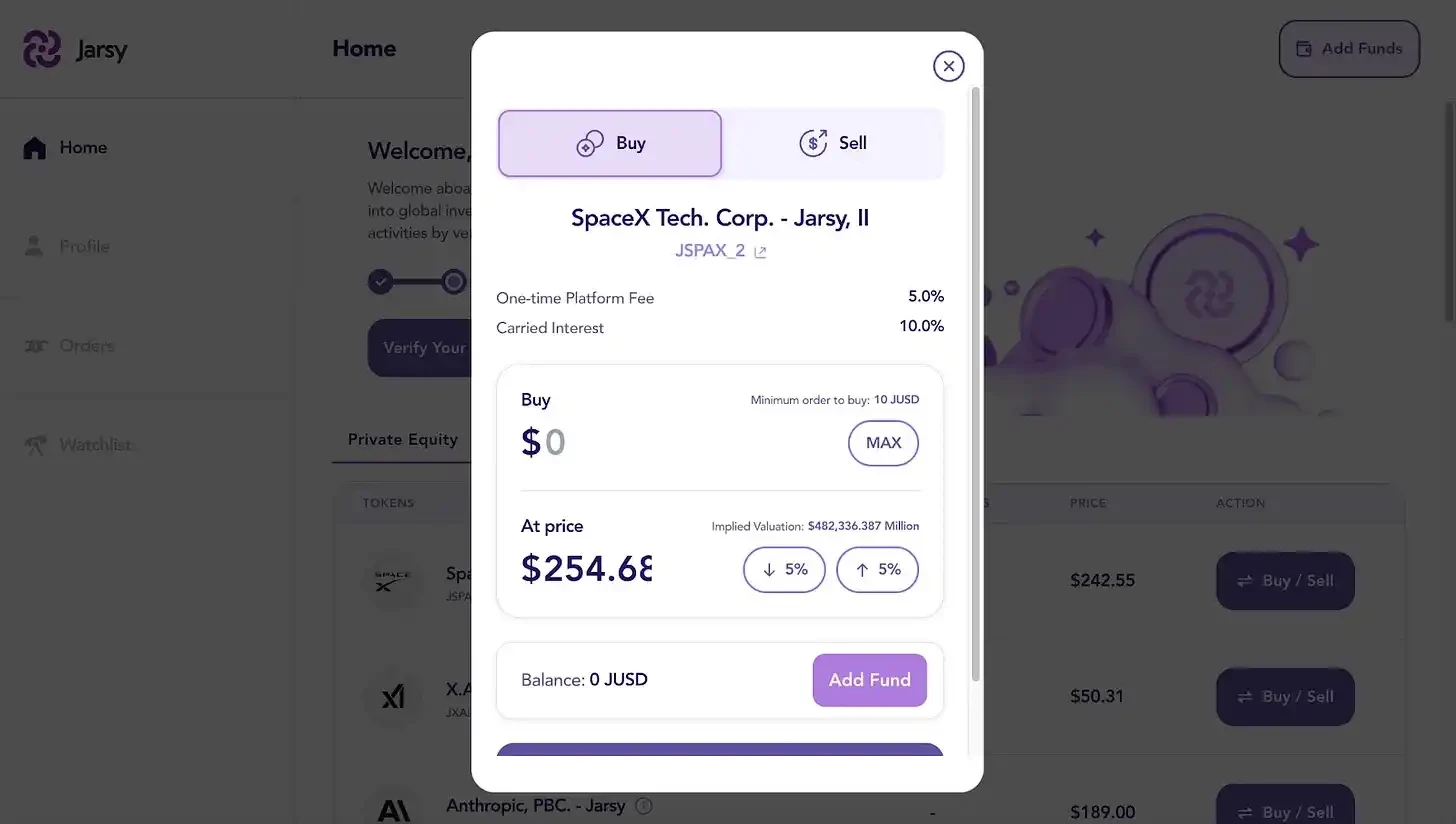

Jarsy

Like PreStocks, Jarsy is also backed by actual equity. However, compared to PreStocks, Jarsy is more like a pre-IPO equity investment platform that combines blockchain technology, rather than a trading platform, because the equity tokens on Jarsy are non-transferable and cannot be used in DeFi. They have built their own trading system, which can only be traded on the platform.

However, Jarsy currently does a better job of transparency disclosure than PreStocks.

Jarsy and PreStocks share some similarities in their advantages and disadvantages. First, both have very low minimum investment amounts: Jarsy requires $10, while PreStocks has none. This is beneficial for users worldwide, lowering the investment threshold for pre-IPO equity. The downside is that the amount of equity they can hold is relatively small. For example, Jarsy's xAI equity tokens (TVL) are only worth about $1.1 million, and SpaceX's two phases combined are about $1.7 million. This limited size of actual pre-IPO equity holdings directly leads to liquidity issues; even seemingly small orders can trigger significant price fluctuations.

Conclusion

Considering the three companies mentioned above, liquidity remains a significant challenge for pre-IPO equity tokenization, making it difficult to attract large amounts of on-chain capital into this sector.

But the benefits are also obvious. In the past, retail investors had almost no way to invest in companies like SpaceX and OpenAI before their IPOs, but now, through blockchain, a door that had been closed has been opened.

Echo, the on-chain funding platform created by Cobie and acquired by Coinbase for $375 million, does something similar, except it doesn't tokenize equity. They previously sold $10 million of their 1X Technologies Series C funding in a private group.

Everything is still in its early stages.