Solana's two leading lenders have fallen out, and a foundation has stepped in to mediate.

- 核心观点:Solana借贷龙头因“风险隔离”定义分歧爆发公开争端。

- 关键要素:

- Jupiter Lend宣发“风险隔离”与支持再抵押的设计存在偏差。

- Kamino抨击其虚假宣传并封禁迁移工具,加剧竞争。

- Solana基金会呼吁停止内耗,共同拓展外部市场。

- 市场影响:引发用户对协议安全性与透明度的信任危机。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This past weekend, two of Solana's leading lending platforms, Jupiter Lend and Kamino, clashed.

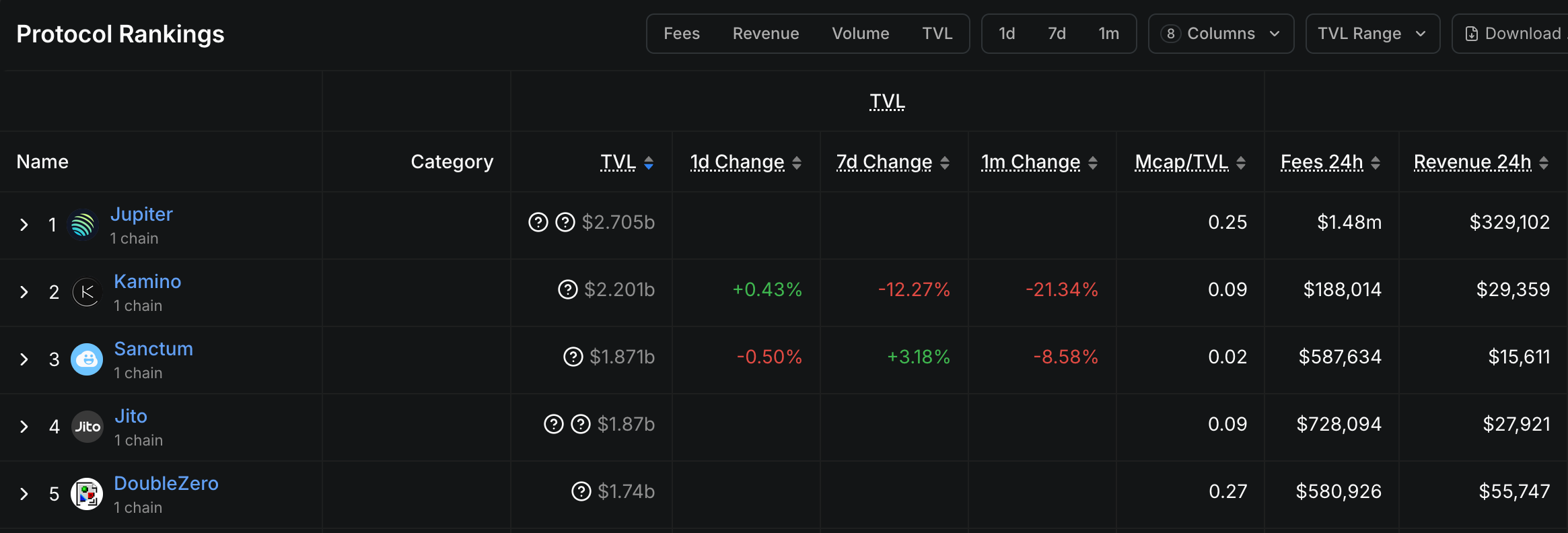

- Odaily Note: According to Defillama data, Jupiter and Kamino are the two protocols with the highest TVL in the current Solana ecosystem.

Cause of the incident: Jupiter quietly deleted a tweet.

The incident can be traced back to August of this year, when Jupiter officially promoted its lending product Jupiter Lend before its launch, emphasizing multiple times that the product had the characteristic of "risk isolation" (related posts have been deleted), meaning that there would be no cross-contamination of risks between different lending pools.

However, the design of Jupiter Lend after its launch did not conform to the risk isolation model commonly understood in the market. In the general market perception, a DeFi lending pool, which can be considered risk-isolated, is a lending pool structure that uses design mechanisms to separate the risks of different assets or markets, preventing defaults of a single asset or a market crash from affecting the entire protocol. The main characteristics of this structure include:

- Pool segregation: Different asset types (such as stablecoins, volatile assets, NFT collateral, etc.) are allocated to independent lending pools, each with independent liquidity, debt, and risk parameters.

- Collateral segregation: Users can only use assets within the same pool as collateral to borrow other assets, thus cutting off the risk transmission across pools.

However, Jupiter Lend is actually designed to improve capital efficiency through re-collateralization (reusing deposited collateral elsewhere in the protocol), meaning that the collateral deposited into the vault is not completely isolated from each other. Jupiter co-founder Samyak Jain explains that Jupiter Lend's lending pools are "in a sense" isolated because each pool has its own configuration, caps, liquidation thresholds, liquidation penalties, etc., and the re-collateralization mechanism is simply to better optimize capital utilization efficiency.

Although Jupiter provides a more detailed explanation of the Jupiter Lend in its product documentation than in its promotional materials, objectively speaking, the "risk isolation" mentioned in its early promotional materials does deviate somewhat from the general market understanding and is suspected of being misleading.

Intense Battle Erupts: Kamino Launches Attack

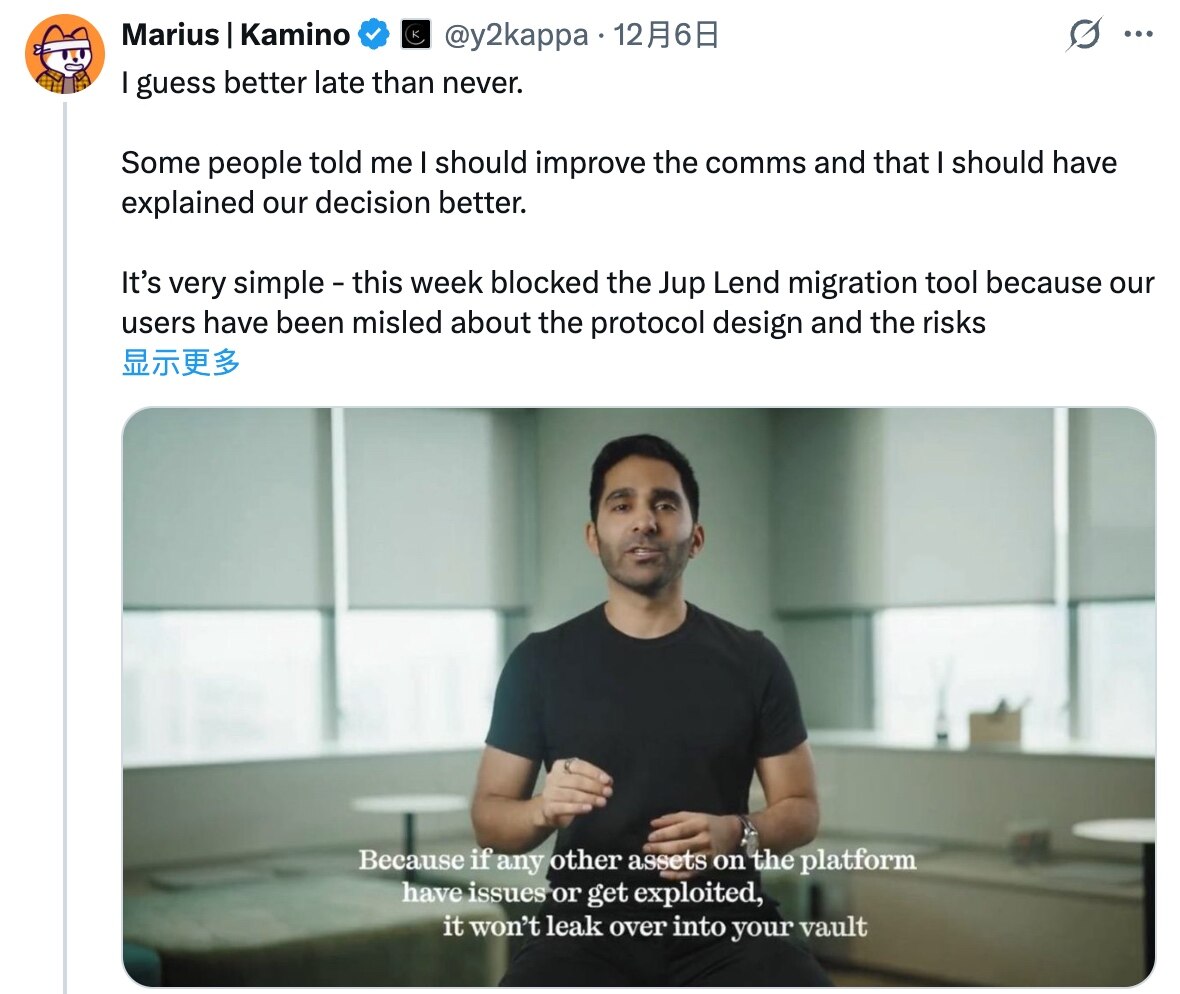

On December 6, Kamino co-founder Marius Ciubotariu took this opportunity to criticize Jupiter Lend and blocked Kamino's migration tool to Jupiter Lend.

Marius stated, "Jupiter Lend's repeated claims of no cross-contamination between assets are utter nonsense. In reality, on Jupiter Lend, if you deposit SOL and lend out USDC, your SOL will be lent to other users using JupSOL and INF for revolving lending, and you will bear all the risks of these revolving loans collapsing or asset defaults. There are no isolation measures here, and there is complete cross-infection, contrary to what is advertised and what people are told... In both traditional finance (TradFi) and decentralized finance (DeFi) sectors, information such as whether collateral is re-collateralized and whether there is a risk of contagion is critical and must be clearly disclosed, and no one should give vague interpretations of this."

After Kamino launched its attack, discussions surrounding the Jupiter Lend product design quickly ignited the community. Some agreed that Jupiter was suspected of false advertising . For example, Penis Ventures CEO 8bitpenis.sol angrily criticized Jupiter for blatantly lying and deceiving users from the beginning; others believe that Jupiter Lend's design model balances security and efficiency, and that Kamino's attack was merely for market competition and had impure motives —for example, overseas KOL letsgetonchain stated : "Jupiter Lend's design achieves the capital efficiency of a fund pool model while also possessing some risk management capabilities of a modular lending protocol... Kamino cannot stop people from migrating to better technology."

Under immense pressure, Jupiter quietly deleted the earlier posts, but this only triggered a larger wave of confusion and uncertainty. Later, Jupiter's Chief Operating Officer, Kash Dhanda, admitted that the team's previous claim on social media that Jupiter Lend had a "zero risk of infection" was inaccurate , and apologized, stating that a correction should have been issued at the same time as the deleted posts.

The core contradiction: the definition of "risk isolation"

Given the current polarized attitudes within the community, the fundamental disagreement seems to lie in the different definitions of the term "risk isolation" held by different groups.

According to Jupiter and its supporters, "risk isolation" is not a completely static concept; there is room for design . While Jupiter Lend is not a risk isolation model as commonly understood, it is not a completely open pooled lending model either. Although it shares a common liquidity layer that allows for re-collateralization, each lending pool can be configured independently, with its own asset limits, liquidation thresholds, and liquidation penalties.

Kamino and his supporters believe that any permission for remortgaging is a complete denial of "risk isolation," and that project owners should not deceive users with vague disclosures and false advertising.

Upper-level consciousness: Some are stirring up trouble, while others are trying to mediate.

Aside from the disputes between the two parties and the community, another noteworthy point in this controversy lies in the attitudes of various upper echelons within the Solana ecosystem.

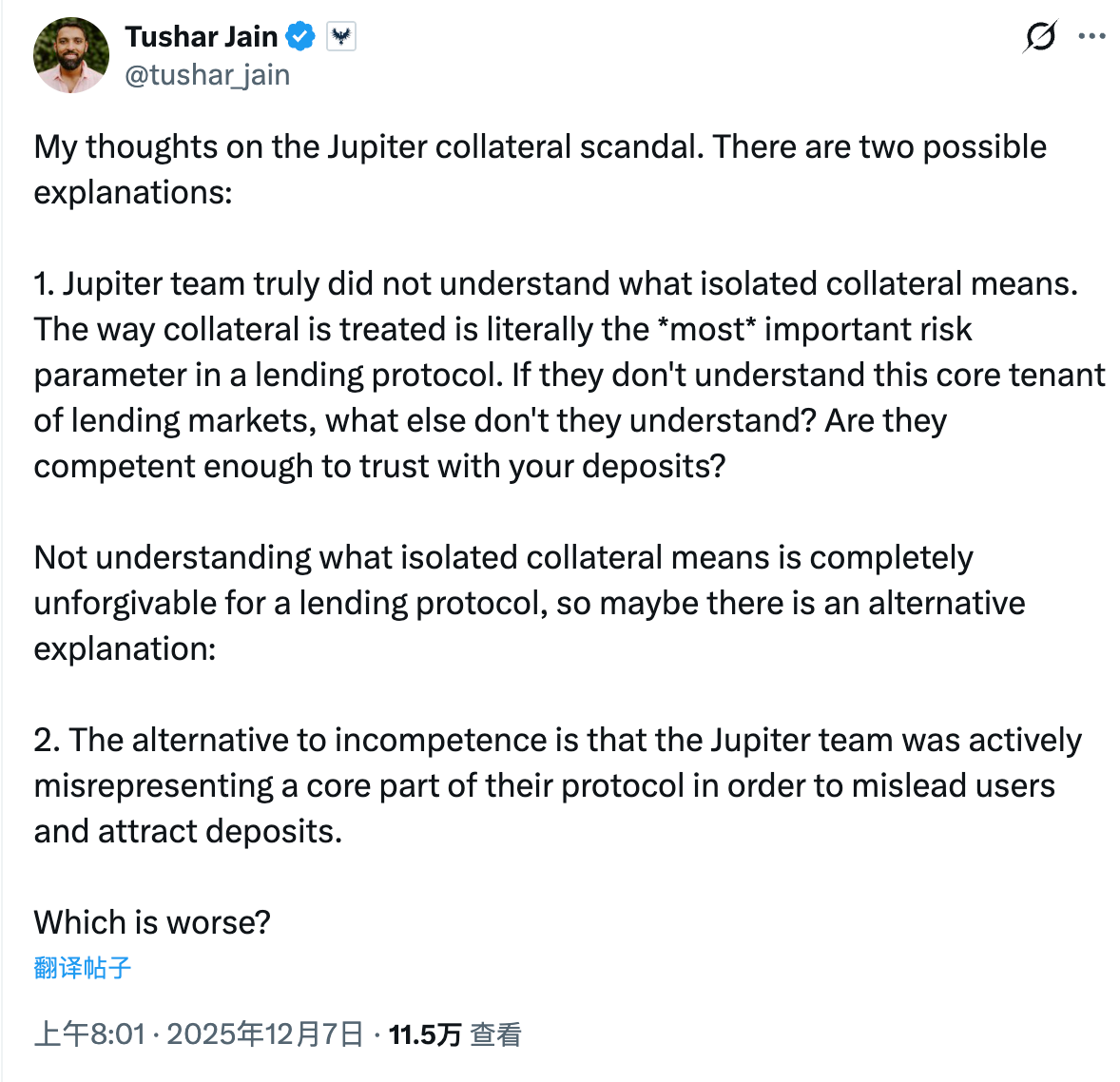

First, there's Multicoin, the venture capital fund with the most influence within the Solana ecosystem (which seems almost unnecessary). As an investor in Kamino, Multicoin partner Tushar Jain directly questioned Jupiter, stating that they were "either stupid or malicious, but neither is forgivable" —objectively speaking, his comments significantly exacerbated the controversy.

Tushar stated, "There are two possible explanations for the controversy surrounding Jupiter Lend. One is that the Jupiter team genuinely doesn't understand the meaning of segregated collateral. Collateral handling is the most important risk parameter in a lending agreement. If they don't even understand this core principle of the lending market, what else don't they understand? Are they professional enough to inspire confidence in depositing funds? For a lending agreement, not understanding the meaning of segregated collateral is completely inexcusable. The other possibility is that the Jupiter team isn't incompetent, but rather deliberately misinterpreting the core parts of its agreement to mislead users and attract deposits."

Tushar's motivation was clear: to take this opportunity to help Kamino defeat its competitors.

Another important statement from the upper echelons came from the Solana Foundation. As the parent ecosystem, Solana clearly did not want to see the two leading players within the ecosystem become excessively opposed, thereby causing the ecosystem as a whole to fall into internal strife.

Yesterday afternoon, Lily Liu, president of the Solana Foundation, posted on the X platform, addressing both projects and urging them to reconcile, saying: "Love you both. Overall, our lending market is currently around $5 billion, while the Ethereum ecosystem is about 10 times larger. As for the traditional financial collateral market, it's countless times larger. We can choose to attack each other, but we can also choose to look further ahead—first, work together to seize market share from the entire crypto market, and then jointly march into the vast world of traditional finance."

To sum it up simply: stop arguing, or Ethereum will just get the freebies!

The underlying logic: the battle for the top spot in the Solana lending market.

Considering the data development and market environment of Jupiter Lend and Kamino, this turmoil, though it started suddenly, seems to be an inevitable collision that was only a matter of time.

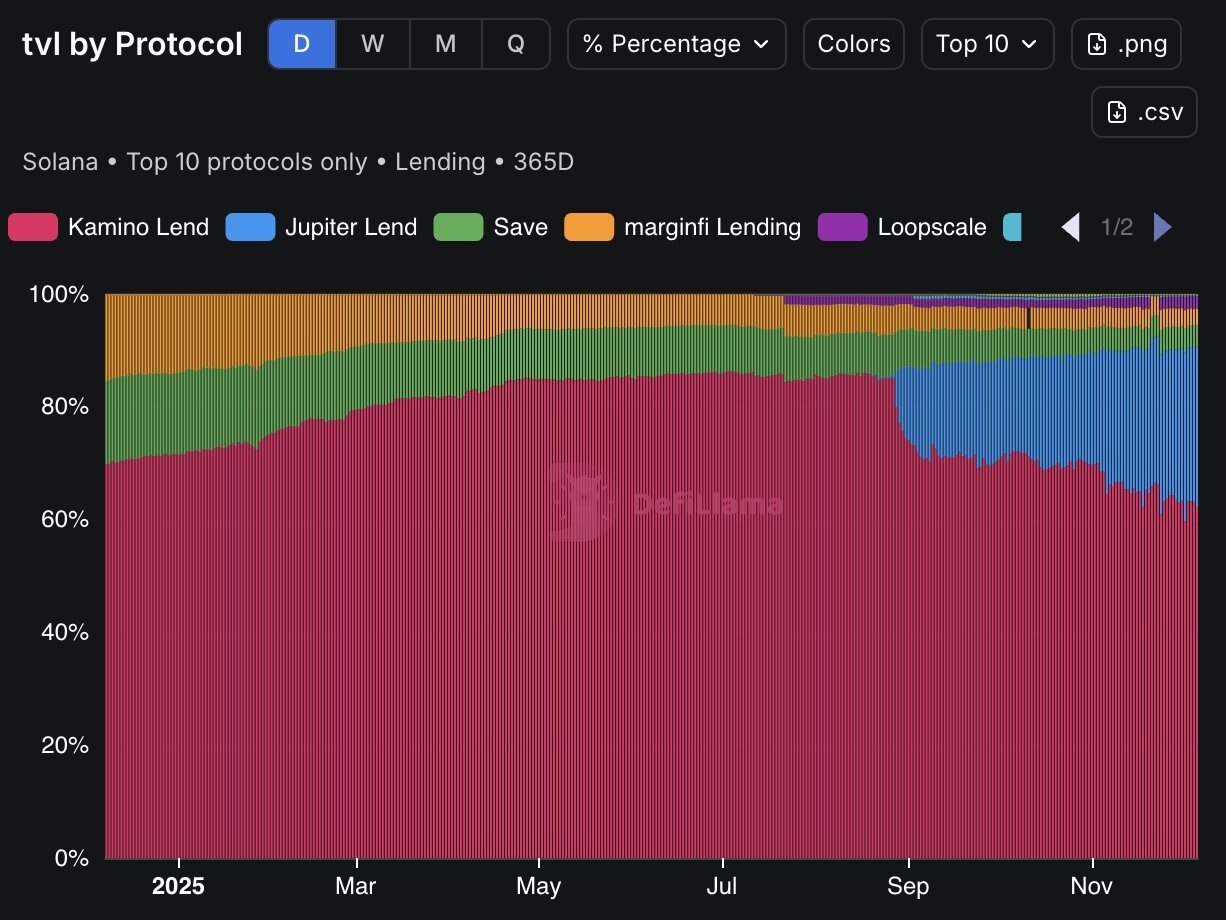

On the one hand, Kamino (red in the image below) had long held the top position in the Solana ecosystem's lending market, but Jupiter Lend (blue in the image below) has captured a large market share since its launch , becoming the only entity in the Solana ecosystem that can challenge the former.

On the other hand, since the massive sell-off on October 11, market liquidity has tightened significantly, and the overall TVL of the Solana ecosystem has continued to decline; in addition, the collapse of several related projects has made the DeFi market extremely sensitive to "security".

When the market environment was favorable and there was ample incremental funding, Jupiter Lend and Kamino were relatively amicable, as both were still making money and it seemed that they would only make more and more money... However, when the market shifted to a zero-sum game, the competitive relationship between the two became more intense , and security issues became the most effective entry point for attack at present - even though Jupiter Lend has never had a security failure in its history, the suspicion of design flaws alone is enough to arouse users' vigilance.

Perhaps Kamino sees this as the perfect opportunity to deal a heavy blow to his opponent.