RWA Weekly Report | The Federal Reserve and the FDIC will push forward the implementation of the GENIUS Act, and the first batch of regulatory rules for stablecoin issuers are expected to be released in December; (November 26 - December 2)

- 核心观点:RWA总市值因统计口径变化腰斩,但用户与稳定币市场持续增长。

- 关键要素:

- RWA链上总价值单周暴跌48.8%,主因私人信贷数据异常。

- 稳定币总市值突破3000亿美元,持有者数量稳步增加。

- 中美监管机构正加速推进稳定币相关监管框架。

- 市场影响:凸显RWA数据波动风险,强化稳定币主流地位与合规预期。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA sector market performance

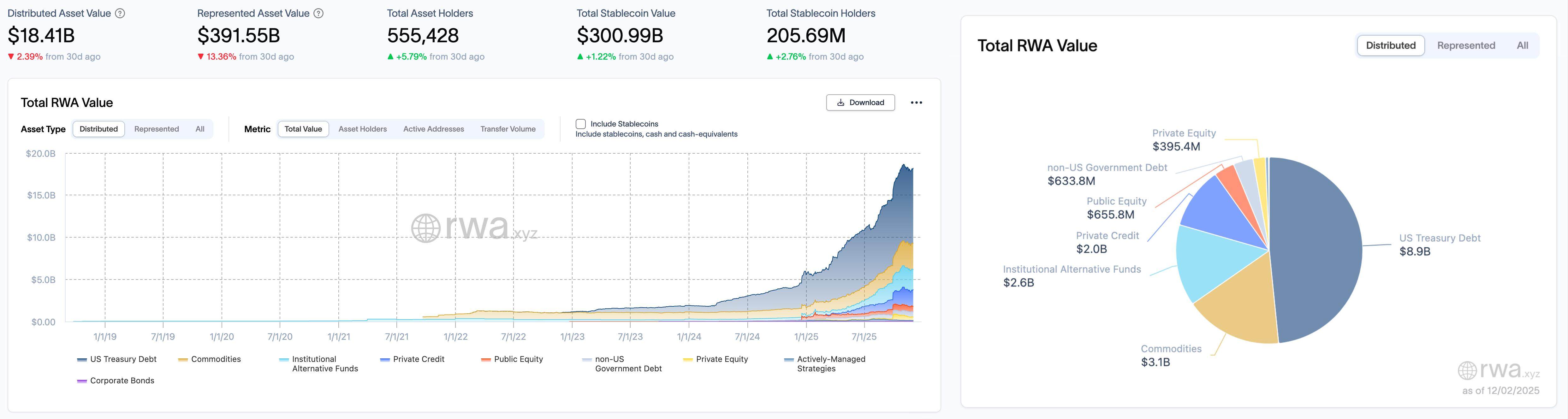

According to data from rwa.xyz, as of December 2, 2025, the total on-chain value (Distributed Asset Value) of RWA plummeted from $36.01 billion on November 25 to $18.41 billion, a weekly loss of approximately $17.6 billion, representing a drop of 48.8%, a dramatic halving. Despite this significant fluctuation in net asset value, the total number of asset holders bucked the trend, increasing from 549,443 to 555,428, a weekly increase of 5,985, or approximately 1.09%. The stablecoin market remained robust and strong, with its total market capitalization successfully surpassing the $300 billion mark, climbing from $298.24 billion to $300.99 billion, an increase of $2.75 billion, or 0.92%. The number of stablecoin holders continued to expand steadily, rising from 204.33 million to 205.69 million, an increase of approximately 1.36 million.

In terms of asset structure, this week saw extreme sector divergence and capital restructuring. The private lending sector experienced a precipitous drop, with its size shrinking dramatically from $18.9 billion last week to $2 billion, a sharp decrease of $16.9 billion in a single week. This was the core factor leading to the sharp decline in RWA's total market capitalization this week, but other assets were not significantly affected. The US Treasury bond sector saw a slight decrease in size this week, from $9.1 billion to $8.9 billion, a reduction of $200 million. Institutional alternative funds also declined, shrinking from $3 billion to $2.6 billion. Amid the widespread decline, commodity assets became one of the few bright spots, with their size increasing against the trend from $3 billion to $3.1 billion. In addition, the non-US government debt sector continued its downward trend, decreasing slightly from $638.3 million to $633.8 million. The public and private equity sectors remained small, at $655.8 million and $395.4 million, respectively.

Trend Analysis (Compared to last week )

This week, the RWA market rapidly shifted from a positive trend led by US Treasuries to an extreme shift towards a "credit collapse and structural reshaping." This shift was not due to a collapse in market confidence, but rather to a change in statistical methods (as illustrated in the chart). The primary reason was the abnormal fluctuations in private credit data, which caused a sharp drop in the total market capitalization curve. However, the continued growth in user data and the increase in the total market capitalization of stablecoins still have positive implications, and analysis of asset structure reveals a clear risk-averse trend in fund flows, with risky assets being sold off or reassessed.

Market keywords: data turnaround, user growth, stablecoin market capitalization surge.

Key Events Review

In his testimony before the House Financial Services Committee, Acting Chairman Travis Hill of the Federal Deposit Insurance Corporation (FDIC) stated that the FDIC expects to release its first set of regulatory proposals for stablecoin issuers in December to implement the National Stablecoin Innovator Guidance and Establishment Act (GENIUS Act). The initial rules will clarify the process for stablecoin issuers to apply for federal regulation, followed by prudential requirements for FDIC-regulated payment stablecoin issuers early next year, including capital standards, liquidity requirements, and reserve asset quality oversight.

The FDIC and other agencies, including the Treasury Department, are advancing their respective regulatory responsibilities under the GENIUS Act. The rules will undergo a public comment period before officially taking effect. Hill also stated that the FDIC is developing further guidance on the regulatory status of "tokenized deposits" based on recommendations from the President's Working Group on Digital Asset Markets.

The hearing will also include testimony from the Federal Reserve and other financial regulatory agencies. Michelle Bowman, Vice Chair for Supervision at the Federal Reserve, stated that the Fed is developing a regulatory framework for stablecoin issuers, covering capital, liquidity, and risk diversification, in accordance with the GENIUS Act.

The People's Bank of China convened a meeting of its coordination mechanism for combating speculation in virtual currencies on November 28. Officials from the Ministry of Public Security, the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate attended the meeting. The meeting noted a recent resurgence of speculation in virtual currencies, with related illegal and criminal activities occurring frequently. The meeting reiterated that virtual currencies lack legal tender status and specifically pointed out that stablecoins, as a form of virtual currency, currently cannot effectively meet customer identification and anti-money laundering requirements, posing risks such as being used for money laundering and illegal cross-border fund transfers. All departments will continue to adhere to the "prohibitory policy" towards virtual currencies, focusing on information and capital flows, and will continue to severely crack down on related illegal financial activities.

According to data from DefiLlama, the total market capitalization of stablecoins has surpassed $306.7 billion, currently standing at $306.775 billion, a 7-day increase of 0.87% (an increase of approximately $2.639 billion). USDT holds a 60.17% market share with a market capitalization of approximately $184.572 billion; USDC ranks second with a market capitalization of $76.982 billion, a 7-day increase of 3.62%. USDe, USDS (Sky Dollar), and DAI rank third to fifth in market capitalization, respectively.

The Beijing Business Daily published an article titled "The Virtual Currency Market Welcomes Another Major Regulatory Signal," which pointed out that industry insiders believe that the People's Bank of China's clear definition of stablecoins means that stablecoins are not regarded as legal tender or payment instruments, but are included in the regulatory framework for virtual assets such as Bitcoin and Ethereum. This provides a logical premise for their subsequent inclusion in the financial regulatory system for anti-money laundering and cross-border capital flows. In addition, the article reveals the root cause of the compliance risks of stablecoins, with frequent "explosions" and the underlying risks and asset quality still difficult to guarantee.

KakaoBank advances its Korean Won stablecoin plan

KakaoBank, a bank under the South Korean internet company Kakao Corp., is preparing to launch a won-backed stablecoin. The bank is advancing the development of a smart contract foreign exchange settlement system, which may form the basis of its planned won-backed stablecoin. Reportedly, KakaoBank is building the technological foundation needed to support on-chain financial services, including smart contract execution, token standards, full node operation, and the backend systems required for issuing and managing digital assets.

CoinShares withdraws its SEC filing regarding staking of Solana ETFs.

Asset management firm CoinShares officially withdrew its application to the U.S. Securities and Exchange Commission (SEC) on Friday for a staked Solana ETF. The filing shows that the registration statement was intended to register shares related to a ultimately unsuccessful transaction; no shares were actually sold, and no future sales will be made under the statement. Previously, staked SOL ETFs launched by REX-Osprey and Bitwise were listed in the U.S. in June and October of this year, respectively. Although these ETFs attracted over $369 million in inflows in November, the price of SOL has recently been weak, hitting a five-month low of around $120.

A Jefferies analysis report shows that stablecoin issuer Tether currently holds 116 tons of physical gold, making it the "largest gold holder outside of central banks," with reserves comparable to those of the central banks of countries like South Korea, Hungary, and Greece. Last quarter, Tether's gold purchases accounted for nearly 2% of global gold demand and nearly 12% of central bank purchases, and its aggressive acquisitions may have already impacted short-term market supply and investor sentiment.

According to investors cited by Jefferies, Tether plans to acquire another 100 tons of gold by 2025. With projected profits of $15 billion this year, this goal seems achievable. Furthermore, Tether has invested over $300 million in precious metals producers and issued the gold-backed token Tether Gold (XAUt), which has a market capitalization of $2.1 billion and whose issuance has doubled in the past six months.

Tether suspends Bitcoin mining operations in Uruguay due to rising energy costs.

A Tether spokesperson confirmed on Friday that Tether, the world's largest issuer of the stablecoin USDT, has suspended Bitcoin mining operations in Uruguay due to rising energy costs, but remains committed to long-term projects in Latin America.

Tether's confirmation comes just weeks after it denied reports of withdrawing from Uruguay. Earlier reports indicated a $4.8 million debt dispute between Tether and Uruguay's state-owned power company, UTE.

According to a report by local news agency El Observador on Tuesday, Tether has officially notified the Uruguayan Ministry of Labor of the suspension of mining activities and the layoff of 30 employees. Tether initially announced the launch of a "sustainable Bitcoin mining operation" in Uruguay in May 2023, aiming to utilize the country's renewable energy sources. It was reported that Tether originally planned to invest $500 million in the mining operation in Uruguay.

Crypto trader Ansem posted on social media that the major value accumulation phase in the crypto industry is "basically over," and the vast majority of tokens ("95% junk") will struggle to gain sustained value in the future.

He stated that in the future, what will truly capture value will be stablecoins and the blockchain infrastructure built on their own chains by traditional fintech companies such as Stripe, Coinbase, and Robinhood, rather than most token projects currently on the market.

Ansem believes that only three areas still offer investment opportunities, both now and in the future: Bitcoin, privacy-related sectors, and the Hype/DEX ecosystem. He added that a new wave of opportunities may emerge after 2027, arising from the combination of AI/robotics and blockchain.

Aishwary Gupta, Global Head of Payments and RWA at Polygon, believes that global stablecoins are entering a "supercycle," and the number of stablecoin issuers could exceed 100,000 within the next five years.

Gupta points out that Japan's participation in government bond and policy stimulus pilot programs through stablecoins like JPYC demonstrates that stablecoins can serve as a tool of national economic sovereignty, rather than weakening central bank power. He states that stablecoins, like fiat currencies, are subject to monetary policy influences and essentially enhance global demand for a country's currency, just as stablecoins have boosted the use of the US dollar.

Gupta also warned that stablecoin yields are attracting low-interest deposits (CASAs) from the banking system to the blockchain, weakening banks' ability to create credit and maintain low-cost capital. To counter this competition, he anticipates banks will issue "deposit tokens" on a large scale to keep funds on their balance sheets while allowing customers to use assets on-chain.

He believes that as the number of stablecoins rapidly expands, the future payment system will rely on a unified settlement layer, allowing users to pay with any token and merchants to receive payments with another token, with the underlying conversion completed seamlessly in the background.

Trending Projects

Ondo Finance (ONDO)

In short:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its token, ONDO, is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest news:

On November 27, according to official news from Ondo Finance, more than 100 tokenized stocks and ETFs launched by Ondo have been officially launched on Binance Wallet based on BNB Chain, opening up investment opportunities to 280 million users.

Previously, Ondo Finance announced a $25 million strategic investment in YLDS, a stablecoin launched by a subsidiary of Nasdaq-listed Figure, to enhance the yield sources of its flagship tokenized fund, OUGG, and improve its diversified portfolio.

MSX (STONKS)

In short:

MSX is a community-driven DeFi platform focused on tokenizing and trading RWA (Retail Assets and Services) such as US stocks on the blockchain. Through a partnership with Fidelity, the platform achieves 1:1 physical custody and token issuance. Users can mint stock tokens such as AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradeFi and DeFi, providing users with a highly liquid, low-barrier-to-entry on-chain investment gateway to US stocks, building a "Nasdaq for the crypto world."

Latest news:

On November 28, data from the MSX website (msx.com) showed that the platform's trading volume reached $1.26 billion in the past 24 hours, setting a new single-day record. As of the time of writing, the platform's total trading volume has exceeded $13.1 billion.

Previously, the MSX platform officially launched its S1 points season and M-Bean incentive mechanism. The platform will statistically analyze real trading and holding activities in US stock spot trading, cryptocurrency futures, and US stock futures, automatically settling the previous day's points at 10:00 AM (UTC+8) daily. M-Beans, a core indicator for measuring user trading activity and contribution, will also be used for the allocation and incentive of the platform's token $MSX. M-Bean calculation considers not only trading volume but also position duration, profit and loss performance, and team Boost level to ensure fair incentives. Team Boost uses a T+2 update mechanism, automatically synchronizing bonuses, and historical trading points are retrospectively incorporated into community incentives.

Related Links

We've compiled the latest insights and market data for the RWA sector.

Stablecoins generate interest through government bonds, through native on-chain mechanisms, and through active management. They share the same name but carry entirely different risks. Understanding their structure is the first principle for understanding the future of stablecoins.

OKX Research Institute | Why will RWA become a key narrative in 2025?

RWA is not a short-lived crypto fad, but a crucial bridge connecting Web3 with the trillion-dollar traditional financial market.