Is the prediction market the next ByteDance? What are the strategies? A breakdown of the billion-dollar market capitalization model.

- 核心观点:预测市场估值高源于其多层级发展潜力。

- 关键要素:

- 事件衍生品交易所支撑基础估值。

- 参数化保险与决策数据层拓展收入。

- AI训练与社交媒体带来想象空间。

- 市场影响:推动预测市场赛道关注与资本流入。

- 时效性标注:中期影响

Original author: Star@Day1Gobal Podcast (X: starzq)

Polymarket and Kalshi are currently valued at $15 billion and $12 billion respectively. Kalshi's annual revenue is projected at $60 million, resulting in a price-to-sales ratio of 200.

Why would VCs offer such high multipliers? This article attempts to provide some answers.

I've been following prediction markets for over a year and was very curious about this issue. I've done some research and will try to answer this question, as well as what stage these two companies are currently at, how much room for growth they have, and a comparison with ByteDance:

Initially, VCs didn't see the value in "news apps" and basically passed on ByteDance. Ultimately, ByteDance became known for its "recommendation engine," using this powerful tool to revitalize almost every aspect of internet business, achieving a market capitalization of $500 billion.

Could Polymarket and Kalshi use their "predictive" capabilities to replicate across other industries? What are some possible ways to participate and strategically position themselves in these markets?

I also recommend reading this article first : https://x.com/starzq/status/1993486485170143499?s=20

【Table of contents】

- Five final forms, corresponding valuations

- In each of the A/B/C/D/E categories, where does Polymarket / Kalshi fall?

- Polymarket vs ByteDance: A comparison of funding and valuation – roughly what stage is it equivalent to at ByteDance?

- Easter Egg: Layout Method

Disclaimer: All discussions in this article are not investment advice, but merely a record of valuation ideas. This article was co-authored by myself and ChatGPT.

1. Five final forms and their corresponding valuations

In my view, predicting the final form of the market can be roughly divided into five levels:

- A: Event Derivatives Exchange

- B: Parametric Insurance Infrastructure

- C: Decision-making & Governance "Truth/Probability Layer"

- D: AI Probabilistic Data & World Prediction OS for AI & Agents

- E: Prediction-native Social Media

The higher up the hierarchy, the more abstract the narrative becomes, and the greater the potential for valuation growth.

We will now disassemble it layer by layer.

1.1 Form A: Event Derivatives Exchange

Keywords: YES/NO contract, Fed, CPI, election. Valuation projections: billions to tens of billions of US dollars.

This layer's story is the easiest to understand:

- Turn questions like "Should we raise interest rates?", "Will CPI not exceed 3%?", and "Who will win the election?" into tradable, standardized contracts.

- Each event corresponds to a pair of YES/NO shares. At settlement, you either receive $1 or your share is zero.

- Price = Probability, 0.32 ≈ 32%.

From this perspective, prediction markets are essentially a "new asset class branch of CME/Binance":

- Users/Hedge funds/Market makers: Use event contracts to hedge macroeconomic risks (Fed, inflation, unemployment rate), or purely for speculation;

- Exchanges make money through transaction fees, clearing fees, and matching fees.

A very crude valuation logic:

- Assuming an annual transaction volume of 100-300 billion US dollars;

- Commission rates (including hidden income) are 0.1%–0.2%.

- Annual income = $100 million to $600 million;

- A PS ratio of 10–15x is more likely to be accepted by the market for "high-growth exchanges/financial infrastructure";

→ Corresponding upper limit of valuation = US$10-90 billion.

If you're even more optimistic and believe it can do it:

- Annual transaction volume exceeding 500 billion

- Annual income of $500 million to $1 billion;

So, Layer A alone can support a ceiling of 5-20 billion US dollars , which is already on the same order of magnitude as mainstream crypto exchanges and some mid-sized CBOE/CME business lines.

1.2 Form B: Parametric Insurance Infrastructure

Keywords: Windstorm/Flood/Agriculture/Business Disruption Valuation Expectation: Adding a layer of "US$50-200 billion" to A's valuation.

Layer B takes "speculation/hedging" a step further, directly targeting the traditional insurance industry.

The logic of parametric insurance is:

- You're not insuring the "amount of loss," but rather an "observable trigger" : typhoon wind speed > 80 mph ( the case I shared before was very vivid ), rainfall > a certain threshold, or a certain index drop > X%.

- Once the conditions are met, compensation will be paid automatically; otherwise, no money will be paid.

The YES/NO contract in the prediction market is essentially a "parameterized trigger," just expressed in a different way. If a platform runs successfully at layer B:

- Upstream: Connecting insurance companies/reinsurance companies/corporate risk management departments;

- For downstream applications: use event contracts to abstract various natural disasters/climate/business interruption risks;

- What they collect is not the full insurance premium, but rather infrastructure/clearing/data usage fees;

Then it will become:

It is now a "routing layer for global parameterized risk + reinsurance matching platform", rather than just a "gambling platform".

What are your thoughts on valuation?

- Global P&C/Cat/Special Purpose Insurance premiums are in the trillions of US dollars .

- A small portion of this (e.g., 1–3%) can be parameterized and abstracted.

- Another portion of this is priced and matched through platforms like Polymarket/Kalshi.

This layer brings the platform the potential for an additional several hundred million US dollars in revenue :

- Conservative estimate: an additional $100-300 million in infrastructure fees annually;

- Aggressive: Achieve $500 million to $1 billion.

If we add the portion related to the A-level event exchange, the combined A+B entity could potentially reach a ceiling of 10-30 billion US dollars.

1.3 Form C: Decision-making & Governance "Truth Layer"

Keywords: Truth price, policy model, corporate forecasting, market valuation imagination: adding another layer of "Bloomberg/MSCI-style" premium, $30-80 billion range.

If predicting market prices, long-term results prove to be more accurate than:

- Poll

- media

- Expert Interview

If it's closer to the true probability, then it can easily become a "probability dashboard" in various decision-making processes:

- Government: Before introducing a policy, examine how the implied probability of related events changes;

- For businesses: internal budgeting, employee forecasting, and gathering "collective wisdom" within the organization;

- Investment institutions: Integrate event pricing directly into their strategies (such as the probability of over-raising or not raising interest rates).

At layer C, the platform no longer sells just "contracts," but rather:

- Probability Data API;

- Decision-making & governance tools;

- Various "event indices", "risk factors" and related index authorizations.

This is somewhat like: Bloomberg + MSCI + a little bit of Palantir.

If A+B can already contribute $500-1 billion in revenue annually, then layer C could very well:

- Contributing hundreds of millions to billions of US dollars in data/tool/index licensing revenue;

- To form an "event & probability infrastructure" with a total annual revenue of $1-2 billion.

Using the logic of "high-stickiness data infrastructure + financial infrastructure" to give a PS ratio of 15-25x, the valuation will naturally slide into the range of 300-500+ billion US dollars .

1.4 Form D: AI Probability Data & World Prediction OS

Keywords: World model training, dataset with feedback, valuation imagination: key layer pushing towards the "hundreds of billions of dollars" level

Layer D is the most abstract, but it's also the layer that has been most seriously discussed in the last two years:

Prediction market = a set of world probability datasets with monetary gains and losses, timestamps, and result feedback.

For AI, this is fundamentally different from ordinary text:

- Text: It can only learn "how humans speak" and "how they feel";

- Predictive markets: They can learn "how people assign probabilities to events under different information sets"; each sample has "post-hoc truth" for comparison; they are naturally suitable for world model calibration and reinforcement learning.

If a certain platform truly succeeds at layer D:

- An API for prediction tasks open to AI models;

- It provides an environment specifically designed for agents to "constantly place bets/get proven wrong/be rewarded";

- The predictive abilities of humans and AI are evaluated and ranked using a unified set of metrics.

Its role in the AI ecosystem will then be similar to:

"Probabilistic data from OpenAI + Kaggle + financial sandbox".

At this point, A/B/C bring about "steady-state cash flow," while D brings about:

- The story behind "high valuation and high premium"—

- This is also the key to pulling the whole story from tens of billions to hundreds of billions.

1.5 Form E: Predicting Native Social Media

Keywords: viewpoint + position + timeline, valuation imagination: adding a layer of "ByteDance-style attention premium" to the whole story.

The final layer is the most imaginative: new types of social media.

Traditional social media revolves around:

- People: Who do you follow?

- Content: What are you browsing?

- Interaction: Like/Comment/Share.

In predicting the original form of social media, an additional dimension has been added:

"How much have you bet on this?"

The same "topic card" can carry:

- Events: such as "Can Trump win?" and "Can NVDA double next year?"

- Price: Current implied probability of Polymarket / Kalshi;

- Opinion: Long-form analysis, short commentary, and memes;

- Position: Who is on which side, and what is their past performance in prediction?

The user's behavior path will also change from:

See the topic → Like/Watch the drama

become:

See the topic → Check the odds → Check the KOL's positions → Place a small order on the spot.

The biggest variable here, and what excites me the most, is that the entire content distribution system will be restructured, shifting from the past "traffic model" to a "transaction model":

- In a traffic-driven model, rewarding "popularity" rather than "truth" often leads to a proliferation of fabricated stories, while those with genuine insights fail to gain traffic.

- In the trading model, because "betting on the truth" can bring rewards for successful predictions, it will attract both funds and traffic, creating a new flywheel: traffic may not necessarily bring transactions, but good transactions will definitely bring traffic.

Content involving transactions will become a new source of new content, and may even have the potential to build a new type of native social media.

Meanwhile, the prediction platform's "monetization methods" have evolved from A to D:

- Transaction fees

- insurance

- Data service fee

Extended to:

- Advertising/branding budget;

- Content subscription/donation;

- Tools/reports/services targeting high-net-worth individuals;

- Various "commercial entry points surrounding prediction topics" (sponsored markets, co-branded events, offline conferences, etc.).

if:

- A+B+C+D will push platform revenue to $1-2 billion per year ;

- E will contribute hundreds of millions to billions of US dollars in advertising/subscription/service revenue;

That story could potentially generate two to three billion US dollars in revenue per year.

In the context of the quadruple overlap of "finance + data + social + AI", a valuation of 50-100 billion US dollars is no longer a figure that is completely arbitrary, but an "optimistic scenario" that can be seriously discussed.

And that is precisely why:

When at least three layers of A–E are formed and the other two layers have clear paths, a market capitalization of 100 billion is achievable.

2. In which category (A/B/C/D/E) does Polymarket/Kalshi fall?

With these five floors, we can more calmly assess the situation:

Where are Polymarket and Kalshi now in the A–E stages?

2.1 Kalshi: A is the best, C/E are just beginning to emerge, and B/D are almost blank.

A: Event-driven derivatives exchange (✓✓✓)

- With a full CFTC license, it is positioned as a "regulated event futures exchange" ;

- The contract design is highly financialized: macroeconomic data such as CPI, non-farm payrolls, unemployment rate, and unemployment benefit claims; political events such as elections and congressional control; and now sports and entertainment themes have been added.

- We have integrated with multiple brokerages (Robinhood, Webull, etc.) to incorporate event contracts into traditional trading interfaces.

This line can be said to have already taken a clear shape: a hybrid of a smaller version of CME and CBOE.

B: Parametric insurance (× / Not yet developed)

- I haven't seen Kalshi directly link event contracts to an "insurance/reinsurance" structure yet;

- It's more like they just moved the "hedging that insurance companies originally used derivatives to do" onto their own platform, but didn't really redesign the insurance product itself.

C: Decision & Data Layer (✓ / Early Stage)

- Macro traders and the media are already using Kalshi prices as an "enhanced poll";

- However, it is still far from being "written into the decision-making process by governments and enterprises" and "formed into standardized APIs and indices".

D: AI World OS (× / This is entirely a story)

- At least for now, there are no publicly available product lines specifically designed for providing world prediction data/training environments for AI models;

- Currently, this layer is entirely a story, existing mostly in the imagination of investment research circles.

E: Predicting native social media (✓- / The product shows promise, but it may not be fully priced in).

- Kalshi's own front-end UI is much better than traditional brokerages in integrating "topic cards + probability + news";

- However, it has not yet built a complete content and social ecosystem like X or TikTok; it is more of a tool than a media platform.

Conclusion: Kalshi = A is the most solid, C/E has some initial form, and B/D is basically a blank slate. It is currently valued at 12 billion, which is essentially the price of a "CME prototype of a new asset class + some data story".

2.2 Polymarket: A is very strong, C/E are highly anticipated, B/D are still in the story zone.

A: Event-driven derivatives exchange (✓✓✓)

- It adopts a hybrid architecture of on-chain settlement and off-chain CLOB order book, and its depth and trading experience are very close to those of mature crypto exchanges;

- In the sectors of politics, sports, and macroeconomics, Polymarket's perceived activity level is among the highest in the entire prediction market sector.

- During the 2024 election cycle, this single sector already generated billions of dollars in cumulative transactions, making it a leading application in the crypto space.

B: Parametric insurance (× / Not yet tested)

- The currently publicly available markets are still dominated by politics, sports, and macroeconomics.

- There is no evidence that systemic weather insurance, climate insurance, and supply chain disruption insurance are abstracted into "insurance/reinsurance" business;

- This part mostly focuses on the "can be done later" slides in the PowerPoint presentation.

C: Decision & Data Layer (✓✓ / The option with the clearest path)

Polymarket has done two very key things in the past 12 months:

- Partnering with Twitter to become one of the official sources of forecast data;

- A strategic investment and data distribution agreement has been reached with ICE, the parent company of the NYSE: ICE will invest up to $2 billion, giving a pre-investment valuation of approximately $8 billion; at the same time, it is agreed that ICE will distribute Polymarket's event data to institutional clients worldwide.

These two steps are essentially about grasping:

- Web2 traffic entry point (X);

- TradFi's paid data gateway (ICE).

If the collaboration continues, Polymarket's story at level C will become:

"Infrastructure that provides global event probability data and metrics for individuals and institutions."

D: AI World OS (× / Concept exists, product not yet available)

- Both official sources and media outlets are talking about "the value of prediction markets for AI training world models";

- However, I haven't seen anything like a "prediction API/benchmark platform for LLM/Agent".

This is more of a "page that appears on the pitch along with AI," and it's still a long way from true commercialization.

E: Predicting native social media (✓ / possibly a unique card for Polymarket compared to Kalshi)

- In terms of product design, Polymarket is more like a "prediction-based Reddit + TradingView" : each market has a long comment section, icons, and price trends below it; the community atmosphere is more Crypto Native, with memes, analysis, and betting all mixed together;

- If the collaboration with X really moves towards deep integration in the future (such as directly embedding the odds into the tweet card), it will create a completely different path from Kalshi's in the E layer - "building a social timeline around prediction".

Conclusion: Polymarket = A has already emerged, C/E has very concrete leverage, and B/D is still a highly abstract option. At a valuation of 15 billion, the essence is that the market has already assumed it is "the one with the best chance of occupying A+C+E in this round of Crypto prediction market".

3. Polymarket vs ByteDance: A comparison of funding and valuation; roughly what stage is it equivalent to for ByteDance now?

Another interesting thing is that a few days ago I shared an interview that I think offers the deepest understanding of prediction markets. The guest was Jeff Yass, the founder of SIG, the largest options market maker in the US, and currently a major market maker for Kalshi.

What Asian users are more familiar with is SIG's $5 million investment in ByteDance in 2012, which has now yielded returns of over a billion US dollars, making it a true grand slam.

Those familiar with ByteDance should know that initially, VCs looked down on the value of "news apps" and basically passed on them; in the end, ByteDance became the story of "recommendation engines", using the powerful tool of "recommendation" to rework almost all of its internet businesses, reaching a market value of 500 billion US dollars.

(There are also many early employees of ByteDance on Twitter. They probably never imagined that their stock options would be worth so much money 10 years ago, haha.)

Is it possible for Polymarket and Kalshi to use their "predictive" capabilities, starting with social media, to replicate this across other industries?

One interesting perspective is that if Polymarket does have the potential to become a "predictive version of ByteDance" in the future, roughly what stage of ByteDance would it be equivalent to now?

3.1 ByteDance: The Curve from 500 Million to 500 Billion

According to publicly available information, ByteDance's valuation process can be roughly summarized as follows:

- Series C funding in 2014: $100 million raised; valuation approximately $500 million . At that time, Toutiao had just proven the effectiveness of its content recommendation model.

- 2016 Series D funding: $1 billion raised; valuation approximately $11 billion.

- In its 2017 Series E funding round, General Atlantic led a $2 billion investment, valuing the company at approximately $22.2 billion .

- In 2018, SoftBank's $300 million Series E+ funding round boosted its valuation to $75 billion, making it one of the world's most valuable unicorns at the time.

- Around 2020: A new round of financing + share buyback, with a valuation of approximately US$180 billion;

- 2024–2025: The mainstream valuation range for employee buybacks and off-exchange transactions is around US$300-500 billion.

It can be simply summarized as follows:

- 500 million: Toutiao is just getting started;

- 11-22 billion: The information flow advertising model has been validated, and Douyin is beginning to explode.

- 750-1800 billion: TikTok + Douyin dual engines begin to define the next generation of "Attention OS";

- 300-500 billion: A global-level super platform + a multi-business matrix.

3.2 Polymarket: Accelerating from Tens of Millions to "Tens of Billions"

Let's look at Polymarket again:

- 2020–2022: Several seed rounds + Series A funding, raising millions to tens of millions of US dollars, with valuations ranging from tens of millions to hundreds of millions;

- 2024: Reports mention a funding round with a valuation exceeding $1 billion (the starting point of a "unicorn");

- June 2025: Founders Fund and others entered the market, with market rumors suggesting a valuation in the range of $1 billion to $1.2 billion ;

- In October 2025, ICE invested up to $2 billion, giving a pre-investment valuation of approximately $8 billion according to the terms of the agreement. Some media outlets reported the post-investment valuation as $9 billion.

- Some secondary market transactions and rumors: Numerous sources claim that Polymaket is in talks for its next round of financing at a valuation of $15 billion.

Looking at the numbers alone: Polymarket's current valuation range of 8-15 billion is on the same order of magnitude as ByteDance's valuation of 11-22 billion in 2016-2017.

3.3 However, in terms of "business maturity," Polymarket is far from reaching ByteDance's level of maturity (2016-2017).

The key difference is here:

- ByteDance 2016–2017: Toutiao was already the leader in China's information flow advertising, with very strong cash flow from its advertising business; Douyin was just taking off, and the S-curve of short videos was just beginning to unfold; its valuation included both "steady-state cash flow" and "Douyin options".

- Polymarket in 2025: Products: Demonstrated strong demand for event prediction, with a surge in volume during the election cycle, and the X/ICE partnership opened two important entry points; Revenue: Still mainly in the stage of "subsidizing liquidity, market-making rewards + initial fee experiments" , much of the GMV has not yet turned into stable, high-quality revenue; Regulation: Just passed the DOJ/CFTC review and returned to the United States by acquiring a licensed exchange, which happened within 12 months.

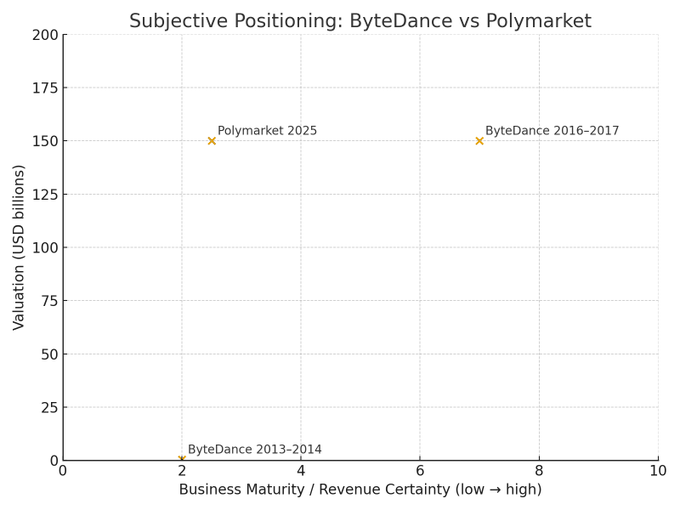

If we use a two-dimensional coordinate system to draw it (purely subjective):

- X-axis = Business maturity / Revenue certainty;

- Y-axis = valuation size;

It will be arranged roughly like this:

- ByteDance 2013–2014: Business just launched, valuation 500 million;

- ByteDance 2016–2017: Business and cash flow are highly certain, valuation of 11-22 billion;

- Polymarket 2025: Business certainty ≈ ByteDance 2013–2014, but valuation has already jumped to the 2016–2017 level.

The market is already pricing Polymarket based on the perspective of "almost guaranteed success at Layer A + clear path at Layers C/E". At the same time, a portion of the "option premium" has been paid in advance for B (insurance) and D (AI).

4. Easter Eggs: Layout Method

TL:DR 4-type layout method

- Interactive prediction markets, especially those not TGE, such as @Polymarket , @opinionlabsxyz, and @42space ( @Kalshi is only available to US users).

- Yap: Polymarket also rewards content creators, so please go to the official website and link your X account as soon as possible.

- Primary Investment: Many people probably don't know that the pre-IPO platform Jarsy has listed pre-IPO equity in Polymarket and Kalshi, valued at $17.8 billion and $13.8 billion respectively. It's not cheap, but those particularly bullish should definitely check it out. We've included our previous interview with the Jarsy founder at the end. Another option to consider is xAI. If prediction markets can become a new type of social media, I think the giants most likely to benefit are X, Robinhood, Coinbase, Reddit, and Meta (Facebook), essentially finding new business growth. X is now part of xAI, a company Musk highly values, currently valued at $171 billion, and can be bought on @PreStocks . Jarsy also has xAI, but due to different platform mechanisms, the valuation is higher.

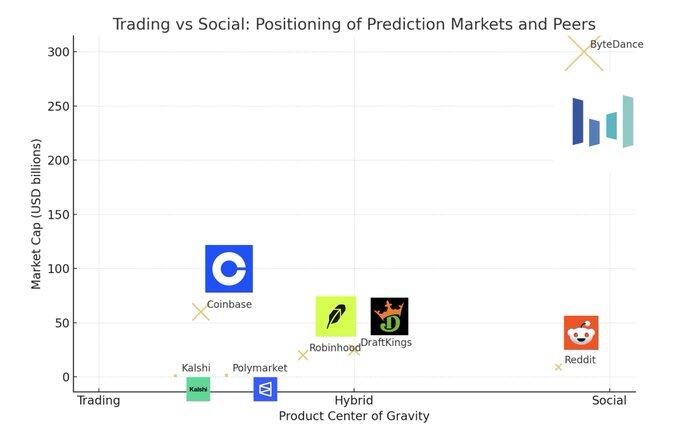

- Secondary Investment: Following the logic above, prediction markets could become a new type of social media, and are highly likely to become a significant growth driver for Robinhood, Coinbase, Reddit, and Meta in the future, especially for Robinhood and Coinbase, both of which currently have market capitalizations in the hundreds of billions. Robinhood and Coinbase have already partnered with Kalshi, and Reddit and Meta, with their more diversified businesses, seem to be better positioned to wait until there are clear signs of them entering the prediction market before making a decision.

Finally, let's conclude with a tweet from the founder of 1confirmation, who, in the current climate of negative EV in the crypto market, predicts that the market will generate positive EV within 10 years. https://x.com/NTmoney/status/1993473872914751758?s=20

With trading on one side and social interaction on the other, more and more players are entering the field and continuing to pay attention to it.

To reiterate: all discussions in this article are for informational purposes only and are not investment advice. DYOR