The Crypto Gold Rush Ends: When "Dumb Money" Disappears, Where's the Next Oasis?

Original author: IcoBeast

Original article translated by: Deep Tide TechFlow

Over the past decade, a notable characteristic of cryptocurrencies (not specifically Bitcoin) has been that any ordinary person with internet access, some free time, and about six functioning brain cells can quickly turn a small amount of money into a large sum of wealth.

Since 2016-2017, the crypto industry has experienced three to four widespread "gold rush" cycles. These cycles share a common characteristic: the price of a mainstream on-chain asset is extremely low, but it has enormous compounding potential, and the value of this asset subsequently skyrockets.

Every time, the "dumbest person" you know in this industry makes an astonishing amount of money, and then they tell their friends, who in turn bring in even more people. After all, "If that fool can make $100,000 from $100, why can't I?"

Let's take a look back at these historic moments of wealth creation...

Looking back at history

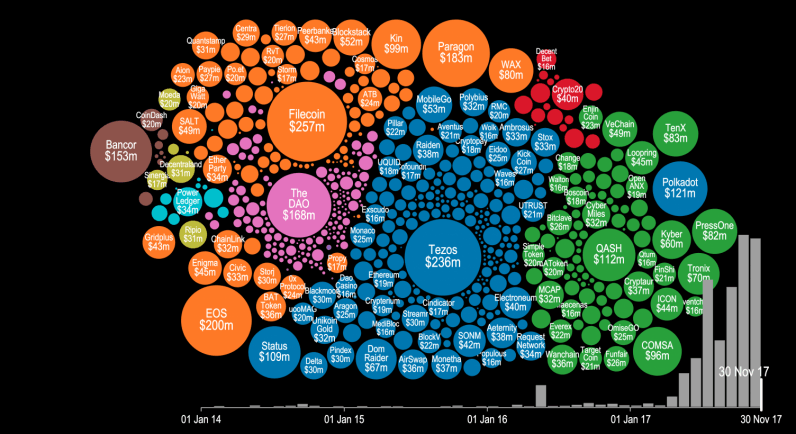

2017 - ICO Craze (After Ethereum ICO)

In my opinion, this was essentially the "golden age" of the crypto industry. Almost every day a new project would appear, complete with a white paper and a cool gradient logo. Even though these projects had virtually no practical functionality, everyone was scrambling to invest their ETH to secure a share. Then, these tokens would be listed on exchanges, and people would flock to buy them, causing prices to skyrocket. You could make a fortune and then exchange your profits back into ETH.

ICO Craze: Charts Speak for Themselves

That was fantastic. At the time, there were only about 100-200 tokens on the market, but none of them were actually usable or meaningful. Everyone simply and crudely invested their ETH in various ICO projects and made a fortune—it was practically free money. Everyone was trading those few fixed tokens, aiming to accumulate more ETH…it was incredibly easy. People would even share this "get-rich-quick scheme" with their friends, who would then join in. However, we were all eventually taught a lesson by the market; the crypto market began to collapse, followed by a two-year bear market.

2020-2021: The DeFi Craze of "Yield Mining + Food Ponzi Scheme"

I personally didn't participate much in this wave of hype (due to real-life issues), but its essence was the launch of some "real" DeFi products for the first time (started with Compound's COMP token distribution). This spawned various liquidity mining games and Ponzi schemes... Everyone once again frantically poured into a small selection of tokens, still aiming to maximize their ETH holdings.

Many early crypto Twitter figures rose to prominence during this period. The market attracted a surge of new capital because nobody really knew how to play the game, and tools for maximizing returns were not yet widely available. Furthermore, the price of ETH began to rise rapidly, further boosting profit margins (PnL) and attracting even more speculative funds.

2021-2022: The Crazy Era of the NFT Bubble

In the past, when the pandemic brought the world to a standstill, people received government subsidy checks while losing their jobs (or businesses were forced to close), so they spent their days in clubhouses and on Twitter Spaces.

Just then, a group of people started minting NFTs. Among them, Bored Apes became the industry's "kingmaker" (although its minting process was long enough for anyone to participate). With Bored Apes' success, the market's floodgates were opened. You could mint the worst-looking image for 1 ETH, and then wake up the next day to find it selling for 20 ETH... and then its price would skyrocket to 50 ETH. It all made no sense; nobody really wanted these JPEG files, and nobody really believed they were worth those outrageous prices. But everyone wanted to make money and wanted to keep playing the game.

This insane wealth effect allowed people to flip a few images with a small amount of ETH and eventually accumulate a large amount of ETH... with almost no skill involved, simply because "they were there." This obviously attracted huge attention, and NFTs quickly went mainstream. However, the bubble eventually burst, and most participants were ultimately eliminated by the market.

This wealth effect was briefly replicated during the Ordinals craze in early 2023. At that time, Bitcoin prices plummeted, and early Ordinals became a crazy "cooking" opportunity: you could quickly double your small amount of BTC into a large amount. Subsequently, Bitcoin prices experienced a parabolic surge. (And those who clung to their JPEGs were ultimately "liquidated" by the market.)

January 25, 2023: The Meme Season's Wealth Frenzy

This could be considered the longest period of wealth creation in the cryptocurrency "dumb money" cycle—the ETH and Solana meme coin craze. Strictly speaking, it all started with the explosive growth of BONK after the FTX crash at the end of 2022, but I prefer to see the real starting point as the rise of PEPE (based on ETH) in April 2023 and WIF (based on SOL) in November 2023, which kicked off a crazy token rally that lasted for more than a year.

These worthless cryptocurrencies, devoid of any real purpose or plan, and existing only as a "hype," have seen their market capitalization soar to billions of dollars. Especially in the early days, simply buying a random token for a thousand dollars almost guaranteed a 10x return the next day... and this could continue for weeks.

As time goes on, the game becomes increasingly difficult: bots become smarter, arbitrage tools become more efficient, and developers are better able to cash out when they "run away," gradually raising the overall barrier to entry. People start withdrawing their money from the "casino," rather than continuing to pour money in after seeing a friend make $20,000 in 17 minutes with a token like "pepefartsockinu69420." Meanwhile, new trading pairs appear every day, allowing you to accumulate more ETH or SOL through these trades.

Then came the "9/11" of Meme coin. Trump, Melania, and finally, the last nail in the coffin—Hayden Davis's Libra. All of this changed the game. Everyone knew deep down that the game was "cooked." When one party can steal over $100 million from the "collective pool" in a second, the game is no longer worth playing… After all, what could be crazier than the US president secretly issuing a token and causing its market capitalization to skyrocket to $70 billion FDV (Fully Diluted Valuation) overnight?

This is where we are today. About nine months have passed since that "fatal blow." While there have been some standout opportunities (especially since mainstream assets have performed well since April), there hasn't been another event like this one that rapidly multiplies native tokens or mainstream assets and allows for significant appreciation through the power of compounding wealth.

Frankly, I don't know if this situation will repeat itself. NFTs? They've been "cracked"—there are probably only about 17 people left in the world still wanting to trade or deal with NFTs. Memecoin? Also "cracked"—becoming a 24/7 token deployer is obviously safer and simpler; you can profit without any risk. On-chain Ponzi schemes? Everyone basically understands now…only the "sharks" are still playing; you must choose your exit time very precisely, or you'll be swallowed up. Perhaps ICOs will make a comeback? Monad is performing well. We'll wait and see.

Over the past year, we've seen virtually no easy wealth creation opportunities driven by "dumb money." That's why everyone's furious. They've become accustomed to always catching a wave of such hype, but for the past nine months, we've only seen desolation (unless you hold a significant amount of mainstream assets, especially Bitcoin).

Recently, I mentioned on my timeline that what's currently available on the chain hasn't been particularly inspiring, and much of it feels somewhat outdated. However, some teams building interesting "new" things have contacted me, and I plan to delve into their prototypes and document my testing and findings (and, of course, plenty of updates on Kalshi cryptography).

One of the teams was @zigchain, who wanted to sponsor this article of mine—something I had actually been planning to write for weeks.

They are building a platform described as an on-chain version of "Wall Street," offering tokenized RWA (Real World Assets) yield products. These products aim to allow ordinary users to access higher-yield investment opportunities with a smaller capital threshold, rather than being limited to traditionally high-threshold investments that are unfriendly to retail investors.

While I have a long-term positive outlook on RWA (such as perpetual contracts and tokenized stocks), I am generally skeptical of the RWA-related projects currently on the market. However, the @zigchain team claims that their first application (Zignaly) already has over 400,000 real users, so I plan to try it out myself and see how their product performs.

Whether RWA products can deliver the kind of ultimate wealth creation opportunities we've been missing, who knows? But I'm ready to return to the "theoretical trenches," try new things again, and share my experiences. It's been too long since we've had this kind of exploratory content; we need more content that sparks interest and curiosity on our timeline.

If you've read this far, thank you for your patience. I'm truly grateful—I still believe one of the coolest things in the world is that there's a group of people online who are willing to take the time to read what I write. I hope this article has been of some value to you (whether for entertainment or something else), and I'll be sharing more content with you soon.

- 核心观点:加密市场周期性财富效应正在减弱。

- 关键要素:

- ICO、DeFi、NFT、Meme币四次热潮。

- 早期参与者轻松获得超额回报。

- 当前市场缺乏简单暴富机会。

- 市场影响:推动行业转向RWA等新叙事。

- 时效性标注:中期影响