Miners Amidst the Bitcoin Crash: Who's Profiting? Who's Holding On?

- 核心观点:比特币矿工面临收入下降与成本压力。

- 关键要素:

- 矿工7日平均收入下降35%。

- 老旧矿机与高电费增加挖矿成本。

- 部分矿企每枚比特币总成本超11万美元。

- 市场影响:矿工或减少比特币出售,支撑价格。

- 时效性标注:短期影响。

Original author: Prathik Desai

Original translation by Chopper

The financial logic of Bitcoin miners is quite simple: they survive on fixed protocol revenue but face fluctuating real-world expenses. When markets are volatile, they are the first to feel the pressure on their balance sheets. Miners' revenue comes from selling the Bitcoins they mine, while their operating costs are primarily the electricity bills for the heavy computers needed to run mining.

This week, I tracked some key data for Bitcoin miners: the network pays them, the cost of earning that revenue, the remaining profit after deducting cash outlays, and the final net profit after accounting.

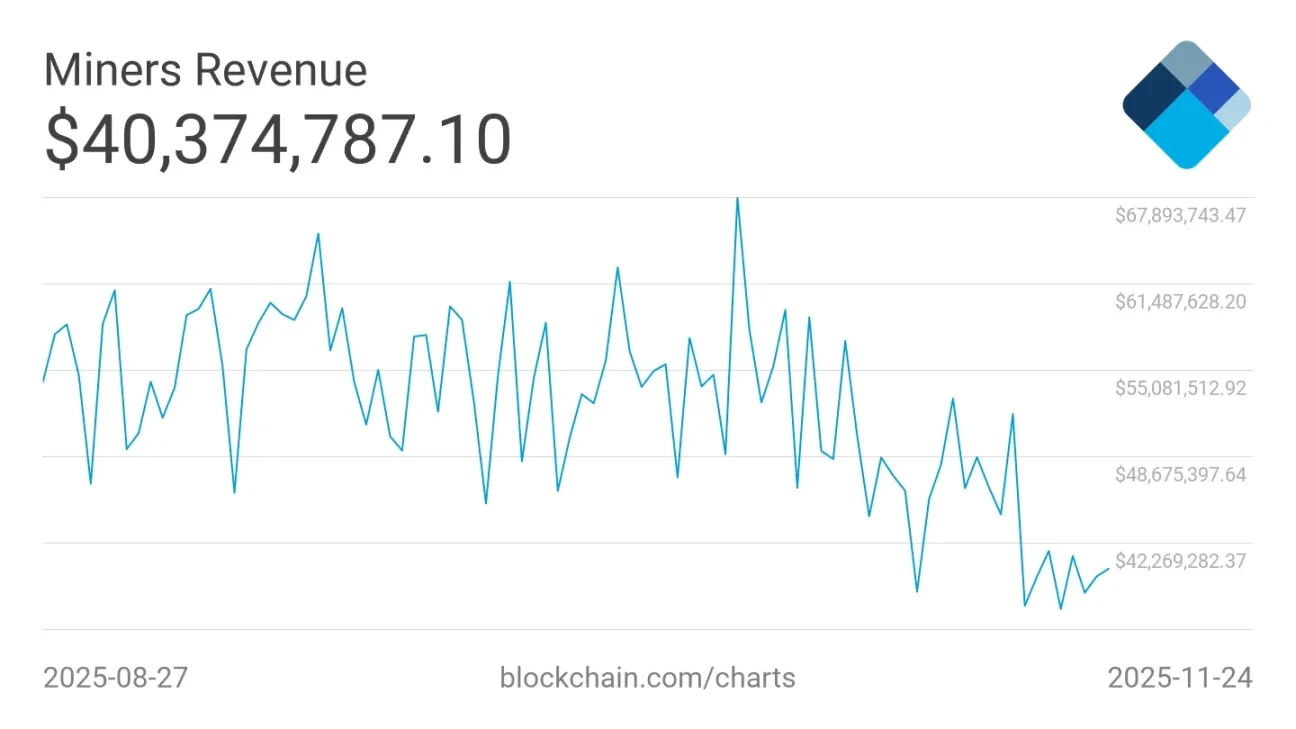

With Bitcoin prices currently below $90,000, miners are facing difficulties. Over the past two months, miners' average 7-day revenue has dropped 35% from $60 million to $40 million.

Let me break down the key logic in detail.

Bitcoin's revenue mechanism is fixed and encoded in the protocol. The mining reward for each block is 3.125 Bitcoins, the average block time is 10 minutes, and approximately 144 blocks are generated per day, which is equivalent to approximately 450 Bitcoins mined daily across the entire network. Based on a 30-day calculation, global Bitcoin miners have mined a total of 13,500 Bitcoins, which, at the current Bitcoin price of approximately $88,000, is worth approximately $1.2 billion. However, if this revenue is distributed across the record-breaking 1078 EH/s (Ahashi) hashrate, the final revenue per TH/s (Tehashi) hashrate is only 3.6 cents per day. This is the entire economic foundation supporting the network operation of this $1.7 trillion network. (Note: 1 EH/s = 10(18) H/s; 1 TH/s = 10¹² H/s)

In terms of cost, electricity is the most critical variable, and its level depends on the mining location and the efficiency of the mining machine.

If miners use modern S21-level mining rigs (consuming 17 joules per terahash) and have access to cheap electricity, they can still achieve cash profits. However, if the mining rigs are primarily older or involve high electricity costs, each hash calculation will increase costs. At current hash prices (affected by network difficulty, Bitcoin price, block subsidies, and transaction fees), an S19 mining rig using $0.06 per kilowatt-hour of electricity can barely break even . If network difficulty increases, Bitcoin price drops slightly, or electricity costs surge, its economic viability will further deteriorate.

Let me analyze this using some specific data.

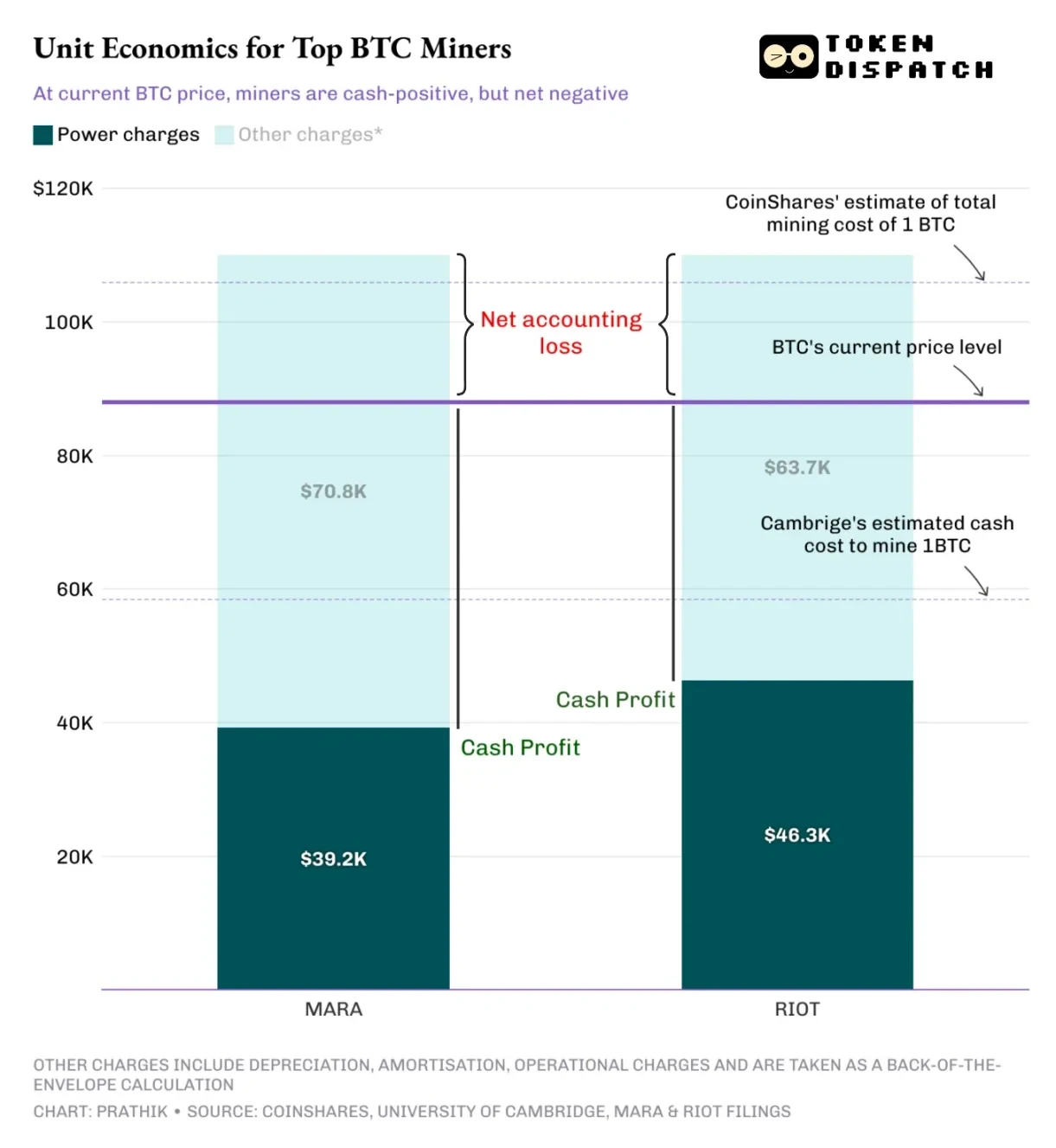

In December 2024, CoinShares estimated that the cash cost for publicly traded mining companies to mine one Bitcoin in the third quarter of 2024 was approximately $55,950. Now, Cambridge University estimates this cost has risen to approximately $58,500. Actual mining costs vary among different miners: Marathon Digital (ticker symbol MARA), the world's largest publicly traded Bitcoin mining company, had an average energy cost of $39,235 per Bitcoin in the third quarter of 2025; the second-largest publicly traded mining company, Riot Platforms (ticker symbol RIOT), had a cost of $46,324. Despite Bitcoin's price falling 30% from its peak to $86,000, these mining companies are still profitable. But this is not the whole story.

Miners also need to consider non-cash expenses, including depreciation, impairment, and stock option compensation, all of which together make mining a capital-intensive industry. Once these costs are factored in, the total cost of mining one Bitcoin can easily exceed $100,000.

Mining costs of top mining companies Marathon and Riot

MARA mines using both its own mining rigs and third-party hosted equipment. MARA incurs electricity, depreciation, and hosting fees. A rough calculation shows that its total mining cost per Bitcoin exceeds $110,000 . Even CoinShares' estimate of the total mining cost in December 2024 was approximately $106,000.

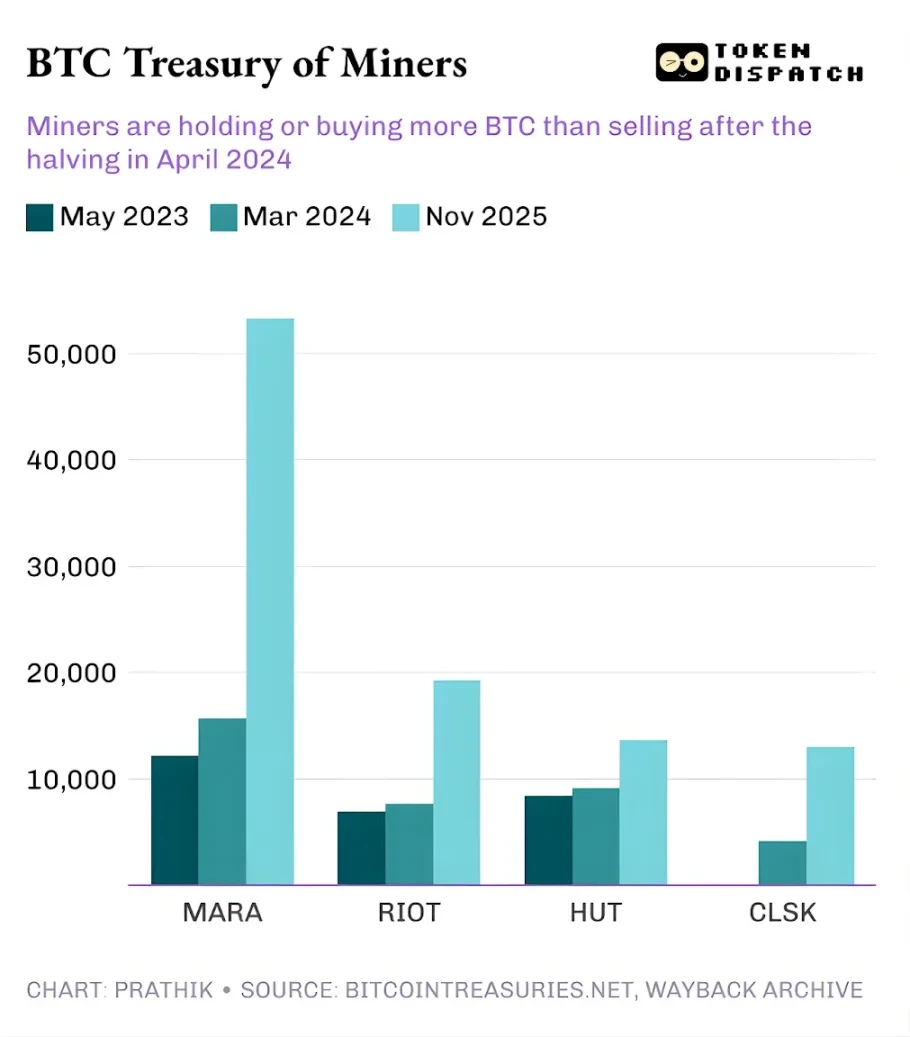

On the surface, the Bitcoin mining industry appears stable. Cash margins are high, accounting profits are expected, and the scale of operations is large enough to easily raise funds. However, a deeper analysis reveals why more and more miners are choosing to hold onto their mined Bitcoins, or even increase their holdings on the market, rather than selling them immediately.

Bitcoin reserves of leading mining companies

Stronger mining companies like MARA are able to cover their costs because they have ancillary businesses and access to capital markets. However, many other mining companies could face losses if the network difficulty were to increase again.

In summary, the mining industry presents two coexisting break-even scenarios:

The first type is large, industrial-grade mining companies, which possess efficient mining rigs, cheap electricity, and low-capital balance sheets. For them, daily cash flow would only turn negative when the price of Bitcoin drops from $86,000 to $50,000 . Currently, they generate over $40,000 in cash profit per Bitcoin mined, but whether they can achieve accounting profitability at the current price level varies from company to company.

The second group is the remaining miners, who will struggle to break even once depreciation, impairment, and stock option expenses are factored in.

Even with a conservative estimate of the total cost per Bitcoin between $90,000 and $110,000, this means many miners have already fallen below their economic break-even point. They are able to continue mining because their cash costs haven't fallen below their cost basis, but their accounting costs have exceeded it. This may prompt more miners to choose to hold onto their Bitcoin rather than sell it now.

As long as cash flow remains positive, miners will continue mining . At a price level of $88,000, the system appears stable, but this is predicated on miners not selling Bitcoin. Once the price of Bitcoin falls further, or miners are forced to liquidate their positions, they will approach the break-even point.

Therefore, while the price crash will continue to affect retail investors and traders, it is unlikely to harm miners at present. However, the situation could worsen if miners' access to financing becomes more limited, at which point the growth flywheel will break, and miners will have to increase investment in ancillary services to maintain operations.