CoinW Research Institute Weekly Report (November 17, 2025 - November 23, 2025)

Key points

The global cryptocurrency market capitalization totaled $3.03 trillion, down approximately 10.88% from $3.40 trillion last week. As of press time, the US Bitcoin spot ETF saw a cumulative net inflow of approximately $57.64 billion, with a net outflow of $1.22 billion this week; the US Ethereum spot ETF saw a cumulative net inflow of approximately $12.63 billion, with a net outflow of $500 million this week.

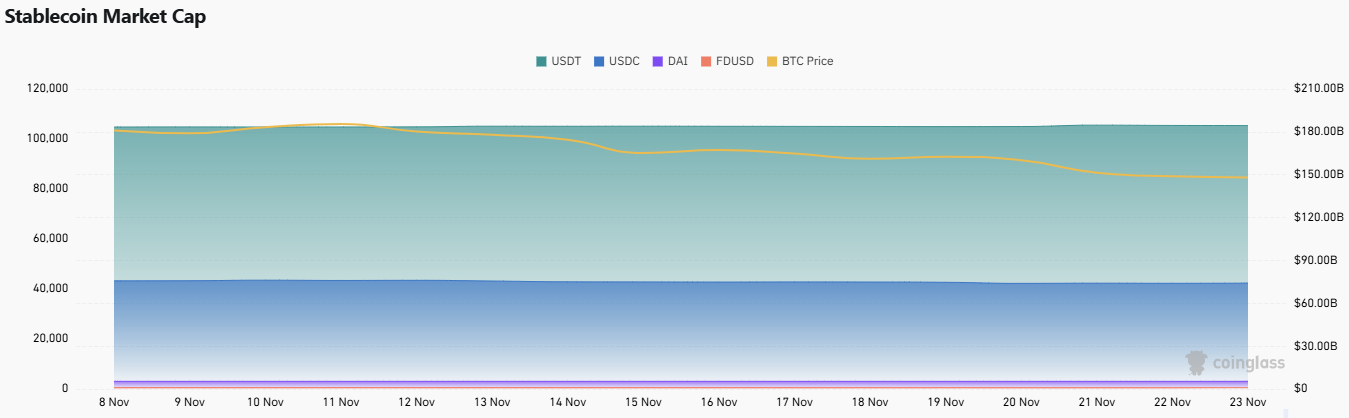

The total market capitalization of stablecoins is $309 billion, of which USDT has a market capitalization of $184.4 billion, accounting for 59.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $74.09 billion, accounting for 24% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.7% of the total stablecoin market capitalization.

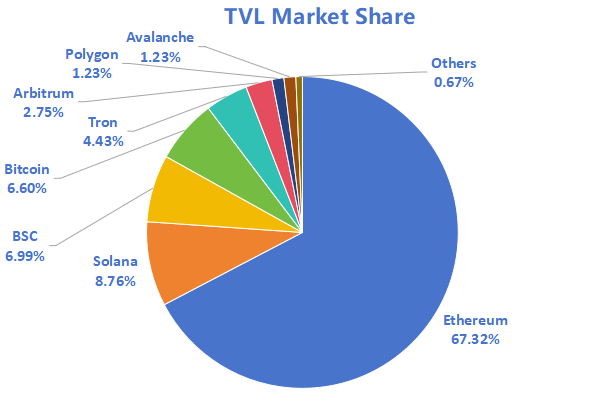

According to DeFiLlama data, the total TVL of DeFi this week was $114.4 billion, a decrease of approximately 6.54% from $122.4 billion last week. Breaking it down by public blockchain, the three blockchains with the highest TVL were Ethereum (67.32%), Solana (8.76%), and BNB Chain (6.99%).

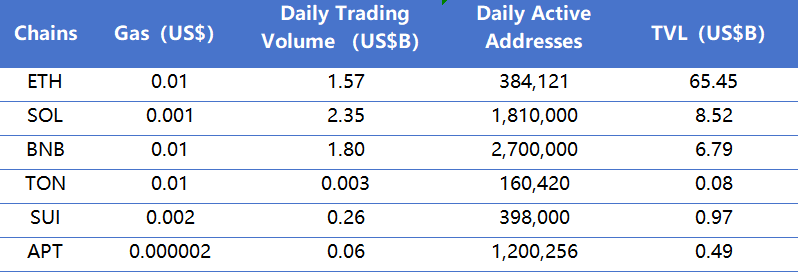

This week, public blockchains experienced pressure on activity and weak funding. In terms of daily trading volume, Solana saw the largest increase this week, rising approximately 5.2%, followed by Aptos at 4.1%. Other public blockchains generally declined, with Sui down 30.7%, BNB Chain down 30.4%, Ton Chain down 26.5%, and Ethereum down 8.8%. Regarding transaction fees, Sui saw the most significant drop, decreasing by approximately 71.4%; Aptos decreased by approximately 33.3%, while Ethereum, Solana, BNB Chain, and Ton Chain remained largely unchanged from the previous week. In terms of daily active addresses, Ton Chain performed best, rising by approximately 41.4%; BNB Chain rose by 3.5%, while other chains experienced varying degrees of decline, with Sui experiencing the largest drop, falling by approximately 45.9%; Solana decreased by 9.1%, Aptos by 7.7%, and Ethereum by 2.7%. Regarding TVL, all chains saw an overall decline this week, with Sui experiencing the largest drop of approximately 17.8%; Ton chain declined by 9.1%, Solana by 8.3%, Aptos by 7.5%, Ethereum by 7.2%, and BNB Chain by 5.6%.

New projects to watch: Nuvolari is an AI-powered collaborative assistant built on the Sonic ecosystem, dedicated to reshaping the user experience of DeFi through intelligent means; HelloTrade is a Web3 trading platform built on the MegaETH ecosystem, committed to providing global users with 24/7 uninterrupted stock, commodity, and RWA trading services, emphasizing a mobile-first experience and supporting high-leverage perpetual contract trading; Nado is an order book-based decentralized exchange focused on providing professional traders with a high-performance spot and perpetual contract trading experience.

Table of contents

Key points

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

2. Fear Index

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD exchange rates

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance Status

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

2. New Project Insights

III. New Industry Trends

1. Major Industry Events This Week

2. Major events that will happen next week

3. Key Investment and Financing Activities Last Week

IV. Reference Links

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

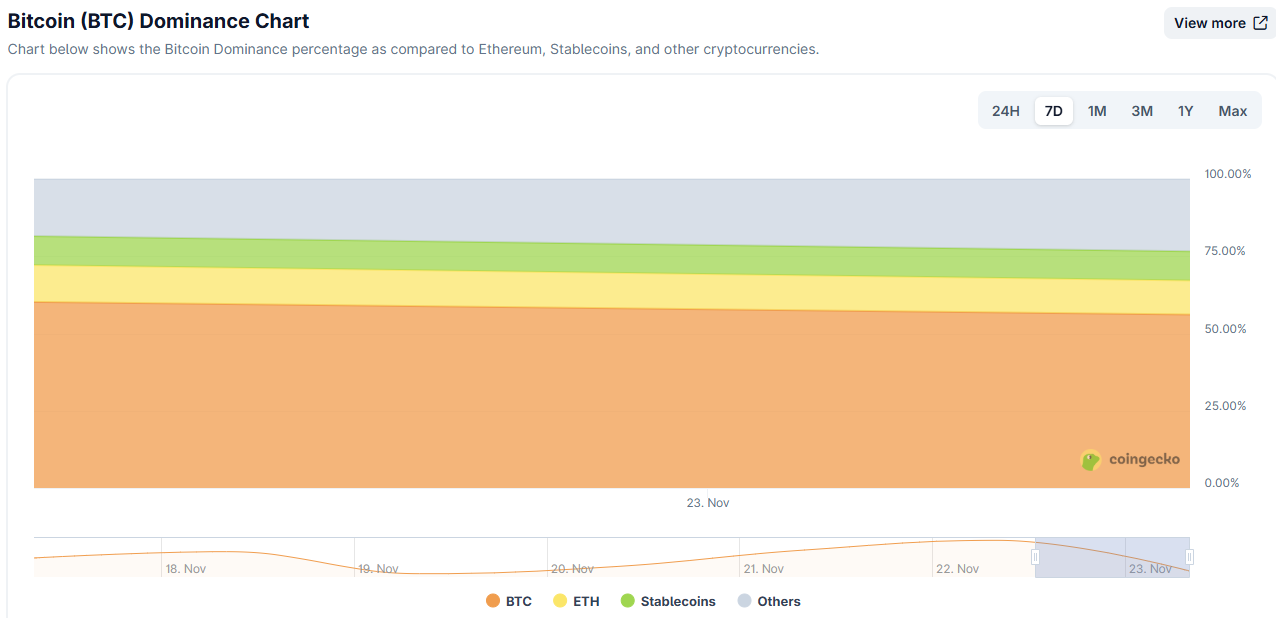

The global cryptocurrency market capitalization is $3.03 trillion, down from $3.40 trillion last week, representing a decrease of approximately 10.88% this week.

Data source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of November 23, 2025

As of press time, Bitcoin 's market capitalization was $1.73 trillion, accounting for 57.15% of the total cryptocurrency market capitalization. Meanwhile, stablecoins had a market capitalization of $309 billion, representing 10.23% of the total cryptocurrency market capitalization.

Data source: Coingeck, https://www.coingecko.com/en/charts

Data as of November 23, 2025

2. Fear Index

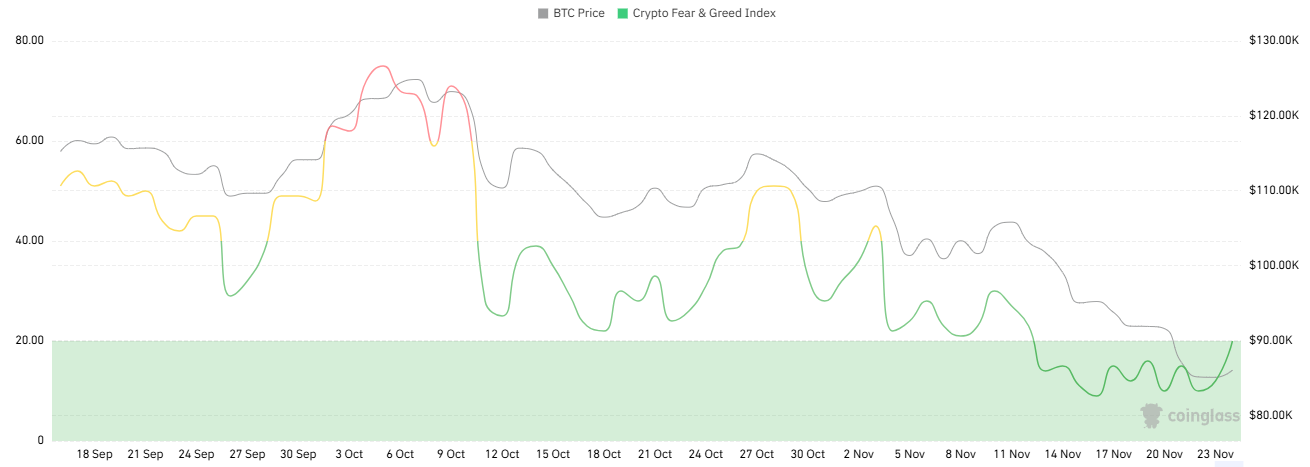

The cryptocurrency fear index is 20, indicating extreme fear.

Data source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of November 23, 2025

3. ETF Inflow and Outflow Data

As of press time, the total net inflow into US Bitcoin spot ETFs was approximately $57.64 billion, with a net outflow of $1.22 billion this week; the total net inflow into US Ethereum spot ETFs was approximately $12.63 billion, with a net outflow of $500 million this week.

Data source: Sosovalue, https://sosovalue.com/zh/assets/etf

Data as of November 23, 2025

4. ETH/BTC and ETH/USD exchange rates

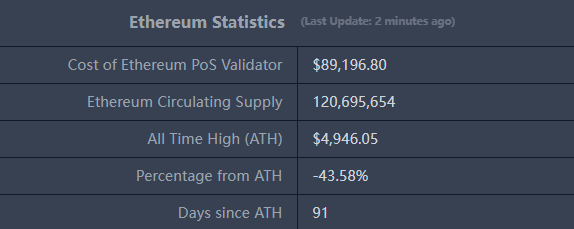

ETHUSD: Current price $2,783, all-time high $4,946.05, down approximately 43.58% from the high.

ETHBTC: Currently at 0.032140, with an all-time high of 0.1238.

Data source: Ratiogang, https://ratiogang.com/

Data as of November 23, 2025

5.Decentralized Finance (DeFi)

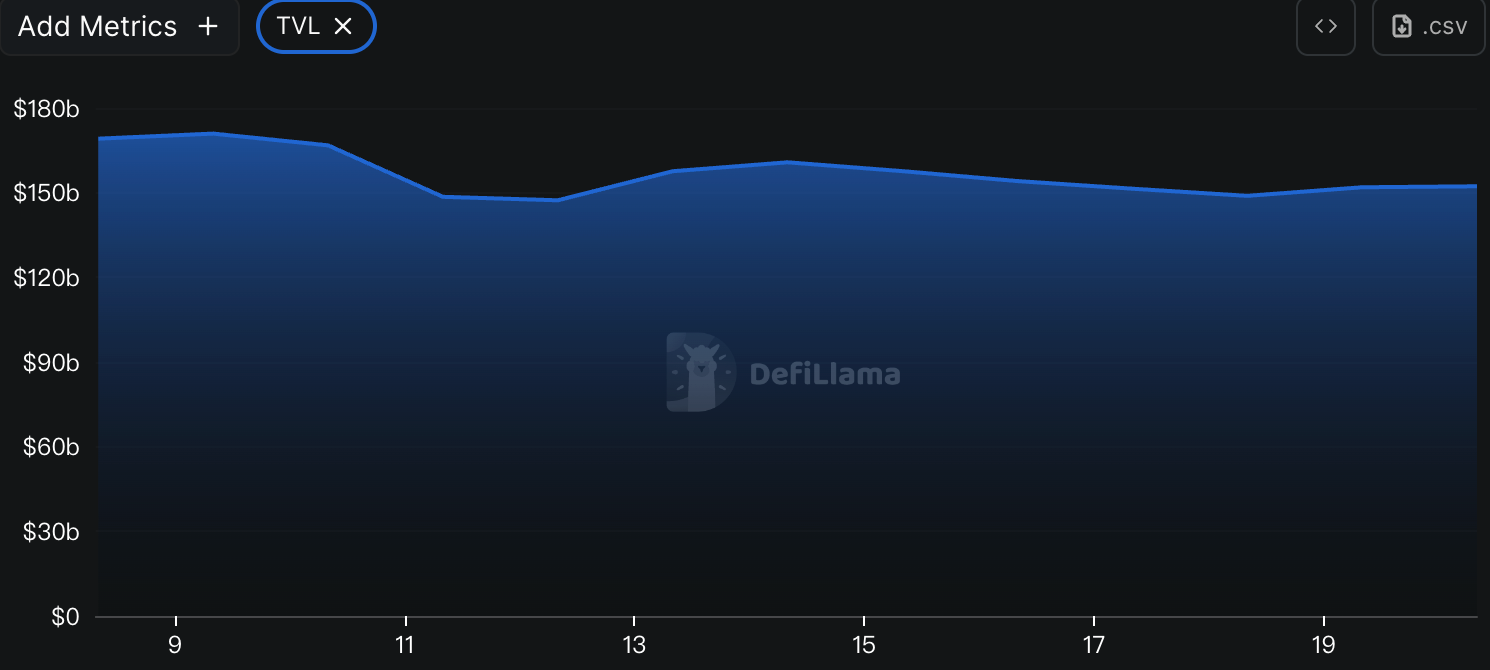

According to DeFiLlama data, the total TVL of DeFi this week was $114.4 billion, a decrease of approximately 6.54% from $122.4 billion last week.

Data source: Defillama, https://defillama.com

Data as of November 23, 2025

Based on public blockchains, the three public blockchains with the highest TVL are Ethereum (67.32%), Solana (8.76%), and BNB Chain (6.99%).

Data source: CoinW Research Institute, defillama, https://defillama.com

Data as of November 23, 2025

6. On-chain data

Layer 1 related data

The analysis primarily focuses on daily transaction volume, daily active addresses, and transaction fees, covering the current Layer 1 data including ETH, SOL, BNB, TON, SUI, and APT.

Data source: CoinW Research Institute, Defillama, https://defillama.com

Data as of November 23, 2025

Daily trading volume and transaction fees : Daily trading volume and transaction fees are core indicators for measuring the activity and user experience of public chains. In terms of daily trading volume, Solana saw the largest increase this week, rising approximately 5.2%; Aptos rose 4.1%. Other public chains generally declined, with Sui down 30.7%, BNB Chain down 30.4%, Ton Chain down 26.5%, and Ethereum down 8.8%. Regarding transaction fees, Sui experienced the most significant drop, falling approximately 71.4%; Aptos fell approximately 33.3%, while Ethereum, Solana, BNB Chain, and Ton Chain remained largely unchanged from last week.

Daily Active Addresses (DAU) and TVL : DAU reflects a public chain's ecosystem participation and user stickiness, while TVL reflects users' trust in the platform. In terms of DAU, Ton chain performed best, rising approximately 41.4%; BNB Chain rose 3.5%, while other chains experienced varying degrees of decline, with Sui experiencing the largest drop of approximately 45.9%; Solana fell 9.1%, Aptos fell 7.7%, and Ethereum fell 2.7%. Regarding TVL, all chains declined this week, with Sui experiencing the largest drop of approximately 17.8%; Ton chain fell 9.1%, Solana fell 8.3%, Aptos fell 7.5%, Ethereum fell 7.2%, and BNB Chain fell 5.6%, reflecting a cautious short-term funding environment.

Layer 2 related data

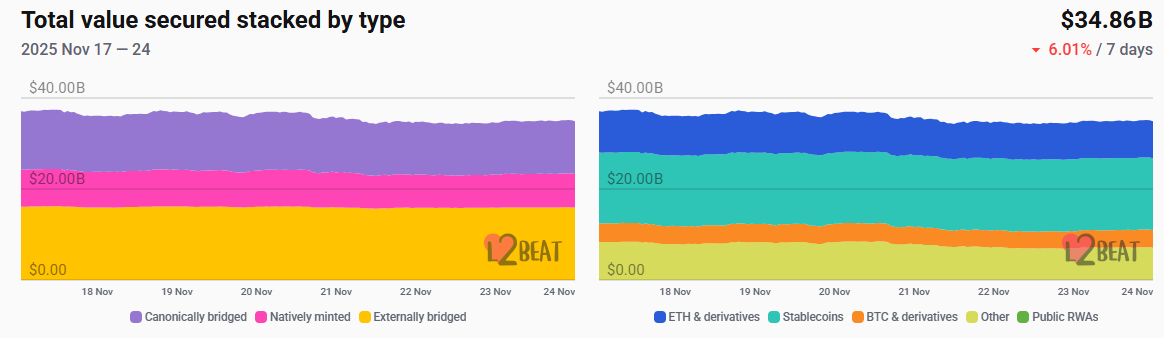

According to L2Beat data, the total TVL of Ethereum Layer 2 is $34.86 billion, down 6.01% from $36.9 billion last week.

Data source: L2Beat, https://l2beat.com/scaling/tvs

Data as of November 23, 2025

Base and Arbitrum hold the top positions with market shares of 38.26% and 35% respectively. This week, Base ranked first in TVL for Ethereum Layer 2.

Data source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of November 23, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market capitalization of stablecoins is $309 billion, of which USDT has a market capitalization of $184.4 billion, accounting for 59.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $74.09 billion, accounting for 24% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.7% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of November 23, 2025

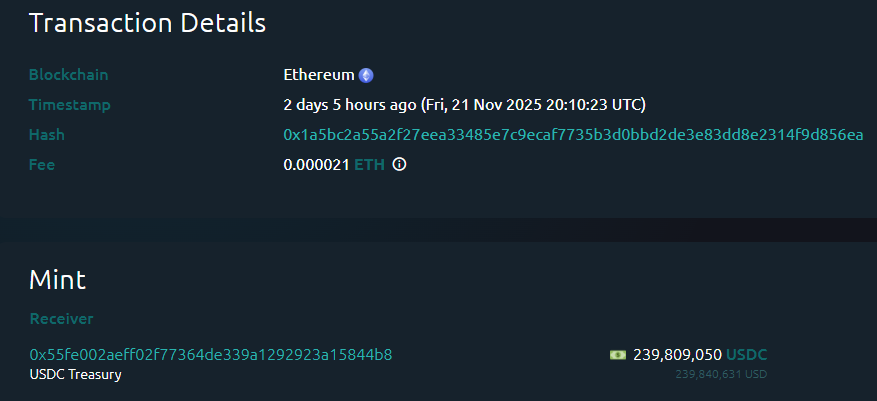

According to Whale Alert data, the USDC Treasury issued a total of 3.71 billion USDC this week, while the Tether Treasury did not issue any USDT. The total stablecoin issuance this week was 3.71 billion, a slight increase of approximately 0.3% compared to last week's total issuance of 3.698 billion.

Data source: Whale Alert, https://x.com/whale_alert

Data as of November 23, 2025

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

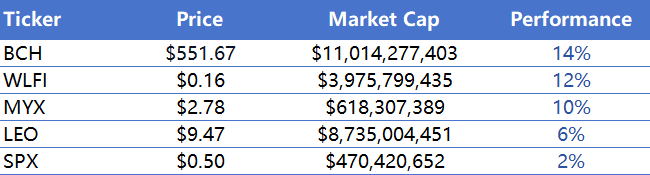

The top five performing VC coins in the past week

Data source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of November 23, 2025

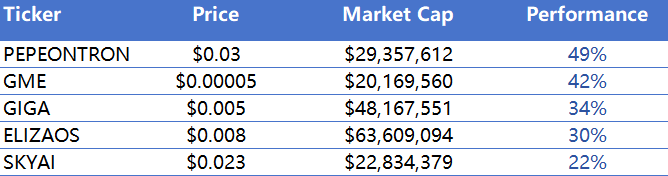

The top five gainers in the past week: Meme coins

Data source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of November 23, 2025

2. New Project Insights

Founded in 2025, Nuvolari is an AI-powered collaborative assistant built on the Sonic ecosystem, dedicated to reshaping the user experience of DeFi through intelligent methods. With AI at its core, Nuvolari simplifies complex on-chain operations into intuitive, secure, and familiar workflows, improving asset management and strategy execution efficiency without sacrificing security. It targets users who want to lower the barrier to entry for DeFi but still seek an efficient user experience.

HelloTrade is a Web3 trading platform built on the MegaETH ecosystem, dedicated to providing global users with 24/7 uninterrupted trading services for stocks, commodities, and RWA. It prioritizes a mobile-first experience and supports high-leverage perpetual contract trading. HelloTrade integrates the advantages of DeFi and derivatives, emphasizing global access and efficient execution capabilities, aiming to lower the barriers between traditional finance and the crypto market.

Nado is an order book-based decentralized exchange focused on providing professional traders with a high-performance spot and perpetual contract trading experience. Its core feature is a unified margin mechanism that allows collateral to move dynamically between different positions and enables real-time risk hedging, thereby improving capital efficiency and position management flexibility.

III. New Industry Trends

1. Major Industry Events This Week

SkySafe, a San Diego-based drone defense company backed by Andreessen Horowitz (a16z), is launching its new project, FliteGrid, a cryptocurrency-powered sensor network designed to allow users to host their sensors at home by paying them cryptocurrency. SkySafe has already sold drone tracking intelligence to law enforcement and critical infrastructure operators. The network is built on the Solana blockchain and is inspired by the rise of various decentralized physical infrastructure networks (DePIN). The sensor, priced at $949, will begin shipping next spring. Upon launch, users will earn points that can be redeemed for FLITE tokens in 2027. FliteGrid is currently only available in the US and will launch in Japan and the EU in 2027.

Orderly Network is launching a four-week UCC Trading Championship with a total prize pool of $200,000. Participants will be awarded prizes based on their Points-to-Live (PnL) rankings. The event supports participation on platforms including WOOFi, Aegis DEX, WHAT Exchange, SalsaDEX, ZoomerOracle, and Taiki DEX. Users trading with the Aegis stablecoin YUSD will be eligible for an additional reward equivalent to 0.3% of the total Aegis token supply.

Falcon Finance has announced the launch of a new staking vault, allowing users to deposit existing tokens, retain all potential upside, and directly earn USDF. The first vault supports FF, offering up to 12% annualized yield, a 180-day lock-up period, and a 3-day cooldown. More vaults will be launched in the future.

Perp DEX aggregator Liquid announced the launch of its Season 1 points program, distributing 100,000 points weekly starting November 18th. Users can accumulate points through trading, depositing funds, referring friends, and using new features. Liquid also stated that its app is now available on the US App Store. Previously, Liquid distributed 600,000 points during Season 0 (May 1st to November 3rd) and 200,000 points during Season 0.5 (November 3rd to November 17th).

2. Major events that will happen next week

Makinafi's token, MAK, will be ICOed on Legion on November 25th. Makina is a multi-chain DeFi execution engine project that aims to provide asset managers, AI agents, yield funds, protocol vaults, and crypto-native users with non-custodial, high-frequency automated on-chain strategy execution capabilities, including multi-chain arbitrage, hedging positions, atomic withdrawal mechanisms, and risk control modules.

Bitdealernet will hold its TGE on November 27, 2025. Bitdealer is a Solana-based Meme Launchpad platform that aims to reshape the creation, issuance, and scaling of meme tokens by pairing them with real-world gaming assets.

Pendle has announced an sdeUSD liquidity pool compensation program, partnering with Elixir to distribute USDC to users holding PT, YT, LP, and SY, according to Elixir's compensation framework. USDC will be available for claiming via the Pendle Dashboard on November 28, 2025. Users will be notified once the claiming function is ready.

The Reya token sale will launch on CoinList on November 26th. Reya is a top-six perpetual contract DEX with a daily trading volume of $1-1.5 billion and is backed by Framework Ventures, Coinbase Ventures, and Selini Capital. The sale is valued at $150 million, with 50% of TGE tokens unlocked. A bottom-up allocation mechanism will be used, prioritizing smaller investors. Participation is not available in certain regions, including the United States and Canada.

3. Key Investment and Financing Activities Last Week

Kraken has completed two funding rounds totaling approximately $800 million. The first round raised $600 million from investors including HSG, Tribe Capital, and DRW Venture Capital; the second round raised $200 million, led by Citadel Securities. Kraken is a long-established global cryptocurrency exchange founded in 2011 and headquartered in the United States. It was the first trading platform to obtain a cryptocurrency banking license in Wyoming, USA. (November 18, 2025)

Doppel has completed its latest Series C funding round, raising $70 million. The round was led by Bessemer Ventures and Andreessen Horowitz (a16z), with participation from South Park Commons, Script Capital, and other institutions. Founded in 2022, Doppel is a real-time cross-chain monitoring platform specializing in NFT fraud detection and risk prevention. By continuously tracking on-chain behavior and abnormal transaction patterns, it helps projects, platforms, and users identify potential fraudulent activities, thereby improving the security of the NFT ecosystem. (November 19, 2025)

Numerai has completed a new Series C funding round, raising $30 million, valuing the company at approximately $500 million. Investors in this round include USV, Shine Capital, Paul Tudor Jones, and endowments from several top universities. Numerai is a decentralized quantitative hedge fund platform founded in 2015, dedicated to building machine learning models through a global community of data scientists. (November 20, 2025)

IV. Reference Links

1.Coingeck: https://www.coingecko.com/en/charts

2.Coinglass: https://www.coinglass.com/pro/i/FearGreedIndex

3.Sosovalue: https://sosovalue.com/zh/assets/etf

4.Ratiogang: https://ratiogang.com/

5.Defillama: https://defillama.com

6.L2Beat: https://l2beat.com/scaling/tvs

7.Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

8.Coinglass: https://www.coinglass.com/pro/stablecoin

9.Whale Alert: https://x.com/whale_alert

10.Coinmarketcap: https://coinmarketcap.com/

11.Nuvolari: https://x.com/nuvolari_ai

12.HelloTrade: https://x.com/hellotradeapp

13. Nado: https://x.com/nadoHQ

14.Kraken: https://x.com/krakenfx

15.Doppel: https://x.com/DoppelHQ

16.Numerai: https://x.com/numerai

- 核心观点:加密货币市场本周普遍承压下行。

- 关键要素:

- 加密货币总市值下降10.88%。

- 比特币和以太坊ETF净流出17.2亿美元。

- DeFi总TVL下降6.54%。

- 市场影响:短期资金面偏谨慎,市场情绪恐慌。

- 时效性标注:短期影响