The latest SOL proposal aims to lower the inflation rate. What are the opponents thinking?

- 核心观点:Solana提案加速通胀减速,利好币价。

- 关键要素:

- 通胀减速翻倍至-30%,目标提前3年。

- 未来6年减少发行2230万枚SOL。

- 质押收益率将逐年下降至2.42%。

- 市场影响:可能提升SOL稀缺性,吸引机构资金。

- 时效性标注:中期影响

Original article by Odaily Planet Daily ( @OdailyChina )

Author|CryptoLeo ( @LeoAndCrypto )

Devout Solana defenders have recently received some comfort because the Solana community has put forward a new proposal called SIMD-0411 (which translates to Double Inflation Suppression, meaning that inflation is decreasing even though deflation has not yet occurred) . The proposal was initiated by Solana community contributors Losin and helius Dev Ichigo and is currently in the governance discussion stage, and will soon enter the voting stage.

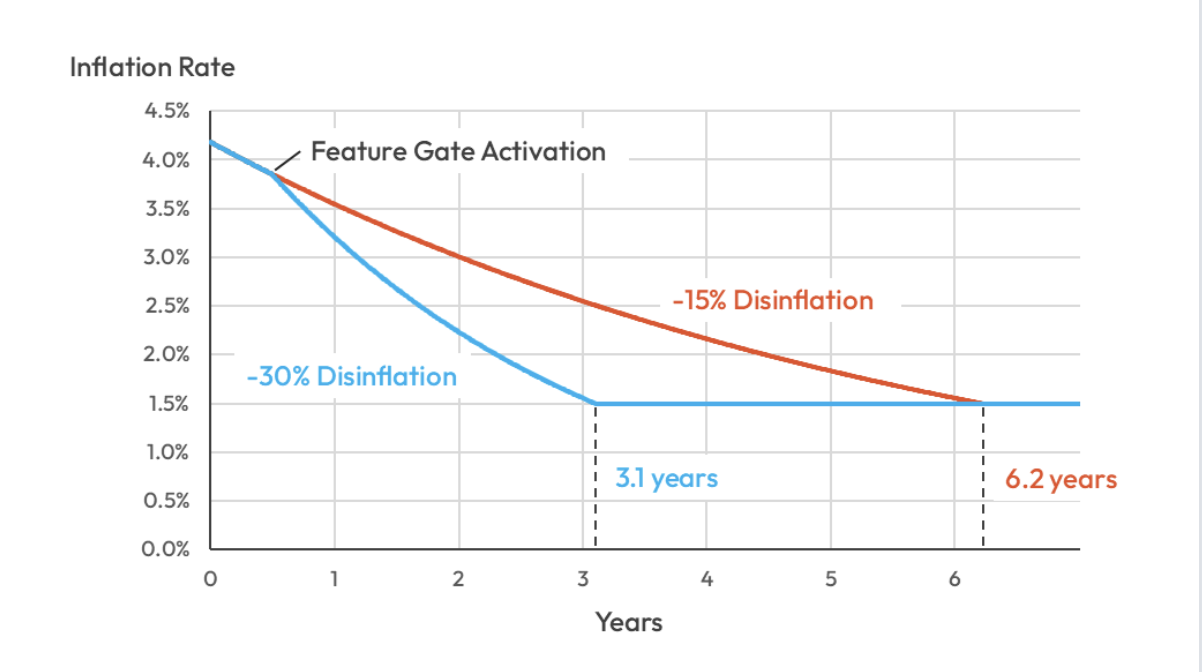

The proposal suggests doubling the SOL inflation rate from -15% to -30% . This parameter adjustment would bring forward the timeline for the SOL inflation rate to drop from the current 4.18% to 1.5% from early 2032 to early 2029. In other words, reaching the 1.5% inflation target would only take 3.1 years. Under this parameter, the estimated SOL supply will decrease by 22.3 million tokens over the next 6 years (721.5 million under the current mechanism, and 699.2 million under the SIMD-0411 mechanism), amounting to approximately $3.12 billion based on the SOL price of $140 at the time of writing.

What are the differences between SIMD-0411, the simplified security version of SOL SIMD-0228?

Let's first review the SOL token inflation plan, which was originally designed with an initial inflation rate of 8%, an inflation deceleration rate of 15%, and a final inflation rate of 1.5%, which is currently at 4.18%.

SIMD-0411 is not the first proposal to improve the Solana inflation mechanism. Earlier this year, early Solana investors such as Multicoin Capital released a proposal called SIMD-0228, which also aimed to modify the Solana inflation model by adjusting the Solana issuance rate to a dynamic and variable model. The proposal set a target staking rate of 50% to enhance network security and decentralization. If more than 50% of the Solana is staked, the inflation rate decreases, reducing rewards to discourage further staking; if less than 50% of the Solana is staked, the inflation rate increases, increasing rewards and encouraging staking. Based on the Solana network situation at the time, the final inflation rate was set at 0.87%.

However, the proposal was too complex and met with strong opposition from the community, ultimately failing. At the time, most community members opposed it because of the conflict of interest between large and small validator nodes.

Large validator nodes support the SIMD-0228 proposal, and inflation quickly decreases, leading to a rise in token price and greater returns.

Smaller validators are concerned that reduced staking rewards will significantly decrease their income, while some DeFi projects are worried about liquidity issues. If smaller validators leave, Solana power will concentrate in the hands of a few large validators, affecting the network's decentralization.

SIMD-0411 can be considered a simplified and secure version of SIMD-0228. Based on this, the solution proposed in SIMD-0411 is more targeted, doubling the rate of inflation decline while maintaining the existing consensus-based final inflation rate of 1.5%. It achieves this by adjusting only a single parameter, unlike SIMD-0228 which redesigned the entire inflation system. It provides a minimized, predictable, and low-risk approach to strengthening the inflation design of the SOL token without increasing protocol complexity. It is simpler and easier to govern.

What is the community's viewpoint?

Opinions on SIMD-0411 remain mixed:

Positive outlook: Institutions are optimistic, encouraging innovation and DeFi activity.

DeFi Dev Corp (DFDV), a financial firm specializing in SOL (Social Security and Investment), also expressed support for SIMD-0411. DFDV's analysis states:

1. In addition to the emissions reduction of 22.3 million SOL tokens, SIMD-0411 applies a single and easy-to-understand parameter adjustment, avoiding any complex or dynamic monetary logic and enhancing predictability. Furthermore, SIMD-0411 includes a 6-month activation grace period to allow network participants to prepare accordingly.

2. Regarding staking rewards, DFDV stated that high staking rewards are reasonable in the early stages of blockchain network development, helping to attract developers, accelerate the decentralization process, and stimulate token demand, but Solana has already passed that stage. For data comparison:

Solana's protocol revenue grew from $29 million in 2023 to $1.42 billion in 2024, and has reached approximately $1.38 billion so far in 2025: a nearly 50-fold increase in just one year. By 2025, Solana's protocol revenue will be more than double that of Ethereum. Solana took approximately four years to reach $1 billion (while Ethereum took six years).

Solana's DEX trading volume grew from $12 billion in 2022 to $55 billion in 2023, then to $694 billion in 2024, and is projected to reach $1.45 trillion in 2025. Solana's processing volume this year is approximately 1.6 times that of Ethereum's DEX.

Between 2023 and 2025, Solana processed approximately 68.6 billion transactions, while Ethereum processed only 1.27 billion, a difference of 50 times. Solana's annual transaction count grew from 12.3 billion in 2023 to 25.9 billion in 2024, and has reached 30.5 billion so far this year, while Ethereum's annual transaction volume has consistently remained below 500 million. Solana has achieved scalability (while Ethereum has not).

Solana has outperformed Ethereum for many consecutive years in almost all key metrics, including network revenue, transaction data, DEX trading volume, and new wallets.

3. High inflation is currently dragging down the price performance of the SOL token, and this urgently needs to be addressed;

4. Institutional investors, DAT and ETF issuers prefer to issue assets that are predictable, have reliable long-term economic benefits, and have low structural inflation.

5. Lower staking yields will also lead to more SOL flowing into DeFi products, such as lending, LPs, and stablecoins;

6. Reduce reliance on token inflation and encourage innovation among network validators.

Concerns exist regarding a series of issues arising from the reduction in staking rewards.

According to Pine Analytics, after SIMD-0411 is approved, the corresponding nominal collateralized yield on SOL will also steadily decline, as follows:

Approximately 5.04% in the first year;

The second year's figure was approximately 3.48%.

The third year was approximately 2.42%.

Furthermore, according to 0xSpade's analysis, after SIMD-0411 is approved, 10 validator nodes will go from being profitable/break-even to unprofitable in the first year, 27 in the second year, and 47 in the third year.

In response, DFDV stated:

1. A lower inflation rate will make the economic benefits of validators more challenging, reduce staking participation, decrease economic security, and cause short-term volatility.

2. As the yield decreases, some verification nodes may incur losses or even be shut down;

3. Uncertainty surrounding a sudden adjustment to Solana's inflation plan could lead to market volatility;

5. Yields on ETFs, pledged products, and DAT will decrease;

6. Interfering with the token mechanism may set a bad precedent, and not all networks can follow this mechanism. Most network dynamics and token designs should remain unchanged.

With DAT, ETFs, and inflation-boosting measures, shouldn't SOL (Social Securities Index) take off?

Although the price performance of the SOL token has been lackluster this year, there has been significant progress: First, the DAT Treasury, while not as high-profile as BTC and ETH, has seen continuous buying; second, the SOL ETF, according to SOSOValue data, saw a net inflow of $128 million in a single week (November 17th to November 21st, Eastern Time). As of this writing, the SOL ETF has a total net asset value of $719 million, with an ETF net asset value ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 1.01%, and a historical cumulative net inflow of $510 million.

Data from the Strategic SOL Reserve shows that SOL Treasury and ETFs hold a total of 25.581 million SOL tokens, worth approximately $3.55 billion. While other crypto assets are being dumped and experiencing continuous losses, SOL has gained a stronger backing, with ample institutional buying support forming. Related reading: " SOL Guardians, Don't Panic, Major Funds Are Here to Support It "

In my opinion as a SOL defender: "A short, sharp pain is worse than a long, drawn-out one. In the end, the inflation rate will reach 1.5% anyway, so I'm optimistic about SIMD-0411. Of course, the decrease in collateralized yields may affect ETF data, and concerns are reasonable. However, in the long run, the 'new transparent and predictable inflation mechanism' will attract more retail and institutional investors, far outweighing the risk of 'decreasing collateralized yields leading to some investors leaving the market.' Moreover, the volatility caused by short-term potential selling pressure is likely to be followed by 'continuously new highs' in the future."

Hopefully, SIMD-0411 will pass the voting process as soon as possible, and not end in failure like SIMD-0228.