In-depth research report on the privacy coin sector: a revaluation of its value from the periphery to the mainstream.

- 核心观点:隐私币正从边缘特性转变为Web3基础设施刚需。

- 关键要素:

- ZEC三个月涨幅超2200%,市值破百亿。

- 欧盟2027年反洗钱新规成行业分水岭。

- 零知识证明技术成熟推动隐私功能普及。

- 市场影响:重塑数字资产估值逻辑,催生合规隐私赛道。

- 时效性标注:中期影响

Since September 2025, the privacy coin sector, which had been dormant for many years, has undergone a remarkable revaluation. According to Ju.com data, Zcash ($ZEC) surged from a low of $35 in August to a peak of $750 in November, a gain of over 2200% in less than three months, driving the entire privacy sector's market capitalization to over $64 billion. This seemingly sudden explosion is actually the inevitable result of the interplay of four forces: technological maturity, regulatory pressure, expansion of on-chain monitoring, and market reflection.

This Ju.com analysis report systematically reviews the technological evolution, regulatory dynamics, core project fundamentals, and macro valuation framework of the privacy coin sector, attempting to answer a core question: In an increasingly transparent on-chain era, why is privacy becoming even scarcer and more important? Ju.com analysts' research indicates that privacy is shifting from a peripheral feature of cryptocurrencies to a fundamental requirement of Web3 infrastructure, and that compliant privacy approaches, represented by Zcash, may become a key bridge connecting traditional finance and decentralized systems in the next five years.

Investors need to recognize that privacy coin investment should not be reduced to short-term speculation, but rather incorporated into a strategic portfolio management approach as a defensive asset to hedge against systemic risks associated with transparent public blockchains and to cope with the increasing global surveillance environment. Meanwhile, the impending implementation of the EU's new anti-money laundering regulations in 2027 will be a watershed moment for the industry in the next 18 months, determining which projects will survive the regulatory cycle and which will be marginalized. The core conclusion of this Ju.com report is that the privacy coin sector has moved beyond the laboratory stage and is on the eve of large-scale commercial application, but this path is fraught with uncertainty, requiring investors to remain rational and patient.

I. Market Background: The Awakening of the Sleeping Giant

1.1 Historic Price Breakthrough

Zcash ($ZEC) experienced a remarkable price surge in the fourth quarter of 2025. Starting at $35 in August 2025, the asset climbed to a peak of $750 in just three months, representing a cumulative increase of over 2200%. This performance also propelled its market capitalization past the $10 billion mark, returning it to the top 20 cryptocurrencies by market capitalization. Meanwhile, according to Ju.com data, another leading privacy coin , Monero ($XMR) , also showed strong momentum, with its price fluctuating upwards towards $400 and its market capitalization remaining stable at around $7 billion.

According to CoinMarketCap market data , the overall market capitalization of privacy coins has jumped from less than 1% of the total cryptocurrency market capitalization at the beginning of the year to the current 2%. Even more noteworthy is the explosive growth in trading volume: ZEC's 24-hour trading volume peaked at over $750 million, more than 20 times higher than at the beginning of the year. This simultaneous increase in both price and volume contrasts sharply with the fleeting success of privacy coins at the end of the 2021 bull market, suggesting a potentially deeper structural shift behind this surge.

1.2 Resonance of Four Driving Forces

This surge in prices is not accidental, but rather the result of simultaneous qualitative changes across four dimensions: supply, demand, technology, and narrative. Understanding these underlying drivers is a prerequisite for grasping the investment logic of privacy coins.

Supply side: Halving cycle combined with shielded pool locking

Zcash completed its second halving in November 2024, reducing the block reward from 3.125 to 1.5625, drastically cutting the rate of new coin issuance by half. The impact of this monetary policy adjustment is often underestimated by the market. Historical experience shows that Bitcoin only truly enters a long-term imbalance in supply and demand after two halvings, thus driving the price into a sustained upward trend. ZEC uses the exact same supply curve design as Bitcoin, only with a seven-year timeline, so it's reasonable to infer that the second halving in 2024 marked the beginning of a new supply contraction cycle. More importantly, on-chain data shows that the lock-up ratio in the shield pool reached an all-time high, further tightening the actual tradable liquid supply and creating strong supply-side constraints.

Demand side: Privacy awareness triggered by on-chain monitoring

The 2025 case in which the U.S. Department of Justice seized 127,000 bitcoins from a Cambodian gang powerfully demonstrated to the world the vulnerability of transparent public blockchains to state-level surveillance capabilities. This incident not only proved that law enforcement agencies had mastered sophisticated on-chain tracking technology, but more importantly, it triggered a collective reflection on privacy issues within the cryptocurrency community. Users began to realize that as long as a wallet address had ever been associated with KYC identity verification, whether through deposits and withdrawals on centralized exchanges or participation in DeFi protocols requiring real-name authentication, all of that address's historical transaction records, asset holdings, and fund flows could be completely reconstructed by algorithms.

This shift in perception is particularly evident among high-net-worth individuals. When on-chain addresses are linked to real-world identities, anyone can query their asset size through public blockchain explorers, exposing large cryptocurrency holders to extortion, phishing attacks, and even threats to their personal safety. Blockchain analytics companies like Chainalysis are already able to predict fund flows using machine learning algorithms, pre-identify "high-risk addresses," and even provide real-time monitoring services for law enforcement. In this context, privacy is no longer a niche pursuit for tech enthusiasts but has evolved into a fundamental requirement for all on-chain participants.

Technical aspects: Engineering breakthroughs in zero-knowledge proofs

Over the past two years, Zcash has completed a series of milestone upgrades: the introduction of the Halo 2 proof system completely removed the original trusted setup requirements, solving the long-standing problem of initial trust that plagued the project; the launch of the Orchard shielding pool standardized the address format, significantly lowering the barrier to entry for users; and the NU5 and NU6 network upgrades fundamentally improved the efficiency and reliability of privacy transactions. The cumulative effect of these technological advancements has transformed ZEC's privacy features from a laboratory product into a production-grade tool. The improved user experience is directly reflected in adoption data: shielding pool usage has surged from a historical average of 5% to the current 30%, highlighting that improved ease of use is a key bottleneck for large-scale adoption.

Narrative Endorsement: Collective Endorsement by Opinion Leaders

BitMEX founder Arthur Hayes publicly stated that Zcash is "the last chance to achieve a 1000x return" in the cryptocurrency space, arguing that privacy technology has matured, and increased regulatory pressure will actually amplify the scarcity of privacy assets. Renowned Silicon Valley investor Naval Ravikant has even marked ZEC as his second-largest bet, believing that privacy coins will play a similar role to Bitcoin in the past decade. Grayscale, acting as a bridge between traditional finance and cryptocurrency, continues to operate ZEC trust products, providing exposure to accredited investors, which to some extent gives ZEC an "institutionally endorsed" label. The collective pronouncements of these opinion leaders have redefined the position of privacy coins in the crypto narrative, transforming them from marginal assets in a regulatory gray area into strategic tools against financial surveillance.

II. The History of Technological Evolution: A Twenty-Year Journey from Coin Mixing to Zero-Knowledge Proofs

2.1 Generational Leap in Privacy Technology

The history of privacy technology development in cryptocurrencies is essentially an arms race between cryptographers and on-chain analytics experts. Each generation of technology is a response to the shortcomings of the previous one, and also lays the groundwork for the next generation of innovation. Understanding this evolutionary trajectory is a necessary prerequisite for assessing the investment value of current privacy coins.

First Generation: Limitations of CoinJoin Mixing

The first generation of privacy solutions is represented by Dash's CoinJoin mixing technology. The core idea of this solution is extremely simple: mix the transaction inputs and outputs of multiple users together, making it difficult for external observers to determine who paid whom. From a technical implementation perspective, CoinJoin's advantage lies in its simplicity; it doesn't require modification of the underlying blockchain protocol, only coordination at the application layer. However, this simplicity also exposes a fatal flaw: the effectiveness of mixing is highly dependent on the randomness of the number of participants and their behavioral patterns. If the mixing pool is insufficient, or if an attacker can control the mixing nodes, the entire privacy protection will collapse. More importantly, with the advancement of machine learning technology, researchers have developed various algorithms that can reconstruct the flow of funds before and after mixing to a considerable extent through transaction graph analysis, time correlation, and amount matching. This makes CoinJoin-like solutions ineffective against national-level surveillance capabilities.

Second generation: Monero's protocol-level privacy

Monero represents the pinnacle of second-generation privacy technology. Unlike Dash, Monero redesigned its privacy protection mechanism at the protocol level, introducing a triple protection system: ring signatures, stealth addresses, and ring confidential transactions. Ring signature technology blends genuine transactions into a set of decoy transactions, making it impossible for observers to distinguish the true sender. Stealth addresses generate a one-time receiving address for each transaction, completely severing the long-term association between the address and the identity. Ring confidential transactions go a step further, encrypting the transaction amount as well, ensuring that external observers cannot see the transacting parties or know the amount transferred. The combination of these three technologies makes Monero one of the most privacy-preserving assets in the cryptocurrency world.

According to DeFiLlama's on-chain data analysis, Monero's usage share in the darknet market grew from 15% in 2021 to 45% in 2025, surpassing Bitcoin to become the preferred payment tool in the underground economy. This data indirectly confirms the practical effectiveness of its privacy technology. However, Monero's design philosophy also determines its biggest point of contention: privacy is mandatory and cannot be turned off. Every XMR transaction is encrypted by default; users cannot choose a transparent mode, nor can they selectively disclose transaction records to third parties. While this purist stance aligns with geek values, it has led Monero into a protracted confrontation with global regulatory agencies. Several jurisdictions, including the EU, Japan, and South Korea, have explicitly stated that they will list Monero as a key regulatory target, and many centralized exchanges have been forced to delist it. More alarmingly, as the application of artificial intelligence in on-chain analysis deepens, the anonymity of ring signatures is being challenged. A paper published in 2024 by a Japanese research team showed that by training deep neural networks to analyze transaction time distribution, network propagation paths, and decoy selection patterns, the true sender can be inferred with over 60% accuracy. While this success rate is insufficient to support law enforcement action, it reveals a disturbing trend: probabilistic privacy is gradually failing in the face of powerful computing capabilities.

The third generation: Zcash's zero-knowledge proof revolution

The breakthrough in third-generation privacy technology comes from Zcash's engineered application of zero-knowledge proofs. Zero-knowledge proofs, a cryptographic theory that originated in the 1980s, are based on the idea that a prover can demonstrate the truth of a statement to a verifier without revealing any additional information. For example, Alice wants to prove to Bob that she knows the password to a vault, but doesn't want to tell him the password. Traditional methods either reveal the password or are unconvincing. Zero-knowledge proofs offer a third way: Alice can convince Bob that she does know the password through a series of cleverly designed mathematical challenges, but Bob doesn't gain any information about the password itself throughout the process.

Zcash applies this theory to transaction verification. When a user initiates a blocked transaction, the sender's address, receiver's address, and the transfer amount are all encrypted, and external observers can only see a ciphertext. However, the transaction still needs to be verified by the network: nodes must confirm that the sender has sufficient balance, there is no double-spending, and the calculation is correct. Traditional blockchains achieve verification by publishing all data, while zero-knowledge proofs replace this by generating a mathematical certificate. This certificate proves to the network: "There exists a legitimate transaction that satisfies all the rules," but does not reveal any specific content of the transaction. The entire verification process takes only milliseconds, and the proof file is only a few hundred bytes in size, which allows privacy transactions to achieve strict cryptographic confidentiality while maintaining efficiency.

More importantly, Zcash introduces a design philosophy of optional transparency. The system supports both transparent and masked address modes, allowing users to choose flexibly based on specific scenarios. Transparent addresses can be used for corporate settlements requiring auditing, while masked addresses are used for privacy-conscious personal savings. Zcash also innovatively designs a "view key" mechanism: the owner of a masked address can generate a special key that authorizes specific third parties (such as auditing firms or regulatory bodies) to view the address's transaction history, but does not grant them transfer permissions. This granular access control achieves a technical balance between the seemingly contradictory demands of "privacy and compliance."

2.2 Zcash and Monero: The Ultimate Divergence Between Two Paths

Within the privacy coin sector, Zcash and Monero represent two drastically different philosophical paths. This divergence is not only reflected in their technical implementation but also, more profoundly, in their differing understandings of the "essence of privacy." Understanding the differences between these two projects is crucial for determining the long-term evolution of privacy coins.

Zcash (ZEC) Monero (XMR) privacy technology zk-SNARKs zero-knowledge proof ring signature + stealth address + RingCT privacy mode optional (transparent/masked dual track) mandatory (all transactions are private by default) compliance support viewing keys selective disclosure cannot be audited, difficult to comply with exchanges support mainstream platforms retain transparent address support most platforms have delisted regulatory attitude gray area but there is room for dialogue EU explicitly bans in 2027 technical threshold has been significantly lowered recently (Zashi wallet) relatively high applicable scenarios corporate settlement, high-net-worth users, extreme privacy requirements

Monero proponents insist that privacy must be mandatory, and any design that allows for optional transparency would compromise the integrity of the anonymity set. This argument has its own logic: if only a few people use shielded transactions, then the shielded transaction itself becomes a marker, implying "this transaction needs to be hidden." Only when all transactions are encrypted by default can a single transaction truly blend into the crowd, achieving an invisibility effect. From a purely cryptographic perspective, this position is irrefutable. However, the complexity of the real world lies in the fact that perfect privacy often conflicts with other needs of society. Businesses need to be audited to obtain financing, individuals may need to prove the source of their assets to tax authorities, and financial institutions must comply with anti-money laundering regulations. Monero's "all or nothing" design renders it completely unsuitable for these scenarios.

Zcash has chosen a more pragmatic middle ground. Its dual-track design allows users to choose between privacy and transparency, while the key viewing mechanism provides the possibility of "post-auditability." Critics point out that this design sacrifices theoretical privacy strength. However, supporters argue that 100% privacy is meaningless if it means 0% usability. Cointelegraph's in-depth analysis indicates that the core reason the EU's new anti-money laundering regulations differentiate between Monero and Zcash is precisely because the latter possesses the technical capability to "meet reasonable regulatory needs without compromising privacy."

From a market performance perspective, these two approaches showed a clear divergence in 2025. While Monero also saw considerable price increases, its liquidity continued to shrink under regulatory pressure, and delisting from major exchanges led to a double deterioration in trading depth and OTC costs. In contrast, Zcash maintained a relatively healthy liquidity environment: mainstream exchanges, by supporting transparent address trading, both met regulatory requirements and preserved entry and exit channels for users. Users could purchase transparent ZEC on exchanges and then transfer it to a privately controlled, shielded address, thus finding a balance between compliance and privacy.

From a technological development perspective, the two projects are heading in different directions. Monero focuses its efforts on enhancing the robustness of existing privacy mechanisms, such as expanding the scale of ring signatures, optimizing the decoy selection algorithm, and introducing full-chain membership proof (FCMP++). These upgrades all revolve around one goal: maintaining the effectiveness of anonymity in the context of continuously improving AI analysis capabilities. Zcash, on the other hand, while consolidating its advantages in zero-knowledge proofs, is actively exploring integration with a broader blockchain ecosystem: the Crosslink upgrade will introduce a PoS consensus layer to improve network throughput; the Tachyon project aims to extend privacy payment capabilities to a "planetary-level" scale; and integration with the NEAR protocol makes cross-chain privacy exchange a reality. This difference reveals the two projects' different visions for the future: Monero is committed to becoming the cash of the digital age, while Zcash attempts to become the privacy foundation layer of Web3.

2.3 A Panoramic View of the Privacy Coin Ecosystem: A Complete Map from Core to Edge

Having understood the evolution of privacy technologies, we need to examine the entire ecosystem from a more macro perspective. Based on functional positioning and technical architecture, the privacy coin ecosystem can be divided into five layers: the core privacy coin layer, the infrastructure layer, the DeFi application layer, the tool service layer, and the market data and trends supporting the entire system.

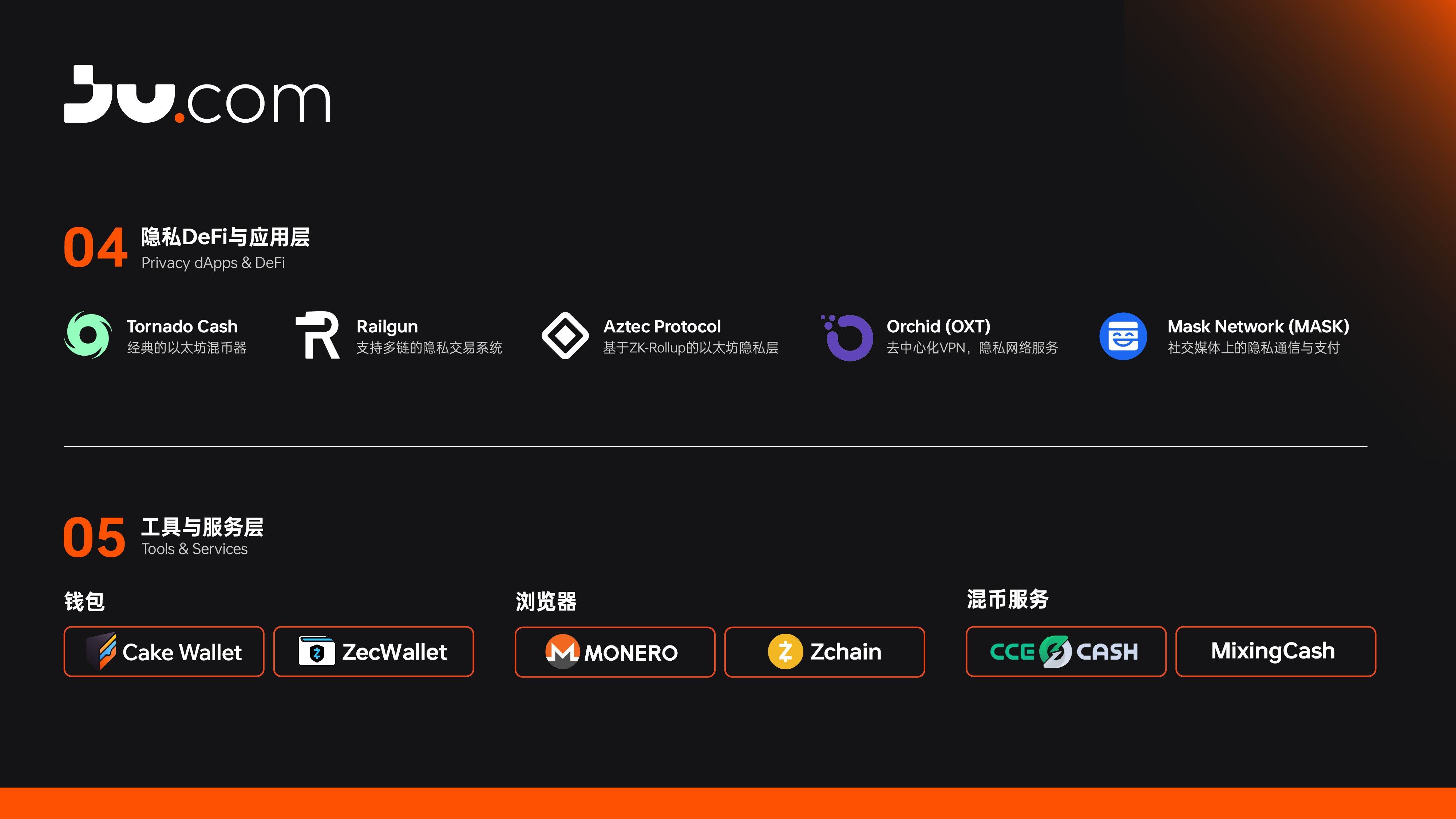

In terms of market size, the privacy coin sector has a total market capitalization of approximately $64 billion, with a 24-hour trading volume of nearly $7 billion, and its search popularity index continues to rise. The three core narratives currently at play—regulatory developments, Zcash technology advancements, and institutional attention—are reshaping the valuation logic of the entire sector. At the core layer, Monero holds the "privacy orthodoxy" position with its mandatory privacy, Zcash represents compliant privacy with its zero-knowledge proof technology, and Dash seeks a balance between instant payments and optional privacy. At the infrastructure layer, projects such as Secret Network, Oasis Network, and Aleo are providing underlying support for a wider range of privacy applications.

The booming application layer is particularly noteworthy. While Tornado Cash has faced regulatory crackdowns, its technological approach has been widely adopted. Railgun and Aztec Protocol continue to explore DeFi privacy, while Orchid and Mask Network extend privacy to VPNs and social media. At the tool layer, wallets (Cake Wallet, ZecWallet), browsers (MONERO, Zchain), and mixing services (CCE.CASH, MixingCash) constitute the last mile for users to actually utilize privacy features.

The key message revealed by this ecosystem map is that privacy is no longer a feature exclusive to a particular blockchain, but is evolving into an infrastructure capability of Web3. From payments to DeFi, from identity to communication, privacy needs are ubiquitous, and the technological solutions that meet these needs are rapidly maturing. Investors need to understand that betting on the privacy sector is not just about buying a particular token, but about laying the groundwork for a fundamental paradigm that could profoundly change the rules governing the digital world.

III. Regulatory Storm: The Industry Watershed in 2027

3.1 EU's New Anti-Money Laundering Regulations: A Reform That Has Been Finalized

In May 2024, after two years of debate and negotiation, the European Parliament officially passed the Anti-Money Laundering Regulation 2024/1624 (AMLR). The full implementation date for this regulation is set for July 1, 2027, leaving the crypto industry with less than two years to adapt. Unlike many previous regulatory proposals that were more talk than action, the core provisions of the AMLR are completely locked, leaving no room for substantial amendments. Vyara Savova, Senior Policy Director of the European Crypto Initiative (EUCI), stated in an interview: "These rules are the final version; what remains is the clarification of the technical implementation details." This means that the privacy coin sector is facing a definitive and irreversible regulatory shock.

Analysis of core terms

Section 79 of the AMLR is the most damaging part of the entire regulation, its wording concise yet uncompromising: all credit institutions, financial institutions, and crypto asset service providers (CASPs) are explicitly prohibited from maintaining anonymous accounts or handling "anonymity-enhanced crypto assets." The section specifically states that "anonymity-enhanced assets" include, but are not limited to: tokens using mixing technology, cryptocurrencies employing ring signatures or stealth addresses, and any digital assets that weaken transaction traceability through technical means. Projects such as Monero, Zcash, and Dash are explicitly included in the regulatory scope, although Zcash's dual-address design theoretically leaves it a sliver of hope.

The design of the enforcement mechanism also reflects the EU's determination. The AMLR stipulates that a new Anti-Money Laundering Authority (AMLA) will be established in Frankfurt to directly supervise at least 40 large crypto service providers operating in the EU. The criteria for inclusion on the regulatory list include: operating in at least six member states, having more than 20,000 EU resident customers, or having an annual transaction volume exceeding €50 million. This standard precisely covers all major exchanges and wallet service providers, leaving virtually no regulatory vacuum. Even more stringent, all cryptocurrency transactions exceeding €1,000 must undergo a full KYC process, including collecting identity information of the sender and receiver, a statement of the transaction's purpose, and proof of the source of funds. This threshold is far lower than the large transaction standards of the traditional financial system, meaning that the vast majority of crypto transactions will be included in the monitoring network.

The consequences of violations are equally significant. According to the regulations, companies that violate the AMLR face fines of up to 10% of their annual revenue or €10 million (whichever is higher), and in serious cases, their operating licenses in the EU may be revoked. Even more deterrent is the regulator's power of "preventative suspension": if the AMLR determines that a platform poses a money laundering risk, it can freeze its operating license before the formal investigation results are available. This "presumption of guilt" regulatory tool means that any company attempting to operate in a gray area will face enormous uncertainty costs.

3.2 Industry Response: Early Planning and Path Differentiation

Faced with the impending regulatory upheaval, the crypto industry's response has been polarized. On one hand, mainstream exchanges are accelerating their efforts to distance themselves from privacy coins, attempting to complete their compliance transformation before regulations take effect. On the other hand, some projects and service providers are exploring technical solutions, hoping to find a new balance between privacy and compliance.

Binance, the world's largest cryptocurrency trading platform by volume, was the first to announce the delisting of Monero in early 2024, citing "compliance with evolving regulatory requirements." This decision sparked a strong backlash from the community at the time, with many users accusing Binance of betraying the original purpose of cryptocurrency. Binance projected an image of a partner rather than an adversary in the eyes of EU regulators. Kraken followed suit, announcing that it would delist XMR from Ireland and Belgium by the end of 2024, and planned to expand the delisting to the entire European Economic Area in 2025. Coinbase's stance was more cautious: the platform refused to list completely anonymous cryptocurrencies from the beginning, only providing trading services for transparent addresses for Zcash, and its address-blocking function has never been enabled.

This wave of early delistings dealt a substantial blow to Monero's liquidity. Data shows that XMR's daily trading volume on centralized exchanges plummeted. While over-the-counter (OTC) trading partially filled this gap, the widening bid-ask spread significantly increased the cost of frequent trading. More seriously, some payment service providers began refusing to accept transfers related to Monero, fearing they would be seen as aiding and abetting money laundering. The CEO of a European crypto payment company frankly stated at an industry conference: "We have no choice. If we continue to support XMR, banks will simply close our accounts, and we'll be completely out of the game."

In contrast to Monero's predicament, Zcash received relatively mild treatment. Most exchanges adopted a partial retention strategy: disabling deposits and withdrawals to shielded addresses but retaining trading services for transparent addresses. This compromise satisfies regulatory requirements for "traceability" while preserving users' access to ZEC. Users can purchase transparent ZEC on exchanges, withdraw it to a wallet they control, and then manually transfer it to a shielded address. Although this adds an extra step, it at least maintains the asset's accessibility. Electric Coin Co.'s Zashi wallet further simplifies this process: users only need to enter the receiving address, and the wallet automatically determines its type and processes the conversion, with the entire process requiring no more than three clicks.

The Zcash community's response to regulation has been more constructive. Electric Coin Co. and the Zcash Foundation have communicated with EU regulators multiple times, emphasizing that the key viewing mechanism meets legitimate auditing requirements, while masked addresses are a necessary tool to protect ordinary users from privacy breaches. In June 2025, the EUCI's Anti-Money Laundering Compliance Manual specifically mentioned that "privacy technologies with selective disclosure capabilities" may receive exemptions in the future. Although not explicitly named, this is widely believed in the industry to be leaving policy space for Zcash. If this hint ultimately translates into formal provisions, ZEC will become the only mainstream privacy coin legally circulating in the EU, significantly enhancing its strategic value.

However, optimism needs to be approached with caution. The EU is not the only regulatory force globally; major economies such as the US, Japan, and South Korea are also developing similar policies. In October 2025, the joint statement issued by the G7 finance ministers explicitly stated the need to "coordinate responses to the anonymity risks in crypto assets," hinting at a potential future regulatory framework based on cross-border cooperation. If countries follow the EU model, even if Zcash gains some exemptions due to its technological advantages, its market space will significantly shrink. A greater uncertainty lies in the US attitude. While the Trump administration is relatively friendly to the crypto industry, the Treasury Department and the IRS's hostility towards privacy coins has not subsided. In early 2025, the IRS announced it would increase its auditing of "high-risk crypto transactions," explicitly including privacy coin transactions in its key monitoring scope. This means that even if privacy coins are technically legal, holders may face significant compliance costs due to tax audits.

3.3 Global Regulatory Coordination and Geopolitical Divergence

The EU's tough stance is not an isolated case, but part of a global wave of tightening regulations. The US Treasury Department requires all Virtual Asset Service Providers (VASPs) to report suspicious activity, formally incorporating crypto assets into the traditional anti-money laundering framework. Japan's Financial Services Agency (FSA) explicitly prohibits licensed exchanges from listing fully anonymous cryptocurrencies, leading to the complete disappearance of Monero from the Japanese market. The Monetary Authority of Singapore (MAS) requires all digital payment token service providers to implement the "Travel Rule," which mandates that cross-border transfers must include complete identification information for both the sender and recipient. What these policies have in common is that they do not oppose blockchain technology itself, but resolutely reject completely untraceable asset flows.

However, the other side of the regulatory map presents a starkly different picture. El Salvador, after recognizing Bitcoin as legal tender, has adopted a relatively lenient attitude towards privacy coins, arguing that "financial privacy is a fundamental human right." Argentina, after experiencing hyperinflation, has seen a high level of public distrust of the government, leading to a significant increase in privacy coin usage, with regulators choosing a "blind eye" approach. Traditional offshore financial centers like the UAE and Switzerland are attempting to find a balance between compliance and competitiveness, neither completely banning privacy coins nor relaxing KYC requirements, but rather providing differentiated services to clients with varying risk appetites through tiered regulation. This geopolitical divergence has resulted in a bipolar pattern in the privacy coin market: "tightening in developed economies and opening in emerging markets."

IV. In-depth analysis of core projects

Having understood the evolution of the regulatory landscape, we need to return to the projects themselves and assess which assets have the ability to weather economic cycles. The following analysis delves into the core targets of the privacy coin sector from three dimensions: technological approach, market performance, and institutional endorsement.

4.1 Zcash: A Technological Paradigm and Business Prospect for Compliant Privacy

Fundamental data (Data source: Ju.com market data)

Zcash currently has a market capitalization of approximately $10 billion, ranking among the top 20 cryptocurrencies globally. Its circulating supply is 16.38 million coins, leaving about 22% unsupplied before reaching the total supply limit of 21 million. As mentioned earlier, the second halving, completed in November 2024, compressed the annualized inflation rate to below 1.8%, approaching the scarcity level of Bitcoin.

On-chain data reveals a deeper structural shift: the number of ZEC locked in the shielded pool has exceeded 4.9 million, accounting for 30% of the circulating supply, compared to only 5% two years ago. This means that the recent influx of buyers is not from short-term speculators, but rather from long-term holders genuinely utilizing the privacy features. Holding time distribution data shows that over 60% of ZEC addresses have held their holdings for more than a year without moving them, compared to only 35% at the beginning of 2023. This increased concentration of ZEC holdings typically indicates a stronger reluctance to sell.

Technology Roadmap: From Payment Instruments to Privacy Infrastructure

Electric Coin Co.'s Zashi wallet represents a significant leap forward in user experience. By integrating the NEAR protocol's Intents mechanism, users can directly exchange Bitcoin or Ethereum for shielded ZEC without leaving the wallet interface or needing to understand complex cross-chain bridging concepts. Zashi also defaults to transferring all outgoing transactions to shielded addresses unless the user actively selects a transparent mode, thus implementing a "privacy-first" philosophy at the product level. Data shows that within three months of Zashi's launch, the average daily number of newly shielded transactions increased from 150 to over 800, demonstrating that ease of use is key to overcoming the adoption bottleneck of privacy features.

The Crosslink upgrade, planned for 2026, will add a Proof-of-Stake layer on top of the existing Proof-of-Work consensus mechanism. This will allow ZEC holders to participate in block verification and earn rewards through staking, while also shortening transaction confirmation times and improving network resilience. Even more ambitious is the Tachyon project, which aims to boost privacy transaction throughput to planetary levels through innovative technologies such as "proof-carrying-data," enabling Zcash to support the daily payment needs of billions of users worldwide. These technological reserves indicate that Zcash is not content to be a "niche privacy tool," but rather seeks to build a privacy infrastructure that can compete with mainstream public blockchains.

Institutional endorsement and capital flow

While Grayscale's Zcash Trust is relatively small (approximately $120 million in assets under management), its symbolic significance is substantial: it demonstrates the legitimacy of traditional financial institutions recognizing ZEC as an investment target. Pantera Capital, one of Silicon Valley's most influential crypto funds, has held ZEC since 2016 without ever reducing its holdings. More noteworthy is that some sovereign wealth funds and family offices have begun including ZEC in their "alternative asset" portfolios. Although specific details cannot be disclosed due to confidentiality agreements, industry rumors suggest that these institutions already hold over 100,000 ZEC tokens. If Grayscale's ZEC Trust is converted into an ETF in the future, it will further open up channels for institutional capital inflows.

4.2 Monero: The Cost and Resilience of Upholding Idealism

Technological advantages and ideological values

Monero currently has a market capitalization of approximately $7 billion. Its circulating supply is about 18.44 million coins, theoretically with no total limit, but it employs a "tail emission" mechanism: after the main emission period ends, each block permanently produces 0.6 XMR as a miner incentive to maintain network security. This design philosophy contradicts Bitcoin's "scarcity" narrative, but proponents argue that continuous small inflation is a necessary cost to maintain a decentralized mining ecosystem.

Monero's technological advantage lies in its maturity and stability. Since its launch in 2014, it has withstood multiple bull and bear market cycles without experiencing any major security incidents. Its mandatory privacy design ensures the integrity of the anonymity set: each transaction is mixed with 16 decoy signatures, exponentially increasing the difficulty of tracing. The Fluorine Fermi upgrade, launched in October 2025, further optimizes the node selection algorithm, significantly enhancing its resistance to Sybil attacks. The full-chain membership proof (FCMP++) to be deployed in 2026 is a milestone, giving Monero quantum resistance and ensuring that privacy protection remains effective even in the era of quantum computing.

Liquidity crisis and survival challenges

However, Monero also faces significant challenges. The most immediate threat is shrinking liquidity: only two of the world's top ten exchanges retain XMR trading pairs, and daily trading volume plummeted from a peak of $500 million in 2021 to $180 million in 2025, a drop of over 60%. While over-the-counter trading partially filled the gap, the 8-12% bid-ask spread made frequent trading prohibitively expensive. In August 2025, the Monero network suffered a 51% attack threat, which was ultimately mitigated by a $925,000 defense fund raised by the community, but this incident exposed the vulnerability of small-scale PoW networks. A longer-term risk lies in the possibility that, with the improvement of AI analytics capabilities, the probabilistic anonymity of ring signatures may be gradually compromised, and Monero's mandatory privacy design prevents it from gaining policy space through a "compliance model" like Zcash.

Investment Positioning: An Ideological Hedging Tool

For investors, Monero is better viewed as an "ideological hedging tool" rather than a mainstream asset. It represents the fundamentalist approach to cryptocurrency: decentralization, censorship resistance, and complete anonymity. In extreme scenarios such as large-scale financial system surveillance or currency crises, Monero may become a last resort. However, in normal market conditions, its liquidity disadvantages and regulatory risks make it difficult for it to play a major role in an investment portfolio.

4.3 Exploration of Emerging Privacy Infrastructures

In addition to established projects like ZEC and XMR, a number of emerging forces have also appeared in the privacy field, attempting to provide differentiated solutions for specific scenarios.

Railgun: A privacy layer for the Ethereum ecosystem

Railgun, as a privacy layer within the Ethereum ecosystem, allows users to interact with mainstream DeFi protocols like Uniswap and Aave while maintaining privacy through its zk-SNARKs smart contract system. Its unique feature is its proactive integration with the OFAC sanctions list, blocking blacklisted addresses from using its services, thus giving it a compliance advantage over mixers like Tornado Cash. However, the complexity of smart contracts also introduces security vulnerabilities; a small attack in 2024 resulted in a loss of approximately $500,000.

Aztec Network and Secret Network

Aztec Network, as an Ethereum Level 2 (L2) blockchain, provides a fully encrypted smart contract execution environment, supporting innovative applications such as private NFTs and private lending. However, its insufficient network effect is also a prominent issue, with a TVL (Total Value Limit) far lower than mainstream L2 blockchains like Arbitrum and Optimism. Secret Network, on the other hand, adopts a cross-chain privacy solution from the Cosmos ecosystem, but also faces similar adoption bottlenecks.

The common challenge for these projects lies in persuading users to pay additional learning and transaction costs for privacy features within a public blockchain ecosystem that has already established a strong network effect. From an investment perspective, these emerging projects are better suited as satellite investments, capturing the beta benefits of technological innovation, rather than as core holdings.

V. Investment Value Analysis: Essential Needs and Scarcity

5.1 The Structural Rigidity of Privacy Needs

The investment logic for privacy coins fundamentally hinges on the question of whether the need for privacy is a long-term, inelastic demand. From an individual perspective, with the increasing prevalence of on-chain finance, the risk of privacy breaches for high-net-worth individuals is rising exponentially. An early investor holding 1,000 Bitcoins, if their address is linked to their identity, faces multiple threats, including targeted phishing attacks, kidnapping for ransom, and social engineering scams. By transferring assets to ZEC-shielded addresses, the size of their holdings becomes unknown to outsiders, significantly reducing security risks.

From a corporate perspective, protecting trade secrets is a fundamental requirement. When two companies conduct on-chain settlements using a transparent public blockchain, competitors can deduce cost structures, and suppliers can obtain bargaining information. By using privacy coins, transaction amounts and counterparty information are kept confidential, thus maintaining the fairness of business negotiations.

A deeper need stems from the paradoxical situation of financial institutions: they want to leverage blockchain's 24/7 liquidity and instant settlement capabilities, but they absolutely do not want their trading strategies and positions to be seen by competitors. Zero-knowledge proofs and key-viewing mechanisms precisely resolve this contradiction: complete confidentiality to outsiders, and optional disclosure to regulators. JPMorgan Chase collaborated with the Zcash team in 2022 to explore enterprise-grade privacy solutions, although it ultimately did not materialize, it proved the demand was real. As the wave of RWA going on-chain progresses, the privacy requirements in scenarios such as private equity on-chain will become even more urgent, because the prices and participants in these transactions are often highly sensitive information.

5.2 The explosive potential of supply-demand imbalance and the room for valuation repair

Supply-side analysis

From the supply side, ZEC's supply curve is exactly the same as Bitcoin's, only the timeline is shifted by seven years. After Bitcoin's second halving, the supply-demand relationship entered a long-term imbalance, with the price rising from $650 to nearly $20,000, an increase of about 30 times. If ZEC repeats this path, starting from its bottom of $35, the conservative target is $1050. Of course, history doesn't simply repeat itself, but the underlying logic of supply shocks is the same.

The combined effect of the locked-up pool (4.9 million tokens, accounting for 30% of the circulating supply) further tightens the actual tradable supply, providing structural support for price increases. Once this positive feedback loop of "lock-up - scarcity - price increase - more lock-up" is formed, it will significantly amplify price elasticity.

Valuation Comparison Analysis

From a valuation perspective, according to Delphi Digital, ZEC's FDV-to-earnings multiple is only 20.34x, significantly lower than Hyperliquid's 68.66x and Jupiter's 29.48x. While valuation multiples for different types of projects shouldn't be directly compared, this data at least indicates that ZEC hasn't been overhyped by the market. If the narrative surrounding privacy strengthens further, there's considerable room for valuation recovery.

More importantly, there has been a qualitative change in the holder structure. As mentioned earlier, the proportion of shares locked in the shield pool and held for the long term has increased significantly, leading to a continuous contraction in the actual circulating shares. Increased share concentration usually indicates a stronger reluctance to sell, which can easily trigger a rapid price increase driven by supply shortages when demand rises.

VI. Future Outlook: Privacy as the Underlying Paradigm of Web3

6.1 Technical Spillovers of Zero-Knowledge Proofs

Zero-knowledge proof technology is permeating from privacy coins to all layers of Web3, and this diffusion will reshape the underlying architecture of the entire crypto ecosystem:

Scaling Direction : ZK Rollups have become the mainstream scaling solution for Ethereum, with projects like zkSync, StarkNet, and Scroll accumulating a total TVL (TVL) exceeding $4 billion. These L2 solutions not only increase throughput but also inherit the privacy capabilities of zero-knowledge proofs, laying the foundation for future private DeFi.

In the area of smart contracts : zkEVM supports a zero-knowledge execution environment for general-purpose smart contracts, enabling developers to build complex applications without sacrificing privacy. Aztec's Noir language and Aleo's Leo language are becoming new standards for privacy-preserving smart contract development.

In terms of identity : ZK identity is becoming the core technology of decentralized identity (DID). Users can prove "I meet a certain condition" (such as being over 18 years old, holding a certain NFT, or owning certain assets) without revealing specific identity information. This "minimally disclosed" identity system will become a prerequisite for the large-scale adoption of Web3.

In the AI field : ZK Machine Learning protects the privacy of AI model inference. Users can send data to AI models for prediction, but the model provider cannot see the raw data, and users cannot reverse engineer the model parameters. This technology will resolve the most critical privacy issue in the AI era.

As a pioneer of ZK technology, Zcash's Halo 2 proof system has been adopted by multiple projects, and its research results are spilling over into the entire industry. From this perspective, investing in ZEC is not only betting on the privacy coin itself, but also on the long-term value of the underlying technological paradigm of zero-knowledge proofs.

6.2 Three Scenarios of Regulatory Evolution

Pessimistic scenario (probability 30%)

The EU has completely cut off liquidity for privacy coins, and all G7 countries have followed suit; Zcash failed to receive an exemption. In this context:

- All major centralized exchanges have delisted ZEC and XMR.

- The project has become a tool for the dark web and the gray economy.

- Only DEX and P2P retain a small number of transactions.

Neutral scenario (probability 50%)

With lenient regulatory enforcement and a transition period granted, the market has become differentiated. In this scenario:

- ZEC gains partial exemptions by viewing the key, allowing for compliant use under certain conditions.

- Mainstream centralized exchanges (CEXs) retain transparent address transactions but restrict blocked addresses.

- XMR is shifting to full decentralization, maintaining circulation through DEX, P2P, and OTC.

- The overall market size has shrunk by 30-50%, but core users are more steadfast.

Optimistic scenario (probability 20%)

ZEC is considered a compliant privacy solution and thus receives an explicit exemption. In this context:

- Traditional financial institutions are beginning to adopt ZEC for cross-border settlements.

- Grayscale ZEC Trust converted into an ETF, attracting a large influx of institutional funds.

- Zcash becomes the "enterprise-grade blockchain privacy standard"

- Monero remains banned, but XMR holders are converting their assets into ZEC.

Ju.com analysts believe that a neutral scenario is the most likely outcome, and investors should develop strategies based on this, while also hedging against a pessimistic scenario.

6.3 Prediction of the Inflection Point in Enterprise Adoption

Enterprise adoption may reach an inflection point in 2026-2027, triggered by the following conditions:

Settlement needs of multinational corporations : Current cross-border payments via the SWIFT system take 3-5 business days and incur high fees. If multinational corporations use ZEC for instant settlement, they can enjoy the efficiency of blockchain while protecting trade secrets through address shielding, preventing competitors from analyzing fund flows. The first adopters are expected to appear in the supply chain finance and commodity trading sectors.

Privacy services from payment companies : Demand for privacy payments continues to grow among high-net-worth clients. Payment giants such as PayPal and Stripe may launch "privacy payment" value-added services, using ZEC for backend clearing. This B2B2C model hides the complexity of privacy coins beneath the user interface, greatly reducing the barrier to adoption.

Compliance tools for auditing firms : The Big Four accounting firms may develop auditing tools based on Zcash that allow companies to view keys, enabling them to meet privacy requirements while demonstrating compliance to regulators. This need for "auditable privacy" will become even more urgent after RWA (Real-World Assets) are put on-chain.

Once a positive cycle is established, privacy coins will transform from "speculative targets" to "production tools," and their value logic will shift from "price speculation" to "discounted cash flow."

6.4 The Inevitable Connection Between RWA and Privacy

On-chaining of real-world assets (RWAs) represents the next trillion-dollar market in the crypto industry, and privacy technology is a prerequisite for the widespread adoption of RWAs.

Real estate tokenization : When real estate shares are traded on-chain, buyers don't want sellers to know about their other assets, and sellers don't want the transaction price to be publicly disclosed. By using shielded transactions, market information asymmetry is maintained, and transaction efficiency is actually improved.

On-chaining private equity : The LP list and share allocation in traditional private equity investments are highly confidential. If the shares are tokenized, privacy technologies must be used to protect investor identities. The combination of ZK identity and masked addresses perfectly meets the dual requirements of "verifying the identity of qualified investors and not disclosing specific holdings".

Supply chain finance : A company's accounts receivable, inventory value, and procurement costs are all trade secrets. By putting supply chain finance on the blockchain, smart contracts can automate the process, but the data must be encrypted. Zero-knowledge proofs allow financial institutions to verify that "the company does indeed have sufficient collateral" without needing to know the specific amount.

ZK technology can simultaneously achieve "on-chain verifiability" and "non-disclosure of details," making privacy technology no longer an option but an essential module of RWA infrastructure. From this perspective, Zcash's future competitors are not other privacy coins, but traditional public chains that lack privacy capabilities.

VII. Core Conclusions

Ju.com analysts believe that under the triple scrutiny of AI, big data, and CBDC, financial privacy is becoming a scarce resource. The technology is mature, and products like Zashi prove that user experience is no longer an obstacle. Regulation is a double-edged sword; the EU ban poses a threat, but it also forces the industry towards compliance. ZEC's dual-track system offers a solution. Valuations may not have peaked yet, but one should be prepared to withstand a 50%+ drawdown. Portfolio allocation and long-term holding are rational strategies. Privacy coins should be used as hedging tools within the portfolio, with a holding period of at least two years.

The privacy coin resurgence in 2025 is essentially the latest chapter in the eternal struggle between freedom and surveillance, transparency and secrecy. As Arthur Hayes stated, "Gold is a tool for nations to combat inflation, Bitcoin is a tool for people to combat inflation, and Zcash is humanity's last line of defense for financial privacy." Whether ZEC eventually rises to $1000 or falls back to $100, privacy technology itself will profoundly impact the Web3 infrastructure of the next decade. Investing in privacy coins is not just investing in a cryptocurrency, but also voting for a value: in a world of increasing transparency, we must still retain the right to be free from prying eyes.

Disclaimer

This report is for informational purposes only and does not constitute investment advice. Cryptocurrency investment involves extremely high risks and significant price volatility. Investors should fully assess their own risk tolerance and only invest funds they can afford to lose. The views and forecasts in this report are based on currently available information, and future market movements may differ significantly from expectations. Investment decisions should be based on independent judgment, and professional financial advice should be sought when necessary.