Robotics & Crypto: How will the crypto market capture value as robots begin to replace humans?

- 核心观点:机器人×加密赛道成新风口。

- 关键要素:

- 机器人NEO发布引爆市场热情。

- 赛道总市值超10亿美元。

- 融合AI、机器人、区块链技术。

- 市场影响:推动机器经济代币化发展。

- 时效性标注:中期影响。

summary

In late October 2025, Norwegian company 1X Technologies released NEO, a humanoid robot priced at $20,000. Capable of folding clothes, tidying dishes, and serving tea, it brought the vision of "robots in the home" within reach for the first time. A meme coin, $NEO, immediately appeared on Solana, instantly boosting its market capitalization to over $4 million, demonstrating significant market attention and enthusiasm. The narrative of "robots" or "decentralized physical AI (DePAI)" quickly became a new focus in the crypto space. This report aims to comprehensively analyze this emerging sector, exploring its market overview, core drivers, major projects, and future potential and risks.

The core of this narrative lies in leveraging Web3 technologies, such as the Decentralized Physical Infrastructure Network (DePIN) and AI-powered agent payment protocols, to address the ownership and control of robots in the future physical world, building an open " machine economy." Although the sector's total market capitalization has just exceeded $1 billion, indicating its very early stage, its integration of AI, robotics, and blockchain technologies makes it a noteworthy next market opportunity. However, investors must be aware of the multiple risks it faces, including technological immaturity, high market volatility, and regulatory uncertainty.

I. Market Overview

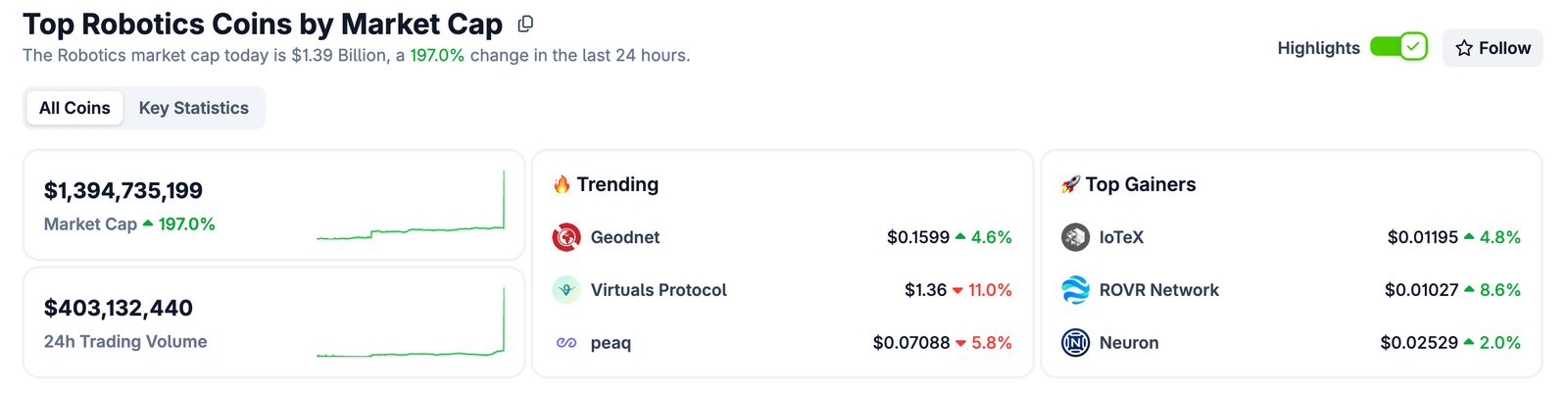

While the robot narrative is full of potential, its current overall size in the crypto market is relatively small, leaving considerable room for growth. According to Coingecko data as of November 2025, its total market capitalization was nearly $1.4 billion, but it achieved a 197% increase in the last 24 hours, indicating that although this new sector is still in its infancy, it has already attracted significant investor attention.

Morgan Stanley predicts that the number of humanoid robots worldwide will reach nearly 1 billion by 2050; Tesla CEO Elon Musk has gone even further, stating that by 2040, the number of humanoid robots will surpass that of humans; Nvidia CEO Jensen Huang asserts, "Every car will become a robot, everything that moves will be a robot, and in the future you will definitely be surrounded by robots." Behind these predictions lies the formation of a trillion-dollar machine economy.

If DeFi captures over 100 billion token market capitalization by serving traditional financial markets through decentralized financial infrastructure, then Robotics × Crypto, as a combination of decentralized physical infrastructure (DePIN) and decentralized physical AI (DePAI), could potentially reach or even surpass DeFi's market capitalization during a bull market cycle when serving a much larger "machine economy" (not just the 200 billion robotics industry, but also machine-to-machine transactions, autonomous agent economies, etc.). If this narrative materializes within the next 2-3 bull market cycles, the increase from 1.4 billion to over 100 billion represents a conservative growth potential of over 70 times . Of course, all of this hinges on: large-scale hardware deployment, protocols finding product-market fit (PMF), and regulations not stifling innovation.

This raises another crucial question: how should the crypto market capture value?

The core logic is simple: use technology to solve the problem of ownership and control of robots in the future physical world, making an open "machine economy" possible.

II. Core Driving Force

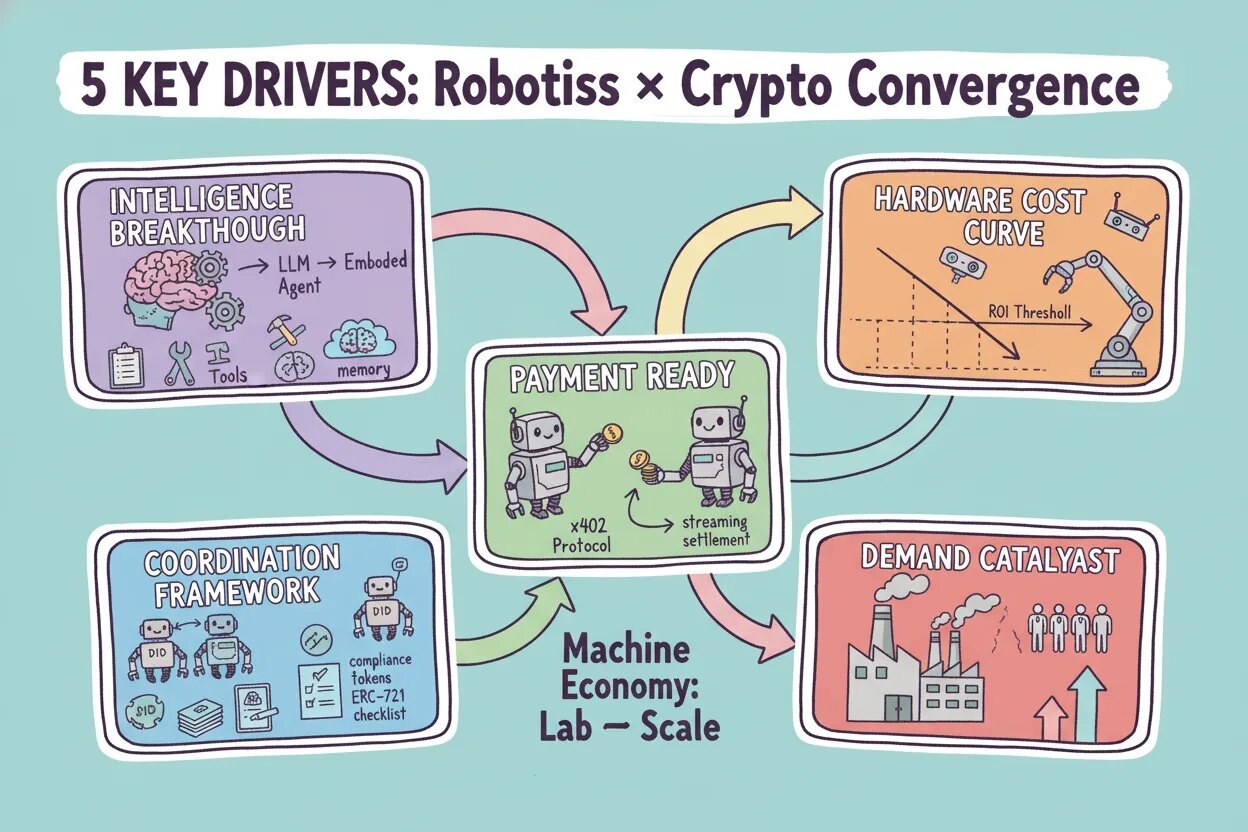

The collision of Robotics and Crypto is essentially a resonance of technological maturity, economic feasibility, and institutional restructuring within the same time window—the machine economy is moving from the laboratory to large-scale production, and encryption becomes the natural foundation for capturing this value.

Inflection point of multiple S-curves

The collision between Robotics and Crypto is not a single innovation , but rather the superposition of multiple S-curves: intelligent evolution, hardware cost reduction, the maturity of encrypted settlement and collaborative frameworks, coupled with the external push of labor and compliance requirements, pushing the "machine economy" from demonstrable to scalable.

- Smart layer inflection point

General-purpose large language models are evolving from language understanding to embodied agents , possessing capabilities such as planning, tool invocation, and long-term memory; the gap between simulation and reality is narrowing, and reasoning costs are decreasing, enabling robots to move from "demonstrable" to "deployable".

- Hardware and Cost Curve

Sensors, actuators, and edge computing power continue to reduce costs and increase efficiency, while standardization and modularization improve assembly and maintenance efficiency; unit economics are approaching the enterprise ROI threshold, and more service scenarios have the commercial feasibility for large-scale implementation.

- Payment and settlement ready

High-frequency, micro-amount, cross-border, and programmable machine-to-machine payments are becoming an infrastructure capability. Coinbase's x402 Protocol provides a native payment layer for AI Agents, enabling streaming settlement, conditional release, and escrow mechanisms to operate at low cost while naturally preserving the traceability required for auditing and compliance.

- The framework for collaboration and ownership is taking shape.

Trustless identity, verifiable execution, and spatial consistency provide consensus and records for "who was present, what did they do, and whether they met the standards"; the divisibility and combinability of assets and revenue rights enable expensive hardware to shift from one-time CAPEX to usage-based payment and revenue distribution, lowering the barriers to financing and social participation.

- Demand and policy catalysts

Structural labor shortages, pressure for service sector automation, and demands for supply chain resilience are raising the marginal returns of "using machines"; regulatory and auditing preferences for " verifiable and traceable " data are accelerating the adoption of on-chain clearing and settlement as a foundation.

The convergence of these five driving forces signifies that the technological, economic, and institutional conditions for a machine economy are essentially in place. At this historic turning point, cryptography has constructed the underlying architecture for value capture across three levels: payment, coordination, and ownership —from micro-payment settlements between machines to cross-platform collaborative networks, and then to the tokenization of assets and profit distribution, each layer is fostering new business models and investment opportunities.

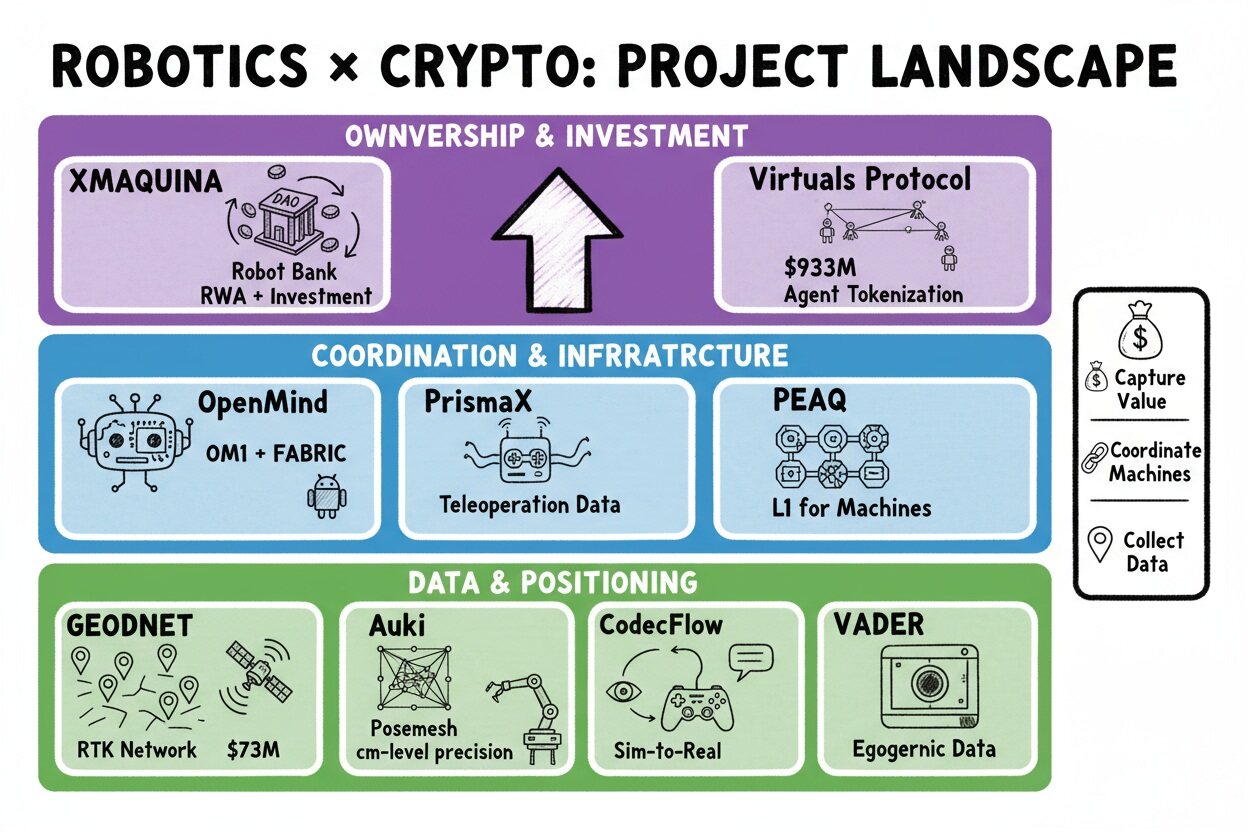

III. Projects to Watch

Which projects in the current market are turning these possibilities into reality? In this section, we will review projects related to the Robotics sector.

Openmind (awaiting TGE)

OpenMind is dedicated to building "the Android of robotics," developing an open-source AI-native software stack for intelligent machines. Its core products include:

- OM1: An AI-native operating system that provides robots with a complete intelligent pipeline of perception, memory, planning, and execution, supporting deployment across hardware platforms.

- FABRIC: A decentralized coordination protocol that provides a trust layer for machine authentication, location tracking, and task coordination, achieving centimeter-level positioning accuracy.

The project aims to solve the fragmentation problem in the robotics industry by enabling robots from different manufacturers to collaborate, learn, and interact economically through a hardware-independent software layer and a blockchain trust mechanism.

Background: Founded in 2024, raised 20 million RMB.

Narrative path: Open source customer acquisition leads to enterprise subscriptions; protocol and marketplace layers collect micro-fees/platform commissions; on-chain identity, staking, and reputation enable tokenized value transfer.

PrismaX (Pending TGE)

PrismaX is a San Francisco-based robotics intelligence platform that addresses a key bottleneck in the development of physical AI—the scarcity of data for training basic robot models—by integrating artificial intelligence (AI), blockchain (Web3 technology), and robotics. The project positions itself as the infrastructure layer of the robotics ecosystem, enabling decentralized, incentivized collection of high-quality visual and sensor data through remote human-robot control. Core products include:

- Remote control platform: A web-based interface that allows users to remotely control robot hardware for data collection.

- Data Marketplace and Collection Portal: A Web3-driven system that rewards high-quality data contributors with "Prisma Points".

- Basic model development tools: Collaboration toolkits transform collected data into AI models.

Improving AI models through remotely controlled data, thereby enhancing operational efficiency, aims to accelerate the path to fully autonomous robots while ensuring that human contributors are rewarded and empowered.

Background: Founded in 2024, raised 11 million in funding.

Narrative path: Build a remote operation coordination layer to consolidate network transactions, usage, and data into the cash flow and assets of the platform or protocol layer as much as possible.

XMAQUINA (Pending TGE)

XMAQUINA is a decentralized autonomous organization (DAO) and Web3 ecosystem that aims to democratize access to automation technologies through community ownership, governance, and benefit from the growth of humanoid robots and physical AI. It positions itself as a "robot bank," pooling token holder funds to invest in high-growth robotics startups, tokenized real-world machine assets (RWAs), and decentralized physical AI (DePAI) protocols.

Background: Founded in 2024, with approximately $5.5 million in funding from venture capital and community (pre-seed + auction).

Narrative Path: By decentralizing the traditional centralized robot value chain, DEUS serves as the fuel for governance and interaction, enabling investment profitability and buybacks through supporting the humanoid robot industry, and capturing value in the form of a sustainable community DAO.

Virtuals Protocol ($VIRTUAL, $731M)

Virtuals is a decentralized AI agent infrastructure platform built on a Base Layer-2 blockchain, focusing on the creation, tokenization, co-ownership, and monetization of autonomous multimodal AI agents. The project positions AI agents as productive entities capable of generating services or products, autonomously participating in on-chain commerce, owning assets, executing transactions, and interacting across gaming, entertainment, social platforms, and DeFi sectors.

Background: Virtuals ecosystem infrastructure, ACP protocol/GAME framework developer

Narrative Path: Virtuals Protocol has a first-mover advantage in the field of AI agent tokenization, and its value capture mechanism is expected to benefit significantly from the explosive growth of the robot market.

PEAQ ($PEAQ, $83M)

PeaQ is a Layer-1 blockchain built specifically for the machine economy. It is designed based on the Substrate framework (Polkadot ecosystem) and is dedicated to providing decentralized physical infrastructure network (DePIN) services for robots, IoT devices, vehicles, and AI agents.

Background: Founded in 2017, raised 43.5 million (5 rounds) in funding.

Narrative path: PEAQ puts the "infrastructure of the machine economy" on the blockchain, productizes key capabilities such as identity, permissions, verification, and time, all of which need to be used and governed through $PEAQ; then it uses financial structures such as VEO to stabilize liquidity, and finally allows the scale of real applications to continuously accumulate token demand and network value.

Geodnet ($GEOD, $62M)

GEODNET is the world's largest decentralized physical infrastructure network (DePIN), dedicated to providing a real-time dynamic (RTK) Global Navigation Satellite System (GNSS) reference station network. The project deploys over 20,000 satellite reference stations (miners) through crowdsourcing, providing centimeter-level positioning accuracy services for robots, drones, autonomous vehicles, and AI agents.

Background: Founded in 2021, raised 15 million in funding.

Narrative Path: GEODNET provides the essential precise positioning infrastructure for the robotics economy with a 90% cost advantage by decentralizing traditional centralized RTK networks. With the explosion of physical AI and embodied intelligence, the demand for sub-centimeter-level positioning is growing exponentially. GEOD tokens, serving as a payment medium for data access and a network incentive mechanism, directly capture the value flow of the robotics market (estimated at $210 billion by 2026) through a revenue buyback and burning model.

Auki ($AUKI, $43M)

Auki Labs' Decentralized Physical Infrastructure Network (DePIN) focuses on machine perception and collaborative spatial computing. Its core product is the Posemesh protocol, which provides a trust layer for real-time spatial data sharing among robots, AR glasses, smartphones, and AI agents, overcoming the limitations of traditional GPS in indoor/urban environments and providing centimeter-level positioning accuracy.

Background: Founded in 2023, raised 10 million in funding.

Narrative approach: Assetize the “machine readability of the real space”, financialize it through protocol-based supply and demand settlement, and finally bind network effects and cash flow together through tokens.

CodecFlow ($CODEC, $10.9M)

CodecFlow is an AI execution layer built on Solana, focusing on providing vision-language-action (VLA) AI operators for robotics and software automation. This platform enables AI agents to perceive their surroundings (through screenshots, cameras, or sensors), reason using natural language commands, and execute actions through UI interaction or hardware control via an isolated, on-demand computing environment.

Background: In 2025, there are no VCs.

Narrative path: Use VLA to drive generalizable execution, and use decentralized computing power and on-chain settlement to transform execution into cash flow and forfeitable reputation.

Neuron ($NRN, 10.6M)

NRN is the native token of the AI Arena ecosystem, the predecessor of Neuron, a decentralized AI agent platform developed by ArenaX Labs. At its core, it uses Web3 games as an "AGI development sandbox" where players train AI agents (tokenized as NFTs) to engage in PvP battles, employing imitation learning and reinforcement learning techniques to allow the AI to learn behavioral patterns from human game data.

Background: Founded in 2021, raised 11 million in funding.

Narrative Path: By using games as a training sandbox for robot AGI, the value flow of the multi-billion dollar robot market is captured. As Sim-to-Real technology matures, virtual-trained AI agents are directly applied to physical robots, and $NRN serves as a payment medium for data contribution, model training, and machine coordination, establishing sustainable value capture through deflationary mechanisms and network effects.

VADER ($VADER, $8.1M)

VADER is an AI agent token built on the Base blockchain and belongs to the Virtuals Protocol ecosystem. It is specifically designed to create a decentralized data layer for the robotics and embodied AI revolution. The project collects, processes, and monetizes egocentric first-person video data through crowdsourcing, providing crucial data support for real-world task training of humanoid robots and physical AI systems.

Background: Founded in 2024, Virtuals launched.

Narrative Path: Creating a flywheel effect for physical AI by bridging cryptographic incentives with the data needs of robots. With the explosion of physical AI and embodied intelligence, the demand for first-person data is growing exponentially. $VADER, as a payment medium for data access and a network incentive mechanism, establishes a sustainable value capture mechanism through the BCM model and network effects.

Due to space limitations, more tokens will not be discussed further:

RICE AI ($RICE, $4.4M)

Predi by Virtuals ($PREDI, $3.0M)

RoboStack($ROBOT, $1.9M)

VitaNova ($SHOW, $690K)

See Coingecko's dynamic listings for more information: https://www.coingecko.com/en/categories/robotics

IV. Conclusion

The undeniable reality is that the Robotics & Crypto sector is still in its extremely early stages. Most projects in the market are more like "vision white papers" than "real-world application cases"—the narrative component far outweighs actual value creation. Essentially, many projects are closer to narrative-driven meme coins , their value primarily derived from community consensus, market hype, and sentiment transmission, rather than a verifiable business model or cash flow. Therefore, in selecting investment targets, we prioritize new projects or protocols that haven't yet issued their own tokens, as they are more likely to capture market attention in the short term.

The integration of robotics and the crypto economy is still in its "infrastructure building phase," facing multiple challenges including technology integration, market education, and large-scale application. However, as one institutional investor stated, "This is not an experiment, but the early stage of a long-term structural transformation." It's worthwhile to continuously track projects that can effectively address core issues such as robot collaboration, data valorization, and the construction of open economic systems—these projects may experience a true value explosion during the next 3-5 years of technological maturity.

Article time: November 17, 2025, 11:00 AM

Disclaimer: This analysis is based on publicly available information and technical reasoning, and does not constitute investment advice. Cryptocurrency investment carries extremely high risks; please make decisions prudently based on your own risk tolerance. Information on some tokens is limited, and the actual situation may differ from the analysis.